The decision to pay down debt or invest is a personal one. It depends on a lot of factors such as risk tolerance, your number of income streams, liquidity needs, family expenses, job security, investing acumen, retirement age, inflation forecasts, and bullishness about your future in general.

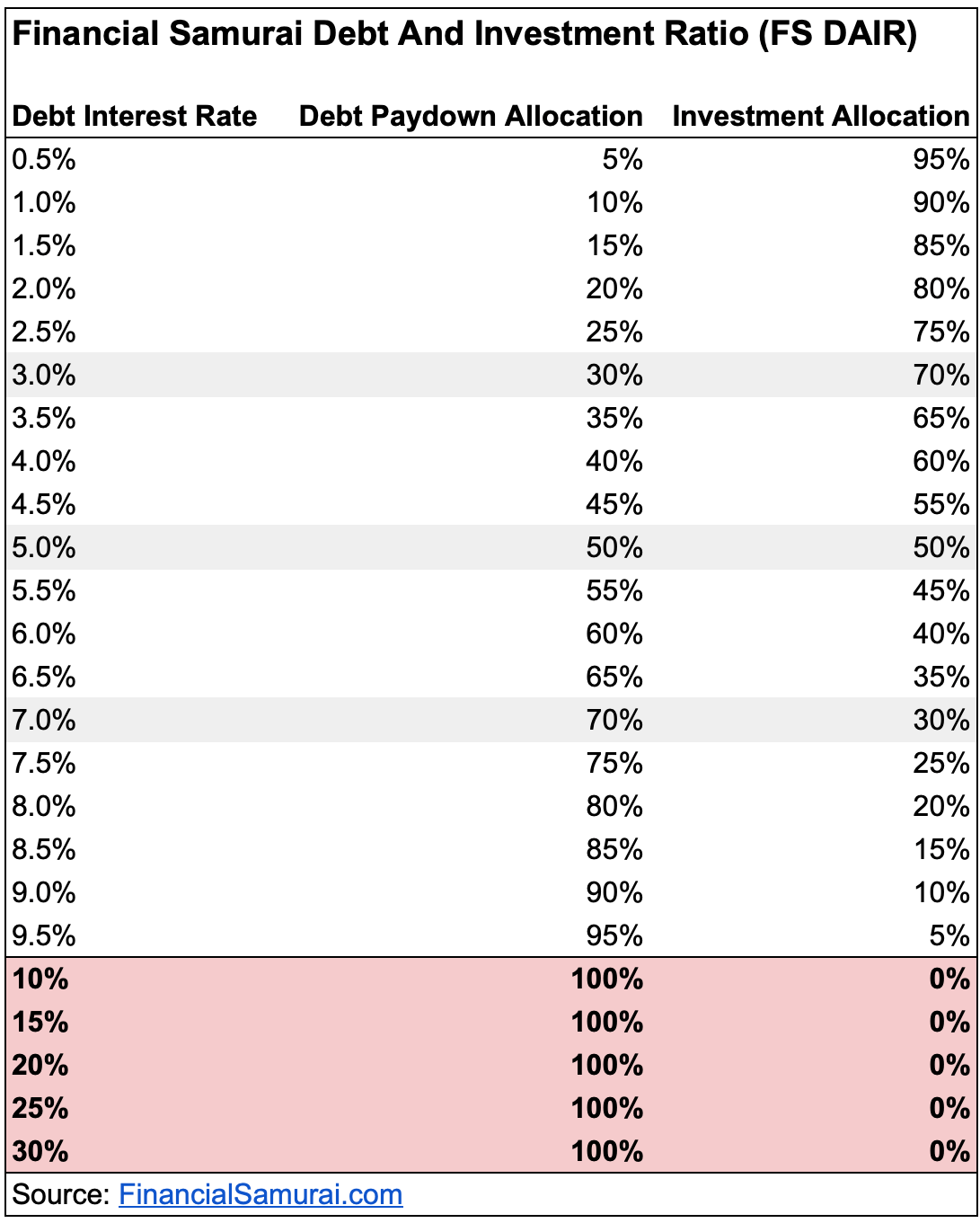

I've had hundreds of people ask me whether to pay down debt or invest over the years. As a result, I came up with the Financial Samurai Debt And Investment Ratio, or FS DAIR for short back in 2014. Despite interest rates plunging since then, the FS DAIR framework still holds up strong.

The FS DAIR formula for deciding whether to pay down debt or invest is as follows:

Debt interest rate X 10 = percent of cash flow after living expenses allocated towards debt pay down

In other words, if you have a mortgage with an interest rate of 3%, utilize 30% of your monthly cash flow after living expenses each paycheck to pay down debt. Invest the remaining 70% of your cash flow based on your investment preferences.

If you concurrently pay down debt and invest, it's very hard to lose in the long run. Ultimately, it's best to be debt-free when you retiree or no longer have the desire to work.

As the CFO of our own finances, it's up to us to figure out the most efficient use of capital. With FS DAIR, you will approach paying down debt or investing in a rational manner.

Basic Background Of Interest Rates And Returns

When deciding on whether to pay down debt or invest, it's good to get some fundamental background on interest rates and risk asset returns.

Stocks have historically returned as little as 1% in the 2000s to as high as 19.58% in the 1950s. The average stock market return since 1926 is roughly 10%.

We also know that the 10-year yield has come down from 14.5% in the mid-1980s to around 1.6% today.

The 10-year yield is a great barometer for mortgage interest rates. But credit card interest rates have stayed stubbornly high all these years. We're talking 17-19% in the 1970s to still around 10%-15% today for good creditors.

When times are good, you generally want to invest more money and leverage up. When times are bad, you want to reduce exposure to riskier investments. You also want to improve your financial security by paying down debt and raising cash.

Given interest rates are so low now, there is a tendency for investors to chase yield. The risk is that investors allocate too high a percentage of their capital to risk assets at historically high valuations.

Lack of discipline can result in financial catastrophe. With FS DAIR, an investor with leverage always rationally allocates new capital. Use FS DAIR to decide whether to pay down debt or invest.

Everything Is Yin Yang In Finance

Finance is Yin Yang. Nothing happens in a vacuum. If income growth, the stock market, and inflation all start going ballistic, the Fed will raise interest rates more aggressively to contain inflation. With higher borrowing costs, stocks may fall and income growth may fade. As a result, inflation may come down.

In a protracted bear market with falling stock prices, deflationary income, and rising unemployment, the Fed will lower rates to stimulate the economy through more borrowing.

This is exactly what the Fed did after the dotcom bubble burst in 2000, the housing market crashed in 2008-2009, and the economy tanked in 1H2020 due to the global pandemic.

Unfortunately, the Fed's actions can also create asset bubbles, which often end in tears. Using monetary policy to tweak the economy is not easy, but we're getting more efficient at it.

Interest Rates Tell Us A Lot

You can view interest rates as a reflection of inflation. Tell me the interest rate on a savings account in any country and I can tell you the country's nominal interest rate within a couple percent.

For example, a while back, a couple of readers commented they were earning an 8-9% savings account interest rate in India. That's an incredible return since the average US savings interest rate at the time was only around 0.25%.

The reason why Indian savings accounts were returning 9% a year was that nominal inflation in India was running at least 8% a year! The real interest rate was, therefore, only 1%. There is no free lunch.

The real interest rate is calculated by simply subtracting the nominal interest rate by the nominal inflation rate. In fact, many borrowers have negative real interest rates now because rates are low and inflation is high.

If you are getting a 100% raise a year, but all your costs are going up 100% a year, you're swimming in place. Everything is always relative in finance.

Property Buying During A Low-Interest Rate Environment

Real estate in America is hot partly because mortgage rates have come down. I believe the best time to buy property is when you can afford to do so mainly due to inflation.

Given the average property value is multiples higher than the average income, property will eventually become unaffordable for more and more people due to inflation.

For example, if a $1 million dollar property increases by 3% a year and your $100,000 a year income also increases by 3% a year, you are actually falling behind by $27,000 a year!

You have to increase your income by 30% a year just to keep up! The alternative way a potential homebuyer can benefit is when mortgage rates decline. However, hope is not a great wealth-building strategy.

If you can't afford to buy your primary residence, then at least gain exposure to real estate through REITs and real estate crowdfunding investments around the country.

I personally invested $810,000 in real estate crowdfunding in 2016 and 2017. My investments mostly are in heartland real estate where valuations are cheaper and rental yields are much higher.

What To Do When Interest Rates Increase?

If you believe interest rates will be rising, then your existing debt becomes “more valuable.” When your debt becomes more valuable, you should, therefore, hold onto your debt for longer.

For example, let's say you are borrowing at 3%, but comparable loans rise to 10% in three years. The value of your debt increases because other people would be willing to pay you more for the ability to borrow at 7% lower interest rates. Your debt is more valuable because it is relatively cheaper to fund.

In terms of investing, if interest rates rise to 10% then your investments should aim to return a level of 10% or higher to compensate you for the risk you will take (equity risk premium). Otherwise, you can just lend out your capital, which entails its own risk.

If you believe interest rates will stay stagnant at these low levels or decline, then you should be more inclined to invest in equities, real estate, REITs, private equity, and more given the opportunity cost or hurdle rate to invest in equities has declined.

For example, let's say the interest rate on a 5-year CD drops to 1% from 4%. Two percent-yielding stocks start looking more appealing now. Therefore, incremental capital will likely flow towards stocks.

In fact, common practice is to allocate more to equities whenever the S&P 500 dividend yield is greater than the 10-year bond yield. This is one of my favorite bullish indicators for stocks.

Pay Down Debt Or Invest? Financial Samurai Debt And Investment Ratio (FS DAIR)

Now that you've got a basic understanding of the correlation between interest rates, inflation, and investment returns, let's look at FS DAIR in more detail.

I truly believe FS DAIR is the most logical way to decide how much you should allocate towards paying down debt or investing. FS DAIR smartly helps you allocate capital based on the environment.

Once again, the percentage of one dollar you should consider allocating to paying down debt is the debt interest rate X 10. In other words, if your debt interest level for your student loan is 5%, then allocate 50% of your savings to pay down your debt and 50% of your savings towards investing.

There is one important point about FS DAIR that should also be followed. If you have a debt interest rate of 10% or higher, then you should consider allocating 100% of your savings to paying off that debt. I use 10% because it’s easy to remember and it’s the average return for stocks since 1926.

The only debt interest levels above 10% in this current interest rate environment are debts from credit card companies, payday loans, and loan sharks.

You might also be consolidating your debts by getting a personal loan. You should be able to get a personal loan interest rate that is much is lower than the average credit card interest rate.

FS-DAIR (Debt and Investment Ratio) Chart

Below is my FS-DAIR guide to help you decide whether to pay down debt or invest.

FS DAIR is not perfect. But it is formulated in a way that seeks to maximize the efficient use of your capital over time. In our current low interest rate environment, it is rational to invest more than pay down debt. If you follow the FS DAIR framework, you will remove emotion from your decision-making process.

Some of you might be asking what to do if you have multiple debts? The simple answer is to focus on paying down your highest interest rate debt first using FS DAIR.

Paying Down Three Types Of Debt Using FS DAIR

Let's say you find yourself with the following types of debt:

1) 16% interest credit card debt for $10,000

2) 9% interest on a personal loan

3) 3% student loan debt for $10,000 over 20 years.

Using FS DAIR, you would allocate 100% of every dollar saved beyond your comfortable liquidity level (6 months minimum is my recommendation) until the 16% credit card debt is paid off. Then you would allocate 90% of your savings towards paying down your P2P loan debt and 10% to invest.

Once the P2P loan debt is paid off, then allocate 30% of each dollar saved towards paying off your student loans. The remaining 70% of your savings can be used to invest.

Of course, you are welcome to also pay down the smallest absolute dollar value debt as well to keep motivation alive.

Paying Off A Student Loan And Investing In A 401(k)

Now let's take a look at a common situation where a recent college graduate would like to invest in her 401(k) and pay down student loan debt.

1) 3% student loan debt of $25,000

2) 100% 401(k) company match up to $3,000

Allocate 30% of savings to paying down extra student loan debt each paycheck. At a minimum, contribute at least $3,000 in one year to get the full $3,000 match for an automatic 100% annual return.

Depending on disposable income, the ideal situation is to contribute the maximum possible to a 401(k) ($19,500 for 2021). This way, after 30+ years of contributing, you will likely have at least $1 million in your 401(k).

With any money left over, aggressively build a taxable investment portfolio in order to generate useable passive income.

Paying Off Mortgage Debt Example

Finally, here's another common example of deciding whether to pay down mortgage principal or invest.

1) 4% 30-year fixed mortgage and no other debt

2) $100,000 gross income

It's good to calculate the real mortgage interest rate after deductions. If you are beyond the standard deduction levels and can't figure out the exact deduction value, then a good estimate is to simply take your mortgage interest rate and multiply it by 100% minus your marginal tax rate.

In this case, 4% mortgage X (100% – 32% marginal tax rate) = 2.72%.

Use FS DAIR again to allocate between 27% to 40% of your savings towards paying down mortgage principal. The remaining 60% – 73% should be invested after paying for general living expenses.

Although it may feel off to pay down such cheap mortgage debt, your goal is to remain disciplined in following the FS DAIR framework. You never know how your risk assets will perform. If your risk assets perform poorly, at least you'll feel great knowing that you paid off some debt.

Lowering your mortgage rate and then continuing to pay down extra principal is a power move.

When You Have No More Debt

So what happens when you no longer have any debt to pay off? The answer is simple. Enjoy life, throw yourself a party, continue building passive income streams, and make sure your money doesn't run out!

Paying down debt is a great feeling. I've never regretted paying off a mortgage in my 20+ years of owning property. Paying off my $40,000 business school loan with a 3.5% interest rate in 2008 also felt great too because the stock market imploded soon after.

However, making money in stocks, real estate, and other risk assets is what will make us richer over time.

If low interest rates are too tempting to ignore, make sure the debt payments are affordable. I've got the 30/30/3 rule for home buying and the 1/10th rule for car buying to cover the majority of purchases using debt.

I never recommend anyone carry revolving credit card debt unless there's just no other way. Credit card interest rates are simply way too high.

Boom times are here again in the stock market and real estate market thanks to an accommodative Fed, effective vaccines, a rebound in corporate earnings, and a recovery in job growth. Just make sure to stay disciplined if you have debt.

If you find yourself asking yourself whether to pay down debt or invest, I say always do both. This way, you'll guarantee to always do at least one thing right!

Related: Ranking Debt Types From Worst To Best

Achieve Financial Freedom Through Real Estate

Real estate is my favorite way to achieve financial freedom because it is a tangible asset that is less volatile, provides utility, and generates income.

In 2016, I started diversifying into heartland real estate to take advantage of lower valuations and higher cap rates. I did so by investing $954,000 with real estate crowdfunding platforms.

Take a look at my two favorite real estate crowdfunding platforms.

Fundrise: A way for all investors to diversify into real estate through private real estate funds. Fundrise has been around since 2012 and now manages over $3.5 billion for over 500,000 investors. For most people, investing in a diversified eREIT is the way to go.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations, higher rental yields, and potentially higher growth due to job growth and demographic trends. If you have a lot more capital, you can build your own select real estate portfolio.

Both platforms are long-term sponsors of Financial Samurai and Financial Samurai is currently an investor in a Fundrise fund.

For more nuanced personal finance content, join 60,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009. Everything is written based off of firsthand experience.

Hi Sam,

I don’t have a finance background but I try to build models for certain long term household finance decisions like early primary home debt repayment. I’m having trouble justifying any early mortgage repayment based on my model. Please poke holes in it as necessary.

Primary home (only debt) $1.82M current balance, originated late 2020 @ 2.875% 30 yr fixed. Total interest over 30 years comes to $947K for the loan. Applying your formula would put 17-28% of our extra savings toward early debt repayment – so call it $2K a month / $24K a year. That repays the loan around year 22. On the flip side, if I throw that annual $24K into the S&P at 8% CAGR * number of periods remaining for each tranche, I calculated $1.2M for throwing in the ~S&P rather than early debt repayment. Total interest paid at end of year 22 is $678K in the early payback scenario since the amortization schedule skews heavily toward interest in the beginning. So net interest saved is only $270K at a cost of losing a $1.2M S&P investment.

But for someone who would like to be pretty much retired at the end of year 22 on this mortgage, in the early payback scenario I have the extra $96K a year not going to the mortgage. But in these next 22 years, there’s plenty of room for career growth (higher income), and coupling this higher income/inflation against the fixed $96K a year mortgage payments, doesn’t that become more affordable for years 22-30? Meaning at a targeted 3.03% average annual inflation for the next 20 years, that $96K is 80% less expensive then (assuming my employer has kept up with inflation raises).

Thank you!

~Josh

Hi Financial Samurai,

I had a question about your definition of “cash flow after living expenses.” How do other savings/investments factor into that number? Is the FS-DAIR framework supposed to replace or supplement existing monthly debt payments?

For example, let’s use the following numbers:

– $10,000 in monthly gross

– $1,000 to 401(k)

– $3,000 in taxes

– $1,000 mortgage with 3.5% interest

– $500 to IRA

– $2,000 in bills and general expenses

That leaves a net of $2,500. In this example, do I apply the FS-DAIR framework to the $2,500 net (ie. $875 extra to the mortgage)? Or do I apply the framework to the $5,000 left after taxes and expenses (ie. $1,750 to the mortgage)? In the latter case, do I consider the payment I’m already making a part of that total (ie. an additional $750 on top of the $1,000) or do I make that in addition to the payment I’m already making (ie. $1,000 + $1,750 = $2,750)?

In the section “Paying Down Mortgage Debt,” you say the following:

“Use FS DAIR again to allocate between 27% to 40% of your savings towards paying down mortgage principal. The remaining 60% – 73% should be invested after paying for general living expenses.”

It sounds like living expenses should come out of the 60% – 73% allocated to investment. That seems like a small amount to be investing, relatively speaking.

I would appreciate whatever clarification you may be able to provide. Thank you.

Hi Auggie,

Thanks for your question. It can be both.

At the basic level, it is the later. Your 401(k) contributions count as a part of the investment portion of FS DAIR. At the same time, I encourage readers to almost max out their 401(k) and take it as given. B/c the ultimate goal, if you want to achieve financial freedom sooner, is to build as large of a taxable portfolio as possible to generate as much passive investment income as possible.

But once you get used to maxing out your tax-advantaged retirement accounts like your 401(k), then it is about using FS DAIR for your $2,500 in this example. And given you can get a mortgage for ~2.375% – 3% today, then I would only allocate 23.75% – 30% of your $2,500 to paying down extra principal, and investing the rest.

Then again, since we have negative real mortgage rates today, you might want to pay down an even lower percentage of your cash flow to paying down your mortgage. It depends on how much idle cash you have as well.

Sam

Is it truly possible to not have closing costs? I tried out the Credible referral you had and for a higher *but still lower than my current* interest rate, they are offering to cover the closing costs.

I’m aware of points but I don’t see those mentioned. But I’m highly suspicious. It sounds too good to be true.

It’s called a no-cost refinance. The lender is covering your closing costs, in lieu of a slightly higher mortgage rate.

If you can refinance without fees, and at a lower rate, you are winning. You were instantly save on your monthly interest cost. I like no cost refinances because there is no breakeven period.

See: https://www.financialsamurai.com/all-the-mortgage-refinance-fees-in-a-no-cost-refinance/

I have a 3.85% interest rate on an investment property, 30 year loan fixed and the balance of the loan that I have remaining to pay is 100k. I am currently renting out the property. Aside from this, I have 300k in cash in money market and 400k in cash in the stock market. Just want to get people’s opinion on here and I know its not financial advice.

Option 1

Simply pay off the 100k balance and then I fully own the property which I rent out

Option 2

Re-finance and try to get a lower rate than 3.85.

Option 3

Pay off partial loan balance (maybe half) and try to get a lower interest rate.

Option 4

Change to a 15 year loan and get lower rate.

Thoughts and opinions? Am I missing additional possible options?

Option 1. $100K is not a big balance, especially with $700,000 remaining cash after.

Why wouldn’t you pay it down with so much cash?

Related: https://www.financialsamurai.com/the-biggest-downside-to-paying-off-your-mortgage/

agree, how would I approach it if I wanted to pay it partially off? Like 50k? Just ask the bank to give me a better rate in exchange for paying 50k off?

Hi Sam, I have taken your guidance to a new level! I have taken 30% of my liquid assets and paying down the mortgage on our primary residence to secure a rock bottom rate. 1 million total liquid assets, taking 300K to pay mortgage down from 800K to 500K to secure a conforming loan (instead of jumbo). Going from a 3% 30 year fixed at 3% to a 15 year fixed at 1.625%!! Never thought I would see a mortgage interest rate this low in our lifetimes!

Wow! GREAT rate and something I’d totally do as well. A double win.

You can calculate your return on your $300K by dividing it by your annual interest savings. It’s pretty high!

Thank you Sam! Glad to hear I am not the only one that would make that choice. Very interesting thought you have on doing that calculation to determine an effective return on investment (which is a risk free investment/use of funds I might add). I hadn’t thought about doing that type of calculation. Would you take the next year’s interest due on the 30 year loan to do the calculation or would you take the remaining interest on the 30 year loan divided by 15 years (the term of the new loan) and use that annualized interest amount?

I like your first paragraph showing risk appetite, income, age and a lot of other factors as everybody will find what’s right for them. Your simplistic formula is interesting, devil is in the details as usual but at a high level could work.

Below is my current philosophy for what it is worth:

I’m 35 and I’m investing 100pct. No way I’m repaying a penny with current interest rates and tax shield I can get too. I am below 3pct interest on debt and there is way too much opportunity for me to make more $ right now. My debt to income ratio is also ok (about 2x). Beating 3pct pre tax isn’t rocket science! I know a lot of wealthy people who don’t use debt to leverage their wealth and I respect this, having said this, from a pure return perspective the income loss is huge. These guys don’t care for the most part and just want piece of mind, they are set for life but if you are here to maximize your wealth (depending on interest rates) you’ll win.

Ultimately goal is to create enough income streams to pay all your expense including your interest and anything else long run should winter come. Once you achieved financial freedom up to you invest more paydown everything etc. Do you ever need to own your primary house for instance? I’ll argue that you don’t as there’s a high chance you’ll be moving multiple times in your life. Close to retirement makes total sense to own as you may not have time to absorb a crisis. Again lots of factor to come into it, I’m bullish invest invest invest (for low interest rate people, but of course paydown high interest debt!!!).

The last point to keeP an eye Is total debt to income. You do not want to over leverage and go bankrupt either. One other way to think of is to invest and get some income through your investments (e.g. dividend etc) and use that new source of passive income to paydown debt. It won’t be too painful tax wise (in theory) and you would still feel that you are prepaying a bit which is another question Sam, do you reinvest your dividends or not and if you reinvest is it within same class of assets or do you actually diversify again by reinvesting elsewhere?

I love this framework! I’ve been regularly paying down an extra $1500 in additional principal each month because I built it into my autopays after I refinanced. I figured I’d try and keep my monthly payments the same as before I refinanced but work towards paying down the principal faster. Anything I can automate helps so much because I find myself easily bombarded with things to do otherwise.

Great article and I really like the super simple formula to use when deciding which bucket to put money into. When talking to people early in their career this is a great formula to share, or help people with several debt all going at the same time. I am fortunate to only have housing debt left, and making a solid effort to pay that off while still maxing out the 401k.

Below is a link to is a really good article from Milliman that talk about the issues with 4% withdrawal rule I got today. Some really good numbers and statistics about retiring. Your .5% is super conservative, but you might not be off by much especially if you have a family history of longevity!

I recently read a book, “How I invest my own money” written by Josh Brown and Brian Portnoy. It’s a collection of stories by some of the most well known financial advisors in the industry. A couple things stood out. First, many value a paid off house more than optimizing debt versus investment returns. Second, they hold a lot of cash.

There seems to be 3 different types of investor on Financial Samurai. The people who optimize every penny they earn. The people who try to do more than the average and finally the set it and forget it crowd.

Your FS-Dair method is an easy way for all investors to determine what to do regarding debt repayment vs investment gains. Like you said, at least you guarantee you’ll do one thing right. My opinion is you’ll be doing both things right.

Love the simple formula. By default I am prone to paying down debt over investing. However, over the years I have seen the power in investing and often have to consciously tell myself I’m better off investing. Luckily, I only have mortgage debt at 3.125%.

I also like the bit about discounting your marginal tax rate from the formula. In an effort to constantly optimize (which is probably often to my detriment, but as an engineer I can’t help myself!), I’m wondering if it makes sense to also discount a risk-free and LIQUID rate of return, e.g. from a savings account. My money market just notched down to a paltry 0.4% APY, but adding to this to the formula would now account for rising interest rates if they ever come. Interest from savings accounts are taxed at ordinary income levels, so it makes sense to reduce by that rate, as well. In this case, I would be left with…

3.125% mortgage X (100% – 32% marginal tax rate) – 0.4% APY X (100% – 32% marginal tax rate) = 1.85%

Sam, does where you are in the amortization schedule come into play with this analysis? On a 30 year fixed, paying extra principal early jumps you ahead many more payments than it does at the end. It seems prepaying the early years provides a very strong rate of return, far above the actual interest rate on the loan; whereas the value in later years is nominal.

There is none as I don’t want to over complicate things. The FS DAIR rule’s effectiveness is in its logic and simplicity.

And yes, Paying down debt earlier will help pay off the loan earlier given a greater percentage of the payment will be to paying down the principal.

I had this same thought. Having just “reset” my 30 year fixed rate at 2.5% with the purchase of a new home, I found myself rounding up my payment to add additional principal whereby, my principal payment was a little over the interest portion of my total payment. I guess even on payment number 1, I can’t help but bump my principal payment.

My credit union account is still paying 1.5% on savings. The (fun) dilemma will be if/when my liquid CU savings account surpasses my 30 mtg interest rate.

If you have extra cash, what you can do is pay a lump some to principal to make the 30-year amortization table match the remaining years left on your previous mortgage if you wish.

I’ve done this many times before to keep me from straying. It’s also felt good.

It already has, kinda. For example, on a $500,000 30 year mortgage at 2.5%, you will have paid a total of $711,217.62, or $211,217.62 in interest paid. If you put the same $500,000 into your 1.5% savings (which is a hell-of-a rate, btw!), you would have $783,935.76, or $283,935.76 in interest earned. The break even is ~1.18% APY for a 30 year at 2.5% (not considering tax deductions/payment consequences).

Your savings compounds every month, whereas your mortgage is taxed on a smaller and smaller amount each month due to your principal payments. The two interest rates aren’t really apples to apples. With that said, if that savings APY goes above your mortgage APR, it will definitely be worth celebrating!

Thanks for the insight. I love this site.

I love this article. The chart may be overly simplistic in that it doesn’t take into account what the expected rates of return and inflation environment are, but any tool that attempts to apply broadly will inherently miss details. I think it’s a great rule of thumb and I think it’s great that the question is not answered with a binary: if the interest rate is x then pay all of your debt before investing. This method gives some diversification and acknowledges that we don’t know for sure whether or not our investments will outpace our debt. So it’s better to pay off some of each, depending on how certain you are that one will beat the other.

Point of clarification: There is a modifier that has to be applied if you are talking about investing in taxable accounts vs tax advantaged accounts vs debt.

Sure, feel free to elaborate.

Nice post with plenty of data for minds to chew on. A couple of nits to pick:

First, the Fed didn’t cause the housing bubble of the 2000s. This was a direct effect of the removal of Glass-Steagall by Clinton and the ‘Conservative’ Republicans in the mid-90s along with the loosening (or complete abandonment) of sensible regulation to allow subprime mortgages. It was Congressional and Banking greed, no leadership under the pretense of ‘free markets’, nothing more. The Fed sets the Prime as this excellent blog author has pointed out many times — but the housing bubble was ultimately the voter’s fault for whom they chose, and failed to keep on a tighter leash.

Second — the FS-DAIR is more complex than many may like. A simple formula to decide what gets paid off vs invested can be one’s monthly investment yields minus highest interest rate minus monthly inflation. If the answer is positive, continue directing excess cash into investments. If negative, direct excess cash toward highest debt. (If (Yield – (Debt I + Inflation)) > 0, invest, otherwise pay down Debt. (Or use annual or running 12 month values).

This becomes more complex when the investor moves beyond easy calculations like cash/equity/bond rates and into real estate, but using the mortgage interest + annual property tax hikes can be a suitable substitute to evaluate paying that down.

All of this is predicated on paying at least a little attention to monthly trends, without lettings yourself get caught up into daily micromanaging. If debt makes you emotionally uncomfortable, don’t tolerate it in your life at all. However, economically, it makes more sense to let your more liquid assets work for you if you can profit from the spread between your yields and your obligation costs (debt costs+interest).

This is the most comprehensible framework I’ve seen. Well done, Sam. I like this rule since it is so simple and will lead to a better life.

Cool, glad you Find it useful. My goal was to make it simple and easy to understand and your lies.

Thanks FS for the article.

I have a question. If you have a 30 year fixed loan at a very attractive rate 3.1% and you could invest in a 30 year investment grade bond at 4.5%. Would it make sense to invest 100% in the bond to take advantage of the interest rate arbitrage between the two instruments?

I am assuming that you keep the bond ’til maturity and that you bought it at par.

When paying down debt, you have a 100% chance of earning that return. In your example, you would get a ROI of 3.1% by making a principal payment. Even an investment grade bond has a risk of non-performance by the borrower. You need to discount for this over long periods of time. A bond rate AA has a roughly 99% likelihood of full return of principal. You would want to down rate the investment return based on the likelihood of return of principal. In your example, this would be .99 * 4.5%.

This needs to be adjusted for taxes in two ways. First, if it’s a loan that allows for interest deduction, then you will reduce your tax benefit at your current marginal income rate (which may vary year to year due to regulatory risk – e.g. changes in tax laws). Second, if you are earning a return on a bond with taxable interest, you will need to determine the after tax income at your marginal tax rate inclusive of the investment earnings.

A key thing to understand is your aggregate return will be dependent upon the margin tax rate you pay each year during your holding period. An investment may look attractive in this analysis now, but if your marginal tax rate goes up by 33% (133% of what it is now; from 32% to 43%) then your return will be wildly different.

Similarly, if your loan was tax advantaged, but loses it tax-advantaged status during the holding period, then you will have a very different aggregate return.

A further complication in taxable accounts, which you avoid in your example, is the tax effect of OID (Original Issue Discount).

For your example, if you’re in the higher marginal tax brackets (e.g. 32%+), You may be better off paying the loan, if you feel taxes will go up during your holding period for the bond.

It’s amazing to me that after 6 years in the job market I arrived at a very similar conclusion (50% debt payoff to 50% investing) after taking my company match and tax into account. Managing finances in US is hardcore stuff. Thankfully I’m passionate about finances and economics in general. Thanks for all you do, validated my approach and also enlightened me over the years.

I like the overall idea, and thanks for offering a broad rule for many to follow. Great post!

One proposed modification:

Shouldn’t the DS FAIR change though based on the risk-free interest rate for investing? If the interest rate on your debts is fixed and the return on investments variable on market conditions, the latter would seem to be an important variable to consider in allocation of capital.

To this end, I’d maybe offer the (interest rate on debt) – (risk free interest rate) * 10 to calculate the new DS FAIR? It does add a new wrinkle, but seems to be more logically consistent to me.

I don’t understand why you would pay down any debt? I allocate all of my money to my leveraged stock investments in order to take full advantage of compounding interest. I am confused as to why anyone would remove dollars from a compounding interest investment to pay off debt at a very low interest rate.

I wrote about my investing approach here: patientwealth.com/extreme-investing/

Sometimes markets go down and the economy turns bad. Have you been investing since circa 2009 or before? How much money are you investing total? I’ve found my risk tolerance tends to go down the more I accumulate.

For example, let’s say you return 5% on $10 million, that’s $500k, enough to live well. But if you lose 10% on the $10 million, that’s a pretty painful loss.

Have you considered working as an investment professional given your track record? It’s a pretty lucrative business. I know one guy who simply trades a pretty reasonable $3 million portfolio of his own for a living.

FYI: in my 20s I went 4:1 leverage on San Francisco property that turned out OK. Now I’m retired and don’t want to take as much risk.

I appreciate that you religiously remind folks that markets go down. Absolutely true. In the short term. And if one is investing by picking individual stocks, there’s much risk with the potential greater reward by not diversifying. I’d suggest you add in:

Markets can go down (even to $0 in theory). In the short term. The gamble is: will you NEED the money when you are at the trough of a cycle, or somewhere north of it. The fact is, WHEN the market goes down and you need some (or all) of those assets then, you’ll realize a loss rather than just have paper losses. The prudent investor has a spectrum of investments just as Sam has preached in other posts — simple savings like a CD ladder that is cash-available for short to mid-time frame life expense coverage, and a mix of equities/bonds/munis/physical investments in various percentages. Most of us will live long enough to see the far side of whatever recession is on the horizon, and should be coached to think both short and long term.

[…] Pay Down Debt Or Invest? Implement FS-DAIR […]

[…] Related: Pay Down Debt Or Invest? Implement FS-DAIR […]

[…] version of Financial Samurai. My only innovation is coming up with new financial metrics like FS-DAIR for paying down debt or investing, FS-FR Score for measuring fiscal responsibility, the 1/10th rule […]

I’ve been reading a few of your articles, and I’m now feeling very sick about my retirement savings. And I’m not seeing many, if any, articles that apply to people that make under $100k/yr. (some of us choose to live in areas of the US in lieu of higher paying jobs.) My husb & I have a combined income of $80k/yr. I am 48 and my husb is 52. I feel like, based on your tables and articles, I’m VERY behind in my retirement saving. We have about $250k saved. We have $150k mortage debt (including 2nd mortgage, which I regret taking on, to help with house repairs/renovations), $10k cc debt (and now my $12k student loan debt for a portion of my MBA degree that I will receive in Dec’15 — no regrets on my degree). I have 8% added to my 401k with 4% match and my husb has 10% added to 401k (no match). I’m trying to pay down our cc debt. I have been increasing my 401k contrib amt by 1-2% for the past couple years, but we just don’t have that much extra funds to spare. Any advice?

Abby, my family is in the same boat as yours re lower income. But we live in a lower cost-of-living area, so there’s some compensation there. For those of us making <$100k, the math is simply a longer and not-as-steep gain curve. That means we simply do everything slower.

Unlike a lot of folks here, I'm not a CFA or work in the Financial sector. But I will say from an emotional stance, that debt is a huge stress burden. That stress isn't something easily calculated into a simple math formula. However, what you wrote suggests you guys are well on your way to where you want to be: Your household is already contribution 18% to retirement (w/o match). You already have a substantial savings.

I'd say try a de-stressor experiment: Take any additional money you have and pay down the highest interest debt while making minimal payments on all others. Just commit your resources to making ONE headache go away. (Personally, I despise credit cards and would target that, but if the cards have an immutable interest rate lower than other debts and no annual fees, choose the highest rate debt first.) It's amazing what removing one bad element of your life can do to your mood. Becomes addictive toward killing off others. The only caveat here is if you don't have a built up emergency fund — do THAT first, even if it's only a couple of month's living expenses, have that buffer in place with sometime simple and cashable like CDs, even with their crappy interest rates.

Abby,

Don’t be discouraged, you will be fine. Truth is, you’ve managed to live your life on less income than many others on this site, and you probably will need less than they need in retirement. My advice would be pay off credit card debt first. Don’t even bother saving elsewhere until cc debt is paid off. Once you get to zero cc debt, you will then have significantly more to contribute to your retirement accounts each month. Avoid cc debt at all costs.

[…] – $20,000 a month in various securities while paying off some rental mortgage debt (Related: Pay Down Debt Or Invest?). I am unwilling to go naked long American Airlines due to the stock’s […]

[…] Buffet can beat the average credit card interest rate over his illustrious career. Please read FS-DAIR, my guide to helping you decide how much debt to pay down and how much to […]