Some employers pay their employees with company stock as part of their total compensation package. This way, employees become owners and potentially feel a greater sense of duty towards the firm.

If you don't own any of your company's stock, you might be less inclined to come in early or leave late. Without company stock, maybe you'll walk by the piece of trash in the hallway instead of picking it up. Instead of going the extra mile, you may do just enough not to get fired!

Since I began working after college in 1999, I've always received company stock as part of my total compensation. First it was at the two investment banks I worked for 13 years. Today, my wife and I own 100% of Financial Samurai.

Company ownership does feel good. However, not all company stock is created equal as you’ll see below. First of all, it's unlikely you've been working at the same job for over 30 years. Just imagine working at Apple since the 1990s when shares were trading for less than a dollar compared to over $200 today. Instead, you've likely held multiple jobs and seen various company shares go through through many cycles of ups and downs.

Why You Should Regularly Sell Your Company Stock

Although it feels great to own part of the company you work for, you should still regularly sell some of your company's stock whenever you can. Here are the four main reasons why.

1) Diversification. You're already highly leveraged to your company.

For most people, their career is their #1 money maker. The better your company does, the better you will likely do, and vice versa. To then accumulate company stock means more concentration risk.

When your company is doing well, you're thrilled to own as much company stock as possible. However, things never go well forever. As a minority investor, the vast majority of decisions are outside your control.

If your stock begins to do poorly because of bad senior management decisions, you may experience a double whammy of a decline in your company's stock price and a job loss. Therefore, selling your company stock to diversify your exposure makes sense.

The longer you work at your company, the more company stock you will receive. As a result, it's wise to regularly sell some or all of your vested shares each year. Even after selling, you'll still own shares since you can rarely sell your entire holding at once.

In 1965, the average tenure of companies in the S&P 500 was 33 years. By 1990, it was 20 years. It's forecast to shrink to 14 years by 2026. Why is the tenure of companies in the S&P 500 striking? The main reasons are due to competition, M&A, innovation, and failure.

Your company's share price will inevitably go through a downturn. When it does, you will be glad to have diversified.

2) To build passive investment income.

Besides diversifying your net worth, you should sell company stock to generate more passive income. There's a good chance your company's stock does not pay a dividend. For example, the majority of tech growth companies do not pay dividends.

Therefore, the only way to capitalize on your company's share price is to sell. Once you've sold your shares, it's worth reinvesting the proceeds into assets that will generate passive income. These assets include dividend-paying stocks, REITs, bonds, and private real estate.

If your company does not pay dividends, it is likely a higher beta company that is highly dependent on future cash flows. The more dependent a company is on future cash flows, the riskier it is because the future is so unpredictable.

One of the keys to getting rich and staying rich is to turn funny money into real assets. And I consider companies that don't pay dividends a type of funny money. One day its share price could be flying high. Another day it could crash down to earth due to an endless number of exogenous and endogenous variables.

The more passive investment income you can generate, the more freedom you will have.

3) To pay for things today to improve the quality of your life.

Holding any company stock means investing for the future. However, we also need to live for today. By regularly selling company stock, you can use the proceeds to pay for vacations, buy a safe car, purchase a nice home, take care of your parents, and pay for school tuition.

There's no point in saving and investing your money if you're never going to spend it. Even if your company's stock price continues to appreciate in value after selling it, you will still be able to enjoy the experiences and the things you've purchased with the proceeds.

Say it with me. Occasionally selling stock to pay for things you want is OK!

4) To pay for taxes.

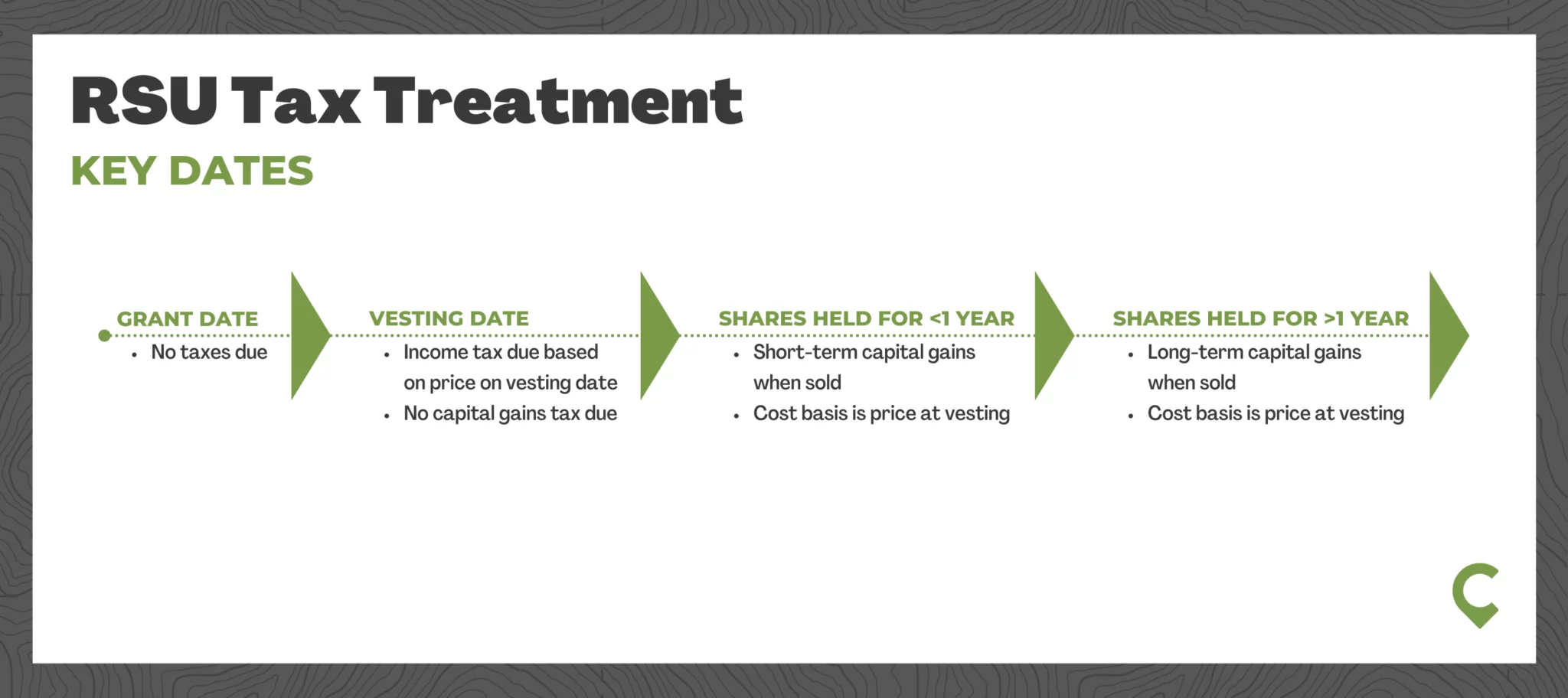

With Restricted Stock Units (RSUs), you are taxed when the shares are delivered, which is almost always at vesting. Your taxable income is the market value of the shares at vesting.

RSUs compensation is taxed at your ordinary-income tax rate. Think of them as a cash bonus that’s linked to the price of your company’s stock.

If you hold the shares for a year or longer after vesting, any gain (or loss) is taxed as long-term capital gains (shares held less than one year from vesting are taxed at short-term capital gains tax rates).

If the value of your company stock plummets before you sell, then you may face a highly unfavorable tax situation.

Example Why Selling Some Company Stock Is Important

Let's say 1,000 RSUs vest at $100/share and you are in the 35% marginal federal income tax bracket. You have to pay $35,000 in marginal federal income taxes on the $100,000 in proceeds.

However, if you decide to hold onto your shares after vesting, and the share price declines to $35/share, you're losing. Not only do you still owe $35,000 in marginal federal income taxes, but now you only have $35,000 left in stock! In other words, because you didn't sell your RSUs on the vesting date, you are left with nothing.

Sure, you have a $65,000 loss that can be used to offset a $65,000 gain immediately that year. However, it may be hard to come up with a $65,000 gain in such an environment.

Selling your stock options as they vest is good tax liability management. Plenty of people got burned during the 2000 dotcom bomb and 2022 bear market by not selling stock after vesting.

Glad I Sold My Company Stock Every Year

From 2001 to 2012, I worked at Credit Suisse. Each year, I sold my vested shares to diversify into real estate. After experiencing the 2000 dot-com bubble, I was determined to buy more real assets. I sold shares valued between $20 – $70/share during this 11-year period.

In 2012, I negotiated a severance package that let me keep my three years of deferred Credit Suisse stock. I proceeded to sell stock every year they vested between a price range of $25 – $30 from 2013 – 2015.

It didn't feel great selling Credit Suisse stock every year at a 10% – 30% lower share price. However, I wanted to sell because I was bearish on the equities business.

Part of the reason why I left in 2012 was that technology was hollowing out our business. Algorithmic trading and the internet meant commissions and fees were headed to zero. If I was bullish on the equities business, I would have stayed for six more years until age 40.

R.I.P. Old Employer

On Monday, March 20, 2023, Credit Suisse's share price dropped to an all-time low of 0.98 a share after getting acquired by archrival UBS.

I feel sad because Credit Suisse didn't need or accept bailout equity financing during the global financial crisis, but UBS did to the tune of $69 billion. Funny how fortunes turn.

CS made too many mistakes after I departed in 2012. One of its most egregious blunders was losing $5.5 billion due to its exposure to Archegos Capital. Archegos Capital was over-leveraged, and Credit Suisse was left holding the bag as one of Archegos' prime brokers.

Be careful which firm you plan to dedicate your life to. If you pick the wrong horse, you may have wasted a lot of time, especially if you didn't sell company stock to pay for a better life.

What If My Company Stock Continued To Go Up?

It's easy to be glad to have sold company stock if your company's share price ends up imploding. However, what if your company has lots of positive momentum? You feel strongly your company's stock price will continue to rise over time. Should you still sell your stock each year?

I think the answer is still “yes,” but perhaps not 100% of what you are able to sell each year. Remember, usually, only a portion of your shares is eligible to be sold each year due to a normal three-to-four-year vesting period.

No matter how bullish you are on your company, random exogenous variables happen all the time that can deliver huge setbacks. Recent variables include the pandemic, lockdowns, government law changes surrounding evictions and student loans, bank runs, wars, and an overly aggressive Fed.

In 2022, companies such as Meta gave up five years worth of stock gains. In 2023, Silicon Valley Bank gave up 40 years of stock gains as it went into government receivership. Stock prices can correct in a hurry.

Sure, you could get lucky being an early employee at companies like Apple and Google. If you never sold shares for at least ten years, you would be rich beyond your wildest dreams. But the odds of joining a superstar company early and lasting for ten-plus years are small.

Don't forget, your reinvested proceeds can also do well.

The One Thing To Buy With Company Stock Proceeds

If you are bullish on your company, my best recommendation is to sell enough company stock to pay for things that provide you with incredible value today. Buying a nice house to enjoy life and raise a family if you have kids is a prime example.

I doubt you will ever regret selling company stock to buy a house you love. The memories you create in the house are priceless. Positive memories tend to appreciate in value over time. Everything else, such as entertainment and food, can be payable through your salary.

In 2023, I decided to take a leap of faith and buy a forever home. Prices were down and the stock market was up, so I figured, why not buy a nice home to take care of my family. My Provider's Clock is ticking loudly with two young children. I want to provide everything for my children until they go away to college and hardly ever visit us again.

Besides, the better your company does, the more you will get paid overall. Therefore, even if you sell some company stock that continues to appreciate, your salary will continue to go up and the rest of your unvested shares will continue to appreciate as well.

Carefully Analyze Your Company And Industry Each Year

If you are receiving company stock each year, then be realistic about your company and the industry's prospects. After a while, it's easy to get so drunk on your company's Kool-Aid that you are no longer aware of the circling sharks.

Living in San Francisco, it was relatively easy to see banking was a lagging industry that would continue to lag compared to the technology industry. As a result, I sold company stock every year, left after thirteen years total, and leveraged technology to start Financial Samurai.

I tried to get a job at Airbnb in 2012, but couldn't. So I just incorporated my own business and bought other tech companies instead.

When the government forced so many businesses to shut down in 2020, I became more bullish on owning an online business that couldn't be shut down. High-margin, cash-cow businesses that don't require employees are great!

New Challenges Ahead

However, today, the sharks are circling with the growth of artificial intelligence and short-form content from the likes of TikTok. Therefore, maybe it's a good idea to sell some of my company's stock and diversify.

The reality is, I'm unmotivated to sell off a piece of Financial Samurai because I don't need the money. Further, my net worth is already highly diversified.

Inviting minority partners just means extra work and headaches. One of the main attractions of running a lifestyle business is not having to manage anybody! Besides, I can always leverage AI and create more short-form content as well.

Company stock is just a variable component of your total compensation. Treat the risk asset like any other risk asset and do your due diligence accordingly.

Reader Questions and Suggestions

Do you regularly sell company stock? When were the times you regretted selling some company stock and why? What are the main things you buy with company stock proceeds?

With mortgage rates coming way down after the regional bank runs, I'm more bullish on real estate. Take a look at Fundrise, my favorite private real estate platform that invests primarily in the Sunbelt, where valuations are lower and net rental yields are higher.

In addition, one of the most interesting avenues I'm allocating new capital toward is Fundrise Venture. It invests in:

- Artificial Intelligence & Machine Learning

- Modern Data Infrastructure

- Development Operations (DevOps)

- Financial Technology (FinTech)

- Real Estate & Property Technology (PropTech)

A sizeable amount is invested in artificial intelligence, which I'm extremely bullish about. The investment minimum is also only $10, as Fundrise has democratized access to venture capital as well.

Financial Samurai is an investor in Fundrise funds and Fundrise is a long-time sponsor of Financial Samurai given our investment outlook is aligned.

For more nuanced personal finance content, join 65,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

I sold most of my stocks and options when I left INTC. They will never reach their dot com height again. Everything has to go right for their stock price to go up. That rarely happens. INTC went up during the semiconductor shortage, but it’s back down to earth now. I have a few shares left because they pay dividends. I should have sold them in 2021.

RIP Gordon Moore.

I would agree to sell rsu regularly for most companies. However, if you work at let’s say a start-up/ mid size company that experienced robust growth for past few years and you are pretty sure it will continue long term, why would you sell? I understand this is not diversified strategy at all but isn’t this the best way to reach your net worth if the stock outperforms s&p500 or average housing growth by a wide margin? Also if you sell stocks that have huge capital gain in past years, it will trigger large tax consequences.

Yes, it’s easier to tell a startup’s growth trajectory and therefore, hold if the growth is robust.

However, a lot of startups’ valuations got hurt in 2022. Even Stripe, went from raising at $100 B valuation to only $50 B valuation recently. Still amazing for early employees. Not so much for employees who joined over the past 3 years.

Thank you for your insight. My husband has just started to receive RSUs so we are new to this. This info is very helpful.

In my opinion anyone believing they will receive more than %5 return in the market over the next decade, or just about another investment right now is fooling themselves. With inflation this means you are actually loosing money. Believing you are the smartest guy in the room investing in any single stock, sector ,or mutual fund almost guarantees that you will loose a lot of money in my opinion. Jumping in and out of stocks and sectors all the time may work for a while if you don’t go crazy in between watching your money move quickly up and down. Few people have the stomach to wait 7-15 years for the Dow, or the Nasdaq to rebound if they bought at the wrong time and only a fool would believe that the markets will always go up. The legendary Jack Bogle predicted before he died that the only way we will these big annual returns again in the market is if we get a %50 decline. Factor in all of the taxes you will have to pay jumping in and out of the market and it is truly enough to make your head burst. I believe everyone should be ready for the pain, and the tremendous buying opportunity when the real crash arrives. Good Luck :)

Sam

I hope you write about the following 2 problems that are on our doorstep.

1 commercial loans to office space and the banks that hold the paper. They are amortized over 20 years but they reset every 5.

So many of these loans are in bad shape, and the banks that have the paper are in bad shape.

Kind of the same but different Europe, UK and Canada homeowners don’t have 30 year mortgages. They have 30 year mortgages that are variable, reset every 3 years. They are screwed, with raising interest rates and central banks raising rates, Europe is bound to have a major recession. That will leak into the United States…my opinion

With bounces in the stock market this year, I’ve been selling portions of recently vested RSUs more aggressively than usual. My normal strategy is to cap the value of my company shares I would like to have tied to my net worth. When above the cap, I feel I can sell with no remorse even though I don’t need the extra funds since regular income covers living expenses.

I’ve had a philosophy that money in the market should stay in the market, so my diversification strategy has been to sell RSUs and buy into a three-fund ETF portfolio. With the bear market of last year, it has been fine for me to sit on unrealized losses in the diversified portfolio since dividends automatically re-invest, which has actually meant that I haven’t needed to invest new money as actively for it to grow.

My approach actually shifted a bit this year due to the fact that I can get decent returns from investing cash. So with the funds from RSUs I’ve been selling, I’ve opted for cash versus growing the balanced portfolio. I figure we’re still in uncertain times and I can bide my time and be patient for downturns/opportunities to incrementally grow the balanced portfolio.

The other benefit of I’ve found with regularly selling portions of RSUs is that any remorse tied to missing out on upside feels very temporary. For example, in boom times it might seem like I sold too early but when I consider the fact that I’ve also seen decent gains in the balanced portfolio coupled with dividend income, it’s not as easy to make a direct comparison into how much upside I truly missed out on. Plus, I still experience that upside with RSUs I didn’t sell. With a bear market like last year, I saw large unrealized losses in the value of vested RSUs but I didn’t feel pressure to sell because it just meant I was below my designated cap and needed to wait for more RSUs to vest. So essentially, the value of my vested RSUs reflects the comfort of risk for it to be completely wiped out from my net worth in (hopefully) a very unlikely scenario.

Additionally, it’s been nice going out for fine dining knowing that I have extra funds by realizing cash above my RSU cap, and also knowing that more RSUs are still in the pipeline to vest.

In general I agree with the advice to sell company stock quickly to diversify. Sometimes other considerations come into play tho. I was a senior executive at a large company and got RSUs that vested each year. I was working in CA, which has a punitive state tax rate, but planned to retire to a no tax state. I was able to defer these awards until retirement when they will be paid out in 10 annual installments. So I avoided 13.3% CA tax. It did force me to build up a big equity position that I will be able to divest slowly. So being locked in seemed to be a downside. However so far its worked out well with the stock up big, even last year. But it was a gamble for sure.

Curious, what was the stock that was a big last year during the bear market?

One of the things also to consider is the net investment income tax and the higher 20% long-term capital gains tax if you are above a certain total income.

Edible typo :). RSU’s are often taxed at vesting so you get shares after taxes have been paid. 10 shares vest, 3 are used to pay taxes, you only receive 7. Avoids the whole 2000 implosion issue

I typically hold a portion of my company performance shares once they vest since the dividend is 4-5% (public utility). Where I got burned was on a spin-off the company did in the early 2000’s. The spin-off stock price peaked a few weeks afterward and then dropped like a rock and never recovered. I thought it was foolish to sell so quickly like some folks did…lesson learned!

Next time then! At least you got some dividend income.

+1 to this advice. I’ve been selling all my RSUs during the open trading windows ever since I started working for publicly traded companies 8 years ago. I’m consistently shocked by how many of my peers hold onto the shares, thinking that they’ll be able to somehow beat the market. My strategy is super simple: sell all the RSUs I’m allowed to when I’m allowed to and put all of it into a Vanguard index fund.

Related to the question of selling RSUs, I’d love to get your take on the mega backdoor Roth conversion. My naive assumption is that for folks that plan to retire early, it’s not worth it, but I haven’t had time to do a thorough analysis.

I would do it after retiring because, presumably, you would be in the lower tax bracket.

See: https://www.financialsamurai.com/shifting-retirement-assets-from-tax-deferred-to-tax-now-roth-ira/

Thanks Sam,

Very timely post for me. I work for Microsoft and big part of my compensation is stock based. For several years, I sold annually most of my vested stock. However, now I haven’t sold in almost 2 years, while the tech stock prices have been declining due to higher interest rates. I still feel bullish on Microsoft’s future, but I almost weekly think of selling, while I have too big part of my networth invested in MSFT. This post helped me to make the decision to reduce my exposure.

So much hype around chat GPT, an artificial intelligence. A nice rebound recently.

It depends on how much money you have, what percentage of Microsoft stock is your investable assets and net worth.

Do your company stock like any other company stock and do your due diligence. It’s hard not to feel very positive about your own company. After all, you’re working there.

You are right Sam, The AI hype has definitely helped to rebound the tech stock prices – especially MSFT. I have one third of my net worth (and 50% of my whole stock portfolio) invested in MSFT, which is obviously way too much. MSFT is probably one of the most analyzed stock in the world, so I don’t even dream about having more insight of its fair value than the market has. Also, my background is technical and doing deep financial analysis on stock prices is not my strong point. After writing this, it is even more obvious that I should just sell and diversify. Rest of my stock investments are index funds.

PS. Obviously, it would be interesting to see how the AI investment pays off, before selling. However, that’s more gambling than investing.

Hard to know the future. But the one thing I 100% know is that Google is going to come out with an incredible AI version as well. Don’t count them out!

I participate in my companies ESOP program which is part of the 401k match. Since I contribute much higher than required for the match, I get a healthy amount of employee stock with each contribution. I try to regularly look at the balances and shift around, but still ultimately end up with a high single digit percentage of my 401k. It’s not my only source of retirement savings but a good chunk.

While I understand the logic, and it’s something that was preached to me all through my business school classes, I know of others that have taken the advice fully and diversified it all out and missed gains over the past 10 years. I work for a very large defense contractor, and I truly don’t see any risk over the short to medium term the way our country operates. After Afghanistan, I was hoping we’d turned a corner on some of these “forever wars”, but it became clear pretty quick that our federal government looks at the military industrial complex as a major priority to keep funded, no matter if it’s an R or D next to the name in office (which historically has mattered significantly). Our company stock also pays a healthy dividend, so I’m not sure I should take the approach to move it all out of my current allocation. Obviously, things can always change though.

Howdy, how did the people completely diversify out unless they left their jobs? Because so long as you are working at a job that pays you some compensation in stock, you’re always getting more stock. Thx

They just keep rebalancing within their 401k. Moving it from their ESOP fund as it grows to another fund within the different offerings. Obviously the stock is still contained in those somewhere as most are various index funds, but not as direct as the ESOP.

The article is spot on. I worked for a large Telecom firm that went bankrupt and many of my colleagues failed to diversify and lost a large portion of their wealth. Diversification is the key to any sound financial plan and most people view their employer through a rose colored lens and don’t want to admit that it can fail. I certainly lost money in the bankruptcy but fortunately I had sold plenty and came out better than most. Be objective with your money and don’t fall in love with your company for the wrong reasons which can lead to bad financial decisions.

+1, sell when able during best it at a trading window.

Early in career can take some risk and hold, but over time you’ll need to serial by diversifying.

I am fairly new to receiving RSUs so I really appreciate your perspective. My company automatically cashed in the % needed to pay estimated taxes on them as soon as they vest. I didn’t like that at first but probably for the best (at least in my case). I have been sitting on the vested stock and planning to convert to an income generating asset – probably div stocks or another rental property. However the stock price is down over the past two years and i would have done better to follow your advice an sell. I have to take another look at it and decide what to do.

I’ve never been one to own my own company’s stock but RSU’s feel like “found money” and easier to just let it ride and hope for the best. The company is still solid and I figure if it tanks and I lose my job as part of a mass layoff, the stock may jump (like many tech companies recently) and I can sell them.

Still pondering but appreciate you addressing the topic and giving me more to think about.

“ I figure if it tanks and I lose my job as part of a mass layoff, the stock may jump (like many tech companies recently) and I can sell them.

”

This is an optimistic way of looking at things. But I think it is incorrect. Please reassess.

Wow…thanks Sam, your article just came right in time to solve the dilemma I have. In my case it is not the RSU but the “free” pension money the company gives me every year. The penalty for early withdrawal is the same as the IRA and it is also being taxed at federal and state level. I am going to use this “free” money to pay down my high interest debt so I can increase my cash flow for investment.

Sounds good to me! I have never regretted paying off high interest rate debt or even low interest rate debt.

I’ve always sold a bit of my vested RSUs, vested options and ESPP periodically. I typically sell to maintain a constant balance of vested and unvested shares. I’ve won a little less on the upside but lost less on the downside. Basic diversification strategy. I try not to get too greedy and I’m still fine with this decision which has been going on for over a decade.

I was lucky. I held all my stock in a tech company for 10 years which included rsu, bonus, and espp. Luckily it was still at all time highs when I cashed it all out last year when I left with severance and plowed all those funds into my primary residence. Couldn’t be happier.

Nice. Did you end up retiring? Be careful to have too much concentration in your primary residence as well.

Sahd for now with young children. Only 40 so not sure if I’ll go back to work. Right now, relying on a working spouse and spending dividends. I can make it all work since the paid off house reduces my cash flow needs.

Should you hold a year and sell the gains as long term gains, or sell soon after they vest?

In my previous job, I had bought stock at a discount at prices in the $40 – $70 range. In 2016, it started to go down, and I didn’t realize I was still buying until the end of 2017 or 2018 (I don’t remember). Then starting in 2017, I was awarded equity, 80% in stock options, 20% in RSU. By 2017, the stock was in the 30s, then to 15, though in 2019 it jumped to 20s for a few weeks. I should have sold then, but I thought I had inside information, which I didn’t. I left in 2019, when the stock was down to $9, and forfeited all my options that were much higher than that. I still have that little but of stock in a Fidelity account that I think of selling.

For my current employer, my first equity award (100% RSU, no options) vested 9 days ago and sold a lot to pay the taxes. I am waiting for it to go up a tiny bit (7.6% higher than it was granted at), and then I’m going to sell the whole thing and put it into my house ARM loan, which goes from 3% to 5% in a few days. My dad suggests waiting so the 7.6% increase in gain is long term not short term, but I’m too nervous based on my prior employer and want to diversify now.

This is spot on. I will share my experience working for a large diversified non-tech company. I joined this company in late 2000s and still work there today. Many employees and executives traditionally were over-allocated to this company. Financial exposure as follows:

1) Ongoing salary

2) Pension (program has since been closed)

3) Stock options and RSUs

4) Employee stock purchase program

At it’s peak, over 20% of my net worth was tied to this company (15% equity, 5% pension). The company’s stock price tanked and is now at a 10-15 year low.

I lowered my exposure over the past five years before things got really ugly. Many of my peers did not – they kept shares because they didn’t want to pay taxes, kept allocating salary to the stock purchase program, and kept electing for options (not RSUs). Thinking this company is a steady eddy. Nope.

Fast forward to today and <1% of my net worth is tied to company equity. My pension value has increased to 10% of my net worth given my years of service.

Glad you diversified! And I’m impressed your pension is worth so much. Very rare nowadays.

Sam, I didn’t know you worked for Credit Suisse. What a crazy story. I like how you stated that they started making errors after you left in 2012… maybe if you stayed on you would have convinced them to divest from Archegos Capital, and maybe would have saved the company! ;)

Seriously though the AI piece is interesting, but who knows how it will play out. It will certainly disrupt a number of jobs and businesses, but I think that it could also consolidate trust in individual/private businesses with established track records. One of the main reasons I visit this site is the personal/individual touch and feel that is has.. most people like personal relationships and unique individual attention.. and AI is going to have challenges with that. That being said I tried ChatGPT myself and was blown away by answers to some very complex subspecialty questions.. but I think it is better at collating and distilling data, than predicting the future for investments..

Anyway, have you ever considered starting your own private investment office or firm? I would invest, and you probably could get a lot of people here to invest….

Yes, if only they made me a Managing Director and head of prime brokerage. I would have sniffed out Bill Hwang’s excessive leverage and saved CS $5.5 billion in losses! Oh well. Next life!

AI will definitely disrupt the search model if the search results no longer have any results from different websites, such as mine. Therefore, it’s important that all creators keep on building their own channels, their brands, and their community. I’ve believe this since day one. But it’s also harder to do than said

I also go to websites that share a personal angle and can tell stories. That’s the reason why I don’t just read encyclopedias and dictionaries for knowledge.

I thought about starting an Investment syndicate. But it takes a lot of work. It might be easier to actually just be a venture scout to generate leads. I am sure there are a lot of great companies and interested Capital from the Financial samurai community. Just takes work!

What’s your thoughts on selling company stock purchased through ESPP? Would you recommend a different strategy with these?

For over 10 years I participated in my company’s ESPP. But stopped a few years ago. Check your policy – for mine, you had to hold for 1 year. If you held for 2 years, there were favorable tax treatments on the discount and dividends.

Over the past 5 years, I stopped participating and slowly sold off shares in chunks to diversify.

Another way to think about executing a strategy on company stock (RSU, Options, etc.) is to determine your annual funding needs to have a very comfortable retirement by a certain date (preferably early retirement). Sell enough stock each year to fund that amount and hold the remaining balance of shares in your account.

Of course, if you have a huge run up in value then maybe take 2 to 3 years of your retirement amount and invest it then. It is almost like a $ cost averaging technique for stock and at least a disciplined way to save money for retirement. I did this over an 10-year period and it worked out great.

I tried probabilistic modeling on option values (binomial) for an answer on when to execute, and it was all predicated on variables that I could not readily define. I went back to the simplest solution that gave me inputs to my Monte Carlo retirement model (annual savings amount) that allowed me to retire early if I so desired.

I think there is no right answer but one, take money off the table and do it towards a goal that you define.

Good way to think about it.

The thing is, even if you sell your company stock, you will likely still have a lot more company stock behind. And if you continue working at your company, you’ll get even more company stock at higher prices if the stock is appreciating.

Very sound advice. There’s definitely risk involved in having your entire salary and equity tied up into one company. I think selling stock on a regular basis to then diversify it into other investments is the way to go. Especially in these volatile times. Thanks Sam

Sam – You should consider selling a portion of FS! I’ll invest $100 and you can pick any valuation you want. It’s like a nice fat pitch for a post on April 1!

In all seriousness, I sold 100% of my options as soon as they vested at my former employer. Having a paycheck and company stock felt too concentrated for my risk preference.

Oh man, with $100, I could buy 90 McDonald’s cheeseburgers and feed my family for the week! Very tempting. :)

Alas, a simple life is a wonderful life. Can you imagine having to go from total freedom to providing quarterly updates and answering to shareholders?

Freedom is the best! But thank you for your offer.

Related post: The Lifestyle Business Or The Big Pay Out