Remodeled homes will sell for bigger premiums going forward because it has become so much more costly and difficult to remodel today. In the previous article, I focused mostly on the negatives of remodeling. However, this article will focus on the financial benefits of remodeling. Namely more rental income and a higher property value.

If you want to build above-average wealth, hold onto your rental properties for as long as possible. This way, you let inflation and economic growth be the driving forces for rent increases and property price appreciation over time. You’re also have an asset for your children to manage or enjoy.

The home I bought and began remodeling in 2019 turned into a rental in October 2020. Here's a case study on how much money I ended up spending on the remodel and how much additional rental income it now generates. I'll also calculate how much potential value the remodel created if I were to sell.

Remodeling Your Rental Property For More Rental Income

After remodeling the kitchen and three bathrooms on the top two floors, I ended up renting out the space for $6,700 a month. I also refinished the floors and painted the walls. The top two floors consists of four bedrooms, an office, dining room, kitchen, living room, and three bathrooms.

The ground floor was uninhabitable because my general contractor blew everything open in order to more easily rewire the house with modern ROMEX wiring. Therefore, I lost a half bath and a room. If both those rooms were kept, maybe I could have rented out the house for $6,900 a month. The rooms were just really run down.

I was hoping to spend $100,000 gutting and remodeling the ground floor. Unfortunately, the project ended up costing me about $130,000 due to delays and rising labor and material costs. I thought the remodel would take 10 months to complete. Instead, it took more than two years!

With the downstairs remodeling project done, I'm now renting out the entire house for $8,000 a month, a $1,300 a month increase. Luckily, I found tenants the very next month after my previous tenants moved out. Hence, full occupancy.

Let's do the quick math on the remodeling return. One of my consistent goals is to keep building more passive income to remain free. And one of the easiest ways I've been able to do so is by rehabilitating properties and renting them out at market.

Gross Return On Remodeling Project

Charging $1,300 more a month in rent means earning $15,600 more in rent a year. Therefore, to get an annual return, I would simply divide $15,600 by $130,000 (cost of remodel), to get 12%.

A 12% annual return is great compared to the 10-year bond yield (~4%), the average stock market return of ~10%, and the average bond market return of ~5%.

Obviously, in a down market, a 12% annual return is even better. However, a 12% annual return is not the true return on the remodeling project. Let's calculate further.

A More Conservative Calculation On The Remodeling Project Return

Did my $130,000 downstairs remodel really enable me to generate $1,300 more a month or $15,600 more a year in rent? Probably not.

Thanks to inflation, rents would have increased slightly anyway from the existing $6,700 a month in rent charged from October 2021 through May 2022. The rent from October 2020 through October 2021 was $6,550. Upfront, they agreed to the $150 increase after one year.

Realistically, the market rent would naturally go up by 4-5% after one year, starting in October 2022. The San Francisco rental and property market never got too crazy during COVID. Whereas property and rent prices in San Francisco rose by ~20% over two years, heartland cities like Austin and Memphis saw a 40%+ increase in prices.

Hence, with the power of inflation, my original $6,700 rent would probably have naturally increased to $6,900 – $7,000 by October 2022. Hence, the real rental power increase for my downstairs remodeling project is closer to $1,000 to $1,100 a month ($8,000 a month minus $6,900 to $7,000 a month), or $12,000 to $13,200 a year.

Therefore, the real annual return on my remodeling project is closer to 9.23% to 10.15%. Still a solid real return compared to all other asset classes. However, it's not the initial 12% annual return I had calculated.

If only I could have kept the remodeling project cost at $100,000, my real annual return would now be 12% – 13.2%! Oh well.

An Easy Way To Further Boost Remodeling Project Returns

Charging a real $1,000 – $1,100 more a month is not bad after spending $130,000 on remodeling. But if I wanted to make an even greater return on my remodeling project, I could simply find a separate tenant for the downstairs unit. Although it doesn't have an official kitchen, the new laundry room has space for a kitchen, microwave, and stove top.

I could easily charge between $1,600 a month for the downstairs space alone. If so, my return on my remodeling project would therefore rise to 14.8% a year.

Making a 14.8% return in this market would be a home run. Alas, the additional absolute dollar amount I would be making of $600 a month isn't worth the hassle for me at this stage in my life. Having to deal with two sets of tenants for an additional $7,200 a year isn't a good tradeoff. What if the two tenants have a conflict?

As a landlord, you're always comparing the value of extra rental income versus more work and potential damage to the property. Two sets of tenants creates bigger liability issues.

The more people who work from home on your property, the more wear and tear there will be. There are also liability issues to consider as well. Hence, fewer tenants is usually better.

Another Consideration That Drags Down Remodeling Returns: Time

The longer it takes to remodel your property for greater rental income, the lower your returns. Sometimes, your contractor may hold you hostage given he found a more lucrative project to work on. This has happened to me many times before.

In a perfect world, my downstairs rental property would have been remodeled with a snap of my fingers. Instead of charging $6,550 a month in rent starting in 2020, I could have charged $7,550 a month in rent.

Hence, every month I spend remodeling is like losing out on $1,000 a month in rent. And if my expectations were to finish the remodeling in 12 months and it lasts 24 months, then that means I actually lost $12,000 in rental income.

One positive I can think of regarding my delayed remodeling project is that it might have taken me longer to find tenants in 2020 at $7,550. Although it's not six figures in rent, as I profiled in another post, spending $90,600 a year in rent is still a lot of money.

A Realistic Time Frame To Find Ideal Tenants Is Important

Back then, I might have broken down and just accepted multiple roommate tenants to obtain the higher rent. If so, I might have had to deal with a lot more turnover. I did come close to renting to a group of four techies relocating from India. But they were extremely nit-picky. Two of the roommates said they only planned to stay for a year.

Whenever you take on a remodeling project to boost rental income, you must have as realistic a timeframe as possible for when the project will be completed. Always expect your remodeling project to take longer and cost more than expected.

Unfortunately, COVID delayed project completions by 50% – 100%. Thanks to inflation, costs also rose with the delays. At least the delay also delays my property tax increases given I remodeled everything with permits.

Calculate The Payback Period

Getting an annual return on your remodeling project is one benefit of expanding your property. The other benefit is making “infinite returns” once the cost of your remodeling project is paid off.

For example, if you earn a 10% annual return on your remodeling project, your remodeling project will be paid off in 10 years. 10 years is your payback period. After 10 years, any return over the cost of maintaining that portion of the property is gravy. Of course, you will still have to maintain the property.

If your annual return on your remodeling project is 5%, then your payback period is 20 years. The payback period is simply calculated by dividing the cost of the remodeling project by the extra annual rental income generated.

One good rule of thumb is to hold onto your rental property for as long as the payback period. By doing so, you ensure capturing the returns on your remodeling project. While you're earning higher rents, your rental property may also be appreciating as well.

Once the payback period is over, you can then decide whether to earn infinite returns or sell. However, in general, it's best to hold onto your rental property for as long as possible.

Remodeling Your Rental Property To Create More Value

Now that we see how remodeling can increase rental returns, let's now look at how remodeling can increase your rental property's value.

I ended up spending about $130,000 to create 630 square feet of living space. The 630 square feet consists of a living room, bedroom, walk-in closet, full bathroom, and laundry room. Therefore, I spent $203 per square foot.

Given selling costs for a remodeled home with views in my area are about $1,200 a square foot, I could say that I created $756,000 in value. The gross profit would therefore be $756,000 minus $130,000 for $626,000. However, this calculation is incorrect.

Increase Real Estate Value By Expanding Livable Space

I didn't create 630 square feet more of livable space. I only created 330 square feet of livable space because I had to blow out 300 square feet of existing space. But the 300 square feet of existing space feels way better. But its increased value won't go into this calculation.

To calculate the new building cost for new livable space, I now take my $130,000 cost and divide it by 330 square feet to get $394. The value created from my remodel can now be calculated as $1,200 per square foot (average selling price) times 330 square feet equals $396,000. Therefore, my real value creation is only $266,000 ($396,000 – $130,000).

$266,000 is better than a kick in my face. But it's certainly not the original $626,000 gross profit calculated. That said, if I were to estimate, I would say I improved the original 300 square feet of living space by at least $80,000. Hence, the total return may be closer to $350,000.

How Much Do You Really Want To Optimize For Maximum Rental Income?

The reason why mom-and-pop landlords like myself don't make maximum rental returns is that as we grow older, we tend to opt for simplicity instead of money. We want more harmony and less turnover. Simplicity is why I've invested a good amount of capital into private real estate funds. I just can't deal with more tenants and maintenance issues any longer.

I'm just looking for good long-term tenants who will take care of the property. Yes, it would be great to earn maximum rent. But I will happily charge less for better tenants and fewer tenants per rental unit.

One strategy I have used to keep up with market. Rent is to highlight. The future rent increases in the initial lease. This way, rent is automatically increased over time and there are no awkward conversations or surprises.

Maximize Real Estate Returns With Professionals

If you want to try and earn maximum returns, then investing in a real estate fund, a public REIT, or a real estate syndication deal with a sponsor may be the better move. Their number one goal is to earn the greatest returns possible for their shareholders and limited partners.

I simply don't have the same hunger for making money as I did in my 20s and 30s. All I really want is to have as much free time as possible to do what I want.

Before writing this post, I was feeling a little bad that my rental remodel had taken so long and cost $30,000 more than expected. But after doing the math, it turns out the returns are just fine. Always do the math folks!

Rental property income is superior to dividend stock income. The taxes are lower and the regeneration power of the rental income is higher. As a result, I strongly urge everyone to own rental properties to build greater wealth over time. Yes, you will have to spend time managing them. But the returns from remodeling, better marketing, and finding higher-paying tenants is worth it.

Invest In Real Estate More Strategically

Real estate is my favorite way to achieving financial freedom. It is a tangible asset that is less volatile, provides utility, and generates income. Stocks are fine, but stock yields are low and stocks are much more volatile.

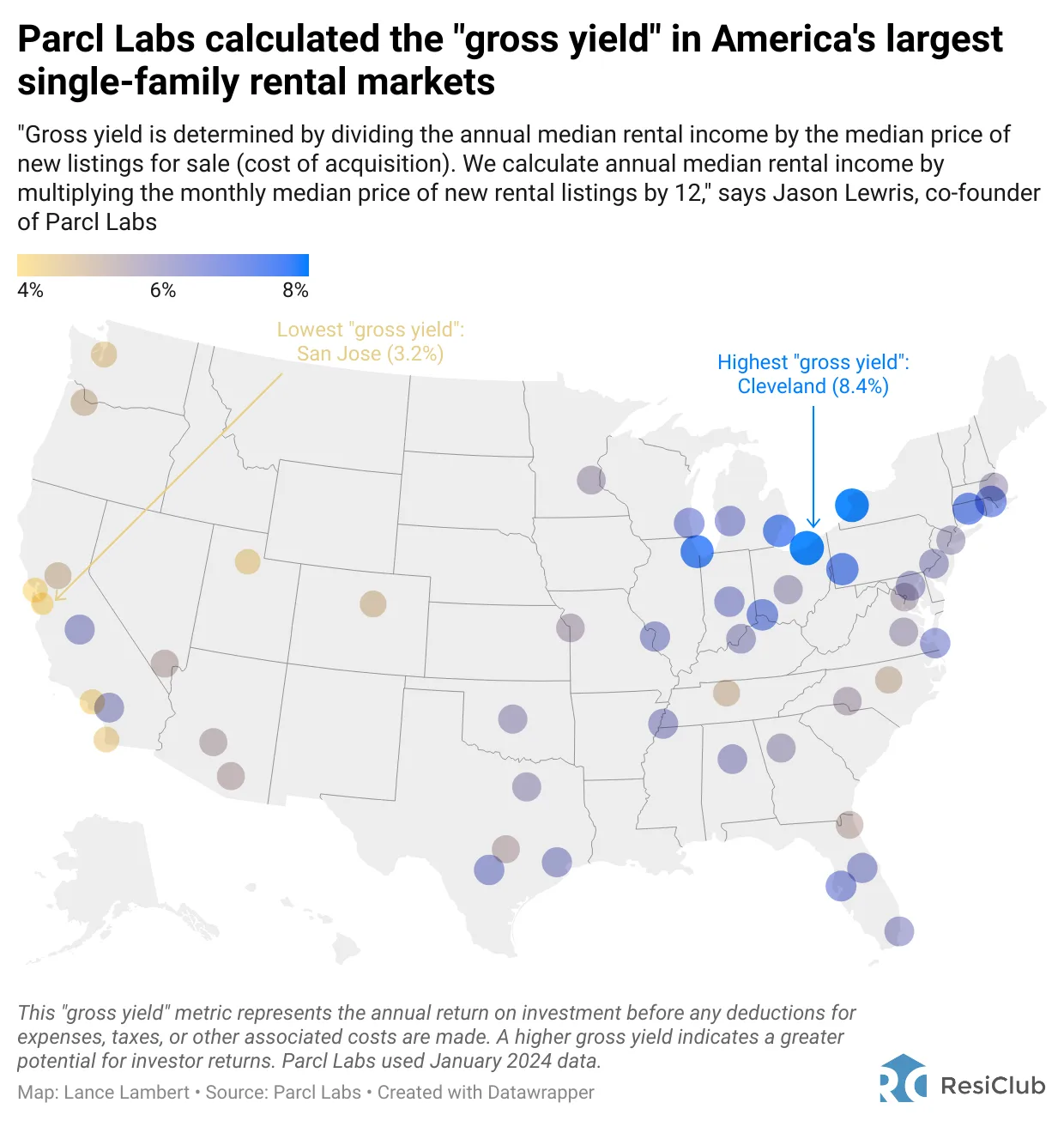

The combination of rising rents and rising real estate prices builds tremendous wealth over the long term. Meanwhile, there are more ways to invest in areas of the country where valuations are lower and net rental yields are higher thanks to crowdfunding.

Best Private Real Estate Platforms For Passive Income

Take a look at my favorite private real estate investing platform, Fundrise. It is a way for all investors to diversify into real estate through private funds for as little as $10. Fundrise has been around since 2012 and has roughly $3 billion in assets under management and over 350,000 investors.

Another great private real estate investing platform is Crowdstreet. Crowdstreet offers accredited investors individual deals run by sponsors that have been pre-vetted for strong track records. Many of their deals are in 18-hour cities where there is potentially greater upside due to higher growth rates. You can build your own select real estate portfolio with Crowdstreet.

I've personally invested $954,000 in private real estate funds across 18 projects. My goal is to take advantage of lower valuations in the heartland of America. My real estate investments account for roughly 50% of my current passive income of ~$300,000.

Both platforms are a long time sponsors of Financial Samurai and Financial Samurai is a six-figure investor in Fundrise funds.

When we had to replace the old carpet in our one-bedroom condo, we put in vinyl plank flooring, updated lighting fixtures, and gave the place a fresh coat of paint. We didn’t want to put much more money into remodeling, such as granite countertops or new interior doors since our tenants are typically college students. What we did do to get more rent was fully furnish the place, including everything needed in the kitchen to cook and eat meals. This allowed us to increase the rent by 20% compared with other condo units. The cost of the reno/furnishings was recouped in two years.

I have my tenants split the cost for upgrades. I.e. they wanted two ceiling fans with wiring put in, cost $400 each, $800 total. So upgraded the condo and they got the benefit. Moreover, renewing is just as much a benefit for the tenant as it is for you a landlord so no reason to give an extra incentive.

I have offered my tenants an “upgrade” if they resign their lease. The rental property needed a new deck, new counter tops and new kitchen floors anyways. So I let them pick which one they wanted me to do and told them I would complete that upgrade if they resigned their lease. Having a unit empty for 1 month was more expensive then doing the upgrade so it was a win for me – eliminated missing out on rent for 1 month and increased the value of my rental property and the tenants felt they were getting something for resigning their lease.

Hey Sam, long time reader. This article matches perfectly with my family scenario: dad is 71, mom 67, they have $5.5m cash in the savings account earning just .85% as just sold one of their 83 fully paid off California rental homes.

What is your suggestion on their asset allocation as they are completely risk averse now just wanting capital preservation and/or decumulation? They live even more simply than you, have always been ~90% residential RE, 10% stocks, has a $50k/year CA pension and some social security. No mortgage, car payments, credit card, student loans, etc. Do you provide quickly offline your suggestions as well?

I like your background as it matches mine being a former i-banker, Cal grad, immigrant, humble, Bay Area, blogger as well (I was with SA, MF back in 2010-12)

Thank you in advance and keep up the insightful writing! I’ve happily referred hundreds of not thousands to your website as I always get the question due to thankfully being somewhat successful in my own right outside of my parents success “how does one get rich Brian?” And honestly my first thought is FS

Hi Brian,

Sounds like your parents are doing well, given $5.5 million is just the cash and they own so many rental homes. They don’t face much risk at all since they don’t have debt. I would highly encourage them to spend more, give away more and live their best lives for the remainder of their lives.

With a net worth in the tens of millions, they can afford to live a little and NOT care about making returns.

If you would like more 1X1 consulting advice, you can check out my consulting page.

Thanks!

Sam

Did you include the ongoing home value appreciation? That would add about 2.3% annually (4% x $756k of add value = $30k in the first year, divided by $130k invested), which means your original 12% estimate was pretty right on.

I haven’t. I just guesstimated a $1,200/sqft selling price in the section to calculate the value creation vs the cost to build per square foot.

But good way to think about principal appreciation as well of the space.

For those that have rentals or have remodeled a rental, what do you feel are are the best flooring materials for a future rental? I want to put in a heavily distressed engineered wood for our own enjoyment but realize it may not be the best choice in terms of durability for a future rental. Thoughts on engineered wood, stone plastic composite (SPC), wood plastic composite (WPC) or tile (that looks like wood) for a rental in terms of durability, feel and function?

We have had good luck with luxury vinyl planks. One trick a realtor taught me was to run a key across the grain of a plank, to see if it scratches or not. It is surprising how little price correlates with durability for this test. The ones that passed the test have held up well.

To paraphrase Cyndi Lauper: “Sam just wants to have fun!”lol Also, a very good example of opportunity costs from an economics perspective.

Thanks Sam, I would love to read a post about your opinion on long term ownership of low cap rate properties in expensive cities. We own a 20 year old rental with a 2-2.5% cap rate and are trying to decide whether to borrow against it to buy stock, or just sell altogether and put the money in a reit. It’s a rock solid rental – never been vacant for more than 6 months. but the condo fees are at such a level that selling it would mean we get below market prices.

We did a kitchen and bath remodel 2 years ago which cost 50k and gave us about $200 more in rent per month. We borrowed the 50k. We looked at the reno as a necessary expense since things were getting so old. But really, to have the property kept in pristine condition, we should gut the rest at a cost of 50-75k.

2%-2.5% cap is very low, and below the risk free rate of return of 3% currently. Seems better to sell.

Here’s a related post: https://www.financialsamurai.com/real-estate-investing-rule-rent-luxury-buy-utility/

Hadn’t seen that post yet. Very helpful. Thanks!

Hi Sam, do you feel comfortable sharing the purchase price or price range of the property? How much did you spend to remodel the upper floors? Thanks.

I’ve only ever done one full remodel. It was a fixer upper and my first set of tenants stayed for 3 years. Then I rented to family after. ( haven’t raised rent in two years ; and probably don’t plan to.. that’s prob the downside of renting to family) its a sfh in the peninsula and I imagine that I can easily rent it for $500-600 more per month

For my other rentals, I’ve always rented to families. I find that families with children who attend the local schools tend to stay longer. I’ve successfully renewed leases 3+ times with my current tenants. In the last set of renewals, I did raise the rent a bit but it was still a tad lower than marker. As long as they take good care of my property, I’m happy. And as long as they don’t bother me much. Most of the time, I ask the new tenant if they would be comfortable signing a 2 year lease and I would offer a minor discount. I own mostly SFHs.

Here in SF, a one-year lease and month-to-month is the law here. Can’t make tenants sign two-year leases.

If I introduce new numbers, it takes away from focusing on the remodeling project for the downstairs and calculating the returns.

Thx

Maybe in a future article? :)

Hi Sam, longtime reader here. Investing in rental property is a great tax strategy in general, and is extra beneficial right now, as there is a bonus depreciation available in 2022, where you can immediately deprecation 100% of expenses that have a life of 20 years or less, per IRS guidelines (this just excludes structural elements that are part of the building like the roof and the floor, etc).

The bonus depreciation still applies for future years but goes down 20% per year until it is eliminated (80% in 2023, 60% in 2024, etc).

When you invest in a rental property and want to take advantage of this, you would split out the costs based on their depreciable life, to see which ones you can bonus out.

The benefit of this is to get an immediate loss on your Schedule E, to offset any other passive income such as partnerships, etc.

Good to know! Thanks. Most beneficial if you already have a high income right?

What would be the situation we’re doing the bonus depreciation in 2022 is not worth it? If you have minimal to no income? Or already have losses? I’m trying to figure out the downsides. Thanks

You would then opt out of the bonus depreciation and spread it out over the normal amount of years. So yes, it does benefit high income – particularly passive income – from K-1s, as it offsets that.

Do not “split” a single family home into separate rentals in San Francisco. You would be putting your property into rent control not to mention the liability (renting an illegal unit). No separate utility meters causes problems as well.

Curious, did you do that and get fined?

No. I’m a landlord attorney and work on these types of cases. Lots of lawsuits from tenants. I know it’s common practice in San Francisco to split a SFH into separate rentals to maximize rental income. Many times the landlord and tenant has no problem as the tenant acknowledges they are benefiting from the situation as well. But when the tenant is aggrieved, all the blame will be placed on the landlord.

Gotcha. You must see a lot of fascinating cases then. What are some of the worst grievances you’ve seen?

Too many. For unpermitted units, typically a tenant will stop paying rent. Landlord lives upstairs and the two parties get into altercations with each other. Imagine living in the same property as a non-rent paying tenant! Many accusations of property damage, intentional sabotage and once even a dead rat being thrown. If you just search on the internet for San Francisco and unpermitted units, you will get tons of results for tenant attorneys writing about this topic. They are itching for clients and to sue.

It’s honestly sad because most of my clients don’t know how to handle the business. Many of my clients are not fluent in English. The law treats the big corporations and the mom and pop landlords the same. Most of the time after a case is resolved and the landlord regains possession, I tell my clients to never rent out their property ever again! They are not equipped to keep up and comply with the many rules and regulations. But as regular workers, real estate is basically the only way for lesser educated immigrants to gain a financial foothold in the city.

Ah yes, that is an awkward disaster if the tenant downstairs from the landlord refuses to pay.

You make me feel good about not getting another set of tenants!

Thx

Nice work on your rental remod. It’s so much work to go through any amount of remodeling and glad it turned out well for you.

I’ve done one remodeling project on my own home and it was a lot of work. If I was younger and had a solid contractor and crew it would be nice to remodel a rental property but I don’t have the capacity now. It’s also really hard to find reliable and experienced workers in my area. Too many horror stories from friends.

In my neck of the woods, Florida’s gulf coast, it’s cheaper to build a home, if you can wait 6 months for the permits, than buy a older home. I’m building 2, if the permits ever get done. I’ve also found that flippers do a lousy job of re modeling a home. I’d rather remodel it myself, (I can’t swing a hammer, but will have the work done), so I can control quality.

Why no mention of a cash out refi or HELOC to further juice returns?

Because I did neither. I’m writing about my experience.

But can you share how a cash out refinance or HELOC would improve returns with this remodel? Thanks

You could get a HELOC or a cash out refi on the newly appraised value of the property, and then reinvest the proceeds into a new real estate deal (further leverage).

So let’s say you purchase a $1m home with 20% down (200k). You put in 300k of work. It now appraises for $1.5m when you do a HELOC or cash out refi. At 75% loan to value, you would be able to pull out your original down payment of 200k, plus 125k of the work you did, for a total of 325k cash to you.

That 325k can then be used to go buy a 1.625m property with 20% down (325k). At this point you now have 3.125m in RE, all from the 500k of cash.

So the massive return in doing renovations comes from the forced appreciation to the home value, and then leveraging that with the bank to buy more property.

Is that what you have been doing? Remodeling definitely does help one extract more cash out. But I’m not down with leveraging up to take on more leverage at this stage in the housing market. Are you?

Yeah, I force appreciation through remodels, and then “reuse” those same funds to do it over and over again. I certainly hear you on market timing. I wouldn’t want to buy retail SFHs right now. Yet generating a higher velocity on your investable funds is what it’s all about. Instead of buying SFHs, I have been buying small multifamily that breaks even through rents and then look for appreciation thanks to inflation and increased rents. Plus depreication!! In your situation, you could use the HELOC and cash out to further invest in your heartland stuff or buying the index dips, or i-bonds or whatever. But the point is that a remodel can generate significant returns beyond just rent payback.

Sounds good. Good luck on your process.

I’m too old to take such risks now unless there’s some crazy good deal.

I fear having to get a job too much!

Doing the same. Going to use one of my HELOCs to fund a light remodel in Orange County. Main reason is to free up cash for alternative asset deals. Lately, I’ve been ramping up an alternative lending business that has better opportunity use/returns than HELOC costs (Prime+.5%). You can also pay it down w/ the new rent delta. Agree w/ both of your ideas, just don’t get too over leveraged & have a strategy for the cash. PS – Couple good lenders that are doing HELOCs for Investment Properties in SoCal (PenFed Credit Union & Cal Bank & Trust).