Are you asking yourself whether you should buy a home in a rising interest rate or high interest rate environment? Let me share my thoughts as an investor in real estate since 2003 with a $10+ million real estate portfolio.

Rising interest rates is usually a headwind for the real estate market. It makes makes mortgage borrowing costs higher. At the same time, rising interest rates also tend to happen when the economy is heating up or strong.

Therefore, the question is whether a stronger economy or rising interest rates has the most impact on housing prices. Over the short-term, higher interest rates will slow down the economy. However, over the long-term, a stronger economy is a more significant factor for real estate, my favorite asset class to build wealth.

As of September 2024, the Fed is finally embarking on a multi-year interest rate cut cycle. As a result, mortgage rates should begin to decline, providing a tailwind for real estate investors to maximize returns. However, mortgage rates have remained sticky due to trade wars and a strong economy.

Executive Summary:

- You'll learn why Fed rate hikes doesn't necessarily mean higher mortgage rates

- The main determinants of buying a home

- Where we are in the property market cycle

- You can always refinance. You can never change the purchase price of your home.

- Why everyone should invest in real estate and at least own their primary residence to get neutral real estate

The Interest Rate Market

As soon as the Fed starts raising rates, brokers and real estate pundits in the media tend to say, “Buy now before it's too late!” There's nothing like a little Fear Of Missing Out to get people to make big decisions without thoroughly thinking things through.

The instant response everybody should have when fed this line is: Don't higher interest rates make homes less affordable at the margin? If homes are less affordable, doesn't that hurt property demand? And if demand for property declines, doesn't that mean prices might go down instead?

Whenever you are talking to someone whose main source of income is through transactions, be a little suspicious. After all, from a real estate broker's point of view, it's always a good time to buy or sell!

We've already discovered how to invest and potentially profit in the stock market when rates rise. Now it's time to explore whether to buy a home in a rising interest rate environment.

My hope is that this post educates future homebuyers, reduces the number of future debt flakers, and creates a stronger America as a result! When you buy a home, you have got a lot to think about.

Understanding The Fed Funds Rate

To first understand whether to buy a home in a rising interest rate environment, it's important to understand the Fed Funds Rate (FFR).

The Federal Reserve controls the Federal Funds rate, the interest rate everybody is referring to when discussing rising rates. The Federal Funds rate is the interest rate in which banks lend to each other, not to you or me.

There's generally a minimum reserve requirement ratio a bank must keep with the Federal Reserve or in the vaults of their bank, e.g. 10% of all deposits must be held in reserves.

Banks need a minimum amount in reserves to operate, much like how we need a minimum amount in our checking accounts to pay our bills. At the same time, banks are looking to profit by lending out as much money as possible at a spread.

The Fed Funds Rate Spurs Bank Lending

If a bank has a surplus over their minimum reserve requirement ratio, they can lend money at the effective Federal Funds rate to other banks with a deficit and vice versa.

You can see how an effective Fed Funds rate of only 0% – 0.25% would induce a lot more inter-bank borrowing in order to re-lend to consumers and businesses, and keep the economy liquid.

This is exactly what the Federal Reserve hoped for once they started lowering interest rates in September 2007 as home prices began to collapse.

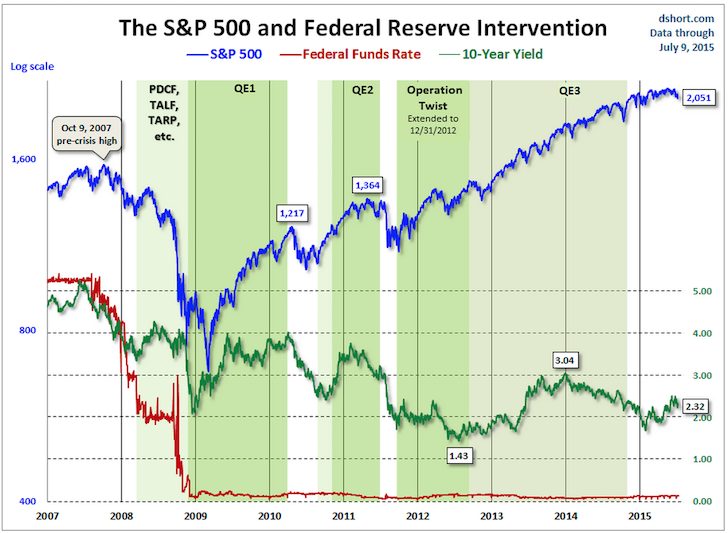

Study the Fed Funds Rate charts below.

Federal Reserve Combatting Recessions

By the summer of 2008, everybody was freaking out because Bear Sterns was sold for a pittance to JP Morgan Chase. And then on September 15, 2008, Lehman Brothers filed for bankruptcy. Nobody expected the government to let Lehman go under, and that's when the panic really began.

What happens when everybody freaks out? Banks stop lending and people stop borrowing! This is called “a crisis of confidence.” The Federal Reserve lowered the Federal Funds rate in order to compel banks to keep funds flowing. Think of the Federal Reserve as keeping the oil flowing through a dying car engine.

It's been years since the Federal Reserve lowered the Fed Funds rate to 0.15%, and since January 2009 the stock market is up more than 220%; the housing market has recovered with some markets like San Francisco blowing past its 2007 peak by 30%, and unemployment has dropped to 4.1% in 2018 from a high of 9.9% in March 2010. What does this all mean?

Well, the global pandemic happened. The Federal Reserve slashed rates in 2020 again. Now, we are in a wait and see mode for employment to come back. However, it sure seems like everybody wants to buy a home today.

Inflationary pressure!

The Federal Reserve's main goals are to keep inflation under control while keeping the unemployment rate as close to the natural rate of employment (full employment) as possible.

The Federal Reserve does this through monetary policy – raising and lowering interest rates, printing money, or buying bonds. They've done a commendable job since the financial crisis, but inflationary pressure is an inevitability.

Why is inflation bad? Inflation isn't bad if it runs at a foreseeable 1-3% annual clip. It's when inflation starts going at 5%, 10%, 50%, 100% where things get out of control because you might not make enough to afford future goods, or your savings and investments are losing purchasing power at too fast a pace, or you simply can't plan your financial future.

Who Likes Inflation?

The only people who like inflation are those who own real assets that inflate along with inflation, e.g. real estate.

Remember to always try and convert funny money into real assets! Everybody else is a price taker who gets squeezed by higher rents, higher tuition, higher food, higher transportation and so forth.

The Federal Reserve needs to raise interest rates before inflation gets out of control. By the time inflation is smacking us in the face, it will be too late for the Fed to be effective since there's a lag in monetary policy efficacy.

Higher interest rates slow down the demand to borrow money, which in turns slows down the pace of production, job growth and investing. The rate of inflation will eventually decline as a result.

If the Federal Reserve could engineer a 2% inflation figure and a 5% unemployment figure forever, they'd take it!

High interest rates makes saving and lending more attractive. Hence, if you can find better returns with your cash, it's OK to sell your real estate too. Just be sure to reinvest the proceeds.

How Does The Fed Funds Rate Affect Mortgage Rates For Homebuyers?

The Federal Reserve determines the Fed Funds rate. The MARKET determines the 10-year yield. And most importantly, the 10-year Treasury yield is the predominant factor in determining mortgage rates.

Here are the components affecting mortgage rates.

There is definitely a correlation between the short duration Fed Funds rate, and the longer duration 10-year yield as you can see in the chart below.

Study this chart very carefully, as it will tell you a lot about whether you should buy or sell a home in a rising interest rate environment.

The first thing you'll notice is that the Fed Funds rate (red) and the 10-year Treasury yield (blue) have been declining for the past 30+ years. There have definitely been times where both rates have spiked higher between 2% – 4% within a five-year window. However, the strong trend is down due to knowledge, productivity, coordination, and technology.

What else can we learn from this chart?

1) From 1987 – 1988, the Fed raised rates from 6% to 10%. From 1994 to 1996, the Fed raised rates from 3% to 6%. Then from 2004 to 2007, the Fed raised rates from 1.5% to 5%.

2) The longest interest rate upcycle is about three years once the Fed starts raising rates. We now know that 4% and three years are the backstop for a rising interest rate environment.

3) The 10-year yield doesn't fall or rise by as much as the Fed Funds rate. In other words, you probably don't have to fear a large interest rate reset if your ARM mortgage expires. In fact, anybody taking an ARM mortgage over the past 30 years has seen their interest rates fall. Owning a 30-year fixed mortgage is a more expensive route.

4) The S&P 500 has generally moved up and to the right since its beginning. The steepening ascent corresponds to the drop in both interest rates since the 1980s. The S&P 500 can be a representation of housing prices across the country.

5) The current difference (spread) between the Fed Funds rate and the 10-year yield has been over 2% for the past seven years, which provides a significant buffer for the Fed to raise Fed Funds while the 10 Year Treasury yield can still stay the same.

Take a look at what happened between 2004 and 2010. The spread between the 10-year yield and Fed Funds rate was around 2%, just like it is now. The Fed then raised the Fed Funds rate to 5% from 1.5% until they burst the housing bubble that they helped create! The Fed Funds rate and the 10-year yield reached parity at 5%, instead of the 10-year yield maintaining its 2% spread and rising to 7%.

Important Point About The FFR

The Fed can raise the Fed Funds rate, and the 10-year yield may not even budge higher given the spread is about 1%. There is what's called a Mortgage-Treasury spread to consider.

Below is a closeup chart of the S&P 500, the Fed Funds rate, and the 10-year bond yield.

The Market Is Efficient And Knows Best

Now that you've got a great understanding of interest rates, you can see how vacuous a statement it is when someone tells you to buy property before interest rates go up. If anybody says this to you, they are either ignorant or do NOT have your best interest at heart.

The Fed Funds rate could easily go back to 2% over the next three years. Meanwhile, the 10-year yield might very well stay below that range. Or it may at most maintain a 2% spread during the same period. Remember, the markets determine the 10-year bond yield, and we've so far just discussed domestic demand.

China, India, Japan, Europe are all huge buyers of US government bonds as well. Let's say China, Japan, Brazil, Switzerland, and Greece all go through hard landing scenarios. International investors will sell Chinese, Japanese, Brazilian, Swiss, and Greek assets/currency, and BUY US government bonds for safety. The USD is, after all, the world currency. If this happens, Treasury bond values go UP, while bond yields go down.

The US has foreigners hooked on our debt because US consumers are hooked on international goods, most notably from China. The more the US buys from China, the more US dollars China needs to recycle back into US Treasury bonds.

China certainly doesn't want interest rates to rise in the US. If they do, their massive Treasury bond position will take a hit, and US consumers will spend less on Chinese products at the margin!

The Main Determinants Of Buying A House

Rising interest rates are generally a result of a robust economy. A robust economy is by far the most important determinant of housing prices.

If the unemployment level is declining, people in your city are getting raises, and expectations for continued growth are there, housing prices will continue to go up, despite rising rates.

The issue the Fed has is getting the TIMING of their monetary policy right to contain inflation and engender maximum employment.

I recommend everybody be at least neutral the property market by owning their primary residence. Being neutral the property market means you are no longer a victim of inflation given your costs are mostly fixed.

You can't really profit from the real estate market, unless you sell your house and downsize. You don't really lose either, so long as you can afford the house, since you've got to live somewhere.

Before going neutral the property market, it's important to have the confidence that you'll own your house for at least five years, if not at least 10 years.

Hold Onto Your Property For The Long Term

I never go into a property purchase thinking I'll sell within 10 years. In fact, I always have the mindset that I plan to buy and own forever since I buy property for lifestyle purposes first.

The only way you can gain confidence of owning your property for 10 or more years is if you are:

- Bullish about your employer's growth prospects

- Positive about your own career growth and talents

- Have 30% or more of the value of your property saved up in cash or liquid securities (e.g. 20% down, 10% buffer at least)

- Love the area and can see yourself living there forever

- You've got rich parents, relatives, or a trust fund to bail you out

If you're taking out a PMI mortgage because you've got less than 20% down, it's understandable why you'd be scared buying property. You can't afford it! In the old days, most people would simply pay all cash!

Property Market Forecast

I'm bullish on real estate for the next few years. I believe mortgage rates will stay low for the rest of the decade. The intrinsic value of real estate has also gone up because we're spending much more time at home. Therefore, you want to buy a home not rent.

Everybody wants larger properties with more more space. As a result, expect to see an aggressive move up market. Further, we should see an aggressively move out market from small rental properties to first-time homes. Buy a home to make money and live a great life.

With robust stock market returns, some of the gains will flow to real estate. In addition, with more forecasts for lower stock market returns going forward, real estate should get a boost. At the very least, I would get neutral real estate by owning your own home.

In addition to buying rental properties, I'm also investing in real estate crowdfunding to buy real estate in the heartland. Valuations are much cheaper in the heartland of America. For example ,10X annual gross rent vs 20 – 30X annual gross rent in coastal cities. Net rental yields are also much higher as well (8% – 15% vs. 2% – 4% in coastal cities).

If I can earn a 9 – 12% returns on my crowdfunding investment, I will equal my cash flow from my $2.74M house that I sold with $2.24M less in exposure.

Grow Your Net Worth In A More Stable Way With Real Estate

Get into the practice of saving and investing as much of your income as possible into real estate, especially if you already have a 401(k) and company stock. Real estate is a more stable asset class that generates income and provides utility. If you don't own your primary residence, all the more reason to invest in real estate.

Check out Fundrise, my favorite private real estate investment platform open to all investors. With an investment minimum of only $10, it's easy to diversify into real estate and earn more passive income.

The real estate platform invests primarily in residential and industrial properties in the Sunbelt, where valuations are cheaper and yields are higher. The spreading out of America is a long-term demographic trend. For most people, investing in a diversified fund is the way to go.

I've invested ~$1,000,000 in private real estate so far, with over $300,000 in Fundrise, a long-time sponsor. My goal is to diversify my expensive SF real estate holdings and earn more 100% passive income. I plan to continue dollar-cost investing into private real estate for the next decade.

I enjoyed this article.

I believe prices will be going down in 2019, with exception of America’s heartland as the author points out.

Yes, employment is at a high but rates are now hovering near 5%, baby boomers will soon offload their holdings, less interest from foreign buyers and de-centralization of workforce around city clusters.

Thoughts?

I’m looking to buy a multi family but think I should wait a year. I’m searching in northern New Jersey just outside New York City so prices as astronomical.

“I don’t believe property prices will go down nationwide, especially since rates will stay relatively low, and Hillary will come in and do everything possible not to mess up the bull market.”

I assume this was a pre-election prediction stating Hillary would come in.. but I am curious if you have a theory of how the market in general would have reacted with Hillary taking office instead of Trump now that it has been a year into the new administration? (ie no trade war/tariff talks, no tax cut, different possible proposals I am not aware of that would have been introduced). Good discussion to have and reflect on when the next elections come around.

Howdy Ben,

Unfortunately, coastal city real estate is now softening. I sold my San Francisco rental house last year, and I redeployed $550,000 of the proceeds in real estate crowdfunding to take advantage of the heartland of America.

https://www.financialsamurai.com/focus-on-investment-trends-why-im-investing-in-the-heartland-of-america/

I think it makes sense to invest in non-coastal city real estate. Valuations are so much lower, net rental-year-olds are so much higher, and you can now make money completely passively. Being a landlord was a pain in the butt once my son was born.

Interesting article and comments. People thinking that the real estate “bubble” may burst in 2015. Now it’s 2018. Prices continued to go up. You were correct.

Yes, it’s been a great ride. But, I couldn’t take managing two rentals in SF and a vacation rental in Lake Tahoe so I sold one rental property in mid-2017 to simplify life. I don’t regret it as I reinvested the proceeds in real estate crowdfunding and other assets that have done well, but with NO hassle anymore! As a new dad, I want to be as focused as possible in raising my son.

Valuations are 10X the median household income here in SF now w/ <3% cap rates. By redeploying in the heartland, I'm hopefully going to be making 10%-15%.

Related: Buy Utility, Rent Luxury

Any change you can update your outlook given the recent geopolitical events and the recent leap in mortgage rates?

HI Sam, I am a complete newbie in real estate and I am looking to buy something for the first time, primarily with the purposes of saving (to not throw away money on rent) and to build equity. I was looking at multi-unit families. Now, I understand (sort off) the market situation you describe but its a bit contradictory and I was wondering if you could clarify something for me: so you say that inflation will be good for people with assets (like real estate) and at the same time you describe that higher interest rates will choke off borrowing which will diminish demand, and thus lower home prices. Which one is more important to consider? Should I buy now or not?

Sam, you advocate a 5/1 ARM with the expectation that inflation would never occur. Why should everyone be buying a property or be at least neutral property?

As a fellow Bay area resident I know rents are crazy. But for someone who lives in Midwest and rents have hardly risen; what is the advantage in buying property if inflation will be contained by the FED?

Check out:

Real Estate: My Favorite Asset Class To Build Wealth

Containing inflation still means there is inflation.

If i was going to build a house in san diego by the beach. I was going to buy a lot then build a house on it. Sounds like this is probably not a good idea. Land is scarce in san diego. Should i just buy the lot and hold onto it for a year and see what happens before the build?

You can’t get a loan for a vacant lot. Find something that has existing utility and that can be leveraged. Single level ranch on a large lot is going to be the property type of choice for the aging boomer generation. Easy to open up walls, great candidates for cosmetic remodels.

Oceanfront new construction is a nightmare in California due to the coastal commission. The required seawall can easily run $400,000….most projects never get to this point because of litigious neighbors.

One of the major banks is now offering a 40 year loan that amortizes over the final 30 years after the initial 10 year interest only term. Interest rate is fixed for that initial 10 year period, and they allow up to 50% DTI. Lending is becoming more and more attractive for those with the credit and income. Still lots of opportunity in this market for the smart investor who can value add and keep monthly payments low.

Is anyone keeping track of revised FEMA flood zones due to.be effective soon? The.new zoning.can drastically increase flood insurence premiums and also require many new owners to purchase insurence. I can only assume that properties in flood zones or properties that will become designayed a/ae zones will lose a lot of.value. NYC has already hired its own experts and.challenged the.new FEMA zoning. Was trying.to.post a link to.the article but.I guess Sam doesnt allow external links. Anyhow, premiums are projected to go.upto 15k a year by 2030. NYC is trying.to come up with special plan.for home owners.but everything.is.still up in.the air. Next year might be a really.good or a really bad time to.by.in NYC as homeowners afraid.of the projected premiums will want to.sell.and run,.those willing.to grab .those properties cheap.can flourish if.NYCs wins its.challenge.to FEMA , or they can be bankrupt if.the premiums do rise as projected. I found.as good listing asking $1.2 mil.for 3 family 3100 sq ft in.bath beach area of.brooklyn. Great.neighborhood, but up for being.flood zone according.to FEMA. Anyone.else.looking.into.this?

Great article. The bubble chart is interesting, I’m hoping the bubble in Canada doesn’t pop as soon as a lot of people are predicting

Fascinating charts! I liked what you said in the beginning of the article, “You can always refinance. You can never change the purchase price of your home.” I certainly don’t see property prices slowing down in San Francisco anytime soon but I plan to keep an eye on the markets. It does seem like interest rates are going to be rising for the next several years, which hopefully won’t be that bad.

San Francisco property I think has hit it’s peak for this current cycle. Condos in particular will be vulnerable given all the new supply in the pipeline. Single family homes are still at a premium and will continue to be in demand particularly in places like Noe Valley, Glen Park & Bernal Heights. If I was looking to purchase I’d rent and reassess in early spring.

Do you rent or own now? And where?

I own four properties…two SFH’s in San Francisco and two condos in Oakland. 1200 per square foot condos in SOMA, for example, just seems like the market has gotten ahead of itself. SF is not quite London, New York or Hong Kong so at the moment my gut feel is that we are headed for a moderate downward correction within 12 months. However if you must live in a coveted neighborhood like Noe Valley with limited SFH supply then I expect prices will continue to surge despite the general trends.

Do you plan to sell any of your properties?

The condo situation seems like there is tons of supply coming on board.

I recently had an opportunity to sell one of my Oakland properties but just didn’t have the time to commit to a sale so decided to re-rent which was easier. About 60% of my wealth is locked up in real estate so selling at least one property for the going market price is tempting.

Nice article, only partially agree with the following statement:

“Anybody taking an ARM mortgage over the last 30 years has seen their interest rates fall”

Above statement is true for some but those that took out subprime ARMs got creamed.

How did they get creamed? It wasn’t because interest rates went up, unless they took a NEGATIVE AMORTIZATION mortgage. It’s b/c they welched on their debt b/c their income stopped coming in, or they strategically defaulted.

Sub prime mortgage is what bankers and investors use to call borrowers.

I encourage you to find a sub prime arm chart and compare it to a prime arm chart

Feel free to.

Again, sub prime is a denomination used for the class of borrower.

Why is it a surprise the sub prime borrowers did the worst in terms of paying back their loans during the crisis?

I am surprised no one questioned your presumption of a Clinton victory. I am honestly surprised people tolerate her as a candidate. Jeb too.

Ah, you caught that! I might as well publish a post saying why a Hilary Presidency seems obvious, but so is a Trump Presidency.

Besides the obvious which is everyone wants to make history by electing the first female president…gotta outdo the last histrionic act to prove our progressiveness.

Please do!!! I would love to see how you would phrase it without offending half of you readers.

Excellent article.

I’ve had this discussion with my mortgage mortgage for the past year.

I’ve refinanced my home three times with 7/1 adjustable and managed to lock in a ridiculous low rate of 2.625%. Each time he recommends I go with a thirty year fixed and I try to explain that long term rates cannot go up.

Of course, personal finance entails optimizing for maximum comfort, not maximum gain. So some people are better served with a 15 or 30 year loan. No point getting an adjustable if you can’t sleep at night!

Send him my article on 30 year fixed vs. 5/1 ARM. I’d love to know what he says.

Interest rates have been going down for 30 years in a row now, and Japan’s rates have been flat for decades. We’ve seen this story before.

The reason why people don’t sleep better at night is because mortgage bankers are pushing higher interest rate 30 year fixed loans and creating anxiety so they can make more money!

Excellent article! Please, write more articles like this, that explain how financial systems work. I would be interested in seeing an article about bonds and how they work in a rising interest rate environment. (And now Ill go search to see if you have already written that :))

Check these post out:

Should I Buy Bonds? Wealthy People Don’t

Creating A More Defensive Portfolio With Bonds

Will rent cover all associated costs of ownership? Is the property in a location that is geographically constrained, in a good school district, or close to mass transit? If so it is a good time to buy. If you live on one of the coasts, in a major city, with robust employment, then you can be relatively assured that rents are never going down. In a nightmare scenario you rent your primary home for a few years, and arbitrage by downsizing into a smaller rental or by moving to a cheaper city. This is your safety valve, it is called “utility”, a unique benefit to a real estate investment.

In a declining economy, home ownership rates decline. People who lose their jobs or homes will need a place to live. They might be willing to spend 40% or 50% or 75% of their income in rent to keep a roof over their heads…where as a lender will only let them spend 35% for a home purchase. A family of three in distress is not going to downsize if they can rent a 3 bedroom in a good area and get by, maintain schools and friendships and proximity to family, etc. This keeps the rental market stable.

Regions like the Bay Area, Los Angeles, and San Diego are waaaaay behind in keeping up with housing demand. San Diego is only building 1/10th of the housing required to meet future population demands. In California, up to 45% of the cost to build a new living unit is swallowed up by regulation and government fees. The state can’t even find a way to fund affordable housing projects….the last attempt at a document tax just failed in committee earlier this year. Even it had passed it would have only raised $800,000,000, the result being ~4,500 affordable housing units statewide. This is about .02% of the state housing inventory.

If you have experience in real estate, you can purchase 5+ unit apartment buildings with 25% down. The loan is underwritten based on the financials of the building, not your personal finances. Returns will be much higher than a comparatively priced single family or condo investment. Because of regulation it’s almost impossible to build apartment units for less than $180,000 a door, so if you can purchase for less than $180,000 per door you will probably do pretty well long term.

The big loser right now is green field development in unincorporated areas. For example, to split a 10 acre lot into 10 separate 1 acre home sites, expect to spend several hundred thousand dollars and several years trying to obtain entitlements. This type of onerous regulation will keep new construction limited and prices stable, especially for the single family detached market.

This is one of the best articles I have read in a while on the topic. So kudos.

One point I would like to mention is your bias against fixed rate mortgages. Clearly you are correct “they cost more”. But where I digresss with you on this is I FIRMLY believe that the premium in terms of added monthly costs for a fixed versus variable mortgage is well worth it. I believe that recent history bias in terms of declining rates for so many years has biased people (yourself included) against long term fixed rates because of the increased costs. Yes you pay more. But there is NO WAY GET A LOWER RATE BACK IF RATES GO UP BUT you can always refinance if rates go down. This is a huge benefit for what is nominal costs

When interest rates begin a longer, up cycle (and they will it is just a question of when) the fixed rate people will be better protected.

Just my thoughts. Keep writing the GREAT articles like this!

Of course there is a way to go back down. Refinance.

Uh, no there isn’t. If rates go higher and the homeowner used an ARM they are ‘stuck’ at a higher rate.

This is why ARMs are popular when rates are high (easy to refi and get lower rate when rates come down) and why fixed rates are popular when rates are low (higher rates to refi when rates go up).

Given the consensus that rates are ‘low’ now fixed rates are more popular

Dave,

You’ve got to think in terms of spreads, the perceived rise in interest rates, and timing.

If the spread on a 30 year fixed and a 5/1 ARM is 1.75% (4.25% vs. 2.5%), and you believe the maximum rise in interest rates over the next 5 years is 2% as I believe, you’re still winning for years to come. Just input the various costs and break even scenario in an Excel spreadsheet.

There is also a cost to refinancing.

So my question to you is: what rate is your 30 year fixed currently and what did you see for a 5/1 ARM?

Which is exactly why I’m not worried about my ARM loan.

With a 2.65 rate and maximum increase after ten years of 5 percent, even if the rate goes to maximum, I’ve already paid a third of the loan term if I wasn’t already paying it off at an increased rate.

7.5 percent on the remaining decreased principal doesn’t worry me in the least. If I was worried rates would ever go that high again, which frankly I doubt.

Right now the spread is about 1-1.25%. (Per bankrate)

So after 5 years you have saved 5-6% interest. Call it 5.5%

Worst case on 5/1 ARM w typical caps is

Year 6 you have saved 4.5

Year 7 you have saved 0.5

Year 8 it will cost you 5.5%

Year 9 it will cost you 11.5

Best case at year 9 is it will save you 9%. Because of the index lift of 2.75 there really isn’t much room for the arm to decline.

All above don’t account for amortitazation which is low on 30 year loan

You are correct. It’s all about the spreads AND you view of risk and your propensity to keep the property.

Fyi. I did do a 5/1 once. The spread was about 2%. So it was a no brainer. At 1% spread it is less compelling.

When it absolutely is a no brainer to do an arm is if you feel at all confident you will not keep the property.

That is a good point at the end. It’s wise to match duration of ownership with the duration of the fixed rate loan.

However, since I buy with the plan to own forever, I am in conflict with this advice. And this is because of my outlook on rates being lower, for longer. A 2% rise is the absolutely max in interest rates I foresee over the next decade, and the spreads I’ve seen are at 1.5-1.75%%, so for me, it’s a no brainer to take the immediate savings for the first 5 years guaranteed.

The other thing is the ability to pay down principal. The loan size is smaller after five years, so the like for like refinance cost will be less.

The other thing is your overall net worth structure, which may be the second most important determinant of which type of loan you want to take. If you take out a loan of $500,000, and have $800,000 in cash or liquid securities… it’s simply accounting. You will likely NEVER have to face a interest rate cap reset of 4-5% after the 5 years is up.

I dunno, Sam, a 2% rise max in interest rates is pretty small. You probably understand a lot more about economics than I do, but if we hit a patch of runaway inflation, like we did in the 1980s, interest rates can get pretty far out of hand, pretty quickly.

I’m not saying all ARMs are bad. If the spread is big enough, it’s worth taking the risk, or if you have enough in liquid assets that you can pay down a good chunk of the loan balance, then that’s fine, too. But if you’re a regular working Joe who stretches a bit to buy a house, then a significantly higher payment can come back to bite you. If you have equity and can sell instead of being foreclosed, then great. But if interest rates rise and housing prices drop, you might be left holding the bag.

Only time will tell what interest rates do. That’s the beauty of taking a risk. If we have the right risk/reward framework, there should be a long term positive outcome.

What is your current view on rates, housing, and what type of loan do you have?

If a buyer has a budget of $1800.00 a month for mortgage, homeowners insurance and property taxes, then that sets their market. At least for working class properties/buyers. I figure a middle class home in middle suburbia will sell for less when/if rates go higher. Let’s say I am looking to get an $1,800.00/month buyer. If rates are higher, the mortgage must go lower. Same goes for tax rates. Tax rates continue to rise and you are probably correct that a democrat will win, so effective tax rates will continue to rise. This also cuts into my $1,800.00/month buyer’s budget. Hmmm. Middle class real estate sounds like a loser to me.

You can always refinance. You can never change the purchase price of a home.

Meg, I think you hit the nail on the head. I’ve only been in the housing market for 15 years, and obviously there are multiple factors in play, but I see a strong inverse correlation between interest rate and housing sale prices. If average income is x, then the market has to have some housing in x’s price range, otherwise there won’t be enough demand and prices will drop to make the market balance out again. A tiny interest rate change can make a big difference in the amount of principal you can borrow over 30 years.

If the interest rates shot up, I’d be looking to add to my real estate portfolio then, because I think the prices would drop pretty significantly. (Which is not to say that I’m not interested now. I will just be MORE interested then.) And, like Sam points out, you can always refi later to drop your interest rate if you bought when rates were high.

We are closing on a house this weekend with the intention of owning it forever and renting it out if we move on. Thanks to constant reading on your blog we were able to secure an extremely low rate 5/1 ARM which is saving us hundreds a month on the cost of the loan and in interest. Home prices are also projected to go up fairly consistently here due to the high demand and low availability of housing (Seattle).

I cant tell you how many brokers “advised” us of the benefits of 30 year mortgages.

Drew, is Seattle still affordable? From looking at the listings, I do not see anything that is a good deal on a SFH. All I see that is maybe affordable are those newer townhouses but I am bias and they just don’t have any charm. Can you give some detail as to what you bought and approx range for that area? Is it a good location and desirable for renters?

I curious because we are contemplating a relocation to Seattle from SoCal. Thanks!

Doesn’t affordable depend on your income? Everybody’s situation is different.

Look at Amazon surpass Walmart this week in market cap!

True, it depends on your price range, desired location, commute time etc

But with the increase in tech companies and rich Asian immigrants, much like San Francisco housing will start to be overpriced.

We bought a rambler south of Seattle in a neighborhood of mostly 300-350,000$ homes depending on updating.

Good mindset Drew! Good luck with the purchase.

Seattle, Portland, Austin…. all great cities where I would happily move to and buy with a long term mindset.

Wow! You really broke this down. I am very impressed at the knowledge you have of the economy like that. I admit although I invest in real estate and will continue doing so, I dont have a super solid grasp of how interest rates work at least not to the extent that you broke it down with on this post but I can tell you I have a lot more knowledge now after reading this article.

Honestly, I did have to read it twice for me to really fully understand it but I really like how you are shedding light on what is actually happening and what most likely will happen based on that historical data.

I keep hearing as well where I live and invest that now is the time to buy and it has grabbed my attention, but I feel much better about it now. I dont want to stop borrowing money to buy real estate so lets hope this all pans out well.

Thanks for the mind stimulating article!

I hope everybody who is a RE investor or who is looking to buy reads this article twice. It’s a lot to take in, and I could have written another 1,000 words, but I’d probably lose more people.

First, awesome background on the federal funds rate. It is a rather misconceived mechanism.

Unfortunately, markets still govern the prices of fixed income vehicles. So, even though a rising fed funds rate may do nothing for loan rates, the effect we’ve seen in the last few months on fixed income investments, bonds, and high yield stocks has been quite pronounced and painful.

I can only hope this is an overreaction to the uncertainty around the timing of the federal reserve increases, and that when increases do come, these assets can return to better prices (closer to NAV).

Eric

There is always A LOT of volatility once the direction of interest rates gets changed. Let’s see if there are any buying opportunities during the next 12 months!

Market mouths are getting antsy. Can you make sense of this? There is too much conflicting information. Where is earlyretired?

Great article Sam.

– Realtors in my area are pushing the BUY NOW mentality (FOMO).

– I couldn’t agree with you more about understanding interest rates.

– I constantly observe and listen to other realtors and can say without hesitation that the mass majority have no idea what your article means…. sad reality of the industry.

– There are realtors out there who know the process of buying/selling a home BUT they sure as heck don’t know anything the economic variables in play.

Realtor in Charleston SC.

Hola Ed,

There’s too challenges with this article:

1) Explaining housing and interest rates in a manner people can understand and absorb

2) Letting real estate industry people explain to their clients what is written in this article

If one is going to make of the biggest purchases of their lives, they need to spend the most time ever trying to understand everything related to interest rates.

I enjoy going to open houses and speaking with many people because it helps me understand the LEVEL of understanding of the market.

When the level of understand is at complete ignorance, I get very, very afraid. We’re at around a 3 or 4 out of 10, with 10 being the maximum level of understanding.

The worst is when you don’t understand, lose money,get bailed out, and then blame other people!

Hey author! (Not sure of the name)

Thank you so much for the article. It is very comprehensive with the articles spread throughout, letting me catch up with my learning while also understanding the larger picture. Looking forward to similar articles, thank you!

– Jake

Great post, Sam!

What do you think about current levels of the Case-Shiller Home Price Index and US Median Income as a measure of housing affordability?

RE is local, so I tend to look at the market from a city to city basis.

I’ve always felt an index / median income ratio to be a little off b/c the median person isn’t really the buyer who is moving the needle. This is why there is a ever widening wealth gap, and a rising uproar in many cities like SF. The median $80,000 earner is not buying the median $1.1 million home. The $1.1 million home is being purchased by the $200,000+ household income earner.

Why isn’t the median wage earner able to buy the median home (or close to it)? $200k income puts you in the top 10% of Bay area incomes, shouldn’t those people be expecting to live in a top 10% home, or at least top 20%?

Being in the top 10% of income earners, but struggling to afford an average house sounds like the definition of bubbly.

It’s always been that way here.

The reason is: the median wage earner is not the only source of home purchase. Add on a spouse’s income and their parent’s income/wealth and then you have a truer buyer reflection.

Then add on the international demand curve blowing locals out of the water, whose income and wealth aren’t a part of the median income calculation.

San Francisco is rising on the international front as one of the cheapest international cities in the world. Prices change based on sales at the margin. Very little of the housing stock sells a year. Like having a 1% float of a public company.

https://www.financialsamurai.com/the-cheapest-international-city-in-the-world-san-francisco/

Where do you own/live? And how is your market doing?

I am fascinated in a city driven by those fundamentals long term, why 60% of the population would bother living there. They would have much better lives and earlier retirements in the other 80% of the country.

Maybe it has something to do with the fact that it’s an amazing place to live? Have you read Sam’s articles describing how SF is actually one of the cheapest places to live when compared with other international powerhouse cities?

It’s all relative. I for one would be miserable living in a fly over state even if I were “retired early”. Frankly, I make a lot of money in SF, and pay a lot of money to live here, but my overall quality of life is vastly superior to what I experienced on the East Coast.

For those that make a lot of money in San Francisco (ie the top 20%), it makes a lot of sense to live in the city. However, earning more than say 60% of the population, means an income of around $75k in San Francisco. Why would you live in San Francisco earning $75k (ie nurses, firemen, police, experienced teachers, book keepers, etc). I think those people would have a much better life in another city, and are part of the bottom 60%.

If you are earning $250k in tech/law/finance in San Francisco, it is a great life. However this is far from the majority.

Hi FS,

I’m loving the blog (new here,) but I have to say your comment “it’s always been that way here” is just not true. My aunt and uncle bought in SF in the late 1970s or early 1980s (don’t remember which.) They did not have a ton of money or make very high incomes, but they were able to save enough to get into a flat on the panhandle. That would be impossible today for earners of their caliber.

See this chart, and select “price to income” in the tabs:

https://www.economist.com/blogs/graphicdetail/2016/08/daily-chart-20

We’re buying a condo right now — it’s cheaper than renting in our area, we have a favorable interest rate (we missed the lowest rates ever, but it’s still pretty damn low historically), we need the space with a new baby, it’s in a great area (walkable parks and elementary school, great restaurants and public transportation), we love the condo, and we’re pretty sure we’ll be there for 5 years and that the housing market is pretty stable (we live in a large city, and this area has long been a very popular area to live in).

I’m not worried about interest rates now that mine is locked in on a 30 year fixed rate mortgage — interest rate changes won’t impact my monthly payments at all, and indeed raises in interest rates being generally a result of/reaction to inflation (real or possible), it’s likely that any rate increases are reflective of inflationary pressures that will increase the cost of everything….thus making my “fixed” cost housing (ignoring for a moment insurance and taxes) all the more valuable to my cash flow.