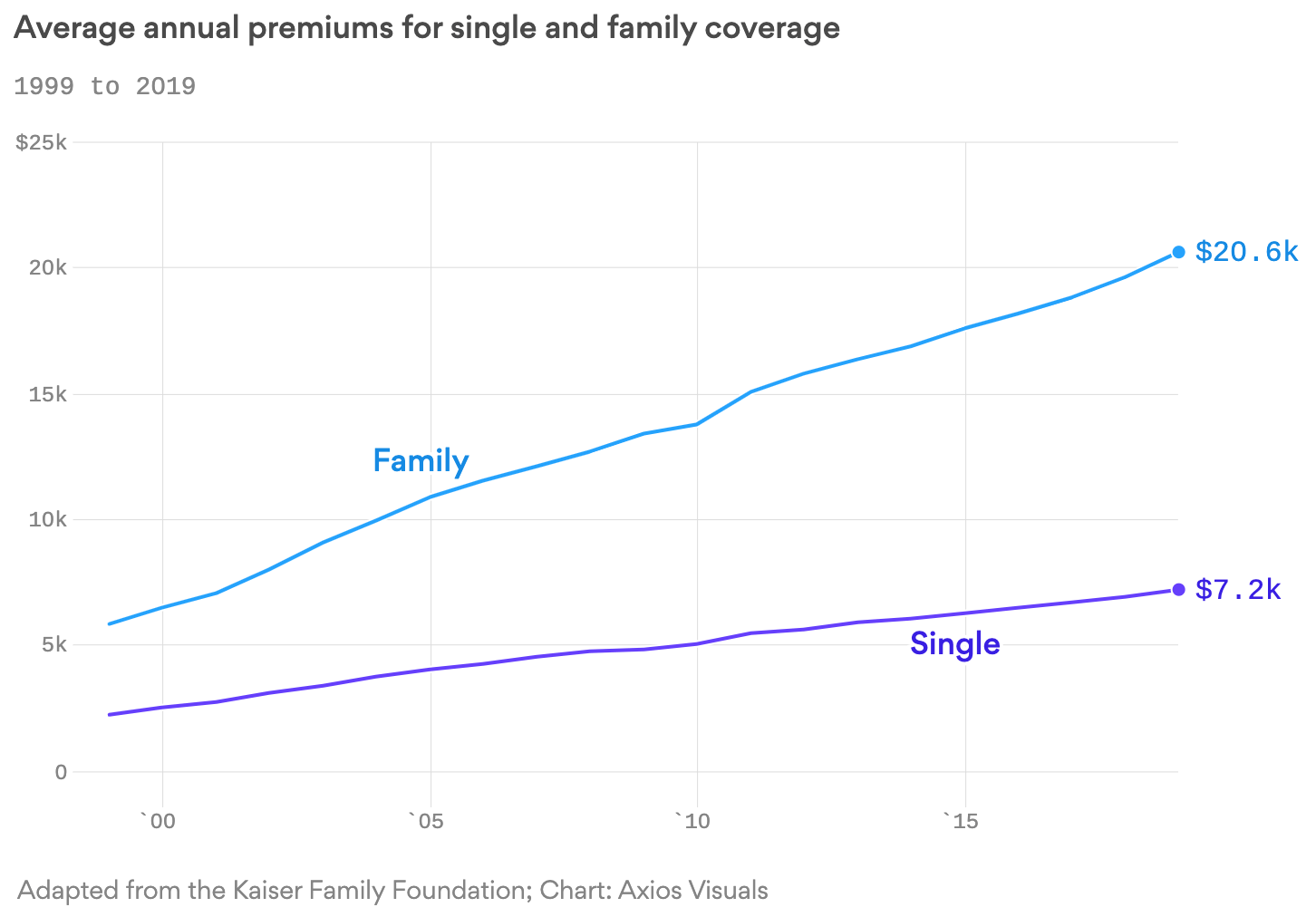

According to the Kaiser Family Foundation, the average cost of family health insurance offered by companies is now a whopping $20,576 a year, or $1,714.66 a month. Employers paid for 71% of that cost on average.

Meanwhile, the average premium for single workers was $7,188 a year, or $599 a month. Employers covered 83% of that cost on average. The KFF surveyed over 2,000 companies.

If they had asked us what we paid, we would have brought up the average because our health insurance cost is jumping by 7% to $23,131.38 a year, or $1,927.64 a month for a family of three! Previously, we were paying “only” $21,788.88 a year, or $1,815.74 a month.

With one child we have a PPO Platinum plan with a $250/$500 deductible (single/family), a $3,200/$6,400 out-of-pocket max (single/family) and 80% co-pay insurance.

The Average Cost Of Health Insurance Is Unsustainable

Despite workers' earnings rising roughly 26% from 2009 to 2019, healthcare deductibles rose by 162% over the same time span. In other words, employees are getting squeezed. It is only logical that companies not pay employees as much if they have to pay for ever-increasing benefits.

Below is a list of other items that have inflated quite drastically over time. If you want to save on costs, then you should stay as healthy as possible, don't go to college, don't have kids, and be a homeowner.

Out of curiosity, I asked our healthcare agent how much our healthcare premiums would go up if we had a second child. He said adding a second dependent under age 15 to our PPO Platinum plan would cost an extra $440 a month for a total of $2,360 a month or $28,320 a year!

Using a 25% effective tax rate, our family needs to earn $37,760 a year just to pay for our healthcare premiums. Using a 4% return or withdrawal rate assumption, we would need to accumulate or allocate $944,000 in investments to cover our healthcare premiums if we continue to stay unemployed.

If you don't think you need at least $2 million to retire early with kids, you are seriously fooling yourself. The math doesn't lie folks. $1 million needs to be set aside for healthcare costs that are growing by 5% – 7% a year. The other million is used to pay for basic living expenses.

Healthcare costs are going to be your largest unavoidable expense. You can save on tuition by just going to public grade school and public university. Housing costs can be controlled if you pay off your mortgage or relocate to a lower cost area of the country. But there's nothing you can do about runaway healthcare expenses unless you retire in or near poverty in order to get subsidized healthcare.

Analyzing Our Health Insurance

Given both my wife and I don't have employers to subsidize our healthcare expenses and we earn more than 400% of the Federal Poverty Limit ($83,120) from our retirement portfolio, we do not qualify for goverment healthcare subsidies either.

Once my wife stopped working in 2015, we decided to just get the best plan possible so we could minimize health insurance headaches and rest easier knowing we can get the best possible care. However, healthcare costs are now starting to push the upper limits of our comfort zone.

One solution to lower our healthcare cost is to downgrade from a Select Plus PPO Platinum plan to a Select Plus PPO Gold plan to save roughly $160 a month in premiums. However, if we do so, our out-of-pocket max rises from $6,400 to $12,000.

Given we have a 2.5-year-old, we still don't know for sure how his overall health will be. So far he's doing OK, but we won't really know until maybe after he's five years old what other health issues he may have.

Further, if we have a second child, having our current plan saves us more money given the lower out-of-pocket max and 80% co-insurance. You can't just get a better plan to cover a big healthcare expense and then downgrade to save on premiums once that expense is covered the next month. These plans are year-long contracts.

We analyzed this comprehensive list of family healthcare plans arranged by price. You'll have to zoom in on the graph to see the details. I'm curious to know which plan you'd choose and why if you are a relatively healthy family of three with no chronic illness or pre-existing conditions. Your child is 2.5-years-old and you may have a second child.

The Core PPO Platinum plan seemed like a great alternative, but our agent informed us it has a much smaller network of doctors which excludes some of our current doctors. We'd also have a similar problem of a smaller network of doctors if we switched to an HMO plan, and would require PCP referrals for specialist care, exams and tests.

How Do Retirees Afford Healthcare?

I've been scratching my head a lot, wondering how other early retirees / long-term unemployed afford healthcare insurance. Therefore, I went and asked a bunch of people and this is what they said:

1) Have you looked into Liberty Health Share? It’s a Christian based plan. It’s equivalent to a PPO with a $2250 deductible/ max out of pocket for only $499 a month for my family of four! I’ve had it for four years and love it.

2) I have Liberty Health Share as well. Last year we had our first child and paid only a 1,500 deductible. It was amazing. What impressed me from the very beginning was you could get a person on the phone right away and they actually cared and tried to help you with whatever you were calling about.

However over the past 6 months or so the service has gone downhill. They no longer try to pay claims within 60 days and sometimes it seems like it’s an absolute nightmare to get them to do their jobs. Still it’s better than I remember from Blue Cross Blue Shield so we are holding on and hoping things get better again.

Note: Dealing with insurance companies who may not pay the claims is the nightmare I'm trying to avoid by getting a better healthcare plan. I really don't have the time or desire to deal with insurance BS.

3) My wife works and we are all on her company's healthcare plan. We pay about $550/month for our family of three for a Gold-level plan. Our estimated net worth is $2.5 million.

4) Both of us are retired and live off about $38,000 a year from our $2 million investment portfolio and part-time work. We live in a very low cost area of the country where you can buy a house for $250,000. We are a family of five and qualify for tremendous healthcare subsidies given our income is only 130% of the Federal Poverty Limit. We pay less than $120 a month for a Bronze health plan under the ACA. Our deductible is $15,000.

5) We are a childless couple who live on about $28,000 a year. Our portfolio is about $1.1 million and we live in a middle-to-higher cost area of the country. My wife has a pre-existing condition that requires constant medical supervision. Our household income is at about 150% of FPL, so we only have to pay about $3,200 a year for our health insurance under ACA. We make an extra ~$10,000 a year in side income working online.

6) We started a business so that we can deduct our health insurance costs. Our business income comes from doing various consulting work online and offline. Last year we pulled in roughly $40,000 of consulting income and deducted $24,000 of health insurance expenses for the three of us. Effectively, we've lowered our health insurance expenses by roughly 20%. We also make roughly $90,000 a year from our various investments.

Healthcare Is Only Going To Get More Expensive

For most retirees, the solutions to comfortably afford healthcare insurance are to either get on your working spouse's healthcare plan or earn 200% or less of the Federal Poverty limit to get tremendous subsidies from the government. Even earning between 300% – 400% of FPL, you're only required to pay at most 9.86% of your gross annual income to healthcare premiums under the ACA.

The high cost of healthcare also makes me wonder whether more workers will be hesitant to retire early as well. I guess so long as you're willing to earn less than 400% of FPL in retirement, healthcare is manageable.

Unless we want to incur a tremendous tax bill by selling our income-generating assets, the only way our family can immediately reduce our health insurance expense is if at least one of us goes back to work. If the new employer pays 71% of the annual cost, then we would be getting a healthcare subsidy of $16,423 a year or $1,368 a month.

It might very well be time to dust off the old resume!

Related: POS vs. PPO Plan – What's the Difference?

Readers, how much do you pay for health insurance a month and how much does your employer pay? Do you think it's morally OK to get healthcare subsidies if you are a millionaire? If you don't work, how do you afford such egregious healthcare costs?

I’ve recently concluded that health insurance is a scam if you’re generally in good health. In nearly all cases you’re better off banking your annual premium into an index fund and using that to pay medical bills in cash.

I’ve been paying my family’s private insurance premiums for years. Our expat insurance had US coverage and a $10k deductible and cost ~20k/yr for our family of 6. Geoblue, our carrier, paid in full office visit fees outside the US, no deductible. Any tests or charges beyond the doctor fee counted towards the deductible, or in other words we had to pay it. We never, ever reached the deductible amount in any year.

One day I decided to download our visit history and payments from my Geoblue account. I found that OVER 10 YEARS WE PAID ~$70K MORE IN PREMIUMS ALONE THAN WE WOULD HAVE JUST PAYING STRAIGHT CASH TO THE PROVIDERS. Bear in mind in addition to the premiums we paid health bills that fell under the deductible.

That blew me away. “This can’t be right,” I thought. “You’re always supposed to have health insurance. Not having it is irresponsible. Financially it’s a good deal.”

Math doesn’t lie.

Then we moved to the USA. I found out health insurance here is even worse.

Bronze plans will cost us $2600/month with a $14k deductible plan (Platinum plans are just overpriced bad math and like 2x more expensive which is insane). And unlike our expat insurance, Bronze US health plans rarely pay anything for doctor visits until you hit the $14k deductible. So with a plan we’re paying ~$30k in premiums PLUS up to $14k in care expenses = $44k until the “insurance” (LMAO) pays anything!

What a monumental joke.

It’s even worse because I discovered that often you will pay MORE with insurance per visit than you will if you have NO insurance. Yes you read that right. The cash-pay price often can be less than the deductible charge if you have insurance. It’s because providers jack the price for insurance carriers.

Many providers will give you a 50% discount if you have no insurance and pay cash. I paid all-in $3k for a colonoscopy, cash. My kid’s pediatrician cut a $300 bill to treat an ear infection to $150 because we paid cash, no insurance. We’re just a month into our experiment — in the first month we’ve paid about $1200 in health bills, and it was a heavy use month. Compare to $2600 premium plus $1200 = $3800. No brainer.

I’m still gathering data on health costs not having insurance as we encounter the health system in the US. Maybe I’ll discover something that will change my conclusion. But even so I reckon we always can sign up for a plan in November each year if disaster hits. But the disaster would have to be pretty bad to make the numbers turn against not buying insurance. Meantime we are banking $30k/year (less cash health expenses) for our health fund.

So to recap — insurance will cost us minimum $30k/year in premiums. Then we have to pay the first $14k in health bills anyway. So up to $44k/yr before I see any real benefit from health insurance, and even then my health bills would have to be >$74k before insurance turned net positive for me.

Yes, I’m taking more “risk” in terms of getting some terrible chronic costly disease. But again Obamacare prohibits discrimination for pre-existing conditions, so the most we’d wait to get a plan is max 1 year and more likely ~6-8 months. That seems like a reasonable risk to me given what “health insurance” will charge me to insure against that risk. I can afford a surprise $100k-$300k hit. Call it “self-insurance.”

As Sam points out, insurance is expensive because most people eat poorly and don’t exercise. Looking at my own numbers I’m convinced there’s a power law in effect — a small fraction of the population is driving the lion’s share of health cost. “Health insurance” isn’t insurance at all — it’s a cost sharing and subsidy scheme. Do the math — I bet 90% of readers have paid more into health insurance than they ever got out if you include what employers pay. Plus providers and carriers have incentives to jack costs.

I would love to buy a policy where I pay 100% of the first $75k/year health care cost, then it pays 80% of everything above that. That is real “insurance.” But it doesn’t exist. Because if it did financially and probability-savvy people would buy it and deprive the cost sharing/subsidy scheme of cash cows.

Am I missing something? I know it’s heresy, but I’ve been over this again and again and don’t see a flaw to my logic. I know my risk tolerance is higher than most.

Hi,

I’m an ex health insurance executive in CA and I can show you how to cut your overall healthcare and health insurance bill in half. I’m not a broker or selling anything, just want to help you and your readers. Your $24K health insurance (plus copays, etc) and overall after-tax healthcare bills can be lowered by $10K in Y1 and likely $14K in Y3 using great CA healthcare providers and insurers such as Kaiser Permanente – an institution revered nationwide for its great care. Happy to help you with a more elaborate blog post including specific San Francisco health plan options, a spreadsheet that demonstrates the savings and perhaps a Q&A discussion that helps dispel various misconceptions.

-Dan

Yes, Dan. Please do share your trick.

I’m thinking of moving my family of 5 back to the CA from the EU to help my dad. However, at these costs, it would be all but impossible.

Thank you in advance.

I’m late to the discussion, but you should consider signing up with a Direct Primary Care Physician. These physicians provide you primary care for a fixed ongoing monthly fee, that is much less than what your cost would be if you went to a fee-for-service doc and they billed your high deductible insurance. And if you have children, it strikes me as even better deal as everyone I know who has kids seems to max out their deductible and with these DPC docs you will still come out ahead.

My wife and I are retired, accidentally from rental income, just like Sam. We’re 53/54 now.

We don’t have any health insurance, never had it, and don’t plan on having any. What for?

Primitive pharmaceuticals?

MERS and Candida infested hospitals?

Doctors whose ethics are so bent they are seeing dollar signs everywhere?

A system in which “help” means drugs with side effects that need more drugs?

A fear-based proposition where not taking responsibility for your own health and always “talking to your doctor” who really knows only about studies and averages, but your body and mind are nothing like the “average”?

Pushing people into drugs and procedures they could do without?

Being all about money?

We see healthcare system in the U.S. as a fraud of gigantic proportions. We talked about buying insurance, but decided it’s not even about money.

We both agreed we’d rather die than let us go under the “tender care” and “mercy” of American health industry. Perhaps for things like fixing up a broken bone, for which we’d pay ourselves.

But for anything else, I’d take my chances with better food, exercise, discipline and whatever my genetic code has in store for me, and be at peace with it, over glorified leeches called the healthcare system.

It’s shameful the shackles of fear this industry has over Americans. Actually the shame is more on Americans for falling for it all and believing there’s a “pill for everything”, than on bunch of greedy unscrupulous people who tried to con us all.

Exactly the reason i’ve remained in the military and intend to do so to not only earn a pension at 41, but healthcare for my family and I. The healthcare is more valuable to me as the cost appears to be exponentially growing. Even in a HCOL area of the Bay Area (where we’ve been stationed multiple times), my family and I find the care great.

Is there anyway you can label your article on the date?

Btw I really resonate with your previous article about how the middle class in the Bay Area requires at least 300k of income and still barely sail by. We pay 39% fed and state tax, property tax, 9.5 sales tax and our disposable income is so low we can’t even afford health care. It’s pathetic

I am deciding whether to retire at 50 in 5 months, or work till 55 at which point my municipality offers paid for medical for my entire family!

At 50, my yearly premium would be $20,000 plus the out of pocket costs for family coverage, (on a great BCBS PPO) until my wife and I are eligible for medicare.

After having saved and invested for decades and being debt free, it’s unsettling to have to pay $1,666 per month in premiums until Medicare, knowing darn well that these premiums will continue to skyrocket until I am eligible for Medicare. Even after decades of saving and invested, I feel handcuffed to my job!

I think an area that could help improves costs dramatically is in nutrition. We are a nation with many obese and chronically ill people that are addicted to sugars and starches.

This has led to an increase in type 2 diabetes in the young and old. A devasting disease which many other diseases stem from like heart disease and cancer.

The food industry should be regulated like the tobacco industry. They have caused so many americans to be sick and the government has been complacent and in bed with them by not telling americans the truth that the food pyramid is dead wrong and so was Ancel Keys!

Imagine if we could stem all these chronic diseases by eating real food like our ancestors. Our “sickcare” system wouldn’t have the demand for services that we are currently putting on it. And hence the cost would go down.

In a perfect world, we’d eat like our ancestors and there would be a DRAMATIC reduction in all of the diseases that were unheard of hundreds of years ago!

But I know it will never happen, because profits are what drive people and people in government that could change the food pyramid, can be bought with donations.

The food industry wants to keep us sick. Doctors receive very little nutrional education in medical school. And most give bad nutrional advice as a result. Those that speak up contrary to the food pyramid, get sued! And we pay the price as we get sicker and sicker!

Grant it there are accidents and genetics that will not prevent some from falling ill, but for a majority of people, if they can fix their nutrition, we could put alot less of a burden on our sickcare system and drive the costs way down.

Unfortunately, we are a nation of addicts, addicted to the very crap the food industry sells us and I won’t see it ever changing.

If I was only concerned about myself, I’d roll the dice and retire, but I can’t control what my teenagers eat, and their well being obviously concerns me.

There is no incentive by the government and corporations to want to make us healthy. And I am a capitalist at heart and believe in smaller government, but the food companies should be regulated by how much sugar they put in the foods they make. And Americans made aware of how devastating it is to our health!

Apology’s for any typos.

Whenever politicians (Republicans + Joe Biden) complain about the costs of a Medicare for All plan, they conveniently leave out the amount we’re already paying to for-profit healthcare companies. True, Medicare for All might cost $32 trillion over 10 years, but our current system will cost at least $34 trillion and STILL not cover everyone or ensure affordable coverage.

Despite what some might say, Medicare is also highly efficient, only spending about 2% of its budget on administrative costs compared to 15-20% for private insurers. Further, Medicare is able to set prices for services. Price is a huge reason why health care is so expensive in the US as mega hospital systems dominate markets, resulting in an MRI cost $3,000 while Medicare pays $500.

Saving $2T in the economy that could be spent on more productive activities while also covering everyone with comprehensive coverage seems like a no-brainer to me.

Medicare’s administrative costs are in large part passed on to providers and hospitals. This is why they are so low.

The Health Sharing ministries are not insurance companies and are under no obligation to pay any claim. Not sure why folks in the FIRE community continue to be enamored by a “religious” exemption loop hole in the ACA. They also exclude a number of pre-existing conditions. Insurance premiums are to be paid for piece of mind. Last thing I need when ill is to be worried what would be covered or not by these ministries.

Also ACA is watered down from the original plan and it is worse in the Republican states which voted against expanded Medicare coverage. CA and other blue states have decent options and prices on the respective state exchanges.

The cost of health insurance is a major obstacle for my husband and me to retire early. It would take us an extra 3 years of working to build up the capital to generate the passive income needed to pay for the health insurance premiums. Now, if everyone was provided with Universal Basic Income of $1,000/month then health insurance premiums would be paid for. How awesome would that be?!

Families planning to rely on a working spouse to get affordable health insurance should make sure to choose an employer that pays for family coverage. If employer just pays for employee only coverage but not family there’s an ACA family glitch that may make you ineligible for subsidies no matter how little the employee earns or how expensive the non working spouse and kids coverage costs. I’d say more but the page has reloaded twice while typing and I didn’t want to type this comment a fourth time. Google ACA family glitch.

It’s a great financial point

I came to USA roughly 5 years ago and we had to face with a pretty tough medical services reality as soon as in my home country all medicine is free. That’s disputable the quality sometimes but in general it’s affordable for almost everyone and you can get any commercial medical service for a little pay if you choose it. So just the thought itself to pay $300 monthly in US for our family of 4 for medical service which I can only use in theory was devastating.

As soon as current president administration canceled fines for not having medical insurance we stopped contributing anything to this crime insurance lobbyists. And we are family with two teenagers.

Our net worth is roughly $ 2000 000 without taking into consideration inheritance and other money could inevitably grow up in the next 10 years in 401(k), but we don’t even consider to keep living in USA after our kids are done with college education. We are planning to live everywhere all over the world including Asia, Australia, Europe and Latin America after our early retirement where is affordable cost of living, affordable medicine and fantastic food. I believe there’s always a choice to stay somewhere you get used to live being scared of any potential adversity which could happen when you change your life drastically, or move freely all over the world being challenged and saving as much money as it possible.

Thus we are not horrified by cost of medical expenses when we turn 60-70-80 just because we are gonna meet that amazing age in another well developed country with a great medicine and still pretty good net worth.

As with many comments on this subject, I am in what one commenter called the “danger zone”. My wife and I are 56 and have accumulated a very nice nest egg over 34 years of working. My wife works part-time w/no benefits so leaning on her to cover healthcare so I can retire next year is not going to work. We have budgeted $25K for Healthcare until we turn 65, then we budgeted $10K every year until age 99 to supplement Medicare. We budgeted $5K for Dental/Vision from 56 – 99. All dollars are inflation adjusted (2%). Using Personal Capital for our Retirement Planning assumptions & calculations. I can stay working for 5 more years and get all insurance supplemented through the corporate retiree program which is substantially lower than the individual rate in the open market. My issue is that I have to work another 5 years and I will be 61 to get it and really don’t want to be held hostage by healthcare to keep working. We may be able to take advantage of subsidies if we can keep our MAGI under the threshold of 400% but then again, I am taking a chance on ACA and it’s future. Our financial advisor tells us not to let Healthcare dictate my retirement date per our situation but spending this kind of money each year makes my stomach turn. Does it make sense to work through a Health Insurance Broker to navigate all of these choices to see which one is best?

You need to present alternatives to traditional insurance (sharing plans, direct primary care, and more). The system can be arbitraged.

I’m on a ministry plan and pay 80%+ less in premiums vs. the ACA plans in my area. Not for everyone, but an option.

Not of fan of letting the government handle my business but this is one of the exceptions where there is no other way than to have our government handle it.

I lived in Iceland for 20 years before I came here to college and now I work as a CPA in the U.S. I have relatives in Scandinavia so I have had exposure of having the government handle the health care and then being insured by the private sector here. Having the government handle has in my opinion been a more efficient (suprisingly) and a smoother experience.

This might be the only thing the government handles better than the private sector.

Thinking about it objectively makes you realize that it does not make any sense that the health insurance companies in the U.S had a combined net profit of around 90billion dollars in 2018.

It’s the same reason we don’t have private police and fire departments, or private highways.

Health care is a public good, just like those.

doddiozil we should note that Iceland is not a good example because it’s a country the size of a small town(a little over 300k people). Many things are atypical in Iceland versus the rest of the world. One look at how it operated during the 2008 financial crisis and you could argue that the country is run similar to a large hotel. Therefore, it is not an apples to apples comparison.

I too come from a country where healthcare is run by the government and let me tell you… IT SUCKS ! Anyone who claims otherwise has simply not been in a system to experience this and is jaded by people/politicians who throw out there unicorn ideas that appeal to people(who doesn’t want free healthcare or free $1000 a month) but in reality/practice, it would be a complete disaster and simply not feasible.

First misconception is that it’s free. It is not. It is simply deducted from your paycheck without your say so or choice. If you happen to work as an employee AND have your own business on the side, you get “deducted” twice, no choice again.

The most important part is that the service, conditions and doctors provided SUCK.

When it gets to the point of 2 patients sharing a bed, having to bring your own bandages and such from home because the hospital is bankrupt, it will quickly change your mind. Dilapidated hospital buildings and reject doctors(cause the best fled to the west for real money) that won’t touch you unless they get “a taste” in an envelope, plus nurses that won’t check on your or change your bed sheets if you don’t make a personal donation to their pocket. Bribe to get in front/know someone or wait 2 months for a surgery. Literally wait in the E.R. until you die because they are understaffed/don’t care due to lack of funds. And when it’s all said and done, you’ll still need to drop by the private hospital for further treatment or a follow up to make sure you are treat of your ailment.

I don’t generally like analogies, but they seem to be popular:

Cars are not free. Not everyone gets a car. Want a Bentley ? Pay the premium.

Food is not free. You die without food. Want a steak ? Pay the premium.

Same with education and so forth.

Not to sound harsh but it is not my obligation to make sure you have a car, food or a masters degree.

Matt – how many years and in which country have you lived to be able to share your experience regarding government ran healthcare ?

And I hope you won’t mention Canada because my brother complains every time we talk about what a joke their healthcare system is. Furthermore, there is no Canadian health care system. Health care there is funded and administered by each province and territory. By comparison each US state would have it’s own healthcare.

I agree that costs are out of control, but instead of handing it over to the always-incompetent government, I’d rather aggressively deregulate and let capitalism take it’s course and drive prices down by competition.

JimmyD:

Thank you for sharing your experience.

I am sorry you come from a third world country. It must have been hard for you growing up. My comment focused on comparing other developed countries to the united states, not undeveloped countries. Like i mentioned above my experience with health care in a developed country was significantly better than the health care here.

There is just no reason for the health insurance company to have a net income of 80billion dollars in a year.

Thank you for sharing your experience. The U.S. can control runaway health care costs without having to become a health care provider itself. They can set prices for premiums and requirements for quality, just like Switzerland did. The health care providers and insurance companies can still survive, just like they do in Switzerland. In that country, monthly premiums are about $300 per person and $900 for a family, and the premium covers everything.

I used to sell health insurance. After Obama my premiums and deductible went up 4-7x. Now with a family of 3 we choose to self insure. Anytime we have had to go to the doctor we pay a reduced amount in cash which is about 20% cheaper than paying with insurance and we rotate dentists using Groupon for 90% off dental cleanings. I fractured an ankle a few years ago and paid 300 bucks for xrays and doctor visit. I found the ankle support brace on craigslist for 40 bucks as opposed to the new one they wanted to bill me $500 for. We drive a big safe SUV and carry over 500k in unsinsured/underinsured motorist coverage to cover any car accident injuries. Given that most insurance plans don’t kick in until the deductible is met people are paying out of pocket anyhow and if we need catastrophic coverage maybe well get employed with a friend’s company or find a job at a bank. Its outrageous what medical care costs and we think medical tourism will become even bigger business if the US healthcare system isn’t fixed. Some people might say going without health insurance is stupid but then again so is a life of risking obesity and getting sick eating unhealthy food working a desk job. To each their own, but HSAs were supposed to be the saving grace but that hasn’t turned out so well unfortunately. At a minimum all healthcare expenses including premiums should be tax deductible for everyone. Employer sponsored or not.

Great financial and ethical questions.

If I retired now I would roughly make 60k in passive income. That comes within 3k of the subsidy cutoff for a couple. In the area I live in 60k is a little over the median household income. We owe nothing other than the bills no one can avoid so I think money wouldn’t be an issue so long as we didn’t do anything too nutty.

The one thing that keeps my wife from being comfortable with me retiring is our insurance. We pay $600 a month in premiums and are constantly hit with a barrage of copays, deductibles, etc.. which we keep well managed. I can easily see how medical bills could quickly pile up even with insurance. She’s afraid that we would eventually get behind. With a nut of around $3k and an income double that I think we would be fine. I especially feel comfortable if we took advantage of the subsidy.

With the subsidy I believe I could get the Blue Cross gold which would amount to a $500 premium with similar deductions and copays as I have now. Anyway you look at it I’m gonna spend between 10 and 20 thousand on health care.

This begs the question you already asked. Is it ethical for a high net worth couple to play the system? In my opinion, ABSOLUTELY. We have a system that is rigged to gaff the middle and upper class for the supposed benefit of the poor. Who’s really benefiting? The insurance companies. And the political machine on both sides of the aisle. We don’t have socialized medical and we certainly don’t have free market medical either. Because if the market was mostly free with some important regulations (think preexisting conditions and antitrust policies), competition would drive it back to more manageable levels. I would have no problem taking advantage of subsidies set up for people with my income level.

Is there a better way? I’m sure. It won’t happen as long as big industry and their political pets are getting their palms greased.

One more data point for this discussion: my mother is moderately wealthy and has had private (individual) health insurance from age 50 until Medicare age arrived (about 10 years ago). Prior to her becoming eligible for Medicare, she was paying approximately $20K a year for an individual platinum level plan (plus an additional ~$150 a month for concierge service).

She was (and fortunately still is) incredibly healthy – so for all those years she never had any major medical issues. Yet the amount of money she had to allocate each year really made an impact on my wife and I. We quickly realized that we will need over $1.5M in investment assets alone to cover a plan for our family of three when we retire around age 55 (five years from now). We can’t imagine how people cover private medical insurance and other living expenses in a high cost of living area without at least $5M in investment assets.

Have you explored the idea of developing your numerous posts into a book and marketing it to college students and young professionals. You have a wealth of information that would be valuable to serious professionals that have not discovered your site. I am an old dude (working as a CFO in manufacturing) and look forward to your weekly posts and generally learn good information.

Regards, Mike

Hi Sam,

Longtime reader. New poster.

I live in Saudi Arabia. My healthcare costs domestically are virtually $0. I pay nothing for all of my care. I pay nothing for all of my prescription drugs (and some over the counter). I work for an oil company, and my company has its own hospital within compound. Because I’m an American, I pay $200 a month into a health insurance policy (for my family of 3) through Aetna that kicks in if I need insurance while I’m abroad or in the US. If I work for my company for 10 years and reach 50, then I can keep my insurance at $583 (current cost). I’m 42 now, and I consider working here until 60 because American health insurance is such a mess. If anything, I consider trying to get a job in Canada for the geoarbitrage in terms of insurance and university tuition/acceptance rates. If single-payer health insurance through Medicare for all becomes a reality in the US, and everything insurance wise doesn’t suck anymore, I’d feel more confident.

The outrageous cost of healthcare is the reason my husband and I are still working. I’m 49 and he’s 54. We have rental properties generating a total net income of $100K per year, a paid off home, and $2.5M in investments. But, even with a net worth of $5.5M, I don’t feel that it’s safe to retire and personally assume the cost of healthcare. My company completely subsidizes the monthly healthcare premium in our high-deductible plan. So, if we both retire, we will need to absorb about $30K per year of premiums – cost that we don’t pay for at all right now. So, not only will we be losing our income, but our net expense will also go up significantly. We’ve found the right balance of having jobs we like and take lots of vacations. I don’t see a need to retire and just be stressed about money. That wouldn’t be a fun retirement at all.

I’m a retired 56-year-old with Kaiser in the Bay Area (South Bay). Kaiser just sent me my 2020 premium quote for next year. I don’t qualify for any subsidies so bear the full cost myself. My 2019 premium is $632.46 for an individual. My 2020 estimated premium will increase to $706.74. I’d rather go with a PPO rather than an HMO like Kaiser but Anthem is the only PPO insurance carrier around and I’m assuming the monthly PPO premium will be approx. $1100-$1200 per month. I could probably afford it but barely. When I can no longer pay my premiums due to price increases, my plan is to take in a renter to offset premium costs. That’s the only way I can think of to remain in retirement in the very expensive Bay Area.

I like the idea of universal cheap health care for everyone. However, I would be terrified of the thought of the government running the health care system. I say this as a gov employee. They cannot even maintain basic websites, they are rife with inefficiencies, and 90% of the work force would not make it in the private sector.

Health care costs are out of control. One way to get those costs down would be to increase the technological efficiency of health care. Putting it in the control of the gov would take it in the other direction — guaranteed. The current system is broken and unsustainable, but there have to be other solutions to consider.

But govt is already in healthcare with Medicare. Ask older people about whether they want their medicare, I bet most would fight tooth and nail if you tried to take it away from them. Medicare is their trial, the result is based on whether you think Medicare works for our older population.

When my wife and I retire, we plan to do a combination of:

1) Self-care – eat healthy, workout, etc.

2) Direct Primary Care

3) Medical tourism

4) Self-insurance

5) Catastrophic insurance.

Should be less expensive and avoids having to rely on insurance companies for most needs.

All these people who think they can lifestyle future healthcare needs away are dead wrong. You don’t know what you don’t know. You are going to get sick and the sickness may be something you don’t understand, you can’t exercise away, you can’t eat whole grain avacado toast away, and you can’t overcome without a good diagnostician and science backed treatment. You will be scared, tired, and in pain. If you choose to go the cheap ass way about covering yourself of family, you’ll be getting cut rate care-treat and street. Just enough care to get you out of a chair or bed that a good paying customer can occupy.

Hello, FS

Great topic, on my wife’s and my mind a lot lately as we are planning a change soon.

I work for myself and my wife is a part time nurse. We have two boys ages 3 & 1, with a girl on the way due in February. We are on her employer subsidized plan currently, plat. PPO. Since she is part time they pay half of the $1900/month, so we are paying 950/month right now which I think is great. The costs are even more affordable if we use her hospital and their affiliates for services.

Due to my work taking me out of town often, my wife is planning on leaving work for the foreseeable future to be home with our children.

We do not qualify for subsidies so we will be bearing the full burden of insurance costs. I do agree with you 100% on getting the best plan possible, and that is what we will be purchasing. Growing up the oldest of 6 boys I saw first hand what a huge variable medical costs can be for even a healthy family with children. My brothers and I were all healthy kids, but there were still plenty of broken bones, stitches, burns, ect. My parents enjoyed an excellent employer subsidized plan through Ford For the majority of our childhood, requiring little out of pocket costs. They said back then they didn’t have to pay a dime to birth any of us for example, I’m 32 and my youngest brother is 23. Those days are gone though.

If I could get a subsidy for insurance I would take it, I feel the amount of taxes and insurance premiums I’ve paid over the years would more than make up for it.

I will say I am not looking forward to leaving the security and affordability of my wife’s insurance. The burden of being responsible for the premium every month feels quite heavy. My hope is that at some point my wife will go back to work part time once we are done having children and they get a bit older so we won’t have to fork over such large premiums all on our own.