If you want to build great wealth, you must invest in risk assets over the long term. If you hold most of your net worth in cash, your purchasing power will fall behind due to inflation. In this post, I'd like to discuss what the last 20 years of inflation teaches us about building wealth.

Today, $3 million is the new $1 million when people talk about what it's like to achieve real millionaire status. Heck, some people might double that figure to $6 million if there is a two-parent household. Inflation is that powerful of a wealth destroyer, which is why you must continuously invest in stocks, real estate, bonds, and alternative investments.

I remember filling up my Toyota Corolla beater for 95 cents a gallon back in 1995. Today, I sometimes have to pay over $4.5 a gallon. So many things have gotten so much more expensive over the past couple of decades. Inflation really is a nasty bugger if you're on the wrong side of it.

Let's drill down and see how the prices of select consumer goods and services have changed since January 1998.

The Inflation Of Select US Consumer Goods and Services

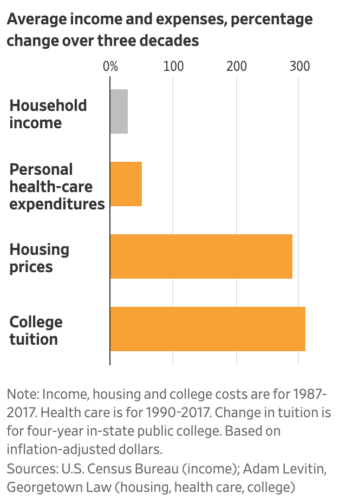

Below is my favorite inflation chart by Carpe Diem. All of the data comes from the Bureau of Labor Statistics. Based on select US consumer goods, services, and wages, overall inflation rose by 82.4% from January 2000 to December 2023. This is an annual compound inflation rate of 2.5%.

From this inflation chart, we can learn the following:

1) Letting yourself go physically is costly due to high healthcare expenses

While Medical Care services have grown 2.2X faster than overall inflation, the cost of Hospital services has grown 4X faster than overall inflation since 1998. As a result, it is imperative that we all stay as fit as possible.

If you are on the path to financial independence or have achieved financial independence, it makes zero sense to be out of shape. Once you've won the lottery, your goal should be to live for as long as possible.

Even if you have to pay more to subsidize the less healthy, it's worth staying in shape and eating better to try and reduce your chances of heart disease (~23% of all deaths), cancer (~21% of all deaths), chronic lower respiratory disease (~6% of all deaths), strokes and cerebrovascular disease (~5% of all deaths), and more.

Once you lose your health, no amount of wealth matters. Let's all cut down on sugar, exercise at least 3X a week, and work on our mental health as well. Please focus on getting as healthy as possible, especially if you're on the path to financial independence or have already achieved FIRE.

2) College is a racket if you have to pay full tuition.

The primary cost to run a college is personnel costs. So how is it that college tuition, fees, and textbooks have risen 3X faster than the overall rate of inflation since 1998 and hourly wage growth has only grown by 35% more than overall inflation?

The answer: colleges take advantage of parents' hearts and charge excessive amounts for a depreciating product. Colleges know that parents want the best for their child, even if they can't afford the cost. As a result, despite massive endowments, colleges purposefully jack up tuition and fees out of greed.

You should be mad that college textbooks have grown so expensive despite the huge growth of digital books. Colleges and publishers are in cahoots. Publishers price their product as if they were oligopolies and don't even promise their graduates jobs.

I'm hopeful that more students and parents will wise up to the fact that colleges have been taking unfair advantage of the American public for way too long. I've been saving aggressively in my son's 529 plan for seven years and I still don't think I'll have enough by the time he goes in 2036.

If you have to pay rack rate for college, do not go! Or, find a cheaper alternative, please! Starting your work career with massive debt is a big mistake. Eventually, going to college will only be for the rich or poor. For the middle class, be careful spending too much.

Related: You Should Accept $1,000,000 To Go To Public School Over Private School

3) Younger Americans are doing better than they think thanks to inflation.

Despite constant reports saying that real wages haven't kept up with inflation, Average Hourly Wages according to the BLS has grown faster than overall inflation by about 35% since 1998.

It's only after you have kids and want to send them to college do you start feeling poorer. For most Americans, the burden of health care costs doesn't hit until the last third of our lives. Therefore, younger Americans with no kids should be feeling pretty good about life.

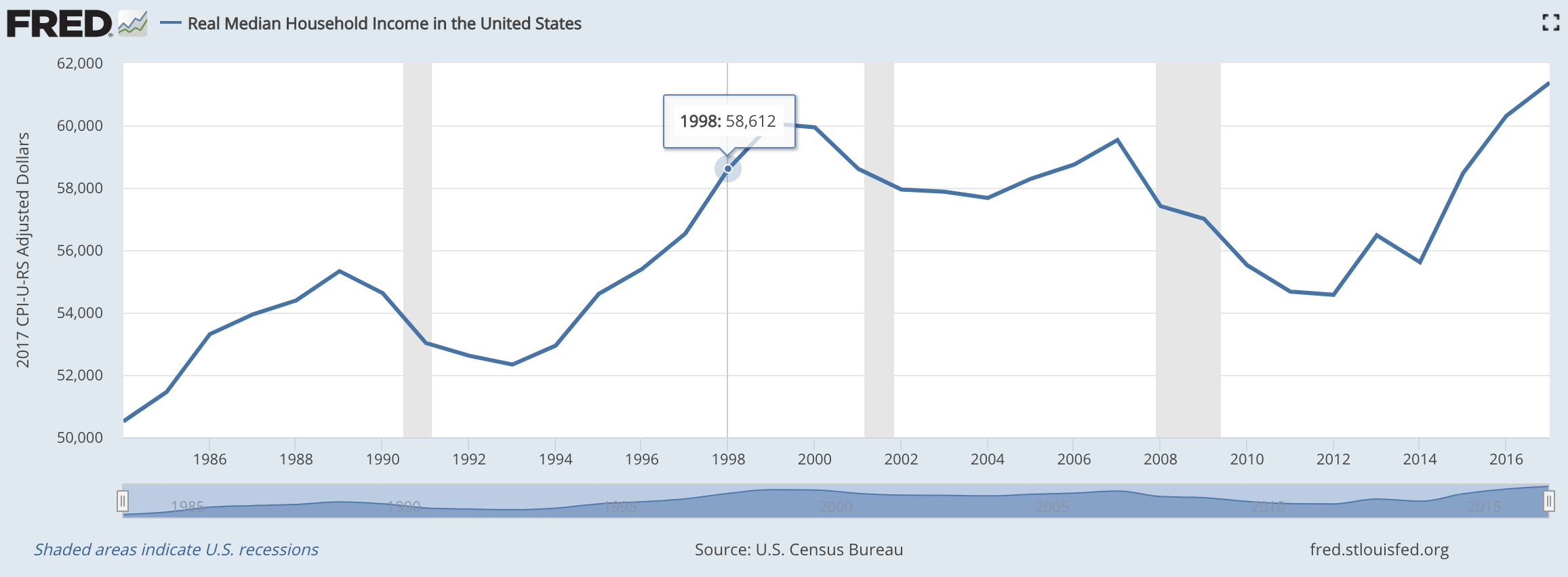

Although, if we look at the Real Median Household Income according to the U.S. Census Bureau, the median household income of roughly $62,000 is only 6% higher than the median household income of $58,612 in 1998. At least we're now at a record high of around $80,000 in 2025.

Families, on the other hand, are getting hurt by inflation the most. Parents must pay for college, buy a bigger house, and pay more for medical expenses thanks to children.

If you want to achieve financial independence sooner, one obvious solution is to not have kids and never get sick.

4) Owning your primary residence is a wise move to beat inflation.

Housing inflation has slightly outperformed overall inflation since 1998. As an average homeowner, not only do you benefit from your home's value inflating at ~4% a year on average, you also get the benefit of fixing your mortgage rate and paying it back with inflating dollars. This is a triple win!

Contrast the homeowner's situation with the renter's situation who now has to pay 60% higher rent today than in 1998 while having no equity after all these years. Renting for the long-term is like shorting the S&P 500 for the long-term. It is likely going to be a losing proposition.

Obviously, don't churn your property or buy more property than you can comfortably afford. The return on rent is always -100%. At least with long-term property ownership, there is a chance to make money.

Once you pay off your house, it makes it much easier to live on a near-poverty income in retirement if necessary. But who wants to do that?!

Combatting inflation is straightforward, but not easy. By getting neutral real estate by owning your primary residence, living gets much easier.

Please follow my House-To-Car Ratio if you are thinking of buying a house and a car, which most people do. Too many people spend way too much car to their financial detriment. My ratio will help you spend on both more responsibly.

5) Take full advantage of cheap electronics to create, not just consume.

I'm not sure whether we truly appreciate how incredible it is to have powerful laptops and mobile phones. Back in the 1990s, it cost a fortune to own a 286 computer. There was no internet at our fingertips to do any research or make any money online.

Today, thanks to cheap electronics, the internet, and video conferencing, you no longer have to go into an office, work a traditional job, feel as bad leaving loved ones for a prolonged period of time, or pay to learn anything.

Instead of manually tracking my net worth with a pen and paper or Excel spreadsheet, I do so for free with a financial app on my phone. Instead of typing out a blog post, I can voice dictate the entire post on my phone on the beach.

Back in 2009, it cost me about $1,000 to set up Financial Samurai. Today, you can set up your own website in under an hour for under $50. Take advantage of the cheapness.

Don't feel guilty buying a $1,000 mobile phone or a $1,800 laptop. Buy the best TV, receiver, and speakers you can afford. Electronics are truly the best value out of all consumer goods today. They are even better if you use your electronics to create instead of only to consume. Use technology to positively change the way you live your life.

To Beat Inflation, Don't Stop Investing

Your goal should be to own as many inflating assets as possible, especially if you plan to raise children and get out of shape. My favorite inflating asset over the past 16 years has been San Francisco and Honolulu real estate, followed by the S&P 500.

For the next 20 years, I'm betting on heartland real estate to handily beat overall inflation every year. I suspect the S&P 500 will beat inflation as well given the dividend yield alone is already about 2%. Overall, over the long run, I don't think surpassing a 2.3% average inflation rate a year will be very difficult.

My favorite real estate investing platform is Fundrise. It manages almost $3 billion and has over 350,000 investors. Fundrise predominantly invests in residential and industrial property in the Sunbelt region where valuations are lower. For most people, investing in a private real estate fund that's highly diversified is the way to go.

Another private real estate platform to consider is CrowdStreet. Crowdstreet is a marketplace that mainly sources individual commercial real estate deals from various sponsors around the country. This way, you have more customization to build your own select private real estate portfolio.

Make sure you diversify your portfolio and do your due diligence on all the sponsors. Look up their track record, their management, and whether they have had any blowups before. Although CrowdStreet screens the deals, you have to do your screening as well.

Both platforms are sponsors of Financial Samurai and Financial Samurai is a six-figure investor in Fundrise funds. I think there's tremendous opportunity buying residential commercial real estate now as prices have decline since the Fed started raising rates aggressively in 2022. However, the economy is strong and there is a huge 2+ million deficit of housing supply.

Invest In Private Growth Companies

Finally, consider diversifying into private growth companies through an open venture capital fund. Companies are staying private for longer, as a result, more gains are accruing to private company investors. Finding the next Google or Apple before going public can be a life-changing investment.

Check out the Fundrise venture capital product, which invests in the following five sectors:

- Artificial Intelligence & Machine Learning

- Modern Data Infrastructure

- Development Operations (DevOps)

- Financial Technology (FinTech)

- Real Estate & Property Technology (PropTech)

Roughly 55% of venture product is invested in artificial intelligence, which I'm extremely bullish about. In 20 years, I don't want my kids wondering why I didn't invest in AI or work in AI! I've personally invested $137,000 in the Fundrise venture product and plan to hold for at least 5 years.

The investment minimum is also only $10. Most venture capital funds have a $250,000+ minimum. In addition, you can see what Fundrise is holding before deciding to invest and how much. Traditional venture capital funds require capital commitment first and then hope the general partners will find great investments.

I've personally invested over $155,000 in Fundrise Venture with a plan to build my position up to $250,000.

What The Last 20 Years Teaches Us About Inflation is a Financial Samurai original post. All rights reserved. Sam Dogen is the bestselling author of Millionaire Milestones: Simple Steps To Seven Figures.

For those worried about inflation and cost of living and don’t have anything specifically tying them to the US, consider moving abroad after retirement. It would probably be one of the most effective ways to combat inflation.

There are places you can go in the world that are as safe, clean, and enjoyable as any US city, where people speak perfect English, and where the cost of living is a fraction of what it is here.

I’ve been low key kinda considering moving abroad somewhere down the line. It’s much better than grinding it out here for decades on end.

Just the cost of health care alone in this country makes the United States a subpar place to spend your retirement.

Again, that’s all assuming there’s nothing keeping you here. Overseas relocation won’t exactly work if your family will disown you and your spouse is committed to staying in the US.

Sincerely,

ARB–Angry Retail Banker

Taking care of yourself health-wise is one of the most financially smart things one can do. The cost of healthcare combined with the cost of driving to appointments and loss of time is never fully accounted for. Over the last 6 years, my wife and I have helped both my parents and her two grandparents pass over to the other side. Other than financially draining, it is mentally and physically draining, and it takes a long time to recover.

Your post shows the risk of just saving and not putting the money to work. it is a huge risk to not invest your financial nut. Time can either be your best financial friend or worse enemy. It is important for your readers to put money to work and invest to generate a return that is higher than the rate of inflation.

I recently ran some numbers and, due to inflation and high cost of living, an upper middle class lifestyle in NYC costs about $480,000 a year.

I think parents with kids going to college in the future may really have to think long and hard about where they decide to live a couple of years before Junior starts college (to meet in-state residency requirements) and make plans to land in a state that has the kind of college choices you want for your kids.

Our daughter could have had most of her college paid for through scholarships and grants, with no initial out of pocket for us, had she chosen to stay in-state. Of course, she chose a good public out of state school that will wind up costing us ~200K over 4 years. My parents sent me to college for 4 years on less than what one semester costs me now for our daughter. And of course, they really stick it to out of state attendees to make up for the dollars they are losing from the state budgets.

It really is quite the racket and makes me somewhat glad our daughter is an only child!

I do have a question- Why was daughter the only one involved in the decision as to where to go? I personally never felt any obligation to provide financing to children above what our in state public colleges cost. At the time, we were living in WI which has a very good BIG 10 public University system. GOOD ENOUGH!

As Sam and you have indicated, college is a racket anyway and where one goes to college means very little to 99% of us “regular folk”.

I have never paid much attention to what University degree someone had when hiring experienced individuals. I have never asked about college pedigree from any doctors, dentists, lawyers or financial consultants I have hired for my personal life. No one does. IT DOESN’T MATTER.

Our kids turned out just fine and are doing great. There is NO need to spend big $ on the college racket.

I (and millions of others) will be really PO’d if we are forced to finance BAD decision making by students and families via tax dollars to forgive student loans. The moronic Dem candidates are shooting themselves in the foot with those stupid ideas.

In our case, she wasn’t the only one involved. I too have lived in WI and our daughter was also accepted at Madison when she applied. Love the state! Our decision came down to her major, her specialization and the uniqueness of the program which was not similarly offered in our state. At the end of the day, we made the decision on the best program for her and not the cheapest route we could go. We also made a decision early in her life about paying for it so that she didn’t have to start her professional life in debt. In doing so, we started a 529 for her and contributed monthly for 15 years so that she would have enough money to choose the program and the major she wanted without affordability being a determinant. There is enough in the account now to fund both an undergraduate and graduate degree in her Major.

I too will be madder than a hornet if a Democratic-led Congress and President try and forgive college debt and fund free college with our tax dollars after having gone the route we chose.

I like the idea of telling your children you will pay for college up to stay at school tuition. Anything over is up to them. This way, it makes them think about their choices. While also helping them as well but not giving them everything.

To each his own. Perspectives change over time. Talk to me in 15 years or so when your son is at that age. We never had to worry about our daughter in terms of work ethic or understanding the value of a dollar. She worked an after school job from middle school through high school and maintained a 4.6 GPA. She knew what was expected of her and so far has not disappointed. Deans List every semester in college going into her Junior year.

I never wanted money to be in the way of her choices. First, choose your life calling and we would try and help put you on the right path to achieving it were our thoughts.

I think circumstances and results dictate decisions and nothing is written in stone. I would definitely feel different if she wasn’t so committed to doing her best and taking advantage of her good fortune but that hasn’t been the case.

And many college teachers never use the textbooks you are required to buy

Love the data. Thanks for sharing! Quite insightful and scary too to see how much critical costs like hospital care have continued to skyrocket. Now that I’m getting older snd my parents are well into their senior years, I really value and appreciate quality and reliable hospital care. It can get so expensive too. Scary to think how much it will cost when I reach my senior years. It’s good motivation to save and invest wisely though.

“Therefore, younger Americans with no kids should be feeling pretty good about life.”

And that right there should be the headline. Accurate and sad on the status of our country.

Can you elaborate why that is sad? It’s nice to be free and unencumbered.

I think I understand Marks comment. There is a definite message sent that children are a “burden.” Nothing could be further from the truth.

Is only point of life to be able to see the world, have nice crap and “be free”??

I have been fortunate enough to travel the world both for work and for pleasure. Ya seen one beach – ya seen them all. A temple in India looks like a temple in Japan. After a while all that shit runs together and it becomes meaningless. Besides the cool places like Great barrier Reef of AU or Macho Pichu are overcrowded with tourists now.

Living in a fancy house and eating fancy meals late in life without the fun, noise and community family brings will lead to lonely and depressing lives for many lost souls in this country over next decades.

Sure, they may have $ – Who cares??

Always good to sit back and re-evaluate what your doing. Invest long term in a variety of assets that appreciate and get rid of debt. A recipe for long term success.

That chart is cool, and profound. Where do you constantly get this stuff? I guess that is why your the Financial Samurai.

Some things will remain secret.

I’m always looking for some interesting stuff to share with the community online. When people ask me whether I run out of ideas, the answer is always no because there is an endless amount of things to talk about every day. I’m just limited by my capacity to write because I’ve got a crazy little one I’ve got to take care of!

If you ever come across some interesting stuff please feel to share as well!

Many great points here Sam, but I LOVE that you started out with maintaining physical fitness as your number-one point. It is truly shocking to me that so many people work thousands upon thousands of hours to ensure wealth in retirement, yet don’t even spend an hour or two a day working to ensure health in retirement. As you yourself know from your battle with back problems, a retirement full of pain and disability is just nowhere near as fulfilling as a retirement full of adventure including physical pursuits — whether that is playing tennis like you or running up mountains like me. There’s obviously no exact statistic to indicate precisely how much health, strength, and physical energy are “worth” in retirement, but compared to the alternatives of pain and illness they are very nearly priceless. I would suggest that people spend at least half as much time investing in their health through daily workouts and attention to diet as they spend investing in wealth through things like work and financial research. I have a pretty good idea how much time you spend working on FS, Sam, so for you that would mean at least a couple hours a day working out your body (especially focused on core strength to protect your lower back and allow you to keep playing tennis into your later years)! Are you spending that much time on it? I truly believe it would be a much better and more existentially profitable investment for you at this point than spending more time working. After all, I think we’re all hoping to still be reading FS and hearing about your adventures in senior tennis 20 years from now!

I’m definitely going to do more core strength exercises to protect and strengthen my lower back has well. After having my son, my free time got cut in half.

It’s a tricky balance to choose spending time with my son, riding online, playing tennis and softball, and spending time with my wife of course.

I work out three times a week. Once my son goes to preschool in September, I work out four times a week.

Do you have kids?

Yes, I have two kids. I’m very fortunate that my daughter takes after me so we go to the gym and on hikes and trail runs together often. Every year on her birthday (which was just last week), we run up a mountain to celebrate! But back when she was your son’s age it definitely did cut into my workout time, so I understand. And four times a week is pretty good. Hopefully your son will soon be out hitting balls with you — nothing better than when quality family time and workout time are the same!

The inflation chart is very interesting. I notice that the blue, more affordable categories are mostly lifestyle items. Most regular households probably spend more money there due to lifestyle inflation. Everyone has a big screen TV, nice cell phone, a laptop, and nice cars these days.

You can only hold down cost if you’re mindful about it.

My takeaway is you can’t do anything about your financial situation. Need items are expensive and want items are cheap. Sure, you can do something but there is not a lot you can do. All the financial advice in the world won’t change that.

If people feel like there is nothing they can do about their financial situation, it’s because there’s more than just a grain of truth in that feeling.

I have no advice for anyone in “it’s expensive to be poor” poverty. I get that it’s expensive to be poor, but what do you do in that situation? Money can open up cheaper options for big ticket items such as medical tourism or retiring overseas.

There is certainly nothing you can do about your financial situation if you don’t make any effort. There is plenty you can do about your financial situation if you choose to. Most of us aren’t born with wealth but we attained it through hard work, good decisions, discipline, and perseverance.

To just accept one’s fate is not living your best life. You can control your own destiny to a point but it does take courage and effort to get where you want to be in life.

The first chart is interesting because the wants are cheaper (i.e. TV) and the needs (i.e. healthcare) or needs are more expensive. Business (and they are all businesses) know what consumers want VS need and price accordingly. I suppose it’s smart business.

Colleges do not set the price of textbooks, publishers do. While I can understand why college education costs have increased significantly at public schools (defunding at state levels), I can’t understand the increase in the cost of textbooks. Most faculty try to choose cheaper options for textbooks when possible.

Agreed. I was recently in a couple of classes and the professors used copies of texts and online items to massively reduce cost.

The classes are still way too expensive and I am unsure why no-one talks about college overhead (administration, luxe dorms and food plans, etc.) along with the defunding issues. College is a racket but the costs will stop rising when people stop throwing money – 529s and student loans come to mind – at it.

We have another choice; college is a free market system, but it doesn’t have to be that way. We can leave the private institutions alone (no student loans, no govt. aid) and publicly fund the rest. Private can compete against public and like the public school system the costs will flatten as states no longer see these institutions as cash cows and the burgeoning administrations and outsize construction costs are pulled back in line.

But if the bulk of inflation went into financial assets? Jason Burack recently postulated 65T in currency has been electronically created since the GFC. The bulk of it in the form of currency swaps which are off balance sheet. When one looks at the vast bulk of sovereign debt with negative yields, 65T seems plausible. Monetary inflation is locked up in financial assets. At least until now.

What will happen when the mother of all bubbles ( sovereign debt) pops? Maybe that’s why the central banks decided not to renew the CBGA last Friday. They know it’s going to pop and they will have to revalue something to plug the black hole on their balance sheets.

Love the graphic representation of those consumer good cost changes over the years.

Healthcare and college tuition are really getting out of control and I just cannot see how that trend can be sustainable long term.

College tuition is going to price out a lot of people eventually as there will be a tipping point between educational cost and the career earning benefit achieved from a college education.