Credit cards are an amazing tool. You can use credit cards to improve your credit score. In addition, you get an interest-free loan on all purchases if you pay off the bill each month. But with so many rewards credit cards out there, it's hard to know which ones to get. As a result, some people go overboard and apply for too many. So what's the ideal number of credit cards to improve your credit score?

I've seen some people open up their wallet with eight different credit cards! They've got one credit card for dining, one credit card for travel, one credit card for gas, one credit card for Walmart, another credit card for electronics, etc.

Too Many Credit Cards Isn't Good

Not only is carrying so many credit cards hard to keep track, it's hard to concentrate enough points on one card to get any meaningful rewards. You might also miss a credit card payment or hurt your credit score with too many lines of credit open.

So what is the ideal number of credit cards to improve your credit score? Let's first take a look at how credit scores affect your credit score. We'll also cover the top three types of rewards cards and the best credit cards to improve your credit.

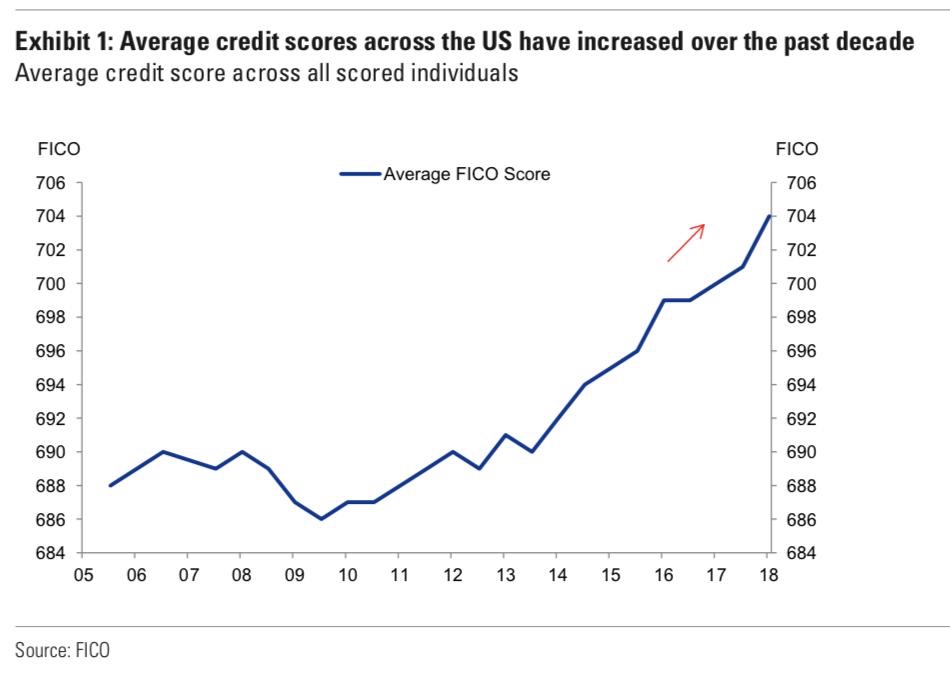

Having a credit score of at least 700 is important to get better rates for credit cards, car loans, and home loans. As a matter of fact, the average credit score for approved mortgages is about 760 and the overall average FICO score is roughly 704.

How Credit Cards Affect Your Credit Score

Having a credit card where you use and pay in full each month is a great way to build your credit score to over 700. Really shoot for a 700 credit score to start. You'll eventually get to a 800+ credit score after enough time passes.

5 Main Factors

Credit cards affect your credit score in all five of the main factors:

- Payment history (35%) – Make sure that you pay at least the minimum due each month, but preferably the entire balance. Set up an automatic payment each month.

- Amounts owed (30%) – keep the amount owed to less than 25% of your total credit limit. For example, if your credit limit is $5,000, don't charge more than $1,250 a month. A low utilization rate is good for building credit.

- Length of credit history (15%) – Every time you open a new account it lowers the average age of your credit accounts. Keep no-fee credit cards open for as long as possible to boost your average length of credit history.

- Credit mix (10%) – Lenders want borrowers to have a mix of active credit accounts on their report. A good credit mix includes having a credit card, a mortgage, and perhaps a car loan.

- New credit (10%) – Each inquiry on your credit will lower your score by an average of 3 to 5 points for approximately 6 to 12 months. Spread your inquiries out by at least three months, and preferably six months to keep your credit score high.

Getting a credit card has gotten slightly more difficult over time. The credit card companies will check your credit score, and the best rewards credit cards will often have a minimum requirement of 690 FICO score or higher.

How Many Credit Cards Is Too Many?

If you apply to too many credit cards too quickly, your credit score will get dinged. Thus, if you plan to apply for a credit card, I would apply to a new one once every month at the minimum.

Ideally, I'd wait for three months before applying for another new credit card. Remember, with each inquiry dropping your score 3 to 5 points.

If you're 40 years old with eight credit cards, you're probably going to be fine given your longer payment history and consistent payments. But if you're 25 years old with eight credit cards, you're likely hurting your credit due to too many inquiries and your lower average age of credit accounts.

Don't Lose Track

One of the key risks to having too many credit cards open is not being able to track everything carefully. Just one missed payment will be a negative mark on your credit report. In addition, it could stay on your report for 7 to 10 years.

I've missed payments before simply because I was traveling or just forgot. I've called my credit card company each time and asked for forgiveness and a removal of the missed payment penalty. They've complied, but I'm not sure if they removed the record of me missing my payments.

Related: How Many Credit Cards Should I Have Until It’s Too Many?

What About Owning Credit Cards With Zero Balance?

Owning credit cards with a zero balance is good. They keep your credit utilization low, which is great for achieving a higher credit score. As I said, I recommend having a utilization rate below 25%, and ideally, below 10% if you want to achieve as high of a credit score as possible.

Credit scores are based on both your individual credit card utilization and your overall utilization. If you are carrying balances on your other credit cards, the zero balance credit cards help to lower your overall utilization.

As a result, it's actually smart to have ONE or TWO no annual fee credit cards that you hardly ever use to lower your overall utilization rate. You don't want to have a bunch of no-annual-fee credit cards open that you never use because then your New Credit percentage will start getting hit.

How Many Credit Cards Is Ideal?

The ideal number of credit cards to open is three. Three is great for your credit score and also easy to keep track of. With three credit cards you can also concentrate your rewards points better in order to get the most benefits.

After three credit cards, it starts getting hard to keep track and you may find yourself wanting to spend more money on your credit cards than you should.

Match Your Card To Your Lifestyle

You want to match the types of credit cards you have to your lifestyle. For example, if you love to travel, you should have a credit card that specializes in rewards travel. If you love to go out to eat and drink and go to shows, then you should have a rewards card for dining.

Have A Go-to Card

You should also have your GO-TO credit card, a cash back credit card. A cash back credit card is the best type of credit card because you can use the cash for anything. The responsible person uses the cash back as credit to pay down or off their credit card bill each month.

For reference, according to a study by CreditKarma, the average American has 4.73 credit cards. But the average American consumer is also broke and can't come up with a $1,000 emergency and has under a $80,000 median net worth. You don't want to be like the average American. You want to be way better than average!

Best Credit Cards By Type

Here are our reviews on the best types of credit cards by category:

- The best cash back credit cards

- Top travel rewards credit cards

- The best dining / entertainment credit card

- Popular small business credit cards

The Best Credit Cards For Your Wallet

Given the ideal number of credit cards is three, here are the top three credit cards I recommend for your wallet. These are the top three after hundreds of hours of analysis and comparison.

- The best travel credit card: Capital One VentureOne Rewards Credit Card

- Best cash back credit card: Capital One Quicksilver Cash Rewards Credit Card

- Dining / entertainment credit card: Capital One SavorOne Cash Rewards Credit Card

I would own at least one, if not all three of these credit cards to get the best rewards points possible. Once you have these three credit cards, you will steadily be able to improve your credit score if you pay your bills on time and keep your utilization rate below 25%.

It was only after 15 years after college that my credit score finally broke 800. During this time, I've accidentally missed payments on my credit cards, but I have always paid my mortgages in full.

Use Credit Cards Wisely

We should all be taking advantage of the best rewards credit cards out there to improve the quality of our lives. Just make sure you always pay your credit card bills on time. The last thing you want to do is pay their high APR rates.

Finally, don't let the tail wag the dog when it comes to rewards credit cards. Only buy things you will use and greatly enjoy. Spending money on superfluous items just so you can get more rewards points is completely backwards. Happy spending!

Pay off Your Debt Faster

If you don’t have enough cash, getting a personal loan from Credible is a good place to start.

Personal loan rates have come down significantly in comparison to the average credit card interest rate. Thus, if you have expensive credit card debt, consider consolidating your debt into a lower interest-rate personal loan.

Credible has the most comprehensive marketplace for personal loans. Up to 11 lenders compete for your business to get you the best rate. Get real personal loan quotes in just two minutes after you fill out an application. Check out Credible today and see how much you could save.

If you enjoyed this article, please sign up for the Financial Samurai Newsletter here to receive exclusive content.

And be sure to check out my Top Financial Products recommendations to help you grow your wealth.

Further, you can subscribe to the Financial Samurai podcast for even more insights and tips.

About the Author: Sam worked in investment banking for 13 years at GS and CS. He received his undergraduate degree in Economics from The College of William & Mary and got his MBA from UC Berkeley. In 2012, Sam was able to retire at the age of 34 largely due to his investments that now generate roughly $250,000 a year in passive income. He spends most of his time playing tennis and taking care of his family. Financial Samurai was started in 2009 and is one of the most trusted personal finance sites on the web with over 1.5 million pageviews a month.