Good news! It just got a little bit easier for everyone 40 and under to become 401(k) millionaires by the time you turn 60.

The maximum 401(k) contribution limit for 2021 is $19,500, the same from 2020.

Meanwhile, the combined employer and employee contribution limit rises by $1,000 to $58,000. In other words, your employer in 2021 can contribute up to $38,500 to your 401(k) in terms of a match or a profit share.

The employer 401(k) contribution portion can become a major retirement contributor as you gain seniority within your firm. For those of you who like to job hop every year or like to roll the dice with a startup, realize what you're potentially missing. When I left my firm in 2012, I forsook $20,000+ a year in annual employer contributions.

For participants ages 50 and over, the additional “catch-up” contribution limit will rise to $6,500, up by $500.

Curiously, the limit on annual contributions to an IRA remains unchanged at $6,000. The additional catch-up contribution limit to an IRA for individuals age 50 and over remains $1,000.

Overview Of The Maximum 401(k) Contribution Limit For 2021

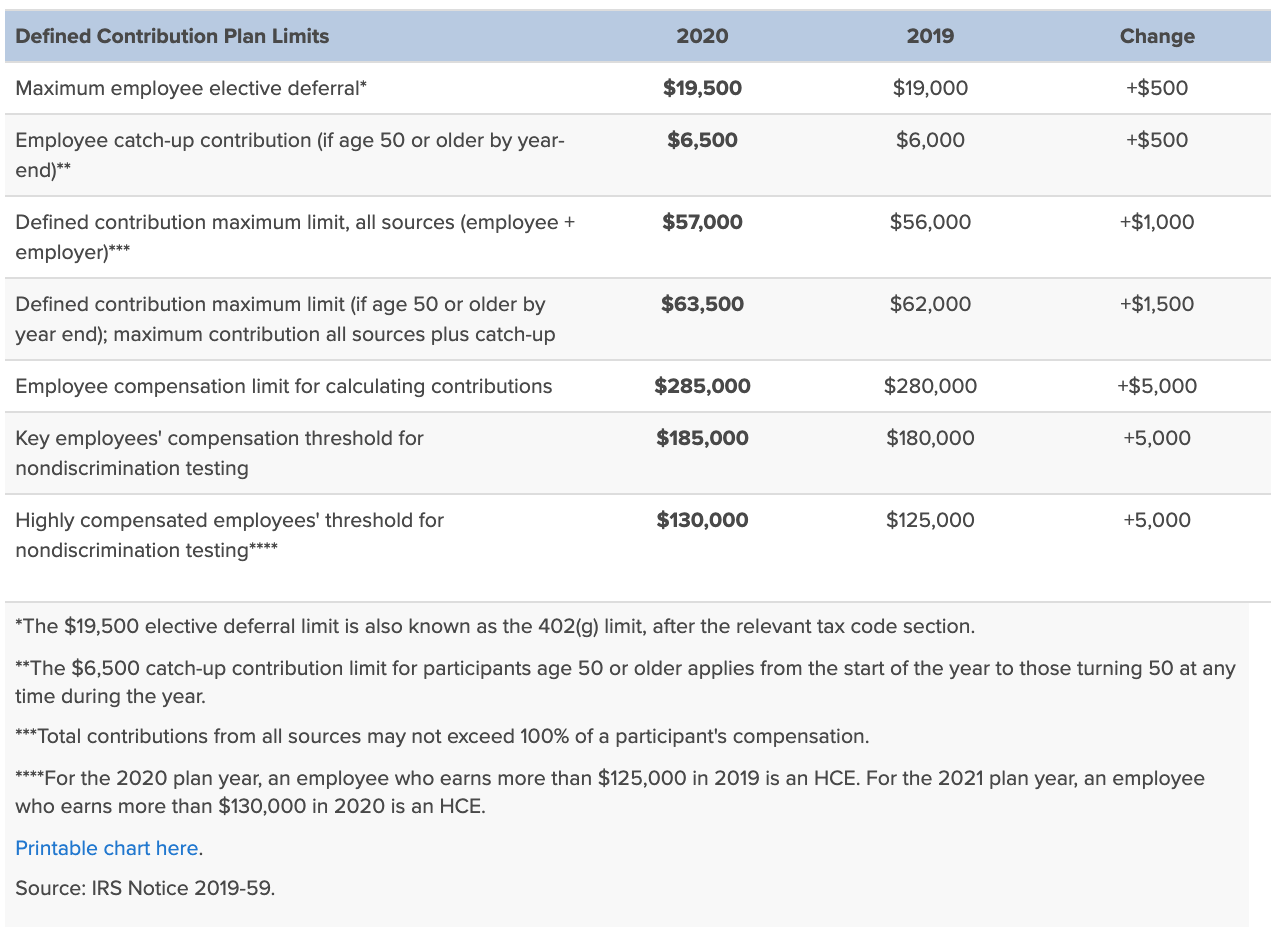

Below is an overview of the 401(k) contribution plan limits for 2020 compared to 2019. 2020 is the same for 2021.

According to Fidelity Investments, one of the largest administers of 401(k) plans in America, employees' average 401(k) contribution rate is now 8.8 percent of their pay, nearly a full percentage point higher than 10 years ago.

If we use the median household income of roughly $63,000, that equates to $5,544 in annual 401(k) contribution per household. Add on an average 3 percent salary match, and we're talking another $1,890 employer 401(k) contribution for a total of $7,434.

Contributing between $5,000 – $8,000 a year in a household's 401(k) is not bad. However, I encourage folks to force yourself to contribute the maximum amount allowed to your 401(k) each month.

Although maxing out your 401(k) might be painful, depending on your income, you will learn to live on less and figure out new ways to make more money if necessary.

Contributing the maximum to your 401(k) should be a default automatic assumption so you can then aggressively build your critical after-tax retirement portfolio for passive income.

Pre-Tax And After-Tax Retirement Portfolio Overview

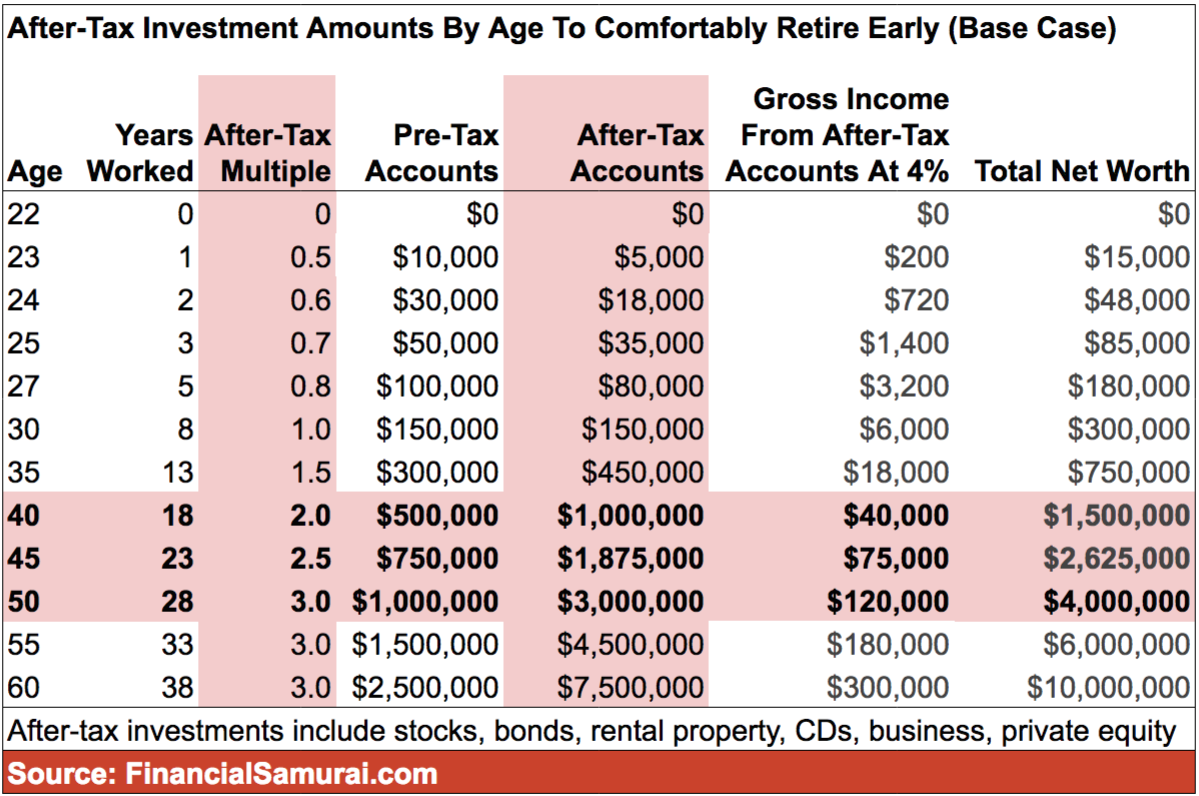

Below is my base case guide for how much you should accumulate in your pre-tax accounts (401(k), IRA, etc) and after-tax accounts by age if you want to comfortably retire early.

Your after-tax accounts can include your online brokerage account, rental property, venture debt, private equity, royalty income, side business income, real estate crowdfunding, royalty income and more.

Ideally, you want to accumulate an after-tax retirement portfolio that is 3X your pre-tax retirement portfolio or more. In other words, your after-tax accounts are much more important than your 401(k) for the purpose of generating livable passive income.

If you can ultimately build a net worth of between $1,500,000 – $4,000,000 by the time you hit 50, you should be good to go for the rest of your life. The net worth spread accounts for various costs of living and lifestyles.

The Median And Average 401(k) Balances By Age

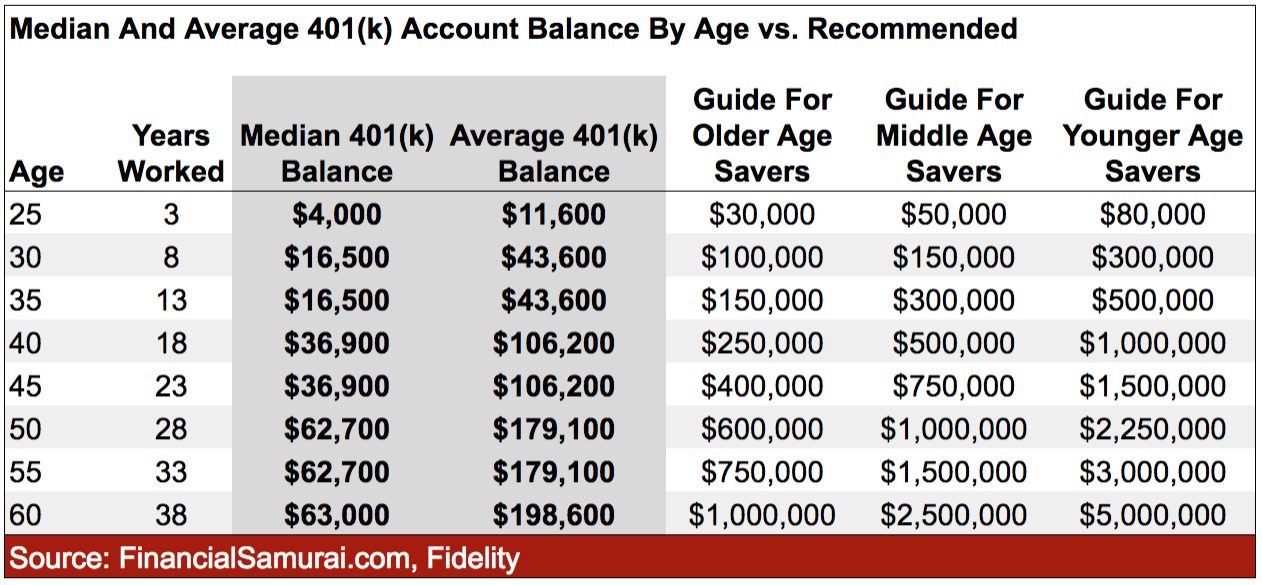

Perhaps you are thinking that becoming a 401(k) millionaire by 50 is a stretch, despite historical investment returns and maximum contribution increases. You would not be wrong if you compare yourself to the median and average person in America.

By age 50, the median 401(k) balance is $62,700 and the average 401(k) balance is $179,100 according to Fidelity.

By age 60, the median 401(k) balance only increases by $300 to $63,000 and the average 401(k) balance increases by $19,500 to $198,600.

The overall average 401(k) balance is $106,000 as of 2Q2019, up 2% from $104,000 in 2Q2018.

Why the median and average 401(k) balances hardly grows from age 50 to 60 is hard to say. Perhaps the reasons are due to increased medical expenses and skyrocketing educational expenses that reduce a family's ability to save for retirement.

What's good to know is that among participants who have been in their 401(k) plan for 10 years straight, the average balance reached $305,900, more than five times the average balance of $59,900 for this group 10 years ago.

Whatever the case may be, if you only have about $200,000 – $300,000 in your 401(k) by 60, you're kind of screwed, especially if you don't have a larger after-tax investment account or pension.

You do not want to be the median or average American! Not only does the typical American have an underfunded retirement account, but the typical American is also quite unhealthy.

You can be broke and healthy or rich and unhealthy. But please don't be broke and unhealthy!

Historical 401(k) Maximum Contribution Limits

Finally, I want to leave you with the historical 401(k) contribution limits. It's good to see the government has authorized steady increases to keep pace with inflation.

There's no reason to think the government won't continue to increase the 401(k) maximum contribution limit by $500 or more every year or two. By the year 2030, the employee 401(k) contribution limit will probably be around $25,000.

If you want to retire comfortably, please max out your 401(k) each year at the very least. After 10 years, you will be astounded at how much you've ended up accumulating.

Once you've developed an automatic maximum 401(k) contribution habit, focus all your energy on building your preferred passive income investments.

Your 401(k) really should be an afterthought, just like Social Security. If it's there when you retire, great. If not, you never counted on it in retirement anyway.

As an old man now, I greatly prefer earning dividend income, tax-free municipal bond income, REIT income, and real estate crowdfunding income. My desire to own physical rental property has waned. However, there is one real estate opportunity I'm eyeing that may just be too good to pass up!

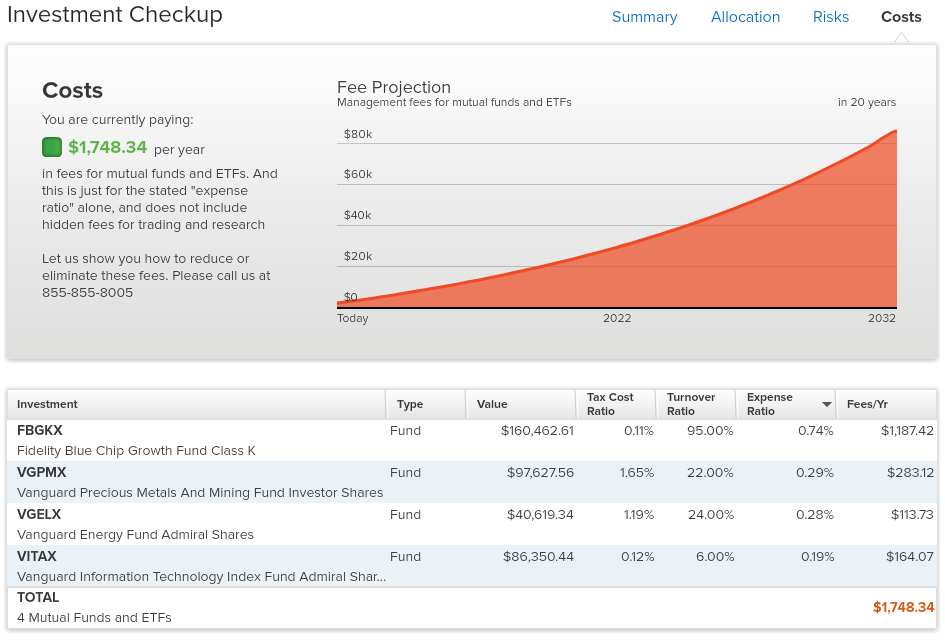

Recommendation: Analyze your 401(k) for excessive fees with Personal Capital's free Investment Checkup tool. I was paying $1,700 a year in 401(k) fees I had no idea I was paying. After I ran the tool, I booted out the expensive Fidelity Blue Chip Growth Fund and swapped it with a Vanguard Growth Fund that charged 90% less. Don't let fees drag down your performance over time.

Readers, if you're not maxing out your 401(k) please share why not. How's your path to 401(k) millionaire status coming along? Are you on tract to have a seven-figure 401(k) by age 60?

Sam,

thanks for the great website. I have been a big fan of your work/blogs.

Any thoughts on what is a good ratio to allocate money in these 3 buckets?

1. pretax (401k etc) vs 2. Roth accounts vs 3. taxable (regular investment accounts)

Sure, I would love for my after-tax investments to be 3x my pre-tax investments. But, that takes a much larger income than I earn. Able to max two 401ks, two IRAs, one HSA. However, there is not enough left over to grow my after-tax accounts to 3x.

Hi Sam, i cannot find any post on non qualified retirement accounts. I max out my 401k and debating if i should participate to this plan. Do you have recommendations?

Thanks

I don’t think Roth 401k’s have been mentioned?

We are in the 24% bracket and will each max out our traditional 401k & 403B this year, and also max our Roth IRA’s.

My employer allows the Roth 401k option and i’m tempted to go that route for 2020..

FWIW we are 32 yrs and have about ~$140k in pre tax and ~$55k in Roth combined. Another $48 in post tax brokerage and ~$130k in real estate between primary and investment property.

Any thoughts one way or the other?

I struggle with the advice that after-tax assets should exceed pre-tax assets by 3x. Due to maxing out 401(k) contributions for 30 years and getting a pension buy-out, I am very fortunate to have a $1 million IRA and a $1 million 401(k). No way I could have 3x that amount ($6 million) in after tax assets. To further add to my good fortune, my wife has a pension that will pay $120k or so when she starts drawing it. So, I feel good, but miss you 3x window by a lot.

If you have a pension, you’ve won the lottery so to speak. If your wife also has a pension, you’ve on the lottery twice. You can throw my 3X target rule out the window.

See: How To Calculate The Value Of My Pension

You are not missing by much, your wife’s 120k pension is worth 3 million as a perpetual annuity, assuming annuity that pays 4% annually, it equals 120k / 0.04 = 3000k. You and your wife will also be eligible for social security, social security should be adding about 30k income for each of you a year at full retirement age (you can estimate your retirement benefit at ssa.gov). You will probably go up to a higher income tax bracket after you start mandatory withdrawal from your deferred 401k or IRA. Both social security and pension can worth a lot if one can stay alive for a long time, so remain healthy!

Did you rollover some of your 401k to the IRA? $1 million sounds like it would be on the low side for a 401k maxed over 30 years.

Yes. One job for 14 years. 401(k) to IRA. Next job 16 years and counting. 401(k). Also, great job timing out of market before 2008 crash, but not so good timing back in. Too slow. Finally, both accounts are north of $1 million, but less than $1.3 million.

Any ideas on how to get after-tax $ up? I’m 38 and have $400K in pre-tax 401k, $80K in pre-tax lump-sum present day pension value (similar to a cash balance plan, thought not exactly), $240K in a Roth IRA, and $360K in non-restricted after-tax accounts.

So how should I be thinking about this from your table? $480K Pre-tax retirement and $600K after-tax(?). The ROTH IRA has restrictions on before 59, but I have enough unrestricted after-tax to last 5 years while implementing a ROTH conversion ladder from the pre-tax accounts if I retire early.

Does that $1,500,000-$4,000,000 Net Worth figure by the time you’re 50, to retire comfortably, apply to a couple or to an individual?

Either. It depends on your expenses and how much of a team you guys are.

And also, it’s mostly a guide for readers under 40 years old. If you don’t get there, it’s not the end of the world. You’re just gonna have to work until age 60 or 65 like most Americans, which does two things: And also, it’s mostly a guide for readers under 40 years old. If you don’t get there, it’s not the end of the world. You’re just gonna have to work until age 60 or 65 like most Americans, which does two things:1) allows you to earn more and 2) need less in retirement due to less life to cover.

I just recently started working, and don’t have employer match. It seems to me that you could save/invest your money on your own, not through a 401k, with as much success (assuming that you have the self-control to not tap those savings until retirement). It also seems that compounding interest doesn’t outpace the raise in my tax bracket that I anticipate will come with gaining seniority, so a Roth 401k makes more sense. Do you still 100% recommend a 401k even without employer match, and traditional over a Roth 401k?

You have to judge for yourself whether you think Roth or Traditional is right for your own situation.

If Roth is your choice, you can do a Roth IRA via the backdoor method regardless of income. I would prioritize an IRA over 401k absent of match. However, the IRA yearly limit is only $6,000. Therefore, you should also contribute to the 401k to get further tax benefits.

If you invest outside of a 401k or IRA then you aren’t getting the tax benefits.

I max my Roth IRA and pretax 401k. My state doesn’t tax 401k withdrawals up to a certain amount, and my federal tax bracket will likely be lower in retirement.

Thanks for the breakdown! Here is where I get stuck: I don’t see how my tax bracket would be lower in retirement. It seems like that’s something most people bank on, but where does that calculation come from?

I front load my 401k contribution level to 50%, so by May or so I have already maxed out my 401k, instead of spreading it out throughout the year. If anyone also does that, make sure you have a “401k true up” with your company for the company match.

Since the company match is based on each pay period. If I max early and your company doesn’t have a True Up, then you can lose some matching funds.

“For instance, a highly compensated employee fully funded her 401(k) by April 15. The company funds for the year ended up being 70 percent less than if the employee’s contributions had been spread throughout the year. With no true-up, the employee missed out on those funds.”

Jim, I do similar and I do have a true up, or I would not follow this strategy. I end up getting about $75K in my retirement accounts as a result. I’m now 60, been doin that for about 10 years or so. I’m fortunate to be highly compensated and I budget to live on about 50% of my salary from Jan-June. I max my 401K (actually switched to a Roth 401K this year), then I continue with both after tax as well as top-up. This year I have hit the total limit allowed which is $63.5K already, but each March my company adds to my account the amount that they were prevented from adding from the prior calendar year (that’s the true up kicking in). It will be another $12K. So by changing my timing, I actually manage to stash away about $75K per year. I’ve told others, but I don’t think they have adopted.

Great article, and thanks for sharing the new numbers! I totally missed the catch up at 50 was going up another $500 till I saw the chart. As a person who is newly eligible this is a great news. I was capped for 5+ years at the max, but the additional $6K is huge for me.

Any person who looks at these numbers and thinks I can never make it to a million it can happen quicker than you think. Had less than 200k in my 401K in 2009 and just hit 1 million this month. The bull market, and generous employer contribution helped, but putting the max in for most of the last 10 years was a huge driver to the goal.

Congrats and well done! And for the younger generation who gets to start at $19,500 a year max + employer match, what a gift!

When I started work in 1999, the max was only $10,000.

Take advantage folks!

Thanks for another great 401k article. I’ve enjoyed reading your articles over the years on 401ks. They reinforce something I knew was important, but seeing it laid out with actual numbers and projections has made it easier to stay the course of the years. Someone I respect told me to max out my 401k when I started my first job “at all costs.” There have been times over the past 10+ years when life got hard and it would’ve been easy to take a break, but I never did, and the balance is now right in the middle of the middle age and younger savers (I went to law school so couldn’t start contributions until age 24). It works!

Nice article. My wife and I have consistently invested in our retirement accounts since we graduated college. Half our wealth is in retirement accounts and the other half is in our home (we don’t have a mortgage). We are now working towards building our brokerage account and non-retirement investments.

Any thoughts on converting Traditional IRAs to Roth IRAs? I think taxes are going up in the future in general because of the rising national debt and the desire for things like M4A. I expect we will be in a similar income bracket in retirement. So, I’m considering paying taxes on the conversion now while they’re low.

If you’re below the 24% federal marginal income tax rate (22%, 12%, 10%), then I think it’s OK to convert or contribute to a Roth IRA.

But if you are at 24% or higher, I wouldn’t do it. Just max out your 401(k). You will UNLIKELY make more in retirement than while working.

Please read this article: https://www.financialsamurai.com/disadvantages-of-the-roth-ira-not-all-is-what-it-seems/

Living in one of the high local tax city, e.g. New York City, California. It’s best to max out 401k during high income working years (asset gathering phase in life). Businesses typically pays higher salary in higher income tax state. So it’s normal for prime working age couple to pay 32% marginal income taxes (22% federal + 10% local) for every dollar earned above 103k (79k + 24k standard deduction). 401k contribution can stretch that limit higher by 38k (2 x 19k). Once the asset gathering phase is over, the couple can save up to 10% by moving their primary residence to 0 income tax state. For New Yorker, they can live 183 days in Florida to claim primary residence. Trump is doing exactly that after he pass the tax cut bill to limit SALT deduction.

I think the future tax hike will come from tax rate hike for investment income, the wealth tax proposed is hard to implement, while shifting investment income tax rate is easier. Current investment income tax rate is 0% for earned income tax bracket up to 12%. For top tax bracket say 37%, the gap is even larger, it’s 13.2% (37%-23.8%). If the gap between income earned from wage vs investment were to shrink to 0, then the wealth gap in the US will shrink as well. However, given our political system, it’s unlikely that the tax rate gap between labor and capital will shrink to 0. Politicians still rely on getting elected from sponsorship. You can’t play the game if you don’t have the capital to begin with.

Great article/writing. Two quick comments from my experience. One is to ignore the advice to roll your 401k into a traditional IRA if you are high income and doing an annual back door Roth. The IRS will prorate your conversion among all IRAs.Just keep your 401k with former employer or roll into your new plan. Second piece of advice is to take advantage of the max contribution allowed (56k for under 55 or 62k for over 55) and do a spillover option so the excess of pre-tax goes in as an after tax contribution which you then convert to a Roth tax free. That’s an amazing tax gift that can allow you to amass lots of tax free wealth.

Hi Jeff, I am very interested in the second part or what people call Mega roth IRA. Can you elaborate how you can do it? I tried to talk to the 401k administrator for my company and they had no clue. My friends at big tech firm seemed to have success in it.

Simple. Figure out what percent of your salary you want to contribute to get the maximum amount allowed. For under 55 that’s 56k but that includes company match. So if your company matches 6% and you make 200k then you want to contribute 22% (56-12/200). Then it’s important to check the spillover box with your provider so that when you hit the pretax max it switches to after tax. Voila. Last thing is you may need to convert that after tax money into a Roth 401k. Some plans do this automatically. Mine requires you to do it and you can do as often as you wish with no penalty. This is an amazing tax gift for those who can afford to save that much. When you switch over to after tax your paycheck will get smaller so be prepared. But we’ll worth it. This and the Blackfoot Roth will make you wealthy over time. Good luck.

I’ve done the mega backdoor Roth successfully. Let’s get one thing straight… YOU have to know what you are doing because it’s easy to screw up. Other people won’t have a clue what you’re talking about.

It only works with certain 401k programs (generally large older corporations) who have “after-tax” contributions. These are NOT Roth contributions. You have to roll those over yourself to a Roth IRA. You pay only the tax on any gains in the meantime that occur before rollover which shouldn’t be much if you rollover quickly.

Check out thefinancebuff or bogleheads for more info.

Mind elaborating the spill over process a bit more for someone with a salaried job that can only contribute ~25 k pretax to 401k? Thanks!

Interested in hearing your thoughts on the after-tax 402k contribution. For 2019 the max total contribution was 56000 so for companies that allow an after tax contribution, that’s another 34000 in contributions after you max out the pre tax portion (19k) and assuming 3% match on 100k income.

The nice part about after tax contributions is that it can be rolled into a Roth IRA after you leave the company and earning then grow tax free. In some cases, company’s allow you to take an in-service rollover of after tax funds into a Roth IRA. Either way, you can always take your contributions out without penalty.

I really like this benefit as it keeps more of your funds in one place (assuming your employer provides good investment options), allows for flexibility if you really need that money, and supercharges you Roth if you leave the company.

I’ve been maxing out the after tax component of my 401k for two years now and it’s helped keep me disciplined in my savings plan. Wondering if anyone else has/uses this benefit

Is now really a good time to max out your 401K contributions if you are over 55? The stock market is at all-time high evaluations and the Fed is infusing insane amounts of money to keep the market propped up. Current quantitative easing efforts can’t keep things going forever. I have been putting in the maximum amount for over 10 years and starting this month, I reduced it to the minimum to get my employer match. I will return to making 401k contributions when sanity returns to the market. However, my plan is to retire next year.

For long term retirement funds, it is a fools game to think you can time the market. Just invest the max and enjoy the long term tax advantaged growth.

I agree with this feedback, even at 55. Come up with your appropriate asset allocation and contribute the max every year you have a job. Don’t think about timing the market with your 401(k), IRA, and 403(b). You don’t have to go heavy stocks.

I would do a deep dive on your after-tax investment portfolio and cash balance. You’re close to the finish line.

See: https://www.financialsamurai.com/the-first-rule-of-financial-independence-never-lose-money/

Difficult to time the market. However, what usually follows “all time highs” are future all time highs. Someone that exited the market back when Dow was at an all time high when the Dow was at 20,000 lost out on another 40% market return. Of course, someone could argue if you times it right before subsequent falls, you would be out ahead, but you would also be losing out on dividend growth which more than makes up for the declines (in the long term). I would suggest making sure your portfolio is diversified between asset classes, identify how much you truly need for regular living (and get an income source set up to deliver that), and then ride out the growth in the long term.

And, congratulations to retirement on the near term horizon. That is awesome.

There’s no guarantee that stocks will keep going up forever, and it’s true we could see a long period.

However, if you are someone who believes in long-term market returns, then in theory you should not be scared of all time highs.

Logically, a stock market that is not achieving all time highs is a stock market that is losing money.

I just want to point out that all these “average 401k balances” and “median retirement account balances” statistics are completely worthless! One reason the average 401k balance doesn’t increase much over time is that employees tend to switch employers, and many if not most folks roll their previous 401k balances into IRAs (or leave them where they are). So they start all over with another very small 401k even if they have 6-7 figures invested overall.

My husband and I have 8 retirement accounts between us. Two Roth IRAs, two traditional IRAS (with zero balances except when we contribute once a year in prep for backdoor Roth contributions), 2 401ks, and one former employer 401k (DH’s last employer offers an S&P 500 fund with 0.00% expense ratio so we left it there) and one deferred comp plan. The averagebalance of all these accounts is $150K. But we have $1.2MM in retirement (plus $1MM in taxable, plus RE investments). Statistically, we are “way behind” and “unable to retire” according to the average stats used in a lot of these scary articles. But those stats leave out the fact that most households have multiple retirement accounts – not to mention pension and SS income as well as RE and taxable investments. The doom and gloom surrounding most retirement stats is overblown in my opinion.

Besides, median figures muddle the waters. The reality is that many Americans have NO retirement savings – and most of them can live just fine off Social Security or other entitlements which replace a majority of their income. The other “half” which is actually more like a third or a quarter have LOTS of retirement savings and other investments. Some of those my struggle to replace their working income, but many others will die rich.

Is in the most important thing to know your total combined 401(k) balance? Curious why you don’t consolidate your accounts or roll over to a SEP-IRA?

I do think that these balances are under estimating the reality, and Americans are richer in the retirement than we think. And I think that is a pro or my target 401(k) balance is by age.

Indefinitely agree your targets are on point and only seem high to some people based on all the problematic average stats we are used to seeing.

We can’t consolidate into a sep as neither of us is self employed; we are both employees so we have two active employer plans plus two roths plus two traditional iras which stay active since we use them annually to make backdoor Roth conversions. So the absolute minimum number of retirement accounts we can maintain is 6. We have two more for the reasons I stated above (we could consolidate my husband’s old 401k I to his new one, but the fees are higher. Rolling to a grad ira would mess up backdoor Roth tax free conversions).

Sam

What is the total amount that the self employed can max btw a solo 401k being both the employer and employee?

I’m just going to say I don’t agree with contributing the maximum amount to your company’s 401K plan. Most companies have terrible options for their employees. The idea is that these options are providing ideal asset allocation for your target retirement date but they fall well below what you could do for yourself with a little bit of research and interest in investing. It might make sense to create a brokerage link and open up the pool of investment options so you can find some better (and less expensive) options for investment. Also keep in mind that your money is locked up for a LONG time.

Now factor in that you have a SIGNIFICANT rise in corporate adoption of artificial intelligence as a result of the proliferation of cloud computing. What does that have anything to do with it? Well, there will continue to be a massive displacement of the workforce and unfortunately the stuff I’m reading in the news doesn’t adequately cover the impact this will have to you and I. This isn’t something that’s happening in the far future, this is something that will dramatically shift within this next decade. I personally believe we’ll hit AGI (Artificial General Intelligence) in this next decade (or less) which basically means systems will have situational awareness that will be comparable or exceed that of a humans. Why should you care? Because if machines can think like humans and can work for nothing and don’t need medical benefits, companies will be looking to leverage this as a competitive advantage.

So now you have a workforce that has been throwing money in their 401ks at a significant clip but suddenly find themselves without a job and unable to pull from that money until 10, 20, 30+ years.

Here’s my take: Put in what you can to get your company’s match (because it’s free money). Max out the Roth (if you’re salary is low enough to contribute bc 6k isn’t going to break most of the readers here) and put as much as you can into a taxable brokerage or invest it in real-estate. Yes, taxes suck but I think it’s imperative to start generating passive income while you’re working and not rely on the fact that you’ll be working for the rest of your adult life.

Yes, it’s important to have tax-advantaged accounts but I’m highly mistrustful of using these as the be-all end-all of your future given that no one is talking about how the world is going to change in the next 10 years +. It’s a different world than when these investment options were created…you need to think beyond convention.

That’s my take on it anyway…

Dave

Any concern that the rise of AI, replacing lower and mid income jobs, will reduce the pool of quality renters? As someone who invests in B and C investment properties I am concerned that this will happen in the near term. Yes, these people will still need a place to live but it’s likely any government subsidy for housing will be much less than what we see now for the same market/ property class

Hi AR,

That’s a great question and a hard one to answer. I would expect that the big tech companies will continue to push into real estate, offering people what basically amounts to connected homes in smart cities. This will allow renters an opportunity to live in cost-contained spaces allowing for synergies with other products and services that these companies offer. I think that’s the vision-basically companies will monetize your lifestyle or at least those folks who will allow it in exchange for cheap living. The subsidies won’t be coming from government as much as they might be coming from industry.

I think you need to see how things play out though and just recognize that there are potentials for change coming soon. It doesn’t necessarily mean you’ll be sitting on empty property if my thoughts above come to fruition, you might see an entirely different demographic looking to occupy your properties.

Most people carry debt whether it’s car, mortgage, student loans…

So if you’re not going to max out 401k, another option would be to divert those funds towards paying down debt.

Sam,

Any thoughts on what that means for folks who have both a W2 job and enough 1099 income to also max out the profit sharing portion of a solo 401k? For those of us 50 and over (just turned 50), it looks like you can do a personal contribution to your 401k of $26k, and then a profit sharing contribution to a solo 401K of another $57k for a grand total of $83k. I’ve been ramping up to these contributions for the past few years since retiring from the Army (so I do have a modest pension), and finally just hit the $1M mark in my pre-retirement accounts. I’ve only got about $200k in after tax accounts, so am working to build that up. My only debt currently is still just over $500k on our primary home mortgage at 3.25% fixed. My goal is to have this paid off in the next 6-7 years before considering retiring. I’m tempted to throw money from the after-tax accounts at the mortgage, but I would then be worried about not having enough in liquid assets.

Given your age, you’re pretty close to the 59 1/2 year-old finish line. If you make enough in 1099 income to contribute the maximum to your solo 401(k), then I would do so.

That’s over $200,000 a year in 1099 income plus your day job income. So I wouldn’t worry one bit. I think it’s a great idea to pay off your mortgage completely when you no longer want to work.

Thanks. I sort of have things a bit backwards, as my main effort is on the 1099 stuff (ICU physician at several hospitals) totaling about $400k, and a part time W-2 gig that only grosses about 50k. I’ve been using that gig to take advantage of their match to my regular 401k, and use my 1099 gigs to max out my solo401k via profit sharing. I’ve been working myself to the bone, but am trying to do everything I can to be done with everything in the next 6 or 7 years, corresponding with the 2 kids finishing college (hopefully!) I’ve really appreciated your blog over the years. Thanks!

“As an old man now…”

You need to stop this old age mentality. Unless, you want to leave most of you on the table unexplored!

I’ve given up. What can I say. It was a nice life though and I have no regrets.

I love random comments! Keep them coming.

I am a bit behind on the pretax 401k suggestion because of 2 large factors:

As a physician, even though I am 48 years old, I do not have 26 years of working (technically I am at 22 years of being paid if including residency)

The biggest factor is my divorce in 2010 when I lost my entire 401k to my ex (about $150k). I used an online calculator to see what that would be worth today if it was all in the S&P 500 (which truthfully it would not have been) and it came back at $404k (which actually would have gotten me with 100k of $1M) so I guess I could have been almost on target.

Fortunately the other stuff (taxable) has more than compensated me being behind in this one category.

I really wish the 401(k) limits would be doubled since social security is in trouble. I know many of my coworkers believe only 401(k) contributions are sufficient and don’t do any after tax contributions

Glad to hear the maximum contribution level is raised for next year. It should be! I don’t have an employer sponsored 401k anymore but I really enjoyed mine when I did. The company match was also a really nice benefit. I encourage anyone with access to one to take advantage of those benefits while they have them!

Those 401k balances seem low. Does Fidelity aggregate a person’s 401k accounts from multiple employer’s plan providers? My guess is no. Many people don’t roll over old accounts when they switch employers which misconstrues the state of American’s retirement savings based on this data.

I am among those people that have multiple 401k scattered over different employers. I have been using personal capital to monitor all in one screen, but I am thinking seriously now to pull every thing together in one place for easy planning

So I am 54. I will be retiring in 199 days. I have a significant amount of money in my 401k and IRA. I will be investing additional money in the coming years. Per the rule of 55 I will be able to withdrawl money from my 401 when I retire (55) but plan on working part time until around 58.

What would be the ideal ratio of 401k / IRA / After tax money

I encourage folks to have 3X their 401(k)/IRA in after-tax money.

But every situation is different. Given you plan to work part-time for another 3 years, you’re probably good to go. You know your expenses and needs best!