Given day job income is the number one source of income for the majority of the population, it behooves us all to go where there's robust employment. Let's look at the top 5 cities in America to get rich and enjoy life!

After reading one too many “best places to live, retire, work” articles that left me scratching my head in disbelief, I decided to create my own list based on the following criteria.

Criteria To Determine The Best 5 Cities To Get Rich And Enjoy Life

* Experience. There's no voodoo journalism where the author writes about places he's never been to. I've lived in all of these places for years except for one.

* Wealth. Wealthy people can live anywhere in the world. So it's logical to follow their money to see where they reside.

* Weather. “Go West young man!” said one of our first settlers. No rational person would choose living in freezing cold weather for half the year when they could live in temperate or warm weather all year around. Polar Vortex be damned!

* Diversity. The world is global. Life is much better when you speak a second language, experience different cultures, and eat all sorts of food. If you only speak one language, have never traveled internationally, and eat chicken every day, this list is not for you.

* Employment. All five cities on my list have unemployment levels below the nation's unemployment level of ~6.7%. Go where the jobs are.

THE TOP 5 CITIES IN AMERICA TO LIVE A WONDERFUL LIFE

Based on the above criteria, here are the top 5 cities in America to live.

#5) West Los Angeles down to Newport Beach, California

Pros: With the average temperature of 71 degrees Fahrenheit year around, LA along with San Diego have the best weather on the mainland. I make a distinction between West Los Angeles and Los Angeles because LA is huge with a roughly 3.9 million population, and a 13 million greater LA population.

It's all about living along the coast down to Newport Beach. LA is the mecca of the TV, movie, and music industry. Las Vegas is 3.5 hours away by car for some debauchery. There's a great amount of diversity. Finally, there are plenty of international flights and ports out of LAX.

Cons: Traffic and pollution. If you can live in West LA and work in West LA, you're fine. But if you've got to commute to downtown LA from West LA during rush hour then problems arise. With such an enormous population, it can be maddeningly frustrating to get things done. Smog is a mainstay problem in the area. The median home sales price in LA is roughly $519,000.

Recommended minimum income per person: $75,000. Commuting costs are terrible and home prices have rebounded quite rapidly over the past two years.

#4) Honolulu, Hawaii

Pros: What's there not to love about living in paradise where the average temperature is 77.2 degrees Fahrenheit? The waves, mountains, and sunshine are free. There's a fantastic mix of Korean, Chinese, Hawaiian, Italian, Filipino, Japanese, and American food. Locals get discounts to play one of the several dozen public golf courses on the island. Pensions are not taxed and the sales tax is only 4.8% as opposed to 8%+ in many other states.

Unemployment is a nation leading low 4.5%. The rise of the Chinese consumer is energizing the tourism industry like the Japanese consumer did in the 1980's. Honolulu would rank higher on the list if it had a larger and more diverse commercial industry.

Cons: The median housing cost is roughly $570,000. Milk can cost $5 a gallon and gasoline is regularly always the highest in the nation as everything is imported. It can sometimes take an hour to go 15 miles in rush hour traffic.

If you do not have an internet business or are not interested in the hospitality business, then options are limited. But there is a burgeoning financial wealth management business due to the influx of wealthy Chinese and retirees from the mainland. Hawaii life is so nice that you might never maximize your potential.

Read: If You Can Make It In Hawaii, You Can Make It Anywhere

Recommended minimum household income: $90,000+. A good portion of Hawaiian households have multiple generations under one roof to keep costs down. Minimum individual income: $45,000. 7.2% of the number of households in Hawaii are millionaires, #2 in the country.

#3) Washington DC and Surrounding Area

Pros: Thanks to fat government contracts, roughly 6% of the total 266,000 households are millionaires. Northern Virginia (suburbs of DC) is right up there with some 6.5% of households as millionaires. Maryland is #1 in the country at 7.2% of households as millionaires. DC and its suburbs provide access to great museums and year around festivities.

Home of the “power lunch,” roughly a half million federal government workers with pensions are able to enjoy a lifestyle supported by US taxpayers. Flights are plentiful to Europe from Dulles International Airport. There's also a great cluster of world class universities including: Georgetown, UVA, and William & Mary within 2.5 hours away. The public high school system is also one of the nation's best.

Cons: Summers get extremely humid and winters can go below freezing. Those who have allergies will suffer given the area produces some of the highest allergen counts in the country. Average listing price for Fairfax, Virginia homes is roughly $564,000 according to Trulia.

Recommended minimum household income: $100,000+. The DC area is immense. You can find plenty of cheaper areas to live if you are willing to commute from places such as Herndon or Chantilly. Areas such as Langley, McLean, Vienna, and Chevy Chase are some of the most expensive neighborhoods that require $150,000+ household income levels to be able to afford a place.

#2) New York, New York

Pros: Every time I left NYC for business I was so glad to return because NYC is the most vibrant city in America. Where else can you go eat Korean BBQ at 4am after hitting one of the clubs? Where else can you go to Carnegie Hall to listen to Yo Yo Ma play his cello and hit a rooftop pool party at The Standard Hotel?

If you want to be in finance, publishing, art, media, and entertainment there's no better place to be. NYC has the best variety and quality of food hands down. It's easy to meet new people given the incredibly efficient and affordable subway system.

Cons of living in New York City

Cost is the biggest issue. Even if you are making $100,000 living in Manhattan, it's very difficult to save. The noise and pollution can get to the average person if s/he is not used to all the hustle and bustle. Given the 8.4 million population, your patience might wear thin as you're always standing in long lines for food, shows, and transportation.

The average housing list price is $2.6 million and the median sales price is $1,055,000 according to Trulia if you want to live in Manhattan. Luckily, there are more affordable boroughs such as Queens where the average list and median price is around $450,000. Taxes are high thanks to a city tax on top of state and federal taxes. Finally, the winter months can be very harsh.

Read: How Do People Live Comfortably In NYC On Less Than $100,000 A Year? This article will show you how people who don't make my recommended minimum household income make it!

Recommended minimum household income: $250,000+ in Manhattan depending on the number of children you have given private school costs $40,000+ a year and rent for a three bedroom apartment can easily go for over $6,500 a month in a decent neighborhood. If you avoid Brooklyn, you can comfortably live off $60,000 a year as an individual.

#1) San Francisco Bay Area, California

Pros: What can I say about my favorite city in the world. I've lived in six countries and have visited hundreds of cities so far, and hands down San Francisco is the #1 city in America to make money and live a balanced life. The job market is booming because of the strength of the tech / internet sector.

The weather averages a temperate 61 degrees fahrenheit. San Francisco has a minority majority population promising a huge diversity of food and culture for everyone to enjoy. Close by are world class destinations in Napa/Sonoma Valley, Lake Tahoe, Half Moon Bay, and Carmel By The Sea. The Bay Area is home to tech giants such as Apple, Google, Yahoo, eBay, Twitter, and Intel. The unemployment rate of 5% is one of the lowest in the nation and opportunities are endless.

I don't know any other city in the world that is churning out as many millionaires as San Francisco. Millionaires are a dime a dozen here. When you retire, you can easily go anywhere else in the world to live an even more comfortable life. Berkeley and Stanford are two great universities that help produce a good amount of research and innovation as well.

If you think I'm biased, Travel+Leisure Magazine recently ranked San Francisco as the #1 city for intelligence, attractive people, sexual acceptance, tech-saviness, fine dining, and wine bars. NYC is #1 for luxury stores, performing arts, historical sites, diverse foods, and sandwiches. I'd take attractive people to drink and fine dine with over checking out historical sites any day!

Cons of San Francisco

The median housing price in San Francisco is roughly $840,000, the nation's highest compared the the median household income of roughly $73,000. As a result, 60%+ of residents rent. The average rent for a 1,000 sqft 2/2 is around $3,200/month. Social unrest due to increased evictions and rising rents have caused demonstrators to block Google buses in the Mission District on a monthly basis. State income taxes can run up to 13% but averages around 8% for the median household earner.

Recommended minimum household income:

$150,000+. There's sadly no way to comfortably buy a median priced house that costs $840,000 on less than $150,000 unless you have a huge downpayment.

A single person without dependents can comfortably live off $60,000 a year, but savings will be limited to at most $20,000 a year. On the bright side, San Francisco properties are about 30% cheaper than Manhattan properties on a like for like basis.

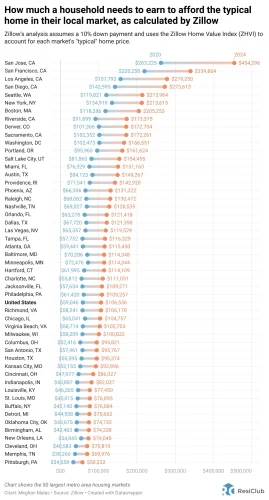

Below is a great chart that shows the income needed to afford a typical home in the top 50 cities. Notice how San Jose is #1 followed by San Francisco. But living in San Francisco is way better than living in San Jose!

See: Why Earning $300,000 Is A Middle Class Income Today

CHOOSE A BETTER PLACE TO LIVE WITH YOUR ONE LIFE

I grew up in a real small town in upstate New York. The very first thing I did after graduating college is I moved to the San Francisco Bay Area because I knew the odds there were just going to be better…Second thing I did was…[say] to myself ‘I'm going to try a number of things which are high risk but possibly high reward. Try as many of them as I can until one of them gets lucky.' Sooner or later luck is going to find you. You just have to stay in the game. – Scott Adams, Creator of Dilbert

If you enjoy city life, these are my top 5 cities to live in America. If you don't enjoy city life, not to worry because each one of these cities have terrific suburbs close by. There's Malibu for Los Angeles, Hillsborough for San Francisco, Kahala for Honolulu, Great Falls for Washington DC, and Westchester for NYC to name a few more idyllic spots on the top 5 list.

For Younger Folks, Go Where The Job Opportunities Are The Greatest

For those of you who are graduating college or looking to find better job opportunities, all of these places give you the best chance for a thriving career. Perhaps you'll have to slum it for a bit due to the high cost of living, but that's what we do when we're paying our dues. It's absolutely worth going to where the action is. Mindshare is a very powerful phenomenon that keeps on enriching everyone around.

Some of you will never leave your current residence due to family. Change is hard and being away from loved ones can be especially difficult for those who've never traveled. But in the age of Skype, Facetime, and quick transportation, give your dreams a chance!

Once you've made your money, you can afford to fly your family out to be with you, or you can always return. The farthest flight in America is 9.5 hours from NYC to Honolulu. That's nothing compared to the three months early settlers took to cross the continent.

Honorable Mention Top 5 Cities

Seattle, Washington. No state income tax. Strong employers in Amazon, Microsoft, and Starbucks. Median home price of $420,000 half that of San Francisco. Only con is that it's kind of gloomy more days than desired.

Readers, what are your top five locations in America or the world to make your fortune and live a great life? Why don't more people move away from slow growth areas to high growth areas if they want more opportunities? Why isn't there more of a migration to nicer weather locations? If you believe a city should be on the list but isn't, please let me know and explain why!

Related articles to top cities:

Easy Coast Living – Is It Really That Bad?

West Coast Living – Yes It Really Is That Much Better

States With No Estate Tax Or Inheritance Tax

Real Estate Investment Suggestions

To invest in real estate without all the hassle and unexpected costs, check out Fundrise. Fundrise offers funds that mainly invest in residential and industrial properties in the Sunbelt, where valuations are lower and yields are higher. The firm manages over $3.5 billion in assets for over 500,000 investors looking to diversify and earn more passive income.

Another great private real estate investing platform is Crowdstreet. Crowdstreet offers accredited investors individual deals run by sponsors that have been pre-vetted for strong track records. Many of their deals are in 18-hour cities where there is potentially greater upside due to higher growth rates. You can build your own select real estate portfolio with Fundrise.

I've personally invested $954,000 in private real estate since 2016 to diversify my holdings, take advantage of demographic shifts toward lower-cost areas of the country, and earn more passive income. We're in a multi-decade trend of relocating to the Sunbelt region thanks to technology.

Manage Your Money In One Place

Sign up for Empower, the web’s #1 free wealth management tool to get a better handle on your finances. In addition to better money oversight, run your investments through their award-winning Investment Checkup tool to see exactly how much you are paying in fees. I was paying $1,700 a year in fees I had no idea I was paying.

After you link all your accounts, use their Retirement Planning calculator that pulls your real data to give you as pure an estimation of your financial future as possible using Monte Carlo simulation algorithms. Definitely run your numbers to see how you’re doing.

I’ve been using Empower since 2012 and have seen my net worth skyrocket during this time thanks to better money management.

I don’t think Justin Keller would agree with you.

Coming from FS, I’m not surprised San Francisco is first :p

Would be interesting to see a worldwide version of this list.

[…] The Top 5 Cities In America To Get Rich And Enjoy Life […]

Greenville, South Carolina….give it a look. $400k or less for a 3,500 sq. ft. Southern colonial on a wooded acre, cul de sac, twenty minutes to downtown. R/E taxes under $2K. GE Energy Plant, BMW Plant, Michelin US HQ, Clemson U, Bob Jones U (for the Christian Right oriented). Great airport under current renovation feels like a private facility, with Southwest on board. Totally awesome downtown….on everyone’s top five places to live/work/retire. Only downside is K-12 systems…some are rather weak.. Absolute heaven for engineers and the CNC-capable.

Good post. A couple more notes about DC…

Cons: The traffic and the significant income inequality. Although there are many millionaires, there is also a lot of poverty within the city.

Pros: In addition to the federal government, there are several other major industries in DC. Medical research is big in the area because there are businesses like John’s Hopkins (which is only about an hour away in Baltimore), NIH, ect. Also, businesses seem to like to locate themselves in DC to take advantage of the skilled labor force. For example, there are actually a couple companies that build computer games in the area. Some of them got a start building simulations for the government and have since branched out.

Sam,

You know what’s great about New York City?

New Yorkers! I work with many folks from New York City. They’re fun!

They’re friendly! And…… They are very direct! I like direct.

I think that translates throughout a good chunk of the east coast. You should put New York City as number one. I think the culture is so much better.

Ace,

i’ve definitely considered east coast, in particular philly considering its low col compared to nyc/bos/nova. i’ve lived in seattle for over a decade and the culture is very different for sure.

right now, it’s a toss between oakland/sacramento in the west coast and philly in the east coast. i’ve heard that the east coast is much more fast-paced than other parts of the country, i don’t know if i can handle that, although i can adjust in time.

you seemed to have lived/traveled to many parts of the country, may i ask where you are currently based out of?

Pisces1,

I’m currently residing in the Chicago area, but I do travel around the country frequently. At some point, I’ll relocate again. Kind of like the Austin area, though the traffic seemed kind of crazy for a mid-sized city.

I’ll probably wind up back on the east coast. I’m really pretty happy anywhere.

Absolutely NOTHING compares to the SF Bay Area. I’m always so proud to call this place my home.

Lisa,

I certainly enjoyed my time there back in around 1980 to 1985. But, I’m happier not living there.

I actually work with so many people whom have lived in the San Francisco Bay Area at one time or another. It’s very rare to find anyone wanting to move back.

I think I only know of two (and one of them had family connections there). But, I do run into people with an interest in moving to Southern California.

You are only focusing on single people, let me remind you there are 51% households with children under 18, who care more about School Districts than Broadway shows.

So try thinking outside the box and don’t just focus on dating, clubbing and drinking. We need parks, child care, best elementary, high-schools etc. For all that you need to stay away from lists of mega-cities you mentioned above or else even with 200K+ you will still be broke and most probably your kids will be potheads by the time they graduate high school, if they ever did.

So best places to live and make money are, where you can find good balance of jobs and family life. I would say mid-size cities like, Pittsburgh; Raleigh,NC ; Columbus, OH; St. Luis; Austin,TX, Milwaukee,WI are best value for your money.

Are you saying that these cities and the surrounding areas are not inhabited by families who care about education?

You do know that the best public high schools in America surround these cities right? Langley and McLean in Northern Virginia, Marin/Hilsborough/Atherton in the SF Bay Area etc.

This is not a list for best value for your money to be miserable. This is a list to live a great life and make a lot of money. Is this not clear in the title and the body of my post?

That’s really true!

Another “gedunke”:

If your goal is to be financially independent…… That means that your passive income will support or exceed your normal expenses.

If….you can accomplish this in a low cost/lower cost city (maybe a Cleveland, or a St. Louis, or a Fort Worth), you have a comfortable family lifestyle, a relatively short/low cost commute, aren’t you rich?

As I face a move in the next few years, it is interesting to me to see how different my list is from yours. With kids, we have to consider the quality of schools, but also probably rate quality of life a little differently– I wouldn’t want to raise them in NYC, for instance.

Weather is certainly a factor for us (more so for my wife who prefers the warm– I like to ski and enjoy different seasons).

Cost of living is a big factor, including tax rates. We also want to get as much home as we can get (not in terms of square feet, but one that meets our conception of quality) with cash and no mortgage.

Politics matters to me as well. As a swag, a good mix for us is red state economics, blue state culture, and libertarian live and let live.

I complete agree with the idea of going where the money is, which obviously doesn’t always square with the rest of our criteria.

Right now, we’re favoring Texas (Austin, specifically), Florida, and South Carolina. Having spent some time in California, I’d love to live there– it is a natural wonder– but it just seems too expensive and too taxed. If we could make it work, we would undoubtedly enjoy ourselves.

All that said, we’ll probably just go where I can find the best gig, wherever and whatever that ends up being.

Glad to see DC and Northern Virginia represented on this list! For anyone thinking of relocating to the area, might I recommend:

Arlington, VA – Especially the neighborhoods along the metro, like Clarendon. Great for a younger crowd, tons of good restaurants and bars, very walkable community, easy access to DC.

Reston, VA – Pretty much the best the suburbs have to offer; lots of green space, miles of trails for running/biking, 15 public swimming pools, a great “downtown” area (Reston Town Center), and good commuter access as well, with a metro station opening later this year.

I shoulda bought Arlington property 10 years ago!!! Doh.

I remember Reston in the mid-90s was such a sleepy town. I bet real estate prices have gone bonkers as well.

As a new resident of the Peninsula (SF Bay Area) I’d have to say that the wealth here is absolutely insane. The hubby and I attended a lovely party the other night where–it’d be safe to assume–at least 95% of the attendees were millionaires. The other 5%, you ask? Billionaires. ; ) In general, the people here are fabulous, quite welcoming, and very down to earth. And whether you’re a city slicker or the outdoorsy type, you’ll never run out of things to do. The only con in my opinion (and it’s a big one) is the overall cost of living. Housing (purchasing and renting, we’ve done both this past year) is extremely expensive and our dining out bills are higher than ever. Even the grocery stores seem much more expensive than those I frequented in SoCal. And on a final note, Go Niners!

Congrats on buying a place! Was it a competiie situation? Where did you come from before?

This is so perfect! I have recently been thinking of moving from Texas after paying off my student loan debt and LA is my top pick! So glad to see it posted here. :)

For the sake of an interesting discussion, I’m going to throw a few more ideas out there.

I know people scoff and laugh at this. But, what if you are a confirmed east coaster. The east coast is all about you, your family, your culture, your attitude, etc. living in NYC would be optimum, but you never got the $500,000/year investment banker job (or maybe you’re kind of an underachiever in general). So you can’t afford NYC.

Consider: Philadelphia

America’s fifth largest metro area (population 4 million). You get a biotech or pharmaceutical gig for $100,000/year. You buy a nice $350,000 house in the semi-rural suburbs 20 miles north of the city.

You have some that big city stuff in downtown Philly with that east coast vibrant attitude, for a much lower cost.

You are about an hour and half drive from the beaches in New Jersey and you have mountains to the west and north (some of them skiable).

Life is good. Boom!

Ace,

Your comments are right on. Chicago in the Midwest and Philly in the East Coast are very good places where one can potentially make a high income without the high expenses. If you don’t mind a little warmer weather Atlanta is a good bet in the Southwest.

Pisces1, I have only been to Atlanta once, on a business trip.

It seems like a nice city, but I can’t render an opinion. I certainly wouldn’t rule out a city that has hot summers (or cold winters) as long as there are good opportunities.

My opinion (and this is only my opinion) is that the only US city with perfect weather is San Diego.

I’ve got very little feel for Philly just that folks at U Penn are at the edge of a rough neighborhood?

$100k job and $350k house sounds like a good combo.

Yes…. Philly can have a rough edge, but if you are from NYC, my assumption is that you likely have pretty good streetsmarts.

Overall, the Philly metro area is really a nice place to live. The population is very affluent (the largest mall in America is King of Prussia), the traffic is certainly much lighter compared to a Chicago or an NYC. And the food is really good. If you get the chance, check out Wegman’s.

Having been to 47 states – missing Alaska, Maine, and (sadly) Hawaii – I can say that San Francisco tops my list of best cities. I have family there, have visited innumerable times, and concur with your assessment of that place as #1. Culture, positive vibe, intelligent fit people, beautiful city and surroundings….its a great place. Hard to break in there now, with prices what they are.

Now, I do think that Chicago merits consideration in the top group. It has its flaws, such as the obvious cold winter weather (I was cursing this place last week), and the growing financial problems it has. Though that’s the case in California too, from what I understand.

But Chicago is a place with that true big city feel, world-class dining and shopping, and some great neighborhoods. The people are down to earth compared to some other areas. It’s pricey, but not as extreme as SF or NY.

And yes, I’m biased because I live in this area.

Great steakhouses in Chicago and relatively inexpensive housing. I just can’t take the winter. Call me a wuss, but I want to be playing tennis all year around!

Sam,

People do play tennis all year round in Chicago. They play at indoor tennis clubs.

Some of them quite fancy!

People in Chicago also swim all year round (indoors), they go skiing and snowmobiling in Wisconsin (or Michigan). And they sometimes do strange activities such as ice fishing in northern Wisconsin (or photographing eagles at the Mississippi River).

I love the Los Angeles area- the weather is great, lots of things to do, but like you mentioned the traffic is a nightmare and the cost of living is high! The sprawl is also just terrible.

I haven’t lived anywhere else, so I have nothing to compare it too (I can’t count NYC since I left when I was four and visit only once a year.)

I’ve been looking for an alternative, but can’t find anywhere I really like that’s less expensive (love Pasadena, but MORE expensive than where I currently reside). But, I just read that Claremont, CA is a great place to live with a small college town feel near the base of the San Bernadino Mtns. I’ll have to check it out.

My favorite cities to get rich and enjoy life are the ones closest to my extended family.

As the US economy becomes more info-centric, working remotely becomes more and more feasible.

Taking my Silicon Valley salary and relocating to a lower cost area on the eastern seaboard is my goal. Perhaps the RTP area.

I think your reason for favorite city is why so many don’t move, even though they realize the weather is horrible and their local industry is dying e.g. Detroit, Flint, Michigan etc.

I heard a couple people say CLT- and I can honestly say that there is a lot of opportunities to create wealth there. Cost of living is VERY affordable, with low property taxes, a good job market and quite a bit of relatively inexpensive industrial and commercial space (great for entrepreneurial endeavors). BAC is located here, as well as Duke Energy- I have lived here for 11 years after grad school, and started multiple businesses in the health science field (I have sold a couple). Weather is pretty good- gets a little hot in the summer, but not that bad, and the mountains and the beach are a relatively short drive. I have been to most major cities around the world (love to travel and travel for biz), and I like Singapore probably the best, followed by Sydney. I like Cali (recently had a chance to move to SD)- but I love NC

Love the blog- lot of like-minded people on here

Working in outside sales (as I do) you can live anywhere. Salaries in my industry vary by 3-5% based on a given city’s COL. However COL can vary by as much as 200% on the outliers. Anyway I have to visit all your top 5s for work all the time (except Honolulu… unfortunately!). So I can enjoy many of the benefits… gratis!

Spitballing: why wouldn’t one want to reverse your thinking? Meaning… get “rich” in a low cost area (basically any sizable city in the South) then move to one your Top 5s? Weather is mild 10 months per year (July/Aug can be brutal, but this year was mild). SF can get COLD, Sam!! 60s and windy (SF) generally feels colder than 50s and still (typical winter day in the South).

Also… having lived throughout the South (as well as the NE and even the NW for a brief time) I can vouch that it’s a great place to raise a family. In the bigger cities you have moderate diversity. Just make sure you introduce your kids to it (local cultural fairs/food, international travel, etc).

When you (later in life) move to a Top 5 you won’t have to worry about income so much because you won’t have a mortgage unless you want one. Yes food, gas, etc might be higher cost… but it’s housing and taxes that are the REAL drivers of COL. 80/20 rule strikes again! Admittedly, you tend to want to spend more money when the weather is gorgeous and you’re surrounded by world class dining… but that’s voluntary.

Thoughts? Figure I’d play Devil’s Advocate by flipping your theory around…

**FYI I generally agree with your salary suggestions… for a household of two or fewer**

I just don’t see those six figures jobs and investment opportunities as readily available in the lower cost cities (feel free to mention specifics as I have in this post).

There’s a reason why there’s a term in Liar’s Poker, “Equities in Dallas!”

Guess I should count my blessings then…

That said, I firmly believe there is opportunity everywhere.

Also, as far as your request for specifics:

Houston (Energy), Atlanta (Alpha City), Charlotte (Banking), Raleigh-Durham (Bio-tech)

Maybes: Nashville (Pharma/Music), Charleston (Aerospace/Logistics), Richmond (Banking)

Cool, thanks!

I like to visit the cities on your list, but I wouldn’t want to live there. They are all too busy. I don’t want to live anywhere that have traffic jam all the time. Rush hour is bad enough.

My retirement location list is very short –

1. Santa Barbara

2. Portland

3. Hawaii – not Honolulu…

Those are not great places to make money, though. I probably need to visit a few more locals.

Joe, this isn’t a retirement list. This is a list where you can find high paying jobs and live a great life. Can you share what specific companies and industries there are in Portland?

Oops, you’re right. I was thinking of myself when I replied.

I wouldn’t enjoy life in the city you listed. It’s too busy. Portland is good for independent minded creative type. It will take a lot of luck to get rich in that niche though.

I appreciate your thoughts Sam but I believe it comes from your perspective of a single person without kids in SF. (I did that too and I loved it!) My wife and I have 4 kids, we are both doctors, and living in SF would be a terrible experience for us. In SF, there is an oversupply of MD’s, the competition is cut-throat, litigation and taxes are oppressive, cost of living is high, physicians incomes are relatively less, etc., etc. Meanwhile, our life experience here in upstate NY is minimal commutes, high income, debt freedom, kids in high quality private schools, tremendous amounts saved every year for the option of early retirement or paying 4 college tuitions, world and domestic travel at will, country club, etc. etc. Plus, kids love 4 seasons. I just wanted to give you another perspective because as much as I love visiting the places you mentioned, my Bay Area friends are jealous of our life.

Definitely it comes down to perspective. If you have a family, it’s great living 30 minutes away in places like Marin, Kentfield, Hillsborough, Burlingame etc. Schools are top notch.

Always fun to hear doctors make so much more in less populated places with less competition. Friend makes double as a anesthesiologist in NC.

Why do you think it’s so competitive in SF and NYC? The best hospitals are there along with Boston and Johns Hopkins.

For physicians, I believe the laws of supply and demand hold in the major metropolitan areas such as SF, NYC, Boston, etc. There are a lot of medical schools in those regions and many of the students have family ties to those areas. Thus, many of the graduates stay, thereby driving down compensation. (For example, there are a lot of docs that will do anything to work in NYC despite making less than six figures and having enormous educational debt. Personally, I don’t get it but I respect their decision.) Their opportunity cost is multiple six figures/year! Also, many doctors are terrible with their finances, so they do not engage in data driven decision making when it comes to their careers.

Having earned degrees at Stanford and trained at an Ivy League institution, I am familiar with these “medical Meccas.” I am not convinced the overall quality of care is substantially “better.” Health care, like politics, tend to be local. I can get my friends world class care in my region but you would be surprised some of the places include community hospitals! (It’s true but not well known.)

If we lived in the SF burbs you mentioned, we would be sacrificing multiple six figure compensation, living in a smaller house, and spending tons of time driving. (I know those areas well.) For us, I love the fact we sit together for dinner practically every night (because we can choose not to work crazy hours and are not stuck in traffic), attend kids recitals, attend kids/professional sports events, have diverse/well educated friends (who are nice!), travel, and enjoy the other benefits I previously mentioned. For us, if the cost is 2-3 months of winter (which is fine b/c we ski), then so be it. For MD’s, the cities you mentioned may not be the best balance between compensation and lifestyle.

I can’t agree about the getting rich part, but I can definitely agree with having a great life! I lived in LA and Brooklyn and loved it. Lots of jobs, culture, the arts and money. SF is one of my favorite cities as well, though I would say some of the character of it is fading due to the tech boom. Too many rich people does not equal diversity. I went there recently and though it was great, it felt different. I currently live in Portland and it feels like you could get rich here if you had a nice salary as the COL is low. However, I hate the weather and I miss LA so much for that reason.

Portland really does seem to be a nice option for the low COL. But are there enough big bucks salary opps like Seattle with Amazon, MSFT, and corporate Starbucks? If so, id consider.

Is Portland weather really that bad? Joe from RB40 seems to love it, but of course he’s biased, :)

If I was rich, I wouldn’t want to live in Portland b/c gloomy weather is not fun compared to year around sunshine.

I would say there are some high paying jobs, but probably not as much as Seattle. I personally don’t like the weather, but I was born and raised in LA so the constant rain is tough. It’s legitimately hard on me and I’m trying to work through it. Other people love it and have no problem with it. I also don’t have a car, so I bike year round, which is a factor. Portland is nice, but it’s not my forever place.

Agreed, the Bay Area has the best weather all year around. Even though, quiet a few places in the East coast offer great salaries and great to live for ONLY 3 seasons. Dealing with snows in the winter is no fun. NJ is home to many big pharmas such as JNJ, Celgene, Bristol, Hoffman la Roche, Sanofi Aventis etc….not hard to find great paying jobs. Cons – expensive home price, outrageous property taxes and the winter. Boston is also nice except the winter. As for retirement, I think Charlotte, NC is perfect. Cost of living is reasonable, low taxes, warm, a good international airport and a huge financial industry that pay decent. Many companies are moving there in the last few years because the baby boomer managements are preparing to retire there.

I hear a lot of good things about Charlotte too. I’ve gotta go check it out.

I have not lived in as many places, but I spent 3 years in Maryland (didn’t like the weather), 4 years in Santa Barbara (wonderful place, but not much industry), and the rest of my life in San Jose. I don’t see any reason to leave San Jose. Like San Fran, it takes a pretty high salary to live here, but there are lots of opportunities with many of the tech giants and engineering firms in the area.