Being financially independent is the best. The key is staying financially independent and never going in reverse.

The first rule of financial independence states that once you've amassed enough money, you should never lose money. The second rule of financial independence is to never forget the first rule.

If you lose 50% of your net worth, you need a 100% gain to get back to even. But worse than trying to recoup your losses is the loss of time. The older you get, the more you realize everything you want to do is a race against death.

There's no better feeling than to have your gross passive income cover your best life's living expenses. To not have to work for a living is wonderful because commuting to work, playing office politics, and taking directive from imbecile colleagues is soul-sucking.

You can't guarantee your investments will never go down after reaching financial independence. After all, in any given year you've got a 30% chance of losing money in the S&P 500. But over the long run, your stock and real estate investments should do well.

What everybody who is financially independent can and should do is avoid an annual net worth decline.

To protect our net worth we can do the following: de-risk, diversify, or have alternative income streams beyond your passive income to bolster potential investment losses.

Let me share some examples of three financially independent archetypes who plan to stay retired forever.

Financially Independent Examples Who Plan To Stay Retired Forever

Example #1:

60-year-old couple, $3 million net worth, $90K passive income, $90K total income, $50K expenses.

Due to inflation, $3 million is the new $1 million. We've got to move past the belief that having a $1 million net worth means you're a millionaire. A $1 million net worth means you're earning about $30,000 – $40,000 a year in gross passive income, which does not reflect the traditional millionaire lifestyle.

With a respectable $3 million net worth, however, archetype #1 lives a comfortable lifestyle off a low-risk 3% return or $90,000 a year in net passive income from AA-rated municipal bonds.

The 60-year-old couple has no debt and their kids are independent adults. They could increase their withdrawal rate and eat into principal, but they want to remain conservative.

The couple has no desire to work part-time or consult for money. They are happy with what they have.

Since they only spend $50,000 a year, they get to reinvest $40,000 a year to earn another $1,200 a year in net passive income to keep up with inflation and boost their financial buffer.

Their net worth should never go down because there has been a 0% default history on AA-municipal bonds in their state.

Further, within five years, the couple expect to begin receiving an additional $40,000 total in Social Security for the rest of their lives.

Example #2:

Late 30s, $10 million net worth, $208K passive income, $80K part-time consulting income, $288K total income, $130K expenses.

This couple hit it big when the husband started early at a hot startup that went public after 10 years. At the age of 38, the husband decided to retire and live off the $10 million after-tax windfall after he sold all his company stock.

He married a school teacher eight years his junior and asked her to spend more time with him in retirement to travel. They're planning to have their first child in the next two years and want to do the crazy dual stay at home parent thing.

Because the couple is relatively young, they feel comfortable taking on more risk. Further, with part-time consulting income of $80K a year, they only need to earn about $50K after-taxes to fund their $130K in annual expenses.

As a result, their net worth is composed of: 20% in the S&P 500, 20% in their primary residence, 50% in AA-municipal bonds, and 10% cash.

Strong Passive Income Profile

60% of their net worth will generate about $180,000 in passive income at a 3% rate of return. The $2 million S&P 500 index position also generates about $28,000 a year in dividends due to a ~1.4% gross yield. Add on the $80,000 in part-time consulting income, and we're talking $288,000 in annual net worth increase, or 2.8% +/- any increase or decrease in the value of the S&P 500.

With $2 million of their net worth exposed to the S&P 500, this couple can afford to lose 13% in their stock holdings before their net worth starts going down. They are indifferent about the value of their $2 million primary residence because they plan to own it forever.

Their ultimate goal is to grow their net worth by a stress-free 4% a year so that in 10 years, their net worth will have grown to about $15 million. If there is a particularly rough patch in the stock market, the husband will ramp up his consulting work in order to never see a net worth decline. He has the capacity to earn up to $250,000 a year in consulting.

Worst case, they could invest $10 million of their liquid net worth in 10 years in a portfolio of municipal bonds that yield them $300,000+ in after-tax passive income.

Even if their expenses grow from $130K to $200K after conceiving a child, they'll still have a $100,000 a year gross surplus of cash flow. This couple is unlikely to ever lose money again.

Example #3:

40s, $5 million net worth, $150K passive income, $300K active income, $450K total income, $120K expenses.

$5 million is the recommended minimum you'll need if you want to retire comfortably in an expensive city with a child. One look at the budget and you'll recognize this reality.

Archetype #3 is in their 40s with one 5-year old child who began attending private kindergarten that costs $30,000 a year. The couple's total after-tax living expense is $10,000 a month.

The couple is financially dependent and are no longer working full-time jobs after 20 years of grinding away. The difference with this couple and the other two couples is that they have an online business where they generate $300,000 a year in gross income.

The wife started her online store selling a variety of women's goods on the side while working as a Marketing Director.

She read Financial Samurai and thought, why not utilize my expertise at my day job and create something of my own. After all, one of the best ways to get next-level-rich is to grow your own equity.

Strong Income Profile

With a combined $450K a year in gross income and only $120K in annual after-tax expenses, they have roughly a $300K annual gross buffer. Therefore, this couple is willing to take more risks with their investments.

Their net worth is currently composed of 30% in various large cap dividend stocks, 25% in real estate, 40% in AA-municipal bonds, and 5% in a high yield online savings account.

With $1.5M in stocks and a $300K annual gross surplus after expenses, this couple is able to withstand a 20% decline in their stock portfolio before they start losing money.

Using Financial SEER, this couple's Risk Tolerance Multiple is a reasonable 13.8X if using a 35% expected average bear market decline, and just 7.9X if using a 20% expected decline in their stock portfolio.

This couple's ultimate goal is to achieve a $10 million liquid net worth by their 50s so that they can generate ~$300,000 a year in passive income and hedge against a decline in their online business.

Financially Independent For Life

The average bear market declines by roughly 35% since 1928. However, that's for stock performance alone.

Once you construct a balanced retirement portfolio of stocks and bonds, the volatility declines tremendously. Add on alternative investments, and it may be even harder to lose 35% in any given year.

Take a look at the worst year performances of the following balanced portfolios below. Even with a 60% / 40% weighting in stocks / bonds, -26.6% was the worst annual decline.

If you've actually achieved financial independence or are clearly on your way to financial independence, there's no way you should be risking the majority of your net worth in risk assets without having alternative income streams. You are already comfortably happy with what you have. If you are not, then you have not yet achieved financial independence.

Recommendation For Achieving Financial Independence

To increase your chances of becoming financially independent, you must stay on top of your finances like a hawk. Check out Empower, the web’s #1 free wealth management tool to get a better handle on your finances. I've used them every week since 2012 and have watched my net worth more than 5X since.

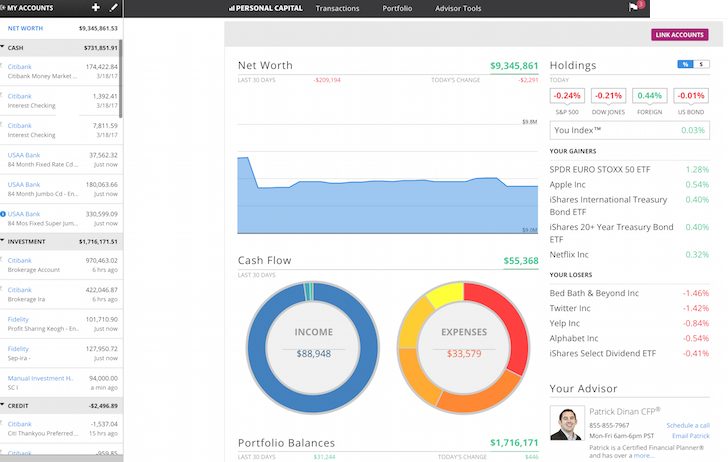

Personal Capital allows you to track your net worth, track your cash flow, analyze your investments for excessive fees, and plan for your retirement using your actual income and expenses. After you link up all your financial accounts, their software will give you a fantastic snapshot of your money.

Remember, there's no rewind button in life. It's better to retire with a little too much, than a little too little. Nobody cares more about your money than you. Below is an example of the Personal Capital dashboard.