It's hard enough to retire early, say before age 45. However, I've discovered it may be even harder to stay retired once you retire early!

As I was going through my archives, I realized I had a master plan to re-retire by September 1, 2022, several months after my 45th birthday. Given the birth of my daughter in 2019 and then the onset of the pandemic, I figured I might as well work more online until the pandemic ended.

Clearly, we're well past the date and I wanted to review some reasons why I’ve continued to stay engaged with online work.

Quick Early Retirement Background

I decided to leave work behind in 2012 at age 34. The corporate finance grind had burned me to a crisp and I wanted to be free. I had no kids to take care of and my wife, who is three years younger than me, agreed to also work until age 34 before retiring early as well.

We had a blast traveling the world and doing other leisurely activities until we had our son in 2017. After he was born, I decided to become more entrepreneurial by making more money online.

I felt a great responsibility to provide for my family once he was born. Even though I ran the financial calculations multiple times to ensure we could survive off our existing passive income, it felt irresponsible to not have a day job. As a compromise, instead of getting a day job, I worked more online.

Without a traditional working spouse, like most of my male peers had, I felt greater pressure to make money. With no safety net, I couldn't mess things up. This was my first failure to stay retired as my Provider’s Clock ticked loudly.

After two years of being more entrepreneurial, I declared on January 6, 2020 that I would re-retire within three years. I'd stop spending time on business development, no longer long to go back to a traditional job, and I'd just write whatever the heck I wanted.

Financial Requirements Needed To Re-Retire By 45

In order to re-retire by 45 in mid-2022, I created two audacious financial goals.

- Boost our net worth by $1.5 million.

- Increase total income by $5,000 a month.

Achieving one, but ideally two of the goals, would be the only way I could feel OK not working with two young children. It takes between $20,000 – $55,000 a year before tax to raise a child in San Francisco, and I wanted a buffer.

Financially, my main goal is to achieve perpetual Fat FIRE, where my investment portfolio generates at least $250,000 a year forever. Unfortunately, inflation has made so many things more expensive. Then again, inflation has also helped boost dividend and bond income.

Finances Are Not The Main Issue

In the beginning, I thought boosting my net worth by $1.5 million was a highly unlikely goal. I assigned a 30% probability this financial goal could be achieved.

Risk assets like stocks and real estate felt fully valued in January 2020. Given we were a dual NO job household, we lacked a significant financial engine to boost our net worth by $500,000 a year for three years.

Therefore, I decided to focus on trying to make $60,000 more a year instead. I knew I was leaving a lot of money on the online table, but in the past, I didn't care partially because I didn't have kids. If I had cared more about the money, I'd still be working! Once the children came, I became more motivated to try.

I assigned a 75% probability this financial goal could be achieved.

Achieving The First Goal

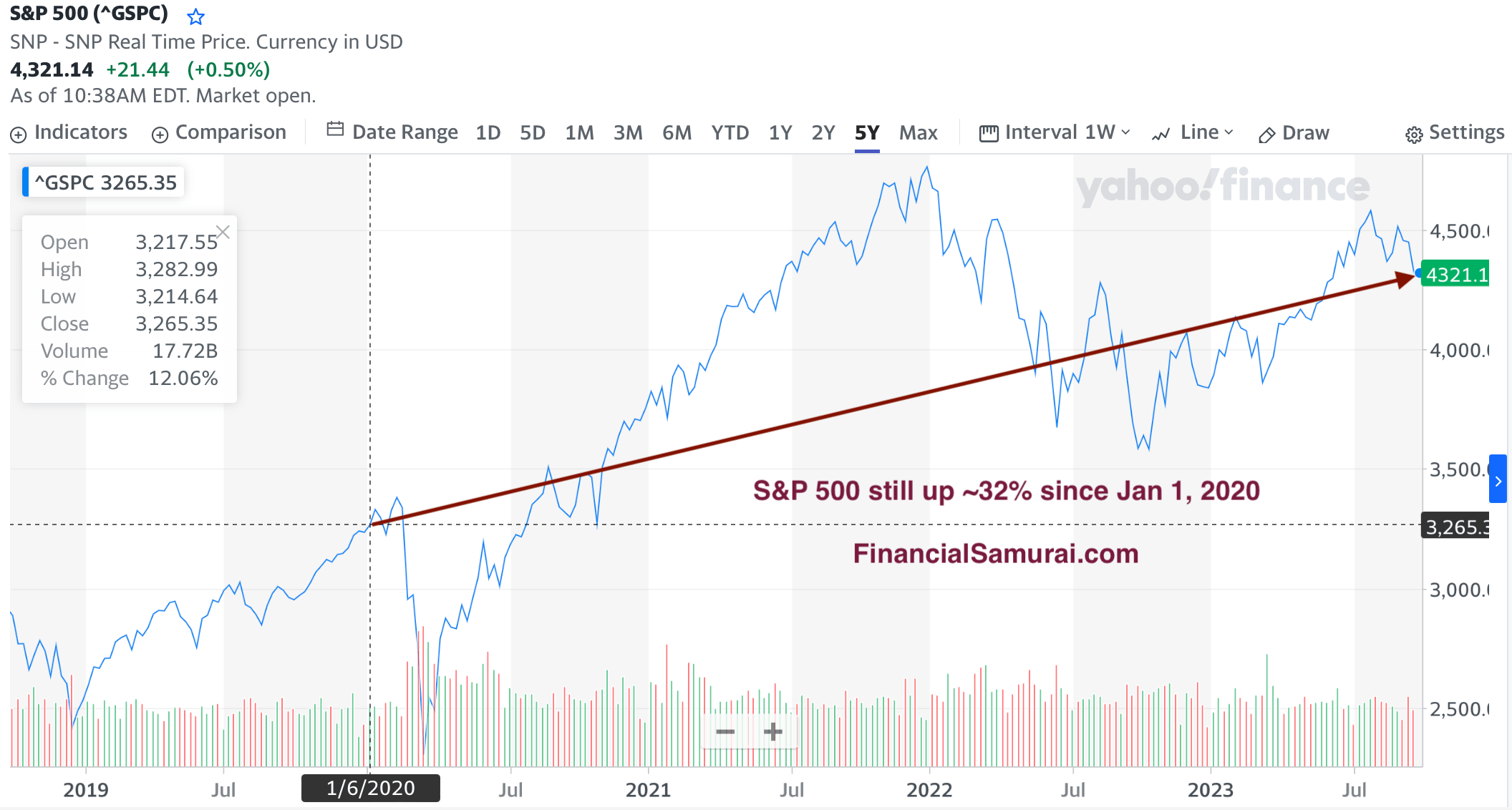

To my surprise, my net worth goal was achieved because stocks and real estate both surged higher since January 2020.

Even after the 2022 bear market, the S&P 500 is still 30%+ higher today than it was in January 2020. Meanwhile, San Francisco real estate prices are still up 15%+ since January 2020, despite the pullback since May 2022.

Given the majority of my net worth is exposed to risk assets, I was able to benefit from the rise in prices. Hence, the lesson here is to save aggressively and stay invested for the long term. 70% of the time, good things tend to happen.

Doing nothing and making money from your investments feels good. However, part of the price of entry is to stomach the pain of potentially losing a lot of money as well. We experienced a gut-wrenching March 2020 and a dismal 2022.

Achieving The Second Goal Was A Matter Of Effort

Making $5,000 more a month was straightforward. I just decided to say “yes” a little more often to the many companies that have asked to partner with Financial Samurai.

I still had to evaluate carefully each company before featuring it because there are so many companies out there and not all will survive or offer great products. It took time to test out the products myself. However, once I opened the site up to business, more business came.

The lesson here is that you can probably make more money than you currently are – whether from your day job or your platform. But it's up to you to find the optimal balance between time and money. Adjust the ratios as your situation changes.

Main Reasons Why I Didn't Re-Retire

Despite achieving both financial targets, I didn’t stop working online. The following reasons will highlight how difficult it is to completely let go of work.They will also expose how our attitudes towards money change over time.

The earlier you retire, the harder it is to stay retired.

1) Hard to break old habits

I've been publishing three posts a week without fail since July 2009. If you've ever done something consistently, after a while, like going to the gym, it becomes a part of who you are.

To end my 13-year writing streak in 2022 would have made me feel like a failure, so I didn't want to stop. Besides, there were simply too many fascinating things to write about to quit.

I also viewed editing and hosting a well-written sponsored post as a partial reprieve from my publishing schedule. If an expert could write about farmland investing, the fine art market, wine, Sunbelt real estate, or the latest financial habits of its clients, I was all for it.

Related: The Secret To Your Success: 10 Years Of Unwavering Commitment

2) The fear of losing a lot of money again

Boosting our net worth by $1.5 million required practically no effort. After buying a forever home in mid-2020, we mainly just let our investments do their thing.

Given little effort was required, it doesn't feel like the net worth gain was real. Instead, it felt like funny money that could disappear overnight. And much of it did in 2022!

During the process of giving up a lot of gains in 2022, when the September 1, 2022 deadline came to hang up my boots, I kept them on. Who knew how long the blood-letting would go on? It turns out the recent stock market bottom was in October 2022, the very next month.

When you're losing lots of money in a bear market, it can sometimes feel like you'll continue to lose money forever. Oftentimes there are “dead cat bounces” or “bear market rallies” that give you shimmers of hope. Sadly, said hope is dashed when the market resumes its sell-off.

As the Fed aggressively raised rates, I felt I had no choice but to keep battling. My wealth boat was sinking and I urgently needed to dump water out to stay afloat.

3) A whirlwind of busyness

Buy This Not That came out on July 22, 2022, which meant I was busy marketing the book for a couple of months after publication. I had little time to think about re-retirement when I was busy going on a bunch of podcasts and doing live TV interviews.

If you want to feel anxiety, spend two years writing a book, then publicize it on live TV! The experience will awaken scintillating emotions you never knew you had!

Once the lion's share of the marketing was done, after October 1, 2022, I did take it easier for a month. But taking it easier was really just going back to my pre-book normal routine of ~15-20 hours a week online. Truly dialing things back would have meant going from 30 hours a week down to 10 hours a week.

But I did not do so because spending time on the book had necessitated spending less time on Financial Samurai. I felt like I had to catch up on some neglected items, such as updating old posts and cleaning up backend technical stuff.

4) A large new bill came

In August 2022, we decided to send our daughter to preschool two days a week. As a result, we took on a new $1,400 a month bill.

Although my goal of making $5,000 more a month was in anticipation of these types of new expenses, the reality hits differently once you actually get the bill!

Once we started having to pay $1,400 a month for preschool, I told myself I needed to make $2,000 more a month gross to cover this new expense. Because if I didn't, I would feel like I was losing progress.

Eventually, her preschool cost will rise to $2,500+ a month once she starts going five days a week. Knowing this, it felt difficult to re-retire.

Psychologically, it's hard to lose financial ground, especially when you have dependents. We constantly reset our financial expectations higher. As a result, we end up grinding longer than we may need to.

5) The desire to win back my losses and not violate the 1st rule of FI

Given the 2022 bear market, I felt bad for not selling everything during the height of the mania at the end of 2021. I did reduce my asset allocation to stocks at the beginning of 2022. But the amount was not enough to prevent me from losing ~70% of my gains 2021 gains in 2022.

As punishment, I told myself I'd continue working to make up for my losses. After all, the first rule of financial independence is to not lose money. And I had violated that rule with my investment losses in 2022.

I didn't want to see negative net worth growth in 2022. So I did what I could to counteract the investment losses.

6) Found new excitement in podcasting

My theme for 2023 was “back to easy living.” The combination of writing and marketing my book, fatherhood, staying consistent with FS, and then losing a lot of money in my investments in 2022 wore me out.

I ended 2022 with a roughly flat net worth, which felt like a sad win after all that effort. I needed a break and wanted to spend more time with our daughter. Early retirement was back on the agenda!

To my credit, I did take things down by about 30%. For about three months, I felt like I was back in early retirement mode given I did almost zero business work. But it also felt odd doing less work given our daughter transitioned to school three days a week in July 2023. I had one more day of free time.

Then it dawned on me that I had enjoyed going on podcasts during my book marketing tour. I also wanted to pay back the podcasters who had invited me on. As a result, with my new free time, I decided to learn how to use podcasting software to enable me to interview others.

Felt Like I Was Back In 2009

The excitement I felt interviewing people for the Financial Samurai podcast (Apple or Spotify) felt similar to when I first started Financial Samurai in 2009. I was off on a new adventure!

I make no money from podcasting, but I'm having a lot of fun interviewing folks. It's a great way to connect with interesting people and learn from other experts in their respective fields. I also think our kids, when older, will enjoy hearing what mom and dad talked about when they were younger.

When you've found a new challenge, it's hard to stay retired or give it up and re-retire. Now my wife and I are slowly learning how to edit, which is a great new skill to learn.

Here's a podcast episode where I talk about the solution to staying retired once you retire early. Have a listen and subscribe!

7) The importance of filling a void

If we want, we can send our daughter to school five days a week next month. But we're holding off because we enjoy spending Tuesdays and Thursdays with her. Since she will be our last child, we are trying to cherish the remaining time we have with her before she turns five.

I'm both happy and sad our kids are growing up. The past 6.5 years of fatherhood have been incredibly joyful and challenging. But I would enthusiastically go back to when each was first born and do it over again.

The more time you spend with someone, the harder it will be to no longer spend as much time with them. This is one of the biggest downsides of being a stay-at-home-parent. Eventually, most of our children will leave us and live their own lives. Young children make you more aware of the speed of time.

I've found the best way to combat my troughs of sorrow is to stay productive, like a tuna that keeps swimming in order to survive. Not only are our children getting older, so are we, as are our parents. If I spend too much time doing nothing, I will feel like a part of me has disappeared.

8) Too many exciting opportunities to stay retired

Finally, you may be living in a city where there are simply too many exciting opportunities to stay retired. It's like trying to go on a diet but having freshly baked cookies of different varieties pop out of the oven every hour. In such a scenario, it would be impossible to not eat at least one!

San Francisco is currently the epicenter of the artificial intelligence boom. Roughly 70% of Y Combinator's last batch of companies are in AI. Over 50% of the new downtown office leases are coming from AI companies. Everywhere I go, whether on a playdate or on the pickleball court, I run into people either investing in or working in AI. As a result, I can't help but feel AI FOMO.

To counteract missing out on what will be a massive wealth building opportunity, I'm investing in private funds such as the Fundrise venture capital product, which is investing in artificial intelligence companies. However, why not go ALL IN and try and get a job at an AI company? So many of them are based in San Francisco. Therefore, that's what I will try to do.

20 years from now, I don't want my kids asking me why I didn't invest in AI or work in AI given I had a chance to near the beginning. The only way to stay retired is for us to relocate to Honolulu or another slower-paced town. The temptation is simply too great to get involved living in San Francisco.

Money Becomes A Smaller Part Of Your Retirement Decision Over Time

Yes, being able to generate enough passive investment income to cover your desired living expenses is a necessity to be able to retire or retire early. However, over time, money's importance for staying retired declines.

What you will long for is having a continued sense of purpose for the rest of your life. If you are still working, don't take for granted the purpose work provides, even if you don't always like what you do.

When you retire early, you are left with a void to fill. I'm not sure what I would have done if we didn't have children after we left work. There's only so much tennis and pickleball I can play before my body aches. And if I started writing more than three posts a week, I'd probably stop enjoying the activity.

Once both kids are in school full-time, I plan to give up on early retirement. The void you will feel is why it's so hard to stay retired once you've retired early.

Finding a community of great people with a common mission is what I long for the most. And if I can work from home two times a week when my daughter isn't in school, even better! Alas, the work from home trend is dying down as the economy slows down.

Maybe Retirement Is All In Our Heads

I'm not sure our mind ever truly retires until we die. For many years now, I've embraced my faux retirement given all the time I spend writing online and now writing books and podcasting regularly.

But one day, I could choose to stop all my creative endeavors and say I'm done with work for good. When that day comes, I hope it's because my mind can no longer function. Because if I can last until then I will know that I lived a full life doing what I love.

Summary Of Why It's So Hard To Stay Retired Once You Retire Early

- After a lifetime of work, it's hard to completely stop doing anything productive

- There is this perpetual fear of losing money in a bear market, which are hard to predict

- Unexpected financial variables pop up all the time that need to be paid

- If your investments lose money, there is an inherent desire to try and make back your losses by taking action

- Unless your mind is gone, you'll naturally find new passions in retirement to fill the void

- Boredom and loneliness

- You live in an exciting city filled with smart and hungry people looking to create new things and build massive wealth

As I embark on my journey to unretire, I'm now finding it difficult to get a good job after retiring for so many years! This is to be expected given I haven't had an official job since 2012. So let's see where this journey takes us.

Free Wealth Management

Empower is the best free wealth management platform for investors. You can x-ray your portfolio for excessive fees and get a snapshot of your asset allocation by portfolio. Empower's free tools also let you easily track your net worth and plan for your retirement.

When there is so much uncertainty in the world, you absolutely must stay on top of your finances. Understand where your risk exposure is and stay on top of your cash flow. Empower's free wealth management tools will help you bring calm to the chaos.

I've been using Empower since 2012 and it has helped me growth my net worth tremendously since retiring. It is the best free wealth management platform today.

Subscribe To Financial Samurai

Listen and subscribe to The Financial Samurai podcast on Apple or Spotify. I interview experts in their respective fields and discuss some of the most interesting topics on this site. Please share, rate, and review!

Join 60,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

If you think like you do, you are just bluffing about being retired. Excuses every time

Thank you. At what age and how long have you been retired? How did you get over the one more year syndrome?

You may enjoy this post: 10+ Years Of Fake Retirement Later

I had gotten to the point that I could finally retire but something much more exciting happened. Don’t get me wrong. It’d be tough to retire but we could have done it. All debt free. My wife and I have 2 paid for houses, healthy 401k’s, about 2.5 mil in assets with a lot of reserves.

Now back to the exciting part. I’d been trying unsuccessfully for 12 years to land my dream job. Yes 12 years! I wanted it so badly that I even took a lower level position just to get in the door. It finally happened. So here I am at 56 and loving every minute of it. Time off and travel benefits are so amazing. Pay is 2x above my highest previous salary. And here’s the icing on the cake. I finally got the old school pension that I’ve so desperately wanted! My previous years of employment even counted towards longevity. I’ll have to put in 8 more years but it’ll guarantee over 100K per year in lifetime pension, plus there’s impressive 401k contributions.

Yes retirement sounds fun, but this is so much better for us right now!

Congrats! Your comment begs the question: what is this dream job?

Hi Sam. Thanks! And thank you also for all the fine work! Your book was among the gifts to my son for his college graduation;)

The job is an airline pilot, which has been my profession for many years. This particular position has been my career goal all along. Definitely worth taking a couple steps backwards to achieve the overall goal. With the kids out now we can use this opportunity for a progressive preretirement.

Planing to keep a primary residence but also renting in key locations while traveling. This will allow us to sample some of our favorite locations for a few months at a time before actually retiring.

Even most rich folks seem to have some sort of a job. It may seem weird but there it is. Of course, work is quite a different animal when you get to pick what you do, when you do it, where you do it, how hard you work at it, and how often you actually do it.

Oddly enough, I suspect that all makes a difference in how you regard work. Education seems to have a similar draw, once one no longer has to have more just to get started in life.

Yes, work is much more enjoyable if you don’t need to work for the money. It’s an incredible feeling if you find a great job!

Really enjoy your posts — lots of thought-provoking points for me, especially in my current “semi-retired” state after having turned 50. Agree with your point about some level of FOMO with everything going on in tech and AI these days. It’s not so much about the money, but the excitement of innovation…. HOWEVER I have no desire to get back into a full-time role again with all the stress associated with that in this industry. Can you please do a post on how you’re approaching this and how to get/stay plugged in without being totally overwhelmed and maintaining that balance?

Congrats on entering semi-retirement. The excitement of innovation is palpable. But I’m realizing it’s also tough to get a job in a hot field, as it logically would.

They used to consult part-time, I would do so for 20-25 hours a week. Basically, that was my sweet spot where I felt good working, but it didn’t burn me out.

Now I just spend most of my free time writing, which is mentally stimulating and fun.

Sam – thanks for that great post. No doubt one of the major reasons for the popularity of your blog is that you’re so frank about your doubts/misgivings/mistakes as well as your good calls. I wouldn’t trust advice from anyone who implies they have all the answers.

The FOMO point resonates with me, although I’m far from the AI epicenter (in Santa Fe, NM). As a law firm partner who works in the tech field, I couldn’t imagine missing out on the AI revolution, despite being past the traditional retirement age. Plus nothing gets me more energized than exploring legal issues. I love pickleball, and powerlifting, and lying on the beach, but I can’t imagine those activities being my reason for getting up in the morning.

I can totally see full retirement being an attractive option if you’re burned out, bored, or working in a toxic environment. But if your work still gets you jazzed, and you have flexibility as to how many hours you work (i.e., the discretion to turn down projects), why hang up your spurs? Just spend less time in the saddle.

Thanks!

Yes, why I hang up your spurs indeed. I think people will do also because they no longer see any upside opportunity or the ability to put it into something new and exciting.

Every time I hear, Santa Fe, I think about the TV show, Breaking Bad. And now Chuck’s partner brother at Hamlin.

What a great show!

Sam,

Everyone is, as we know, different.

I retired at 53, now 58. I worked in high-stress banking/technology roles in Asia (think Singapore/Hong Kong). I have NO (as in zero, zip, nada) interest in ever dealing with corporate bullsh*t ever again. I am done with it. I may not be FAT-FIRE, but with ~$4m, and a cash flow of ~$180k/year, I have more than enough to live a great life style based here in Bangkok. In fact I can grow my portfolio! I spend a number of months a year travelling. This year 2 months in Europe, a month in Japan, and a couple months in Australia/NZ. Everyone is different and we all have different situations – in my case my children are grown and now have their own careers.

Personally, I don’t agree with your final points.

1. After a life-time of super stressful work it is SUPER-EASY (for me) to do NOTHING. NOTHING is what I do best!

2. Bear markets come and go. With interest rates at their current level I could just put the $4m in the bank and earn $200k/year with zero capital risk! We (being self-funded retirees) should be the very people that understand markets and not fear the bear.

3. There can be unexpected financial variables of course. But prudent financial management should mean that these are factored in before you FIRE. Right? Did you not stress-test your retirement model to cater for a black-swan or two?

4. Unless you are doing something fundamentally wrong, investments do not loose money long term. We are still investing long term and in a prudent manner, right?

5. Yes, you find new passions to fill the void. Things like travel, exercise, and hobbies. But a new passion, for me, will never include having to put up with the stress and daily discipline required to make further earned income.

6. Bordom and Loneliness. If someone thinks to combat these things they need to start earning income again, I feel sorry for them. I am not bored or lonely after 5 years of retirement! I don’t expect I will ever be bored and lonely just as I don’t expect I will ever bother with working to earn income again.

Anyone not retiring due to one or more of the items #1 – #6, either is not able/ready to retire, because they need to build more capital, or has the “1-more-year” syndrome – if the former plan your “number” – if the later, you need counselling.

Based on the numbers you talk about, I would conclude that in your case you have a very severe case of “1-more-year” syndrome and need counselling. Yep, you have a child to educate. I get that. But you seem to now have an unhealthy obsession with worry and the need to build more wealth, that seems to be bordering on the irrational. The top 1% in the US have a net worth of $10m+ – and I would imagine you are in this bracket. If you are not able to bring up a child, worry free, and earned income free, something is not right. Please accept my apology if this is offensive, but it is an honest view based on my perspective and is a blunt apprasial made in good faith.

In summary, my early retirement started at the (relatively late) age of 53, and it has been dead-easy to stay retired since. And long may it stay this way. Forever I hope!

John.

John,

Congrats for having a great retirement so far with no worries and great adventures. You’re the first person I’ve met to not have any of these issues or doubts about retirement I have mentioned. Do you think you’d be open to writing a guest post about how you were able to achieve your situation? I along with many people would appreciate your wisdom.

I probably do need counseling as it helps with tackling problems and understanding my worries. I’ve found writing to be therapeutic as this platform also brings in different perspectives, such as yours.

I wonder if the age of retirement has something to do with it? You left at 53, 19 years after I did, and 7 years older than I am now. I was already burned out by 34, so I definitely think I’d be reduced to ashes if I grinded in finance until age 53. I could more easily see myself do nothing like you have from 53-58, because by 53, I would have done much more.

To be clear, I’m not looking for something that involves a lot of stress. I’m looking for more community in an exciting new field (e.g. AI) and continued purpose.

Some questions for you!

* Do you not long to spend more time with your adult children and live closer to where they are? I’m curious how some parents simply check out and never keep in touch once their children become adults. I’m not saying you, but I wonder what happens to cause this.

* How do you overcome not feeling productive after working for 30 years? What exactly do you do to stay busy?

* If you have a wife/partner, what does she do? What are her thoughts about your retirement and how do y’all make things work?

* “If you are not able to bring up a child, worry free, and earned income free, something is not right.” What are strategies you deployed to not worry about your child’s health, happiness, and general well-being? I have yet to meet a parent who doesn’t worry about their child is some way, so this insight is particularly important.

Thanks!

Sam

P.S. if you have recommendations for the type of counseling and therapy I could benefit most from, I’m all ears.

Related post: Feeling Down And Out In This Perfect World (Based on your comment, I think you’ll enjoy this post)

Sam,

We are all different and there are many different factors influencing how we feel. I am sure you are right that age plays a part – and that my later FIRE changes my perspective compared to your earlier FIRE.

With regards my children – I have 2 – one made the decision to re-locate for career and life-style reasons. They are now a 4 hour flight apart from each other. My children are grown, have their own partners and own lives now – as they do once grown up. We are still close, even if not always physically so. Maybe this trait runs in the family as most of my working life I was a 12 hour flight away from my parents given I was born in a small country town and my career took me to the world of technology and banking and a world that was physically a long way away from where I grew up. I don’t view myself as checked-out and I am in touch with both my children 4 or 5 times a week on average. But, similiar to my adult years with my parents, we are not physically close that often.

I don’t understand the obsession with being “productive”. I am not “productive” in the way that most people would define “productive”. But I am busy, and importantly happy. If travelling I am out and about every day, typically 12 hours a day, walking and sightseeing. If not travelling, a morning coffee, browsing the internet, followed by the gym, a long walk, catching up with friends and/or a massage and the day is done. It is easy to be busy. This morning I have been busy for an hour writing this!

I have a wife. My second wife actually and not the mother of my 2 children. We have been married 17 years. She is supportive and part of the life decisions we make. We travel together. We often go to the gym together. We walk together. Life is good. My wife is also buddist – there is a lot to learn from that religon about contentment, how to live a happy and carefree life, and to not worry.

On the topic of “worry”, I would not be honest if I claimed I never worry. Of course I do. There was an article I read somewhere (may even have been on this site) whose message was that no matter how much we have and no matter how comfortable we are, the human condition is such that we will always find something to worry about. If I remember correctly, this article claimed survey’s done showed that people living in a war zone worried no more than those in an up-market USA location! Crazy right – but human nature is such that we always seem to worry. So of course I worry. Interestingly though – the points you mention above – health – happiness – and well being, are 3 things that have little to do with money. You will also find that as your children get older and become indepdendent, it is easier to worry even more! Good right – it satisfy’s that human need to worry! For example, one of my children had a relationship break-up. As the parent of an adult child, there was nothing I could directly do, other than be there to provide support. If your child is stressed out at work, for example, what can you do? Not much. They have to make their own way. So you worry. I know when my first marriage ended my mother was beside herself with worry. But money was not going to solve it. As an adult, I had to work through my own issues, take accountability and responsibilty for my own life outcomes, and move on – while my mother looked on and worried. Your children will make life-decisions – partners, careers, money decisions, how they live, where they live etc etc that are their decisions for their lives. And as grown children they become accountable and responsible for the choices they make. As parents we may not agree or like, for whatever reasons, all the choices they make. So we can “happily” worry! But again, none of this is about money. And money cannot directly help with most of these life-issues. As it happens, I have many things I can choose to worry about apart from how much money I have, and whether I need (or should) be building more wealth.

For your case, I understand you will worry about your children, as we all do. I do wonder whether your focus and obsession on money and wealth is because those are 2 things you can do something about and control. As mentioned above, many things we worry about we cannot control, so I think we may tend to then focus on things we can control, even if those things are in good-shape (like having enough money). Let’s not forget – the real important things in life – health – happiness – and well being, cannot be bought with money. Yes, you need some money to afford good health, and to be happy, and to have well being, but past a certain amount (and I am sure you are WELL past this amount) money does not add anything more to these fundamentally important things in life – health, happiness, and well being.

You say I am the first person you know who does not have issues or doubts. That is only partially true. I think we have to be pragmatic and realistic. I think many retire thinking, that “all is done” and now life is going to be an endless utopia. Things are never that simple and maybe as a result many become disillusioned. I accept that retirement is not a utopia – I still have things to worry about (and if I didn’t, it seems that I would find something to worry about anyway). Nothing is 100% risk-free and maybe some black-swan event will wipe out my money (although this could happen regardles as so whether I have $4m or $40m – so why worry?). What, for me, is the key thing, is that everyday I appreciate that I have time to myself, I can do as I please, and I don’t have to deal with office bullsh*t, and proability is very high that I have enough money. 100% worry-free no and an endless utopia, no – but way better than being on the work-treadmill.

Lastly, you mention you are not looking for something with stress, but a way to have continued purpose. If you can find such a thing, great. But in my experience any opportunity to have purpose and be involved (in AI or whatever is of interest to you) invariably comes with resposibilities and expectations – and therefore stress !

This reply may not help much because I don’t claim to have all the answers. And I am certainly not a counseller or a therapist ! :)

John

Thanks for your thoughts John. So I guess you do worry and ponder like the rest of us after all. My streak of not meeting a worry-free retiree continues!

I *think* if my children are going through a difficult time, as a retiree, I’d pay them a visit and have a beer and listen to them. I’d ask first, but I’d want to just hang out and be there for them. Maybe the new Meta VR headset I’ve seen will suffice in the near future, not sure.

You write, “Let’s not forget – the real important things in life – health – happiness – and well being, cannot be bought with money.”

If this is the case, why did you wait until 53 to retire given you hated your job so much? At 34, I no longer enjoy my job either, so I negotiated a severance. I would rather have my health and happiness than more money at that point.

Related: The Health Benefits Of Early Retirement Are Priceless

I waited until I was 53 because, rightly or wrongly, I thought I needed ~$4m to retire (at this age). Earlier I had less and clearly it would have needed to last longer. I was not as good as you at building wealth so it took me until 53 before I was ready/able to FIRE.

And yes, I certainly worry and ponder. I do try to ponder more than worry ! :) I don’t believe you will ever meet a worry-free retiree, because the human condition is such that no matter how good we have it in life, we are conditioned to ALWAYS find SOMETHING to worry about! Sad, but seemingly true.

You are right re children. The nature of my life-styles means if I need to get on a plane unexpectedly, to go and have that beer, then that is what I would do. And it becomes one of those unexpected financial bills ! :)

All the best with your journey. Try to worry and stress less (retired or not). :)

Hi John, I’m glad you have a more empathetic tone after your initial e-mail. You originally came across as a perfect god.

Life is complicated, and I’ve also never met someone who never worries or has problems.

I say be OK with having worries and sharing those worries! We all have them and you may find more peace as a result.

Great post, I call myself semi-retired and have been since 2020, I am open to entering the work force again, but on my terms. I have enough income to support myself. I have no kids, low expenses and plenty of income and like you I sold some stocks in 2021 to reduce my risk profile. Right now I am 50% short term T-bills (3 and 6 month) and 50% stocks split between growth and value. Growth did awesome in 2021 and terrible in 2022, but I learned the value of value stocks in 2022. I always thought why am I buying this stuff if it underperforms growth so much and now I know why. Value is good for defense and growth is good for offense to use a football metaphor. My value stocks were positive in 2022 and I didn’t sell a single share of growth and now they are doing nicely again, especially my big position in Nvidia. It is shocking what the magnificent 7 stocks have done this year. That is a CNBC phrase not mine. Anyway my income in 2022 was awful, but now with the T-bills I am doing awesome. It is like having a pension with the interest payments coming in all time and I use some of the interest to buy more T-bills and more stocks, because why not grow the stack even higher with the interest money.

I am open to a new job, but I really love the finance world and love making money in the market. I just want to do that for myself for a while and not be responsible for anyone else. I think other people sometimes are willing to take sound advice, especially from someone like me. If I told me my net worth I think more people would listen to me, but I try to keep that part secret. I prefer to fly under the radar and keep achieving my financial goals without attracting attention.

Sam,

Great post, and relevant for all of your followers that are early in their retirement.

I would consider myself a traditional (albeit early) retiree in my mid-50s that retired near the end of 2022. I have consulted very sparsely for the past year but am now considering a role as a part-time W-2 employee. While the increased yield on treasuries / money market funds have us earning more no-stress returns greater than my pre-retirement compensation, the potential new role would increase my knowledge and capabilities.

Doing nothing was never really an option….. Doing what one chooses to do is what it is all about.

By the way, I loved “Buy This, Not That”. Working on finding a good way to get my 20 year old to read it!

As always, thank you for all that you do.

Best,

LandS

Congrats on your retirement! And if you can find interesting work that also boosts your knowledge and your bank account, I say why not.

I appreciate you reading and sharing my book. If you don’t mind leaving a review on Amazon, I’d appreciate it! Every review counts.

If your 20-year-old reads it, they’ll be way ahead of the curve!

It’s hard to retire because you don’t realize just how much you have. You have enough to support multiple families. $2,000/month for preschool? That’s more than the median American spends on their mortgage (estimated at $1,672/month). For preschool. That’s even more than most retirees get for their social security! That’s a small part of your discretionary budget.

I like you and I like your content. Just keep it in perspective that you’re not middle class. You’re still worrying about income and net worth because you’re supporting a high class lifestyle. If that’s what you want to do, no judgement, just know that this is a choice you’re making

Got it. I didn’t realize that I didn’t realize my good fortune. I also didn’t realize I tried to come across as middle class. Thank you for pointing these things out. Please continue!

I think you’ll enjoy this post: Spoiled Or Clueless? Try Working A Minimum Wage Job As An Adult

To save money, did you homeschool your children or not send them to daycare instead of sending to preschool? I’d love to learn more about your story and how you were able to cut costs during the first five years of your children’s lives. Thanks

Please accept my apologies Sam. I’m ashamed to admit that I wasn’t in a great headspace during my initial comment. I latched onto that number and made a running dash of bad assumptions from there.

You handled me with grace. Thank you

No worries Ryan. Is there something particular that’s bothering you?

Childcare is expensive. $2,000/month is par for the court for many families who live in bigger cities.

I really appreciate your thoughts and efforts in expressing what might be unknown to others, and, to those who are in it and are experiencing it.

I’ve been through a lot of financial duress like alot of people this year. I’ve fortunately have made enough to retire and it got deferred with this real estate turmoil that we are in. I am fortunate and grateful that for me it’s just means not making that much money this year as I’ve hedge my portfolio against the losses. Perhaps more importantly I realize that I don’t want to retire at the age of 39. I will work toward work/life balance and work a lot less.

A lot less is more similar to an average person working 40 hrs a week. My goal is to work 20-30 hrs from here on out.For me, they’re only so much traveling and eating that you can do before you lose a sense of purpose. I am also going to make it a point to get reacquainted with my family meaning my young nieces and nephew. I will also spend more time with close friends.

No problem. Getting closer to family is always a good thing.

What real estate turmoil are you talking about specifically? The market is soft now and deals are to be had.

But the market will eventually turn around.

I’m a builder and Seattle is experiencing a correction like other market. Just market suppression on pricing and holding cost is accelerating which compresses margin. Essentially I’m breaking even on the project. Each project as you are aware take 2 years+ from dirt to build. Breaking even in development is a major loss with such effort and stress.

If one can buy right now, it really is a buying opportunity with major upside as I believe this is short term.

Got it. Yes, tough to sell now with rates so high. 2+ years of hard work to then sell in this environment is difficult. I hope you hold on!

Hi Sam, I think we’re about the same age and I understand your FIRE dilemma about needing purpose . I too choose to work for purpose, passion and fun and I’m always trying to remember balance it with rest. Just wrote a blog post in saying goodbye to grind culture… as a fellow Asian I think we face a lot of cultural pressures to be productive.

Life sure is a journey and never fails to throw in surprises and changes. And I hear you on the importance of having purpose. The form of that purpose(s) can definitely change over time, and many times for that matter. But having purpose during both our traditional working years and retirement years is a big part of feeling fulfilled at the end of each day.

Whatever you end up doing, I’m sure you will find many ways to keep your life enriched and purposeful. You seem to have an innate gift for that.

The word “retirement” expresses a certain anticipation in all of us, but I think its use in conversation has expired. It’s relevance to this topic or to society in general is gone. Your particular case proves this point.

The word had meaning when the typical worker did 40 years of hard labor and lived long enough to reach pension and social security age. For most of us reading this, we won’t be forced to leave our main occupation due to age nor will we see guaranteed payments like pensions or social security. On the upside, we are now captains of our fate; on the downside, our fate and the ship’s are intertwined.

Instead of the retirement cliff of yesteryear, our financial journeys progress in steps. I think your post from a month ago on the 3 stages of FI is a good illustration of this. Then again, that is just one of many paths. The world is ready for a new expression.

Retirement accounts went down for me. I have balanced accounts of 50%/50% (stocks/bonds) that lost about 9% last year. Home value here has gone up slightly, so I’m pretty much where I started in 2022.

If your net worth is where you started at the beginning of 2022, that’s great! It means you recouped 100% of your 2022 losses.

A great feeling right? I’ve definitely shifted more toward fixed income to capture the risk-free higher interest rates.

One of my favorite posts youve done in a while. I relate to your desire to remain productive. I’ve only been retired just short of 2 years but I feel what you are saying. Its a much bigger void than I expected. Ive been filling my time with projects but that can only go so far and I think that is starting to sink in.

Thanks Wade. Yeah, it’s important to keep busy and productive. I hope you find new things to do that inspire you.

Maybe mentoring, teaching, or coaching? Feels good to help younger folks.

From what I read you are doing what you want when you want. Work is only tough when you find no joy. You are learning new things, enjoying your family, and covering all your bills while accumulating wealth keep it up!!

What do you plan to focus on in your new book?

Thanks for asking. More personal finance! But in a more succinct and focused manner of making your first million net worth.