One thing I have always tried to get better at is anticipating the future. I do this as an investor and try to see what the world might look like five, ten, even twenty years from now. The earlier you can see the curves ahead, the better you can adjust before you crash into a guardrail.

Recently I had a revelation. After being unable to take investment gains (not principal) to pay for a new $50,000+ car after my old car was causing too many problems, I came to a startling conclusion. I might have the same problem when it is time to pay for college with our children’s 529 plans. In other words, even after diligently saving and investing for 18 years for them, I might still fail at spending the money when the time comes.

For those curious, I recommend contributing to a 529 plan. It is a tax-advantaged way to make college more affordable in the future. If you have leftover funds, there is now the option to convert a portion into a Roth IRA. What is not to like?

The real dilemma is figuring out how much to fund each 529 plan. Consider this post a cautionary tale about the predicament overfunding can quietly create.

The Ultimate 529 Plan Funding Challenge

When I think about the largest financial burdens for parents, three categories always come to mind. Housing. Healthcare. Tuition. These three costs often determine a families sense of comfort or stress for decades.

So the logical steps are straightforward. Get neutral real estate by owning your primary home. Work for an employer that provides generous healthcare benefits. Save aggressively for your children’s college expenses.

If you want to eliminate the fear of not being able to afford your child's dream university one day, then aim for this stretch goal. Contribute enough so that the total balance matches the current four year cost of the most expensive private university today. Once you do, your college expense should be essentially set. In most periods, a balanced 529 portfolio has a strong chance of matching or outperforming rising tuition costs.

That is what I've done. In 2017 and 2019, when my two children were born, I super-funded both plans with this philosophy. My parents also contributed every year. And once five years passed after super funding, we started giving the maximum annual gift again.

Reached My 529 Plan Goal

Fast forward eight years. Each 529 plan is now worth over $400,000, equal to the total cost of four years at the most expensive college. The bull market has helped tremendously. But so has delaying gratification in buying things we don't need, like a new car for the past 10 years.

The most expensive private university currently costs about $100,000 a year, all in. Based on the math alone, we should be in good shape. There will be downturns where we lose years of gains. But over the long run, we should be able to cover college fully between 2035 and 2041 through two 529 plans.

By covering our own college costs, this also frees up financial aid dollars for families who truly need help. That feels good.

Managing Expectations For Your Child

Some people believe that contributing enough to match the cost of the most expensive private school is overkill. Perhaps.

Based on my observations, life is only going to get more competitive due to AI and globalization. What a tragedy it would be if your child worked incredibly hard to get into their dream school, only to realize they cannot attend because you are short on money.

Given young children have almost no ability to earn, save, or invest for themselves, parents must do the heavy lifting. And as a parent, you cannot expect your child to win grants or scholarships. You cannot expect your child to be a prodigy in an instrument or a sport. You cannot rely on the trends of college admissions aligning with your family’s background at the time.

The only things you can control are saving aggressively, educating our children with practical skills, and preparing for the worst.

If your child does receive merit aid or attends a school far cheaper than expected, leftover 529 funds can be passed down to a sibling or even a future grandchild. In fact, using a 529 for a grandchild is one of the most impactful gifts you can give. It reduces their financial stress decades before they are even born.

Your 529 plan contributions don’t just disappear if you overfund and don’t want to change the beneficiary or roll the money into a Roth IRA. If you want the money back through a non-qualified distribution, you simply pay ordinary income tax on the earnings plus a 10% federal penalty on the earnings. Your original contributions come back to you tax-free since you already paid tax on them.

You Might Not Actually Be Able To Spend The Money

Here is where things get interesting. After being unable to use investment gains to pay for a new car after my 10-year old one started causing problems, I realized something deeper is going on. Even when we have the money, it is emotionally difficult to spend it. I fear I will freeze up when it is time to spend the 529 money, even though that is the whole purpose.

College tuition today already feels usurious. With modern technology, why does it still take four years to earn a degree We have unlimited access to information online. We can take entire courses for free from the best professors in the world. Yet tuition is rising at twice the pace of inflation. How does that make sense? We should be able to earn a college degree in three years at most, saving us 25% in the process.

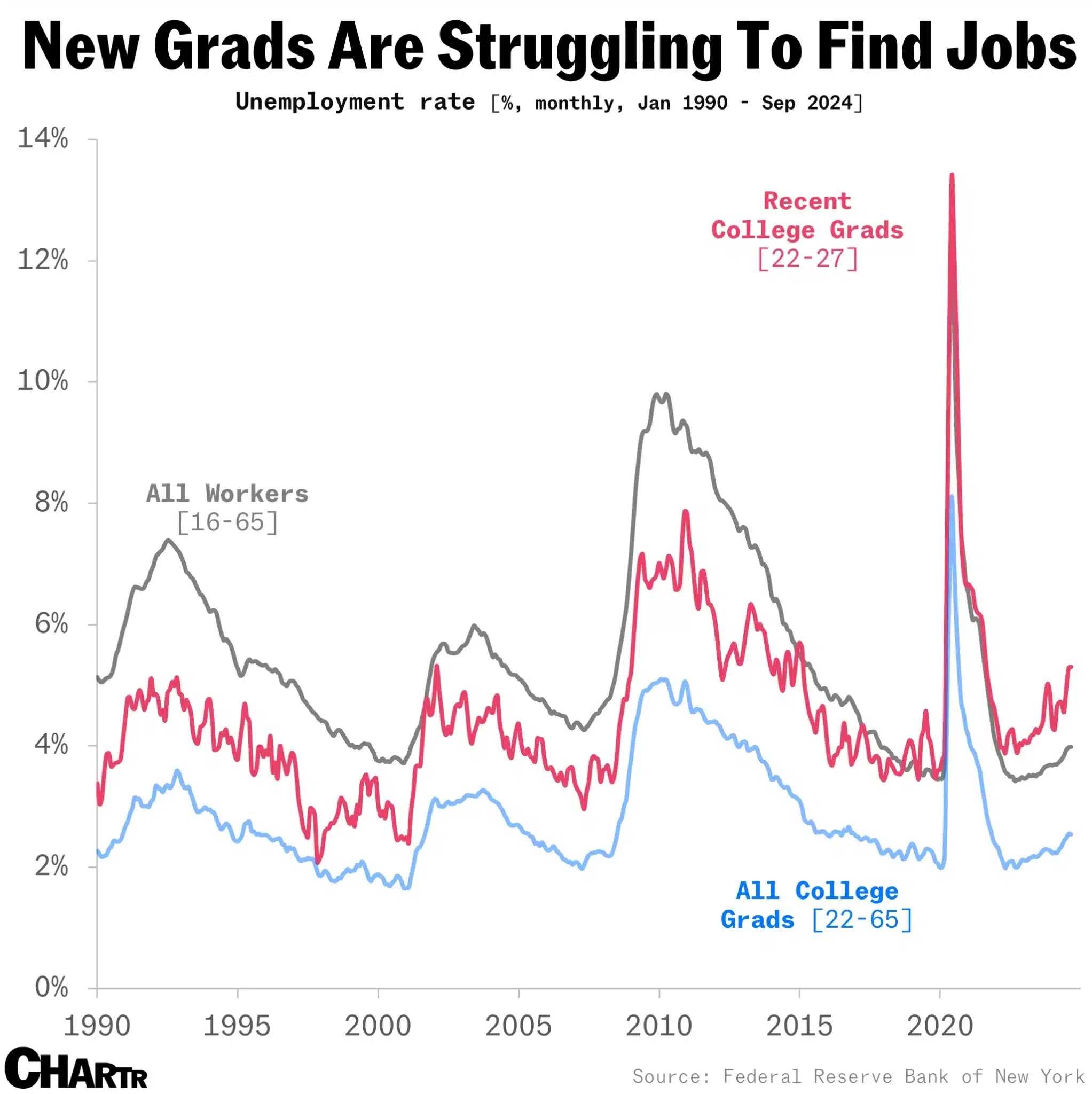

Meanwhile, AI is eliminating millions of entry level jobs. If your kid graduates with a degree that does not align with the future labor market, he might return home just like many of the adult children I have seen in San Francisco.

Over the past 25 years, every neighborhood I have lived in has at least one or two adult children who moved back in because they could not find a job that paid enough. They then end up staying with their parents for 5-15 years.

I am not arrogant enough to think my kids will magically escape this trend. The investor side in me would feel stupid to have paid so much for college only to have this result. Although, the father in me would love to have my children come home because I will have missed them dearly.

A College Decision Thought Experiment

Let us imagine a scenario. Your child gets accepted early decision to a private university ranked in the top 50. You are proud. Your spouse cries tears of joy. You feel validated as a parent after 18 years.

Then the offer letter arrives. No need based aid because your household income is slightly too high. Yet you do not feel wealthy. You live in an expensive city, work hard, and pay taxes out the nose. Your expenses grow every year. You might feel like you're scraping by despite making multiple six-figures a year.

Let us say the school is Boston University. Your household makes $350,000 a year in Boston. You save diligently and drive a modest car. You work 50 hours a week and constantly travel to see clients. Your mortgage is high. Groceries cost a fortune. The total cost of attendance is about $95,000 a year after tax. Thankfully, you have a 529 plan worth $400,000.

Are you truly going to feel comfortable spending almost $100,000 a year for four years if your child can attend U Mass Amherst for $38,000 a year, all in?

I doubt it.

You have talked to dozens of parents whose kids graduated from Boston College, Boston University, Northeastern, Brandeis, Babson, Bentley, Wellesley, and other private schools in the region. 75% of their kids are underemployed. Most are not working in the fields they studied. Some are living at home.

To spend over $400,000 for a degree only to graduate into an AI ravaged labor market feels reckless.

You still believe in college. You still believe in the experience and the friendships and the growth. But you do not believe in a $400,000 gamble when a $160,000 alternative exists.

So you send your kid to U Mass Amherst despite their protest. You keep $240,000 in the 529 plan. You slowly roll the rest into a Roth IRA for your child to use in adulthood. They graduate debt free. They are not suffocated by expectations. And they have money to start their life.

That feels like a much better trade for those who do not receive any free aid.

Fixing My Car Was My Own Public School Decision

When I finally repaired my 2015 Range Rover Sport for $1,900 instead of buying a new vehicle for $50,000+, it reminded me of choosing a public university instead of a private one.

If I decided to YOLO and buy the latest Range Rover Sport for $115,000 out the door, that would be the private university without free financial aid decision. One decision is about desire. The other is about long term pragmatism.

In my WSJ bestseller, Buy This Not That, I suggest parents earn at least seven times the annual net tuition cost if they want clarity on what is affordable. In ten years, the most expensive private university tuition will likely be $150,000. Without free aid, private school effectively becomes a luxury good – one that starts to make sense only once your household income clears about $1.05 million a year. Earning seven figures is highly unlikely for dual unemployed parents like us.

Back in the day, my parents paid $2,800 a year in tuition for me to attend William and Mary while my private school friends were paying $20,000. At the time, my dad even said William & Mary felt like a great deal. I turned out fine. So yes, I am biased toward the lower cost option for my children.

If the 529 plan becomes increasingly flexible, the temptation to save money and use it for more practical things will only grow stronger.

When I Would Actually Spend The Full 529 Plan

After running through this thought exercise, I realized there are only two situations where I would feel comfortable spending the most of the 529 plan on an expensive private school with no aid.

First, if the 529 plan grows to at least twice the amount needed for the full four year cost of the school. For example, if the 529 plan grows to $1 million and the total cost of college is $500,000. Then not spending half of the 529 plan on its intended purpose would feel silly.

Second, if my passive income grows to at least twice our desired household living expenses. With that much excess money without having to do much, then splurging on an expensive degree is more digestible. Because in this scenario, I would be able to pay for the cost of college through passive income.

These are the only two variables that would allow me to accept what is likely a low financial return. A larger net worth would be nice, but net worth is mostly illiquid. What truly matters is income and cash flow.

Ideally, I want my kids to have some skin in the game. They should feel the weight of their decisions by paying for some of their college expenses.

When I was young, I knew my parents were not wealthy. We lived in a regular townhouse and drove an 8-year-old Toyota Camry. As a result, I chose a public school. I knew that if I graduated jobless, I could work at McDonald's and pay them back.

So what do you think? After years of saving and sacrificing to fund your children's 529 plans, will you actually be able to spend the money on an expensive private university, despite the declining ROI? Or will you find ways to optimize, save, and make the dollars last longer even if you can afford the fancy option?

Plan For College The Right Way

One tool I’ve leaned on since leaving my day job in 2012 is Empower’s free financial dashboard. It remains a core part of my routine for tracking net worth, investment performance, and cash flow. Now I'm using the tool to help plan for paying for two college tuitions.

If you haven’t reviewed your investments in the last 6–12 months, now’s the perfect time. You can run a DIY checkup or get a complimentary financial review through Empower. Either way, you’ll likely uncover useful insights about your allocation, risk exposure, and investing habits that can lead to stronger long-term results.

Stay proactive. A little optimization today can create far greater financial freedom tomorrow.

Empower is a long-time affiliate partner of Financial Samurai. I've used their free tools since 2012 to help track my finances. Click here to learn more.

For more nuanced personal finance content, join 60,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

Sam, maybe I missed it, but did you mention the $35k of excess 529 money that can be rolled in to your kid’s IRA?

Yes, you can roll over a lifetime maximum of $35,000 of unused 529 plan funds to a Roth IRA for the beneficiary, tax and penalty-free, under SECURE 2.0 Act rules. The 529 account must be open for at least 15 years, and the transfer must follow annual Roth IRA contribution limits (e.g., $7,000–$8,000+ depending on year/age).

The problem I have now is that my 8 1/2 year-old son‘s 529 plan is worth about $500,000. So the market keeps going over the next 10 years at historical returns, I will have significantly overfunded. Not the end of the world, but not great optimization, especially as schools like Yale are offering 100% free tuition for families that earn under $200,000. My kids won’t get it to schools like yeah, but it’s likely other private universities will increase their free financial aid to remain competitive.

This is what worked fantastic for us!…If you have to choose, pay off the mortgage first with the goal to pay the mortgage completely off one year before the first kid starts college. Then roll the mortgage payments into college payments. No loans required. No timing the market hoping that there isn’t a downturn in stocks before or just as the kids enter college. No government involvement. And a bonus; the government review for scholarships will count against the student the 529 money but not the primary home paid off. If the kid goes another route…still bonus..the house is paid off so you have flexibility (money) to help set your child up with any venture they start out with. Including investing in a business.

It’s a great plan and goal. I hope everybody achieves this.

I have a slightly different recommendation where I recommend parents buy a rental property when their child is born. After 18 years, they can probably pay off the mortgage and generate income to help pay for college tuition.

Regarding your desire to buy a new car, all of the financial advice that I see for building wealth urges everyone to buy a used car. What are your thoughts about that, and how do you feel it relates to your situation. Very interested in your thoughts.

Why aren’t we talking more about trade schools? There’s a massive demand for skilled trades now and in the future as boomers retire. Starting salaries outpace most bachelor degrees, and kids are able to graduate with real marketable skills that are more AI proof than the skills taught in traditional universities. Overall, with the advancement of AI and tech, I don’t see college tuition continually rising. I see the opposite happening. Parents and students are already waking up to the reality of the mediocre ROI of a fancy degree from

a private university.

Definitely a great option. I’ve been trying to slowly teach my kids about building, plumbing, and electrical whenever there is a remodel or problem that needs fixing at a rental property.

But if kids are interested in being auto mechanics, plumbers, electricians, and builders, then it’s hard to force these occupations on them. So, the conservative route is to prepare for the worst, e.g. $100,000 a year for private university to study the history of basket weaving and hope for the best.

Are your children in trade school? If so, how has the experience been and how much does it cost?

This is not theoretical for me. I have one child applying for colleges right now and another next year. I stopped contributing to 529s several years ago when I forecasted 529 growth vs college expense. Each kid’s 529 plans broke the $500K mark this year. Currently the most expensive private colleges cost a little under $100K per year. Even with more than enough saved, I am reluctant to blow it all on 4 years of college. I told my oldest, I’m only guaranteeing a full ride for a top 10 school (I don’t really expect an acceptance from one nor is my kid applying to that many); otherwise, I’ll guarantee a full ride to almost the best public college that makes an offer (likely $40K per year). If it’s not a top 10 private school, I’m paying somewhere between $40K and $100K per year; I can lend them the rest.

I want my kids to understand that $400K is an INCREDIBLE sum of money. There had better be an ROI on this investment. But unfortunately, a big factor in college selection is the “vibe” or “I have a cool friend that goes there”. Putting some financial pressure on the kid is a kind of reality check. Also, I want the kids to have some money left over for grad school.

Of course, if the kids end up underspending their 529 money, I’ll have another problem of where to use the remaining funds. Maybe 529s for grandkids if they produce any. What a gift that would be for them to not have to save for their kids’ educations!

Good luck! Let me know where they end up. I am seriously fascinated by this decision process.

Will a parent really not be willing to pay for a private college if they have saved up the 529 plan money and the college is highly ranked? I am thinking that at the end of the day, parents are going to end up paying up in this scenario. Let me know!

And if you can fund your grandkids’ college education, which could be 30 years down the road with leftover 529 plan money, that would be huge! Investing for a purpose is what it’s all about.

What a great read this Sunday AM. As a parent of two youngsters (8 and 6), and one that has been actively contributing to 529’s for each since birth, this post hits home and resonates hard.

Current balances are $210,000 and $170,000, respectively, invested in Target Date fidelity funds (I know, I know).

As alluded to in your article, I am struggling with the idea of continuing to invest (and having family invest) in these 529 accounts moving forward – averaging about $20k each in contributions per year – or putting this savings elsewhere for them where it isn’t tied to higher Ed.

My kids aren’t going Ivy League and very likely not even Private. We’ve already achieved the current average all-in cost for Public universities and nearing that of Private.

Should we start diverting these funds elsewhere?

I would suggest diverting the funds into custodial investment accounts for them, and then Roth IRA’s once they make earned income. Good to diversify!

$200,000 in each 529 plan is great for six and eight. Model it out. It could be worth $500,000 each by the time your kids go to college.

Sam – Merry Christmas to you and your family. I enjoy your articles as a nice blend of financial education, perspective, and life!

Perspective: I have diligently saved for both my daughter’s college. I sent my oldest to college in the fall and I actually had great pride writing that first check. I believe you’ll find the same experience as a parent.

Best of luck in ‘26!

Using expected attendance costs at your state’s flagship public university strikes me as a much more practical (and sensible) strategy to fund a 529 Plan than expected costs at some “dream college.” The very concept of a “dream college” – usually based on the flimsiest of reasons like the weight of the paper used in their marketing brochures – has led a lot of parents to ruin. We all want the best for our kids. teaching them value should top the list.

There may have been a time when one could credibly trace a linear relationship between the “prestige” of a university and its marketplace value but those days are receding quickly. I think we all know successful folks who attended solid but unspectacular universities and Yale graduates who are making lattes. When the gap in price was relatively modest, choosing “prestige” probably was worth the candle. With today’s disparities in price tag, the burden of proof is on the Harvards and Yales to prove their superior value. After 30 years spent greasing the wheels of finance in corporate America, I ain’t seeing it.

My strategy today (after making some mistakes): you get free 4 years at UC or equivalent. After that, you are on your own.

The thing is, it’s impossible to get into the UC’s today. You could spend 20 years paying property taxes, and your kids will still not be able to get into UCLA, Berkeley, and San Diego. But maybe UC Davis, with a 40% acceptance rate.

So if you can’t get into a UC today, thing about how much hard it is to get into in 12 years. The likely alternative is community college maybe schools like Chico State or San Jose State, or a tier or two or tier 3 private college.

So the act of saving and investing money for your child’s college education is really just a hedge so that they can have more options.

As someone who sent one their kids away from OOS to UCSD, we agree the UC’s are amazing!

UC Riverside and UC Merced emailed a free application voucher after the November 30 deadline. Although my kid isn’t seriously considering them, they are financially viable options. It’s just a matter of whether you think they are up to your standards, or would your rather pay up to $100K for out of state private each year.

It’s hard to accept how expensive college is today especially compared to what I paid in-state as a student. But education is one thing I am able to splurge on within reason because I value it so much. 529 savings plans are so important to being able to plan and afford for college with these huge price tags. Your kids are very fortunate that you’ve done so much prep work and investing for them.

We saved diligently for all 5 of our kids’ college education from their first year of eligibility through 18 years old; even when it was a struggle to come up with the funds. We went the Coverdell ESA route which is limited to $2,000 a year. So far, 3 of our adult kids have tapped the funds. The eldest graduated 2 years ago from a public university Summa Cum Laude. The two younger sons graduated from a commercial dive welding school in Florida. The eldest headed to Korea next month to take a teaching position. The two younger sons are working as machinists as they decided commercial diving wasn’t for for them. That’s ok though, I think it’s important to figure out what inspires you. None of them have a dime of student loan debt. Everything was covered by their college funds. Our two youngest daughters are still in high school, but we still have about $200K left in the funds that can be transferred to them if needed. Plus, I just heard about the ability to convert funds to a Roth IRA before age 30, so that’s a bonus. By the way, we home educated all of our kids K-12. Our eldest attended a local junior college in which he earned a high school diploma and a 2-year transfer degree to a state university. He also lived in Costa Rica for a month and attended an intensive language school. Total cost for two years of college, including the month in Costa Rica? $7,500. I recommend thinking outside the box these days when it comes to higher education. The traditional 4 year university degree ROI is no longer there. As someone once said, “College education is a scam”. (Which DOES NOT mean that education itself is a scam).

Thanks for sharing! Homeschooling is great. You can learn so much more, and more efficiently.

What is your Summa Cum Laude public university kid doing for work now?

I think the issue with a lot of parents, especially in big cities, is that they want their kids to go to a top 25-50 university so they can get careers in tech, management consulting, banking, law, or medicine. So the pressure is on for their kids.

Did your kids aspire to work in any of these fields, or did you aspire to have them work in these fields?

I’m trying to figure out whether it’s worth saving lots of money on college and be OK with reducing their chances of getting into these fields. I guess I should hopefully have an idea by age 15-16 what fields of profession they will be interested in, to make a more informed decision.

Parents who are not aggressively saving for their kids’ college education are putting them at a real disadvantage. Assuming scholarships will magically appear or that the government will step in with free money is wishful thinking. Yet, the expectation of government support and bailouts has only increased over time.

Another uncomfortable truth is that families who can pay full tuition often have an easier time gaining admission, much like international students. Colleges may say finances do not matter, but in practice, they do. Anyone paying attention to the state of higher education knows it is a business competing for revenue. Students whose families can pay full tuition and later donate clearly have an edge over those who cannot.

Don’t be fooled.

Set a budget. Period. “We will pay X amount which can cover 4 years…or if you choose a bougie / private school, it will cover a semester and it will change your quality of life post graduation.” Although getting loans in their name vs parents name will be an issue. Had this discussion when our kids entered HS.

We told our 4 kids we’d pay in state, public colleges, which is still expensive by overall US standards (30-40+k year). Fortunately, we live in Virginia where there are plenty of solid academic options. It’s gotten more competitive for the top schools – UVA, VT, W&M, etc – so if they can’t get in there, they’ll take out loans for the difference for an out of state school and can live at home/work after college after they’re paid off. So far, 3/4 of our kids are in state; 4th is still in HS but it targeting VA schools too.

Also telling our kids not to be too hyper picky in their first job search (i.e. if they major in CS, maybe try to open the field to CS and business or something to get their foot in the door – prove themselves and hopefully opportunities will open up.)

Cool, which universities did the 3 out of 4 go to? I went to W&M in state as I graduated from McLean High School. I really enjoyed my time at W&M.

Unfortunately, it’s impossible to get into any of the University of California schools nowadays, including Cal Poly.

1 at UVA, 2 at VT. Loved W&M (for me – ha!) but my kids want a big, football school.

I hear you about the UC schools. Maybe the demographic cliff will work in your favor by the time your kids apply – or you could move back to VA ;)

So good to see you taking advantage of in-state tuition! I do wonder what happens in households when some kids chose to forsake attending a highly-ranked state school to pay way more for a lower-ranked private or public university. Like…. what’s going on here? Too much money to burn?

W&M was still a 2-hour drive away from Northern Virginia, so it wasn’t like I couldn’t feel like I was getting away.

Would’t that be funny if I moved back to Virginia and my kids got rejected from all the in state schools, but got accepted into a good UC school? Everything is a crap shoot!

But as I type to you from Honolulu right now, there is no way I’m moving back to the East Coast! 10 years was enough for me. Too cold.

Sam – curious are you going to move on to a different financial dashboard than Empower? I also been a loyal 10+ year Personal Capital user but seems like product quality, account refresh frequency and customer service has all gone down since the acquisition. Wondering if there are other tools you are trying and considering endorsing?

Neal

Biggest question: What car did you end up buying?

Check this section:

Fixing My Car Was My Own Public School Decision

When I finally repaired my 2015 Range Rover Sport for $1,900 instead of buying a new vehicle for $50,000+, it reminded me of choosing a public university instead of a private one.

If I decided to YOLO and buy the latest Range Rover Sport for $115,000 out the door, that would be the private university without free financial aid decision. One decision is about desire. The other is about long term pragmatism.

A good article, you mentioned that 75% of the parents you talked to mentioned that the kids are underemployed or unemployed, are there any official statistics on this based on school (I would think this is hard to come by)

Yes there are official statistics. I’ll share them when I get back from the beach and nap.

Here is some info: https://www.stlouisfed.org/open-vault/2025/aug/jobs-degrees-underemployed-college-graduates-have

I agree you overfunded 529’s. Better to fund those at a “barely enough for public school” level, convert the allowed 35k to roth, and then transfer beneficiary to grandchildren, nieces/nephews, etc for any remainder. I think UTMA is better for anything over that basic amount, yes, it is less tax efficient, but you shouldn’t be trading in it anyway, and it’s liquid, use for whatever the child needs, house down payment, college expenses, beginning of their retirement fund, and theirs entirely at maturity. What if your children choose not even to go to college, trade school or nothing is just going to leave unreasonable amounts inaccessible without punitive fees, sitting in that 529. It’s all well to save it for another generation but i think it should be kept to basic levels to avoid this restriction. I also agree take the public university option, plenty of solid choices among these, as much as any college is now with exorbitant prices and poor quality education all around – the ivy schools will simply indoctrinate your children against you, with no better education or job prospects other than a select few with name recognition nepotism offers, at obscene cost that would be much better used anywhere else. Paying more than useful for something just because you can is a little cringe.

Thanks. I’ve been saving and investing in their custodial investment accounts as well. But the amounts are smaller.

I’ve never heard of saving for your children’s college for the worst case scenario as “cringe.” Maybe it’s a cultural difference or generational thing now that I’m old? Can you explain further?

How are you saving for your kids college? And are you not worried about the situation where they actually get into a target school, but cannot afford to attend?

I think it’s a mistake to expect the government or the college to provide for your financial aid or our children to be talented enough to get it.

I think you didn’t understand what i was trying to say. I don’t think the elite private universities offer an education worth what they cost. I would not want to pay for them, even if i could afford to. the cringe, to me, is paying for an elite school just so they could say they went there, without any actual other value besides the “name brand” label stuck on. it’s wasteful. if that school meant “everything” to my kids and they fervently wanted to go – then fine, but not if i could convince them to use their money elsewhere.

our kids college is/was funded entirely through UTMAs. they would have had enough for most situations, and we could’ve helped close any gap by funding live-time from our salaries if necessary, to go to any school they wanted – so, no, that wasn’t a concern. we weren’t counting on scholarships, nor government assistance. they had enough saved after growth, by the time they went to college. at the time we were deciding, 529s just weren’t worth the hassle and limitations to us, the new Roth rollover makes them more reasonable to me for a portion of money intended for the kids, still i would personally not want to put more than about 100k (intended value at age 18) into 529, and any more into UTMA, and now the trump accounts are looking interesting as well. since they went to state university – they had plenty leftover, and the remaining money is theirs, no strings attached as they would have had in a 529. now they can let it grow for retirement, use it for house down payment, whatever.

We did stop declaring the kids as dependents so they could use the UTMA at their own tax bracket rather than ours, when they went to college.

I am simply saying i feel 529s are a poor vehicle for large amounts of savings intended for your children, since they have a lot of restrictions and penalties, and bureaucracy (i don’t want to save receipts and turn them in to prove college expenses, ugh). We preferred UTMA and are probably going to contribute mostly to this and to trump accounts for our grandchildren now.

my point is – what if one of your children decides to go to trade school, for 50k total, or starts a business from their garage instead of university at all, and you have 400k in that 529 now, 800k by the time they’re 18…and neither you nor they can reach ANY of it, without paying income tax plus an additional 10% penalty. you decide to wait and change beneficiary to fund grandkids, but now another 20 years later it has 3.2M and your grandkids may or may not go to university…whew…that’s a lot tied up behind extra taxes and limitations.

the kids can use UTMA (now their own normal taxable brokerage account) at lower capitals gains rate in their lower earning younger adult years, to reset the basis or pay for things they need. and there are no restrictions.

Got it. Thanks for sharing what you did and your philosophy. To address some of your points:

* I’m building their UTMA accounts as well by gifting and investing the max gift tax each year for 18 years at least.

* if they go to Trade school for $50,000, I would actually be quite pleased for all of us to be able to save hundreds of thousands of dollars from the 529 plan. I will just reassign the Beneficiaries to other family members, especially if I live long enough where I have grandchildren. I just see the 5 to 9 plan as another way to invest money for the future. 985% of the time I don’t touch my Investments anyway.

* having $800,000 in a 529 plan when my kids turn 18 wouldn’t be the worst thing in the world. I view it as an insurance policy just in case they do have a chance of getting into a top school where no financial aid is offered. Something to consider is also the 529 plan’s balance as a percentage of total net worth or total investments. If it’s more than 20%, then it might be a problem. On the other hand, if it’s less than 10%, then I think it’s OK. We should really think about percentages a little more than absolute dollar amounts.

I am a proud graduate of the College of William and Mary, a public university. I am a believer in public universities as well. But as a parent, it’s always nice to have the optional to provide something more for their children.

Did your children apply and have the option to attend a top 25 private university? I never had the option bc I felt my parents and I didn’t have the capacity to afford $20,000 in tuition at the time. So I just applied mainly to public schools.

In the end, I don’t think they applied anywhere other than where they went – they’d decided they agreed with us that it was the best deal, and weren’t much worried about needing backup options (if i recall they all did early acceptance option so they would know if they had to keep looking before other deadlines). one was a national merit scholar, the other two close, all top of their class at a good early college high school…so i think they would have a reasonable shot of acceptance if they had wanted.

Cool. What is it that they do after college?

Ultimately, finding a job in the field they studied in or a job they enjoy that can pay the bills is the ultimate goal.

Merry Christmas :). we just heard one is moving from a cool AI startup to a bigger fancier AI venture, he is 22. one is in paid internship during college, so that’s looking good. and the other is low key looking for an opportunity in his desired field still (the job market is absolutely terrible – the success of my other two in starting careers so far just goes to show that public university didn’t hurt them!) – while supporting his wife finishing school (and tied to that location), and not worrying because of his UTMA.

Any concerns about your kids having unrestricted access to a large sum of money in their UTMA account at ~21 years old? I know we are all trying to raise great humans, but unrestricted access to big money at that age can also be ruinous. I’m very comfortable with having a well-funded 529 plan that I control, but I can’t get comfortable with generously funding a UTMA for my kids right now.

Great point!

Hopefully, after 18 years of guidance, education, and doing manual labor with the kids, adult children won’t YOLO too hard on their funds once they have access.

We need to drum it in their heads that the funds are for a housing downpayment, relocation for work, and a safe economical car.

I repeatedly tell them(aka brainwash) to let this money compound and try to teach them financial literacy. that’s all I can do.

My goal was to fund one private education and one public education (~$650K) as way to hedge our bets (we have two kids). We way overshot that goal due to the bull market despite not contributing any money for years. I do not have any preconceived biases against Ivy schools (indoctrinating my children against me), but I’m not jumping at the opportunity to pay for them either. My hope is that my kids attend a top public school vs a top private school. However, should any make it into a top 10 school and they truly want to attend, I’ll pay for it. We certainly have enough money. BTW, I’ve been a public school kid my entire life from from K to MBA but I do see the value in certain private schools as it relates to job opportunities, friendships, business connections, marriage prospects, etc. Whether a kid makes the most of those opportunities is questionable.

One kid is applying right now. We did not early decision anywhere because I did not want to commit to paying a private education. We are waiting to hear back from the public schools. However, friends with less accomplished kids have already ED’d into some very good schools because the ED acceptance rates can be 3x as high as regular decision. We had the wealth to ED, but I was too cheap to spend it. We are rolling the dice.

I stopped saving shy of $400k for my oldest, and I will feel comfortable spending it on their education, wherever they want to go. The amount I’ve saved for my kids is probably disproportional to my overall income and other savings. Most people in my income and net worth bracket probably have less saved in 529 plans for each of their kids. However, my parents fully funded my undergraduate and law degrees, and the only thing they asked in return was that I pay it forward, so that is what I’ve done, and my siblings have done the same thing. If my kid wants to go to Babson only to end up as a ski patroller and rafting guide in the summer, I still believe it is money well spent. Education is a gift. My kids have taken online classes for school credit to make their sports training work, and the quality of education is not the same as that of an in-person class with a great teacher and peer group. I don’t think AI or remote learning can replace a college education with a good learning environment, peer group, and great educators teaching in person. It is about more than just job prospects.

Yes! I have two kids in college and we saved just enough to send them to two excellent private colleges. I am so grateful that we invested consistently for twenty years because our adult children have made the most of their educational opportunities. I’m not focused on ROI. My preference is to focus on them as human beings.

Congrats! And good on you for being able to turn off the investor ROI switch when the time came. I’m anticipating that I cannot as easily.

Did their private colleges pay off? What do your kids do now and how difficult was it to find a job out of college?

Thanks

Experience similar results where kids and family spend absurd amounts of money on a college degree to only be underemployed and or unemployed.

The world is changing too fast to think an expensive education will position the kids fast. I do not believe a 529. Plan is the answer today unless it evolves immensely becomes cheaper and more flexible. Otherwise I’ll put my money elsewhere.

But if you are going to save for college, why not save in a tax-advantaged account where there are no gains on capital gains if the funds are used for qualified expenses? That seems like a no brainer. Where is the better elsewhere vehicle to save at?

The tricky challenge is figuring out how much to fund the 529 plan. I just decided to shoot for the current max cost of a 4-year most expensive university and then let it ride.