If you are a retiree, what do you fear most today? It looks like retirees fear inflation the most, which is kind of sad. As a mega consumer society, we should consider stop buying things we don't need.

On the playground the other day, I spoke to a dad who works at his brother's wood display company (mostly sports memorabilia frames).

Before the pandemic, he said the cost to ship one container of goods from Asia was $3,000. Today, it costs them $20,000! Each container could fit around 1,000 frames.

To preserve margins, they raised prices by 20%. But demand is still rocking, up 3X because their customers have fewer ways to spend money.

What Retirees Fear The Most

Personal Capital, the free tool I use to track my net worth, partnered with Kiplinger to survey the biggest concerns for retirees today. They are:

- Rising inflation (77%)

- Cost of health care (74%)

- Financial strength of Social Security (71%)

- Financial strength of Medicare (67%)

- A recession in the next year or two (62%)

As someone who has to pay about $2,300 a month in unsubsidized healthcare premiums for my family of four, I was surprised with rising inflation being the #1 concern.

The media is now silly talking about how supply chain bottle necks are a war on Christmas. But every time I hear these concerns, I think to myself, How about we just stop buying unnecessary things?

Cardboard boxes to hide in and build fortresses with is still pretty fun. I hope that doesn't make me a bad dad.

I don't fear inflation the most at all because I can just stop buying things I don't need. Whereas with healthcare expenses, I need to keep paying for healthcare insurance and medicines since we don't know for sure what will happen to our bodies.

Social Security Surprise COLA Adjustment

The financial strength of Social Security should be a concern for Americans given it is underfunded by 22%. However, the Social Security Administration raised the cost-of-living adjustment by an astounding 5.9% in 2022!

Therefore, retirees on a fixed income shouldn't be so concerned about inflation, especially since their investments are also surging higher. So far, no reader has agreed with my take that a 5.9% COLA adjustment, when the system is underfunded, is like taking from the poor to give to the rich.

This makes me think that the need for Stealth Wealth, despite a massive K-shaped recovery may be overplayed. I wiill write a new post on this subject. If you're rich, you may no longer have to pretend you are middle class.

Have a $20+ million net worth in the year 2030? Enjoy your $110,000 annual Social Security check with impressive COLA!

As a retiree, you shouldn't fear rising inflation the most if Social Security payments are also inflating massively.

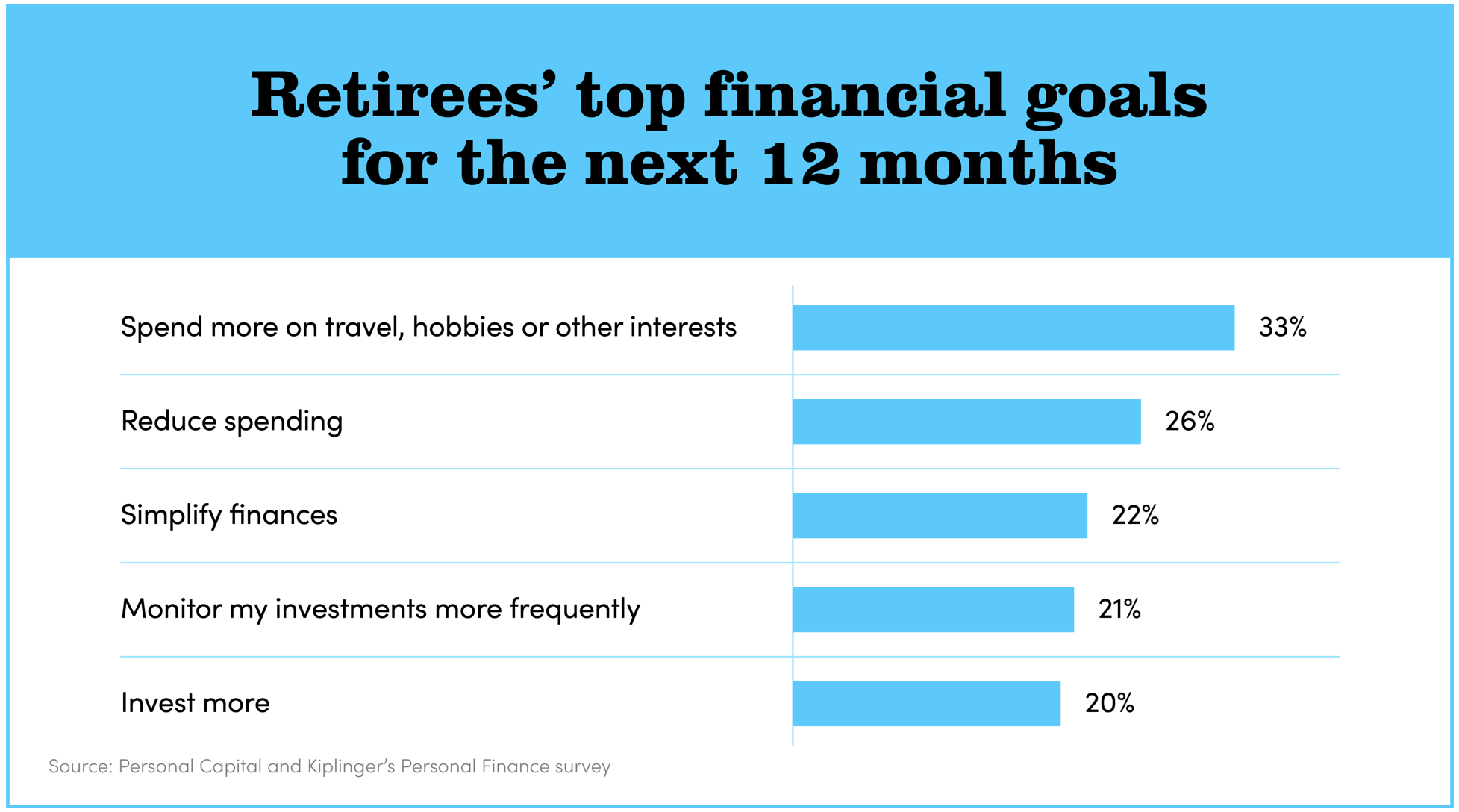

Retirees' Top Financial Goals For The Next 12 Months

Below is a great chart from the same survey that shows the top goals for retirees over the next 12 months. Personally, I plan to spend a lot more money thanks to large investment gains.

Grinding Higher With Strong Earnings

Six of the nation’s biggest lenders — JPMorgan Chase, Bank of America, Wells Fargo, Citigroup, Goldman Sachs and Morgan Stanley — beat quarterly earnings expectations for 3Q 2021.

The C-level executives who spoke after reporting all painted optimistic pictures about consumer spending and business investments. We should have no reason to doubt them. Banks have its tentacles in every aspect of the economy.

Once we get through a historically volatile October, I think we're going to end the year higher than where we are today. Consumers are cashed up and the amount of liquidity in the system remains high.

A couple positive anecdotes:

1) Coinbase said they had 1 million on its waiting list to invest in NFTs after the first day.

2) My poker friend who raises money for firms on Angellist wrote, “The syndicate side of AL is absolutely on fire right now. I just raised $1.3M for two deals in a matter of days. That is about 3-4x what I expected given the deal profiles. I have run ~100 syndicates over six years, this feels like an inflection.”

Now check your own balance sheet. I have a feeling it has strengthened over the past couple of years. As a retiree, you should be loving this bull market!

This bull market is what I want to re-retire. Why bother working when your investment gains are greater than your active income gains?

Real Estate Forecasts

Over the past two weeks, I have noticed a slowdown in the housing market here in San Francisco due to a surge in new listings and overly-aggressive asking prices. I'm seeing similar reports around the country.

Zillow, the company that has done little to lower selling costs for consumers, forecasts an aggressive 11.7% appreciation in home values for 2022. But I would take its forecast with some skepticism.

When the pandemic began, Zillow forecasted a 2-3% decline in home values in 2020. Whereas your boy here predicted a 8%-10% increase in 2020 after writing How Real Estate Prices Get Impacted By A Decline In Stock Prices.

I'm still formulating my forecasts for 2022. But I'm probably going to take the under on an 11.7% price appreciation in real estate. It's hard to see retirees fear rising inflation the most when their stocks and real estate are inflating even faster.

Just look at this chart below showing how much wealth the Baby Boomers have garnered.

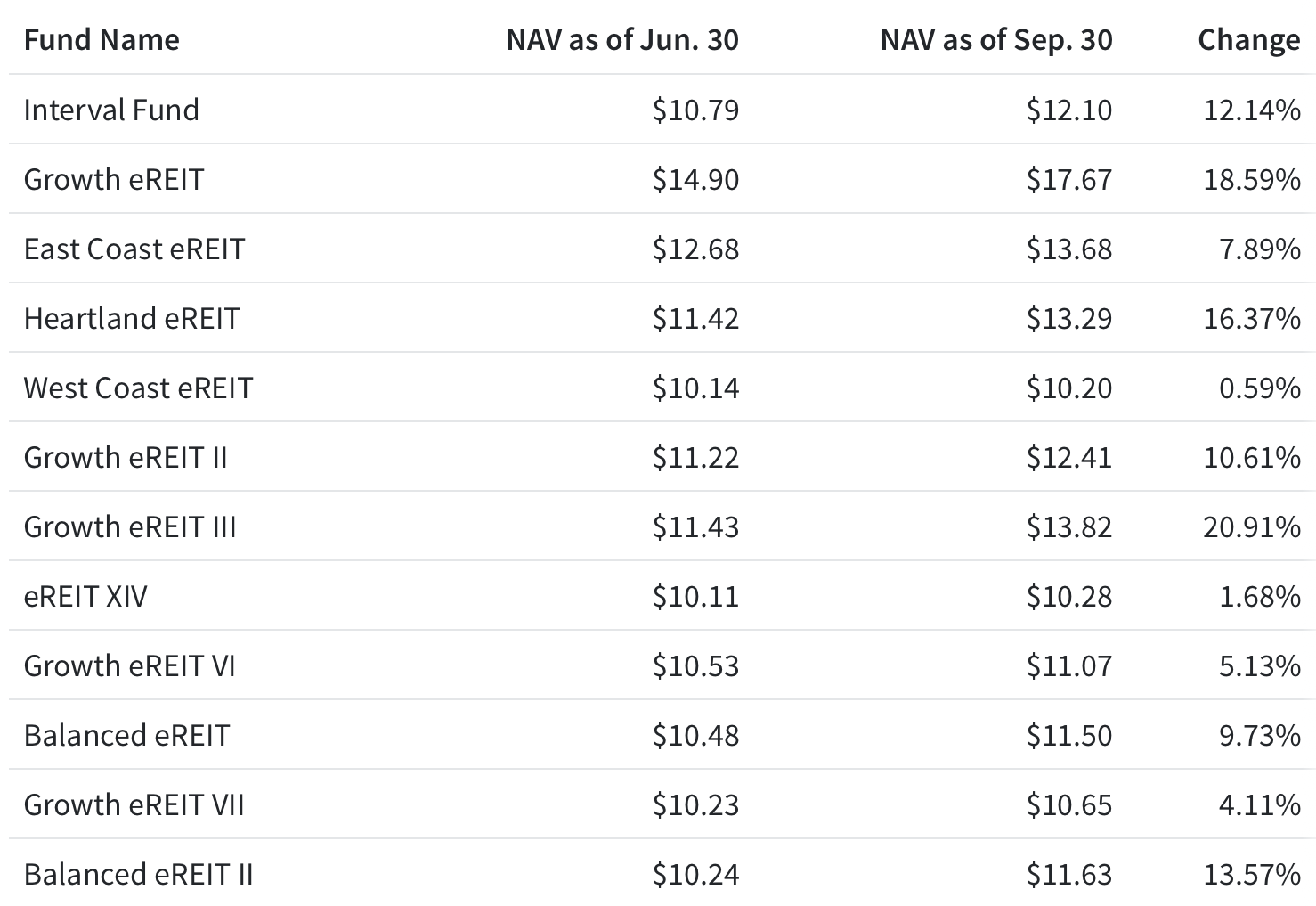

Fundrise Crushed 3Q 2021 Results

As someone who has about $500,000 invested in heartland real estate crowdfunding, I'm always curious about performance.

Fundrise released its 3Q 2021 performance below that made me do a double take. I had to check with the people at Fundrise that the percent change figures were indeed quarter-over-quarter and not year-over-year.

Have a look for yourself.

A greater quarter usually ranges in the 2-5% range, for an annualized return of 8% – 20%. But some of these quarter performances are astounding. It's good to see the Heartland eREIT up 16.37% QoQ. But notice how sad the West Coast eREIT is, up only 0.59%.

As someone who owns physical real estate in San Francisco, the ability to diversify away from my expensive area has been a positive. The idea is to live where I want, but invest where I think has better value and more upside.

I do think West Coast real estate prices are going to narrow the price appreciation gap with the rest of the nation as millions return to the office in 2022. However, I remain incrementally more bullish on the heartland, an investment thesis I've had since 2016.

You can check out Fundrise for more details.

In conclusion, retirees should fear rising healthcare costs and a big bad bear market the most. A bear market wiping out 30% – 50% of one's net worth in a year or so is devastating. That said, the outlook is obviously positive, so rising costs as the #1 concern does make sense.

Regards,

Sam – Financial freedom sooner, rather than later. If you were forwarded this newsletter and would like to sign up, do so here. What Retirees Fear The Most is a FS original newsletter.