As the wealth gap continues to widen, it may be beneficial to learn how to convince people you are middle class when you're actually rich. Otherwise, you might become target enemy number one when the revolution comes!

To get things out of the way, I feel rich. Not only do I feel rich, but I also have enough passive income to be time rich. Being time rich is my favorite form of wealth.

After chronicling my journey to financial independence since 2009, there's really nowhere for me to hide. Hopefully, people will give me some credit for all the years of hustle since graduating from college in 1999.

To avoid the guillotine, my hope is that consistently writing free content 3X a week to help everyone achieve financial independence will be appreciated. After all, I've got nothing to sell, except for a severance negotiation book, which many readers have said gave them the courage to change their lives for the better.

Even when many large media sites put up a paywall during a global pandemic, Financial Samurai stayed free with free podcast episodes as well. My goal has always been, no matter your level of wealth, to provide access to anybody looking to improve their personal finances.

Besides, as a minority, there should be more leniency as well when the uprising comes. It's cool to be a minority nowadays. That is, unless Asians are considered not enough of a minority worth fighting for. In which case, please have mercy!

How To Convince People You Are Middle Class When You're Rich

With Joe Biden as President, class warfare rhetoric has picked up. I distinctly remember heightened class warfare rhetoric during the Obama years (Jan 20, 2009 – Jan 20, 2017).

The Occupy Wall Street movement rose up as Main Street got crushed during the last global financial crisis. Remember the classic slogan, “shit is fucked up and bullshit“?

For a large portion of the population, everything is hunky dory now. But for another portion of the population who doesn't aggressively invest and who doesn't have easy ways to make money from home, things are not as good. Therefore, we must be aware of this dichotomy and act accordingly.

There's also a decent chance we could go through another recession again under the Biden/Harris administration. With so much euphoria being bought with so much debt, things could end very badly for millions of people.

Well, surprise, surprise, a bank run ensued at Silicon Valley Bank and now the middle-class is at risk of getting destroyed. When the Fed is run by a Chairman worth well over $100 million, do you think he really cares about the middle class over his legacy? Of course not.

Hence, if you are a rich person, you must be prepared for anger by the middle class. Let me share some strategies I've learned from rich people on how they've convinced others they are middle class.

How To Convince People You Are Middle Class Strategy #1: Criticize Other Rich People

When you want to deflect attention away from yourself, one of the best strategies is to criticize other people just like you. Therefore, if you are rich, it's wise to try and assimilate with the middle class.

Use words like “out of touch,” “triggering,” “clueless,” “living in your bubble” and so forth. Let me share a great example that just came to me after a journalist at MarketWatch highlighted this tweet from a wealth management professional.

On Twitter, Michael Batnick, Director of Research At Ritholtz Wealth Management, criticized a $400,000 household income budget. Too bad he didn't link to the post, as that would have provided more context and nuance. But his tweet seems to have resonated with many people.

I've spoken to dozens of households in NYC, LA, San Diego, San Francisco, DC, and Boston who make between $200,000 – $600,000 a year. I've also cross-referenced these budgets with my own budget to make sure the numbers are realistic. The reality is, this budget is pretty common for families with children living in expensive cities.

Housing and tuition costs aren't a secret. You can easily look up online what a typical 4-bedroom, 3-bathroom brownstone costs in Greenwich Village, Brooklyn, or San Francisco. Childcare and preschool tuition regularly cost between $2,000 – $3,000 a month.

A Nice Boost In Wealth Since 2020

It was smart of Michael to criticize this budget to put himself on the side of the middle class. Over the past eight years, as the Director of Research at a ~$2 billion money management firm, I'm sure he makes a hefty multiple six-figure income.

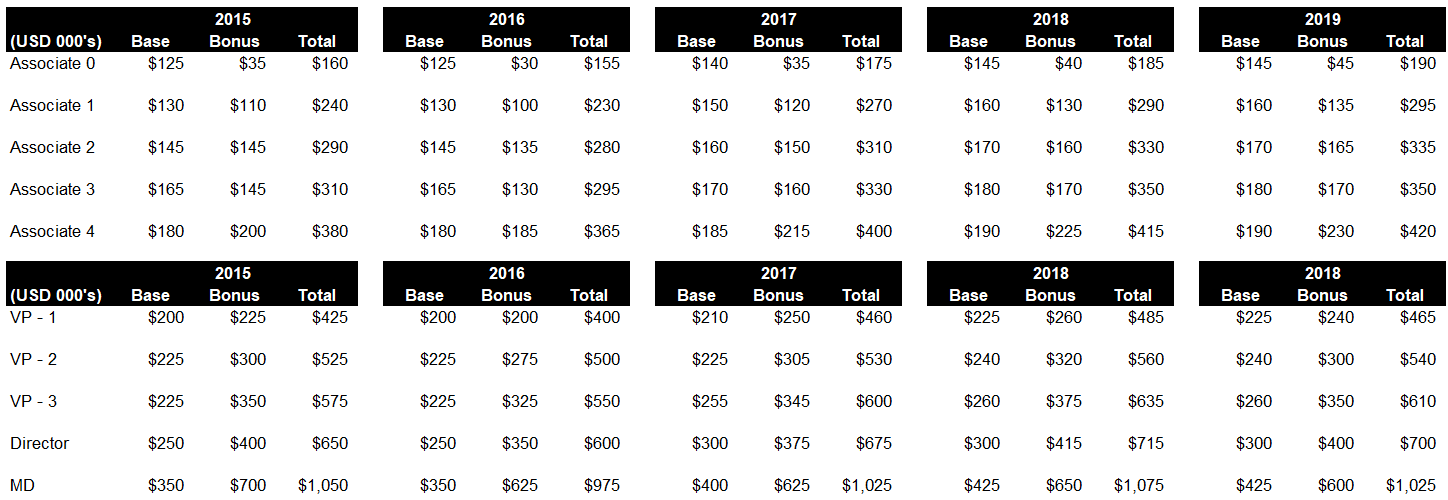

Although not entirely apples-to-apples, Directors in banking often make well over $500,000 a year all-in. Now imagine if you were a Director Of Research at an investment bank. You'd probably make closer to $1.5 million a year.

When Ritholz Wealth Management applied for a PPP loan in 2020 (and paid it back), it was reported their assets under management were only at $1.3 billion. Therefore, a 54% surge in AUM is quite a success and has made their employees even wealthier due to leverage.

Can you imagine if your net worth surged by 54% in one year during a pandemic? You'd be giddy as heck!

The wealth management business is highly scaleable. It does not take more manpower to manage $2 billion in assets versus $1.3 billion in assets. As a result, the employees at Ritholz are making even more money today plus have more valuable equity stakes in the company. With such an immense surge in wealth, learning how to hide in plain sight is important.

Adding On Side Income For More Riches

In addition to making a multiple six-figure salary at Ritholtz Wealth Management (RWM), Michael also makes money from his website and side hustles. He has sponsors for his podcast and blog that have nothing to do with his main business.

You'd think selling other products and services while working at RWM would be in violation of SEC rules. But I guess not!

As a personal finance blogger for 14 years who also worked in finance for 13-years and consulted for a digital wealth advisor, I understand how much you can make online as well.

Too bad I wasn't able to concurrently make a finance income and online income while I was working. It wasn't allowed under company policy as my old firm didn't want any conflicts of interest. This is one of the reasons why I decided to leave in 2012. I wanted the freedom to do as I wished.

But at Ritholtz Wealth Management, all its employees are encouraged to have personal websites to not only make money from advertising, but to also serve as lead generators to sign up new clients to their firm.

It is a fantastic strategy! I wonder why more money management firms don't deploy such a strategy. But, again, there might be some legal reasons or conflicts of interest with larger firms I'm not aware of.

For example, The New York Times recently told its journalists that all new private newsletters need to have management approval first.

The combination of healthy online side income plus Director Of Research income clearly makes Michael a wealthy man. I'm glad for his success. He deserves it. This is America, where dreams do come true! It's just important to stay humble, especially during these times.

Oh, and my offer still stands good rich people at Ritholz Wealth Management. If you're looking to diversify your workforce, I'm a minority who has the relevant finance and online media experience to help grow your business! I would just require a total compensation of at least $400,000 a year as well. Thank you for your consideration.

How To Convince People You Are Middle Class Strategy #2: Display No Material Wealth

To convince people you are middle class when you are really rich, you should drive a beater. A beater doesn't have to be a car that has smoke coming out of its exhaust. You can drive a slightly-used Honda Accord or even a Toyota Highlander to blend in. Those are reasonably priced cars that attract no attention.

If you are a rich person who likes cars, then you should follow my one car for show, one car for dough rule. When it's time to drive back to the office, you should drive your dough car (Honda Accord, Toyota Camry, etc). When it's time to drive to Shinnecock Hills Golf Club on Long Island, only then should you drive your show car (Lambo, Ferrari, McLaren, etc).

Not only should you drive a beater to work, but you should also not wear fancy jewelry or watches. Any ostentatious displays of wealth can get you robbed or kidnapped. Remember my war cry, “Gap not Gucci“! Wearing a baseball cap and sweats when you go out is a good strategy as well.

Always Hide Your Home Address

Finally, you should never give anybody your house address. Thanks to Zillow and Redfin, even if their online valuation estimates are unreliable, people can easily deduce how much you make using my 30/30/3 rule for home buying.

For example, let's say you live in a $3 million house. My 30/30/3 rule would indicate you make around $1 million a year. Worst case, you make at least $600,000 a year (1/5th the house value). Banks really aren't lending more than 5X your annual household income anyway.

Another thing I learned from my beachfront dream house post is that you should never post any house pictures online. Even if you do not reveal the address, someone can download your picture, and then upload the image onto Google to do a reverse search. If the picture was ever used anywhere on the web with an address, the address will be discovered. Curb your desire to show off!

How To Convince People You Are Middle Class Strategy #3: Communicate Poorly

Back in the good old days, I went to Mallorca, Spain with a bunch of friends. We went out for paella at 10 pm and started discussing relationships. As a Stealth Wealth champion, I asked the woman next to me how she was able to tell if a guy was rich if he displayed no material wealth.

She insightfully responded,

“By the way he speaks. Can he hold an intelligent conversation while looking you in the eye. His mannerisms are very telling as well. For example, at the dinner table, will he offer to serve others food first? Will he make sure his neighbor's glass of sangria is always full?”

Therefore, if you want to appear middle class at the dinner table, serve yourself first!

Avoid The Trans-Atlantic Accent To Not Sound Rich

When communicating, don't use big words or speak in a Trans-Atlantic accent as Kelsey Grammer did in the sitcom TV show, Frasier. Dr. Frasier Crane is American. But due to the way he speaks, you might think he was a doctor from the UK. Instead of speaking like Dr. Crane, speak more like his father.

You can hear the Trans-Atlantic accent in Audrey Hepburn movies and in the first Cinderella and Alice In Wonderland movies too.

Back in the '30s and '40s, wealthy people, mostly on the east coast, decided to adopt this hybrid Trans-Atlantic accent as a “class” marker. You know, that “Hah-vahd English” sound. Rich people taught it in boarding schools such as Andover, Deerfield, and Exeter.

Obviously, if you are middle class or poor, you didn't attend boarding school unless you received a scholarship. Therefore, you should speak as a normal person does!

Perhaps you want to speak with a lot of pauses and use the word “like” a lot. Examples: Like, uh, how you doin? Oh, and don’t tell anybody you went to private school either.

Use Upspeak To Sound Less Intelligent

Consider also using “upspeak” by ending many of your sentences in a rising tone like you're asking a question even though you're not. Upspeak helps make you sound less intelligent. Incorporate slang, especially the latest generation slang as well.

When it comes to communicating on social media, you must be particularly careful. Most people on social media tend to curate and display the best of themselves. Therefore, if you want to convince people you are middle class or poor, you can take the opposite route.

Personally, I find upspeak to be annoying and don't use that style of speaking on The Financial Samurai Podcast (Apple, Spotify).

How To Convince People You Are Middle Class Strategy #4: Do Not Reveal You Have Rich Parents

I was reading a piece by a New York Times Opinion writer who said she had children young and that's OK. She lives in New York City, an expensive city with her lawyer husband.

It's wonderful to have kids. And of course it's OK to have kids young if you can afford to. However, kids cost a lot of money and time. Not everybody is lucky enough to make a living from home or afford childcare.

The author of the article went to Brandeis University, where tuition is $59,000 a year. The all-in cost to attend one-year at Brandeis is about $80,000 a year.

I'm pretty sure that if more people had parents wealthy enough to pay huge private university tuition, more people would have kids at a younger age as well. Having wealthy parents is a huge safety net.

Therefore, just like with private school, never reveal to anybody you have a trust fund and wealthy parents. Not only will you reveal you grew up rich, a lot of your work will get discredited as well, rightly or wrongly.

How To Convince People You Are Middle Class Strategy #5: Get A Trust Fund Job

Since I began working in 1999, I've noticed more and more people have regular jobs but live way beyond their means. I'm talking driving $100,000+ cars and living in multi-million dollar homes while earning less than $100,000 a year.

It turns out, many of these folks have trust fund jobs, where their jobs simply keep them busy and relevant in society. They don't need their jobs to live because they have rich parents or already made their fortunes.

The problem with getting rich too quickly is that you lose a lot of motivation and purpose in society. While your friends are grinding away, you get to live a life of leisure. Some people will hate you for your freedom. As a result, you get a trust fund job to deflect envy and attention.

Convincing People Is A Skill That Takes Practice

The most skilled people at convincing others something they are not is the politician. From taking photo opportunities holding babies to going to places of suffering for speeches, politicians are experts at convincing people about their agenda. Therefore, if you want to learn how to convince people, simply study your favorite politician in action.

If you think about it, how else can an extremely wealthy politician hold office, while claiming to represent the interests of the middle class and poor?

How is it possible to convince the masses to ignore the fact many politicians went to expensive private universities, live in multi-million dollar mansions, send their children to private grade school, eat at restaurants that charge $500 – $1,500 a head, and so forth?

It's impossible without developing the power of masterful persuasion.

Virtue Signaling Can Get Too Obvious

Just be careful about doing too much virtue signaling. Eventually, people will get sick of all talk and no action. For example, if you say something like, “we must help the poor,” while having a billion dollar net worth, it gets old after a while.

You can try to go my route and tell things the way they are. You can also be relatively transparent to others about your financial journey. However, I DON'T recommend following me if you want to get richer and more loved.

For example, at least twice a year, I get beaten over the head by the Internet Retirement Police. And the IRP are frequently the most privileged people around!

The middle class is the best class because nobody bothers you. Politicians fight for you because they want to win the most votes. As a middle class citizen, you are part of the majority who can overcome any minority if you want to. If you are rich, learn to convince people you are middle class. Your life will be better if you do.

Related posts:

Are You Smart Enough To Act Dumb Enough To Get A Head

Be Rich, Not Famous: The Joy Of Being A Nobody

The Definition Of Middle Class Is The Same As It Ever Was

How To Convince People You Are Bad When You're Actually Pretty Good

Grow Rich Through Real Estate

Investing in stocks and bonds are classic staples for retirement investing. However, if you want to grow rich, I also suggest diversifying into real estate—an investment that combines the income stability of bonds with greater upside potential.

Consider Fundrise, a platform that allows you to 100% passively invest in residential and industrial real estate. With over $3 billion in private real estate assets under management, Fundrise focuses on properties in the Sunbelt region, where valuations are lower, and yields tend to be higher.

There is a multi-decade demographic shift towards lower-cost areas of the country thanks to remote work. Technology has enabled more people to work from home or anywhere in the world. Post-pandemic, this trend has only accelerated.

I’ve personally invested over $295,000 with Fundrise, and they’ve been a trusted partner and long-time sponsor of Financial Samurai. With a $10 investment minimum, diversifying your portfolio has never been easier.

Reader Questions And Suggestions

Readers, what are some other great strategies to convince people you are middle class when you're actually rich? Why do some people try to convince others they are rich when it's better to convince others they are middle class or poor?

If you are truly rich, please do more to help others get ahead. Volunteer your time. Donate money. Mentor kids. Fight for equal opportunity. Be aware of systemic racism. Speak up when you see an injustice. Society is no good when there is such a great dichotomy in wealth. Fight on!

If you want to escape from a job you dislike with money in your pocket, read How To Engineer Your Layoff. It will teach you how to negotiate a severance and be free. Negotiating a severance was my #1 catalyst to leave investment banking behind in 2012. I haven't been back since! Use the code “saveten” at checkout to save $10.

For more nuanced personal finance content, join 60,000+ others and sign up for my free weekly newsletter here. You can also subscribe to my podcast on Apple or Spotify. This way, you'll never miss a thing.

I’m an Asian immigrant with the typical poor upbringing, lived in public housing, etc, and have been doing all the middle class things you talked about not by choice, but because I’m actually poor and resort to a frugal lifestyle. Now that I’ve “made” it, being financially independent, I’m still working as it helps sell that I’m middle class. My investment grew significantly over the pandemic and now it makes more than my annual salary.

While I intend to look the middle class part, wearing free t-shirts with ads sometimes with holes in them too and driving a 20 years old car, I’m beginning to doubt the purpose of stealth wealth and the dilemma it will cause.

1. Retiring early will give it away as I have no reason to quit because I love my work in cybersecurity and my coworkers. I want to be time rich so I can spend time with my kids who will be teenagers soon.

2. I don’t flaunt my wealth, but if I don’t change my spending habits soon, I might as well be the richest man in the cemetery.

3. Even if I only spend 4% of my net worth, which will practically ensure my net worth will not be depleted, but likely continue to grow, I must live a 200k a year lifestyle. (yeah yeah what a problem to have) The real problem is my kids will inherit the wealth. While they’re financially literate and are grounded for now, living a 200k lifestyle throughout their teenage years, will undo what I’ve taught them and eventually squander it.

For those reasons, why continue the stealth wealth? I recently replaced my 20 years old car with a Tesla Model Y and people have already noticed and that’s only a $1k/mth expense or 5% of what I need to spend.

“ Retiring early will give it away as I have no reason to quit because I love my work in cybersecurity and my coworkers. I want to be time rich so I can spend time with my kids who will be teenagers soon.”

Wouldn’t it be better to retire so you can spend more time with your kids instead?

Model Y I still a relatively middle class car. X is not.

What type of net worth are you talking about here? The good thing is that every investor has seen their net worth grow during the pandemic.

I love this article, because I more or less do the exact same thing. I own half of a business that brings in almost a million in cashflow a year, and also do my own consulting work that brings in nearly the same income as the cash flow from the business I own. I’m in my early 30s, and even my own parents think I’m solely middle class. I do have a bit of a “more expensive” car than the average person, but it’s a sports car that looks a bit stripped down – you could convince people you bought it used cheap for way less money. I only live in a relatively small 2 bedroom condo as well.

It does allow me to take nice vacations at my own discretion, as well as go on shared vacations with family and not really expect to have to pay for the trip. My brother on the other hand gloats about his income, and he has extended family constantly pestering him. I actually make about 50 percent more per year than him.

Wow! That is incredible, earning $2 million a year in your 30s. Can you sure what kind of business you were on and what kind of consulting you do? Congrats on crushing it.

Hi Financial Samurai,

That post contained some pretty humorous points… I totally get why someone of a high-income stature would want to convince others that they are of different financial strata than they actually are. I read “The Millionaire Next Door” a year or so ago to gain some perspective as well.

This country may remain polarized for quite some time and no you shouldn’t have to be ostracized for being of Asian descent nor for being self-made and self-taught. From what I gather it’s the ones who achieve wealth and success from the bottom up who are more grounded in reality and willing to show others how to accomplish those same successes as well. You certainly don’t owe anyone anything but you choose to give back via knowledge.

One point that doesn’t seem to get brought up much is how there are lots of people who are misinformed about wealth, money, and finances in general. I can’t begin to tell you how many people regularly take an annual check courtesy of “Uncle Sam”, bi-annual check from”Sallie Mae”, “Navient” or ” Perkins”, etcetera and spend it like there’s no tomorrow. These same people may not have two nickels to rub together the day they get the funds as a result of poor financial decision-making year-round.

I was once one of those people in my earlier years for reasons I care not to disclose at this time but as I changed my perception and gained a new financial education, and overcome some challenging obstacles along the way, I too strive to help others. Most people who “hate the rich, wealthy, and privileged” are simply misinformed. lack proper financial education and have ingrained beliefs that can be generational.

Greetings from Brazil.

My dad runs a business and I work with him. Some of our new clients take a long time to find out I’m the owner’s son because I tell nobody about this and I pretend I’m just an ordinary employee when dealing with them. Sooner or later they always find out the truth, although I don’t know how, gossips everywhere maybe, but the consequences are not bad. I always find it funny when they stop treating me with arrogance and yelling at me on the phone, to treat me very politely all of sudden.

Greetings! Ah, it must be nice to be the boss’s son and get some respect!

I think it would be fun if your coworkers disrespected u all year and didn’t find out for a long time. Meanwhile, you were always kind and continued to work hard. They’d eventually have massive respect for you!

What kind of business?

I understand the concern with being seen as a “privileged other” if ascending the wealth ladder, but I think mindful living has merit here. Buy what YOU want to enjoy mindfully, and be honest with yourself on whether you truly want that thing or there is some external validation involved. If you really want that sports car, a Miata would realistic deliver just as much fun, if not more, as a Porsche 911. If you want a nice house, then live in it and enjoy it instead of broadcasting it over social media.

When it comes to interacting with people, true empathy and connection is vital. Listen carefully, mirror, and really try to understand the other person; you will naturally code-switch and appear more approachable. Even if a less-wealthy person does get some hints that you are very wealthy and successful, they will see you more as a respectful, caring fellow human being and less as a godless, materialistic elite. Plus, you will also feel gratitude for your own success and maybe even provide some wisdom to those struggling!

Could be good! How are you living your life? And do you not feel bad living it up sometimes?

I think stealth wealth is more pertinent for the online world. They are my world is much more judgy. But the off-line world might just judge you behind your back more.

I am an individual learning how to truly live in abundance after many years of scarcity mindset conditioning. So to answer your question, I’m learning how to live it up WITHOUT feeling bad about it! ;)

I can see how steal wealth is more pertinent for the online world. How the off-line world judges me… I cannot let dictate how I feel internally! These are things I’m definitely working on getting better at. Thank you for the insight, Sam!

Loved the article, good reminders for me.

I am a walking enigma I feel like, 2019 was the first year I earned a seven figure income, last year more than doubled again. This year appears to be better earning year than last year already. I know we are very blessed. That being said historically I have been regality frugal, mange to grow my network to around 1mm by the age of 30 having never earned more than 200k a year. My daily dress wear is gym shoes, jeans or shorts and company polo shirt or plain t-shirt.

I am now one of those people who lives a 300-400k a year lifestyle with my wife and have a lot of guilt over it sometimes. We have no kids and live at our business, our employees are our best friends. I’ve bought the nice cars and jewelry over the last few years. I even gave away 5 Rolexes to my staff this year. I put them in nice trucks which are expensive and take them on international vacations. In my industry my sales team is everything and I need to give them what they want or show them what they can earn. I have seen first hand how it motivates them to go back money for us, but it has lead to me developing expensive tastes.

Congrats! Guilt is real as the fortunate often ask, “Why me and not them?”

The best way to eradicate the guilt is to keep helping as many people as possible. I am totally motivated to keep on writing and helping people achieve financial security because of the occassional comment or e-mail I get thanking me for my efforts since 2009. It is the fuel that keeps driving motivation!

The two things to think about are:

* Children

* $10 million

Having children is a life changer. It has made my existence feel much more meaningful. That said, it’s up to everyone to decide whether they really want children or not given there is no return policy!

$10 million is a net worth hurdle that I’ve noticed starts to provide a lot of security.

Best of luck!

Morgan Housel is like a clone of Michael Batnick. They are always the same, white guys who just support each other and nobody else. It’s comical how incestuous the industry is.

Morgan is also a finance writer with no formal finance experience. If he was a woman or minority, he wouldn’t have been able to get a job.

These white guys on Twitter are so self-serving. It’s just marketing.

I’m not sure if the average rich white male realizes how privileged he is. Michael Batnick certainly doesn’t realize it with his commentary, maybe because he is always on Twitter and seeing other rich white males get richer.

Check, check and check. That is why I drive a nearly 30 year old car that in fact does have smoke coming out of the exhaust and can barely pass the smog test. Plus it was the dream car I purchased right out of college. I have other newer cars–their purchase prices are all lower than that first car. When one is married and working from home, there is no one to impress with material things.

I also enjoy criticizing wealthy people, and I am APPALLED that you believe $400K is barely enough for a family of four–you and those people are seriously out of touch. When the revolution comes, I’m going to reference this comment as evidence of my solidarity.

And if you catch any grammer or speling mistakes this comment, that’s just my poor breeding and education revealing itself.

The Revolutionaries don’t take kindly to polluters though. Walk, ride a big, or take a bus is better.

I see what you did there, very creative. LOL

Batnik wears ironic tee shirts and gets the millenial crowd engaged with his snarky banter. He has a persona to maintain, just like any influencer or YouTube star.

Just wait until some even more snarky journalist needs a juicy hit piece and writes an article titled, “You will never believe how much money these fake middle-class people earn!”

11 million isn’t enough in the Bay Area? 4 million gets you a modest home? You must live in Atherton…4 million will get you a large place most anywhere in Marin or the East Bay, a lot of SF too. The Bay Area has some inflated salaries, but 11million is ballin’ even there. I lived there long enough to know.

$11 million is enough. $10 million or more is the ideal net worth for retirement today IMO.

I get your pragmatism, but it’s sad that it’s come to this. Is there anything – any sphere of human life really – that we (Americans) don’t lie about nowadays, whether to themselves, others or the world? Instead of “life, liberty, and the pursuit of happiness”, we should just change the motto to “Virtue signal, extend, and pretend.”

I’m all about stealth wealth but as long as I don’t have to sacrifice my own life and the things I enjoy. Why the hell should I drive a Camry around when a model y is 10x more fun?! Def raised some eyebrows with my neighbors with that purchase but the funny thing is the car starts at under 50k and the avg car price is 40k. ♂️

It’s tough to hide your wealth though when you buy a $3 million house (I don’t have one) and people can so easily zillow your address. But I like the idea of using a po box for all correspondence and putting up a few barriers. Ex: we moved into a newly renovated house and the 40 pics on redfin looked awesome but I removed them all after we bought the house so you don’t know exactly what’s inside.

Another thing I do is just not post to social media. My wife is pretty good about this too. She’ll post pics of our vacation but doesn’t tag the resort we’re staying at etc. But I do like the idea of spending money on things that are difficult for everyone to notice.

This East/West Coast financial rap beef between two personal finance bloggers I enjoy is pure comedy, and I hope it only continues!

Separately, I do really think people underestimate how much their retirement will cost. Maybe that can all change if bond rates ever get back to mid-single digits; until then, assume you don’t have enough!

I think people over-estimate how much retirement will cost – from no work cost (driving, newer vehicles, work clothes), to no or very limited FICA, to a lower effective tax rate, to not having to save for retirement anymore, medicare once you hit that age (aca subsidies before) and hopefully a paid off home and lastly moving to a lower cost state/no state income tax (eg NJ to FL or NC, CA to AZ or TX)….unless you take up an expensive hobby your cost of living in retirement should be way less than while working!

I don’t know Sam. I think showing off your wealth is a pleasant way to reward yourself for all the hard work. Why hide the fruits of your labor? Believe me, there will be one out of 100 who will be inspired to be better financially from seeing you attain success and wealth. Why do you think people visit your blog site and admire you?

You don’t want to go out talking like a sailor just to hide your wealth or great upbringing and dedication to improve yourself.

The haters are the only ones who will make lots of noise. And to be frank, who cares about those losers.

Plus, most wealthy folks usually have friends and are in social circles with people who are in similar economic conditions. Their kids are in private school and are members of the same private clubs.

The Economy Chief.

Hi,

I opine that there is no need to convince the other people.

Self focus is the way to go as per my perspective.

My two cents worth of views.

WTK

Add don’t write in cursive to the list. They aren’t teaching it anymore. I actually got told at work I couldn’t write in cursive. They’d make fun of my writing and say it looked like calligraphy. Some of the progressive types told me that it was classist to write like that and a white people way of writing. Eventually the boss just told me I can’t write in cursive anymore.

I would add don’t talk about art, books you’ve read, places you’ve traveled overseas. Use terms like “bougie”. Wear a hoodie and leggings. I used to think it was bad thag everyone wore jeans so much. Now they seem positively high class compared to the top tight no underwear basically wearing panty hose out crowd.

In fact, don’t talk about finance. Don’t admit you understand a 401k or IRA. Don’t talk about stocks and dividends.

Better to talk about lotto tickets or collecting something like beanie babies.

It’s a sad sad race to the bottom. I’m shocked at how low class Americans are anymore.

Not sure about the ending your comments “up”. Where did that come from? It’s de riguer in places like Nz and Aus.

(P.s. also don’t pepper your speech with common foreign phrasing…de riguer, faux pas, etc or any Latin…caveat emptor)

Or try to use foreign phrasing correctly before showing off – it’s “de rigueur”. (I’m French)

I’ve found your comment really sad, complaining on one side that’s its a race to the bottom, and investing energy on the other side trying to hide your cultural capital – it would be too bad if someone without such capital would learn a thing or two listening to you, wouldn’t it?

What happened to what I considered to be a typical American trait, leading by example?

Are you really that afraid of the Guillautine, or is that some kind of guilt I’m sensing?

I’m all about avoiding ostentation, but come on!

Hey Financial Samurai,

Thank you for another great post. I’m sure there will always be someone on the internet ready to write negative comments but if it helps in anyway, your posts have made a huge change to mine and my family’s life.

From predicting the bottom like Nostradamus, stealth wealth, house buying rules, car buying rules and many others, your articles have given me the confidence to get invested and stay that way.

We are now well on our way to financial independence. You are a modern day Bogle with your relentless work ethic and free content. Thank you very much, from the other side of the world.

I appreciate the love! Thank you!

I’m very glad to hear your family has benefitted over the years. Your words are very motivating as I slowly loose steam.

What a long strange and fun trip it’s been!

What’s really spooky is that people don’t take age into account in declaring people rich or not.

A person who has saved and invested for several decades SHOULD have a lot more wealth, than a thirty year old just barely getting from paycheck to paycheck (after their automatic 10% deductions for investment are taken out, of course).

On the other hand, that older person is likely either retired, or soon to be retired, which means they need that wealth just to continue living as they have for most of their lives.

My wife and I together make a comfortable living, even in our area, although we drive used cars, live in a rather average looking townhouse, don’t dress up much, wear costume jewelry (she does, I don’t wear any jewelry), and so on.

This past year was the first one where our investment income/growth exceeded our wages. But a big part of that is that (besides being a really good year), being in retirement accounts, and long term investments, very little of it was taxed. That will change a great deal when we retire in two or three years. Plus, of course, inflation will take its toll as well.

We’d certainly swap it all to be age 30 again but, barring that, we will need our savings to get by without being a burden on our children, even though it might be enough to make a 30 year old consider himself rich. I worry that it makes Biden and the federal government think we are rich and that they can therefore help themselves.

That is a good point. For example, although Bernie Sanders is a multi-millionaire and owns multiple homes, he’s 79 years old and should be a multi-millionaire after more than 57 years of saving and investing.

Your point about age is highlighted in the last sentence of my second paragraph:

“Hopefully, people will give me some credit for all the years of hustle since graduating from college in 1999.”

Congrats on making more in investment income than your day job income.

Perhaps it’s time to retire soon!

Barry Ritholtz is kind of obnoxious.

Outstanding.

I’m doubtful that the socialist/marxist rhetoric is going to go away soon. The students and graduates of the elite schools seem so committed to it that they’ll be loath to abandon it without learning the consequences the hard way. You can also rest assured that the corporations will find a way to use #equity as a clever scheme to drop high performer pay to a lower median.

Going Gray is critical.

One strategy is the Rich Dad/Poor Dad approach. Separating yourself and your identity from your job helps to fight lifestyle inflation and the curse of “keeping up with the joneses”. There’s a lot more millionaire plumbers out there than lawyers…

a few ideas:

0. dress down. unless there’s a strategic reason to impress, don’t bother.

1. don’t brag your university on bumper stickers or clothing.

2. downplay your career as just a job. Work as a Principle Engineer at Tesla: “I work in the automotive industry”. … People won’t know if you sell used cars or sit in the C-Suite

3. did someone say Miller Lite? Seriously, can you even imagine how you look sipping a $25 cocktail with that fancy ball shaped clarified ice cube? Is that really the man that you want to see in the mirror tomorrow?

Above all, just check the ego. You worked hard and earned a great career and are being well rewarded for it. Shouldn’t that itself bring you enough pride?

if you ever want to dig really deep into this subject, ask an exotic dancer. They learn early on that the millionaire fresh off the fishing boat spends money that is just as green as the vacationing dad in the polo and salmon colored pants.

Agreed on all points. Btw, Miller Lite is so underrated. It pairs so well with spicy/salty food IMO, but it’s always viewed as terrible beer (friends always ask me why I keep it stocked in my fridge). I mean they do have a point (lol), but for the cost — I’m a fan. No need to be snobby about what you drink/eat.

Your posts are getting increasingly snarky and/or tongue in check… and I’m here for it.

What happened to your post about the Hawaii house!?!

I think it made sense to only keep it up during April Fool’s Day ;)

Lol exactly

Funny post! I follow Batnick and Carlson but remember thinking that it was rich of them to call out your $400K post. My sense at the time was that they knew it was a viral post that caused a lot of backlash and wanted to get a bit of the traffic/action. I’m sure Batnick, being from the NY area, knows exactly how much it costs to live and raise a family to middle/upper middle class standards in NYC…Disingenuous.

So much work and “codes” to live by stealth wealth. Totally believe your story from Spain, though I think you can have manners/pedigree but not tons of money. Reminds me of old school WASPS. Everyone is so apologetic and worried about displaying any trace of wealth or privilege. Not sure a fancy fancy car is safe way to go to bring to a club like Shinnecock. Years ago, when at the patrician Maidstone club in E Hampton with a member, along with my best friend, who’s from a billionaire family. While waiting in line, my friend asked to top up her french fries (the portion was smaller than normal) from the server at the counter of the club’s beach shack…the member just about had a heart attack from embarrassment. “You don’t do that!!!” i.e. meaning put servers in an awkward position and show any complaint/entitlement at all.

Nice to have a best friend from a billionaire family! Any specific benefits from having such a friend? How does your friend view work, hustle, and life in general?

The ultimate benefit is the friendship. Friend has been there for me when I needed, flew out immediately to see me right after I got out of cancer surgery and help out. Always inspiring, smart, super stylish. Lot of fun times going out in the past (I’ve been abroad past 4 years) and overlapping friends in same set. Regarding work, hustle, etc. family does not presently work — they are focused on raising two kids.

Another benefit is seeing the pointlessness of competing/comparing. Negative is when your interests and tastes are similiar (we’ve unwittingly bid on similar pieces at auctions, though I am always on the low end/looking for bargains), but not your budgets. It’s easy to get a distorted sense of what’s realistic to aspire to. Fortunately, I have a varied circle to keep me grounded but the struggle between wanting to make more to maintain at a certain level vs downshifting/geo-arbitraging is real. After all, isn’t the whole point of wealth is being able to cherish and be near friends and family?

A woman inferred that a male who offered others food and drink first is wealthy. Please.

In my 18,600 days of existence I have observed both financially wealthy and financially limited act in congruent and dissimilar ways.

A male human screen writer worth 10 figures acting like a narcissistic punk. Completely disrespectful. A person of limited financial means willing to give you anything you need.

All too often people make assumptions based on limited information. Which I suppose is the point of the post.

It is unfortunate that people have to take deliberate steps to hide the fact they have money. But money doesn’t mean you’re somehow superior to others. Nor should it make you a target.

Spot on observation: politicians engaging in chameleon like behavior to blend in when in fact they speak with split tongue. The excrement is coming out their ears.

Great post! Someday when I am rich, I’ll be able to use this humorous post to my benefit.