Are you wondering which states are best for retirement? As a retiree since 2012 let me share the best states for retirement based on taxes, weather, and lifestyle. My method for calculating the best states for retirement are objective and logical.

In retirement, you want to live in a place that has reasonable taxes. Every day, you'd love to go outside and enjoy nature. Further, you'd love to have great food and entertainment activities. Clearly a state like Hawaii is in the top 5 due to its amazing weather and wonderful pace of life.

However, let's determine the best states for retirement with a little more objectivity using taxes and lifestyle as key variables. It doesn't matter if you retire rich if your state has bad weather, poor culture, high taxes, and bad laws.

Which States Are Best For Retirement?

America is amazing because we're free to relocate anywhere in the country that suits our desires. A lot of people scoff at the idea of just moving because of family and job responsibilities.

But when you can take a plane anywhere in the continental US in under six hours, telecommute from home, and FaceTime with people you care about, why wouldn't you at least give moving to a nicer place a shot? There are now plenty of flexible work from home opportunities thanks to the global pandemic.

The best states to live in have a combination of low taxes and incredible weather. California is awesome, but our taxes are horrendous. Hawaii is also amazing, but food and housing are also costly. At least Hawaii's sales tax is only 4-4.5% and pensions are state tax-free.

I've been to a large majority of the 50 States and hav spent 10 years on the East Coast before moving out West in 2001. I'm biased for California and Hawaii. To me, the best state for retirement is Hawaii, if you can afford it. However, it's time to get objective for the greater good of all Americans.

For a better life in retirement, be willing to relocate.

Taxes Are Important When Considering Best States For Retirement

When we calculate cost of living, we typically think of 1) Housing (rent or mortgage), 2) Car (loan payments and interest), and 3) Education and Child Care (student loans or child schooling). However, in actuality, taxes are usually the number one largest ongoing expense.

Let's take a look at the Federal Income Tax brackets for 2025. After Trump and Congress passed The One Big Beautiful Bill Act on July 4, 2025, taxes are to stay low for years to come. The OBBBA extends the 2017 Tax Cuts and Jobs Act past 2025.

Taxes must be considered when trying to determine the best states for retirement. You also have to understand whether there is state income tax, the level of property tax, social security tax, and so forth.

State Income Tax Rates

From a previous post regarding our polled incomes (2,400+ votes), the vast majority of readers here are going to be taxed at the 25%-33% rate federally. After Uncle Sam gets his cut, we need to take a look at individual states and the associated income tax.

Let's take a look at state income tax rates to get an idea of how much citizens are taxed around the country.

As we can see the grey states represent those with no state income tax and the lighter the purple, the less overall income tax for the top brackets. However, we also need to take into account that some states with no income taxes are going to make it up at the gas pump or via higher property taxes i.e. Washington State, Texas, and New Hampshire.

Overall, the cost of living tends to be a lot more in cities where people would like to live and be by the coasts. We also need to consider our #1 largest expense aside from taxes, which is housing. Median home prices vary significantly from state to state.

Cheapest And Most Expensive States For Home Prices

The bottom 10 range from $125k-155k and include (cheapest to most expensive): Ohio, Michigan, West Virginia, Tennessee, Kentucky, Arkansas, Nebraska, Oklahoma Georgia and Iowa.

The top 10 range from $237k-471k and include (cheapest to most expensive): Oregon, Maryland, Colorado, Washington, New Jersey, Virginia, New York, California, Hawaii, and Washington D.C.

The following chart below is the median household income by state.

Money is basically made on the coasts with lots of it coming in from San Francisco, NYC, Boston and D.C. Therefore, it costs an arm and a leg to live around these metros. A median house in SF is going for around $1.1 Million, for example. It would be damn hard to make a living and reside in the SF Metro if one isn’t making $200,000 or more.

I really like the $200k figure, as it also represents roughly the current median household price in America. The American dream is pretty much about home ownership, freedom, and comfortable living. We want to be able to work hard and be free with a roof over our heads that we own. So with that said, let’s delve into some states really worth exploring if our income isn’t specific to a geographic region.

The Most Attractive States For Retirees

Let's first take a look at the states with the lowest tax burden for residents according to the US Census Bureau. Below are the best states for retirement based on the lowest tax rates.

States With The Lowest Taxes To Save Retirees Money

Florida – No income tax, low cost of living, and warm weather.

Arizona – Low state income tax, low cost of living, and warm weather.

Nevada – No income tax, low cost of living, and warm weather.

Texas – No income tax, super low cost of living, and warm weather. Although, the Texas was also rated the worst state to live and work according to CNBC.

Wyoming – Wyoming is unique in that it doesn’t tax any income, including retirement and social security. Sales tax is a mere 4%, there is low cost of living and wide open spaces.

South Dakota – If freezing temperatures and being in the middle of the U.S. don't bother you, in similar fashion to Wyoming, this is one of the best states for retirement.

Alaska – Also has no income tax, but it's far away from the mainland, cold, dark, and not cheap due to the importation of goods.

Related: States That Don't Tax Social Security Benefits

States With The Most Millionaires For Retirement

Now let's look at the states where there are the most millionaires. Millionaires are more mobile than others, all else being equal. Therefore, it is logical to conclude that states with more millionaires provide better lifestyles. After all, if you're a millionaire, you'll want to use your resources to live the best life possible.

To nobody's surprise, Hawaii has the most number of millionaires per 1,000 household in the country. New Jersey and Connecticut have a lot of millionaires given a lot of residents make their money from NYC.

Globally, millionaires are migrating most to the UAE and the U.S. Hence, the U.S. is still a relatively attractive country for the wealthiest people. It's just hard to fully appreciate how low our tax rates are if we've only lived in America.

States With The Lowest Taxes And Most Millionaires For Retirement

The final step is to compile the highest ranked states on both charts to come up with the best states for retirees! Below are the states with the lowest taxes and the most number of millionaires. As a result, these states are objectively the best states for retirement.

Related: States With No State Tax Or Inheritance Tax

Live In A Nicer State Already

If you've spent a lifetime saving, investing, and working, it's time to reward yourself with a fantastic retirement. Please don't live in a state with high taxes and a higher amount of crime and poverty. America is a big country. Time to move to a better state!

Given I'm OK with paying a lot more taxes than the average citizen, Hawaii continues to be my number one state for retirement. Every time I go back to Hawaii, I get happier. My stress level goes from a moderate 5 or 5 out of 10 to a 2 or 3.

If you want a combination of lower taxes and a nicer lifestyle, Florida is a great state for retirees. But I wouldn't count out Nevada, since Nevada also has no state income taxes. Given how slow Nevada was in counting the ballots during the 2020 presidential election, its extremely slow pace of life might be exactly what retirees want!

For more detail, here are the states with no state income taxes. I go through the pros and cons of each of the nine states.

Where I Plan To Re-Retire

Ever since the global pandemic began, I decided to work again. I didn't go back to a traditional day job. Instead, I decided to work on Financial Samurai. Since a lot of fun activities were and are still closed, I decided to find ways to make more money online.

However, once I get vaccinated and there is herd immunity, I'm done with work. I even put together a pre-retirement checklist that is even better than the first.

I'm happy to re-retire in California for the next couple of years. I think it'll be fun to explore this great state while my baby daughter gets stronger.

But by 2029, my plan is to retire in the best state in America: Hawaii. Hawaii is such a wonderful state. I immediately feel less stressed every time I'm there because the culture is more laid back. Maybe I won't fully retire, but fake retire instead by working on my passion projects. But either way, I plan to retire in a state with great weather, chill people, and a slower lifestyle.

Here in San Francisco, everybody is talking about how much money they are making from their investments. There's a non-stop hustle culture which I want to escape. People are seriously too type-A ambitious here.

Of course, taxes, weather, and where the richest people want to live aren’t the only factors that determine the best states to retire. There are other considerations such as climate change, diversity, and politics are other considerations. Choose the factors that are most important to you.

For A Better Retirement, Keep Track Of Your Finances

Stay on top of your finances by signing up with Empower. Empower is a free online tool I've used since 2012 to help build wealth and plan for retirement.

Before Empower, I had to log into eight different systems to track 35 different accounts. Now I can just log into Empower to see how my stock accounts are doing. I can easily track my net worth and spending as well.

Empower's 401(k) Fee Analyzer tool is saving me over $1,700 a year in fees. Finally, there is a fantastic Retirement Planning Calculator to help you manage your financial future.

Free Financial Analysis Offer From Empower

If you have over $100,000 in investable assets—whether in savings, taxable accounts, 401(k)s, or IRAs—you can get a free financial check-up from an Empower financial professional by signing up here. It’s a no-obligation way to have a seasoned expert, who builds and analyzes portfolios for a living, review your finances.

A fresh set of eyes could uncover hidden fees, inefficient allocations, or opportunities to optimize—giving you greater clarity and confidence in your financial plan.

The statement is provided to you by Financial Samurai (“Promoter”) who has entered into a written referral agreement with Empower Advisory Group, LLC (“EAG”). Click here to learn more.

Diversify Your Retirement Investments

Stocks and bonds are classic staples for retirement investing. However, I also suggest diversifying into real estate—an investment that combines the income stability of bonds with greater upside potential.

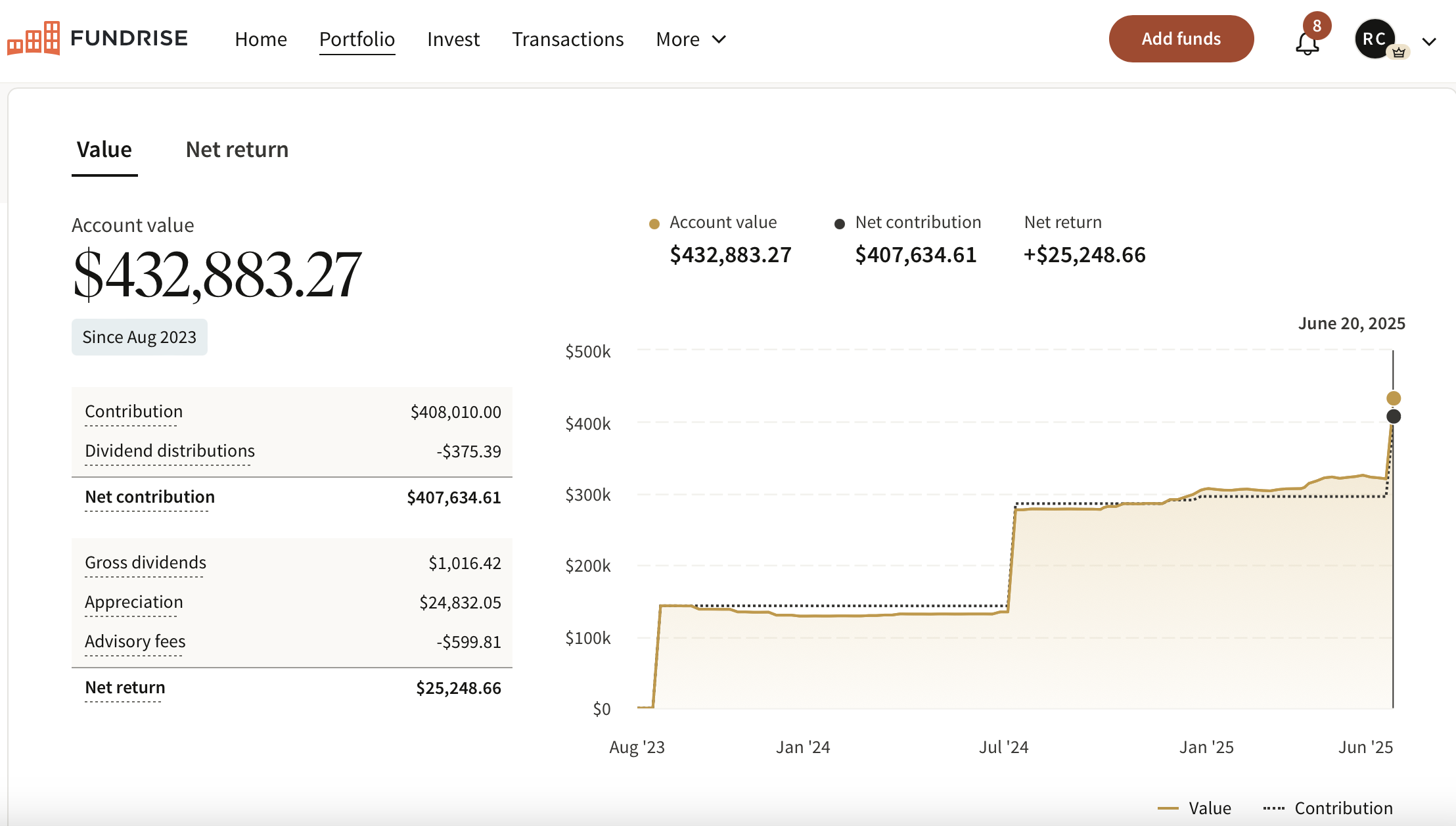

Consider Fundrise, a platform that allows you to 100% passively invest in residential and industrial real estate. With almost $3 billion in private real estate assets under management, Fundrise focuses on properties in the Sunbelt region, where valuations are lower, and yields tend to be higher.

In addition, you can invest in Fundrise Venture if you want exposure to private AI companies like OpenAI, Anthropic, Anduril, and Databricks. AI is set to revolutionize the labor market, eliminate jobs, and significantly boost productivity. We're still in the early stages of the AI revolution.

I’ve personally invested over $400,000 with Fundrise, and they’ve been a trusted partner and long-time sponsor of Financial Samurai. With a $10 investment minimum, diversifying your portfolio has never been easier.

Join 60,000+ readers and subscribe to my free Financial Samurai newsletter here. You can also get my posts delivered to your inbox as soon as they are published by signing up here. Financial Samurai began in 2009 and is the leading independently-owned personal finance site today. Everything is written based off firsthand experience.

Which States Are Best For Retirement is a Financial Samurai original post. I've been helping people achieve financial freedom sooner, since 2009.

Yikes you got vaxxed. Such an intelligent person, yet you don’t see through propaganda and you don’t think it through or do your own research.

I was a little taken back that in this article nothing was mentioned about climate change. Do you feel that plays a part in retirement as to where you chose to move?

There are many factors to determine the best state for retirement. I focused on taxes, weather, and where the wealthiest people want to live.

Climate change can certainly be a factor, with the wildfires in the west and the hurricanes in the southeast.

Grand Solar Minimum is continuing mini ice age. AGW is political science not science. All weather changes are solar based. Our activities on the earth are minimum as per thermodynamics. The current volcanic activity far eclipses any human activity.

How about adding a column on neighborliness or humanness? Just like niceness of Hawaiians, looking for continental US States where humans at least say hello to each other when they meet on the streets. What States still hold a community-like behaviors?

I live in NorCal; nice weather, great outdoors, fine job. Money talks rule in most friends gatherings. On my street, no one steps outside and if they do, rarely or no greeting.

This first-generation US citizen single empty-nester with two kids in the Army often feels living on a planet with no humans. :-)

If you want to claim Florida as your primary resident, does it mean you must be there continually 6 months and one day in a row? Or can you break up that time in different places, but still have a total of 6 months and one day in Florida.

Hi, I’v read most the comments on here!

I see you are high on living in Hawaii? Question?

Just renting on maui, I’m looking into a 55 older community with rent and all utilities being locked in

At $3400 month! I’m done with home or condo buying,

You think it makes sense to live the next 20 years in Hawaii on $45-48 gs a year that includes my SS AND investment withdrawals.. just wanting you opinion..

For people who are seeking a warmer weather and a laid back lifestyle Texas is the ideal destination. Texas has the most affordable hosing, lower tax rates, and ample of leisure activities. Along, with that cities like Sugar Land offers both business as well as job opportunities for retirees looking to launch a second career. Along, with that the state also houses some of the best hospitals and doctors, which can help you manage your health condition and that too at an affordable rate.

I left Texas because their property taxes are insane. I currently live in Scottsdale, Arizona which has really low state taxes, property taxes are about 1/4 of what I paid in Texas, and they have extremely low property insurance.

$120k for a nice home with a pool? In Port St. Lucie? I actually have been looking at real estate in that area for quite a while. If anyone sees that deal, or anywhere near it, please let me know, because I have seen nothing close. This sounds like one of those imaginary tales that are just created to make a point.

Brian, Financial Samurai doesn’t date their articles, but this was originally published in 2015. (Based on some of the comments.) Prices change a lot in five years.

What’s your take on retiring in VA or NC? I live in VA now, but thinking of moving to NC. Are they about par from a retirement standpoint on taxes

Doesn’t seem like it’s worth it. Very on par. Why not try somewhere more exciting and different?

The Cape Fear Region of NC is a great place to retire to. Three seasons no boiling summers water baches very low RE tax. Count all the Raleigh and Charlotte second homers and you have millionaires paradise. .

Sam, this is a good start. Maybe this is an idea for an article on Digital Nomad lifestyle. With so many folks being digital nomads living the full-time RV life we are fortunate here in the US to be able to change our Domicile and for tax purposes reside out of South Dakota, Wyoming, Alaska or Texas – yet travel anywhere and work on the road. Digital nomads can travel to Cali or Hawaii or Costa Rica or wherever…yet for tax purposes tethered to the State that offers them the best deal for their nomadic, AirBnb, or full-time RV lifestyle.

We relocated from New Jersey to South Florida in 2012. I was 57 and my husband 59. We loved the mild winters in Fl! However, we had a four bathroom, four bed (two of which were suites) and a full finished basement with inground pool just 10 minutes from the Jersey Shore when we bought a beautiful new concrete block home just 10 minutes from Florida beaches. The Florida home cost more than what we sold our NJ home for a lot smaller house and property with no pool. Property taxes ran about the same, give or take a few bucks. At that time, gas was about a quarter less in Florida but not any more since NJ increased their tax rate on gasoline. Overall, we didn’t see much difference other than the fact that we didn’t have the bitter cold winters and that was what made our decision. Any tax benefits didn’t really affect us. Unfortunately, between the ridiculous out of control home owner’s associations in the state of Florida and the hurricanes, we felt we needed a break and again relocated to the Carolinas. Although we were, indeed warned about the homeowner’s associations, we were still blindsided by egos so I would definitely warn potential buyers to do their homework with 1) what is the capital contribution, 2) is it corporate managed or homeowners who manage (I would personally suggest corporate management), 3) has a reserve fund been established and if so, how much $ is there, 4) who is responsible for street lights, storm drains and roads, 5) is it gated, staffed or unstaffed and if so is their a wall going around the community to prevent people simply walking into the development to rob you? 6) Is it deed restricted, 7) Ask to see and review the annual budget so you can physically see the monthly expenses that the HOA has and how much it will cost you out of your monthly budget. Remember the realtors and sales people are there not to necessarily be honest but simply sell you a house. Example…the saleswoman was working hard to sell us an inventory home on a pond (Florida calls them lakes). We explained that we weren’t interested and when asked why, I responded that I was not interested in alligators in our backyard. Her response was and I quote, “there aren’t any alligators in this water”! Please know alligators are in Florida and in all the waterways. They move through those waterways constantly. Anyway these are just a few questions that should be asked to lessen the surprises. Our HOA fee was $2,800 a year and the community had no pool or clubhouse! It covered the cost of lawn care, building a reserve fund, maintaining the so called “lakes”, the unstaffed gate that was constantly breaking and the preserve along with the roads, storm drains and street lights. Do you get a tax waiver since these things are not maintained by the city through property taxes. The answer is no.

Where are you and your wife now? We are in MD and try to find a tax friendly place to retire: FL (humidity, hurricane & sinkholes), TX (Austin/Dallas), NV (Las Vegas). There are pros and cons of each place and we have a hard time to decide.

What do you think of southern utah for retirees? We’re looking at Ivins and it looks new and better than Henderson for the price.

Lived in southern Utah for 16 years. The only problem is a series of new progressive tax overhaul is coming for 2020. Lots of poverty in southern Utah and guess who has to pay for it all?

Do you know what the “Tax overhaul” is all about in Utah for 2020?

You should make an update 3 years later.

This is a great article you wrote then.

Even more relevant since you want to go more passive and a little closer to passive retirement.

Interested how your son would impact the location.

[…] The Best States For Retirement Based On Taxes And The Amount Of Millionaires […]

All I care about is financial well-being. Weather is irrelevant. We live in the modern age and your home can be as warm or cold as you want it to be. So can the interior of your automobile.

All I require, outside of financial benefits, is extremely fast internet and as many delivery-services (food, groceries, etc) as possible. Having grown up in Portland, started my career in San Francisco, and spending the past decade in Denver — Wyoming sounds entirely reasonable. I think that may be the direction for me to go… unless the internet is totally screwed up there.

You never go outside?

Sam,

Your poll has Texas twice.

Anyway, I’m hearing the new Florida is Tennessee…

One friend moved from Tennessee to Florida and another friend just recently moved from Florida to Nashville so to each their own.

No more transplants to Nashville please! The conditions are horrible here. As a native, we are struggling to find jobs and our roads are unbearable. No parking and there is no train for an alternative. It’s ungodly expensive and just not worth it. I’m getting out as fast as possible! Don’t move here.

[…] also adjusted upwards as well. To supercharge your Social Security, all you’ve got to do is move to a lower cost state in retirement where the cost of living is […]

Just an FYI: Illinois currently has a 3.75% flat income tax and does not tax pensions or social security.

Also, some of these so-called “low tax” states have very high sales tax and property tax (and all kinds of crazy fees, etc.).

Lower taxes are important, but again, other things are maybe more important when it comes to quality of life…..

Would you actually want to retire in Illinois though? The weather is horrendous for half the year. As I get older, I realize the importance of warm weather for my joints.

Well…. Many retired people do live in Illinois. I don’t see Wyoming (which BTW, never takes down their snow fences) as such as a wonderful climate. And Texas is nasty hot (and comes with very high property taxes!).

But that’s not my point. What I’m saying is people need to really research a place carefully and not just with what limited data is on the Internet. You need to spend time in your planned future retirement area long before you actually retire. You may end up being less than happy in your new retirement home.

I wonder whether it’s due to a lack of funds why they retire in Illinois though?

It is true that there is no free lunch. Hence, a good strategy is to retire in one of the no income tax states and RENT in order to avoid paying property taxes.

I don’t know about renting to save on property tax? My assumption is that is included in the rent.

But anyway, renting might be a good idea. That would certainly increase your flexibility to relocate in the case of your retirement home not working out. It could also provide a retiree with some needed liquidity; avoiding sinking so much cash into a house.

AGREED!!!

Ace, I know this is a older post but I had to add to you comment. As a lifelong Illinois residence, in some ways I have to agree with what you said. Now, through the years I have done my fair share of b..ing about this state’s issues however after searching for a place to retire in the southwest, it not so cut and dry after all. My wife and I have visiting Colorado, Wyoming, Arizona and Nevada and even Northern CA for a retirement location on a yearly basis and there is no total clear winners. In Illinois, you get a nicer larger home with something wonderful called a BASEMENT for less money. Yes property taxes are high but Illinois is rather tax friendly to retirees. We also have in my opinion the best food and shopping and it’s got green grass unlike may southwest towns that are brown. On our visit to Grand Junction last year, the locals pointed us to their best pizza joint in town. After out first bite we realized if they ever got a Lou Malnati’s, they’d think they’d died and went to heaven. All in all, we still plan on moving and Nevada is high on our list. It’s just not as cut and dry as people may think.

Illinois…tax-friendly? I’m a lifelong resident too, and I can’t wrap my head around how you can POSSIBLY call Illinois ‘tax-friendly’. People are literally leaving the state in droves, not to mention businesses as well…because of TAXES, and uncontrolled/misappropriated state spending.

Stacy, please reread my original comment. “Tax friendly towards retirees” meaning retirement income from social security, pensions Income from IRA and 401k’s are not state taxed.

I agree, I can’t get out of Illinois fast enough! Between the horrible weather, high crime, ridiculous politics, high taxes, poor school system (CPS), I can’t wait to leave. One more year and it’s early retirement for me. I’m thinking of AZ or TX.

[…] we add on pensions or Social Security, is the “retirement crisis” really so bad? None of us have to live in expensive cities such as San Francisco, New York, Honolulu or Los Angeles during our non-working years either. We […]

I actually like Pittsburgh, PA as a retirement destination (I know, not a state). PA has just a 3% income tax, but the city of Pittsburgh has no income tax on capital gains (to my understanding). Pittsburgh has a rediculuously low housing cost, and they have big city cultural venue (performance arts, great museums, universities, and a great plant conservatory)! This is a top potential pick for my partner and I when we are ready to pull the ripcord.

But… it’s…. Pittsburgh :( Have you been to San Francisco or Honolulu yet? There is no comparison. Trust me man!

San Francisco?? In the same conversation as Pittsburgh?? No way… prices in San Francisco are some of the highest in the country! Pittsburgh is a great city!

Haha, cool. That’s what’s great about America. We are free to live wherever we want! I’m certainly looking to expand my real estate investments outside of SF. Prices are too high here.

Pittsburgh WAY BETTER than anything San Francisco has to offer. Extreme Liberalism, Overpriced on EVERYTHING, Self Rightous attitudes, EARTHQUAKES. Pittsburgh, better class of people, don’t have to fight traffic for 2 hours to get out of town and enjoy the country. Mountans near by. No not “overrated” Florida, or a cesspool like the whole State of California, but will take Pittsburgh over many places anyday. If San Francisco is SO GREAT……..Why are you all leaving?????

That’s the first I’ve heard of Pittsburgh being better. Glad you like it.

There’s been a big uptick in people wanting to relocate to California and Hawaii for a better life actually.

As the saying goes, “Life is too short not to live in California or Hawaii.”

See: https://www.financialsamurai.com/migrating-to-california-from-the-midwest-or-the-south-for-a-better-life/

I’m ashamed my native state of Nebraska treats retirees so poorly. Not only are the taxes high but there’s really no incentive for anyone to retire here.

Why do you think Nebraska treats older people so badly? Do you guys have some nice income stream going on that allows you guys to provide less incentives?

Egh, I feel like these tax lists are not always fair and balanced.

Is NYC super expensive? Yes. But my city tax covers sanitation, subsidized public transportation, etc.

Also, I work part time in sales (health care) and I would make probably 50% less if I moved to Florida, North Carolina, etc etc.

But I guess if we are talking about “Full retirement”, then yes, it makes sense to leave NY, NJ, and California. Of course, raising kids changes everything…

How about 6 months in Tampa, Fl and 6 months in NYC, that would be interesting : )

I’d still go with Washington with it’s fairly low cost of living, great recreation opportunities, no income tax and still cheap housing if you know where to look. It really makes sense to rent here since rent is still so low and you avoid the higher property tax.

The higher sales tax is easily offset by not buying so much crap. Same with fuel tax since it’s super easy to get around on transit. Seattle is basically a much cheaper San Francisco

Not anymore

And if you live near the Oregon border, you live and work/retire in WA (no income tax), shop in no sales tax Oregon, and you are away from the highest housing prices.

Washington native. Couldn’t get me to move back there permanently until all the Californians leave and go back to California! They like cockroaches, trash their state and move to our state and trash that. Increase the cost of living. More wildfires!!!

We’re currently located in Houston and like it quite a bit (as well as Austin). Property taxes are higher than average, but that’s about the only thing that’s generally expensive. If you don’t mind the climate, I think most people would really enjoy it here. The secret about the weather is the summers may be a bit nasty, but winters cruise largely between mid 50’s and low 70’s, which is really pleasant.

I imagine we would keep our home base here or Austin, unless we wanted to move back to be close to family in Arkansas.

I live in Bridgeland a suburb in Houston, and my property taxes are 3.8% Ouch… Imagine paying that for a home that went up in property value from $500,000 to $900,000.

Ouch is right. There’s the homestead act though or cap isn’t there?

We have Prop 13 in California, but that still means our property taxes go up 3% a year at least.

Colorado , North Carolina, and Florida (in that order) are my dream locations. Lower cost of living, lower taxes, nice weather, and plenty to do!

nice list!

So it’s 2021 where did you decide to live. I am thinking of Grand Junction Colorado.

consider west michigan for easy access to large amounts of fresh water. Might be more of a commodity in 30 years.

Also, miles and miles of beautiful beaches, and awesome autumn colors!