Have you ever wondered who makes a million dollars a year? Making a million dollars a year or more puts you in the top 0.1% of income earners in the world.

A top 1% income is over $700,000 today in America. With such an income, you should eventually have at least a top 1% net worth of over $13 million per person.

If you earn over $1 million a year, President Biden wanted to raise the long-term capital gains tax rate from 20% to 39.4%. Despite only about 0.1% of Americans making over a million dollars a year, it seems like the number is much higher.

If you want to get rich, you might as well focus on joining industries that pay very well. But there's more to just joining a well-paying industry to get you to a million dollar income.

You've also got to perform at a high level, survive cutthroat competition, and receive lots of luck along the way. Let's see who makes a million dollars a year.

Recommendation: If you’re looking to invest in real estate without the burden of a mortgage or maintenance, consider Fundrise. With over $3.2 billion in assets under management and 350,000+ investors, Fundrise specializes in residential and industrial real estate. I’ve personally invested $300,000+ with Fundrise to generate more passive income. The investment minimum is only $10. Fundrise is a long-time sponsor of Financial Samurai.

Survival Is The Name Of The Game To Make Millions

Corporate politics can be brutal on your climb to the top of the pyramid. Oftentimes, it's those who've been able to successfully sell themselves internally who achieve the greatest rewards.

During my career in investment banking, I was too defiant. Despite getting promoted quickly in my 20s, I stalled in my 30s because due to corporate politics.

I also didn't want to relocate to grind cities like New York or Hong Kong. Nor could I pretend to like enough people who could push me forward. In the end, I decided to see what I could do entirely with my own fingers.

We know that a top 1% income varies by age as well. You can't compare a 25-year-old's income to a 40-year-old's income. Instead, it's good to compare top 1% income levels by age.

For those interested in making a top 0.1% income, let's take a look at some career profiles. I think you'll be surprised at exactly who makes a million dollars or more.

Order My New Book: Millionaire Milestones

If you’re ready to build more wealth than 90% of the population, grab a copy of my new book, Millionaire Milestones: Simple Steps to Seven Figures. With over 30 years of experience working in, studying, and writing about finance, I’ve distilled everything I know into this practical guide to help you achieve financial success.

Here’s the truth: life gets better when you have money. Financial security gives you the freedom to live on your terms and the peace of mind that your children and loved ones are taken care of.

Millionaire Milestones is your roadmap to building the wealth you need to live the life you’ve always dreamed of. Order your copy today and take the first step toward the financial future you deserve!

The People Who Make $1 Million A Year Or More

Below are the people who make a million dollars a year or more. They hail from all different industries so there's something for everyone. These are the top 0.1% income-earners.

Once you start making $1 million a year or more, your goal is to become a millionaire. The first million is often the hardest, but once you become a millionaire, you can accumulate millions more.

Making a 7-figure salary won't last for the rest of your life. Therefore, it's imperative to save as much of your income each year as possible. There is a difference between earning a million dollars a year and being able to invest a million dollars a year! You actually want the latter so you don't have to work forever.

Managing Director, Investment Banking

Achieving the title of Managing Director has always meant that you'd finally break seven figures a year, at least when I worked in the industry between 1999 – 2012. The typical MD base is between $450,000 – $500,000. At year-end, these Managing Directors would often earn a bonus of $500,000 or more.

But the bonus is often paid in deferred stock and cash. For example, out of the $700,000 bonus, only $200,000 might be paid in upfront cash. The remaining $500,000 is deferred over four years.

If you quit before the four years is up, you lose your deferred compensation. This is why negotiating a severance is huge in any industry with deferred compensation is so important. Never let your deferred compensation go to waste. You earned it!

General Partner, Private Equity

Private equity is one of the most coveted next step careers for investment bankers. The hours are much better, while the pay also tends to be higher as well. These folks earn salary, bonuses, and carried interest, which can often lead to huge bucks.

Some of the top private equity firms include: Blackstone Group, KKR, Warburg Pincus, TPG, and various sovereign wealth funds like Temasek, GIC, and Abu Dhabi Investment Authority. People in private equity are truly some of the highest income-earners today. Many make millions and millions of dollars a year.

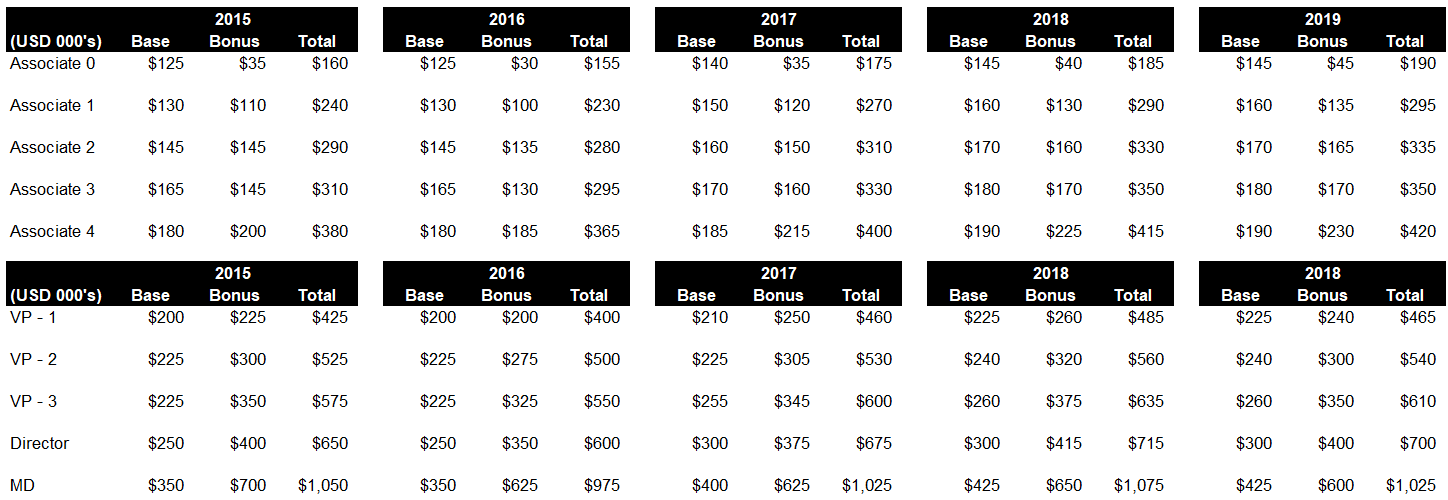

First year associates joining top private equity shops out of business school all make over $500,000 a year. Therefore, by year five, they are likely making over $1 million a year. Below is the average private equity pay in the United States, which is looking light nowadays.

Portfolio Manager, Hedge Fund

Again, your compensation is based on performance, size of assets under management, and the number of employees. First-year associates out of business school can make $300,000 – $500,000 at the largest shops.

By the time you become a general partner or portfolio manager, you should be making at least one million dollars a year if your fund is over $500 million. Hedge funds earn a lot of money due to their fee structure, which is still two and twenty after so many years of underperformance.

Portfolio Manager, Actively Managed Long Only Fund

Fund manager pay is based on tenure, performance, and assets under management. In order to earn $1 million a year, you will probably need to manage over $1 billion in assets under management and have a solid 5-year or longer track record of performance.

A 1% fee on $1 billion generates $10 million a year in revenue to pay the portfolio manager, analysts, office rent, marketing, other operating expenses, and the overall company.

But most of these actively run funds are charging less now (~0.5%) due to the proliferation of index funds. Companies such as BlackRock, Fidelity, Wellington, T.Rowe. Price, Capital, PIMCO, Prudential, Nuveen, Invesco, Janus, AXA, Legg Mason, TIAA-CREF and many more all have portfolio managers and some analysts who earn over $1 million a year.

What's amazing about being an active portfolio manager is that even if your fund underperforms, so long as you have a large enough AUM, you will still likely get paid over a million dollars a year.

Principal/ General Partner, Venture Capital

Just like all the other money management industries, there are good venture capital firms and there are bucket shops. The largest venture capital firms like Benchmark, Sequoia, and Kleiner Perkins pay their General Partners multi-million dollars a year. This is especially true if one of their investments has a huge exit such as when Whatsapp sold to Facebook for $19 billion in stock and cash.

I consider being a VC one of the best vacation jobs or trust fund jobs in the world because you don't have to build anything, you get to earn a nice salary with carry, and you don't have to prove your investment returns for years given the normal 5-10 year lockup periods for funds.

By the time your limited partners discover you've made terrible investments, you'll have earned a lot of money and moved on to a new VC or started a new fund within the firm.

- Analyst $ 80K – $ 150K

- Associate $ 130K – $ 250K

- Vice Presidents $ 200K – $ 250K + $ 0-1MM carry bonus

- Principal/Junior MD $ 500K – $ 700K + $ 1-2 MM carry bonus

- Managing Directors/Partners $ 1MM + $ 3-10MM carry bonus

Invest In Venture Capital

Investing in venture capital is a way to find private growth companies way before they go public. If you can invest in the next google, Facebook, Tesla, and more, you could easily make over one million a year. Every rich person I know invests in venture capital or owns a business. You might as well consider doing the same with a minority percentage of your ivnestable assets.

To invest in private growth businesses, check out the Innovation Fund. It invests in the following five sectors:

- Artificial Intelligence & Machine Learning

- Modern Data Infrastructure

- Development Operations (DevOps)

- Financial Technology (FinTech)

- Real Estate & Property Technology (PropTech)

Roughly 35% of the Innovation Fund is invested in artificial intelligence, which I'm extremely bullish about. In 20 years, I don't want my kids wondering why I didn't invest in AI or work in AI!

The investment minimum is also only $10 while most venture capital funds have a $250,000+ minimum. You can see what the Innovation Fund is holding before deciding to invest and how much.

Partner, Big Law

Big law partners regularly earn over $1 million a year. The starting salary for big law first-year associates is around $190,000. By their 8th year (34-35 years old), their salaries will have risen to around $330,000. The funny thing about big law is that everybody up to the 8th year all get paid pretty much the same across all firms.

Bonuses are nothing to write home about, often ranging between 0% – 20% of salary. Therefore, in order to make over one million dollars in law, you need to become a partner where you're bringing in business and earning a percentage of profits.

Strategy Consulting, Partner

Firms like McKinsey, Bain, and BCG are some of the top strategy/management consulting firms. But to get to partner and $1,000,000+ generally takes about 10 years after business school, and only a few make it that far. Many will either burn out or go join a client for less pay.

Here's the salary progression for a typical strategy consultant.

First-year out of undergrad:

- Base: $85k

- Signing Bonus: ~$5k

- Performance Bonus: up to ~$20k

First year out of MBA:

- Base: ~$165k

- Signing Bonus: ~$25k

- Performance Bonus: up to ~$65k

Manager/Project Leader (2-3 years out of MBA):

- Base: $200-220k

- Bonus: $100-140k

Associate Principal/Senior Project Leader (4-5 years out of MBA):

- Base: $250-320k

- Bonus: $130-230k

Junior Partner/Principal (6-8 years out of MBA):

- Base: $350-450k

- Bonus: $350-550k

Senior Partner/Director (10+ years out of MBA):

- Base: $450-650k

- Bonus: $500k+ (all-in, senior partners at top firms usually make $1M+; top partners can make $4-5M while ultra-performers can make more)

Division I Football Coaches

The average salary of a Division I football coach is roughly $1.8 million. It is the football coach that is often the highest paid state employee.

In 2021, LSU head coach Ed Orgeron is expected to earn $8.7 million and football likely isn't going to even be played. Not bad! In 2023, Lincoln Riley at USC and Nick Sabin from Alabama are expected to earn $10 million a year.

Public Company C-Level Executive

Don't let $1 salaries fool you. C-level executives are often paid mostly in stock compensation. The theory is to tie compensation to performance. They simply end up getting way more stock than anybody at the firm.

For example, Dara Khosrowshahi, CEO of Uber, reportedly got a $200+ million package to join Uber. Yet, Uber has seriously underperformed since he's joined. Shareholders have made no money in Uber since 2015. Yet, the CEO still gets paid massively. Got to love it!

Google CEO Sundar Pichai has a base salary of around $650,000, but got a stock grant worth $199 million in 2016. In 2023, Pichai still makes over $100 million a year thanks to stock grants, even though Google's stock has tanked since 2022. The median CEO pay for the top 100 largest companies is over $16 million.

But you don't even have to be a public company c-level executive to make $1 million or more a year. You can be a Vice President at Apple, Facebook, Walmart, P&G, or any of the giants. You will more than likely make over $1 million a year if you include your stock compensation.

Self-Help Gurus Easily Make Over $1 Million A Year

The self-help industry is estimated to be worth more than $12 billion dollars. It's also growing because we're all jockeying to make more money and gain more prestige. The self-help industry is also considered recession-proof since even more people are looking to get out of the muck during downturns.

Folks like Tony Robbins make millions selling $10,000 self-help seminar tickets. His net worth is estimated at $500 million.

TV personality Dr. Phil wrote a bestseller on how to lose weight and eat right, despite he himself being overweight. Then there are guys like James Altucher whose company generated over $11 million in sales selling himself as a cryptocurrency genius in order to sell his courses online.

There are self-help gurus who sell $2,000+ e-courses on information you can get for free make over $1 million a year. They are taking advantage of vulnerable people and their securities to make lots of money. If they were really there to help people, they will come out with a more affordable solution, like a book.

Whether you succeed or fail, these people will always succeed because people are always feeling bad about themselves in this ultra-competitive world.

Professional Athletes Make Over $1 Million

They make great money, but their longevity isn't very long. One estimate says that if you are able to finish every professional golf tournament at par, you will average $1 million a year in earnings.

Based on the current 2023 cap estimate, next year’s NBA rookie minimum salary will surpass the $1MM threshold for the first time, while the minimum for a veteran with 10+ years of service will approach $3MM

The average NBA player will make ~$25 million during his career. This is based on an average annual salary of $5.2 million and a career length of 4.8 years.

In comparison, the average NFL player will make only $6.5 million due to a lower average salary of around $2 million a year and a shorter average career length of just 3.3 years. Elsewhere, the average MLB player earns about $3.3 million annually, while the average NHL player earns about $2.5 million.

Tennis star, Roger Federer is reported to have made over $100 million in 2021 due to a tremendous portfolio of endorsement deals. Too bad it looks like he's retiring after getting a second knee surgery in 2021. Federer said he wants to give Wimbledon one more try in 2023.

Entertainers Make Over $1 Million

From actors, to musicians, to reality stars, being an entertainer today can be extremely lucrative. No wonder why so many people want to be famous! I thought Judge Judy's salary was only $47 million a year. But according to Forbes below, she took in $147 million in 2018.

Everybody wants to become a YouTube star nowadays with top earners who look like everyday folk earning $10 – $15 million a year. My favorite is Ryan Toys Review, a six year old who pulled down $11 million in 2017 and supposedly over $20 million in 2019.

Streaming giants like Netflix and Amazon doled out $300 million to stars, including Ryan Reynolds (No. 18 on Forbes, $71.5 million), Billie Eilish (No. 43, $53 million) and Jerry Seinfeld (No. 46, $51 million).

Podcasters are making big bucks as well. Bill Simmons (No.13 on Forbes, $82.5 million), sold his podcast company The Ringer to Spotify in February 2020 for $206 million. Joe Rogan agreed to a licensing deal with Spotify for more than $100 million in May 2019.

Hamilton creator and star Lin-Manuel Miranda (No. 62 on Forbes, $45.5 million), made bank when in February 2020, Walt Disney paid $75 million for the rights to air the filmed version of his Founding Father musical.

It was also recently reported that Kim Kardashian is now a billionaire. Not bad!

Doctors Who Own Their Practices Are Top 0.1% Income-Earners

Due to popular demand, I've added doctors to the list. I didn't include them in the beginning due to the enormous cost and time it takes to become a doctor compared to their compensation. Pay has actually been falling for doctors due to many factors, including: government intervention, private practice consolidation by hospitals, rising insurance costs, and more.

Orthopedists top the list with annual average compensation of $443,000, taking into account salary, bonus, and profit-sharing contributions, according to Medscape’s physician compensation report.

Cardiologists and dermatologists come in second and third for earnings, earning $410,000 and $381,000, respectively. The lowest earning doctors are pediatricians, which bring in about $204,000 annually.

In order to make over $1,000,000 a year as a doctor, you need to be a partner in your own private practice and have a great source of recurring clients. I personally think doctors are very underpaid for how much value the provide to society. Teachers too.

Online Entrepreneurs / Bloggers Can Easily Make 7-Figures A Year

Blogging is my favorite business in the world. You can simply write whatever is on your mind and advertisers will pay you, not your readers. Since you give away your product for free, there are no returns, no customer support, and no obligations to your customers. There is only freedom baby!

Once you build a brand and can generate organic traffic of over one million pageviews a month, there's a decent chance you could make $1 million in revenue a year. Here's a sample income report from a personal finance blogger.

There are plenty of online entrepreneurs who are generating a tremendous amount of cash. They are in e-commerce, SAAS, and info product space.

As we've learned from the lockdowns in 2020 and 2021, an online business is even more valuable that before, all things being equal, because its earnings are more defensive. When you can't shut down an online business, its valuation clearly goes up relative to other business that are at risk of being shut down.

You'll definitely be surprised at how much some bloggers are making for a living. It's much more than you think!

Techies Can Make Over $1 million

Back in 2000, many college graduates pursued investment banking and strategy consulting jobs. Today, these same graduates are all clamoring into tech.

Big tech companies like Google, Facebook, and Apple are able to pay the most. They are the most profitable and have the largest market caps. Apple has a market cap of over $3 trillion. They have a bottomless pit of money.

However, you won't be making over one million dollars a year at a tech company until you start getting into management roles. Engineers easily make between $200,000 – $500,000 all-in. First year software engineers out of college are making $180,000+ nowadays.

Restricted Stock Units (RSUs) Plus Salary Can Equal $1+ Million A Year

If you get incredibly lucky, your company's share price might allow you to clear $1 million if you sell some RSUs along with your salary.

For example, let's say you got a $400,000 Google RSU package and a $350,000 salary. You get to sell 1/4th of your RSUs each year. Google's share price would have to increase by 6.5X for your $100,000 annual RSU payment to turn into $650,000 for you to clear $1 million.

The artificial intelligence space is booming. Engineers at OpenAI, Anthropic, Databricks, and other private AI companies are earning more than $1 million a year easy.

I believe AI is the key technology of the future, which is why I'm investing in AI through Fundrise. Fundrise has an open-ended venture capital product that invests in some of the top AI companies today. So far I've invested $170,000 and plan to increase that investment to $250,000 in Fundrise venture.

Below is a snapshot of median pay at some big tech companies like Google, Facebook, and Twitter. $250,000 is a high median pay at Google. However, it's not one million dollars a year.

After a robust 2023 and 2024, there are even more techie making more than one million a year. The equity gains have been massive since the pandemic began!

Mom & Pop Small Business Owners Can Earn Big Cash

There are over 30 million small business owners in America. Potentially up to 9% of these small businesses have sales of over $1 million. But as every small business owner knows, sales does not equal operating profit. Therefore, I estimate only about 1% of small business owners, or 300,000 earn more than $1 million in operating profit a year.

Some of my favorite small business types that have surprised me in terms of earnings. These small businesses include laundromats and real estate empire builders. Of course, online small business owners are still the best, especially in this environment.

Stock & Crypto Speculators

2021 reminded us that stock speculators can make a million dollars a year. It was crazy how much stocks like Gamestop, AMC and more went up thanks to huge shot squeezes. Meme stocks were going bonkers for a while.

In the long run, however, it's hard to make consistent returns day trading and speculating on individual stocks. I don't recommend going on margin and actively trading stocks for the long run. But you can hit it big once in a while.

2022 was a year that cryptocurrencies and growth stocks came back down to Earth. A bear market is always a good reminder to properly asset allocate and have the proper risk exposure.

In case you're curious, here's how I'd invest $250,000 in a bear market. Bear markets created opportunities to build top 0.1% wealth. I certainly plan to take advantage for my kids' sake.

Easiest Way To Make Million Dollar A Year Dream

The easiest way to make $1 million a year or more is as a public company non-founding CEO or senior executive. The compensation is outrageously high for what they do. CEOs have huge teams who do most of the work for them.

A CEO is really just an ambassador of the firm. He or she tries to drum up positive PR and business development deals. They sign off on decisions that have already been carefully vetted. They neither invent new ideas or get in the weeds.

Hardest Way To Make $1 Million A Year

The hardest way to make $1 million a year or more is in a profession that relies mostly on individual performance. If you remove the CEO, the company will still run fine. The stock might even go up.

As a professional tennis player, nobody is going to win a match for you. If you are a fund manager, you're either outperforming your respective index or you aren't. As a professional blogger, you're either going to come up with interesting content that gets shared or suffer in purgatory.

As a professional writer, you need to earn a massive book advance to make over $1 million a year. I wrote a Wall Street Journal Bestseller and it's not enough to earn a million a year, only six figures.

Despite the difficulty of making over one million dollars as an individual performer, there is also a fantastic non-monetary upside. Individual performers get the most satisfaction.

Building something from nothing is more rewarding than jumping on an already established business. Working incredibly hard on your craft and then winning feels amazing.

I don't have to tell you that earning $1 million a year is difficult. That's $83,333 a month in income or operating profit. Even if you do get to such a milestone, it may be harder to stay there over the long-term due to competitive forces that will eat away at your product or services.

Something Things In Common For Top 0.1% Income Earners

From this article, hopefully you agree that making a top 0.1% income is possible in many ways. There are probably over one hundred ways to make more than $1 million a year. But here are some things people who earn a top 0.1% income have income.

- Highly educated

- Tremendous desire

- Grit and determination

- Personability

- Expertise, experience, and credibility

- Have a strong network

- Takes calculated risks

- Luck

You don't have to attend an Ivy League school or the likes to earn a top income. In fact, the median income for Ivy League graduates by age doesn't come close to a top 0.1% income.

However, the more education and the better education you have, and the longer you grind, the greater your chances of making over a million a year.

Never Take Your Luck For Granted

I've said it before and I'll say it again. Your extraordinary wealth is mostly due to luck. Plenty of people make the right decisions and work hard every day. Yet 99.9% do not make over $1 million a year. 99% of Americans do not have a net worth over over $10 million a year.

Never assume you'll make $1 million again the next year. Instead, it’s best to mentally rest to zero so you don’t rest on your laurels. If possible, figure out a way to build a brand around yourself or your business to protect or expand your earning power.

Always work on improving your craft because eventually, you will become irrelevant. When that time comes, however, you already will have saved up a lovely nest egg to support you for the rest of your life in peace.

Remember, you only need to get rich once! Once you get rich, make sure you stay there by protecting your capital.

Recommendations For Getting Rich

It's hard to regularly make over $1 million a year. Sooner or later, your luck and energy may run out. As a result, it's important to save and invest your cash flow aggressively. Ideally, you want your money to work for you so you don't have to forever.

Here are my recommendations for how to invest your money to build more passive investment income.

1) Invest In Real Estate

Every single wealthy person I know has invested in real estate in some form or another. Real estate is a real asset that tends to hold its value and generate valuable rental income. Real estate also benefits from inflation.

Check out Fundrise and CrowdStreet, my favorite private real estate platforms. They enable you to invest in real estate across the country. I've personally invested $954,000 in private real estate funds since 2016.

Fundrise focuses on diversified private eREITs to help you earn income 100% passively. The funds invest mostly in Sunbelt single-family and multifamily homes where valuations are cheaper and yields are higher. For most people, investing in a diversified real estate fund is the way to go.

CrowdStreet focuses on individual commercial real estate deals in 18-hour cities where valuations tend to be lower and cap rats higher. If you have a lot of capital, you can build your own select fund.

Real estate accounts for roughly $150,000 out of my estimated $300,000 in annual passive income. Thanks to technology and the pandemic, the work from home trend is here to stay. Both platforms are long-time sponsors and I've invested over $300,000+ in Fundrise so far.

3) Invest In Private Growth Companies

The richest people in the world are business owners. Therefore, you should consider starting your business and investing in private businesses as well.

You can invest in private growth companies through Fundrise Venture. This way, you've got high-quality private growth company exposure, as private companies stay private for longer. As a result, private investors are gaining more of th upside.

Fundrise venture invests in artificial intelligence, fintech, proptech, and more. Unlike traditional venture funds that are invite only with $200,000+ minimums, you can invest in Fundrise Venture with as little as $10.

Fundrise is a long-time sponsor of Financial Samurai and Financial Samurai has over $290,000 invested with Fundrise so far.

3) Stay On Top Of Your Money

Sign up for Empower, the web’s #1 free wealth management tool to get a better handle on your finances. Remember, it's not so much how much you make, but how much you keep. Run your investments through their award-winning Investment Checkup tool to see exactly how much you are paying in fees.

Then make sure you run your financials through its Retirement Planner to make sure your financial future is on track. There's no rewind button on the road to financial freedom. Best get it right the first time!

Who Makes A Million Dollars A Year is a Financial Samurai original post. I've been writing about personal finance since 2009. Join 60,000+ others and sign up for my free weekly newsletter if you want to learn more ways to become a multi-millionaire.

The federal long-term capital gains tax has nothing to do with the federal taxes imposed on a person’s income or salary. It won’t affect your federal taxes due on income. It only affects assets you dispose of at a profit that were held more than a year. They are two entirely different taxes and only tangentially related. You’ve made it sound as though anyone making more than X dollars would owe more income taxes if the Biden admin upps the fed LTCGT rates. Not true.

Yes, income versus assets. But feel free to do the math on what your long-term capital gains tax rate is once you cross a certain income threshold. The LTCGT rate goes up.

If you’ve been making a top income and paying a top marginal income tax rate and NOT paying a top LTCGT rate, then you might have to file amendments to your prior tax returns.

See: Short-Term And Long-Term Capital Gains Tax Rates By Income

Would love to talk about deal you invest in via CrowdStreet and FundRise. We raise money for our PE Multifamily deals via other sites, and would like to understand why you trust those other platforms.

I have a family member who owns a small law firm with about 10 attorneys. He brings home about $1 million, which is the profit. He used to invest 100% of the profit back into the firm religiously, then one day he decided to stop investing back into the firm and take home the profit. Took him over 25 years to get to that point.

That’s impressive, reinvesting back in your business so aggressively.

But he owns the firm and can probably sell the firm for a handsome sum?

Thank you, yes he’s an impressive induvial. The reinvesting/growing years was very difficult on the family, so I am proud of him for getting to this point.

We believe it is in the ballpark of $3-$5 million, but that is an unprofessional estimate. There are several issues holding down the value of the firm like employee turnover, poor operations process, reliant on the owner and a few key employees to stay consistent.

CRE investment sales brokers can make over $1m per year if they are some of the top performers in their market. The very best in big markets can clear $5m in some years.

Real estate developers also tend to make a lot of money in the long run, and can fairly easily make over $1m on average doing their own deals ir making partner at a big development shop.

Hey Tony, I agree. Im a real estate developer in Australia. I make over $1m net profit per year but it has taken 7 years to get to this point. It becomes easier. The more track record you have with deals the more investor capital becomes available. I also know a lot of people that loose big time in development. Patience in finding the right project is the key.

High paying entertainment jobs are the best because it’s all cash. Where I work, on-air talent, directors, producers, and writers make anywhere from $1 million to $30 million; cold hard cash. They are on contract so the money is guaranteed for a number of years with significant built in increases annually. If the company decides to let them go, they get to sit at home and collect the remaining pay without working. That’s better than a CEO whose package is reliant on a vesting schedule with no guarantee those stock options will appreciate.

If you are shy and don’t want fame, that’s fine. A Line Producer at a late night talk show nets a $1 million starting salary. Booking producers, talent agents, production directors are also in the seven figure club. These roles are numerous in the industry now that content production is ramping up between streaming and linear television, so you’re pretty much guaranteed to get another of these above-the-line job anywhere after one show wraps up. And if you land on a franchise show such as SNL or Good Morning America, you are set for life.

Pretty impressive! Thanks for sharing income insights in the entertainment industry. Making $1 million a year as a line producer ain’t so bad at all.

Accounts at BIG 4. Average salary of a partner is about a million dollars. It takes between 10-15 years to get there. Hours a heavy but far less than IB and a much more sustainable lifestyle. My partner currently makes 1.9 million dollars. Not a big gig if you ask me

$1.9 million a year ain’t so bad after 15 years of working out of college I presume. 37 years old!

I’d take it. Alas, I quit the big money a while ago and I’m fine with it.

I hate this term, “mom and pop” business owners because it’s so condescending to people who own and operate small businesses.

The legal definition of a small business is any business in the USA with revenue under $50 million and less than 250 employees.

We meet those requirements but our highest year of revenue was $40 million! We had 220 employees that year, and could have more but then we wouldn’t get the special “small business” tax treatment.

Just something to keep in mind – private businesses are AWESOME for their owners and many of them are EXPERTS at what they do!

We don’t all run unprofitable coffee shops barely paying rent or keeping the lights on. We do everything professionally and know how the business operates, know how to keep solid financial records, and leverage every type of technology available to us (even in offline “old” industries).

Hey sam,

You didn’t mention Sales at all. Sales folks also make millions a year.

Indeed. Everything is sales though. People just don’t know it.

Im a 15 year old kid and basically I want to go into robotics engineering and my future goal is to have a nice house and own a Lamborghini Huracan or some sort but every thing I read doesn’t really help me nor my confidence in success. I also wanted to start making money on sites and have money mailed to my home so I could stack up for myself and eventually deposit all of it in my bank account when I get one but that is looking quite dull as well.

You have to think out of the box for earning over 1 million. Getting a job, and working there till you catch the top spot and earning millions is not the only solution. Lots of people are earning millions of dollars a year working on things they love to do. Some Bloggers, vloggers, writers, self published authors are earning many millions every year.

There are plenty of people in sports and entertainment making 1 million per year at least. Actors apart of SAG can earn anywhere between 2-3k per day of filming and if that show goes for 6-9 months, you can definitely make 1 million.

Love reading the comments. The only thing I haven’t read is how hard all these professions are if you are a woman with kids. You’ll probably be looked down as you cannot put on the long hours, and will be continued challenged to choose between your career and your kids. Sorry guys, but luck and being a man are still a plus to make large figures.

So very true!

The question should be how many woman actually want that career vs kids, majority of the time once you hit your 30s you will choose the kids because the career is not worth it. These jobs require intense 80+ hrs a week, it’s not like these men are at their desk with their feet on it all day doing nothing. Most of the high caliber career women are married to these men and can afford to leave their jobs to raise their kids vs a nanny doing it for them

The point is men don’t have to choose and therein lies the problem. Your post reeks of fragile man syndrome!

J are you anti happiness? Do you dislike women and want women to be non aware? The fella above is telling statistical truths with zero rancors unlike you.

If your upset men do not carry babies then who are you made at? Evolution? God? The Big Bang?

Are you also made at gravity? And make your dog eat only vegetables and your cat to eat seaweed?

Anyway, go make a million and show the world love.

Investment requires dedication, intelligence and sacrifices… not gender or sex.

Why choose between kids and huge earnings? Have kids super young, earn the rest of your life afterwards via entrepreneurship.

Simple, I’ve solved your problem, or at least the magority problem.

Why can’t a woman from 40 years old to 80 years old kill it out there? Duh, of coarse she can.

She can have kids 20-40, then earn all in 40-80. Clearly this is logical, but what’s not is mixing this all at the same time and poor future planning and excepting others input that negates your biological nature.

Meaning you went to parties, school, and basic jobs career stuff till 30, then often hit a feeling of wanting kids.

Okay.

I want my IRA to be huge but I did start on that till I was 40+ so it’s not fair? Or is it fact?

I can make money in other ways… you can have kids in other ways… cus it’s about giving love and so forth, raising n growing life…

You can always do that. The first thing is to count your blessing and wins and that includes your sex / gender advantage… regardless of what that sex gender is… you always have a advantage in some way.

Are you short, smaller person? You have a advantage… you eat less. Are you taller and bigger? You have more physical power and seen more.

Any advantage is a disadvantage. The bigger taller people get picked on more cus “they can take it b.s. reasons to abuse others”… the smaller people tend to make less cus people look down on the due to geoPsycho (psychological perceptions based on physical positioning), taller people tend to make more money.

These are all advantages n disadvantages. The 1% difference is to use your self to be the best with all your plus minuses.

THINK. BELIEVE. WHY YES, you can make your dream come true? Stop following others dreams. Forgive yourself. Focus on you. Your legit dream. Then gain that. There is always a creative solution available when you focus well enough to be your unique self. WAKE UP :-) it’s free, but it’s not free mentally… you’ll need to work your spirit n brain like never before. It’s do able. Stop being scared, start being faithful too all winning solutions. Get your authentic dreams. Clearly Simple.

I would add one more to this list, one that I’ve been fortunate enough to accomplish: leveraged sales. Meaning real estate, tech reseller, etc. These jobs are not salary based, and most who try fail. Those that succeed understand that their successes over time can build upon themselves as you’re not dinged by “quota creep” as most other sales jobs are (no cap on income). Because of this, if you hustle, work efficiently, cultivate good relationships and get lucky, seven figure W2s are absolutely possible.

Basically all of these jobs are in finance. I guess the closer you are to the money the more money you make.

Sam, I’m very surprised that tech didn’t make it on here! Almost all my friends (now that I’ve relocated to the Bay Area) are either barely getting by in non-tech jobs (education, care, civil service, etc) and qualify as low-income in SF/San Mateo County, or clearing $300k+ in total compensation as SWEs, data scientists, TPMs, etc. – not VPs or directors or anything; just individual contributor roles.

For reference, we all graduated 3-4 years ago, so these are 25-26 year olds.

Was there a reason big tech wasn’t included? It actually seems like the only path to a financially independent life. Or maybe I’ve spent too much time in the Bay Area ;)

Ah, but they are not clearing $1 million! This post explores those who make one million dollars or more. $300K is great, but they need a huge surge in stock to get to $1 million a year.

Check out the section on Techies.

L8+ clear $1m+ at Google

Cool. How long does it take to get to L8 after undergrad and what does the compensation breakdown look like?

At least 10-12 years for absolute rockstars, more like 15+ for most. Many don’t get to L8. ~250-400k base, 30% bonus, rest stock. Sales has an incentive component.

https://www.levels.fyi/charts.html has pretty accurate info on tech compensation. As a software engineer, Facebook L7+, Google L8+, or the equivalent level at tier-1 tech companies can clear 1M. As an engineering manager, that’s generally the director level.

Yep, recently discovered it. Amazing data! Thanks

Big tech folks are clearing 1M+ at director level roles or at a levels or two below that because of recent stock appreciation, but I think very few people are doing to make it level. Definitely sounds less likely than consulting – but in tech it’s definitely less than 1/30 who would reach those levels.

Not a bad route overall though, I got 400-450k this year as an individual contributor because of stock growth and another 400k through capital gains through accumulated investments up till now – I am 29 years old.

Another way to get it is by joining smaller companies pre-IPO and reaping the rewards once they go public – one of my friends who joined Snowflake recently is probably making close to a mill for the next few years after it went public.

Mid-career primary care physician (family of 4) with gross income comfortably 7 figures, net worth comfortably 8 figures. Business owner, employing other providers and providing a wide array of ancillary services – imaging, cosmetics, diagnostics, pharmaceutical, etc. Averaging 15-20% annual growth. Commercial real estate landlord. Personal expenses under 20% of gross income (LCOL, no state income tax so geographically arbitraged), rest gets invested.

Debt free. With an 8 figure NW, investment appreciation probably another 7 figures annually as long as it’s at least 5-10% annually which is not that difficult.

Never expected to be here. Just happened while focused on the highest quality services we can provide. If I can, anybody can with the will and some grit.

Why do you mention online entrepreneurs without offline? Virtually any business owner can make this much if the business is sufficiently large. Ironically, construction and anything industrial-related can easily top $1M in profit per year, especially in oil-rich parts of the USA. Then of course there are private businesses in niches like retail, shipping, etc, real estate, any professional services (not just doctors)…

Offline businesses can definitely make a good amount of money, however, after the forced lockdowns in 2020, I’m encouraging folks to focus more on building an online business.

When you can’t shutdown an online business, an online business and its income stream becomes much more valuable.

Curious why you didn’t mention dentists? My first job out of residency I was comfortably making mid 6 figures then one year in I purchased a practice and grew it 20+%/year. 4 years in I was clearing comfortable 7 figures gross on a 4 day work week. No gimmicks just plain hard work, time and a little sacrifice

What kind of dentist are you? Mid-6 figures as in ~$500k? I’m going the periodontist route and just wondering if it’s worth it

Can’t speak for Perio, but probably similar to any dental specialty. Ortho here and can say yes, it’s worth it. Just remember, posted incomes are normally W-2 salaries and don’t account for the S-corp dividends (~75% earnings). Have to be in private practice (not corporate associate) to also take advantage of tax breaks and own your office building.

You forgot online entrepreneurs. I started my main current online business a bit over 5 years ago with literally $200 and this year I will be netting over 1M not counting my other businesses or investment income. However, I should say that I first started in eCommerce in 2000 so I already had knowledge. I am in my late 40s now and this is most likely the last business for me as I don’t see much point in developing others. Money that I make from now on is basically money I won’t be spending myself and if you leave too much for the next generation, you might be doing more harm than good. My goal in life and much of my identity was tied to my financial progress but now that I have achieved everything I set out to save, buy or do, my next big and ultimate goal is to delegate as much of my work as possible and work no more than 5 hours per week. It’s time to relax and enjoy.

True, and online business is great, especially since I cannot be shut down as easily!

Did you notice your anti self help industry bias Mr Samurai?

At the end of many sections on different careers you spoke well of them reguardless of their merit in the world.

On the self help area you called into question if these leaders really want to help when things are free they charge $2,000 a coarse.

Can you clarify two things for me?

1- why celebrate the other paths with comments that are crass, I trust you can review your work and catch your own final lines…

2- why omit the fact that in these courses people are being supported during times of shaky self change as well as motivated to succeed because they made a sacrificial investment.

For example I went to a Tony Robbins seminar, and changed my health radically in 3 months, a benefit that lasted me almost 10 years.

I spent a months salary on what??? Ideas that were free?

I won’t lol you Mr Samurai, but like most Samurai… us Ninjas are hard to deal with, and come at you on your blind sides… hence stealth and specific elimination skill, not general power of the Samurai.

So please help me learn why you reserve such subtle content for the industry that changes lives specifically but you hail VC’s are awesome because they can abuse their position, move on in failure… and it’s all good.

Thank see no equality in your grading system Mr Samurai and hope to learn where I mis read you? Thanks for helping me understand you, if I don’t already.

If I’m right, and this is a small biases, maybe you can make a change, forgive yourself, and move onto more positive thought leaderships?

I appreciate you for being open to my comment and while I’m a little miffed, your a strong person for responding in awareness. Thank You and I bow deeply and lowly to you ;-)

“For example I went to a Tony Robbins seminar, and changed my health radically in 3 months, a benefit that lasted me almost 10 years.” Wonderful! And congrats. If the thousands of dollars you spent to attend the self-help seminar change your life for the better, then it’s worth it. Don’t let me tell you otherwise.

I’m hoping by $27 retail price book, Buy This, Not That: How To Spend Your Way To Wealth And Freedom will provide even more value. I hope you pick up a hard copy!

Regarding VCs, it is one of the best vacation jobs in the world. You can’t paid well, don’t have to take risks, and if your fund loses money, you still get paid. In other words, I’m being facetious.

Hi Rick,

What type of online business are you in? I’ve been looking for e-commerce idea to help grow my income. Do you have any tips or ideas you can share? also if you are still looking for people to delegate some of your work, I could be of assistance.

Thanks,

M

I sell niche products online. If you are planning to do online retail, the best is to find a niche where there isn’t as much competition. Also, avoid products that compete on price. The best are the ones where there is some sort of value-added intangible that you can create.

Funny, most of the jobs add very little to society, and you could easily make the arguement that many prevent us doing the right things to move society forward. I’m looking at you investment/money management industry.

If there was no investment / money management industry, then:

– Few new companies would get funded. There would probably be no cell phones, computers, solar panels, electric cars, electronic banking, etc.

– Existing companies would have difficulty growing. Far fewer medicines, movies, theme parks, airplanes, etc.

– New construction would be slow to occur: housing, restaurants, office building, schools, hospitals, etc.

– People would have much less money saved for retirement: they would have to work longer and retire with less comfort and enjoyment.

I don’t work in this industry. I own a small business that has steadily grown to 16 employees because I could borrow money.

Most of these jobs are very stressful. Most important thing is that you enjoy what you are doing. Blogging seems like a great option to me!

If you look at some of the houses for sale in California on Zillow and how it breaks it down by estimated monthly payment, you would definitely need to be earning around $12 million a year if you plan on putting 10% down, making payments, accounting for taxes/insurance, and following the 1/3 or ~25% of your income to housing schematic. There are houses that cost more than $40-50 million for sale along with what I think a rather high number of expensive homes. Definitely more than the people on the Forbes list up there.

I cannot imagine how anyone can afford the $25,000,000.00+ homes for sale around Lake Tahoe, in Nevada. I figure the monthly mortgage alone would be around 100K+ and what profession pays THAT kind of guaranteed money over a 30 year period that doesn’t have crime involved?

Well Joey, they do, or the houses wouldn’t exist. And no, crime is not the most profitable career track, I hate to break it to you. Jeff Bezos made over $100 billion completely legally.

I strongly doubt that Bezos, or any other billionaires in the world, made their mind-blowing fortunes in legal and ethical ways. Elected politicians (and unelected politicians, too, worldwide) help them hugely and unethically through legislation….while the real needs of societies at large are completely disregarded by politicians.

In the year I sold my business I made several multiples of $1m but it didn’t change anything for me, other than a significantly reduced level of stress!

It also feels good to know I am ‘FI’ and could ‘RE’ if I wanted to. Currently I enjoy what I do and it gives me purpose.

Maybe I will find another outlet for my energy but I am still well incentivised and treated well by my new corporate overlords ;)

-Sterling

Tripe.

CEO position is more taxing than most, you’re essentially the custondian of millions/billions and have the stress on thousands of employees to care for.

Anything individual is relatively easier.

Managing funds

Consultant partner (very long hrs much less relative stress)

Owning half decent small-mid-tier business

Best option is to have 50M in the family book allocated to you.

Agreed. I work closely with my CEO. As the CEO, the hours are long, EVERYTHING is your responsibility, and something big is wrong every single day — usually multiple big things are wrong. Yes, the CEO can delegate nearly everything, but the ultimate responsibility is still theirs, and believe me, they feel that. The stress is enormous.

Thinking the CEO does little is as ignorant as saying that it’s easy to be a good blogger and produce high quality content everyday. Blogging is hard and being a public-company CEO is far, far harder.

Hey, Sam.

Call UC Berkeley. Find one of those professors who makes $1 million/yr, tax-free (due to treaty) teaching in Saudi Arabia. Multi-year contract. Check the sciences. Would be an interesting interview.

Have you ever lived in Saudi Arabia? I would divorce my husband on the spot, money is not worth it.

My wife and I started off like many college grads with average pay and jobs that we didn’t love. By the time we were in our late 30’s we had both found careers that we enjoyed and were disciplined enough to save about 30-40% of our gross income, tough to do when 30% plus is going to taxes.

30 years after college graduation I’m now retired and my wife is still working only because she loves her career and we have one teenager still at home. The interesting thing is, when you are younger and don’t often love your career, you’d love to quit working if only you could afford it. When you are older you might find that you love your career and you don’t want to stop working, especially if you have teenagers still living with you that you wouldn’t see anyway between the hours of 7:00 am and 5:00 pm. My wife love her career and doesn’t want to retire until our 3rd child is off to college. I on the other hand, found it very easy to retire and stay busy with all my outdoor activities and spending time with our teenager.

Our passive income is now 7 figures and until a couple years ago when we finally bought a couple expensive vehicles and a boat, nobody would have known that our income puts us solidly in the .01%.

I made a typo in the last sentence. We are solidly in the top 0.1% of income earners but not yet in the top .01%, which in the United States would require an annual income above $8.5 million.

I’d imagine those w passive income over 1mm are much more rare

My path to 1 mil+. I never graduated college, I started working in IT as a consultant, then joined a bunch of Wall Street firms (some with us, some no longer). I transitioned back and forth between salaried and being a con man, I peaked at about $300K per annum (salary + bonus).

I am now a Director at a Fortune 50, in my early 40’s, pulling in 400K combined base/incentive comp (55 hours per week on avg), but also have two businesses on the side that I started 8 years ago. These businesses have steadily been increasing in revenue and now bring in 900K to 1.2 mil per annum for the last 3 years.

Wife (doesn’t work), 2 dogs, 2 kids.

The biggest life lesson is to be aggressive when young and forecast your future goal of retirement. Years and life go by quickly.

Save early, bet big and don’t regret.

I lost 15K in my first year “investing” with a broker and then learned to play the market and made big wins.

I walked into job interviews with confidence, clearly lacking the educational background of others but with the ability to look at others in their eyes and articulate why they would want me on their team.

Moral is… Life is a gamble, with luck but most importantly, being just a bit smarter than your competition (shockingly easy).

I actually envy those born to this new generation. The new generation’s work ethic is so clearly different now, that the all-stars are actually average but look like all-stars compared to everyone else.

Amazing career! What are your two side businesses? I imagine if you have a FT job they must be running on autopilot!

I can comment on individuals in the healthcare field. If you are making 1Mill/year, you are not practicing you are selling medicine. You have crossed over an ethical line to serve the public. Every MD I know works their asses off for decades, many times with 50-80hr work weeks, and starting 1mill in debt from school/practice loans. The key IMO is saving/investing. Balance, family, the long haul. My work week in my practice is M-Th 8-4, and I will enjoy working until age 70? My investable assets 4-5 mill. but it took 25 years.

The “quick kill” to a mill, then retire. I don’t get that, unless you are very unhappy with what you do.

Don’t see trader,( currency, options, stock etc) on that list. Based on anecdotal evidence I believe quite a few of them qualify.