Driving an old beater car can make you a lot of money. As a car fanatic who has owned beater cars and luxury cars, let me explain.

After writing, Never Buy A New Car In Its First Year Of Redesign, a reader commented that he netted about $17,500 in reimbursements from driving his 2002 economy car roughly 35,000 miles. At first, I thought there was no way he could receive reimbursements more than the value of his car. Gotta be a loophole!

So like any good Financial Samurai, I decided to get to the bottom of this strange situation with some tax analysis and research. If you have a car, a business, a job that requires travel, or simply love to drive, this post is for you.

Your Old Beater Car As A Money Maker Or Tax Saver

The most screwed up thing about our tax code is how arbitrary it is. For example, why is the phaseout threshold $75,000 for a single person and $110,000 for a married couple in order to receive the full $1,000 child tax credit?

If you're a single mom who is earning $80,000 a year in a city like San Francisco, you can use all the help you can get! Daycare will cost $24,000 a year and a mediocre one bedroom will cost at least $30,000 a year. After taxes, you hardly have anything left for food and transportation.

Always fearful of government discrimination, I went into my tax software and set up three work mileage scenarios: 5,000, 10,000, and 50,000. Each scenario paid $600 in car interest, $200 in personal property tax, and $350 in parking and tolls to isolate the mileage deduction amount.

I also set up my income to be $300,000 as a single person to ensure everything I test in this post will work for everybody. Let's take a look!

5,000 Miles Driven For Business For Your Old Car

10,000 Miles Driven For Business For Your Old Car

50,000 Miles Driven For Business For Your Old Car

As you can tell from the charts, the more miles you drive, the more you can deduct from your income to save on taxes, regardless of how much you make! There is also no limit to the amount you can drive for business nor is there a floor on how old and inexpensive your car can be to drive such miles. In other words, we have a perfectly fair IRS deduction/benefit policy.

In 2024, the standard mileage rate is $0.67 for each business mile you drive according to the IRS. Therefore, if you're doing your 2024 taxes, and have 10,000 miles driven = $6,700 deduction. The true value of your deduction is therefore equal to your Total Deduction X Your Marginal Tax Rate.

In other words, if you pay a 24% marginal federal tax rate, the value of your $6,700 deduction = $6,700 X 24% = $1,608 less in taxes you get to pay. The higher your marginal tax rate, the greater the benefit.

Latest 2024 Federal Income Tax Brackets

Here's a refresher of the 2024 federal tax brackets and rates for your review. Knowing your taxes will help value your beater car.

Very Important: A reimbursement is different than a deduction. A reimbursement is where your company cuts you a check for your expenses. You may or may not have to pay taxes on your reimbursement. If your employer reimburses you the IRS standard mileage rate of $0.67/mile but does not include it in your pay, there is nothing to claim for tax purposes. Best double check. A deduction is a non-cash figure that is used to lower your taxable income. Therefore, a reimbursement is much more valuable than a deduction.

Standard Mileage vs. Actual Expenses

Instead of using the standard mileage deduction, you can choose to deduct the actual cost of all your auto expenses. Let's say you need to drive a $300,000 Ferrari for your business for some reason.

The insurance on such a car might run $10,000 a year. You also only drive it 1,000 miles a year. Instead of taking a $670 deductible using Standard Mileage, you benefit more if you deduct the actual expense of owning the car e.g. $10,000 in insurance cost, gas, oil change, garage rent, polishing, licensing, maintenance expenses, accidents, personal property tax, and business related parking and tolls.

The standard mileage deduction is supposed to be an all encompassing deduction, excluding interest, personal property tax on the vehicle, parking, and tolls. Choose the the method that benefits you the most.

A New Side Hustle Emerges

Now that we understand the basics of how one can use a car to save on taxes or make more money, here's what you should consider doing. Your old car can save you lots of money on taxes.

1) Start a business that involves using your car.

For example, I drive Rhino to see potential advertising clients all around the sprawling Bay Area. I also drive to places like Sonoma, Las Vegas, Palm Springs, and so forth in order to write about my experiences. Practically every single business requires a car, even an online one like mine.

2) Become a freelancer (schedule C) that involves using your car.

Every so often I drive south to see corporate consulting clients in Silicon Valley. Each way averages 30 miles. If I go every work day, that would be 60 miles a day X 20 days a month = 1,200 miles X 12 = 14,400 miles a year. 14,400 X $0.67 = $9,648 x 33% marginal tax bracket = $3,184 less in taxes I get to pay.

Then I also get to deduct all my car loan interest, personal property taxes, parking fees, and tolls related to business driving. Every consultant should start their own website to brand themselves online.

3) Own rental or vacation property.

My Lake Tahoe vacation property is 200 miles away. I'm certainly able to deduct the 400 roundtrip miles (400 X $0.67 = $268) as a rental property management expense plus car interest, personal property taxes, parking and tolls each time I visit. I need to go up at least once a quarter to make sure the place is still in tip-top shape.

4) Own the cheapest, most reliable car possible for business.

The IRS doesn't give you more deductions for driving a Rolls Royce rather than a Honda Civic. It's $0.67 for every mile driven no matter what type of car. If you're able to reliably drive 50,000 miles a year with a $1,000 junker, then go for it because you'll save at least $3,000 a year in taxes.

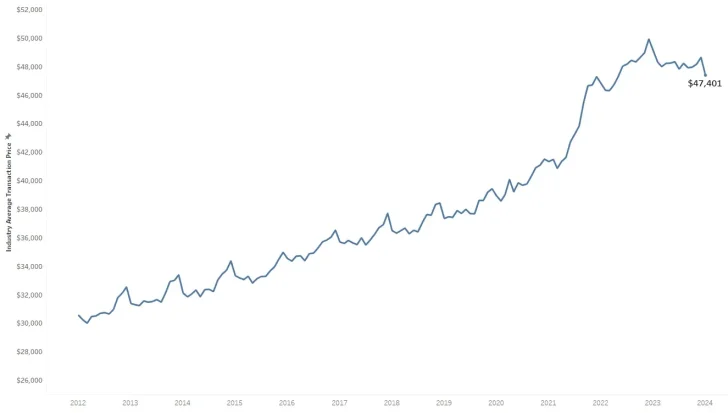

An optimal car may be a 7 – 10 year old economy car that's worth $3,000 – $5,000. After about 10 years, you may want to get another car for safety and reliability purposes. However, just know that average new car prices are incredibly high. so I'd save your money.

5) Consider working for a company where driving is a requirement.

Instead of the IRS giving you a $0.67/mile deduction, perhaps your company will give you a $0.67/reimbursement plus all related expenses. For example, let's say you drive 10,000 miles for work. Your company might just cut you a check for the full $6,700 + parking and tolls instead of you only getting $6,700 + parking and tolls X your marginal tax rate as a deduction instead. If you have zero car payments and your car only costs $500 a year to maintain, then you're making $5,000+ a year.

6) Do all the above to save money with an old car.

The perfect combo for saving/making money with a car is if you love to drive, are in a high marginal tax bracket, have no problem driving a reliable beater, own a rental or vacation property, and can work as a freelancer and full-time employee. Though it was tough for me to make money as a rideshare driver in 2015, driving helped reduce my taxable income by at least $3,500 and consequently saved me over $1,000 in taxes.

Tax Savings Is Not Free Money

Although it sounds amazing that a car can save or make you a lot of money, the reality is that one day repair costs will make your car too expensive to economically maintain. Theoretically, all your reimbursements and tax deductions are supposed to perfectly equal the loss in value of your car. As realists, however, we know this is unlikely. But like any good hustler, we try to squeeze more out of what we have.

Based on my tax calculations, I get paid to drive my leased Honda Fit. Now if I can efficiently figure out a way to rent out my Honda Fit every time I'm not using it to someone who drives a crazy amount of miles a year, perhaps I can earn some extra passive income!

Tax Savings Recommendation

Start A Business: A business is one of the best ways to shield your income from more taxes. You can either incorporate as an LLC, S-Corp, or simply be a Sole Proprietor (no incorporating necessary, just be a consultant and file a schedule C).

Every business person can start a Self-Employed 401k where you can contribute up to $69,000 ($23,000 from you and ~20% of operating profits). All your business-related expenses are tax deductible as well. Simply launch your own website like this one in under 30 minutes to legitimize your business. Here's my step-by-step guide to starting your own website.

Be More Responsible, Buy An Old Cheap Car

Follow my House-To-Car Ratio guide for fiscal responsibility and buy a cheaper old car. If you want to eventually reach financial freedom, you should have a house-to-car ratio of at least 50. Cars are guaranteed to depreciate in value, houses tend to appreciate in value.

As the father of the modern-day FIRE movement, I want all of you to have more wealth and more freedom. No car can match the joy you will experience once you are financially free.

Buy Real Estate Instead Of An Expensive Car

Keep your car expenses to a minimum. Instead of buying a fancy new car, use the money to invest in real estate instead. This way, you can build more wealth and achieve financial freedom, which provides way more value than driving a nice car.

To invest in real estate without all the hassle and unexpected costs, check out Fundrise. It has been around since 2012 and has over $3 billion in assets under management and nearly 400,000 investors.The minimum investment amount is also only $10.

Another great private real estate investing platform is Crowdstreet. Crowdstreet offers accredited investors individual deals such as those in 18-hour cities where there is potentially greater upside due to higher growth rates. You can build your own diversified real estate portfolio with CrowdStreet. However, before investing in each deal, make sure to do extensive due diligence on each sponsor. Understanding each sponsor's track record and experience is vital.

I've personally invested $954,000 in private real estate since 2016 to diversify my holdings, take advantage of demographic shifts toward lower-cost areas of the country, and earn more passive income. We're in a multi-decade trend of relocating to the Sunbelt region thanks to technology.

Both platforms are sponsors of Financial Samurai and Financial Samurai is an investor in Fundrise funds.

Updated for 2024 and beyond. Driving a beater car is still the way to go! But, you may also consider adding a dough car for show. Also check out my tax deduction rules for an SUV.

Great article.

We have been in Real Estate for 35+ years & have always max’d out the deduction for auto expenses/mileage etc. Furthermore, every truck/SUV we have purchased was Sect.179’d against taxable income. (My wife also had her own business so Sect. 179’d her vehicles as well).

However, my 1st IRS audit, (that went back 7 years), was triggered by taking a large mileage deduction that year. Even though I had detailed logs of all mileage specific to the respective properties & jobs, the auditor suggested I spread the mileage deduction evenly over all rental properties, which made no sense at all. I survived that audit & have continued to simply spread all mileage across my Sched E properties equally?

My 2013 Ram 1500 with 175k of deducted miles was just replaced with a new ’24 Tundra & again it will be Sect. 179’d & I will continue to expense the truck mileage. We do own another vehicle for personal use.

My most recent IRS audit went back from 2019-2012 & that was triggered by cell phone deductions. Some of our commercial & multi-unit properties demand 1st responder alarm systems tied to my cell phones plus constant WiFi access & that gets expensive. Again the auditor finally suggested I simply move that expense from my Sched C & divide it across the rental properties evenly on the Sched E ???

That audit went on for 3 months, required 2000 pages of documents/ledgers etc emailed to the auditor as they looked for anything on each & every deduction for every deal/repair/expense taken. Yet they never questioned the large Sect. 179 deductions I took back in 2014 for the 2013 Ram or the wife’s new ‘business’ Toyota Sequoia SUV.

Again I survived, but they did finally concede it was because of our very detailed records.

As my CPA says, deduct, deduct, deduct !!!

This is perfect timing. Based on what I read, I think the following is true, but please let me know if I missed anything.

If I start working as a food delivery person using one of the apps, like Uber Eats, I would be able to get reimbursed for all my business miles.

If I do this work as a part of an LLC, I can also save taxes by contributing any extra cash to a business 401K or IRA.

Thanks for sharing this information. As usual, you’re a great source of financial information.

Hello,

My job offers standard government reimbursement or the use of a rental car which they pay for. Now there a calculator or formula I can use to see if isn’t my car is actually beneficial? Am I truly making money on it? Thanks

On the other end of the spectrum, You have people driving $100K cars who put 10-20k miles on their cars every year and get peanuts back in reimbursements…

Thanks for making me feel better about driving a Toyota Yaris. My workmates laugh that I don’t have an “adult car”. MileIQ and a beater car are a match made in tax deduction heaven!

Yes, the good old employee auto mileage loophole. I’m pretty sure employees have been doing this since before the internet! I’ve been a field employee for nearly 3 years and have been leveraging this to my advantage. I know of several smaller companies that the sales force rack up even higher miles. Personally, I drove 22,500+ miles in 2015 in my personal $10k vehicle, had nearly $13k in reimbursement cash, and lastly netted over $10 grand tax free when factoring my gas expense ([Miles/MPG]*average weekly gas price). Sounds like you weren’t a field worker, so welcome to the party :)

“For example, let’s say you drive 10,000 miles for work. Your company might just cut you a check for the full $5,750 + parking and tolls instead of you only getting $5,750 + parking and tolls X your marginal tax rate as a deduction instead. If you have zero car payments and your car only costs $500 a year to maintain, then you’re making $5,000+ a year.”

You are forgetting Gas!

I drive a mid-2000’s Toyota Camry and put 15 to 20k miles a year on it. One additional point to note is that if you work for a company like mine, I have a set expense budget for the year. I ALWAYS hold back mileage to end of the year (as only expense rule is by year end not within a certain period from incurring expense) and make sure I get all dining expenses reimbursed under company expense budget and any mileage that goes over limit I include in my personal taxes. The govt slashes dining by 50% so I let the company take that hit.

I believe that one can not deduct mileage expense for rental property management unless you meet the IRS definition of a real estate professional (Pub. 527, pgs. 4, 13).

I own one rental property. I work a full-time corporate job, unrelated to property management; and my employer reports my annual earnings on a W2. I cannot deduct mileage expenses incurred for managing my one rental property.

Best to double check with an accountant friend. A rental is like a business. The expenses you incur to run your rental business is deductible.

As someone who recently started a blog (thanks to the ever constant encouragement here at FS), I wonder if I can lower my minuscule tax bill further. I’ll have to look into it come next February.

My 05 Impala with 64k miles on it may have gotten just a bit more valuable!

Your first sentence “Never buy a new car in first year of redesign”… How about buying the first year of a new design?… a la disruptive Tesla. I put 1k deposit on a model 3 when the website opened. That Elon Musk is a smarty in so many ways, opened the door to get in line before he even showed the working prototypes. received over 100,000 orders (including mine) sight unseen. Then once seen orders ballooned to 280,000 with first delivery not expected until end of 2017 at best. Are the 280k of us crazy?

Yes, you guys are the Guinea pigs. So long as you are OK with it, all is good. Personally, I’m waiting until the 3 is out for at least two years.

that would be the prudent view (2 years) except there will likely be no rebate (which is significant $) from Feds or CA by then. Plus there will also likely still be a very long waiting list if its a winner.

My buddy has a traveling sales job and he got around $25k in reimbursements last year. His car is an old Hyundai that has a blue book value of no more than $1500-2000.

Bingo! Exactly the case study benefitting from the situation I describe in this post. And if he had a side hustle, he’d make even more from his beater!

You have left out the best thought of them all. I am an attorney and my client pays mileage. I get a rental car with a company that allows unlimited mileage. My beautiful BMW sits in the garage while I grab a rental and put hundreds of miles on it and get reimbursed. Let’s say I get a car for $19.00 a day. I do a round trip at 500 miles. Gas is equal whether it is my car or the rental so that is a wash. So $250.00 ($ .05/mile), less $19.00 (rental fee) equals a beautiful $231.00 in reimbursement. Pure cash. Can you say no W2! Can you say turn on my UBER app? Forget taxes, depreciation, etc. on your own car. Plus, I do not allow my kids to eat in my BMW. But the rental? Kids, I am coming home and lets go get some food! Hah . . . Sonic!!!

Excellent! Drive on.

Is this even legal if you get reimbursed for mileage from your corporate company?

Ahhh!!! It won’t let me reply on the thread post above.

But one thing…I think this website and you are great! Even if I disagree with a couple things :)

My path is slowly evolving. Here are steps I am taking:

I’m 29 and have been working at a job with a six figure income the past couple years. I’ve been aggressively saving on that. Before this I was making 35k a year.

I would say I have a good amount of cash saved up. I have recently been investing my money with fix and flippers for high returns. I’ve just bought my first rental. This will help me start to realize losses on my taxes too. I have invested in P2P lending. I think it’s great for most people, but I want more return ;) Believe me, it’s out there. People don’t become wealthy with 10% interest….well unless they start out with large capital or become wealthy that way when they reach 80 years old.

My goal is to become financially independent within a few years. I want to leverage other countries’ currency by living there. I only want to make income up to a certain threshold where I will not end up paying federal income tax. I am willing to give up a life of luxury to do this….but still live comfortably. I have no problem with the idea of local and state tax. But federal is off limits for me.

How do I fight the system?

I don’t waiver on my principles. For example, I will probably vote for a 3rd party candidate in the presidential election (even thought the president isn’t very important). Probably libertarian party. People who say I am “throwing my vote away” or “giving my vote to the Democrats” are getting fed that crap by….who?….republicans. The same republicans who double the national debt and created no child left behind. When you choose the lesser of two evils, you are still voluntarily choosing evil. So, not letting myself succumb to all the BS that our “society” spews out is the main thing….Thinking for oneself.

Then I also try to influence others!

Excellent! With a six figure income, the government and I want to thank you for paying tens of thousands a year in income taxes!

Sam,

Thanks for this detailed post. Your ideas remind me of a story my grandfather told me when I was just learning how to drive. During WWII, he picked up a job delivering newspapers just so he could receive the advantage of gas stamps. Needless to say, grandpa was always thinking – and he always had a full tank of gas!

It’s so generous of the government to allow us to keep more of our money for legitimate business expenses. :-)

Great info though. Wish I had this article 5 years ago when I first started using my car for business! Would have saved me a lot of effort.

The one thing I don’t like about “tax deductions” is that you have to spend money in order to get the benefit. And even then….you are only saving a percentage of what you taxable rate is. For example: If you spend $10,000 on car expenses, that all money out of pocket. Now you deduct that from your taxable income (say…28%?) and you now save approximately $2,800 in actual taxes. The $10,000 deduction is deceiving to me. I’d rather focus on how to reduce my taxes other ways than having to spend more money.

True, but if you can deduct stuff you would use anyway, like a car, laptop, or mobile phone, you can still think of it as a benefit.

I guess I can agree with that if you are already doing it. But to me, the whole thing feels a little like begging.

Can you tell I’m a libertarian ;)

Also, when my girlfriend tells me how much she saved after shopping sales, coupons, etc…I ask her, did you still spend money? lol

You either join the system or you fight the system. Fighting the system never works as the government is omnipotent!

That’s what people in Germany said when Hitler was in power ;)

The founding fathers fought the system and won. FIGHT THE SYSTEM (if it’s wrong). Don’t be a sheep. Have courage!

Have you joined me in retiring early to pay less taxes?

As someone with courage, what are the things you are doing to fight the system? I’d love to know!

Commuting expenses between your home and main workplace are never deductible.

Correct! I’ve clarified the language to say “a job that requires travel” in case anybody is confused. Thx.

Set up a space in your home for your “administrative office”. Take your home office deduction. Start and end your days at your “administrative office”. Now your commute is from your bedroom to your administrative office. Trips from your administrative office to your other destinations are now tax deductible.

I wonder if the employer who offers the reimbursement for your mileage can claim any tax breaks. I’d would assume that if the employer does, then a form would be filled out to the IRS.

Great scenarios on maximizing out the mileage. Obviously if I had the choice, I’d find a job that minimizes the amount of downtime of commuting (you can only listen to so much through audiobooks!)

Yes. From the employer’s perspective, the reimbursement is a business expense.

Your post is interesting because I am in a similar situation. I have this car from the 90’s and have to do some driving for work from time to time. I was amazed at the reimbursement rate that my company was giving me! I realized it was this huge bonus but unfortunately there really isn’t any way to take large advantage of it – especially because I want to do the right thing for my company. But I do get a smile on my face when I drive my old car for work. Also, I understand the value of doing one’s own taxes. The details really make the difference and can help you really understand what things can save you money and what things are costing you. Once you know that though – I can’t imagine continuing to do them. Its miserable and impossible to get it right.

Hey Sam, nice to know. Does having to know all this make you want to just let an accountant do it so you don’t have to? I’m surprised with someone of your wealth/earning power that you’d value doing your own taxes (and potentially missing a (legal) deduction) over an accountant doing it for you.

Tristan

It doesn’t b/c this post is more about changing one’s behavior. Perhaps a great accountant will advise you to do all the things I’ve suggested in this post, but usually, the accountant just says “give me all your documents to input” and then tell you the output.

Tax software is almost stupid proof now. I added a screenshot of the Standard Mileage and Actual Expense choice one can choose. Whichever one chooses, they then input their miles or expenses and the tax software does it for you. A normal accountant is just a data entry person.

So perhaps I might be so bold as to say that my posts on taxes are much more valuable to the typical person (and free) b/c I talk about strategies to maximize reducing tax liability and making more money. The tax software won’t allow me to miss a legal deduction.

As a “normal” accountant, I take offense to the notion that I am just a data entry person. :P

Haha, sorry. Are you an accountant who do people’s taxes? If so, how much do you spend advising clients on moves to make to lower their taxes or increase income?

Another good way is to use your Flexible Spending Account to reimburse your miles to a medical visit. I have to go 120 miles roundtrip. This year’s rate is 19 cents/mile, so I get $22.80 tax-free. Not the greatest money-saving scheme, but take it where you can especially when you have to drive to doctors and specialists.

Does the ability to take this deduction occur only when the commuting expenses totals a certain percentage of your MAGI?

No, you are getting reimbursed directly from your FSA.

Thanks!

Interesting post Sam – we have a Family LLC and are looking for a house to flip, will have to look into this since driving around from house to house can add up quickly

Thanks for the tip!

At my previous job, I was always the first to volunteer to drive anywhere. At the Federal rate of 57 cents/mile, I knew I was making money because my old beater truck required very little to keep it rolling other than gas.

Yet another reason to drive the oldest, most dilapidated jalopy you can find…:)

Thanks for the article.

There you go! This article is right about your blog title’s alley.

Indeed! :)

Interesting stuff. I recently “side hustled” my work truck by flipping it. At the end of the lease (through my company) they offered to sell it to me $3K under KBB. I promptly took them up on it and sold it at private value on Craigslist and netted ~2.5K. Boom: mortgage taken care of for April.

Not bad! There’s so much stuff one can do to make money with a used car. I used to do it all the time. But, as I got older and wealthier, the benefits in doing so waned. Hence, I decided to lease my Honda Fit to eliminate dealing with others to sell one day. I’m paying for convenience.