After delving into the exorbitant prices of new luxury cars, I've come to the realization that a larger segment of the population is purchasing such vehicles than I initially thought. This trend poses a significant problem for those striving for financial freedom, which is why I've come up with the House-To-Car Ratio guide.

I see people with expensive new cars parked outside modest homes everywhere. With hefty lease payments and revolving credit card debt, many Americans may find themselves trapped in the rat race indefinitely.

As someone who helped kickstart the modern-day FIRE movement in 2009, it hurts me to witness so much financial irresponsibility when the solution is so easy to fix. With my new House-To-Car Ratio guide, you can check whether you're on track to financial independence or whether you need to make appropriate adjustments.

Given that everyone requires both shelter and transportation, this could be one of the most beneficial personal finance articles you’ll ever read. Let’s dig in! I've provided a podcast episode of this post as well.

The House-To-Car Ratio For Financial Freedom

We are all aware that a car is a liability, with a 99.9% probability of losing value over time. The only exception is collectible cars that appreciate over decades when left untouched.

Conversely, a house is an asset with a ~70% probability of increasing in value over a 12-month period. This probability rises the longer you hold the property.

Both car and homeownership are facets of the “American Dream.” However, the issue arises when individuals acquire too much car and/or too much house, particularly when financed with debt.

Given that homes tend to appreciate in value while cars depreciate, the logical conclusion is that individuals should prioritize investing more in a house, up to a certain responsible limit, and reducing expenditure on cars if they aim to accumulate significant wealth over time.

Coming Up With The Baseline House-To-Car Ratio

To build the baseline House-To-Car Ratio framework, we need to take the median price of a home in America divided by the average car price in America to get a score. For some reason, there is no reliable median car price in America, only average, but we can use the average used car price as well.

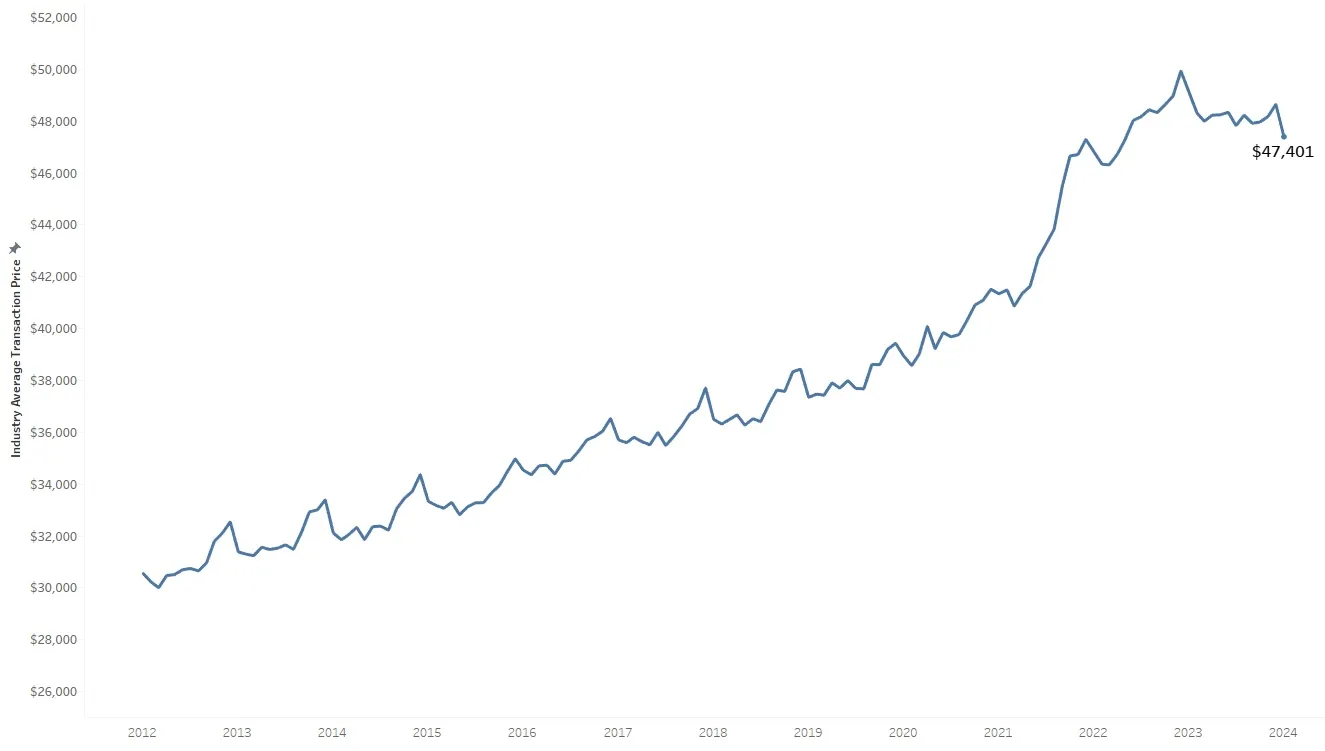

$49,000 is roughly the average price of a new car in 2025 and $53,000 for EVs according to Kelley Blue Book, Edmunds, and Cox Automotive. $420,000 is the estimate median home price in America according to the St. Louis Fed. Both figures change over time.

Baseline House-To-Car Ratio

$420,000 (median home price) / $48,000 (average car price) = 8.57. In other words, the typical American has a House-To-Car Ratio of around 8.57. The higher your ratio, the better because that means your car's value is a smaller percentage of your home's value. The other assumption is that the average person spends way too much on a car.

According to Edmunds.com, the average price of a used vehicle is around $27,297 in 2024. Therefore, we can conduct another simple calculation by dividing $420,000 / $27,297 = 15.4.

In other words, the typical American household has a House-To-Car Ratio of between 8.57 – 15.4. Your goal is to beat this ratio if you want to attain financial freedom sooner than the masses.

Note: If you have more than one car, you must add the total current value of your cars (not purchase prices) to come up the denominator. Your house's value is the current estimate value not your home’s purchase price.

For example, if you have two cars worth $20,000 and $27,000 each according to Kelley Blue Book, then your total current car cost is $47,000. Divide your house's current estimated value by your total estimated current car cost to get your House-To-Car Ratio.

If you lease a car, use the estimated value of your car for the denominator.

Let Us Strive To Outperform The Typical American

We have to decide whether the median American is someone we aspire to be when it comes to building wealth. Based on the data, the answer is not really.

The median American household has a net worth of roughly $192,000 according to the latest Federal Reserve Survey Of Consumer Finances report. That's not bad, but also not great for someone who is around 36, the median age in America.

The average American household, on the other hand, is doing much better. Based on the same report from The Federal Reserve, the average American household is worth about $1.06. million. In other words, the average American household is a millionaire. A household consistent of one or two income earners.

We all know that the median net worth is more reflective of the typical American. Therefore, we should agree that striving for a House-To-Car Ratio above the range of 8.57 – 15.4 is a worthwhile goal.

For those of you who are ultra rich, retired, or who have pensions and little-to-no debt, my ratio won’t be as relevant given you are already set financially. This ratio is most helpful to those still on their journey to financial independence.

What if you don't own a car, but own a home?

If you own a home but don't own a car, you are winning. You're resourceful because you take public transportation, car pool, utilize ridesharing platforms, and/or have the ability to work from home. You might also be lucky to live in a city with fantastic public transportation, such as New York City or every major city in Europe and Asia.

Given a car is a liability that will grow over time with maintenance issues, wear and tear, parking tickets, and potential accidents, to not need a car to get around is a huge financial benefit.

As long as you are saving and investing in the stock market, public real estate funds, private real estate funds, or other risk assets, you'll likely build much more wealth than the average person over time.

If you don't own a car but own a home, you can consider having a Home-To-Car Ratio of about 30. You're doing twice as good as the average American.

What if you own a car, but not a home?

Most people will own a car first before buying a home given a car is cheaper than a home. That’s fine. However, after age 35, if you still only own a car but not a home, you are unlikely to achieve financial independence before the traditional retirement age of 60-65.

Below is a chart that shows the median age for first-time homebuyers in America is 35. The median age for repeat buyers is 58. Overall, the median age for all homebuyers is 49 years old.

Your goal is to outperform the 35-year-old median first-time homebuyer to build more wealth and passive income for financial freedom.

Of course, there are circumstances where one is financially responsible despite owning a car and not a home over the age of 35. Examples include people who delay work to get their PhD and those who’ve sacrificed their finances to help others.

However, given the nature of inflation, if you don't at least own your primary residence by age 35, then you are likely falling behind financially. Hence, it is important to try and get neutral real estate as young as you possible can. Just like shorting the S&P 500 long-term is a suboptimal decision, so is shorting the housing market by renting long-term.

If you own a car but not a home, you can give yourself a Home-To-Car Ratio of between 5-6.

What if you don't own a car or a home?

In such a scenario, you have a clean slate. Don't blow it!

Don't go off buying a car you can't afford just to look cool or satiate desire. Buy the cheapest, most reliable car you can afford or simply take public transportation and ride share. Maintenance expenses add up, even if you have an extended warranty.

As for owning a home, once you know where you're going to live for at least five years, buy responsibly. This means following my 30/30/3 home buying rule. It also means not get into a bidding war and negotiating on price and real estate commissions.

The Ideal Home-To-Car Ratio You Should Shoot For

The typical American has a Home-To-Car Ratio of about 8.57 – 15.4.

Ideally, your Home-To-Car Ratio is 100 or higher. That's right. As a financial freedom seeker, your house should ideally be worth at least 100 time your car.

However, once your Home-To-Car Ratio surpasses 50, you're in the golden zone of financial responsibility. The longer you own your car, the higher your ratio will grow given your car will depreciate and your home will likely appreciate.

Does 50-100+ sound unrealistic to you? Let's go through some real life examples to highlight the various ratios.

Home-To-Car Ratio Examples

- Computer Engineer, Age 26. Rents for $2,400 a month. Car: $60,000 (value of car today) Tesla 3 sport edition. Home-To-Car Ratio = N/A. As a landlord, I see these examples all the time. Recent college graduates want to spend on something nice, so they often buy a pricy car instead of saving up for a home.

- Roofer, Age 56. Home: $780,000. Car: $250,000 consisting of five cars and two motorbikes. Home-To-Car Ratio = 3.1. Al the roofer will be climbing up ladders well into his 60s due to his love of automobiles.

- Software Engineer, Age 39. Home: $850,000. Car: $30,000 Hyundai Sonata. Home-To-Car Ratio = 28. Jack the engineer is doing three times better than the typical American.

- Entrepreneur, Age 46. Home $1,700,000. Car $29,000 Toyota Prius. Home-To-Car Ratio = 59. Lisa the entrepreneur owns a median-priced home in San Francisco and is environmentally conscience.

- CEO of Publicly Traded Company, Age 48. Home $15,000,000. Car $200,000 Mercedes EQS 650 Maybach. Home-To-Car Ratio = 75. Ted the CEO is living large with a home equal to roughly 15% of his net worth of $100 million. $200,000 for a new luxury car is chump change.

- Retiree, Age 74. Home $1,800,000. Car $3,200 1997 Toyota Avalon. Home-To-Car Ratio = 563. At 74, Allen the retiree has no need for a fancy car. He hardly drives anymore and prefers to take the bus or Uber instead.

Income And Debt Levels Are Important Factors To Consider

My Home-To-Car Ratio is a helpful way to determine whether you are being financially responsible and on the road to accelerated financial independence.

Simply take the estimated value of your current home and divide it by the estimated value of your current car or cars, if you have more than one. If you have a Home-To-Car Ratio above 50, you're doing well.

In addition to calculating your Home-To-Car Ratio, you must also take into consideration your income and debt levels to evaluable your fiscal health. Finally, your net worth is also an important variable.

Taking Income Into Consideration To Determine Fiscal Responsibility

Take for example the Computer Engineer above who rents for $2,400 a month, but purchased a top-of-the line Tesla Model 3 last year for $70,000. Although it is financially irresponsible to pay so much for a car while still renting, his salary might be in the top 1% at $600,000. In this case, renting for only $2,400 a month is quite frugal.

Instead, he decides to use his free cashflow on a nicer car with an $800/month car lease payment. Combined, he's paying $3,200/month, which is only 6.4% of his $50,000 gross monthly salary. He wisely invests the majority of his after-tax salary in stocks and real estate online to earn more passive income.

However, this is unlikely the case because he only makes $175,000 a year. I know because I'm his landlord.

Taking Debt Into Consideration To Determine Financial Health

Now let's review the 74-year-old with a Home-To-Car ratio of 563. It is extremely high because he bought his Toyota Avalon new back in 1997 for $25,000. However, because he's maintained the car and held onto it for so long, his Home-To-Car Ratio naturally increases as the car depreciates.

Allen has no mortgage, no debt, and a pension of roughly $85,000 a year. He's set for life and is encouraged to spend more of his wealth on himself, his wife, and his family because he can't take it with him. He should probably buy a new Toyota Avalon for $45,000, however, he's set in his ways.

Overall, the average age of U.S. vehicles is over 13 years as more Americans are keeping their cars for longer.

The ultimate goal is to have a paid off forever home and a paid off car you enjoy. If you can do that, the only main necessary expenses left are healthcare, food, and college tuition, if you have children. Everything else, such as clothing and vacation spending, is discretionary where we can cut dramatically.

Taking Net Worth Into Consideration To Determine Fiscal Responsibility

Let's consider Ted, the CEO, who boasts a net worth of $100 million, owns a $15 million house, and drives a $200,000 car. While his House-To-Car Ratio falls short of the ideal target of over 100, he's still in good shape. His car represents only 0.2% of his net worth. Ted also enjoys an annual income ranging between $5 – 8 million on average.

The bulk of Ted's net worth consists of equity in his company and other private enterprises. He could easily afford a $500,000 car without financial strain. If he were to make such a purchase, his House-To-Car Ratio would be 30, which is still double the average American's ratio. Clearly, the rich CEO doesn't need to follow my House-To-Car Ratio because he is already financially independent.

If your goal is financial independence, I recommend limiting your next car purchase to no more than 1% of your net worth. For further discussion, you can refer to my net worth rule for car buying.

Taking Age And Retirement Status Into Account

For older individuals who are already retired, the significance of having a high House-To-Car Ratio may be less pronounced, as they have likely already achieved financial independence. In contrast, my ratio is more pertinent to those who are still striving towards financial freedom.

Consider a 68-year-old couple who own a $400,000 home and a $22,000 car. With a House-To-Car Ratio of 18, they exceed the average American household, but fall short of the recommended ratio of 50. However, their financial status is far from average, as they are already retired.

In addition to being debt-free, the couple's Social Security benefits cover 95% of their $3,000 monthly expenses. They also possess a combined 401(k) value of $1,500,000, which, using a safe withdrawal rate of 3%, can fully fund their monthly expenses.

While my House-To-Car Ratio may seem less relevant to this couple, it still serves as a useful metric to evaluate their spending habits.

For instance, the couple may be contemplating purchasing a $45,000 car with cash to lower their ratio to 8.88, but may hesitate due to a lifetime of frugality. Alternatively, they might be considering upgrading to a $700,000 home, but are uncertain about the timing. According to my ratio, they should postpone this decision until their cars are valued at $14,000 or less.

Living In Expensive Cities Improves Your Home-To-Car Ratio

One reason why living in expensive cities might actually be more economical is because certain expenses, like car prices, remain relatively constant across the country.

For example, the cost of a basic Toyota Camry, with an MSRP of $31,000, is the same whether you're in affordable Pittsburgh, PA, or pricey San Francisco. Consequently, if you can earn a higher income in an expensive city, everyday items such as cars, electronics, and clothing tend to be comparatively more affordable.

Residents of budget-friendly cities with lower median home prices naturally have lower Home-To-Car Ratios. In other words, it’s harder to build wealth in cheaper cities.

For instance, in San Francisco, where the median home price is around $1.65 million, owning a basic $31,000 Toyota Camry results in a Home-To-Car Ratio of 53.

However, not everyone living in an expensive city will find it easy to achieve a ratio of 50 or more. Consider the case of a homeowner with a remodeled 1,280 square foot house that's worth about $1,550,000. If the homeowner drives a $90,000 Mercedes Benz EQE electric vehicle, their Home-To-Car Ratio would be only about 17.

I see examples like the one above everywhere I go. People are driving way nicer cars than their homes would dictate. This is the opposite of Stealth Wealth.

Meanwhile, according to Zillow, the median home price in Pittsburgh, PA is only $223,000. Consequently, the Pittsburgh median homebuyer who purchases a $31,000 Toyota Camry ends up with a Home-To-Car Ratio of only 7, which is below average.

To achieve better fiscal health, the median Pittsburgh homebuyer should consider buying a car valued at $4,460 or less, or continue driving their current car until its value depreciates to $4,460 or less.

Try To Match Your Car To Your House

You might not care much about my Home-To-Car Ratio for achieving financial freedom, and that's perfectly okay. Spending money on a fancy car is a common practice in America, almost a rite of passage for those who start earning a regular salary. YOLO spend to your heart's content.

I was one of those individuals who purchased a second-hand BMW 528i with aftermarket rims and a premium sound system for $28,000 when I was 24. I had just moved to San Francisco for a promotion and was paying $1,100 a month in rent. Owning a BMW had always been a wish of mine.

Later on, I realized that investing in property was a wiser choice. However, this realization came only after I indulged myself in an even more luxurious car—a $78,000 Mercedes Benz G500!

After that experience, I learned my lesson at 26 and shifted my focus to buying real estate and opting for inexpensive used cars. For me, attaining financial freedom outweighed the desire to drive a fancy car.

Driving A Cheap Car Leads To Financial Freedom Sooner

Owning a used $8,200 Land Rover Discovery II for a decade, from ages 28 to 38, turned out to be one of the best decisions I made. During that time, I diligently saved on car expenses and invested my returns wisely. In 2005, I utilized my accumulated savings to purchase a single-family home for $1.52 million, making a down payment of $304,000.

Twelve years later, in 2017, I sold the property for $2.75 million, and walked away with about $1,780,000. I then reinvested these proceeds into stocks, municipal bonds, and private real estate funds, which have since appreciated in value. The freedom to pursue my desires is far more valuable than the fleeting joy of owning a new car.

By opting out of buying a new luxury car at age 28, I gained the equivalent of 8 years of financial independence based on my family's current annual budget. This span of time is priceless for someone entering the latter half of their life.

For those want want to achieve financial freedom sooner, consider the following:

- Purchase a home you can comfortably afford if you envision living in one place for five years or longer.

- Delay buying a car for as long as possible. Utilize public transportation, a bicycle, a scooter, or services like Uber/Lyft. By abstaining from car ownership, you will save a substantial amount of money.

- If you do decide to buy a car, adhere to my 1/10th rule for car buying and opt for the most economical option available. Remember, maintenance costs, taxes, traffic tickets, and potential accidents can significantly impact your finances over time.

- If you find yourself already burdened with an expensive car purchase, retain ownership until your Home-To-Car Ratio reaches 50 or higher. With time, your ratio will naturally improve due to the vehicle's depreciation.

- If you've overextended yourself with a costly housing investment, resist the temptation to compound the issue by purchasing an even pricier car. Instead, focus on retaining your current car for as long as possible while paying down mortgage debt. Simultaneously, prioritize paying off any outstanding car loans.

Achieving a Home-To-Car Ratio of 50 or higher can significantly improve your financial well-being. Aim to prolong car ownership as a personal challenge, striving to reach a ratio of 100 or more. Only after surpassing the 100 ratio mark should you consider purchasing a new car, which may lower your ratio back down to 50.

Invest In Real Estate To Build More Wealth

If you can't buy a physical property just yet, that's fine. You can still be fiscally responsible by owning real estate through ETFs, funds, REITs, or private real estate funds.

Real estate is my favorite way to achieving financial freedom because it is a tangible asset that is less volatile, provides utility, and generates income. By the time I was 30, I had bought two properties in San Francisco and one property in Lake Tahoe. These properties now generate a significant amount of mostly passive income.

In 2016, I started diversifying into heartland real estate to take advantage of lower valuations and higher cap rates. So far, I've invested $954,000 in private real estate funds and individual deals because I believe the demographic shift to lower-cost areas of the country will continue.

Check out Fundrise, my favorite private real estate platform. Fundrise has been around since 2012 and now manages over $3 billion for over 350,000 investors. Their funds mostly invest in residential and industrial properties in the Sunbelt region where valuations are cheaper and yields are higher.

Fundrise is a long-time sponsor of Financial Samurai and Financial Samurai is a six-figure investor in Fundrise funds. Our views on real estate are aligned and I'm a strong believer in the demographic shift towards lower-cost areas of the country.

The Right House-To-Car Ratio For Financial Freedom is a Financial Samurai original post. Please use the ratio as a guideline to help optimize your finances as you see fit.

I drive an old and paid off BMW M3 and fixed everything on it and keep maintenance the past 16 years. It has been less expensive than buying a new car. It allowed me to buy my first home several years ago. The home appreciated 200k since then and I have been renovating my home to increase value and condition of the home. I use the bus and scooter to get to work downtown twice a week thus saving on gas, parking and vehicle wear and tear. So far it is good decision. I chose a home over a fancy new car and no regrets. I also do 401k/457b to max as much as possible. I cook my own meals at home and brew my own coffee and rarely eat out these days.

I love it! Well done. To have the displaying to hold onto one car for so long and just do the maintenance is great. I agree that you save a lot of money as a result.

My car is coming up on 10 years old in 2025 and I no longer plan to buy a new one or a new used one then. I plan to just keep on maintaining it until it seems on safe or if there is some safety breakthrough with new cars.

Great article & podcast, Sam. I think this is helpful for avoiding overspending in depreciating assets like cars, and prioritizing on wealth building. However, I think there is an oversimplification to use house price or house value, because it’s really the house “equity” that’s important.

Example:

Triplets with identical finances and $1m houses, and $45,000 cars – with the exception of

* triplet A owns house outright ($1,000,000 equity)

* triplet B has a $700,000 loan at 4%, ($300,000 equity)

* triplet C has a $900,000 loan at 6%. ($100,000 equity)

Using your proposal, they would all have the same ratio?

I think you need a HouseEquity to CarValue ratio.

Hi Thomas,

Yes, they’d all have the same House-To-Car ratio. But scenario C would unlikely happen, unless I’m a bear market, if they followed my 30/30/3 home buying guide, which requires 20% down and a 10% buffer.

My ratio is built upon my home and car buying guide assumptions.

While I like the simplicity of your ratio, I think it’s clear that the triplets A, B, and C are not in same condition on their path to financial freedom.

They are really old, in their mid-40’s :-), and the houses were gifted to them years ago. B and C have reduced equity by taking out loans and HELOCs. Only A is disciplined and reads financialsamurai articles! C, is emboldened now because despite their bad financial habits, they point to this ratio and say that they have the same ratio score as A.

If such different profiles have the same ratio score, then I think it needs refinement and more emphasis on equity and not just market value.

Hah! Makes sense to me. Yes, these ratios and guidelines are there to help us make more optimal decisions going forward. We cannot use them in a vacuum and Must adjust accordingly.

Really nice that A and B got their homes gifted! And it’s seldom ever too late to read Financial Samurai, or other personal finance sites to get focused.

Speaking of spending irresponsibly, this is a key point in my new post: Having too much cash could actually make you poorer.

I think a better way to look at car investment is percent value of your cars to total net worth. In fact, think all depreciable assets should be viewed by this ratio (cars, boats motor cycles, ATVs, furniture, yard equipment, etc. This gives you a feel for what percent of your assets are working for you rather than you working for the assets. I am a retired 61 year old but .31% (31 basis points) is my total depreciable assets to total net worth. This means 99.69 percent of assets are investments of have a reasonable opportunity create income and/or to increase in value (i.e. investments, home, jewelry, etc.). Car values to net worth is .22%. House is less than 7% of net worth. Investment heavy relative to net worth. I like assets working for me.

You can certainly do that too. What limits would you put and what would you say to a 30 year old with a $300,000 net worth, for example?

Really good question. I have not really given much thought to depreciable assets or car goal ratios relative to net worth. I just tried to keep assets productive. I can say we maxed out at 11.50% depreciable asset ratio at age 31in 1994. That said, we drive cars to 250,000 miles unless someone wrecks them and kept house payments less than 20% of salary on a 15-year mortgage. Not suggesting any ratios but think people should think how much of their asset base is working for them with the ratios obviously being higher at earlier ages.

By the way, my first post but been reading your blog for many years. I think your blog is the most thought-provoking personal finance blog on the internet. Your material is always fresh even after all these years.

Thanks Doug. Yeah, the challenge is to come up with a personal finance ratio that can be applicable to as many people as possible and be dynamic to life over time.

I think home values by location have a tremendous weighting on this assessment. It was mentioned that living in a more expensive city can help improve this ratio due to vehicle prices not changing. The reverse of that is also true. If you live in an area where the cost of living is relatively low (like I do in the Midwest). My wife and I live well below our means and could afford a bigger house but considering that home ownership is somewhat investment neutral we’re not all that eager to upgrade (especially with current rates). Also, considering that the average home value in my area is less than $200,000 we would have to switch to bicycles to hit a 50:1 ratio. You almost need a sliding scale based on average home values by area.

All true. My House-To-Car ratio is a guide to help keep people’s CAR SPENDING in check.

I’m not encouraging people to spend way more on a house to improve their ratio, unless it’s within my 30/30/3 house buying guide. Instead, I’m encouraging people to own their cars for longer or buy cheaper cars.

For a $200,000 homeowner, buying a $4,000 car, or owning it until it’s worth only $4,000 is recommended. I owned my previous used car until it was worth only $2,800 on KBB, and I was making over $250,000. It can be done! Folks just need to be intentional.

Nothing wrong with public transportation or owning an inexpensive vehicle.

Sam — I’ve read your articles since forever. Usually, I can tell when you are being tongue-in-cheek but I fear you started early on Cinco De Mayo beverage indulgences.

Your advice boils down to “spend less on your car”. Fine. Half of the advice makes sense.

But a ratio is made of TWO parts and implicitly this article suggests you can SPEND MORE on your house to be “better off”.

Your replies to comments seem to bear this out.

There are indeed, two variables in the ratio that can be adjusted. Spending more on a house is a way to improve that ratio for sure. But only if the house is responsibly purchased using my 30/30/3 homebuying guide.

I also provide a discussion on how the ratios are generally much higher for homeowners living in more expensive areas of the country. It helps people think about Geo arbitrage opportunities to make more money, to save more money, and to help people who don’t live in expensive cities understand that relatively speaking, Everything else except for a house is cheaper. A Honda Accord cost the same in San Francisco as it does in Des Moines, Iowa.

I try to challenge readers to think and multi variables to build wealth.

Good article but many people earn the same income whether they live in an expensive coastal city or not. I make near the same what I would make living in southern Nevada than I would in LA, SD, or SF. The slight raise I may get moving back to CA doesn’t even come close to make up the taxes and the real estate price difference. The car ratio idea works well if your income really does strongly correlate to the city you live in.

So…to grow my net worth I just need to move to a high cost of living area with pricier houses? Seems…strange.

I live in lower COL area with no realistic public transportation. House is worth 500k and my household income is about 700k or so. I have 3 cars: Me, spouse, and nanny all need cars (have you tried moving car seats in an out of a nanny’s car? impossible to do quickly or safely. We need nanny car.) All 3 cars are paid off and worth about 54,000 in total now, giving me a ratio of about 9. None of the cars are luxury.

To be richer I should buy a more expensive house? Or get cheaper cars? No thanks. I’ll keep plowing 200K per year into retirement savings and continue driving decent cars.

The post is more to help people purchase less expensive cars or hold the ones they have for longer and focus on spending money on a primary residence or other long term appreciating assets instead.

But I can understand if you are others are not happy if your ratio is lower than my guidance. If you’re happy with your net worth and your and your investment contributions, that’s all that matters.

This post is to help people who are not and still have a long ways to go on their FI journey.

Sam,

I want to let you know I enjoy reading your articles. We share similar philosophies about life, family and money.

Your article about the house to car ratio made me laugh as it came out at the same time I am contemplating my next car purchase. Your logic is sound but somethings in life don’t always play into spreadsheets.

Six years ago at this time I was on sabbatical and starting writing a daily journal. My daily reflection helps me appreciate the good stuff in life as opposed to the bad stuff. I noticed that you are making similar observations as well with your article about commuting, etc.

Please keep the articles coming.

Pat

Around 15 years ago, I lived in a small town in the midwest. As you would typically find in a small town in that part of the country, housing was cheap, with many houses worth less than $50k — though there were also many houses valued at $100k to $200k or more. On one particular stretch of one particular street, most of the houses were small and run-down, and probably worth only about $30k to $40k. But many of those same houses had new or nearly new full-size pickup trucks parked in their driveways, and those trucks probably cost at least $40k to $50k brand new. It always amazed me, the incongruity of seeing such expensive vehicles parked at such cheap houses.

Seems like this ratio breaks down in low cost housing areas. If my income is $100,000 and I live where a house costs $500,000, I can’t afford as low a home to car ratio as I could if I have a $100,000 income where the same house costs $200,000. Even if I’m paying cash for the car, over just 1 year’s time I could buy a car worth substantially more with the extra left vis cheaper mortgage and spend and save the same amount in of money total.

Can you share an example using a car price?

For example, driving a $10,000 car and owning a $500,000 home. Seems doable no?

Home A: $400,000 mortgage, 7% 30 year = monthly payment $2,661.

Home B: $160,000 mortgage, 7% 30 year = monthly payment $1,064.

Difference adds up to $19,164 per year more for Home A.

Let’s say Home A owner has a $5,000 car and ratio of 100.

Home B owner could take his extra $19,164 per year and put just $5,000 more of that toward a $10,000 car and have a ratio of just 20, yet still have $9,164 more in his pocket to invest in appreciating assets and have MORE cash flow in his budget than home owner A.

Yes, longterm the car depreciates and the home appreciates less, but if you assume it is his forever home, Home B owner actually will have more cash to invest in assets he actually wants to sell and profit from (other than home) despite lower ratio, and is living more within his means.

For your baseline scenario, wouldn’t you need to take into account that most households have more than 1 car? You mentioned in your Note that we would have to take 2 cars into account, but your baseline should bake this in to make the ratio more realistic.

Source for Cars per Household: (fool.com/the-ascent/research/car-ownership-statistics/)

In my post, I discuss adding the total value of all vehicles to come up with the denominator to calculate the ratio.

And yes, more cars, more expenses and problems.

Good morning Sam.

Great article. As always, you make me ponder my situation. So here it is-

Combined Net Worth (My wife and I) $5.5m

Primary residence worth $775k, with a 2-5/8% mortgage and we owe $360k. We are pouring money into the market instead of paying off this mortgage.

Second home worth $425,000.00. Bought in 2023 and had a mortgage at 7-5/8% and paid it off in full in 8 months through snowballing. So now- no mortgage. We own it outright so just has the monthly bills.

Vehicles: 2 at primary residence worth $45,000.00

1 at second home worth $20,000.00.

We are considering selling the vehicle at our second home as it seldom gets driven and getting a beater mini van (did I just say that???) in the $5k to $10 k range.

Thoughts?

Sam

Sometimes your San Francisco financial bias is showing. We would beat up somebody who spent $40k on a car because they don’t have $2M in real estate?? This is apples and oranges and not relevant . To me, best way to look at it is how much stretch someone is taking on the car payment on top of home loan. I don’t see a problem with a $40/50k car and $500k house, both could be affordable and it is ludicrous to compare a minimum entry level car price to a massive stretch of $1M-$2M for a home.

Nobody is beating anybody up. People are free to do what they want with their money and buy as nice of a car and as cheap of a home as they want.

But for those people who want to achieve financial freedom, my house-to-car ratio is a nice quick calculation to see whether adjustments need to be made.

Try not to take it personally. If you’re driving around and $50,000 worth of cars, and are SATISFIED with your financial situation, then more power to you.

Instead of thinking about buying a $1 to $2 million car, I’m trying to encourage people to buy cheaper cars and hold them for longer.

Where are you on your financial journey? I’m assuming your house to car ratio is lower than my suggestion, hence the comment.

This is the first question I ask anyone I meet: “what is your house/car ratio?”. If the answer is less than 100, I just walk away.. not worth the time speaking to lesser mortals… Heh…just kidding.. :).

Hah! Love it. It’s not farfetched if my logical House-To-Car ratio goes mainstream. After all, people dating nowadays exchange credit scores.

I like your thought process. We use a fixed 15% of our budget on Home expenses & Debt. This “affords” us a chance to Lease (rent) one vehicle & Buy (own) another. A maintenance free Lease smells good again every 3 years:) Our 2011 Avalanche, still easy on the eyes, runs on gas, but is harder on the nose…lol Cheaper Home = more expensive Wheels;

Expensive Home = cheaper Wheels. Our Home expenses include anything on property (mortgage, home insurance, HOA, property tax, utilities, comms, guest help, etc). All Debts included, so the ratio keeps Debts inline. Saving & Investing 30% & living in a low-cost market makes this possible. Thank you for sharing!

Hi Sam, Divisor zero = large 401k because I enjoyed company car for 33 years of 34.5 year career at electric company. I smiled at your commute story. My RT commutes to NE DC were 130 miles for 25 years, 120 miles for 4 years and 40 miles thru city for 6 years. I was also on call nights & weekends. In 1982 the boss gave me this thing called a beeper. There were only 2 beepers in 2000 person division. I put out the other hand and asked for company car keys on the spot. Happily retired since Fall 2015.

You must be thrilled to no longer have to commute 120 miles a day! That is outrageous! What in the world? What are you doing to have to drive so far away?

Hi Sam, I was chief electric system chemist for Potomac Electric Power, then add in Delmarva power and Atlantic city electric. My work location was NE DC Anacostia at PEPCO property across from old RFK stadium. My Wife’s medical training and practice opportunities were Georgetown, Baltimore, Frederick, Leesburg and Easton.

House / 0 for car = Infinity! You win! ;)

My observations through the years is that car purchases are mostly about showing status and have little to do with financial concerns. As a teenager I visited a parents co-worker. Their house was not much more than a shack, parked out front a brand new Jeep. Since then, I’ve seen endless examples. Real rich don’t give a hoot about what you think of their vehicle, the wanna-a-bees care deeply, much to their detriment. Just drive by poorer rental areas and observe the vehicles. Note also U-Tube videos about vehicle repossessions. Typically not low-end vehicles, they tend to be mid to upper value vehicles. One would think that if their finances were stressed they would purchase an econo-box (preferably used). There is also the trend to purchase much more vehicle than necessary when one really doesn’t need the additional capacity of these vehicles (trucks, large SUV’s, etc.). More fuel, more expensive tire, more costly to maintain…. I have a neighbor (single guy that lives with his parents), has a jacked up diesel F250 that I have never once seen him tow any with nor put anything in the bed (I guess one doesn’t want to scratch the bed with a load). As my pastor said “i didn’t own the truck, the truck owned me…” I too made the mistake of buying a new car early in my new career, but at least I did pay it off early and drove it over 100K….

My number is 1.25 with two cars, a sedan and a minivan. Both are functional, not exciting cars and we’re bought used.

I think a key with cars and saving / investing is paying cash. At least for my family, it’s helped us make sure that we do not overspend on cars. I really do not want to work forever.

This is a good concept but less relevant once you hit a certain net worth. Going to a $15mm from a $5mm house just adds management headaches and having a couple $100k+ cars doesn’t move the needle even if the ratio is a bit sub optimal. A Tacoma may look silly in front of a $10mm house but also don’t think you should go from a $10mm to $15mm house to justify a Ferrari purchase.

Or own a cheaper car? The goal is mainly to help reduce car expenditure given it is guaranteed to depreciate. Keep the car for longer or buy a cheaper car.

$100K car and $5 million house works. And that ratio goes up from 50 the longer you own the car as it depreciates.

I get it. All becomes moot in the tails though. Brick layer needs a $20k+ truck to afford the $100k house. Ratio is off but the guy needs it. $1mm car collection irrelevant for a guy in the $10mm house. Ratio is off but doesn’t matter. The right cars can gain as much value as the house

How has your attitude about spending on things like cars etc changed after you got to $10+ million?

Very little consideration for security or optimization as far as financies are concerned. Almost entirely focused on building things of significance and mentoring others. Love the blog. Have read from the beginning

Sam,

I enjoy my Sunday morning reading weekly of Financial Samurai.

You’re home to car ratio article was very interesting. I do believe there’s some other math factors that should be applied I do not have the formula let me give you my numbers. Married me age 68 wife age 66. Both retired. Social Security income currently carrying us at 95%. Zillow indicates home value $385,000 two cars value $28,000. Thus thus a ratio of 13.75

For security reasons I’m not going to provide my 401k value. Let’s say it’s over $500K and less than $2M. Zero debt, nothing owed. I would like to think that I am in the category of financial freedom but must be cautious of surprises. Perhaps you can chime in adding age, health and net worth as factors into your equation.

-Jim

Hi Jim,

Thanks for sharing. I added the following:

“For those of you who are ultra rich, retired, or who have pensions and little-to-no debt, my ratio won’t be as relevant given you are already set financially. This ratio is most helpful to those still on their journey to financial independence.”

I agree that you’re doing fine and my ratio isn’t as applicable. However, I still think the ratio is useful in thinking about how best to spend your money.

For example, if you really do have $2 million in your 401(k) with zero debt and Social Security covering 95% of your expenses, you are free to move your ratio down to 8.75, equal to the typical American because you have already retired.

The challenge now is to spend down your wealth so you don’t end up with too much.

You’ve provided me a good things to think about and maybe I’ll add this in the post as another example.

Thanks

This was a great article, after doing my math I came up with a ratio of 60, the breakdown is as follows:

Primary Apt

$326k

Vehicle

$5,400

Have additional 2 properties

One being rented worth

$125k

Vacation home, rent some times worth

$100k

I live in Los Angeles my income is in the $150-170k a year 34m, single no kids, no college education, and immigrant. Some time it feels like I’m not doing enough but there are times where I am happy with my life at the moment, I guess it’s all perspective. I don’t live lavishly and on occasion I do go out to eat at some nice restaurants because at home I cook most of the time.

I’m considering renting a place closer to work and rent my primary apt. I did the math and it makes sense because I would sell my car and not need it because of the area and closer proximity.

I know I don’t live in a forever home, it’s a small ish studio apt but it fits my needs and I am the type of person that I would make the sacrifices needed to gain more opportunities that would make me money in the long term.

Also huge fan of the blog have been a reader for a few years.

Looking good to me! Nice work keeping your car expensive low and doing some house hacking to generate more income.

Thanks for reading. If you would like to support my work, I would love a review of my podcast on Apple, and a review of my book on Amazon.

Cheers

Would you adjust the ratio with multiple children?

I can’t see someone with 4 children taking uber black all day.

I remember reading an article mentioning the automobile is part of the reason for negative demographic growth.

How would you adjust the ratio? Are you saying that as a family has four children, they need to buy a more expensive car like a minivan? That makes sense, but if anything, it is even more important for this family of six to make sure their housing and car expenses are correct. Raising four children can be expensive and cost a lot of time and energy.

And I’m assuming with four children, chances are high that one spouse will stay at home to take care of them. But maybe not!

I’m open to suggestions how old are the formula are the ratios to account for children.

I don’t think the ratio of primary residence to cars is very meaningful. Cars are depreciating assets and should be a small part of our net worth. The ratio of value of all cars in the household to income should be small also. On the other hand living in an oversized house people can barely afford mortgage is not good either.

I think I do better than an average American in NW (8 digits) and cars as percentage of income. Yet, my ratio of residence to cars is only about 18. We prefer driving dependable relatively new cars (under 5 yrs) all bought within our monthly income and their total value is about 0.5% of NW while the value of principal residences is 9%.

Maybe the secret is to just encourage people to get to a $10+ million net worth? But it could be harder than you think based on the statistics.

Do you mind sharing your age, what you do, and how you managed to achieve an 8-figure net worth despite spending time getting your PhD?

I think it would be helpful for the readers to understand your background. Best yes, I agree with you that having a $10+ million net worth makes buying a new car easier to afford.

Just one point of reference though. I don’t know a single person with a $10+ million net worth with less than a 50 house-to-car ratio. Most are well above 100, so if you want to build more wealth, you can.

I am 72, wife is a few years younger, both retired. Saving and investing is the key as I have never made above $100K in earnings all my life. My first college job after getting my PhD only paid $31K. Wife used to make a bit more but we were stuck in combined income under $200K until perhaps 2018-9. In retirement we make more than twice that figure.

The relatively low house-to-car ratio come from the fact even though we could easily afford a bigger home our current residences (2200 sqf and 3100 sqf) are more than adequate for the two of us. Besides we live in relatively low cost areas. The same homes in the SF/Bay area would probably be worth close to $4 million at least.

Got it. Thanks for the color. It’s helpful. I have a feeling that once one is retired for over a decade and has a high net worth, the financial challenges for middle-class people, and these type of concepts don’t resonate very well anymore.

At 72, I hope to be spending more money as well. I decided to enter decumulation mode at 45. But it’s been a struggle until I bought a nicer house last year.

What do you plan to do with your millions left over?

Legacy (grandchildren + charitable work).

Thanks Ed. I also agree the cure to being poor and having a difficult time affording things is to be rich.

What did you get your PhD?

The best part of this formula is that car depreciation can now be celebrated rather than lamented!

What’s the deal with with your tenant’s income? Is it truly 175k monthly, as you wrote?

It’s his yearly salary excluding stock compensation. Thoughts on the House-to-Car Ratio? What’s yours?

Our ratio is going to be around 18 this fall, when we finish building house in Pittsburgh suburbs.

Overall I liked the concept of the ratio. It’s good indicator whether you have too much of a car.

Our house is worth about AUD 1.3 million and our 20 year old car AUD 4k. So, that is a ratio of around 300. Car is perfectly functional. One reason why I won’t be buying a new car soon is I would like to upgrade the house :)