If you've got a pension, count yourself as one of the lucky ones. A pension is more valuable than you realize. With a pension, you won't be forced to lower your safe withdrawal rate in retirement like those of use who don't have pensions. This post will help you calculate the value of a pension.

Pensions, also known as Defined Benefit plans, have become rarer as companies force their employees to save for themselves mainly through a 401k, 457, 403b, Roth 401(k) or IRA. These savings vehicles are also known as Defined Contribution plans.

But as we all know, the maximum amount you can contribute to a 401(k) or IRA is $23,000 or $7,000, respectively for 2024. Even if you max out your 401(k) for 33 consecutive years starting today, it's unlikely your 401(k) or IRA's value will match the value of a pension.

Take a look at my latest 401k savings potential chart. After 33 years of maximum contributions, I estimate you'll have between $568,000 – $1,800,000 in your 401k, depending on performance.

$1,800,000 sounds like a lot, but in 33 years, $1,800,000 will buy just $678,000 worth of goods and services today using a 3% annual inflation rate. However, inflation is currently running at ~7.5%.

If you live for 20 after your last 401(k) maximum contribution, you'll only be able to spend $33,900 a year in today's dollars until the money runs out. $33,900 is not bad, but it's not like you're living it up after sacrificing your life for decades at a job you didn't love.

Given the power of inflation, to neither max out your 401(k) nor invest an additional 20%+ of your after-tax income if you don't have a pension is risky. When it comes to your money, it's always better to end up with too much than too little.

How To Calculate The Value Of A Pension

The best way to calculate the value of a pension is through a simple formula I've come up with. For background, I worked in finance from 1999 – 2012, got my MBA from UC Berkeley, and have written over 2,500 personal finance articles on Financial Samurai since 2009.

I live what I write and speak as an early retiree since 2012. Money is too important to not take seriously.

The value of a pension = Annual pension amount divided by a reasonable rate of return multiplied by a percentage probability the pension will be paid until death as promised.

For example, here is an example of how to calculate a pension with the following data:

Average income over the last four years: $90,000

Annual pension: $67,500

A reasonable rate of return divisor: 2.55%

Percentage probability of pension being paid until death: 95%

Value of pension = ($67,500 / 0.0255) X 0.95 = $2,514,706

One can argue my formula for calculating the value of a pension is overstated. After all, the pension's value is dependent on the terminal value, and we all eventually die. Therefore, if you are particularly pessimistic, you can apply a discount to the final calculation.

For example, if you are a pessimistic person in poor health, perhaps you multiply the final value of the pension by 50%. In this case, a $2,514,706 pension goes down to about $1,250,000.

If you have a pension, your goal is to live as long and healthy a life as possible! The longer you live, the greater the value of your pension. This means eating better, exercising, and having a good social network of friends.

How Do Pensions Work?

Most pensions start paying out at a certain age and continue paying out until death. The amount of pension you receive is determined by years of service, age in which you elect to start collecting, and usually the average annual income over your last several years of service.

If you don't know how to calculate the expected monthly or annual payment of your pension, just ask human resources to provide details.

To calculate the value of your pension involves figuring out your annual pension payment, a reasonable rate of return divisor, and a realistic expected chance of payment until the end. After all, your company could go bankrupt and welch on all its pension promises.

Deciding on a reasonable rate of return divisor is subjective. The safest divisor to use is the 10-year government bond yield, which currently hovers around 4%. In other words, one can reasonably expect to earn 4% each year on his or her investments given the 10-year government bond yield is guaranteed.

One could use a more aggressive reasonable rate of return, such as 10%, to reflect a historical annual return of the stock market. However, the higher your divisor, the lower the value of your pension ironically, because it requires less capital to generate your pension income when things are booming.

Pensions Have Become Much More Valuable

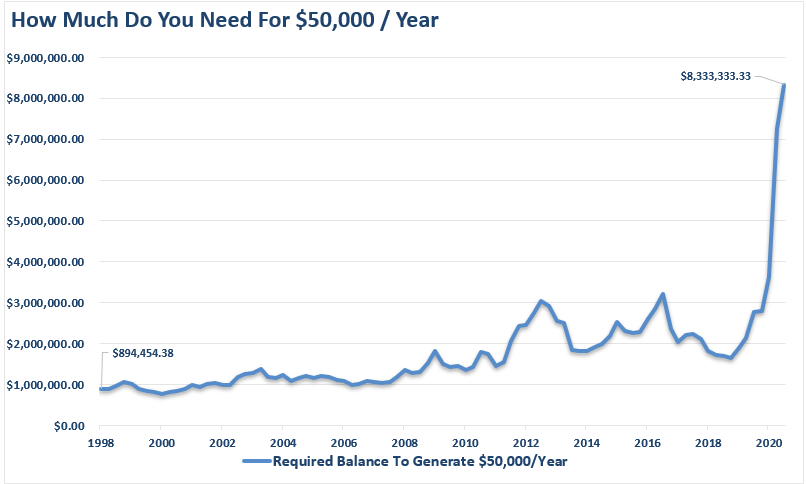

Given interest rates collapsed in 2020, it took more capital to generate the same amount of risk-adjusted returns/income. Therefore, the value of a pension went WAY UP because the value of cash flow has gone way up.

Just take a look at this chart regarding how much more capital is needed to generate $50,000 a year in income. Therefore, the proper safe withdrawal rate should be lower the it was in the past.

Thankfully, interest rates have ticked up from their 2020 lows, making generating passive income easier. However, the higher interest rates go, the more headwind stocks and real estate generally have.

We're now in a situation where the Fed continues to hike rates aggressively to combat inflation. In fact, patient investors can now earn over 5% in risk-free Treasury bonds. The rates likely won't last, which reminds us of how fluid economics and investments are.

Let's calculate the value of various pensions below.

Pension Value Example 1: Police Officer Retiring After 25 Years Of Service

Here is the example again of how to calculate the value of a pension with some commentary after.

Average income over the last four years: $90,000

Annual pension: $67,500

A reasonable rate of return divisor: 2.55%

Percentage probability of pension being paid until death: 95%

Value of pension = ($67,500 / 0.0255) X 0.95 = $2,514,706

Well how about that! After 30 years of service, this police officer will have a pension worth roughly $2,514,706 on top of whatever other assets he has accumulated. Not bad for someone who made a decent, but unspectacular $90,000 year for the last four years of his career.

Let's say this police officer joined the force at age 20. He's still young enough to start another career making additional money on top of his $60,000 pension. Talk about the perfect early retirement plan to pursue your passions without fear.

Pension Value Example #2: Foreign Service Officer Retiring After 30 Years Of Service

Let's say you started in the foreign service before 1986 and finally want to retire. Congrats! You will have a nice pension for life waiting for you.

Average income over the last three years: $120,000

Annual pension: $85,000

A reasonable rate of return divisor: 3%

Percentage probability of pension being paid until death: 100%

Value of pension = ($85,000 / 0.03) X 1 = $2,833,333

I use a 100% probability of the pension being paid until death because the payer is the federal government. This figure is also subjective, but I believe the federal government will honor their promises to older employees. They're just cutting pension benefits for newer employees.

Different Rates Of Returns Change Pension Values

If I used 2.55% as the reasonable rate of return divisor, the value of this retired foreign service officer's pension jumps to $3,333,333. The reason is because an investor needs to invest $3,333,333 in capital to generate $85,000 in annual income when the rate of return is only 2.55%.

Let's say the rate of return was 50%, the value of the pension/capital required is only $170,000. But who on Earth can reliably generate a 50% annual return each year forever? Nobody.

Thankfully, for retirees, interest rates have increased dramatically since the Fed began hiking rates in 1Q 2022. As a result, it's easier to generate passive income now through stocks, bonds, and real estate. But ironically, the value of your pension goes down in a higher interest rate environment.

For example, in 2024, the risk-free rate is around 4.1%. As a result, the value of the pension above declines to $2,073,170 ($85,000 / 0.041) versus $2,833,333 when the reasonable rate of return divisor was 3%.

Note for foreign service officers: For those of you who start the foreign service after 1986, you receive 1.7 percent of your salary for the first 20 years and 1 percent for each additional year. Therefore, 30 years only gets you 44 percent of your salary equal to a pension. However, at least you can still have 401(k) matching and collect Social Security.

Pension Value Example #3: Public School Teacher Retiring After 30 Years

Average income over the past four years: $72,000

Annual pension: $43,000

A reasonable rate of return divisor: 2.55%

Percentage probability of pension being paid until death: 75%

Value of pension = ($43,000 / 0.0255) X 0.8 = $1,349,019

Although this public school teacher wasn't earning a huge amount, she gets to retire with a $36,000 annual pension that is worth over $1,000,000. Using an 75% payment probability seems reasonable.

Most pensions also have an inflation adjuster built in order to keep up with inflation. Although sometimes, the inflation adjustments don't keep up.

Here's a chart I put together highlighting the values of a $35,000 and $50,000 pension (in the range of the most common pension amounts). As the rate of return goes higher, the value of your pension goes lower. Bond values work in a similar fashion as interest rates go higher and vice versa.

Thanks to the craziness of the pandemic, the 10-year bond yield has declined to under 1%. Therefore, the value of your pension has gone way up. You want to hold onto your cash cows for as long as possible. Your reasonable return of return divisor should be lowered to 1% – 2% in this low interest rate environment.

A Pension's Value Is Subjective

Obviously, my calculation is simplistic because we all die at some point. My calculation is based on cash flow into perpetuity. To counteract the perpetuity, I assign a Probability of Payout percent. Further, we all won't have surviving spouses to continue receiving the pension long after we're gone.

You're free to lower the Probability of Payout percentage to account for shorter lifespans or a more pessimistic life outlook. You can also call the Probability of Payout the Pension Discount Rate if you wish.

Just remember that value is subjective. Once we're dead, what does anything really matter? There's no longer a need to earn any money for ourselves. Given most pensions continue to pay out to a surviving spouse, s/he is covered until death as well.

What this article and my calculation attempts to do is provide an easy way for all pensioners to assign a real value to their pensions. I also want to give pensioners hope that their financial situation isn't as dire as expected if they are comparing themselves to private sector workers or my average net worth for the above average person chart.

Cherish Your Valuable Pension

All three individuals with pensions above are millionaires due to their long-term dedication and pensions. Even if you were only receiving a $15,000 a year pension, it's still worth more than $500,000 a year using a 2.55% divisor and 90% payout probability.

Given the median net worth in America is around $100,000, we can conclude that anybody with a pension is considered very well off. Less than 20% of Americans have pensions in the new decade.

Live As Long As Possible To Increase Your Pension's Value

There's one key variable that I haven't discussed, and that's a pension owner's lifespan. Unfortunately, the foreign service officer with a pension worth $2,833,333 can't sell his pension to anybody for that amount. Nor does the pension keep paying out after death.

Although, in some cases, a pension can keep paying out to a surviving spouse. The reality is one's pension value fades as the owner inches closer towards the end.

Therefore, it behooves every pension owner to live as long and healthy of a life as possible to maintain the value of his/her pension. The same logic goes for anybody with passive income, including social security. The richer you are, the healthier you should try to be!

The value of your pension is subjective. You could even multiply your annual pension amount by the average P/E multiple of the S&P 500 to come up with its value. There are many variables and variable amounts to consider.

Just know that your pension has tremendous value, just like your Social Security, the nation's pension plan. If your pension plan has a high cost of living adjustment rate, then your pension is worth even more.

If you feel your net worth is lacking based on my charts for the average net worth for above average people, simply calculate the value of your pension using my formula. The results will likely surprise you.

Invest In Real Estate For More Income

Given the value of cash flow has gone way up, it is wise to invest in assets that generate income. The best type of income-generating asset regular people can invest in is real estate.

Investing in real estate is like getting a pension because real estate tends to produce a steady income stream that gets more valuable over time. Inflation helps left the value of real estate and rents.

Take a look at Fundrise, my favorite real estate crowdfunding platform available for all investors. You can invest in a diversified real estate fund that primary investments in the heartland where valuations are cheaper and rental yields are higher. Fundrise manages over $3.5 billion from over 500,000 investors.

My other favorite real estate platform for accredited investors is CrowdStreet. CrowdStreet focuses on individual commercial real estate projects in 18-hour cities such as Charleston and Memphis. With higher cap rates and potentially higher growth rates due to demographic shifts to lower-cost areas of the country, CrowdStreet is very interesting.

I've personally invested $954,000 total in real estate crowdfunding to generate more diversified passive income. So far so good as my passive income hits roughly $300,000 a year. Real estate is the ultimate inflation.

Stay On Top Of Your Finances

The best way to grow your net worth is to track your net worth. I've been using Empower's free financial tools and app to optimize my wealth since 2012. It is the best free money management tool on the web.

Link up all your financial accounts to analyze your wealth. Start by measuring your cash flow. Then x-ray your portfolio for excessive fees. The best feature is the retirement planner.

There's no rewind button in life. Even if you have a valuable pension, it's important to continue staying on top of your finances. Do your best to optimize the wealth you have now.

Buy The Best Selling Personal Finance Book

If you want to drastically improve your chances of achieving financial freedom, purchase a hard copy of my new Wall Street Journal bestselling book, Buy This, Not That: How To Spend Your Way To Wealth And Freedom. The book is jam packed with unique strategies to help you build your fortune while living your best life.

Buy This, Not That is also a #1 best seller on Amazon. By the time you finish BTNT you will gain at least 100X more value than its cost. After spending 30 years working in finance, writing about finance, and studying finance, I'm certain you will love Buy This, Not That.

Last Word On Pensions

Note: Pensions are most common in the following fields: military, government, education, gas and electric, insurance, and health services. Having a pension is likely winning the lottery. Enjoy it for the rest of your life! Most people are not so lucky.

In a low-interest rate environment, a pension's value has increased significantly. Calculate the value of your pension and make the best career decision possible. Although pension payouts are declining, they are still quite valuable. Don't underestimate public service jobs and other jobs with pensions!

For more nuanced personal finance content, join 65,000+ others and sign up for my free weekly newsletter. I've been helping people achieve financial freedom since 2009. How To Calculate The Value Of A Pension is a FS original post. Your pension is worth more than you think.

I don’t know where you got your figures or how you learned to figure pension, but you are insane! First I worked a very good paying job for 30 years with GM. My pension is 16,000 a year, I know of nobody with a 60 to 80 thousand dollar a year pension!!!!! You calculate a pension like it is savings! You are living off that pension, by the way never goes up so you are losing not gaining every year because of inflation! Give me a 2 million dollar 401K pension any day over a 16,000 dollar a year pension! I could stick that 401k in a CD and make 3 times what I draw!

I have a $75,000 pension that is indexed to inflation after working for my local utility company for 35 years.

Instead of us being insane, maybe you just have not seen or understood the world enough. But at this age, it’s too late for you. But getting educated is not too late for your children and grandchildren.

Don’t let them make the same mistake you made. Have you tried even calculating the value of your pension based on the suggestions in this post?

Hi Sam,

Regarding pension valuations, the mortality tables provided by the Social Security office can be a convenient tool regarding the estimated future number of payments received. Since these tables adjust for age, it will effectively revalue the pension each year.

Also, for pensions with an inflation adjustment, the TIPS yield arguably provides a better discount rate than nominal treasuries.

As a hopeful military retiree, I use a simple PV formula in Excel with these variables to calculate the pension value.

The other option is to plug your estimated annual payment into an annuity calculator. This is likely a closer approximation as those insurance companies benefit from pooling, similar to pension issuers. The result will be a much lower PV than calculating a pension value using treasury yields as the discount rate.

Using my estimated military pension of $9,108 per month in 2034, the PV utilizing a TIPS yield of 2.11% is $2M. Using Schwab’s annuity estimator, it would only cost $1.2M to buy that annuity today (with the same starting period). In reality, the annuity is even cheaper as it is a true Joint-life annuity. The military provides the spouse with only 55% of the original pension value when the service member dies (just to show her that the government always gets the last laugh).

Sam,

I am a regular reader and get your Sunday’s newsletter. I do not understand why you utilize 2.55% as your denominator for the calculation of the net worth of a pension. I worked part-time at the VA as part of a prior academic medicine appointment, and accumulated about 15 yrs of service in FERS, which gave me a calculated pension of about $20,400. I also contributed to their TSP (401K equivalent). I have seen some calculators valuing pensions using 6.67%, partly because they incorporated actuarial data into the denominator and used a historically higher bond return.

Best,

Jose

It’s just one option of many in the chart. With rates and inflation higher, a higher percentage is now more appropriate.

Example #2 is not realistic and should be edited as it’s not the case for the vast majority of people in the Foreign Service, specialists and generalists, across all agencies. Most people in the Foreign Service face Time in Class (TIC) as well as Time in Service (TIS). Only very few specialist categories are exempt from both TIC and TIS. Almost everyone is out by age 65 as we are mandatorily retired for age, with very few exceptions. We cannot join before age 18 and time working as an EFM in the Overseas Seasonal Hire Program (ages 16 to 21) does not count towards thee Service Computation Date. The vast majority join the FS after age 22. While it’s technically possible for someone to join the FS at age 18 and retire at age 65, the chance of them hitting a TIC or TIS or just wanting to retire after age 50 or joining the FS after age 22 is very, very high–leaving almost no one left in the example you describe above. Therefore, almost no one would have joined the Foreign Service in 1986 and still be in the FS as of 2023. Just ask your parents for a more realistic FS annuity example, or ask one of your many readers who are FS for a more realistic example.

True, but I mention how the Foreign Service pension has declined. And people are free to use a lower probability rate or higher discount rate to value their pension as a result.

If you’d like to share an income example based on numbers of years served and the resulting pension amount, I’d love to hear it. thanks

Pension calculations have changed considerably since your parents retired.

30 years would only get you 40% of your high three average. 1.7% for the first 20, 1% for each additional year. However, one does collect social security unlike your parents which makes up some of the difference. The old system was much more beneficial.

Depends what agency you have retired from they are all different..

Sample I’m retired MTA RATE is 2% 20-30years and 1.5% over 30 years

So with 30 yrs service you get 60% final adverge ,

With those that pay less i would get 401/457 for xtra gravy….so start early but it never too late..

Social will be higher if your earnings are higher too…But remember enjoy the journey too…Live Everyday Till you hang you hat up

Financial Samurai, to continue the feel-good factor of placing a value on a pension into retirement, would you run your calculation each year, say, following an indexed increase in the monthly pension, or would you suggest keeping the pension value as it was on the day the pension commenced? Thanks

Since I’m retired military (enlisted), I didn’t have a 401K or TSP to contribute to. I’ve been receiving a military pension for 15 years (avg $30K/yr). To catch up, I’ve invested every pension dollar in stock index funds. I’ve also contributed to my company’s 401K and a taxable account. This approach has worked wonders. My financial situation is great. I’m 56 and hopefully can continue to collect my pension for 30+ years. Fingers crossed.

“… but in 33 years, $1,800,000 will buy just $678,000 worth of goods and services today using a 3% annual inflation rate.”

Can you explain how you got this? (1,800,000/678,000)^(1/20)=1.05, or 5%.

I’m doing a quick annuity factor calculation, and at 4% interest and 7% inflation it looks like a present value of $1,800,000 will fund a benefit of $65,878 for 20 years. Did you get $33,900 assuming 0% interest and 7.5% inflation?

I went the other way and inputted $678,000 present value, 33 years, and 3% annual growth to equal $1,800,000. http://www.moneychimp.com/calculator/compound_interest_calculator.htm

Just used this to help answer so real questions from real people who are contemplating retirement. Thanks for sharing the ideas, Sam.

Apologies if you answered somewhere, but I didn’t see it…

How exactly is the “rate of return divisor” calculated? e.g. where does 0.0255 come from?

Cheers!

Jesse

I am 55 years old. I plan on retiring in 18 months. My pension will be $64,500 per year with no COLA. I am very healthy and would project living to 90. How do I figure the value of my pension to include in net worth? I am estimating approximately 33 years of drawing this pension

Thanks

We got 4 pensions in various California pensions (UC, 2 Calpers, county level). Never thought to calculate the true value of these. Mind boggling they would be worth this much. Let me add to this that in public service, we don’t pay for much work expenses at all as it’s extremely low maintenance and don’t need to join the clubs to drum up business – unless you’re a politician of course. I missed calpers pepra deadline by like 2 months and joined public service spring 2013… ugh! Would have been classic member and getting 100k more a year then what’s now permitted re salary/cap limits. If I only knew at age 33 when I joined public service. My only regret.

My husband is 6 yrs older than me, so I’d like to retire at 62 at 2% (in 2042) but 67 at 2.5% final comp cap limit would be much more lucrative for me (earning 3.5k more a month post taxes). We will have plenty in deferred compensation I think by that time (62 and 68) projecting 10 mil in our 4 deferred compensation and Roth IRAs wouldn’t have to ever touch. Debating still on age to retire (62 v. 67)… can’t buy time that’s for sure and afraid I’ll miss golden years w hubby if I don’t retire at 62. What do you think?

I am not a financial guru but am early retired but my wife is not. She really enjoys (maybe even loves) what she does. She plans on working for another 20 to 30 years which she also will be paying off her part of the mortgage. I really wish she would retire earlier than later because I except the cost of travel will increase significantly for us when we get older- ie first class tickets and hotels instead of economy premium currently. The increase will just be to travel more comfortably the older I (we) get.

If I read it right, you will have $10 million you won’t even need to touch by 62 why you retire. I like to golf, ski, travel and hike. I am going to assume every activity gets more difficult the older you are- recovery wise. If your husband likes to watch netflixs and order take out and is a homebody (nothing inherently wrong with that) than you can pull off working late. If you want to travel and do activities, retire earlier. The one regret I have that will not be fulfilled (maybe) is an around the world cruise that we can afford financially but she cannot (or chooses not to) afford is the year to cruise the world. By the time we have the time, I will be 80.

Take the time if you feel you have enough money. But only you can decide. If I had $10 million in the bank, I would definitely try to sway my wife to take a year off from her job to do that travel anytime before 80.

Your foreign service example is only valid for those who started prior to 1986. I started in 1988 and retired in 2014. Under the current system you receive 1.7 percent for the first 20 years and 1 percent for each additional year. So 30 years only gets you 44 percent. Obviously 44 percent of 120k is much less than 85k as in your example. Under the new system one also gets social security and a 401k match but I would have much preferred the older system that your father retired under.

Yep. Still though, not bad either way!

I totally agree! Continuance of govt subsidized health care is another huge perk.

I couldn’t find a way to add a reply other than to reply to just one of your comments. You probably are aware that Forbes has published through one of its columnists a pension valuation spreadsheet. It includes the value of a pension according to existing interest rates as well as the value according to “regulations”. If you can’t find it, I would be happy to send you, Sam, the version i downloaded last year. I am not able to send it to every reader but you may want to post it.

I have a cash balance pension plan. I worked 35 years , average salary 80,000, 4%

I am 55 years old. I am a black male. what is the value of my pension?

Pensions pay a defined payment until your death and may or may not have a death benefit for your spouse. I had a co-worker that died 3 months after retiring, his $4,000 monthly pension was paid for 3 months. Theoretical value of that at your rates would be about $2 million, but it paid him $12,000.

The way to value a pension is what it would cost to buy it. They are available for sale all over the place, so are high commission terrible products, but you can buy no commission Immediate Income annuities with our without death benefits for you or your spouse.

As an example I looked at what income I could generate by purchasing a immediate income annuity with no death benefit and it pays about 5.4% With Minimal death benefit it pays 5.3%. Full benefit pays 4.5%.

Value will depend on age and life expectance, they above are for 63 year old male retiree. Older retirees would get higher rate because of lower life expectancy.

My suggestion would be to value pensions using a 5% rate and could go higher for elder readers.

This is the truest apples to apples comparison of a pension (which most often leaves nothing when you die).

I have a state pension waiting for me that is worth 58.8% in March of 2022. In a year and 3 months(my date is March) my best 3 years at this point will be about $118k. If I wait, my percentage goes up to 63.8% and then to 80% the following year, which will max me out. So, I’m looking at around $70k/year if I retire in March of 2022. I would like to retire. I’ve had enough. From what I’ve read in your article, it looks like I should be ok. The only debt I have is a new truck that is into its third year of a 60 month plan. No credit card debt and just paid my last mortgage payment. Wife has a good 401k as well. I’m burned out and want to retire. My question is this: Is it foolish Not to wait and get to 80%? One other question is in regard to your article. It’s says towards the end of the article that you should hang onto your cash cow as long as you can. What exactly are you talking about in regards to this?

Joe,

When you say if you “wait” you pension goes up by 5% and then jumps to 80% the following year. How long would you have to “wait” which I assume means continue working or are you saying delaying drawing on the pension?

The 80% vs 58.8% is really significant and, depending on how much longer you would have to work, would probably be worth it.

Safe Withdrawal Rate is 4%, based on your investment keeping up with inflation. As Greg Lee says (sept 18, 2019) multiple income by 25 to get principle amount. But without a COLA you miss out on keeping up with inflation. With inflation at 2% and added tax at 2%. The factor is more like 1/6% (16.7x) or 1/8% (12.5X).

So for every $40K passive income (I like $40K as it translates to $1M):

in a brokerage: $40K*25=$1,000,000

in a pension $40k*16.7 = $666,667

in a pension $40k*12.5 = $500,000

Hi Sam what is your view on federal veterans disability payments in terms of value and stability compared to pensions? The payer is the federal government, and if the ratings are static there is no reexaminations, and after 20 years it cannot be taken away under any circumstances. Would it be wise to factor it into any savings calculations? Thanks

Chris – the value of a VA disability payment should be considered the same as a pension, although there is no survivor’s benefit (in most cases). If you’re getting 100% VA disability payment, it is ~$40k/year (depending on number of dependents). It is tax free, so it’s value is even more than a regular employer pension (which are all taxed at the federal rate, and state rate in some states).

I am wondering if a health benefit associated with a pension adds to the value of that pension. IE: Is a health benefit part of a QDRO? I am possibly facing divorce and both of us have pensions. His is bigger than mine by about $700; mine has the health benefit. I am in California – pensions are CalPERS.

I am just trying to put a good finance package/offer together for a divorce that does not involve attorneys or actually having to file a QDRO since we both have our own pensions.

It certainly does!

My family of 4 now pays $2,500/month for unsubsidized healthcare a month!

Thanks for your reply. So, a health plan is calculated into the overall valuation on a QDRO?

In a similar situation. How would you calculate the value of a pension with health plan included?

It would logically be worth even more. Take the premiums you would have paid for the health insurance plan and divide it by a reasonable rate of return.

Here’s a related post: Getting Your Money’s Worth For The Health Care Insurance Premiums You Pay

Great post. Not a lot of posts on this topic because the US has shat on the working class!

All i need is enough to cover all housing and living expenses. I’ll get a “low stress” leadership job for the benefits and pay.

The correct way is to calculate the net present value, but you have to make an assumption of the number of years the pension will pay out.

Yes, but who’s gonna know how to do that? If you still need to make assumptions, then you might as well go my way. It is more intuitive and easy.

The bottom line is that you cannot really know the true value of any pension because you do not know how long you will live. Any method used is, at best, an estimate. I do believe that your method is more accurate for those who live beyond their actuarially determined age of death.

Indeed. Life is one big calculated bet. Make the most of it every day!

Related: No Need To Win A Financial Argument, Just Win!

This formula greatly exaggerates the value of a pension. It only calculates a principal amount needed to generate a monthly interest payment while maintaining principal. For that to be true, the retiree would still have that amount in his estate at death.

A better way to calculate the value of a pension is to use the amount of payments multiplied by the number of payments based on life expectancy. This will be much less than this rosy picture painted here (but still very nice).

What I would really like to see is someone calculate the value of the Federal Employee Health Benefit for retirees after age 55.

This post needs more attention.

1) The value of the pension is actually worth less because you don’t get to keep the principal capital being used to generate your yearly pension – the annual pension payments stop when you die. With money invested in defined contributions for example, you get to keep (or pass on) the principal capital that perpetually generate the yearly income after you die. You have the option and access to the $X million that’s generating your passive yearly returns and YOLO’ing the initial capital on hookers and booze whenever you want.

2) Pension-based jobs are significantly underpaid especially in the public sector. I’ve made six figures with a pension at public sector position (IT related) but my equivalent private sector colleagues average about 20-30% more in salary, and probably double (100%) if I were to move down south. When deciding between a public/private sector job, you could pick the private sector job (which has no pension) and invest the increased amount of salary in the S&P500 which would likely generate a greater return than the pension offered at the public sector. The man difference is the risk of job loss and work/life balance at the private sector job is probably worse

“1) The value of the pension is actually worth less because you don’t get to keep the principal capital”

As you point out, you can pass on capital in a portfolio, however, from your personal perspective, on death, you don’t get to keep the capital wherever it is, i.e. you can’t take it with you!

Also, for most government pensions, you CAN pass the pension on to a beneficiary. This is not being calculated in. As you said, whether you go private or public, you can’t take it with you when you die. However, you do have the option of passing your pension on to a loved one. Some options allow you to pass it on to a beneficiary for the rest of their lives as well (for a reduced monthly pension for the pensioner).

Something worth highlighting in and among those receiving pensions where (and this is the critical point) the retiree did NOT contribute to Social Security during the years they worked toward said pension; yet DOES accumulate either in post-retirement or otherwise, enough Social Security Quarters to obtain Social Security benefits. They will become subject to the dreaded “Windfall Elimination Provision” or WEP for short. This affects many (but not all) teachers, law enforcement officers, State employees and those under the older CSRS Federal retirement system. In other words, if a pension comes from one of the above sources yet no FICA taxes were paid during those earning years…. then sadly, the retiree will most likely be hit with the WEP. Many a person planning for their retirement ASSUMED that the information gleaned from their SS projected benefits review is accurate and cranks those numbers into their overall retirement financial health formula. But does not realize that SS factors those “lost years” i.e. Zero earnings years right along with actual FICA based earnings years. The retiree becomes shocked later when they find out that their actual SS benefit gets cut about 40 to 50 percent! Read ALL the verbiage on your SS projected benefits statement and this fact will reveal itself. HR resources often failed to realize this part of the SS law which began around 1983 and did not educate their employees accordingly. Even today, one can read tales of misery and woe regarding the surprise WEP penalty and its evil twin the GPO (Government Pension Offset) That’s why sites like the Financial Samurai here are so helpful in cutting through the government mumbo-jumbo so that people can make informed decisions regarding their financial future and financial security.

Thank you Sean. Very good point that often not understood.

As a California Teacher for over 33 years, I can NOT collect any Social Security worth mentioning. Also, If my husband dies I cannot receive any of his Social Security even though he has paid in full. I almost feel I have to subtract what I could have received in Social Security and then recalculate the benefits of 84,000 a year. Not complaining. I will be able to retire at 60 as I have planned instead of 67. Also, my health insurance is paid for my husband and myself until 65. it has been a good and meaningful life. No regrets.

Who the hell are you to say “Not bad for someone who made a decent, but unspectacular $90,000 year for the last four years of his career”.

The average salary for someone 55-64 is $51.714 so I think $90,000 a year is a damn good salary.

Would you like me to change the adjective to make you happier? Happy to do so if you can share more about your situation. thanks

There is an easier way of valuing a pension with a COLA. Multiply the annual pension amount by 25. This gives the amount of the pension portfolio which would be required to give this payout according to the 4% rule.

I am in a quandary about what I should do. If I work one more year my pension goes up 500.00/month. Pensions payments are increased each year with a COLA.

I have a company who really would like me to work for them. How much money would they need to give me to make me “whole” as it relates to the lost 500.00 going forward. I expect to live approximately 35 more years.

This might help as a rough metric… If you use 5% Discounted cash flow, each $100 a month is about $18000 of asset value.

Thank you for such an informative article. I just needed some advice concerning my situation. I also am vested into a pension after almost 19 years of service as a public school teacher. I would like to however transition to something else next year. My current salary is $107,000. If I stay and work 30 years, I would earn over $100,000 annually starting at age 55. However if I leave at 2O years, that number becomes $34,000 annually until death. In addition, I have saved almost $166,000 in a voluntary tax deferred annuity plan (403 b) which will remain until I retire from the system. I guess am a bit anxious about what my prospects are re retirement if I decide to leave in a year. Any advice would be helpful. Thank you.

I faced a similar situation over the last 6 or 7 years. I decided to wait until 30 years (fully eligible) to make a change.

If you do the math you’ll likely see that whatever raise you get you’ll have to save it all and perhaps more if you leave to break even.

Part of my decision was based on happiness studies that show people who retire with a substantial pension are happier AND many of my friends who left state service early lament how much they wish they had a stayed.

One thought is to find a different position that is still covered by your current pension system.

That is a no brainer…stay another 11 years and collect the $100K per year pension and continue to contribute to your 403(b). The difference between 34K and 100K is huge and will not be earned anywhere else in 11 years.

Good morning –

Im hoping that someone is moderating this blog and hope to get some insight on a pension topic.

I have a pensions through CALPERS and have contributed to the pension for a period of roughly 21 years. Through the years I have been a part of many different pension formulas, most are

2-3% at 50-55 years old and are based on a single highest annual salary; and recently I was placed into the PEPRA (Public Employees Pension Reform Act) classification with a formula of 2.7%@57 years old based on a 3 year average salary.

My question is this, I am in the midst of making a decision to take a job with a large company at $122k per year including quarterly performance and company bonuses. I would be starting a 401K which is matched at .75 to every dollar pre and post tax up to a max of 8% salary.

My concern is whether I am better off to state on the new pension formula for the next 12.5 years or contribute to the 401K for that period.

Considering Ive already earned close to 43% of my highest annual salary (98k) I estimate my monthly pension payments (if deferred, until 50) to be approximately $4700/month.

Thanks for any insight you can provide

S

I’m in the SDCERS system and have the same question. Did you receive a response?

You are better off staying with the state. Nothing is guaranteed in a 401k, also you have to consider the health care benefits in retirement that are usually part of public sector pensions. For the most part they do not exist in private sector.

I’m a retired Florida pensioner. For every guy that left the pension early (in other words could draw there pension at the earliest) and seem happy I see three more that said wow I should’ve stayed and maxed out before leaving.

Stay

In my opinion Pension should be treated as RMD from 401(k) with 0 balance at the end of average life expectancy.

If I have 1 mil @6% in my 457 and make RMDs after 70, then I will get 1 million-dollar after taxes(28%) inflation adjusted(3%) distributions at the tender age of 103 and my son will get inflation adjusted inheritance about 250 thousand( I did my own math).

If I have a pension of the same amount as a RMD then after my death at the age of 103 my son will get nothing. If I kick the bucket at the age of 83- my son still will get nothing.

Should this be a present value calculation? Simply deciding the t-bill rate by the annual assumes the person will get to keep the full value of the pension at the end his/her life. A PV is the more accepted way to calculate the value of an annuity.

Absolutely right.

Most private pensions are regulated, and backed up, by Pension Benefits Guarantee Corporation. Currently they are protected up to a monthly maximum of about $5,400 (and few pension recipients receive more than that amount). So if you are in a PBGC plan, I don’t see why, in valuing your pension, you would need to factor in the possibility of the company failing – you would still receive your monthly benefit, from PBGC. (Of course, some people worry about PBGC’s own financial health, so that might justify a small cautionary discount, but nothing like 25 or 30 percent.)

If my memory is correct, I don’t believe that your information is wrong. After the last crash, when Detroit was struggling, the Obama administration changed the rules. Companies can claim distress and reduce pension benefits – even to those already retired. On top of that, these companies DO NOT have to bring pension payments back up once their firm has recovered. There are no guarantee’s when the government is involved.

I stand by my statement. No Obama “rule changes” changed the fact that most private sector pensions are backed by PBGC, and companies cannot unilaterally reduce benefits. Only exception is multi-employer pensions, who were given the right to reduce benefits in an act of Congress in, I believe, 2015.

Can someone explain to me the role of interest in a pension calculation? I was with a company for 7 years, and luckily I got in the year before they stopped providing a pension. My benefits website calculates I have a monthly pension of $609 starting at age 65, with a (current) interest rate of 3.46%. Are my monthly payments growing at 3.46% annually? If so, what is the value of my monthly payment at 65? I regularly get contacted by the company to cash out my pension early, but I don’t think this would be the most beneficial for me (Assuming I live long enough to enjoy the monthly payments…). Thank you!

The interest rate is used in calculating the lump sum you’d get if you or your beneficiaries applied for a “return of contributions” instead of getting a monthly check during retirement. It’s not related to your monthly pension amount. Requesting a return of contributions can have serious tax consequences, including penalties for early withdrawal, unless you are very careful about how you handle it.

I am lucky enough to work for a local government agency and will be able to retire around 58 years. I would have worked about 35 years here by the time I retire. The pension is years workedx2xfinal avg salary for last 3 years. I expect to retire with an income of around $225k annually which would give me $157,500 in pension income a year. They give us the option to take a little less in pension payouts in order to cover both me and my spouse for both of our lifetimes. So let’s say I die first, my spouse will continue to receive my pension until he dies. Instead of getting $157,500, we may end up with $140-$145,000 annually. I think it is worth it to get a little less in order to ensure that we are both covered. I’m also 5 years older than my spouse.

Kate, using the information that you provided for a local government agency, something appears awry (or the people that I know made extremely bad life choices in working for the federal government rather than a local government).

Using the federal government’s Civil Service Retirement System (CSRS), the system that does not include any Defined Contribution Plan, a 35-year-serving federal employee — in order to receive $157,500 in annual pension — would need to be making approximately $237,000 in annual salary while actively working for the federal government. The federal government “caps” the active duty pay the most senior executives (akin to a military four-star-general) are able to receive annually at $192,300.

I am not writing to pry into your personal financial planning; but I can say that the formula that you presented [years worked] X 2 X [most-recent-three-years-average salary] looks extremely similar to the federal government’s CSRS calculation, except that the “2” that you state is “.02” in the federal formula. [“Avg. High-3” X 2% X [years served]]. The first ten years of total service actually receive an average multiplier of 1.625%, instead of the 2% as stated (it kicks in at 2% for all service above ten years).

I don’t know her situation but that does sound about right. 2% multiplier times number of years of service in her case is 70%. In Florida the multiplier can be even higher which is why so many people stay especially if you are in “high risk”. Some municipalities have as high as a 3 1/2% multiplier. Many police officers are leaving with 90% their salary.

Great discussion! I have a CAPERS pension after 32 years in the system. I bought 5.7 years of “air time” under a program that no longer exists. I get COLA and health benefits at group rates.

I have rental income and a small amount of savings that’s invested. A small mortgage.

I figure I gross around 60k year, more or less.

While I’m not hurting, I would like to pay a little more attention to plumping up my investments to cover inflation down the road.

So I find the current market volatility an opportunity to do that in the next 10 years.

Since I left at 61, I think I will hold off collecting SSA till I’m 68 to make up for not working till full retirement age.

Thanks, all of you for reminding me how fortunate I really am.

For those of you wondering if sticking it out is worth it, I can say it was totally worth it. Just stop thinking about the years and just let time pass. And use your vacation when you can and have a little fun! Will make the time pass more quickly.

Wish I could say I maxed out my 401k, but I did have a lot of high adventures financed by a so called golden handcuff job.

Life did not pass me by!

Great advise; thank you!!

I need to calculate the value of a pension for divorce, sadly.

How do I go about getting an equitable valuation -does all the above advice apply?

On my 401k record keeper my company has a section for Pension (not part of 401k)…In this section you get a statement like “$ per month paid at 65 ~ $3840.89 / month”.

Any advice is appreciated…just trying to be fair to my spouse.

Using my private sector company’s pension calculator in 20 years I’ll have an annuity of about $5500/month or a lump sum of a little less the $1 million. That’s 20 years away though so won’t that be about $2250/month or $500,000 lump sum in future inflation adjusted dollars?

Using a rough idea of 3% inflation (as the samurai does), that’s about right: $500K in today’s dollars. The purchasing power of the USD would have been approximately cut in half by then.

Thank you for this posting! We struggled with assigning a value to our pension and social security as part of our Networth so we only accounted for the monthly income.

We also have CA muni bonds at 5% tax free not due until late 2020s. Very happy about those so far and can be treated the same way.

Thank you for the message of hope on this one.

How do you calculate the value of a pension when you have to contribute to it? For example, at a particular institution in my state there is a mandatory 8% employee contribution and the payout calculator is about the number of years worked x 2.5%. How would you compare the value of this pension vs working somewhere else and taking that 8% and investing in it yourself?

I don’t have an answer, but that seems great! I contribute 10.1% and payout is yrs of service x 1.9% x 5 yr avg. with rule of 85. I found this site to figure out the same thing. Would I be better off just stashing away the 10.1% in a 401k for 25 yrs?.?

A couple of years ago, I put together a comparison of a pension v. 401k to see which would be more favorable in retirement. I wish there was a way to attach an Excel file to a post here (let me know if there is and I will be happy to include it), but it goes something like this:

1) Put in your salary for each working year with the contributions you made (EE), as well as an average of what the employer’s (ER) contributions would be to the plan (this is an actuarially determined rate that changes slightly from year to year, but you can get an idea of what the range is by looking at the notes to the financial statements for the employer).

2) Compound the EE and ER contributions over your years worked. I use an 8% rate of return in my example. This will leave you with an estimated balance of how much money you would have at the time you retire.

3) Take the defined benefit from the pension plan (calculated by taking average final compensation x retirement factor x number of years worked) and divide it by the estimated balance from step 2. This will give you a breakeven return, meaning the rate of return that the 401k plan would need to generate to produce the same amount of income as the defined benefit from the pension.

As a reference point, here are the factors I use in my example and how the numbers come out:

EE contributions 6%

ER contributions 6%

Retirement factor 1.85%

# of years worked 30

Breakeven return 6.57%

Additional notes:

1) I used a very basic salary that was smoothed over the working years to provide a true comparison of the plans. If there were any abnormalities, such as pension spiking, then the results could look significantly different.

2) If the 401k could generate a 6.57% return indefinitely, then it would be the more favorable option since you own and control the assets and can pass on to heirs.

3) If the 401k could generate 4%, then it would last for about 24 years (29 years at 5%) if living off the same amount as the defined benefit from the pension plan every year.

4) Since pensions are now mostly only available with government employers that generally pay less, if you could make more with a private employer then you could contribute more to the 401k (although some might argue that an increased salary from a private employer would need to pay for benefits that would have otherwise been covered by the government employer).

Not sure if your employer matches the 10.1% or if your pension is funded totally by the participants; usually the employer (in defined benefit situations) pays more than the employee so if that is the case you probably need to consider that as well. Just a thought and I could be completely wrong.

Just wanted to comment on your Foreign Service Officer #2 example. That may have been applicable with the Federal old retirement plan (CSRS), but it is no longer a reality for the majority of Federal Employees (to include foreign service officers).

The new retirement calculation for Federal (FERS) employees is 1.0% x number of years x high 3 years of salary. For example, if one made $100,000 per year (their last 3 years) and worked for 20 years, their pension would be $20,000 before taxes. If an employee retires at age 62 or higher, that 1.0% rises up to 1.1%.

A pension is nice, but the $85,000 in your example is so far off base from reality I thought I should correct.

Not correct: the amount is 1.7% x high three average for the first 20 years of service, then 1% for each year after that. So retiring at 30 years is 34% + 10% or 44% of your high three average. Still pretty good.

Paul had it correct for the example that he provided; he gave an example of a federal foreign service officer (FSO), retiring under the FERS system.

For Ben, he gave a correct calculation that only applies to a very select few specialty categories in the federal government, and enumerated by the Office of Personnel Management (OPM): Air Traffic Controllers, Firefighters, Law Enforcement Officers, Capitol Police, Supreme Court Police, or Nuclear Materials Couriers (also certain Congressional employees). See: https://www.opm.gov/retirement-services/fers-information/computation/

I am a Foreign Service Officer and Ben is correct. We are not under FERS, but under a specialty category, FSPS, with rules very similar to law enforcement. A person retiring at 50 or over with 30 years of service would have a pension of 44% of the high three average (so a pension of $52,800 in the example in this post). We are also eligible for a social security annuity supplement designed to supplement income until eligible for social security, at which point that supplement stops. Calculations on that are more complicated, and it is means-tested, but that would give you around an extra $16,000.

Should I take a pension of $47,000 a year at age 65 in two years, or the lump sum of $677,000.

or

Should I take a pension of $87,000 a year at age 70, or the lump sum of $1,070,000????

Thanks

Just wanted to clarify your assertion that a foreign service officer pension would be 85K per year. Maybe under the old system, but under the current system (FSPS) the annual pension would be only 40,800 assuming 120K per year average salary over the three highest paid years with 20 years of service. 120K x 1.7%=2040. 2040*20= 40,800. Still thank you for the article and good work.

Thanks. I’m using my 72-year-old dad who spent over 30 years and the foreign service officer as an example. It’s too bad pension amounts are much less now.

Once vested, there are some big decisions regarding optimal time to walk away when additional income can be made. For example, a school administrator in Cali can retire earlier (draw a smaller pension), but work another job and continue to invest the additional income of the new job in a 403 and after tax account.

For example, a CalStrs employee can receive full CalSTRS retirement benefit, with no earnings limitation, if they take a job outside of CalSTRS-covered employment, including work in:

Private industry outside of the California public school system

Private schools

Public schools outside of California

University of California or California State University system

Also, deciding if taking less of a pension in exchange for providing a spouse with benefits after death, versus the cost of an additional life insurance policy, is another big decision.

I retired at 57 as an LEO (3% @ 55) and my wife retired at 58 (2.7%) and I also am retired Military, combined we have a 100K+ a year income without any withdrawals from out 457 (300K) or 401K (250K). I did work for close to 40 years but we are both healthy (I am now 69) and travel a lot. This is not due so much from good planing but a combination of listening to good advice from a friend and a desire to travel. We are really lucky as I see so many of our friends who decided to splurge young and not think about their retirement who now envy our ability to have fun and do what we wish (within reason).

Nice article! On a side note, I have read a lot about of annuity vs lump sum payment and created a bunch of spreadsheets to try and get the wining choice, but I am still struggling. My annuity is not inflation protected, I can get $4500 monthly or $800K in 5yrs and I will be 43 by then.

Annuity: I like the fact my monthly payment is money in the bank that I don’t have to manage, 80% probability I will get it and if not PBGC can give me some discounted portion.

Lump sum: take the cash out and not roll it over at all, pay 25%-30% tax, invest in a commercial property that will get me 10% Cash on Cash and 9% in principal payments (not including appreciation). The commercial property investment numbers are based on personal experience.

Any thoughts why I should still consider the pension?

I just realized: your simple formula only works at the time of retirement. If you are pre-retirement you need some kind of regression. For example if I left my job now (freezing contributions) and retired at 65 (in 30 years) I would have $X at retirement per your analysis. However what is the value of my theoretical pension today? Obviously the numbers are estimates, but when I look at your net worth goals, my pension is a good chunk of my current net worth so as a thought exercise I like a number to work with.

I would also say that you are overestimating the dollar value because your simple model assumes a withdrawl rate at the rate of return with the original chunk left at the end of life, when in fact the final balance would be zero. A drawn down, multiplied by your likelihood factor, I think would be more appropriate. Though once again: it’s a thought exercise so this is more nit picking than anything. But you seem to be overstating the material value of the pension with how you are approaching it.

Nit picking is great. I encourage it! How would you devise a quick way to calculate the value of one’s pension?

I agree on the overstatement thought. Since a pension is in essence a reverse mortgage, couldn’t you just plug in the “(loan) or estimated pension value” amount, the estimated interest earned, and an estimated “(loan duration), life expectancy, payout term”. If you know your monthly pension payout offer (mortgage pymt) and play with the payout term, interest rate and loan amount, couldn’t you match them up and just use a loan calculator?

The actual value of the pension would have to take into consideration the interest earned and principal used as you take your monthly payments.

The only thing you can’t plug in is longevity risk.

Any actuaries with a simple pension thought process?

Dear Sam –

Great article. It gave me a lot to think about.

I know your parents were FSOs so perhaps they were under the old FS pension system, which was more generous and perhaps it will pay out $85K for a $120K max salary. Unfortunately the current FS pension system pays 1.7% per year for the first 20 years and then only 1% a year after that on the high three year average salary. So your example #2 isn’t quite accurate.

Foreign Service Officer Retiring After 30 Years Of Service = 34% for first 20 years +10% for next 10 years = 44%

Average income over the last three years: $120,000

= Annual pension: 44% of 120K = $52,800

source –

The Foreign Service Pension is still quite generous. However, it’s not as good as the military’s pension plan, which pays out 75% for 30 years of service.

Regards,

John

I was recently wondering about how to value my pension (or potential pension) as the result of a career dilemma I’m facing. The article nicely lays out a good way to estimate the value of a pension, and I read through all the comments – a few seem to allude to my issue, but I thought I would throw it out explicitly to see what folks’ thoughts might be.

I’m a 9-year federal government lawyer. Based on my current salary, if I work another 22 years to retire at 62, my annual pension should be around 66k. I’m not even bothering to calculate likely raises over two decades, which would increase that amount significantly, even at the historic 1% COLA raises we’ve been getting. I’m near the top of the GS scale, so while I am relatively well-paid, I’m hitting a ceiling in terms of salary over the next few years.

After nearly a decade, however, I’m increasingly drawn to leaving government. Primarily to give myself more flexibility in where and when I work, and to engage in more entrepreneurial activities that I’m restricted from as a government employee. Potentially, I could make a larger salary, but there’s the risk that I might not. And there’s certainly no likelihood of a pension.

So, I was looking into how to value the potential pension as part of estimating my salary needs in the private sector. This article is helpful, but I’m still not entirely sure how to account for its value in order to make sure I can make it up in salary or other income. And, now I’m wondering whether I shouldn’t leave this job so that I can keep this valuable benefit as a guarantee. But my gut says it can’t be worth it to work another twenty years in a job I don’t love for a pension, and that I should bet on my skills and experience in the private market. Plus, I don’t want to have to work until I’m 62, unless I want to.

My head is on the fence, recognizing the stability of that potential income stream and the low floor (with higher ceiling) on the private side.

Has anyone else wrestled with this issue, or have any thoughts?

Honestly, it sounds depressing to have to work for 22 MORE YEARS so you can get your pension.

I’d start a SIDE HUSTLE and see what happens for a couple years before leaving. That’s what I did for 2.5 years before I left my day job. My side hustle was making a livable income stream by then, so I knew it was now or never.

Sam

That’s how I’m leaning – 22 years is almost half my adult life to that point, and a third of my entire life working a job I’m no longer passionate about – I was just worried that I was being too romantic and by not having a good handle on the value of the pension, maybe overlooking significant economic benefit. But now that I’ve put this in writing, it seems silly to spend so much time just to get a financial reward after two decades. And you’re right – it sounds really depressing. I picture Tom Hanks at the beginning of Joe Versus the Volcano.

Side hustle options are limited because I have restrictions on what I can publish, and on taking on outside employment like consulting (and I’m prohibited from practicing law outside government except in certain pro bono cases). This is one of the reasons I am looking for a private sector switch – to allow for that kind of flexibility. I am able to do some teaching on the side, which is a small but helpful income stream. One area where I’m not restricted is property ownership, so also am considering buying a rental property in the next year or two while figuring out my exit strategy. This website has been invaluable in helping me figure these things out!

DCFed,

I am 56 and work for my state and have close to 30 years. I know what you mean by feeling tired of working for government (I probably have been for over a decade) but the pension trap kept me plugging away. At this point in time, I am currently earning about $110K and about 5 years from retirement. I should get approximately $60K and an additional $22K from SS (since we pay into SS). This income, combined with my wife’s $60K (pension and SS), should afford us a decent retirement.

Conversely, there have been many a times when I regretted my choice of staying in the public sector vs. working in the private sector for considerable more monies or even starting my own consulting practice. At this point, it is probably too late for me but given that you have a good education and if you feel comfortable that you can be successful in the private sector or in your own operation, I would not discount this option.

In my humble opinion, the main thing is what makes you happy.

Best of luck in whatever you choose to do.

I’m a retired Federal employee after 31 years under the old CSRS system. We referred to it as the “Golden Handcuffs” because if a person left Federal Service before being retirement eligible (under CSRS rules) they could only get their own contributions, plus some interest back. Imagine a CSRS employee with many years of service, but not yet retirement eligible, abruptly leaving or gets RIF’d out of their job…there’s not nearly enough in their contributions to sustain a long retirement. Whereas, under the newer (FERS) system since circa 1982, many of the benefits were portable to the private sector, albeit with the exception of what’s called the “Basic Benefit Plan”. The FERS employee could safely leave Federal Service knowing that at least the bulk of their retirement contributions (SS, TSP) were going to be part of their final retirement numbers. Neither system was perfect, and both had their flaws and quirks (the CSRS vs FERS debate rages on among Feds to this day like debates about the Civil War). But fortunately both systems provide a comfortable standard of living as long as a person remains financially vigilant.

Thanks for writing this article! I like to compare our finances to your “Above Average Couple” article, although without including pensions we are way behind… but with our pensions we are right on track. I am 44, DW is 43… Current status below:

Currently her pension would pay about 32,571/year, and mine would pay about 15,050 or 47,621/year together. (I like to use 4% as a guide so I have them worth 1,190,000.) We have about 200k in home equity, and 380k in 403/deferred comp accounts, so all total we have 1,770,000. Just ahead of target:)

DW can retire on her 55th birthday, and I can retire on my 57 birthday. Pensions caculated to be $95,000/year at that time, add 1 million savings projected for 403/ deferred comp, home paid off, and I will still be eligible for SSI. ( Both of our pensions are COLA’D, and have provisions to keep paying the other spouse when one of us passes)

We have 3 kids- goal is to get them through college… then pay off the house, and go chase our dreams, wherever that may take us…

Love the blog and my question is – can I consider ourselves above average? I want validation, My DW does not care…. :)

With a $95,000 a year pension in your mid-50s, by the power invested in me, I hereby grant you two the title of an Above Average Married Couple!

Well done!

Definitely read: The Fear Of Running Out Of Retirement Is Overblown, if you haven’t done so already.

January 2022 Update: (5 years down, 7.5 to go)

Currently have pensions worth 67k/year or 1.67M, 730k 403b, 200k home equity

or approx 2.6M counting pension value (49yo & 48yo)

Paid oldest sons tuition 5 years, assisted middle son x 2 years, paid 2.5 years Daughters tuition- 1.5 years to go for Dtr

Projected at retirement 6/2029: will be 56/57yo

100k/year pension(s), 1.5M 403b, 20-25k/year SSI, (500k home equity), so at 4%w/d rate approx 180k/year (Live in Midwest, low cost area of living)

Keep chasing your dreams!

Pensions may disappear, but some have survivor benefits. It would take an actuary to determine their worth over a survivor’s lifetime. Which begs the question for military folks conflicted about the new retirement system which add a match, but decreases the annual benefit by 10%… What’s the breakout between high, medium and low savers who plan on dying before their spouse, for both systems?

Great article but I’m wondering in your examples if the pension values should be worth less since they do disappear after the person passes away.

In your first example, if the police officer had $2,514,706, they could collect they 67k from from putting that amount in investments and when they pass away there is still $2.5 mill left for their family.

No pension for me, but I learned over Christmas that my father who had been a fed is early retired living off his annuity and VA health benefits. The annuity is small, but more than covers his expenses. Only took thirty years of service between the military and other sectors of the government to achieve.

Just my opinion. If one qualifies for a government pension, it’s just wrong that they can have no real purpose for working profitable, just show up to work for many years, and continue to steal my tax dollars until they die.

Hi Samurai,

Do you have any general thoughts on buying “years of service” in a Govt Pension fund?

I’m in a generally well run and not in any acute crisis State Retirement PERS fund. I’m still allowed to buy up to five years of service credit at an actuarially determined amount based on my age and current salary. I have the money to do it in my 457 deferred comp plan, but it would be a considerable chunk of my savings. I’ll continue to max my 457 contributions, but I’ll obviously be trading the potential compounding return from my own account for the “guarantee” of an extra 13% or so (2.67%/yr x 5 yrs) in the PERs system. I would likely retire at about the same age either way, based on actual years I need to put in, my kid’s ages/school status etc.

Is there an easy financial calculus to determine if its a good idea to reinvest/change allocations from my 457 back into the PERs?

Howdy Jake,

Haven’t thought about your question too much. In general, I’m averse to putting more money into anything government run. Folks w/ pensions should work on building their NON-government retirement accounts and after-tax investment accounts instead.

S

Jake,

Does CAlPERS still allow this? I know CALSTRS does not. This was changed under pension reform a few years back with the state.

I actually bought a bit of time. It’s not a great return on investment but being that I was having trouble with my employer it was sort of insurance to get to that 30 year mark if I lost my job and being able to collect instead of waiting several years.

33 year old here who works at a large megacorp in the Midwest. I joined 8 months before they phased out their pension for new hires – so I’m a hybrid of 401k and pension. Anyone older than 45 is tied to an attractive pension, so they all just bide their time making it tougher to keep working your way up.

That said though I’m very lucky and fortunate to have built up a nice little next egg through the pension having worked there for 9 years. If I left I can cash out as a lump sum, receive monthly payments of $350/month or defer it to 55.

This is how my current company works now as well. They stopped offering pensions I think about 5 years ago, which was a few years before I got hired, but all the new hires get a larger 401k match and a contribution to a personal annuity account, so although I don’t have a guaranteed income stream at retirement I should be retiring with a much higher cash balance to compensate.

A lot of the older guys are actually jealous of the new plan. If I want to leave or retire before I have the time and age to max my pension, I can walk away with 100% of my retirement. If they want to leave without the age or max time in their future pension payments get slaughtered by penalties. Furthermore…their pension is only based off a % of their base pay when they retire, so the relative increase in pension per extra year of working is minute compared to the extra potential compounding of the plan I’m under. If they hit 30 years to get their full payout while they are in their 50s and can’t collect it til 62 without an early retirement penalty, they pretty much end up working a few years with almost no increase to the max value of their pension.

Very interesting – yes for me every year I obtain pension credits equal to 3-4% of a rolling average of your income for the last four years. The % increases the older you are and years of service.

I’m lucky enough where I few my 401k and small pension as simply nice to haves to help in retirement goals – where my own after tax investments will be of more value.

It’s amazing how many people I hear at my company tied to pensions say things like “well I’ve been here for so long, what’s another year” or “if I leave, I’ll be giving up so much”. It can be a curse for that generation.

Easiest apples to apples for private sector pensions is to get a low cost single premium immediate annuity quote for the anticipated benefit amount and age. THat will give you a nice lump sum equivalency.

Both are by private sector companies with regulated asset financial requirements etc. and both have a limited govt backstop either state based insurance backup or pbgc

The 401K numbers seem high, but even with a 0% return, the low end should be reasonable. I maxed my 401K for many years, although not for the first 20 years of working. It is difficult to put in $18K when the limit was considerably lower. Or if your income was not even at the maximum contribution.

My real estate portfolio more than makes up for it, and a small non-COLA pension.

I use a simple 4% to calculate the value as well. For example, an educator contributing 10% to CalStrs and making 100K will most likely have a 60-70K pension coming. That would make the pension worth 1.5-1.75mil X .04% = 60-70K on a 300K investment (or 10% x 30 years). That leaves another 750k-1mil that would need to be put away in a defined contribution account (403b) to cover the other 30-40K (750-1mil X .04%) assuming an individual wanted to make as much in retirement as they did working. Saving 750k-1mil in a defined contribution account is a lot more doable than saving 2.5mil. Of course, many feel like they wouldn’t need to make their full pre-retirement income in retirement so the defined contribution account could be projected to be much smaller.

My husband retired at age 49 after 25 years in law enforcement 3 years ago, and decided to do a rollover of his pension to a new IRA since our rental income is more than sufficient to cover our monthly expenses, therefore, this million dollars plus will be left for our daughter inheritance.

I have about 12 years credited towards a Teamster pension, and I don’t consider it a valuable retirement asset for two reasons.

First, I have enough time in to get 31,000 a year when I retire…but the problem is I started at 18 and was out at 31 and can’t collect it til 64. 31,000 a year isn’t going to hardly amount to anything after 33 years of inflation.

Second, the fund is underfunded and union memberships down. I am almost 100 certain payouts will be getting cut before I can collect. The money just simply isn’t there to support their obligations, and unlike government pensions private pensions can’t just be supported via higher taxes.

I’d rather have had all the money I worked for that went towards the union pension fund instead going into my own 401k. I would have made out much better. I guess in theory if I collected 31k a year for 20 years before I died the pension was worth 620k for me…but roughly 75k-100k isntead dumped into a 401k between 18 and 31 with 33 years of compounding would have equaled a lot more…and well…what if I die at 50…that pension is worthless and the 401k could at least be passed along to others.

Just my take on pensions…but I laugh when I hear people talking about how my generation(millennials) won’t have pensions so we won’t be able to retire comfortably. My worst two retirement investments to date are my Teamster pension and social security. The only pensions that are really a sweet deal are some government pensions, and its only because they get yearly cost of living increases and they aren’t actually pension funds, they are just line items on budgets paid for by tax payers each year.

Good reasons and good perspectives. Good thing at 49, you can still do other things to make money until you can start collecting at 64 yeah?

I guess my question for you and others with pensions is: Did you save and invest money beyond your pension given the low probability of getting 100% owed to you?

It seems many pensioners feel misled by their company/union/government’ promises. I guess I haven’t trusted government since day 1 to do the right thing with the people’s money because there have been so many corruption cases!

Perhaps the grass is always greener.