Healthcare affordability continues to be a concern for millions of Americans. When the Affordable Care Act (Obamacare) was enacted in 2010 I was happy. A universal healthcare system would insure the ~47 million Americans who were previously not insured.

After all, disease doesn't discriminate between rich and poor. Also, being rejected for healthcare coverage due to a pre-existing condition is discriminatory. Healthcare affordability shouldn't be a national crisis. However, things have changed.

If you're wondering: How much should I pay for healthcare? This post is for you. Healthcare costs have risen so much, one of my best recommendations is to invest in healthcare companies. If you can't beat them, you might as well joint hem.

Millions Still Can't Afford Healthcare

Fast forward to today. Millions of people are still uninsured, even though there are subsidies provided by those who make more. (Mostly me and you). What's going on? Healthcare affordability is an important issue for all Americans.

Nearly 65 percent of uninsured adults who were aware of Obamacare marketplaces said they had not visited one to seek coverage because they didn’t think they would be able to afford it according to The Commonwealth Fund, a private organization aimed to promote a high performing healthcare system.

Further, 85 percent of uninsured adults who actually shopped for coverage said they didn’t enroll in the end because they couldn’t find an affordable plan.

Check out this chart explaining why there are still ~25+ million uninsured people in America.

Nobody really believed that all 47 million uninsured people would suddenly get health insurance under Obamacare, despite the subsidies and penalties. But the fact that five years has gone by and 60% of those who were uninsured are still uninsured seems like another example of incredible government inefficiency.

Yes, 20 million more people now have health insurance is progress. But what has been the cost?

Healthcare Affordability Is In Crisis

Given most people work for companies, most people are unaware of the rise in healthcare premiums since ACA passed. Companies are paying the brunt of the increase. The result of such increases include a decrease in wages or a decrease in hiring at the margin. There is no free lunch.

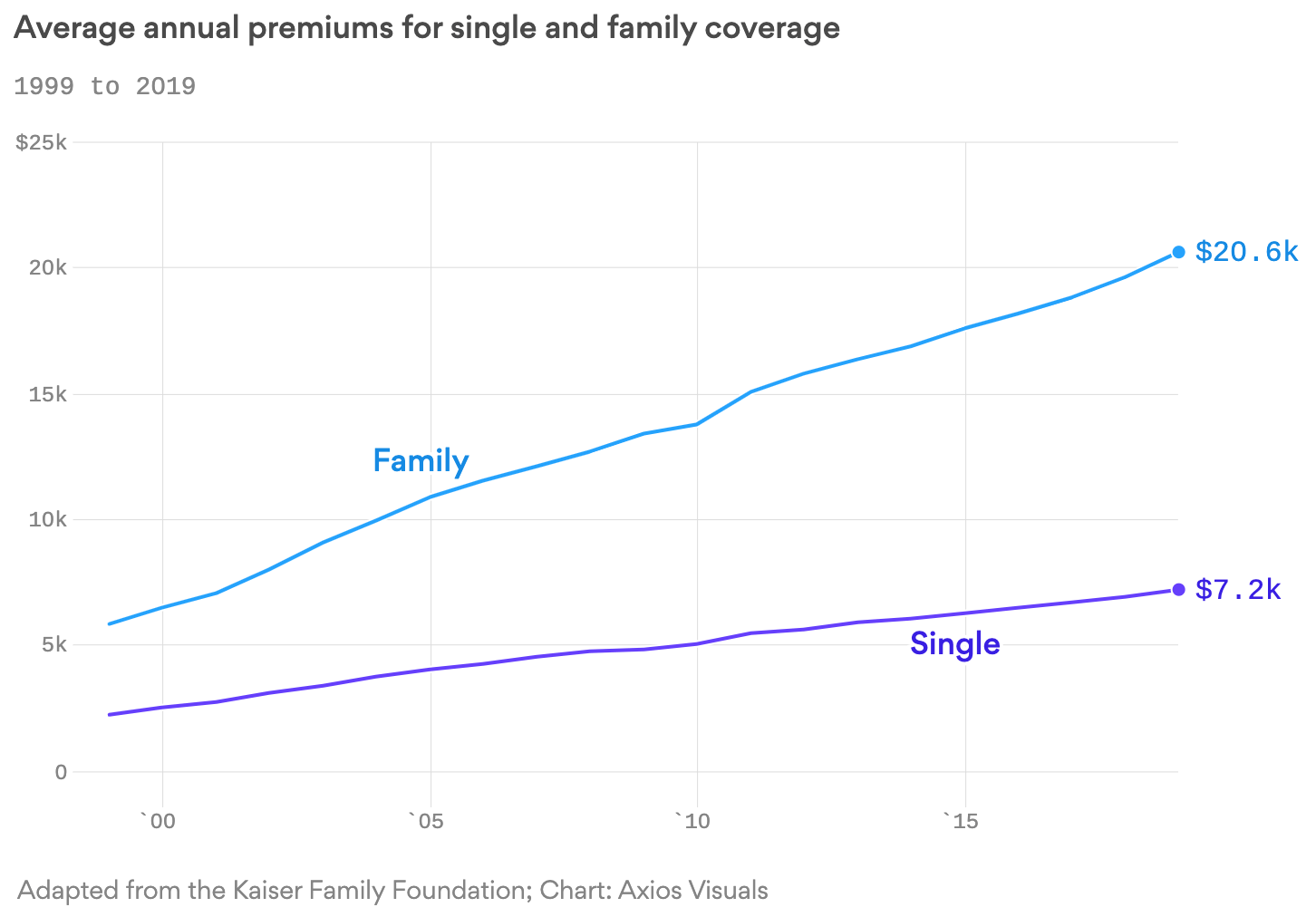

Here's a good chart that shows the average annual premiums for single and family coverage from 1999-2015. Notice the 24% increase in healthcare premiums for singles since 2000 and a 27% increase in premiums for families during the same period.

If the median household income is $56,000, then paying over $18,000 on average a year in after-tax healthcare premiums is absolutely INSANE!

Let's say $56,000 is $45,000 after tax assuming a 20% effective tax rate. $18,000 in health care premiums equals 40% of your after-tax income!

Employer Subsidized Healthcare Is Valuable

Fortunately, most people's employers subsidize most of their healthcare premiums, but don't think for one second that companies haven't baked in the cost of healthcare benefits into part of your pay package.

Take a look at the average annual healthcare premium for single and family coverage in 2019. A family pays an average of $20,600 for health insurance a year and an individual pays $7,200 for health insurance a year. Luckily, most of this is subsidized by the employer. Unfortunately, the cost trajectory looks like it's going to keep going up.

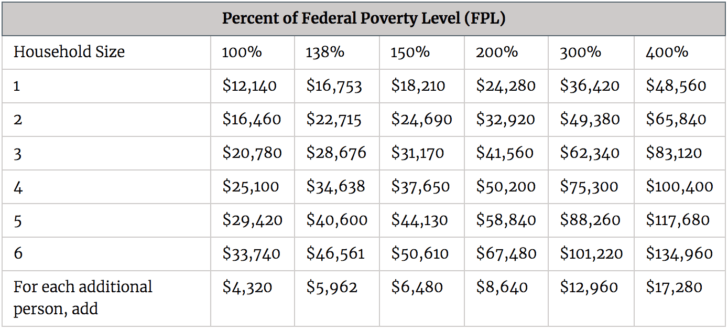

For example, in 2021, my family pays $2,380 a month for health insurance for a family of four. It is unsubsidized because we make more than 400% of the Federal Poverty Level (FPL). If you want to get subsidized health insurance, you need to make less than 400% of FPL.

Examples Of Health Insurance Options

Below are three health insurance plans I was analyzing for an individual in 2020. Everybody should have at least the bare minimum health insurance plan to cover for disaster scenarios. Medical expenses consistently ranks as the #1 reason for bankruptcy in America.

Comparing Bronze, Gold, Platinum Plans

The cheapest Bronze plan cost $426.31/month or $5,115.72/year. Paying a $5,500 deductible before insurance kicks in sounds terrible. With such a high deductible, you may never get insurance coverage because you may never surpass $5,500 in health insurance costs a year in you life.

The Gold plan cost $587.90/month or $7,054.80/year due to the reasonable $250 deductible. But do you want to pay a 20% co-insurance for all health costs, even though the maximum out of pocket was $5,000? I wouldn't.

The final Platinum plan cost $693.01/month or $8,316.12/year. If it was up to me, I'd decide on this plan due to no deductible and only a 10% co-insurance per health expense with a maximum $4,000 out of pocket expense which I hope to never hit.

A $1,262 a year difference in premiums between the Gold plan and the Platinum plan doesn't make a difference to me because they are both in the realm of expensive.

The snapshot above only shows about 3/8 of the total benefits of each plan. I didn't want to stress out getting hung up with some non-covered insurance situation due to the fine print. I essentially am willing to pay a premium for more peace of mind.

Does $8,316.12 a year in health insurance premiums sound reasonable to you? It depends on your annual income amount.

How Much To Pay For Healthcare Insurance?

If you want to buy a house, you should probably limit your house purchase price to no more than 3X your annual gross income after putting at least 20% down.

If you want to buy a car, you should probably limit your car value purchase to 1/10th your annual gross income. The reality is that people violate these guidelines all the time for various reasons.

Spending on healthcare is highly subjective. On the one hand, there's nothing more valuable than our health, hence we should be willing to spend more. On the other hand, there's a high likelihood we'll pay way more in healthcare premiums than we end up using. If this weren't the case, health insurance companies wouldn't be in business.

The Value Of Healthcare Is Subjective

Given the value of healthcare insurance is subjective, let me propose a percent of gross income range of between 5% – 20% to determine how much you should pay in annual health insurance premiums.

In other words, in order for me to pay $8,316.12 in annual health care premium just for myself, I need to make $41,580 – $166,322.

I personally am not willing to pay more than 10% of my annual gross income towards healthcare premiums, therefore, I have a goal of making at least $83,161 a year.

Premiums Add Up Fast With A Family

But imagine if you had three dependents in the form of a spouse and two kids? The cost shoots to around $2,000 month for a similar Platinum plan, or $24,000+ a year in health care premiums.

Under my 5% – 20% proposal, your family needs to make $120,000 – $480,000 a year. Unless you live in an expensive big city, earning such income may be more difficult.

We know the average annual premium in 2019-2020 for an individual was $7,200 and for a family was $20,600. If we follow my healthcare affordability recommendation, an individual must earn $36,000 – $144,000 to be able to afford the average annual premium.

Meanwhile, a family must earn $103,000 – $412,000. Unfortunately, less than 25% of US households make more than $87,725 a year.

Related: How Much Do The Top Income Earners Make

Action Steps To Take Before Early Retirement Or FT Entrepreneurship

If you are on your own, there is a high likelihood that health insurance premiums will feel outrageously expensive (way more than 20% of your gross annual income). Only those of you within 400% of poverty level wages will get any sort of subsidy.

Take a look at the chart below and focus on the very right column. It highlights that once you make over $47,520 as an individual, you will get $0 healthcare subsidy.

For an average family of three or four, that household income maximum is $80,640 and $97,200, respectively. But remember, the subsidies are graduated.

The closer you are to the 400% FPL income, the less subsidy you will have until it goes away completely. You've got to be earning only 100% – 200% of FPL to really get some assistance. But if you are at those income levels, you may have more pressing things to worry about.

Healthcare Is Not Very Affordable

For an update, take a look at the new FPL for 2021. It's slightly higher than it was from 2016, but not by much. Bottom line, you must make less than about 200% of FPL to get a reasonable amount of healthcare subsidies.

If you make 400% of FPL, you will still get some healthcare subsidies, but it really won't reduce your cost that much.

Think About Heath Insurance Costs Before You Quit

If you plan to leave the safety net of an employer, your goal should be to make AT LEAST 5X your annual health insurance premiums first. 5X comes from taking the inverse of 20 percent, which is the top percentage in my healthcare affordability ratio recommendation.

I always recommend people start a side-hustle while working to minimize financial disaster and maximize the probability of eventually breaking free.

Now I've provided you with a concrete annual side income figure you can shoot for before retiring early or becoming a full-time entrepreneur.

Let's Hope Healthcare Affordability Increases

Healthcare affordability is a challenge for many. I've accepted the fact I must pay over $20,000 a year for health insurance premiums for a family of four.

I understand that Obamacare was constructed so that those who are not poor can help subsidize those who are poor so they can get health insurance. It's our duty as non-poor people.

However, a 40% coverage rate on those who previously did not have health care insurance is an unacceptable result. In school, if we receive less than a 60% on an exam we fail. So why are we allowing the government to pass when they've only been able to get a 40% passing rate five years later? The system must improve.

Track Your Spending

Let's all stay as fit as possible. We should track all our spending and eating so we can live healthier, richer lives. You can utilize free wealth management tools to help you track all of your finances and spending.

I've had to stay overnight in the hospital many times before as a kid due to extreme asthma, and I want to delay another hospital stay for as long as possible.

Finally, don't underestimate the importance of mental health. Develop a strong support network. Find a mentor. Meditate. Take a break from electronic devices.

It's not normal to always feel stressed or experience chronic pain and fatigue, especially during tremendous times of uncertainty during the coronavirus pandemic.

Within three months of leaving my day job, all my physical ailments went away. I even stopped getting grey hairs!

The health benefits of early retirement are priceless.

Wealth Building Recommendation

Sign up for Personal Capital, the web’s #1 free wealth management tool to get a better handle on your finances.

You can use Personal Capital to help monitor illegal use of your credit cards and other accounts with their tracking software.

In addition to better money oversight, run your investments through their award-winning Investment Checkup tool.

It will show you exactly how much you are paying in fees. I was paying $1,700 a year in fees I had no idea I was paying.

After you link all your accounts, use their Retirement Planning calculator that pulls your real data to give you as pure an estimation of your financial future as possible using Monte Carlo simulation algorithms.

Definitely run your numbers to see how you’re doing. I’ve been using Personal Capital since 2012 and have seen my net worth skyrocket during this time thanks to better money management.

How Much Should I Pay For Healthcare? Healthcare Affordability Ratio is a Financial Samurai original post. For more nuanced personal finance content, join 50,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009. I help people get rich and live the lifestyles they want.

Today I had to make the painful decision to cancel my health insurance. As a cancer survivor and during a pandemic this seems like insanity but at 20% of our income it is no longer affordable. That is for the cheapest plan that does not kick in until I meet the $6000 deductible for myself or the $12000 for the family, which does not include my husband because we chose to buy a cheaper plan for me and the kids. His out of pocket adds another $5000. From personal experience I also know that the out of pocket expense is actually much higher due to balance billing by the hospitals. Our current insurance does nothing to protect us from excessive charges but also will not count those charges toward the deductible. If we think the bill is unfairly high it is up to us to contest it.

I do not qualify for subsidies because my husband’s job offers insurance, at full price. But if they put me on the company plan insurance goes up for every person employed. They have few options. It is a small company that takes good care of its employees but health insurance is costing them as well. It eats up a larger portion than most people realize. People wonder why wages have stagnated.

We are a pretty money savvy family. I can feed a family of four for $500 a month, and we eat good food. But our gross income is not what we have to live on. Paycheck deductions and taxes take $1000 per check. Cost of living continues to rise faster the the paychecks, even when you make good choices with your money. Add to this the fact that we were foolish enough to start our own small business which is a whole other can of worms. The mechanics of paying yourself for your work are just as messy and frustrating as the whole health insurance mess.

I am tired. I work hard, give my time to my community, make careful decisions and i keep falling farther and farther behind. I have a $10000 tax bill coming up because our subsidy was denied, after we were told we qualified. We don’t have the money. Oh, and our daughter is off to college this fall.

The rich, the congressmen and senators pay the medical insurance at any price. But long ago they worried about having a national insurance that protects their property and fortune, THE ARMY, they cannot defend themselves with all their money from another country, they accepted and they accept to pay taxes to have the army. But medical insurance if they pay easily so it will never be a priority to find a solution.

Why can’t we do something better than we have? Does healthcare always need to tied to employment? Or even insurance companies? I know far too many people that lost their jobs and had to lose all the money to medical bills…. Only if they could work could they have insurance. That doesn’t seem right…..Or had preexising consitions that couldn’t get anything before aca…. 17% of gdp and growing isn’t sustainable……

Wow how things change, re my Feb, 2017 post saying, “An mostly equivalent Obamacare policy is over $16,000” Today that mostly equivalent Obamacare policy is $34,342, while my BCBS policy is $12,200. It is true that If I earned $56,000 the taxpayers would subsidize by paying over $32,000 of that $34,342 prem

The federal government is not using the health insurance premium increase rate to adjust the annual poverty line. I think it is quite deliberate. Per my calculations, my insurance premium has risen 57% in the past decade and the poverty line has only shifted by 16%. This is how they have begun to shut down the ACA. It is devalued by it’s ineffectiveness. I used to qualify for a tax credit that was very helpful, but now I don’t. Not much about my circumstance has changed, I just crossed the line of 400% of poverty. Which by the way is $64,090 – so now I pay 27% of my AGI in health insurance permiums. I have the cheapest policy available that has a $6000 deductible. Not worth much at all. Last year I visited a doc twice.

Good points. Government seems like it’s scamming us like the AMT.

I fall into the gray area where I make too much to qualify for subsidies but not enough to afford full price insurance. I’m basically self-employed, single with no dependents. 48.8% of my income goes toward health insurance which is not doable. I’m considering going uninsured since I’m healthy and only go for one annual checkup a year. That shouldn’t be costing me half my income!

Financial Samurai (or anybody with an idea),

I’m wondering if you can point me in the right direction on something here.

My wife and I are self-employed and our family of 4 is on a Health Net PPO plan which Health Net says would cost the exact same whether purchased through them or through Covered California. We’ve been with Health Net about 17 years now. Since the Affordable Care Act went into effect (January 2014), we’ve gone from $590 a month for a “silver” type of plan to $1,889 for the “bronze” plan in 2019. Just got the notice on the latest increase (22.3% for 18 over 19).

If we make about $100,000 a year in household income there is no discount. We also have a deductible of $7,000 per person ($14,000 max). That means that before we can see a dime in savings, we have to pay $29,668.

But…since we are self-employed and have to pay for this insurance with after-tax dollars (unlike most who are employed by a company), that adds on at least another 10%, right? So that’s basically a minimum annual cost of $32,634 if one person requires $7,000+ of care (which really isn’t that much care) and more like $39,634 should all four of us reach a combined health cost of $14,000 in services in a single calendar year.

In short, to keep “bronze level” insurance (and the pickings are pretty slim when you go below that), we have to minimally pay 25% of our household income. That 25% is only if nobody visits a doctor (not even once) all year. And if we do visit a doctor, we have the potential for hitting 40% of our annual household income, only to have that be the case in a second year if we are unlucky enough to be fully cured/healed before the end of a calendar year.

I haven’t actually been to a doctor’s office (or received any treatment or services of any kind) in over 5 years and it has been extremely rare for the rest of the family. Am I crazy or would I be better just cancelling all insurance, investing that money and negotiating all our family’s health care needs with cash? That seems like a radical idea, and one I’m probably not ready for this year, but in 5 years we’ve seen our health insurance costs increase by 320% and if that continues (and I’m not sure why it wouldn’t), rates could be at least $5-$6,000 by the start of 2025.

Even if it stays the same, how can it possibly make any sense to spend that large of a percentage on health care when one also has to pay for housing (in California), food, transport, hopefully something for retirement, etc.?

I’m not writing to “vent”, but just to get an idea of what other people think makes sense here. It’s hard to find people who are self-employed and pay their own insurance – seems like most people at least have one spouse working for a company and so don’t even notice. Any direction or thoughts on the matter would really be appreciated.

Call a private agent. If you have no major health problems, you can get into a pool. Buy the cheapest plan with the highest deductible and invest the rest. Also, see if you can negotiate cash prices only if you think you won’t meet the deductible.

I feel your pain.

**Sigh**.

My husband and I are in the same boat as you :(

Sorry to hear it. It’s definitely brutal. Health care we can hardly afford to have, but definitely can’t afford to actually use to stay healthy.

I read yesterday about parents giving up guardianship of their children so that those children could qualify for tuition assistance. That’s a little bit different (and pretty immoral), but I wouldn’t be surprised to see similar workarounds for self-employed trying to still be able to afford health care. I’ve already read about couples divorcing (legally) so at least one could get financial assistance.

I’ve checked out other plans, but I’ve only found that cheapest just mirror the “bronze level” and cost the same. ACA seemed like a good idea at the time and is probably really great for those of low income who get the benefit of super-affordable insurance, but it also seems destined to bankrupt a lot of us self-employed folks!

I understand that everyone should have health care bottom LINE it’s important now days with all kinds of new diseases that are out there . For the young and old. But the problem that i am having is why does it go by your GROSS INCOME ?

1- They don’t ask you ANY QUESTIONS about the following things ?

A- Do you have a mortgage ? Or maybe do rent how much do you pay ?

B- If you own a home do you have INSURANCE ? Home owners depending on where you live it could be Wind and Hail ? Flood ? Hurricane / Fire and it goes on…

What Do you pay in TAXES a year on your home.

C- Own a Car ? i’m sure you do. Do you have a car payment or is it payed for. ? I’m sure you have Car Insurance what do you pay a month or every 6 months or a year. ?

D-What are your Monthly Bills Bottom line we all have monthly bills !

they don’t ask any of this ? Why ????? Some of us have higher bills then others !

E- What bothers me the most is if you have a little bit of money in any kind of a FUND and you take it out whether it be a little or a lot ! When you go to get your income tax done now they tell you you made more income then what you said, you now have to pay back… and your HEALTH INSURANCE GOES UP ! That is income … But wait that’s my money that i earned over the years and i tried to do the right by putting into some kind of a fund for my future/ retirement / maybe new widows in my house home improvements ? You can’t even take your own money because now the HEALTH CARE says you had more INCOME ! This is not fair in my eyes it’s a bunch of B.S

Why don’t you ask me why i needed my own money that i worked for over the years. now i’m getting PENALIZED for taking my own money and now my HEALTH CARE IS GOING UP !!!! I don’t get it. Help me please Who can we write to to get this straightened out ?. this is a true story A young couple with a baby wanted to to do home improvements on there house they took some of there own money out of a fund they had. Well to there surprise when they went to get there INCOME TAXES done they had to pay Back $6000.00 to there Health Care ! REALLY !!!! Was it worth it ? just let your house fall apart. Something needs to change in health care and how they determine INCOME ! I AM SICK OF THIS AND IT’S NOT FAIR ! Thank you OBAMA Care. Can’t even take my own money out with out getting PENALIZED it’s one thing paying taxes on your own money But now my Health care goes up AGAIN !!!! South Carolina

Where do i Live ? It should be the best place ever USA Things need to change in my eyes. A lot of people don’t know this and it’s a real SHAME !

Hi Linda, I disagree with much of what you said regarding your expenses, what you’re saying is if I keep my bills low and pay cash for everything, you deserve more subsidy because you didn’t do the same. Your bills should not burden me.

Regarding this, “What bothers me the most is if you have a little bit of money in any kind of a FUND and you take it out whether it be a little or a lot ! When you go to get your income tax done now they tell you you made more income then what you said, you now have to pay back… and your HEALTH INSURANCE GOES UP ! That is income … But wait that’s my money that i earned over the years and i tried to do the right by putting into some kind of a fund for my future/ retirement / maybe new widows in my house home improvements ?”

I got burned by our hardcore savings 35 years ago and it told me the liberals will take care of me if I slack off, but if I work hard to improve my future they won’t help. My conversion came when I was trying to get a mortgage, the going rate for a 30 year mortgage was 16-3/4%. The state I lived in had a subsidized 9% loan. We earned about $20,000, the cutoff for the subsidy was $22,000, but we had saved and had maybe $25,000 earning about $2,500 dollars, that income put us over the maximum income for the subsidized loan.

Because I helped ourselves rather than living paycheck to paycheck, we got no help from subsidy to help low income people.

Great article,

Your analysis of the subsidy structure is the main reason why my incentives to exceed the roughly $90k (x4 poverty level for a family of 4) income levels are virtually non-existent. Why work to pay other people’s premiums when I can have people like you indirectly pay mine. A quite happy life can be had at 90k of income. You just shift focus a bit to non-pecuniary things, work less in the process, contribute less to economic growth and GDP, etc.

In many ways Obamacare allowed me to drop out of the workforce — at much lower levels of income (and productivity) than you consider ideal. And I plan to stay in that semi-idle less productive state.

In turn, my lower contributions to the economy inevitably translate one way or another to less overall wealth and opportunity for the rest of you to achieve financial independence. There’s no free lunch.

Back in 2010, I was paying $4,300 for a family of 4. The policy had a $10,000 deductible and that was also the total OOP. The deductible was a trade off to keep the premium cost under $10,000.

I was happy with this situation. My policy was grandfather in when Obamacare started.

Then came Obamacare policies in 2012, my non Obamacare policy increased 18.2%, 19.1%, and 23% over the next 3 years with a 9% increase in 2016. My premium is now $8,800 a year.

An almostly equivalent Obamacare policy is over $16,000 with a $12,500 deductible and OOP.

I would get a subsidy, of $9,000 or $10,000, as my MAGI is around $80,000, maybe less.

That is, “IF” I can believe the website, and I’m doubting that less everday.

Obamacare was not good for me, and those that do have it keep getting large increases.

Also, I never see anyone talking about the cost to taxpayers for the subsidy, now, and later,

if the taxpayers need to subdidize the 60% that are under 400% of FPL.

Also, I think the poll is skewed, in that some have what they pay and not the real cost (employer portion not included, which is part of their pay).

I clicked 5% to 10%, with it closer to 10%.

Consider yourself lucky. Even with my wife’s insurance through her job (public school teacher) it’s still $950/month with a $5,000 deductible or $11,400 a year. That is insane, it’s like buying a new car every 2 years. I hope this new administration can eliminate the individual mandate and reign in the out of control premiums. And kick out all the illegals that are driving up costs for all the legal citizens. They are breaking the law, they are criminals.

I still have a W2 job and am a business owner on top of it. The ACA got my young, healthy butt on insurance. My monthly premiums are $160 and my out of pocket maximum is $7000. I make ~60K/year. No subsidy, but I’m generally happy with my access to healthcare. Now that I have health insurance and doctors who I can get to while still being able to work FT+, I tried to figure out why I’ve had tremendous back pain for 2 plus years. It has taken over $4000 in medical bills to figure out I needed physical therapy to get the right muscles working again. I was not anticipating this. I’m glad that I have nothing serious, but these medical bills were technically non-catastrophic and they still hurt. I have not fully funded my IRA because of them. Maybe if I was not building a business, I would have more spare money for this.

I’m still grateful for the ACA and hope that it continues to exist. I don’t know how much my business would need to earn in order to afford insurance without the ACA.

As with most government programs, ACA is good if they can get the subsidy, thus being poor, but not too poor where they’re placed in some other government program. The middle class is screwed if they’re self employed. The elimination of denial of coverage of preexisting condition is good though.

If I had emperor like powers and were in charge of government, I would put a means test for social security beneficiaries(maybe starting with assets around 3 million, excluding primary residence) and exclude them from being a beneficiary. I understand they paid into the system, but government can use those funds to help the ACA subsidy for middle class people. Also I’d eliminate the annual maximum income for payroll taxes and funnel that into the ACA.

Good thing you aren’t an emperor! It also seems like you are not a business owner as well? Stealing from others is generally not a good thing James. People should get out of a program they’ve paid into.

Here is my plan. Stay in NYC, become poor enoguh to qualify for Medicaid, receive the best care for absolutely free. NY medicaid is the best in the xountry if you qualify. In the meantime, I am paying for people who have already executed my plan.

Hi Sam,

I’m paying about 4k per year for a family of 4 with zero deductible. I work for the State government and am thinking those are good rates. Please tell me I’m right :-).

It looks pretty good to me. Where you won’t realize the loss is through your income. Everything is baked into your total compensation. So if you want to tell me your income and your experience that would provide a clearer picture.

Because remember, janitors are making over $200,000 a year here in the San Francisco Bay area, and techies and other people are making much more.

But hopefully you get an awesome lifetime pension once you retire. That is the true value!

See: https://www.financialsamurai.com/abolish-welfare-mentality-six-figure-bart-janitor/

Sam –

You presented 3 plans with the least expensive costing $5,115.72 in annual premiums and the most expensive costing $8,316.12 in annual premiums. This is a difference of 3,200.40.

Can you remember any year that you have had anywhere near 3,200.40 in out of pocket costs? What has caused the major out of pocket costs for you?

The HSA plan is almost always the better plan in an overall financial sense. Additionally you can contribute up to 3400 in 2017 to an HSA account and this is tax deductible. This can be used on medical, vision and dental. If we take the premium savings of 3,200.40 and the tax savings on the HSA deduction (estimate 850…25% of 3400) we are now at a savings of 4050.40. The HSA contribution does not have to be used in the year you make the contribution. It does not expire.

How many people will spend 4050.40 on out of pocket costs? Very, very few. Even health plans that have a higher out of pocket maximum will have a max of around 7k.

The only people who should choose the plan you chose are people with serious illnesses that require ongoing medical treatment.

Take your personal situation. How much would have you saved if you chose the HSA plan the last few years? The savings is substantial.

Regarding your friend with the 55k medical bill…..all health plans have out of pocket maximums. Did you friend have health insurance? What caused the 55k bill? Something is missing here.

Additionally, anyone can buy supplemental products. There are plans for hospital stays as well as if you are diagnosed with a critical illness. An HSA plan paired with a couple of supplemental products will provide the best value. You will be better protected and save a significant amount of money.

To clarify some other things posted have stated. In an emergency, such as a car accident there are no network limitations. All hospitals will accept any health insurance plans.

Short Term Medical plans are not health insurance. Do not be tricked into using these. These are not considered a qualified plan under the ACA and you will be fined for not having a health insurance plan if you have one of these.

Lastly, not one posted mentioned using a health insurance broker for guidance. Why not? There is no charge to use one.

People who are past the age of 50 usually have some condition that needs to be followed, regardless of whether it’s serious. Last 2 years I paid the maximum out of pocket. It worked out where I had an elective procedure at the end of the year, making out my out of pocket (7300k) resulting in complications causing me to be hospitalized over the new year- maxing out my deductible by January 3 and eventually my out of pocket (oct). The insurance cost 7000.00 per year. So 30k in two years. Previous years maxed out due to gallbladder removal, ER for kidney stones, and stomach endoscopies. Interestingly, our workplace premiums are also progressive, so you pay according to wages. Doesn’t matter that those other people may have spouses that earn a great income, or that their HSA has accumulated a ton of money because they haven’t needed surgery.

There are many penalties one pays for not being poor that basically lowers your standard of living. It might be fair to pay a progressive tax, but we pay progressive premiums and tuition as well. If you have a bad year, it’s hard to dig out.

Btw, I had a counselor tell me I can afford to pay cash – he wasn’t getting reimbursed high enough from the insurance. He would still take insurance from the lower income families. He was skilled, but I could not justify the money, especially when I was making out my deductible most years.

Oh, did I mention that my niece went to the ER on her state (free) plan for a pregnancy test?

The US health care system is so tilted towards businesses and profits it’s incredible. First there’s absolutely no competition because you can’t shop around, so prices just can’t be competitive. Often you don’t even know the full cost until you receive the invoice so they can just charge you almost anything they want at that point. Why not increase that cost 5% or more a year?

Wouldn’t that be easy to pass a law that all medical charges have, at least, to be pre-approved by the patient? Any garage will ask you to confirm the quote & cost before performing any work, can’t there be a similar requirement for medical expenses?

If health care costs double every 10 years, there won’t be many options for early retirements in the US.

Sadly, Obamacare will be going away under the Trump presidency. What he’s proposed so far will cause premiums to skyrocket. Get ready for some chaos in the insurance markets.

Prior to obamacare, I was extending cobra from my last full time gig for $22k per year for a fam of 4. This is while I was contracting. In addition I had spent another $8k on the out of pocket costs for medical and dental. To add insult to injury none of the premiums were tax deductible like employees get.

This was all so that I could continue with a preexisting condition. If I chose not to extend via cobra, I would be sol and uninsurable.

Obamacare is deeply flawed but its better than before.

Great very detailed post. The hard part is “how to fix it?”

One thing i find odd is that trump has now promised the replacement for aca will be:

— preexisting conditions covered

— nonindividual mandate and

— cheaper

If he plans to actually do all three “trumpcare” will be a much bigger govt spend than obamacare.

Kind of ironic.

You could also be in a business with massive depreciation, pushing you below the FPL while growing your net wort by six figures every year.

It’s a great idea. And one of the benefits/flaws of basing everything on income instead of wealth.

That said, taking on massive depreciation has an initial cost. And I’m in an asset light business.

How about a non compliant catastrophic plan and tell the federalize to pound sand on the

“Penalty/tax” of 2.5 % of AGI. They have no legal enforcement but to withhold refunds, and if you pay quarterly taxes this can be avoided.

I find this to be the best answer for us as there is no recourse for non compliance and the enforcement is surely to go away with the Donald. Thoughts? After all, early retired or entrepreneurs should look at the math and see that if they go this route they can save

Mucho over the years. Lots of permutations on how to accomplish this but should be in everyone’s analysis, considering the VERY

High deductibles.

Sam neglected to mention that the portion of your health insurance paid by your employer that you don’t see gives you an unlimited exemption on both payroll and income taxes. Those not purchasing insurance via an employer do not get that benefit — it is very unfair, to say the least.

As far as why we even have this employer co-op mess to begin with, you can blame Milton Friedman.

I completely agree, I don’t understand why the self-employed or people that buy health insurance outside of their Employer don’t get that same tax break. For the average person, that’s likely a 28% discount on the price of the premiums (assume 15% tax bracket, 5% state, 8.1% FICA ).

I don’t understand why it’s called the “Affordable” Care Act when this tax break was denied to anyone going on the exchange. My theory is ultimately, the government wants to take away this tax benefit to everyone but taking baby steps.

But you can deduct self-employed health insurance premiums on your personal income tax return. https://www.healthinsurance.org/obamacare/self-employed-health-insurance-deduction/

I did not know that. So for a self-employed person, are insurance premiums exempt from FICA as well? Either way, it’s still unfair to not be allowed to deduct Obamacare premiums if you are a regular W2 worker.

I’m not sure about whether it’s exempt from FICA. I think you might still have to pay FICA, but I’d need to prepare a tax return and walk it all the way through to be sure. You could try Googling it. Or if you have TurboTax or something similar, open up your old return and play around with it to see what happens.

I agree that it seems unfair that W-2 workers who are not covered by their employer’s plan don’t have the option to deduct their insurance premiums from their income. Unless those premiums exceed 10% of their income, of course, but that’s a very high hurdle to clear.

Your employer is able to deduct the health insurance costs they provide to you and your coworkers as a business expense. Why shouldn’t a self employed person be able to?

Do you pay twice the amount into social security like a self employed person does? Is that fair? Exactly.

It is amazing what the average person thinks they know about taxes and business ownership.

You seem very knowledgeable and passionate about this topic. Care to share your background and a guest post so we know where you are coming from? You can help a lot more people with a post! This way, any things you think I neglected can be addressed.

Thx

Great post Sam. Love the details in your tables!

When we pull the plug from the workplace in 2 years, our family (2 adults, 2 kids) ) can be covered by my employer’s plan. BCBS, high deductible with HSA. Premiums $895/month. Deductible of $3,000. Former employer pays $1,000 pa into HSA. Platinum level coverage and co-pays etc. We will be well below your 20% guidepost based on our theoretical SWR. FWIW, my company pays me a pension – small compared to current salary but not insignificant at all compared to our projected expenses in retirement.

If healthcare costs go catastrophic, we can lever our dual citizenship and always go back to the UK. But that is not what we would want to do. US is home! Besides, although healthcare costs are low over there, try buying a 3-bedroom detached home with garage on a couple of acres in a beautiful rural location (like our retiree home) for less than $600,000. It will be tough.

How long will your employer cover you once you leave? Best double check that they will and figure out how to leave where all parties are happy!

Good thing Brexit has made property cheaper in the UK! Or has it not, since the world rushed to buy as soon as the discount hit?

I can’t believe the cost of health insurance in the US! No wonder bloggers and those working for themselves focus on it.

In Australia, i pay about $100/month for health insurance as a single. One hundred per month. This is 1-2% of my income.

I don’t know the reason why US healthcare is so expensive but some of the comments here and this article has helped.

AND, Australians have the supperannuation system AND have the highest inheritance in THE WORLD!

Oh, and Australians have a great gap year culture, always seem happy at the pubs, and have the Aussie Open. GOOD LIFE I say!

https://www.financialsamurai.com/average-inheritance-amounts-by-country-talking-with-parents/

I think people are afraid that the middle and upper middle will pay more percentage wise, and the lower income will pay nothing.

Sam, my company pays 100% medical for employees and 50% on dependents. We’re a tiny startup, so I’m happy to have it.

My portion, to cover my wife, baby boy, and me is $377/month which comes out to about 3% of my gross income.

Here’s the kicker…

We had our baby boy in June and he came 7 weeks early. That meant a 32 day stay in the NICU. We ended up hitting our max out of pocket expense for a family of $13,600 which of course comes on top of the premiums I’ve been paying for years.

OUCH!

If you include that, I paid $18,124 in the last twelve months for health related expenses (coverage and having our child). At the time I was making $90k/year salary (now $150k) so it came almost exactly to your 20% figure.

I suppose that should make me feel better about it, but it still stings like hell. It’s incredible to me that between the company and my premiums (~$15,000/year) I still had to pay $13,600 to bring a child into the world.

Considering that the costs were at least $100,000 (including the delivery), you got off pretty lightly.

Glad your kid is OK! As Anne said, the true cost was probably $100,000+ for the care. So $13,600 is pretty good value!

I think that’s one of my main gripes with insurance… you have no idea what the “true” cost is. All said and done, the bills I saw were somewhere around $750,000 but the prices on things seem obscene. My wife needed to transfer hospitals to be at a higher level NICU facility. The ambulance ride alone was billed at $30,000 — it was a 15min ride.

The lack of transparency and inefficiency dealing with insurance has been appalling.

I’m self-employed and was paying about $500 per month for Blue Cross until the AFFORDABLE health care act kicked in and then my rates went up to $650.

Because I don’t believe in Obamacare and now had a reason to resent it more, I looked into shared health care and signed up with Samaritan Ministries. (Medi-share is similar)

It’s technically not insurance and there are requirements – you have to be Christian, engage in a healthful lifestyle and can’t have two pre-existing conditions (diabetes and heart) but I pay only $220 a month now including what would be considered catastrophic care.

SMI expects you to pay small things on your own to help keep costs down for everyone but they were inconsequential to me.

Personally, I’m saving over $400 a month and my so-called deductibles will be small.

The ACA didn’t cause your premiums to skyrocket – that was a trend well underway before it was implemented. And if you don’t like Obamacare, just wait until you see Trumpcare. It’s going to be a bigly disaster.

Funny how that chart showing average annual premium increase is pretty linear even including the ACA years.

Everyone loves to bash Obamacare, oh woe is me! But perhaps people need to look more closely at the insurance companies and insane hospital billing rates and practices in the US.

I have just received a bill for some bloodwork I had done over 2 years ago which was part of my annual physical. Since then, unknown to me, it apparently got kicked back and forth between BCBS and the doctors clinic until finally I got a bill unexpectedly in the mail last week. How much did that mess cost between BCBS and clinic staff hours? Likely far more than the measly blood test cost! That cost ends up somewhere…..but yeah….thanks, Obama!

Bernie has the right idea.

The historical premium increase is exactly what I wanted to demonstrate. Prices went up before and after ACA. Hard to say how much more costs went up due to ACA, but it certainly didn’t help cap costs due to the very nature of subsidies.

You’re only winning if you earn up to 200% of the Federal Poverty Level. But if that’s where you are, then you are still losing. So at the very least, we are helping the poor. It’s just the middle class household earning $56,000 a year which is getting hurt b/c they have to pay ~$18,000 a year if they were to ever go out on their own.

I freaked out for a little bit and then checked my target spending after retiring. It includes $25,000/year for health insurance. It’s such a good feeling to know I’ve already considered this! Now back to earning and saving money. :)

Good! When do you plan to retire? May I suggest UPPING the $25,000/year by 5% each year you plan to retire from today e.g. $40,000 a year in 10 years.

Better to be safe than sorry!

Yikes! We should be FI in less than 15 years for sure (and we’re in the Bay Area). I’ll definitely be redoing all the calculation for expenses as we get closer and closer to our number.

Excellent post Sam, as always. Your description aligns with the incredible complexity I have absorbed from other sources on US healthcare challenges, such as in Darrow Fitzpatrick’s latest book (which is a very good, general FIRE reference and tackles the health care cost challenge and risks very directly with tangible examples from 2016).

It is clear to me, as a Canadian, that this is a major stumbling block that must stifle a great deal of the ambition that might be out there in your population – people on the margin of striking out on their own, or early retiring, or thinking about realistic and plausible new life goals, or changes to break free from the conventional work cycle.

This system is an incredible contrast to our system of a single supply, tax paid service. Most Canadians are left shaking their heads at the situation you face and that families face when the option might be financial ruin or bankruptcy. How ever did employers become responsible for paying for citizen’s healthcare? It really makes no sense but is an element of history and precedence, like so many things are in many areas of our lives.

There is a great deal of rhetoric about the Canadian system and some of it is true and most of it is false. As a steely-eyed business person and father who is very pragmatic, I myself evolved over many years growing up and into adult-hood to a position of believing this system is the best and most reasonable one for a modern, civilised country like ours. I had no interest in seeing doctors and others become “slaves who must supply services according to the oath” but reality catches up in a complex world of multiple employers, the gig economy, globalisation, and options. It is the most essential service of all services.

For what it is worth, if instructive to readers, some of the most pertinent attributes behind our system, at present, include:

– 100% of citizens are covered with no exceptions,

– Core regular, emergency and elective services of every kind are covered,

– Some provinces levy additional health tax on individuals and families. Mine is about $1000. This is on top of our federal and provincial income taxes. Taken together, Canadian income taxes are generally higher than US taxes and in some cases substantially higher and there is an obvious trade off. Of course there are other arguments about the merits or demerits of our tax system and our overall quality of life outside of health care considerations.

– Canada spends much less (1/3?) then the US does as a percentage of GDP, and life expectancy and outcomes are substantially better overall in Canada,

– Triage means very few people die waiting for anything but wait you must for non-life threatening services (and sometimes this is uncomfortably long),

– We don’t have the best-of-the-best here and we don’t have the institutions that will create them or keep them in Canada,

– You can go to any doctor you want within reason anywhere in the country, “insurance” is nothing more than pre-paid services for things not covered like private rooms and vision (I do not advocate for this type of “insurance” if it’s not company paid, just pay out of pocket),

– If you don’t like the wait or need something extra that is truly not covered, you can go outside the system at your own cost. This is commonly done by middle class and up families when needed,

– The supply of doctors, particularly specialists outside of cities, is very tight because the system is at capacity and the population is growing,

– Physicians and health care workers of all kinds are an odd mix of government employees and self employed people, but they all get paid by government directly for their services in the end. They really might as well all be employees unless they run businesses of some type as well (outside their practices). They are generally very well compensated by Canadian standards and in some but not all cases below US equivalents. The grass used to be much greener in the US for these folks but is not now for a number of reasons.

Thanks Biggrey for a Canadian’s view.

Good overview of Canada’s “Medicare for All”.

What was neglected to be mentioned is that it is fiscally unsustainable and private health insurance is now legal to help act as an pressure release valve. More competition is always a good thing.

Thanks for sharing! Perhaps Canadian healthcare is one of the reasons why real estate is so expensive in Vancouver and Toronto? Are you seeing people from America retire in Canada to take advantage? Can we take advantage of your healthcare system if we haven’t spent decades paying Canadian taxes?

I want Obamacare and our entire system to work due to 1) the ability to insure 100% of the uninsured, 2) to make healthcare truly AFFORDABLE for those within 200% of the Federal Poverty Limits, 3) to allow more people to do what they want in life, take risks, and not be a slave to their jobs forever.

I knew when I left corporate America in 2012 that I wouldn’t get subsidies, given I did research on the subsidy amounts at the time. BUT, almost five years later, I can see how costs have continued to grow unabated as an employer. Paying $20,000 a year in healthcare is absurd for a typical household.

My personal opinion is that the Canadian system is sustainable at the cost of increased taxes. That will ultimately be the citizen’s choice, as represented by current and future political parties and movements. Private supplements (in some provinces) and the option to go outside Canada is a real option for some and a safety valve. Sam, I don’t see how the US does not eventually evolve it’s system to cover all it’s citizens despite the cost and the political difficulty of doing so. You can take advantage of the system shortly after arriving to live in Canada. I think the overall situation in Canada – health care, taxes, lifestyle, cost of living, tone and culture – all influence American’s choices. It is a great place to live but we have our own challenges, of course.

I’m pretty sure that America will turn into Europe and Canada over the next 50 years. It’s just the way everything moves after the country gets developed and has enough wealth to support everybody.

See: https://www.financialsamurai.com/ive-seen-americas-future-and-it-looks-bright/

America becomes Europe?

Including a 1-2% structural growth trendline in a world that grows on a 4% annual growth trendline?

Elementary interest compounding analysis immediately shows that the leading national prosperity rankings Americans are so accustomed to and take for granted are unsustainable on such a growth deficit trajectory. With such growth divergence average world prosperity catches up to the average European by year 2040 and then surpasses the average American by 2060. A velocity of decline never seen before in human history.

Is that a bright future?

As full-time travelers, we didn’t qualify for any plans in the state that we are domiciled in. Due to that, we are currently trying out Liberty Healthshare (no, we’re not religious). At $250 a month, I can’t complain.

Sounds very affordable! For two? Can you explain more about this program and what you get? Can anybody qualify? For two, I’m paying $1,400+/month.

Thx

Well, those plans aren’t insurance, so they aren’t subject to regulation and they can exclude whatever they feel like.

My understanding is that Liberty is the only health sharing ministry of the five that allows same sex couples to purchase. So they would be the most inclusive, but they still definitely do some excluding.

They can turn people away for pre-existing conditions. It’s probably condition-specific, but they have a four year period where there’s a cap on what can be shared.

My understanding is that there are things that they don’t cover. The most obvious being birth control and STDs.

https://www.libertyhealthshare.org/do-i-qualify

There’s also a Million Dollar cap per incident, so if you need brain surgery, you’re probably out of luck with a Health Share, but as long as the federal government requires insurance to not turn away pre-existing conditions, you can apply for insurance at the next open enrollment period if you’re not already bankrupt. Risky, but definitely an option for those whose lifestyle happens to co-exist with the “ethical code” of the Health Sharing Ministry. And honestly it makes health insurance more expensive for everyone else because it takes a segment of healthy folks out of the system. Happy it’s an option for those who can’t afford unaffordable insurance though.

I had 100% paid health, dental and life insurance from a previous employer for about 8 years. It was absolutely awesome not having any money deducted from my paycheck for it back then. Even when they decided to start charging us for coverage, the premiums were reasonable. I think I was paying less than $1500 a year for Platinum level coverage. Those were the good old days (for benefits at least, not for work) :)

Health insurance is expensive when you have to pay out of pocket, but I wouldn’t go without it. I’ve had my fair share of claims and have gotten more in services than what I’ve paid in premiums over the last several years even once I started paying 100% for my own policy. Of course it’s ridiculous how much doctors and hospitals charge for stuff but that’s a whole ‘nother can of worms.

Great tables and ratios Sam!

Great and timely article.

One question – you said you wanted to avoid having a big deductible, but I would have thought someone like you (high income, significant b/s) would be the perfect candidate for one. Self-insuring for everything but major medical expenses (esp. through a high deductible plan + HSA) seems to work fairly well in the wacky world we’re in, so I’m curious why you didn’t go that route.

It’s a great question Paul. Your reasoning is highly logical. I had dozens of plans to choose from, and I narrowed it down to the three plans I highlighted in this post.

1) The cheapest Bronze plan I considered cost $426.31/month or $5,115.72/year. I passed because the idea of paying a $5,500 deductible before insurance kicks in sounds terrible. B/c I feel I’m relatively healthy, this plan is like a GUARANTEED loss of $5,115.72/year b/c I’ve never had to spend more than $5,500 in deductible costs a year.

2) The Gold plan that cost $587.90/month or $7,054.80/year due to the reasonable $250 deductible. I was very close to getting this plan. It makes sense, and a $250 deductible is nothing.

3) The Platinum plan costs $693.01/month or $8,316.12/year. I went with this b/c I compared the extra cost of $1,280 a year, or about $107/month to the likelihood of it I was going to have to stay over in a hospital visit. After discovering it cost $25,000 a NIGHT for one of my closest friends who had to stay in the hospital for two nights for an out of the blue procedure, I decided that paying 20% of that cost through co-insurance wasn’t worth it.

My friend was a totally healthy person who had some really bad luck. I feel I’ve been very lucky so far, but as we age, and I’m almost 40, the chance of something bad increases. I didn’t want to sit in the hospital all pissed off about my health AND have to pay the max $5,000 deductible and co-pay and meds.

The Platinum still has a max $4,000 out of pocket, but it is a 10% co-insurance instead of 20% for the Gold plan.

I was on a similar Gold plan since 2013, and decided to just go up one level since I’ll be 40 in 2017. It will probably be a suboptimal decision that will cost me $1,000+ more, but I hope that’s the case. I feel good knowing that I have the best health insurance possible. That’s worth more than $1,000/year to me. Further, my income is finally at a level where the $8,000/year in premium cost feels affordable.

But for others who want to retire early or become an entrepreneur, they might not be so lucky. I know very well how much one has to work and sacrifice to become a self-sustaining entrepreneur. The upside is huge, but the first couple years can be dicey if you didn’t negotiate a severance package or have a passive income portfolio like I did and have. But maybe I would have simply worked harder to not fail. Who knows.

My main recommendation is really for all those looking to pull the chord early to calculate their full cost of health care and multiply it by 5X – 20X BEFORE leaving.

Oops. Sam’s reply hit while I was posting my comment. :D

Sam, I hear that you like the security of it, but financially I still think the cheaper plan is the better choice, so long as you have at least $5k sitting in a bank account somewhere.

True that the cheapest plan is a guaranteed $5,115.72 loss. But by that same logic, the expensive plan is a guaranteed $8,316.12 loss. The difference in premium is $3,200.40 per year. If you end up going just two years with no major expenses, you’ll more than make up the difference in premium. And even if you do have a bad incident in year 1, you’ll have spent $10,115 which is just $1,800 more than the premium plan anyway. Not a huge loss.

I know you’re good at math, so I’m sure you ran those same numbers. Is it just an emotional decision more than anything? (Nothing wrong with that, if it is. Just wondering.)

Can you run your calculations on how the platinum plan is a guaranteed $8316 loss?

I don’t know what the next two years will bring, and I make enough money now to afford the best health insurance plan possible.

The snapshot that I provided in the post is only one third of the benefits. There is a litany of other benefits that I haven’t included because it didn’t fit in the screen.

The thing with plans is that you can change from year-to-year. I feel I have already been winning for the past 16 years getting subsidized healthcare from my employer or paying for a cheaper plan after I left my employer. At age 40, I plan to just pay for the best coverage possible. There are so many things that I have no idea what insurance can and cannot cover. I’d rather pay up for a plan that will cover everything The last thing I want to do is try to get reimbursed for some random thing that gets rejected.

Tell me about your plan and how much it costs. What are the benefits and negatives of your plan?

Sure. The platinum plan is a guaranteed $8,316 loss because the premium costs of any policy are a guaranteed loss. That’s why the bronze plan is a $5,115 loss. If you never use the benefits, all the money you paid for premiums is lost. I’m not saying the platinum is a guaranteed bad deal all around, just that the amount of the premium is lost either way. You would then add back the actual benefits received (health care actually received for free/cheaper than you would have paid if you had the cheaper plan) to determine whether it was a success overall or not.

I understand why you’d want better coverage to try to ensure that you don’t get hit with sneaky unreimbursable costs. Insurance is tricky that way, and it sucks. If you get in a car accident and you’re unconscious or in an unfamiliar area, and they take you to the “wrong” hospital, you could end up with a huge cost because of out-of-network providers, even if you were unaware that they took you to the wrong place. It’s scary. I don’t know if the risk of unreimbursed costs goes down if you have a better plan or not. It may be that once you’re out of plan, you’re hosed anyway.

I’m really lucky in that my employer lets us all jointly choose the best plan for us every year. We have a small office and everyone is loyal, so we don’t put our own interests ahead of the company’s. We balance it to get the best result for all. I know that sounds cheesy, but it’s true.

We normally do a HDHP with an HSA component. The company pays the full HDHP premium and contributes the max allowed amount into an HSA for us. (I know that’s very unusual and we are VERY lucky. Hence the company loyalty.) In years past, we had a deductible of about $3,500, and the employer would contribute the max (around $3,250) into our HSA. So theoretically it was like having a $250 deductible health plan. It was actually cheaper for the employer than a full zero-deductible health plan, though. Go figure. After the deductible, we had coinsurance at about 70% up to max out of pocket of maybe $5,500 or so. These are all individual numbers, btw. Double it if you want comparison of the family limits.

Last year at renewal time, the premiums jumped quite a bit for us, and Anthem eliminated our $3,500 deductible plan. Our choices were to go for a lower deductible with higher premium or a higher $5,500 deductible. The lower deductible meant that a good chunk more went to Anthem in premium costs, but the employer would save some money by contributing less to our HSA accounts. (Tax code limits HSA contributions to the lesser of a statutory cap or the deductible amount. Lower deductible meant less money in HSA accounts.) So it would cost more premium but save on HSA contributions, for a net result of maybe a $500 per employee cost.

Instead, we opted to renew for the $5,500 plan, which would save the $500 per employee cost, and which would allow our employer to contribute the full amount to our HSAs. That meant a slightly higher risk to us (for that one year), but we calculated that just one healthy year would give us the extra money in our HSA accounts to more than cover the difference in the deductible. The HSA money is real, and stays in our account. Extra premium costs are lost forever.

This year, the $5,500 plan was gone, and we were offered a $6,000 deductible or a $4,500 deductible plan. Oddly enough, the $6,000 deductible plan was slightly more expensive. The only reason I can figure is because there’s no coinsurance period, it jumps straight to 100% coverage at $6,000. But the $4,500 plan has 70% coinsurance until $6,350. If you think you’re going to use very little or none of the services, so you likely wouldn’t even hit that coinsurance window, it actually makes more sense to choose the $4,500 plan in this instance.

So that’s what we did. Our plan starting Jan 1 will be for a $4,500 deductible, with 70% coinsurance until you hit out of pocket max of $6,350. The premium for me, age 37, is $346.78/month, or $4,161 per year. Employer also contributes max ($3,350 now?) to HSA. My premium last year was $301.15 per month for the $5,500 deductible plan, so it went up 15% but the deductible went down by $1,000. Our plan is PPO, so we choose our physicians. I don’t really care, but one of the partners at the firm does, so that’s fine.

The premium savings over the years have let my HSA account grow to over $12k. Hasn’t cost the employer any more than what a platinum plan would have cost. My HSA account balance would be even higher except I used it to buy Invisalign for myself several years ago. I don’t use it for medical expenses anymore, because my plan is to keep letting it grow untaxed and then start saving receipts once I get to age 50 or so, so I can start withdrawing from it tax-free to reimburse myself for medical expenses.

Sorry for the long answer. You wanted details. :-/

Sounds good. Thanks for sharing. What you say makes sense. I’m looking beyond the dollar amount at this point to hopefully buy some convenience in case something bad happens. My experience this year with a close friend who ended up having an out of the blue total medical bill of $55,000 pushed me to be conservative. We never would have anticipated something bad to happen to my friend, and we also never realized how much the actual cost truly is. It is SCARY once you find out what the numbers are.

These plans are yearly, and like I do every year, I will reassess. And also, it’s best not to make too many assumptions about someone else’s individual health, family situation etc. There may be some things I anticipate happening in my life or to my family in 2017 I haven’t disclosed for the sake of privacy. Not everything is purely numbers with this decision, and I believe you will feel differently about the cost of health insurance once your employer no longer subsidizes you.

Related: Your Car Insurance Might Not Be Good Enough

You’re totally right. I was assuming you and your family were completely healthy and that you don’t foresee a need to use the coverage in the next year. And of course you shouldn’t feel the need to disclose any of that. I’m sure that the off-the-scenes info makes your choice totally make sense for you.

I don’t think my feelings will change without the employer subsidy, but only because we’ve always chosen plans that are best for the whole team. In fact, starting Jan 1, there is no subsidy, because I’m going to be partner in the firm and footing the bill for my own healthcare costs. Whee! :)

Sam – thanks for the added insight, and it’s a good point that we have to run a lot of scenarios to make these decisions. There’s a big asymmetry in good v. bad outcomes.

You put more work into comments alone than a lot of bloggers put into their posts :-) Thanks!

No problem Paul. After responding to so many comments, I do often wonder whether my time would be better spent just writing another post, since very little credit is given by Google or anybody beyond the person I’m responding to with my responses. In the online publishing world, publishing more URLs is better than less!

All good things for me to think about as we head into the new year. I think other sites my size simply just ignore everybody right? But that’s not too fun! Gotta find a balance.

Ditto. That’s what I was wondering, too. Especially because with a high deductible plan, you can use an HSA and sock away money that way, too. I’m a huge fan of high deductible plans because you can bank the premium savings and it pays for itself after just a couple of years of no major health issues. Everything after that is gravy. You can always switch to a low-deductible health plan in later, less-healthy years if the numbers shake out better that way.

Wow, thanks for highlighting the rising costs. Having my employer pay a majority of the premiums does insulate me from the true costs. I pay roughly $200 /mo for a HDHP w/ a $2600 deductible for my family, but my employer started contributing the deductible to the the HSA, which has been great.

My wife’s employer also offers free full HMO coverage on a std plan.

And this is why the ACA is a TERRIBLE idea. I’m self employed so I get hit with a ton of taxes every year, not even including health insurance. And I’m not making much either, maybe $40k/year on average. Most pf the plans for us with the $2,500 deductible before they will cover a penny are $500-$600/month. So I have to pay $6k/year PLUS the $2,500 before insurance pays out a penny. Everyone that was or is for the ACA is totally clueless when it comes to how much people actually have to pay for insurance when they’re not getting it for free from the Gov’t or their employer.

My wife works for a public school district in CO, and the lowest plan they offer is covered by them, but there’s a $5,000 deductible. That’s terrible also. But she would get two preventive office visits per year, and she would get her $25/month in birth control for free. So that’s basically like paying $415/month just to get $25/month and 2 office visits for free. That’s some Common Core math for you!

but i dont think repealing the ACA will really bring down the cost of healthcare.

We’re still footing the bill for emergency room patients who can’t be turned away. We’re still paying the R&D costs for drugs when the rest of the world doesnt. Doctor’s are getting fewer and further between as they’re making less and less while malpractice insurance soars.

I dont know what the solution is, but i dont think ‘repeal and replace’ is a panacea.

Hi Ken,

The government is lucky that most people work and have their healthcare premiums subsidized, otherwise, there would be a revolt and more accountability. A 40% coverage rate of the insured after 5 YEARS is a crying shame.

I’m surprised though that you don’t get any type of subsidy earning $40,000 a year. The latest chart says that even if you are one person, if you make under $47,000 a year, you should get SOME type of subsidy. Perhaps lower your salary and increase your distributions or adjust your expenses?

Sam

My wife is a public school teacher and makes about what I make. As I mentioned in another comment, her employer will pay for a plan that has a $5k deductible and they won’t cover me at all. I really wish they offered some kind of HSA so we could sock away money tax free for medical expenses. Because right now any expenses we pay are only deductible if we itemize, and since we’ve been stuck renting forever the standard deduction is a lot higher.

We’re planning on moving out of CO (Denver area) to buy a house and lower our cost of living. It’s shocking how many taxes CO levies. There’s even yearly vehicle tax based on value. A friend of mine is paying over $1,000/year for her new $35k minivan. And that’s on top of the sales tax for buying the car in the first place. It’s a sliding scale so it will decrease every year, but come on… At least take all that revenue and repair the terrible roads here. RE isn’t as pricey as some places like SF, but if you’re making what we’re making it’s very expensive. All of my wife’s co-workers live paycheck to paycheck. They’re all urban dwellers who blow all their money every month on rent, food, and drink.

At least we’re doing everything we can to lower our monthly expenses. Plus our neighbors are total jerks who don’t believe in parenting, so their kid jumps off of furniture and runs around all day long. We share walls, but they don’t care. And I work form home. We’re just waiting for the little snot to break a leg running down the stairs or jumping off furniture.

“Fortunately, there are a few factors in play that may help mitigate these increases. (Yay!) First, it’s believed that approximately 85 percent of those purchasing insurance through the HealthCare.gov marketplace are eligible for tax credits and additional aid. The ACA is designed so that tax credits for qualified families and individuals will increase to match any increase in premiums. Be sure to update your application (rather than simply auto-enroll) to make sure you’re getting your full benefits.”

“Secondly, available plans are very specific to where you live, so be sure to shop around. In some areas, premiums are on the rise this year. In other states, premiums are actually decreasing. There are, in most areas, many, many plans available, so it’s important to understand what each plan means and how selecting that plan might affect you (including the possibility that your current doctor may not participate with the plan).”

I tend to dislike low-deductible healthcare plans. First, I visit a doctor maybe once a year for a checkup and I’d much prefer to pay out-of-pocket because that feels more honest. Second, most employers I’ve seen still have a high-deductible plan where the employer covers 100% of the premiums. The most important reason, though, is access to an HSA – $3000/year pre-tax stashed away :)

Great Article FS. This was something I was thinking about this morning and boom you have an article on it. Sad really the state of affairs of Healthcare in America and even worse the middle class seems to eat the bill.

Very good article Sam. I think the horrendous expense of Obamacare is what really drove the election away from the Democrats. I’m of the opinion that Obamacare wasn’t meant to be a permanent solution, but a Machiavellian project to break the existing healthcare system so the government could “come to the rescue” with a universal healthcare solution. Isn’t it interesting that Obamacare premiums were not allowed to be deducted from taxes like the pre-tax deductions from an employer? It’s almost like they were trying to drive up prices.

I think the graduated subsidies are part of a larger problem we have in the states. Welfare is only limited to a narrow section of the population, typically allocated by income. Thus, our social programs are seen to only benefit a narrow group of people—mostly minorities. This creates divisions within our society that are easy to exploited, by say, bigoted Populist extremists. If the US were to adopt a more European style safety net where EVERYONE gets the same benefits regardless of their income, there would be more support and hopefully more social harmony.

You’re right that an actual fair and universal, European-style healthcare system would have huge amounts of support. This is *exactly* one of the reasons the law has been attacked so relentlessly by conservatives since its passage.

The US *has* a universal, single-payer healthcare system that is well-loved and efficient: Medicare. It’s funded, and is more stable since the passage of the ACA. It has better outcomes and lower costs than the private health care system. It’s kept generations of seniors from suffering or going bankrupt. It’s a success story, and Paul Ryan has said explicitly that he wants to dismantle it.

FS: consider yourself blessed for being blissfully ignorant as to the horrific state of individual market health insurance, pre-ACA. Unregulated rate increases, denial for pre-existing conditions, and the absolutely repugnant act of rescission were all very real threats to self-employed people like myself. Those benefits alone are worth the cost of the ACA for me.

Medicare is no magical panacea since it’s a government bureaucracy suffering from waste, fraud and abuse (that is not honestly reported), but it could be substantially improved via reforms. The problem is such reforms have to be political and we know how long that takes… decades.

Medicare will never operate on cost-containment, free-market principles so long as general revenues are required to fund it. That’s why Ryan wants to “dismantle” it in favor of issuing premium vouchers for use in a model like Switzerland’s. But that won’t work either unless private insurance is also reformed. We’ll have to see what can pass Congress since not all Republicans are as “extreme” as Ryan is. Baby steps.

Completely agree. Medicare is demonized for being a “federal bureaucracy” as if that in itself is a bad thing. The real issue, of course, is how cost-effective the system is. Those of us who work in health care are accustomed to working with the “corporate insurance bureaucracies” and believe me, I prefer dealing with Medicare. As a physician, I have looked forward to working in a rational, humane and cost-efficient Canadian-style health care system (with its limitations) for 25 years. Looks like it won’t be happening in my lifetime.

Sounds good Matthew. Please see the intro of the post on my thoughts on pre-existing conditions.

What is your story and how much do you pay for healthcare and what plan do you have? It makes sense to be very pro ACA if you don’t have to pay as much.

Thx