The average 401(k) account balance is now over $100,000 thanks to a long bull market since 2009. Even during a global pandemic, risk asset investments are doing well.

Investment management firm Vanguard reported the average account balances for 401(k) plan participants reached a record high of $120,650 at year-end 2024.

Meanwhile, Fidelity reports that the average 401k balance is now around $120,000 as of February 10, 2025. Among employees participating in a 401k for at least 10 years, the average balance hit $251,600, up 12% from a year ago. There is a significant rise of 401(k) millionaires too, hooray!

Based on the Investment Company Institute (ICI), 51 million American workers were active 401(k) participants. 51 million is roughly half the US workforce out of a total population of 313 million. Hence, if the average 401(k) balance for half the US workforce is $101,650 then I dare say things aren't as bad as they seem.

With MyRA or IRA making up for the other half of the working population with $5,500 a year contributions and Social Security, personal savings, personal investments, and pensions taking care of the other 200 million Americans, we've got America covered.

See: How Much Should I Have In An IRA By Age

OK, maybe it's not so easy. We've got a lot more work to do to ensure a great retirement life, so let's revisit my recommended 401(k) savings amounts by age or work experience to make sure. I also provide a savings balance guide by income chart as well.

Recommended 401(k) Balance BY AGE OR WORK EXPERIENCE

Here is my 401(k) balance by age recommendation. I firmly believe everybody can boost their 401(k) balance each year to become a 401(k) millionaire by 60.

My numbers are $29,000 – $250,000 higher than Vanguard's reported average because we are not average. We are personal finance enthusiasts who spend time reading and writing about money, retirement, and financial freedom.

The average person is saving less than 10% of their income and buying cars worth 50%+ of their annual gross income (median price car is now $31,000 vs. the median household income of $51,000). In other words, the average American will be depending on us to support them. Awesome!

401(k) Balance Assumptions

My 401(k) balance figures are aggressive because of the assumptions a person finds full-time median income employment by 23, and maxes out his or her 401(k) by 26.

I also assume people care about their financial future, which is not apparent based on existing graduation rates and savings metrics.

For the low end of the chart I conservatively provide no growth. For the high end of the chart, I estimate a 5% constant rate of return throughout their entire working lives.

Both assumptions are conservative given the historical ~8% annual return of the S&P 500.

Flexibility of The 401(k) Balance Chart

The recommended 401(k) amounts above can also be used as a guide for all your pre-tax retirement accounts such as your IRA, ROTH, ROTH 401(k), SEP IRA + investments by age if you wish.

You can also use the chart as your combined savings for you and your spouse, although I always highly recommend each spouse build their own financial safety net because things happen.

But based on my recommended net worth allocation, there has to be more to these numbers – namely property, private investments, your business and a potential X Factor.

Ideal Overall Savings Amounts

In a financially robust world, I'd like everyone who has access to a 401(k) to max out their 401(k) and then continue to save and invest all they can in an after-tax investment account. Maxing out your 401(k) probably requires around a $50,000 income to feel comfortable, although there are many examples of folks who are able to put away $17,500 on much less.

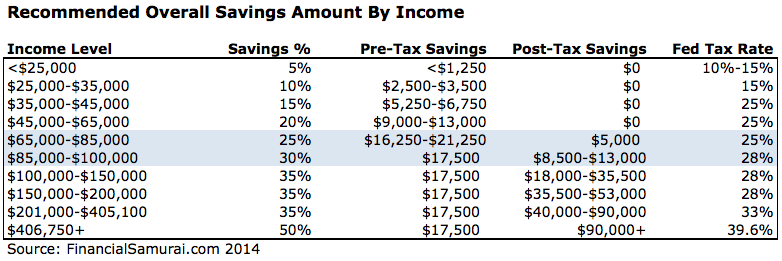

To “feel comfortable” though, is really a luxury. If you feel comfortable in your savings journey, then you are not saving enough. The goal is to really try and increase your income while maintaining your savings habits. Have a look below.

As you can see from the chart, maxing out your 401(k) and accumulating post-tax savings gets easier the more you make. The system I encourage everyone to undertake is to max out their 401(k) first and then multiply the savings % in the chart to your after tax income to save more. So long as you are maxing out your 401(k), a realistic worst case scenario is that you end up with the amounts in the “Low End” of the first chart in this post.

The ideal income level hovers between $150,000 – $250,000 because you're able to max out your 401(k) and still save $35,500 – $53,000 after tax if you stay disciplined at a 35% savings percentage. Your marginal Federal tax rate isn't egregious at 28% either so you don't feel like you're getting pounded by the government.

See: Expense Coverage Ratio Targets

Save Often And Aggressively

The $101,650 average 401(k) figure for the end is a psychologically important number. With over $100,000 in savings, a 10-20% move in performance really starts making a difference compared to the maximum 401(k) contribution of $17,500. It's all about building the financial nut so that your returns start overtaking your contributions.

Once you get to significant milestones such as the $100,000 mark, you'll get even more motivated to save more. Corrections in the stock market will feel more painful. But over time, you should figure out a proper asset allocation of stocks and bonds that matches your risk tolerance.

Make savings a priority by continuously thinking about the financial freedom you will achieve. The sacrifice is worth it because you'll realize after a while that savings is no sacrifice at all.

Free Wealth Building Recommendation

Run your portfolio through Personal Capital's free 401k Fee Analyzer tool. The tool will show you exactly how much you are paying in fees a year, your total fees you'll pay until your desired retirement age, and how many years your fees are lopping off the years until retirement.

I ran my 401k through the tool and it showed I was paying $1,700 a year in fees I had no idea I was paying. As a result, I reallocated my funds into lower cost index funds of similar investments to save about $1,300 a year, and more importantly, about 2 years less time I'd have to wait to achieve my projected 401k goal.

They've also come out with their incredible Retirement Planning Calculator that uses your linked accounts to run a Monte Carlo simulation to figure out your financial future. You can input various income and expense variables to see the outcomes.

Build Wealth Through Real Estate

In addition to investing in stocks and bonds through your 401k, I recommend diversifying into real estate as well. Real estate is a core asset class that has proven to build long-term wealth for Americans. Real estate is a tangible asset that provides utility and a steady stream of income if you own rental properties.

Given interest rates have come way down, the value of rental income has gone way up. The reason why is because it now takes a lot more capital to generate the same amount of risk-adjusted income. Yet, real estate prices have not reflected this reality yet, hence the opportunity.

With real estate, you can earn a steady stream of passive to semi-passive income well before age 59.5, which is when you can withdraw from a 401k penalty-free.

Take a look at my two favorite real estate crowdfunding platforms:

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eFunds. Fundrise has been around since 2012 and now manages about $3 billion for 400,000 investors. For most investors, investing in a diversified fund is the way to gain exposure. The minimum investment. amount is only $10, making it easy to dollar-cost average into real estate.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations, higher rental yields, and potentially higher growth due to job growth and demographic trends. You can build your own select real estate portfolio with Fundrise.

I've personally invested $810,000 in real estate crowdfunding across 18 projects to take advantage of lower valuations in the heartland of America. My real estate investments account for roughly 50% of my current passive income of ~$300,000. Both platforms are longtime sponsors of Financial Samurai, and Financial Samurai is a Fundrise investor.

Follow my 401k savings by age guide. But in the meantime, also build a passive income portfolio so you can live a better life today.

[…] hit $251,600, up 12% from a year ago. Separately, in March of 2014, Vanguard reported that the average 401k balance has now shot up to $101,650. For workers 55 years of age or older, the average balance is […]

I just wish I would have known all this info 25 years ago . I am 56 in the past 2 years started to max everything out in my 401 and try to play catch up. It’s depressing at times knowing would I could have did , and didn’t. One thing I know for sure none if this is for wealthy only anyone and put something away . Right know I’m up to 15 percent with a 4 percent company match . Most of my money is going toward stocks . Right now I have 40,000 in there and just started a few years ago . Any other input would be accepted over here ty

Sam – couple questions for you:

1) How do you view company matches? I contribute ~$12.5K per year to my 401k (the matching limit for my plan / eligible comp), but including company match and small annual pension, $30K is contributed to my account every year. I consider this as having “saved” $30K per year in my 401k.

2) How do you view restricted stock? Do you consider that pre or post-tax savings (vests over three years)? And do you view that as savings when it’s granted or when it vests (and you get killed by taxes)?

My overriding question is – how much would you say I save every year? My breakdown last 12 months:

– $12.5k personal 401k contribution

– $17.5k total company 401k match

– $30k granted RSUs

– $8k vested RSUs from previous grants (after tax – $15k vested as reportable income)

– $40k after tax savings

30 years old. $310 after tax savings. $140k in 401k. $65k unvested RSUs. $10k checking.

Thanks as always for you work.

Hi Jeff,

1) Yes, I consider you have saved $30K.

2) I would take all your pre-tax contribution and multiply it by 0.7 to get a post tax amount + your after tax savings amount. We all eventually have to pay taxes.

Welcome to my site and good work saving so much! You won’t regret it.

Thanks for the response Sam. Your comment makes a lot of sense. I always thought of my true net worth that way (applying discount to pre-tax), but for some reason did not extend to savings.

I understand different plans may make the alternative impossible, but all your savings articles (that I’ve read so far) assumes a max $17,500 401k contribution. Most people should really be saving more than that including employer contributions (and would debunk some commenters questioning your historical 401k contributions by referencing personal contribution limits).

Other question — I’ve been hesitant to buy an apartment in NYC. While I’m obviously not a big spender in general, I can’t fathom buying a run-down place; $800k would be the least I would spend (and that’s really pretty close to run-down here for a 2br). I know you place a high value on real estate, but at any point does it make sense for someone in my situation to continue renting? If I had a family I would surely buy, but not knowing what the future holds adds an additional wrinkle.

Thanks again

Thanks Sam. Long time reader, but seldom commenter.

Just lost a long winded response, so I’ll keep this succinct. I know you place a lot of value on real estate, but does it ever make sense for someone in my shoes to continue renting? I’m single and live in NYC. I’ve been looking at places for a while, but, although I’m not a big spender, can’t envision myself buying something less than $800k or $900k (and that’s on the low end of RE market here). That seems like a HUGE financial decision for someone unaware of what his personal family life will be in the near future. Thoughts?

Thanks again

One of my biggest financial regrets was not buying a 2/2 for $760,000 on 22nd between Madison and Park. Probably worth $1.6 for this double balcony, 1,200 sqft place.

When you can buy, id buy. But buy what you’d be happy living in for 5+ years.

I just glanced at my 401k earlier this evening, and found that my increases YOY in the funds that are available, were simply great! Almost everything was 24%-25%. Heck, I even switched my “core account” to be the high-interest bearing account which had an increase of 9.6% last year! Yipee!

Hopefully I can continue doubling the growth in the account for another 2-3 years albeit painful as it is Sam … thanks for that! :-)

Hi FS,

Thanks for the great post. I’m almost 24 and my wife and I have a net income of around 120k/year. We have ~$25k in our 401ks and ~$30k in our Roth IRAs with Vangaurd. We max out our IRA and almost max the 401ks. Off to a good start, but have a lot of work to do.

Quick question: You mentioned that you you would max out 401k before Roth IRA, correct? Our expense ratios are crazy high with our 401ks, and Vanguard is so cheap. Do you take that into account? I’d love your thoughts on this.

Thank you! -Spencer in Seattle

I’d still max out the 401k. How high is high regarding your cheapest funds?

In Germany, we don´t have a 401(K) Account.

There is an allowance from 801 EUR per person.

If you have more the 801 EUR dividends, you have pay taxes for this amount.

Ca. 30% or if your own tax rate is lower (because you earn not much money), the own tax rate instead of the 30%.

I think the US-taxes are better for investors than in Germany! :-(

Best regards

D-S

I hear the pension system is quite common in Germany though no? I met a German fella who works at Deutsche Bank and he plans to work until 55 to collect the lifetime pension which he says is “very healthy.”

To those who are just getting started saving for retirement, I say don’t give up! I started saving 10% when first employed at age 24 and I’m now 55 with over $600,000 in my 401k. Keep contributing and it can happen.

Hi Sam,

I continue to enjoy your amazing site…I discovered it about a year ago. Thank you so much for the clear, concise, challenging advice. You don’t let us off the hook and I think we (the lot of us, at all income and education levels) need a wake up call.

The 401K suggested savings chart has interested me for some time because of the assumption that people simply begin to work after college or high school and that is the departure point. But there are those of us who take an alternative route to full employment.

I am 44 but with only 10 solid years of full time white collar employment. I am at 193K in the 401K and $1200 in a pretty newly established Roth IRA (1% contribution). So if I look at the chart by age….I am in trouble. If I look at the chart in years worked, I am doing ok.

I went with a 15% contribution to my 401K for around 8 years solid…that is how I was able to catch up. I am now at 12% but I have occasionally gone lower in order to build cash reserves. The Roth will serve as college and other support funding for my two step-children aged 3 and 14 (I seem to do everything about 10-15 years after my peers, just got married back in August).

I think the important thing for me has always been, living within my means, not getting caught up in buying the next big thing, and just looking down the road and preparing. A huge step forward for me was saving my extra income and paying off 26K in student loan debt during those first 8 years….I used all the cash I had amassed and sent it all in. I was back to zero and that was scary but I did it.

We can do this!

Hi Mark,

Sounds like you’ve got some good momentum behind you based on your work experience. Keep it up! What were you up to before age 34?

To answer your question about my path in life up to 34:

–Graduate HS in 1987

–Do almost nothing productive until 21…except that I learn that there are quick roads to nowhere (so maybe I did have something productive come of it).

–Attend University until I am 25

–Volunteer in Peace Corps overseas for two years (really life changing)

–Come back to the states in 1997, work in State government then for a University system…realize that is not enough so time for Graduate school

–Three years of Graduate school which I absolutely loved and where I learned to truly apply myself including searching for every last grant/assistantship there was

–Began a public service career in 2003 and have been there ever since, living very well within my means: Paid off student loans, drove a 1991 Civic until just last year, only bought my first flat screen TV last year, I cook at home most often and reserve going out as a special treat

There’s my story!

Boy, I did a sample savings list based on your recommendation and didn’t leave a lot to live on.

Say a $120K annual pay person:

17.5K 401k

24.0K post tax savings

18.0K Fed tax

8.0K SS/Medicare tax

18.0K mortgage

7.0K extra principle (I realize money is cheap right now but…)

3.5K property tax

______

24K left for expenses

That’s like Top Ramon territory. Can you say a bit more about the post tax savings rate? I realize “you can’t save too much” but that is putting the screws down pretty tight.

Some of the above is real life and some is an estimate for my own situation (mortgage, taxes, 401K). I’m in the $650K area for 401K savings so NOT killing it there. I’m also eligible for a $34K a year pension at 55 (I’m 53). Thanks.

Coincidentally, $24k/year about how much the Mr. Money Mustache family lives on with a paid-off mortgage. Go check out mrmoneymustache.com. I have no affiliation with the site other than being a reader of his blog.

If I could earn what MMM makes on his site, I’d be pumped! He’s got the right formula about talking about frugality and living on less to appeal to everybody. As a result, he’s making tons of money. Ever ask him what he does with his extra income or how much he makes? You’ll be surprised. I’ve got it backwards about talking about how to make more money, which is much harder, but more fun imo.

I’m not saying someone can’t live off $24K a year. For me and others I hang out with who have similar interests (travel, hobbies, entertainment) they are spending twice that. Several of my friends have retired in the last two years and they are spending $45-$50K. Most have no mortgage.

Different strokes for sure and good for MMM for doing it on $24K. I’m guessing no cable TV, one car (maybe less), no travel outside of U.S., don’t go out to eat type of thing. I’ll check out the site. Maybe they cut their dryer sheets in half (just kidding).

Winston,

The public sector employee salaries vary widely by where you live. In NY Long Island teachers and police officers all earn over $100,000.00 when they reach top pay.

In San Francisco, our retired police chief earnings over $200,000 a year in pension money. Our current police cheap makes ~$265,000 a year. Not bad!

Not great, though. Compare that salary to your typical CEO of a similarly-sized organization, and I think you’d find it severely lacking. Of course, we all know that CEO salaries are out of control, so the police chief salary is probably a decent goal to shoot for.

But don’t worry, Canadians have $400,000 average net worths and cheap/free health care! Can’t beat that… except for the long, cold, winters.

Don’t forget we have cheap/free healthcare now, thanks to the ACA … or do we?

I did not take your poll because my wife and I have been saving 50% of our income for the past 15 years. I had also been maxing out my retirement accounts for many years before we were married. We have about equal amounts in taxable and tax sheltered accounts. We are not rich, but we are off the high side of your savings chart. We expect to have enough to comfortably retire in 9 years.

The numbers don’t add up. I am 45 and have been maxing out 401k for 20 years. But my balance is on the low end. Most contributions have been to equities, but a solid amount in bonds for the past 10 years during the bond boom. Are you calculting in assumed or average employer matching contributions that might not be the case for all 401k participants? The table seems to be based on unrealistic total return assumptions instead of actual asset class returns over the past 20 years.

But you’re in the range right? Low end doesn’t mean bad. Low end is excellent, just not high range excellent.

Also, I’m trying to be forward looking to help younger folks shoot for targets. There isn’t as much we can do to help folks in their 40s and 50s unfortunately due to the contribution limits.

Contribution limits were much lower 20 years ago than today. This is one of the big missing pieces.

On my 50th birthday, last month, I walked into the HR office at my employer and increased my 403b contribution to 25%. A 403b is like a 401K but for employees of non-profits and government agencies; the employer (usually) does not provide any contribution toward a 403b.

Now that is an excellent gift to yourself! Well done.

I’m 36 and at the lower end of threshold for my age. We have one income for our family of 4 and manage to put about 15% into our 401k each year. We have decided not to increase that and to put our extra savings into purchasing real estate. We have one investment property now and hope to purchase 3-4 more over the next 10-15 years. The stretch goal is have our primary residence and all investment properties paid off in 15-18 years about the time our kids are both in college.

Paying off your primary and rentals by the time the kids go to college is a GREAT goal. I look at college tuition like taking out a new mortgage :)

With an effective tax rate of just over 30% (Fed, state, local, SS, Med, etc) ,I wish I could save more in my 401K. Right now, my focus is getting my full employer match at 8%, and taking the excess cash to help build up some more liquidity. I’d like to have that in case the market dips (I’m betting this will happen over the next 3 years considering we have had gains from 2009-2013), so I can take advantage of buying opportunities in securities and real assets.

On a side note, any idea why 401k limit is $17.5K while IRA limits are only $5.5K? It seems like anyone without an employer 401k is getting screwed! Why not just make the total tax-deferred limit, regardless of 401k, IRA, or whatever else, a flat limit? Seems fishy to me..

The limits seem kinda of arbitrary and ridiculous don’t they? I’m a big proponent of raising the limits, but if the government does, then they lose a lot of tax revenue.

Will you really buy on dips? For example, did you buy last week when the market corrected 5% in January?

I love these charts. They’re a great kick in the butt and are very realistic. I’m slowly ramping up my 401k contribution every year, and will do a huge ramp up (probably max out) in the next 2-3 years when my higher interest student loans will get paid off and cash flow greatly increases.

I’m currently maxing out my 401K. Started 6 months ago. Yay! I wish I would have started earlier. But it’s ok, we are still young. We will max out our ROTH IRAs for 2013 & 2014, and max out my 401K. That’s about $33,000 invested in retirement for 2014.

$33,000 is a great figure for just one year. Congrats! You’re still young for sure. You’ll be amazed how much your retirement nut will grow in 10 years at a $33,000 a year rate.

As a couple we’re slightly above the high end for our age bracket. We’ve started to focus on our non-retirement investments this year, but will still be maxing out one of our 401(k)s and each of our IRAs.

Gotta love it when BOTH couples save. Things really start racking up quick.

Ah, I do miss having a 401K. My current job offers a Simple IRA plan and to be honest, it’s terrible. The fees are awful and the funds available are mediocre. Unfortunately, I also make too much to contribute to an IRA or Roth IRA anymore. Such first world problems over here :)

Sorry, but I’m just not bullish on 401(k)s or retirement accounts, in general.

A lot of folks in your highlighted age bracket share the same sentiments.

I mean, 60 years old is 27 years away for me. I’d do better by dropping $17,500 in one real estate property per year.

Hell, that can buy the entire city of Detroit in 5 years. haha.

Why should someone who is destined for FI by age 40 rely on a 401(k) that they can’t touch until age 60?

Either way, I guess there’s more than one way to skin a cat.

The ideal is to max out your 401(k) AND save further after tax money for liquidity purposes.

The rule 72(t) helps early retires extra money from their IRA as well.

If all one can do is contribute $17,500, then I would split the money into post and pre tax savings for sure b/c one’s federal income tax rate probably isn’t that high.

Yeah, I get it. But rule 72(t) is a sucker’s bet for the young and motivated.

If I had the time, or made the time rather, I’d write the blog post about it. I’d even use your high-end number of $521,000 at 40 years old.

In short, let’s say one did save $315,000 after working 18 years straight. Using your number, it would mean that $206,000 grew tax-free or was part of the “free- matching”, which is awesome.

But, if the motivated, young FI decides to quit working and theoretically withdraw the entire nest egg in order to retire in the Dominican Republic, he or she will get taxed on the $206,000 of earnings and be subject to an additional 10% tax assuming rule 72(t) doesn’t apply–$50k gone.

If it does apply, one’s money will be locked up for an additional five years if I read the “exceptions” correctly. Not only that, he or she would be lucky to get an annual payout of $10,000 over those five years. The substantially equal periodic payment rule is calculated based on a life expectancy or mortality table. Imagine substantially equal periodic payments based on 44 more years of life.

To be clear, I’m not arguing against the 401(k) per se’. It’s great for the person who values generational wealth distribution, and $50k in taxes is a relatively small amount when he or she has $515,000 saved.

But for the young and motivated, $17,500 annually could likely go much further and return way better dividends in the future if it was used to “invest” in one’s self, if he or she is motivated enough.

How many people would walk away from crappy jobs if they weren’t holding on to the “benefits” of their non-vested 401(k) balances or “free” money? I’m guessing a lot. In other words, the “benefits” of tax-free growth isn’t all that we make it out to be.

Again, 401(k)s are not for everyone. But, everyone should have an actionable plan to retire.

Source: https://www.irs.gov/Retirement-Plans/Retirement-Plans-FAQs-regarding-Substantially-Equal-Periodic-Payments

Interesting pontification you make on folks holding onto crappy jobs for the benefits. I do believe health care and the need for salary is indeed why perhaps 50% of people work at jobs they don’t like. But after several years, your 401(k) balances get vested and all the money is yours if you decide to leave. Sure, you won’t get the company match anymore, but hopefully your new company will match.

The other thing I like about pre-tax savings is that it PROTECTS ONE FROM THEMSELVES. I don’t know how many times I’ve seen people come into money and just spend it all away. Or, folks who look back 10 after 10 years of making a decent income with nothing to show for. For the very disciplined, sure go ahead and invest all the money in yourself and other non pre-tax accounts. But for most, I think it is VITAL to save in accounts that can’t be touched.

You can’t trust people to do the right thing with money, especially as it grows in size.

My husband and I each have a pension and together they are quite substantial. We do not include the pensions in our net worth, however, if we did, I believe we would need over 3mil in our accounts to receive the income we do. We are relatively young retirees from our first careers. I am still retired–for how much longer, I’m not sure–and he’s working an even better job than he had before. Hallelujah! One retiree in the house is just fine in my book! Our life has changed in so many unexpected ways, which has caused us to change our investment strategies. This past year because of the new job and relocation, we switched to investing in real estate and focused less on our 401k’s. (And I have to be honest, we’ve also switched to having more fun and spending a lot of money. The Bay Area will do that to you. It’s expensive here!) I think one needs to be flexible in their Financial Independence strategies because life as we all know it can change at the drop of the hat, just as ours has. In my opinion, I don’t think we should get so caught up on these numbers that we beat ourselves up over where we rank. Let them inspire you–they certainly do me! Thanks as always, Sam–another great article!

A double pension family is like winning the jackpot! Congrats! What did you guys do for a living and for how long? Where you guys going?

The great thing about the Bay Area is that you can move practically anywhere else and save money in the process.

I’m painfully behind in my pre-tax retirement savings, as I only maxed a 401k for the first time last year. Oh well, sunk costs are irrelevant, even if those opportunity costs will be with me forever.

The best thing I can do now is sock away as much as I can, get a bit uncomfortable like you suggested, and try to make up some ground on that hypothetical version of me who was saving all through his twenties and early thirties. I hate that guy.

Have you shared a post about how you were in your 20s and 30s though? Surely you had a lot of fun and good adventure with the money you made. I’d love to read it!

Excellent post. I especially like the guidelines you set forth to let me know how I stack up to the ideal amount in my retirement accounts. I spent my 20s in saving up for, and spending an inordinate amount of money on law school, so I’m a bit behind. These guidelines give me a specific goal to shoot for.

There’s a reason why Vanguard’s statistics doesn’t line up with how most Americans save. I think a few other commenters mentioned this, but I would be skeptical of the median number Vanguard’s pushing. Not that it’s technically wrong, but that it’s misleading. Participation in the stock market tends to skew towards high income, high net worth individuals, means that your average American (as distinct from the average value in 401ks) probably has very little saved for retirement. The market’s 30% growth in 2013 makes Vanguard’s “record high” number misleading.

Imagine a situation where you have 10 Americans. It is Jan. 1, 2013. 8 have nothing in their 401k, and 2 have 400k in their 401k, fully invested in index funds. By Dec. 31, 2013, the 2 savers’ accounts have grown to roughly 500k (up 25%), while the other 8 have nothing because they contributed zero. Vanguard may correctly report this as “an average of 100k in 401k accounts” but that says nothing of the financial health of the 10 Americans.

Hi Lexington,

Two answers to your comment

1) Use the Years Worked column as a barometer instead of the Age column since you started late.

2) You make a good point, but I can also easily argue the other way and state the $101,630 is understated.

The bottom line is, there are people out there saving and investing. One should either decide to do the same for a potentially better retirement, or not. Free will!

Sam

Honestly, that average is interesting conversation fodder but as you know is largely meaningless. Having it broken out by age as you do is much more meaningful, as $100k has a much different meaning for a 30 year old than it does for a 50 year old. I’d also like the see the median number alongside it, as the average can be pretty skewed by bigger numbers.

Agreed. If not meaningless, extremely skewed. Especially considering 50% of Americans are not saving for retirement at all.

Also consider that 75% of individuals make less than 50k per year. Of that group only 23% contribute at least $2500 per year to their 401k.

As some have noted, the goals and figures used on this site are simply not realistic or relevant to the vast majority of working Americans.

It is your choice to view Vanguard’s figure and my recommendations as meaningless or not.

My hope is that readers of Financial Samurai don’t end up like a “vast majority of working Americans” who look back and wonder where all their money went.

The vast majority of workers earn so little that the money they do make has to go towards basic living expenses and nothing else. Do they really have a choice? As usual you blame the income / savings crisis to laziness and poor decisions on part of the individual when it is much more than that. I could understand if we were talking about 25% of the population but we’re not. 75% of Americans live paycheck to paycheck and have no savings.

Blogging to the ultra wealthy about how to become even more ultra wealthy isn’t a challenge. And really, is money seriously an issue for the top 5-10%? If you want a challenge (and a much larger audience) you would start giving advice to the people with real money management problems. What you’re doing here is more or less hobby / entertainment for the rich more than it is providing useful needed information. It’s your site and you can do what you want but you should make it clear to your readers that your site is not geared towards people with average incomes. Doing so might even keep us riffraff from giving you a hard time now and again.

Kay, read your comment again. Do you see how self-defeating your tone is? You call yourself riff-raff, you say these posts are just for the ultra-wealthy, you think I’m blaming people for not working hard enough despite so many posts about the desire to level the blaming field, yet you ignore that facts and the guidance.

Creating wealth starts with the proper mindset, and I’m afraid you have an improper mindset that will keep you from optimizing your finances. You’ve got to believe in yourself.

Would you like a coach? Let’s ping each other at 5:30am every morning and work an extra two to three hours longer than our peers and see what happens after one year. I guarantee you won’t have to be smarter than anybody. Simple math will dictate we will grow faster than the average.

I don’t think your recommendations are worthless. I actually think they’re helpful because they’re broken down by age and because they give someone a meaningful target. They’re thoughtfully done with a goal in mind, meaning they can be used purposefully. That’s valuable.

What’s meaningless is any stat citing the average American’s 401k balance. It’s just not applicable to almost anything. Again, comparing a 30 year old to a 50 year old in terms of retirement savings is pointless, but that’s what that average number is doing. It also isn’t based in any kind of thoughtfulness in terms of what a person SHOULD have saved, so it doesn’t provide any value as a benchmarking tool. I honestly have no idea what we’re supposed to do with it.

Do you not see the analysis of comparing the average age to the average 401k amount?

I created my recommended 401k amounts by age and work experience before Vanguard came out with their stat. I just used them as a basis for comparison.

Can you share your age and 401k so I have a better idea of why there’s so much push back?

Here is another post that details my assumptions further: https://www.financialsamurai.com/how-much-should-one-have-in-their-401k-at-different-ages/

I think there’s some kind of miscommunication going on here.

I think you’re numbers are helpful and well worth understanding as a potential benchmark.

I think the single $100k Vanguard number is not. I’m not sure what value that single number has to any individual. That they break it out by age is somewhat more helpful, but still much less useful than what you put forth because it’s an average, not a target.

I tried to be clear about that in both comments, but I guess I failed. There was no intention to be disrespectful of the work you put in to create your target savings amounts. Quite the opposite actually. My only point is that all of these reports that various sources put out about average 401(k) balances have very little usefulness to the individual trying to plan their retirement.

All the best.

Matt – I don’t mind getting criticized, it’s no big deal. My original comment was at your commenter, and not you.

But I do want to figure out SOLUTIONS. Maybe that’s just the MBA in me always looking out for solutions b/c just looking at data is nice, but not very helpful.

So my other attempted solution was to try and figure out the veracity in the $101,650 figure by Vanguard by doing a poll. So far, it looks like after ~640 entries, the majority of folks are in the $100,000 – $200,000 range. So at least from my survey, the Vanguard number is in the ballpark.

So carrying on, what kind of solution can you offer? That’s what I’m really excited to read about rather than discrediting data. Maybe you can write a post on your site with a solution and site our arguments here and what I’ve done?

Thanks