The Yin Yang Investor Mindset post talks about looking for opposite investment opportunities whenever one asset class is roaring. I used the sell-off in bonds as an example of finally beginning to build a meaningful muni bond portfolio to earn double taxation free income.

Now I'd like to highlight more reasons why folks who have a large enough financial nut, are within five years of retirement, or are already in retirement should consider allocating more towards bonds.

For over 20 years, I was heavily invested in equity to try and build my financial nut as quickly and as large as possible. However, after a 10-year bull market in equities that began in 2009, I decided to take down risk. As a family-man now, the last thing I want to do is lose money and have to go back to work.

With interest rats at 17-year highs after the Fed's aggressive rate hikes, it's time to buy bonds. The aggregate bond index has declined tremendously since 2020.

Find A Purpose For Your Money

If you already live on less than you earn, making more money is meaningless if you don't earmark a specific purpose for your investment returns or paycheck.

The irony of equity investors making fun of bond investors is that bond investors tend to be much wealthier. Bond investors tend to want to protect the principal they've spent decades accumulating.

There's no greater joy than being able to live freely. Being able to do whatever you want, whenever you want cannot be overestimated. It is amazing. Take my word for it.

But what if you could live freely AND live for free? That would be heavenly. Some people get to do both, but experience no joy because everything was given to them. Good thing most of us have worked long and hard for our money. Reaching a goal based on merit is so much more satisfying.

With the goal of living freely and living for free, I began aggressively paying down mortgage debt. The property now generates about $3,050 a month in cash flow after all expenses.

The Case For Investing In Bonds

Since 1989, the worst year for the aggregate bond market was -2.9%. I was surprised when I saw this graphic by PIMCO, one of the largest bond managers in the world, because I was under the impression that 2008-2009 was such a bad period that bonds sold off more than -2.9%.

Domestic and foreigners were selling all US dollar denominated assets indiscriminately because it felt like the entire US financial system was going to collapse.

The reality is, if you had bought the iShares Core US Aggregate Bond Fund AGG you would have done just fine during the biggest financial meltdown of our lifetimes. See how stable the Aggregate Bond Fund has performed over the past 10 years.

Case Study For Buying Bonds

Of course history is no guarantee of future performance, but lets say the AGG stays flat over the next 10 years – one could earn a 2.375% gross annual yield. It's not amazing, but guess what? 2.375% is the exact interest rate on my recently refinanced 5/1 ARM that expires on August 1, 2021.

Below is a snapshot of my originally $981,000 5/1 mortgage that closed on August 1, 2016. I paid down about $131,000 of principal to refinance $850,000. The original monthly mortgage payment was ~$4,333 due to a larger principal balance and a higher 2.625% interest rate. Now the monthly mortgage is $3,303.55; $1,621.26 of which goes to principal.

To live for free, all I've got to do is invest $850,000 in AGG after the recent sell-off. There's just one problem. I don't have $850,000 lying around. I could sell off other investments to create this “live for free arbitrage,” but I don't want to just in case my other investments return better than 2.375% and the bond market sells off even more.

But, what I can do is focus on making NEW money in order to build a position in AGG to slowly chip away at living for free. The beauty of this strategy is that there's a two-pronged attack.

On the one side, I'm building a bond position to get to $850,000. On the other side, I'm automatically paying down the mortgage through monthly payments and random extra principal payments so that I DON'T have to amass an $850,000 live-for-free bond portfolio!

How fun is this challenge? So fun for a financial enthusiastic. Living for free with great investment returns that make more than your active income sets yourself up for a very comfortable retirement.

Given I've got a higher risk tolerance, I'm building a California Municipal Bond fund position as part of my bond portfolio mix. CMF has a ~2.5% double tax free yield, equivalent to over a ~4.3% gross yield based on my tax rate. CMF is more volatile than AGG and has corrected by a maximum of 10% over its lifetime. But a 10% correction fits nicely with my risk-tolerance. Any more than a 10% loss feels too painful for me.

Who wants to just live for free when one can actually get paid to live in a cozy house and potentially make money from a house that inflates with inflation over the long run? With CMF, I earn a gross adjusted yield of almost 2% over my 2.375% mortgage rate. I'm willing to take more risk for this even better scenario.

Build Your Money Army

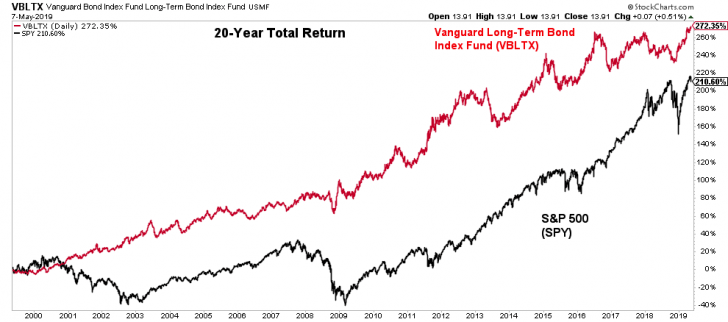

I hope people get motivated to earn more and save more. If you check out the chart above, you'll see that the Vanguard Long-Term Bond Index Fund has done quite well compared to stocks – practically even performance actually, with less volatility.

Further, when stocks are melting down, as they are with the coronavirus in 2020, bonds can actually play offense and make you a lot of money. Take a look at this chart below with various bond funds and ETFs.

Having a Money Army work for you so you don't have to is a good scenario. If your Money Army can also allow you to live for free, even better!

To recap the investment case to buy bonds:

1) Having a purpose for your money makes saving, working, and investing that much more fun and meaningful.

2) The aggregate bond market's worst annual decline since 1989 was only 2.9%. Those of you who are near retirement, in retirement, or looking for less volatility in their investment portfolio should consider increasing bond exposure after the recent sell-off. There are no investment guarantees. Bonds can continue to sell off. We've only seen that bonds are much less volatile than stocks.

3) There are all different types of bonds with varying levels of risk and return profiles. US Treasury bonds are the least risky, followed by municipal bonds from states with strong balance sheets. Emerging market high yield corporate bonds are some of the most risky e.g. Greek bank bonds. Bonds provide diversification, income, and potential return.

4) For those in a 33% or higher federal marginal income tax bracket and who also live in a high income tax state such as California (13.3% top rate), Oregon (9.9%), Minnesota (9.85%), Iowa (8.98%), New Jersey (8.97%), Vermont (8.95%), District of Columbia (8.985%) or New York (8.82%), municipal bonds provide better relative value. If you don't like munis, AGG offers the total bond market exposure.

5) Make sure you have a diversified portfolio that matches your risk tolerance. We could very well be at a turning point in the US bond market's 35+ year bull run. Unlikely, but possible. After significant moves in any asset class, it's always good to give your investments a checkup to compare your current allocation to a recommended allocation. You may be surprised at what your results might find.

6) Interest rates are at 17-year highs. Take advantage after the Fed has been aggressively raising rates. Treasury bond yields are over 5% now. Here's how to buy Treasury bonds.

Here's an example of running one of my investment portfolios through Empowerls free Investment Checkup tool. Earning risk-free higher returns is wonderful. When you've made a lot of money since the global financial crisis, a good idea is to keep it!

Updated for 2021+: The 10-year bond has collapsed all the way down to 0.5% in 1H2020 from 3.28% in October 2018 due to coronavirus fears. Real estate crowdfunding should outperform and everyone should be refinancing their mortgage today.

Hi Sam! Thank you for your regular articles and newsletters. I thoroughly enjoy reading them and using them to analyze my situation with your perspectives in mind. You’ve saved me a bunch of money!

One question I do have: what are your thoughts on EE saving bonds? I was given around $6k Face Value worth of these bonds over the course of 15 years (with earliest one maturing in 2025 and last one maturing in 2039). The interest rates range from 1% to 3.6%.

As a 25 year old, do you recommend cashing them in now and reinvesting into something to get a higher return? Or do you recommend I only cash them in as they mature?

Would love to know your thoughts!

Thanks,

Sawyer

What about the ETF PFFD a preferred stock index fund for Income

I like how you said that US Treasury bonds are the least risky, followed by municipal bonds from states with strong balance sheets. My friend likes to invest his money in stock and he is always looking for ways to make extra money. I will share this article with him so he can think about investing money in municipal bonds.

You might want to look into I-bonds. You can buy them direct with no sales charge and hold them in a treasury.gov account. Also I disagree with the premise of paying down mortgages to be “free”. You’re never free. When you have a low interest rate mortgage, you are stealing from the bank. Because your house is going to appreciate far quicker in a hot market like San Francisco, IMO you’re much better to build up a large I-bond position or Muni bond position while paying the regular mortgage, rather than paying it down. For most people if you lose your job or have a crisis, the first thing you want is to access the money locked in your house. Guess what, nobody’s going to give you a HELOC when you’re out of work. Plus there’s always property taxes. So you’re never truly free until you sell that house. I bought a house in Alabama that’s about 60 minutes from the beach with 1 acre, and the property taxes are $250 Per YEAR. I also have three house rentals and three mortgages, 3.25, 3.26, and 2.25, so why pay them off? The properties all generate money and are appreciating, no reason to pay them off, you’re stealing from the bank. You could have made that arguement in 1980 when mortgages were 12% but not now. We’re at the long end of a historic bull market in bonds, the only reason they don’t go up is the market is holding the bond market hostage.

Hi,

I am 34 and starting my financial journey to build Muni bond portfolio.

Where can i buy California muni bonds directly in primary market without any brokerage/fees, if available.

I read that Fidelity is recommended but are the fees high enough to dip my returns?

Suman,

In 2010, we started buy individual muni bonds from LPL, HSBC, Citibank to generate tax free passive income to start our journey to FI.

In 2015, after we learned that banks and LPL charges 1.25% to 2% more per bond, we started to buy individual muni bonds ONLY from Fidelity due to the low 0.10 markup fee which is $10 per $10,000.

Citibank charges 1.25% which is $125 per $10,000

HSBC charges 1.75% which is $175 per $10,000

LPL charged 2% which is $200 per $10,000 (this was several years)

Chase charged around 1.5% -1.75% more per bond than Fidelity

Adam

Are you content to buy bond ETFs rather than actual bonds, because of the long-term stability of the bond market? With a bond, you get interest and then your principal back at maturity. With a bond ETF (or mutual fund), you never get your principal back; you sell the bond at the current market price to get your money out.

So: risk? If the bond market can go down sharply and for a long time (because interest rates generally go up), then one risks losing principal by holding funds rather than bonds.

It is a bit harder sometimes to buy bonds, and of course a fund diversifies better than buying individual bonds. Too bad if the issuer of the bond one buys goes belly-up!

So if you are confident that you can sell the fund at more or less what one paid for it, then your principal is safe and you collect the interest for as long as you choose to hold it.

Does that sound right to you?

Bond rate exceeded 2.7% today. Do you have any updated thoughts?

Also, what do you think of Nuveen munibond ETF, NAC in particular? It’s a Cali munibond etf with 5% yield.

I’m following my 2018 investment framework and buying muni bonds.

Thanks Sam as always! Currently looking for ways to diversify as I’m heavy on stocks, real estate yet no bonds. A friend of mine recommended I look into Muni Bonds and sure enough my first google search was: “financial samurai muni bonds”. :)

I have 10% of my portfolio in cash and want to minimize to 2%. I want to build a bond portfolio as well with low fees and relative high yield, I’m OK with risk (given I have no bonds!).

For AGG and CMF – I bank with Schwab. Do you recommend a specific brokerage to buy these?

Also – what should I be looking at when comparing Muni Bonds and potential purchase. How can I find NAME City Bond | Yield | risk?

Any help is greatly appreciated!

I have a banking relationship with Citibank and Fidelity, so I use those too. Fidelity seems like it has the most options with the best prices. I think they are fantastic.

Just ask your representative to pull up a list of specific bonds with certain minimum ratings and yields.

Just be aware though that bonds have rallied back to even before Trump got elected. I’d patiently wait for another opportunity. In the meantime, I’m diversifying away from coastal city real estate and buying heartland real estate through my preferred real estate crowdfunding platform, RealtyShares.

Next time, hopefully Financial Samurai will show up when you just search “muni bonds”! But I know that it’s a tough search term. But I’d love it if more people did “Financial Samurai XXX” in search, b/c I think I’ve covered the vast majority of topics in depth.

Great post FS. I am very interested in Muni bonds right now. I have been a long time reader, but first time poster. My wife and I have just started our journey on to FI at 33 & 28. When discussing our situation with our financial advisor, he suggested as an alternative to muni bonds we could look into a 10 pay life policy. He said that since we were starting so young it may be worth the upfront costs to have the guaranteed 3.5% (he said after dividends ~5%) net return. He said it would be a way to provide a safe harbor for money and provide an eventual inheritance. He was very upfront that there were many upfront fees, but they may be lower now since we were young. I was just curious as to your thoughts on such an arrangement in the long term since you can then perhaps fulfill the bond portion of a portfolio with this option and be more aggressive with the equities you may have? We are just looking for ways to further diversify, protect assets and not be linked directly to the market with all of our money (outside of the home we currently have).

OMG I hope you did not buy into the “financial advisor” suggestion of life insurance. I am 59 years old, fell for this a number of years ago, and wish I had not. It is the most embarrassing thing in my portfolio. Since I am now an avid reader of financial planning articles and blogs, and have learned to pay close attention to my investments, I realize that almost no independent and credible financial writer recommends any form of life insurance products as “investments”. The old advice to buy term life for your life insurance needs and diversify the rest in low cost investments, is still true. The reason is obvious: there is no magic money making secret the insurance company has that can make up for the huge amount you are paying in commissions, up front (whether hidden or not). They have a hundred clever ways of tailoring these products so as to obscure this simple reality.

Need some advice: Married with 2 kids in NY. I’m self employed wife is an attorney I’m 47. We own 3 homes, primary, rental and a vacation home. Combined total mortgage $1,150,000. We have $110,000 in a savings account earning 1.05%. Continuing to save for possible buying another rental. We don’t own any stocks or bonds. Nor do we have retirement plans. Any suggestions?

Gasho, Financial Sumari! As a retiree and investor, I’d like to know if you’ve ever read the work (website) of Martin Armstrong on capital flows and economic cycles. He certainly has some very surprising things to say on government debt and investor confidence in the current cycle. Your penchant for research and analysis could be useful to your readers regarding his work. His AI software predicted major upheavals in 2016 in the EU (Brexit) and the US presidential elections – over 20 years ago!

I would prefer to use less cash to generate an equivalent return using TLT options. By selling a cash secured put, you take the same risk as if you were purchasing the asset at the strike price (so in the case of AGG you risk 2.9 loss in the cash you are using) but recieve a premium to keep which offers a nice buffer. In the event that your position gets assigned, you simply end up purchasing TLT and immediately sell calls against it to reduce your cost basis further. If the calls get assigned, you return to selling puts. Doing this can match the returns while using far less cash than simply buying the funds outright while also smoothing out volatility and controlling risk. Risk is controlled by minimizing position size on order entry, volitility by trading non-correlated assets and bringing in premium consistently.

Interesting. So a gross oversimplification of the big picture is:

1. Rates go up forever- Bond ETF gets killed as even new bonds added to ETF lose value as rates rise forever.

2. Rates go up and stabilize – Bond ETF loses value short/medium-term until lower yield bonds mature and new higher yields are added. Percentage change in value and velocity dependent on average duration.

3. Rates stabilize or go down – Bond ETF remains stable or increases.

4. Rates randomly walk in whatever direction they want – At lease Bonds have a yield right? :)

I think I have a good idea of which one of these four probably won’t happen.

Great post and comments everyone! Maybe I’m completely missing something here, but I have a question about bond etfs such as MUB, AGG, and VTEB. What I’m wondering is since these etf’s have bonds that are constantly maturing and being replaced by new bonds at prevailing rates, in a rising interest environment, shouldn’t that reduce some of the “beating” they will take? I know it has to do with the average maturity of the bonds in the fund, I guess I’m just wondering what the relationship is if say the 10-year goes up 1%, how will each bong etf be affected. If rates rise and then stabilize for a long period, shouldn’t the bonds recover from their “beating” as new higher yield bonds replace the older ones?

Good question. It all depends on the bond duration makeup of the fund. For example, if the fund is 90% short maturity bonds, it will outperform a fund with 90% long maturity bonds in an sudden interest rate increase. This is why you see TLT (20 year bond ETF) sell-off more than IEF (7-10 year bond ETF).

Let’s hope the 10-year yield doesn’t go up another 1% from here! If so, the economy is going to grind to a half and go in reverse IMO.

I think we’ll see 10-year Treasury yield stabilize at around 2.5% in Q1 2017; there’s so much pent-up demand for U.S. debt that it becomes self-stabilizing.

Hi Sam,

Do you think with the new administration coming soon that interest rates will rise, thus causing bond prices to come down and entice buyers to buy more bonds? I was initially thinking about buying some bonds, but if there is a good chance the price will drop in the upcoming months, I might as well wait and accumulate a bit more cash in the process.

Hmmm, I thought I addressed your question with this post. Let me know where it’s unclear and I can elaborate. Thx

I found this “Now that interest rates have moved higher, at least temporarily, I’ve realized something very significant that all of us who took my refinancing advice earlier this year can do. We can buy the Aggregate Bond Market through ETF, AGG and live for free!”

Maybe I should wait until next year, looks like the rates have a likelihood of continuing to go up.

Since the 10-year Treasury yield has surged past 2%, have you looked into long-term U.S. Treasury bonds (e.g., TLT) compared to munis or AGG?

Of course, the interest income from Treasury bonds are exempt from state and local taxes, which is useful in a high-tax state like California. Plus, long-term U.S. Treasury bonds have had a much better return profile than AGG over the past ten years (AGG includes exposure to shorter durations and corporate bonds with much higher credit risk). “Past performance…” and all that, but I’m curious if something like TLT (or individual bonds from TreasuryDirect) fits your risk tolerance better.

I have, and I’m nibbling on TLT and IEF in my rollover IRA and self-employed 401k.

For my after-tax investments, I’m focused on muni bonds since they won’t be taxed.

Sam, I have 3 mortgages all fixed rate 30 year for the lowest rates I could get. I look at these like long term shorts of the current rates. The stock market has averaged a long term return of 7% in real terms so all income I invest I lean towards equities with a portion in bonds and cash for safety and income. My target portfolio return is to beat my 30 year interest rates (4-5%) so that I use the mortgages as leverage for my current investments.

However I agree that bonds are getting more attractive. US equities are at very high valuations and I have been selling off for the past 2 years. In terms of equities I have been recommending defensive sector etf’s such as the consumer staple etf’s (VDC and KXI) this sector has beaten the S&P 500 over a 40 year period and only fell 16% during the 2008-2009 crisis. I also agree that muni bonds are the way to go, for those with more risk tolerance there are also closed end funds that offer muni tax free returns with some leverage such as PNI.

That’s a very interesting proposition, FS. I am like you, very little invested into bonds, but similarly, I benefited from being almost exclusively exposed to stocks as they provided a significant basis for growth in recent years. In your case, having this as a platform for “living for free” is a great psychological tool, and I think it also signifies a shift from your side towards more conservative, less yielding investing opportunities. Great stuff, will continue to watch your developments.

At the moment 100% in stocks and realestate. Currently however with the surprise election of trump And expected dec. Fed rate rise I see an interesting opportunity to jump into muni bonds.

1. Taxes should go lower under trump for very high income earners and that will lessen the attractiveness of munis dropping prices as people move out of the field

2. The fed will raise rates creating a psychological shift in addition to the true shift we’re seeing now with the 10 year yield.

3. Panic selling from people that have piled into munis or inappropriately been placed into them by robo-advisor programs that thought these were “ultra-conservative” investments

The opportunity is that I see all these things as short term. In the long, long run I see higher taxes, lower rates for a longer time and then a true beneficial shift back into munis.

So I have an eye out. Overall I think it will be beneficial especially as you approach/pass the 77k income threshold from other passive sources you’all utilize in your hopefully early retirement. I’m currently planning on working at least through a trump 4 year term. 8 if he stays in. After that if taxes go up (and I suspect they will) I’ll look forward to living “in poverty” under the tax level (currently anyway) from dividends and real estate (minus depreciation) with a nice tax free bonus from munis…maybe food stamps won’t be so bad.

The irony is that taxes will go UP for the middle class $90K – $190K individual income earner by 5%. Therefore, there may be a higher interest in munis from the mass affluent even though the top 1% federal marginal income tax pay decline by 6.4%.

Possibly but I think the mass affluent class is likely to be heavily weighted in tax advantaged accounts rather than investment in taxable account. So munis wouldn’t appeal to them outside what little over they save. I haven’t seen numbers but suspect most mass affluent are there due to 401ks and primary residence.

I may be wrong but either way am going to wait and see how the shift plays out. Not in munis at this time but have my eyes open to a move.

Sam,

Given that you are planning to purchase another house in the next 2 years; where are you storing the down payment? Is it in bonds or you have other thoughts?

It’s certainly nice to be debt-free. But I also like the power of leverage. I’d rather have 2x the number of properties, each with a 50% mortgage. So, both for rental properties as well as my primary residence I’m in no rush to pay off mortgages. It’s just taking a page out of the playbook of large successful real estate investors (or any other investor for that matter): Most (all?) REITs and Private Equity real estate investors use leverage. You wouldn’t be able to generate competitive returns without leverage. Of course, everything should be done in moderation, because we don’t want a 2008/9 repeat, but I know many RE investors who did just fine during that period.

I strongly do not recommend people getting into a lot of leverage at this point in the cycle. Seriously, the cost of leverage has gone up in real estate prices are softening around the country. Please, please, please for those who are reading this or have friends who want to lever up right now, please do not do so.

What is your story about how much leverage you had in the previous financial crisis and how much did you have invested? I’m always curious to know from people who have retired early what they did during the previous downturns. Thanks

Just to be clear: I am not retired (yet). I plan to retire in 2018. During the last two downturns, I have been invested pretty much in 100% equities (or equity-like investments) with 30-year mortgages on my respective primary residences. I never made a payment above the minimum required and invested in assets with a higher expected return than 3.25%*(1-Tax Rate).

That said, housing in early retirement is something on my radar screen:

https://earlyretirementnow.com/2016/11/16/housing-choices-in-early-retirement-rent-vs-own/

Owning a house mortgage-free normally falls behind the leveraged option, but I also like the peace of mind of a mortgage-free house as a hedge against bad equity markets. Big decisions coming up in 2018!!!

My current real estate investments are with several Private Equity funds that invest in multifamily housing properties. I prefer the diversification and the professional management without any time commitment on my part. All properties are leveraged with mortgages. Not heavily, but enough to juice up the expected return, otherwise they couldn’t be competitive in that space. All Private Equity investors I work with have several decades under their belt and did very well during the 2001 and 2008/9 recessions. I wasn’t invested back then, though.

Retiring in 2018 is close enough! I’m excited for you. You should read: Overcoming The “One More Year” Syndrome To Do Something New. A lot of early retirees found it VERY difficult to leave the security of their day job so they kept on delaying the decision.

Also check out: The Fear Of Running Out Of Money In Retirement Is Overblown

Good luck! I’ll check out some of your latest articles.

Thanks, Sam! Yes, these two articles are true classics! Thanks for the reminder! :)

Cheers,

ERN

What about the inverse relationship between interest rates and bond prices? Interest rates are nearly at an all time low so they can only go up and kill bond prices. Wouldn’t that make it a bad time to go into bonds? I personally will wait till interest rates are higher before going into bonds.

Indeed. Where do you think interest rates will go before you buy? I’m deploying the rest of my position at 10Y 2.5%.

Being that I live in the state of MA, I have a MA muni bond fund from Vanguard. Is there anything you’d recommend from Vanguard, as i’d like to buy more bonds…

I don’t like bonds. Even less so because I am in Canada where I don’t know of any tax free bonds like the munis down south and 10 year govt yield is even lower here than US (around 1.6%). Thus, with inflation around 1.5-2%, I am basically guaranteeing I will be losing money on an after-tax, after inflation basis. I allocate my networth to 35% real estate, 2.5-5% cash, 10-12.5% 5 year CD ladder, 5% preferred stocks, and 45% dividend common stocks (both are in ETF’s so no company specific risks). The goal is eventually for the 50% dividend and preferred stocks to generate enough tax preferred income to cover lifestyle. The 35% real estate would include a paid off primary residence and secondary property for vacation/rental purpose (the rental income here would just be bonus as the 50% stock side covers my income needs. So I am never dependent on stock prices ever, only on dividends which are much less volatile but still volatile. Let’s say I have to prepare for a worst case scenario of a 33% drop in dividend income for a series of years due to financial calamity which has likely seen stock and real estate prices crash. Well on the real estate side I don’t care because I’m still living in my house and using my secondary property or getting bonus rental income from it. On the stock side, I don’t worry about the price as I only have to look at dividends. That 5 year CD ladder helps here. The 10% allocation to it would represent approximately 5 years of living expenses. So each year the CD that comes due would replace any dividend shortfall and the remainder reinvested to a 5 year CD. Such a system can withstand a 33% dividend income fall for 15 years. Even during the depression dividend income had recovered by then. Where would I need bonds in this plan? I don’t.

Really appreciate everyone’s perspectives and insight on this. I am new to your site, but as a finance guy and 50 yr old who doesn’t want to go to work everyday in the same office for the same thing for another 15 years, I am really looking for ways to produce passive income that produces an after-tax yield in the 5-7% range. I have been buying some Nuveen muni funds and some specific higher-yielding stocks in the utility sector (Southern Cos) and insurance sector (Pru). It appears I can’t get into my desired yield range even with muni funds, as the after expense net yield is closer to 5% than 7%.

I am intent on building a portfolio that produces $150k of annual cash yield, hoping beyond hope that it will sustain me until my pension kicks in at 65 and SS kicks in at 61.5(?). Not sure about the SS timeframe. I will continue to read this sight for thoughts on how to do what I want to do, but I wanted to tell you how glad I am that FS has created a place where people of the same persuasion (those who want their money to work for them) can come and learn.

I’d like to know what people think about dollar valuation and its impact on interest rates. My initial thoughts are that we may need to someday soon undertake QE again to maintain dollar parity vs other currencies (here I’m thinking dollar valuation may get too heated), and that will keep interest rates low and bond prices stable/increasing. Another way to look at it is, if interest rates increase at the Fed, the economy uses up more dollars in debt service and dollars become scarcer, thereby increasing relative dollar value. Am I right? Does anyone believe differently? Trying to make a case for buying bonds in a low-rate environment that has been around for the greater part of 10 years and feels like it should revert back to a long term norm.

Thanks

Chomps

Don’t think QE will be in the works for at least another 2-3 years. A strong dollar to me means more buying power of foreign goods domestic and abroad and an increase in wealth relative to foreigners.

My Chinese mainland neighbor who plunked $2.25M cash earlier this year is probably feeling pretty good right now. Good diversification of their wealth.

If you look at the long-term norm of the 10-year bond yield, it’s basically straight down for 35 years. You will see 1-2% fluctuations over the past 10 years, but the trend is down. Nobody can say for sure whether the trend is now broken, but maybe. I don’t think so, which is why I’ve been buying CMF now. I’m not done yet, as it will take 4-5 years to build a $800K+ position.

Did you guys see the recent article on Barron’s with Gundlach predicting bonds could be at 6% in 5 years? Thoughts?

I have some cash I need to invest for the medium term.

Saw it. If that happens, the bond market will take a huge beating, down ~20%-50%, depending on what type of bonds.

If he is talking the 10-year yield at 6%, that would mean 30-year mortgage rates will go to 8% – 8.5%.

Could happen! Doubt it. If it does, let’s hope it is because inflation has jumped from 2% today to 5% and we’re all getting incredibly rich owning assets.

“What matters is my desire for income, principal protection, and diversification so I don’t ever have to go back to work for a living.”

But but but…in your previous post, you said if Trump wins, you’re going to go back to work to take advantage of the tax rate? In which case, you would want more equity exposure since you can afford to take on more risk. Am I missing something?

Sure. The post was written before a surge in interest rates and a sell-off in bonds, REITs, etc. Now that interest rates have increased, I’ve realized I can arbitrage my living expenses by building a muni bond portfolio.

I still plan to look for job opportunities in 2017 and beyond. But I never find the right one b/c I want the ideal pay, fit, and balance. Those really don’t exist. But, I’ll keep trying so I can write more about the experience.

It takes time for new tax laws to take into effect. But it also takes time to find a job. And it is so fun to look for a job when you don’t need a job! I’ve got stories to tell.

Great article! I love municipal bonds! I am currently building a national muni bond portfolio with my after tax savings and buying on dips. Trying to diversify from my heavy real estate portfolio which is 70% of my net worth. Currently maxing out my 401k at work and investing it in vanguard stock funds as well. Real estate and muni bonds have been very good to me and my wife as we are high earners. Love investments that are tax advantaged!

Good stuff Eric. Just be careful that real estate and bonds are correlated in that in the short-run, real estate and bonds sell off when interest rates rise. But in the long run, higher interest rates are an indication of inflation, and your real estate should simply rise with inflation.

I hate paying taxes too. Who does!

Interesting post Sam but I am not convinced that bonds do what you think is valuable. Diversification works only if the correlation is close to zero but that’s not the case. The biggest bull market of the past 30 years, without interruption, has been in Bonds. Only now are they showing signs of price weakness, so too early to jump into bonds. Also, if your dividend income, which is far more stable than stock asset price, is sufficient for you to live on, you don’t need to worry about asset prices as much. Principal protection implies you intend to sell your assets in the near future so don’t want to be caught in a stock market downturn then. If not, then principal value will recover as long as the underlying business is doing OK and survives the recession.

Sounds good. That’s why there’s a market to accommodate both sides. Remember to do what you think is best for yourself.

Share with us how you’ve constructed your investment portfolio and where you are on your financial journey. thx

Bonds are like stinky old wool socks. There is nothing exciting about them and they also smell bad. They are also itchy and old. Some people like stinky old wool socks though and insist that they are warm. But what about nice new top of the line winter socks for snowboarding?!!? Those would be stocks.

Hey I am open to all investment vehicles but bonds are one that I just can’t get into. I figure it would be better to make a loan myself at a higher rate or perhaps buy a REIT or High Yield dividend stock. Why not buy an ETF of dividend stocks? These ETFs are a low-cost way to get 3%+ yield and appreciation.

If concerned about a downturn in stocks why not just hedge the position?

Why not buy an ETF of dividend stocks? Because I already have a large position in DVY and VYM.

So I can write better, does this post make it seem like I’ve only got real estate and some cash, and now I’m only planning to build a bond/muni bond portfolio to cover my RE costs? If so, I can elaborate on all my investments or simply put up the entire passive income chart instead of just the RE chart. That’s probably a good idea. (Edit: Added my entire passive income chart instead of just the RE snippet to give readers a better idea)

I’ve found that one’s attitude towards bonds depends on where one is in their financial journey. The later they are in their financial journey, the more they are accepting of bonds. The less they had invested during the 2000 dotcom bubble and the 2008 financial crisis, the less they care for bonds.

Where are you in your financial journey? I just want to live freely and live for free, hence why bonds have now gotten more attractive to me.

Thx

Yeah bonds are clearly a great addition to a balanced portfolio and make sense for those later in their financial journey. And you hit the nail on the head in theorizing that I am earlier in my financial journey! That is why I don’t like bonds. I am sure I will warm up to them eventually but for now I really really don’t like them. Sometimes our investments come down to personal style. I would rather get yield from dividend stocks or through my RE investment properties than bonds.

And I get that bonds are a different asset class and therefore provide diversification through less correlated returns. Its a good idea for most but I am an extreme investor. Maybe I just need to grow up? :)

I like to get other perspectives because maybe I am TOO extreme – so I enjoy seeing your perspective on bonds! Its also easier to speak from the position of success than from my position of still trying to get there.

Great post.

Cool. It’s hard to know one’s true risk tolerance until one lives through a downturn with a meaningful amount of money invested. It’s no fun. I do hope the good times continue. My investments are exposed to the good times.

But at the very least, I’m going to build a bond portfolio with NEW money with this new fun goal of trying to live for free in my existing house I really love. I should have started building a muni bond portfolio when I was making good money between 2005 – 2012, but I didn’t out of laziness, lack of knowledge, and my own self delusion that I’m a great equity investor.

I didn’t bother building a muni bond portfolio from 2012 – 2015 because I made 50% – 80% less than what I was making after leaving my day job. The double taxation free benefits weren’t that attractive. But now, earnings have recovered to the “good old days” AND bonds are selling off again. Hence, bit by bit, I will lay my muni bond bricks. And for those who also want to live more conservatively, bonds may be a good option for them too.

I can see the value in that. The tax benefits and the significantly lower risk profile makes sense. You already have a significant amount of real estate so why not?

I’m big on simplicity so one day I may simply buy a target year retirement fund. Have you considered doing that to cut down on administrating all of your different investments?

Nice post, Sam. I got the exact same rate on my place — 5/5 ARM 2.375%. That’s looking pretty good right about now. I have looked into some individual issuances of corporate debt specifically utilities that are yielding over 5.5% and are investment grade trading at a 10% discount. Today sell off may be a precursor for even wider spreads. I’ll average in. Who’s gonna do better than 6% looking ahead and feel safe?

I must admit that I do not understand the allure of bonds. You highlight AGG as likely to deliver 2.375% gross annual yield. This is pre-tax, I assume? And the interest income is taxed as ordinary income? After-tax yield will therefore be meaningfully lower. And, importantly, it will be lower than the inflation rate. So, essentially, one is guaranteed to lose money on a real basis. Even with tax-free municipal bonds (2.5% yield in your example), the yield is still slightly lower than inflation. In contrast, dividend paying stocks should appreciate over time (at least at the rate of inflation) and also generate a dividend yield in the 2-4% range. And those dividends will be taxed at a lower rate. Yes, the underlying stock value will be more volatile in the near term. But the dividends themselves tend to be more stable. So, unless one has an extreme need for stability of principal, dividend paying stocks seem to have the edge. I think a similar argument can be made for real estate vs. bonds. What am I missing?

No problem. Bonds aren’t sexy like stocks. The allure is diversification, less volatility, income, and potential price appreciation. Bonds provide income and have shown an increase in principal value historically (see the 10 year chart) for a total return of ~4% or thereabouts. If the stock market corrects or the economy slows down, bonds will tend to outperform.

Don’t forget to diversify.

What is your current age and investment portfolio makeup now? Folks under 40 or who plan to work for another 20+ years are much less interested in bonds. But let’s say you amassed a $5M portfolio, $2M in stocks, and $3M in muni bonds. 2.5% yields a tax free $75,000 a year and you still have stock and stock dividend exposure. Not bad I say.

I am mid-40s, and still accumulating wealth. But I am hoping in the near term to transition into a “semi-retirement”, and am considering options. Portfolio is currently 70% stock, 20% real estate, and 10% bonds. So, I do have some bond exposure, and I do value the diversification. But, whenever I evaluate the bond portion of the portfolio, I am reminded that (in round numbers) my after tax, after inflation yield is approximately zero. While I appreciate the stability of bonds, and the tax-free nature of munis, I am concerned about the long-term impact of inflation. In any case, I love the idea of passive income, and am a big fan of your articles on this topic. Thanks for writing on this topic and for responding to comments.

Inflation has been coming down for 35 years now. I doubt it will suddenly start getting out of hand. But if it does, you are on the right side w/ stocks and real estate.

It’s just easy to forget the bad times since we’ve had the good times for so long.

If you are in your mid-40s, you may not want to work for 20 more years. You tell me. The people who planned to retire in 2008-2010 got ROCKED if they had 90% of their net worth or investable assets in stocks and RE.

Sam,

Munis!!!!! OUR FAVORITE TOPIC!! WE LOVE MUNIS!

We are NOT your atypical readers. We only buy individual muni bonds and have ZERO dollars in the stock market. Yeah, we are ultra financially conservative. As long as the bond matures or gets called, we will get back the face value and won’t lose money expect for the premium paid above PAR. That is why we will not buy any muni bond funds ever again since you can lose money as interest rates rises. We buy bonds with a min of 4% coupon and a YTW of 4% which is like a 6% CD. I hope 5% bonds will be PAR again in the near future.

Next year, we will get 87K of bond interest triple tax free and we will buy more to reach 100K of passive income from munis within 3 years. Instead of us working for our money, our money is working for us.

Some say it may be risky to have such a big financial nut in munis for one state but we will have 2 other passive income streams (pensions and 401Ks) to cover our expenses 100% separately. Our state is quite financially stable so, we are not worried. We also have enough cash saved until I collect my pension at 55 in case we lose all our muni bonds fron some major disaster.

If you live in a state like Florida which is state tax free then you can buy muni bonds from other states to minimize your exposure to one state.

Adam

That is pretty great to live in one of the seven income tax free states and then DIVERSIFY your muni bond portfolio with other states you believe are in great financial health. Very smart.

I’ve been saying I will relocate to the Nevada side of Tahoe for a while now… but alas, no friends and family there, so what’s the point? Too much excitement and action here in SF!

I’d love for you to write a guest post on building the perfect muni bond portfolio by age/financial stage if you are up for it.

Sam,

I am honored that you asked me to write a post on muni bonds!! I am not sure if I know enough to write a post on creating the perfect muni bond portfolio by age and financial stage. Now, I wish I learned about muni bonds when I was in my early 20s which is over 30 years ago. I have to think about that and how I would have created a bond portfolio for my younger self. I can only write about my personal experience.

I try to keep it simple when we buy bonds. We first determined how much income we need to be FI and then we started buying a lot of muni bonds. My close family friend introduced us to munis and he said ratings is the most important for a bond and someone else said to buy what you know. If insured – even better.

We started buying munis in 2009 and reached FI in 2014 with a passive income of 66K at age 49. Next year, our munis will generate 87K and we have a goal of 100K. I am happy to share what I know and what type of bonds we buy.

I recalled in your prior posts that you don’t spend your passive income and live off your online income. You invest around 20K per month.

For your 850K mortgage, would you consider these options to get rid it asap before interest rate is adjusted in 5 years.

Option 1. Pay an additional 20K/mo towards principle and your mortgage will be over in 3 years and 2 months.

Option 2. Pay an additional 15K/mo towards principle and your mortgage will be over in 4 years and 1 month.

Option 3. Pay an additional 12K/mo towards principle and your mortgage will be over in 4 years and 11 months.

You may say that you want to have cash for a better financial opportunity. By paying off your mortgage first you are guranteed in saving 2.375%.

Why pay the bank a $1 interest to get back 33 cents from the government?

If I had your cash flow then I would choose option 1 to paid an extra 20K per month and by age 42, you are done with that huge mortgage.

After the mortgage is done, then you can buy 25K of 4% individual muni bonds every month until you reach the bond portfolio you like. Or buy a 100K bond every 4 months to reduce the amt of individual bonds to track. I don’t like bond funds because there is a possibilty that you can lose principle.

In 3 years, you will have 900K in munis and it will generate 36K tax free. You can even use 200-300K of your CD money to buy more munis in one shot in addition to the monthly 25K. I think you should have a min of 3 million dollar in your muni bond portfolio and at 4%, it will generate 120K a year tax free when you are age 51!

But I suspect the Sam that we know can’t wait 3 years to pay off the mortgage before buying bonds.

Option 4. Two-pronged attack! Pay an additional 12K/mo towards principle and your mortgage will be over in 4 years and 11 months. Also, pay yourself more money if needed from your online income and buy 10-20K of muni bonds each month.

– buy 10K monthly of 4% muni bonds. It will be 120K for a year and will generate $4,800. After 5 years, you will have 600K of bonds and it will generate $24K yearly.

– buy 15K monthly of 4% muni bonds. It will be 180K for a year and will generate $7,200. After 5 years, you will have 900K of bonds and it will generate $36K yearly.

– buy 20K monthly of 4% muni bonds. It will be 240K for the year and will generate $9,600. After 5 years, you will have 1.2 mil of bonds and it will generate $48K yearly.

You have endless options and it will be fun to get rid of the HUGE mortgage and to build your bond portfolio to generate tax free income at the same time!

Adam

Adam, I have an account with Fidelity and they offer very few muni options. I do not want to invest in a fund because of the risk of loss of principal with rising rates. I want to buy bonds directly over time. Do you buy new offerings or on secondary market? Which brokerage are you using? Do you only buy bonds issued by municipalities in your home state? Thanks.

Trying to get ahead,

I used to buy individual muni bonds from banks BUT I recently learned that they cost a min of $2 more per bond. For example, a bond at Fidelity may cost $100 but the same bond at a bank may cost $102. I opened a Fidelity acct two years ago. I now buy bonds on my own for my state only since we have to pay state taxes for interest own outside of our state. If you live in a tax free state then you can buy bonds from any state.

What is your state so that I can test the search for you?

The Fidelity muni bond search is fiddly. Meaning that sometimes you enter the info and it returns no bonds. I think the maturity date selection is the fiddly part. Trying different values until it works or call Fidelity’s help line. I do a search for a min YTW of 3.5% or 4% in descending order to see the highest yields at the top of the list. Click on the YTW column on the search results page to sort them. Once you get the search working save it in Fidelity and book mark it in your browser! I use the browser book mark everyday to check for new listing of munis.

I now only buy individual munis from Fidelity to save money. Some munis may be newly issued and many bonds were issued in the past.

Here are my Muni bonds criterias

1. Ratings is extremely important. I tend to avoid investment grade which is a B. I look for bonds that are rated a min of upper med grade (single A).

Best quality – AAA

High Quality – AA

Upper Med Grade – A

See this site for the ratings chart –

2. Buy what you know.

I like MTA (mass transit), water, Dorm Authorities for schools and hospitals. Make sure the school and hospitals are well know. People will always need these facilities. Bonds will vary from state to state so buy what you know in your state.

3. I only buy Revenue Bonds. I avoid GO (General Obligation) bonds. With revenue bonds, municipalities can increase revenues to pay back bond holders.

I started out buying GO bonds because they were backed by taxes. Many thought that GO bonds were safe too until issues in Detriot and Puerto Rico. As a result, I now buy REV bonds. To be on the safe side, one can buy a mixture of GO and REV bonds but it comes down to financial stability of your state.

4. Tax exemption. Make sure it is totally tax free. Check the bond details.

Federally taxable – NO

Subject to AMT – NO

5. Insured

If a muni bond is insured then the bond is safer. Insured bond are tough to find and they are usually a bit more expensive.

6. YTW (Yield To Worst or Yield To Call) greater than 4%. In a 33% tax bracket, it is like a 6% CD.

YTW is the min the bond will earn when a bond is called. Most bonds are callable after 10 years of being issued so I dont really pay attention to maturity date. Bond prices are currently dropping so I like to buy bonds in x amounts. Dont spend all your money on just one bond. Currently, I can easily buy a 4% bond below PAR. I am hoping to get 4.5% YTW next and then a 5% YTW bonds in the near future. In the end, just be happy with the yield and dont go crazy if the bond price drops. If you hold the bond until it is called or matures then you will get the face value back to avoid lost of principle except for the premium paid.

I like to sort all the munis for my state with YTW in descending order which will display the highest yield at the top of the list. This makes it easier to select a bond.

7. Call dates, mature dates and month interest is paid.

You can buy bonds with different call dates and maturity dates to create a bond ladder. This way your bonds will return your principle at different years so that all of your money is not locked to a specifc year.

I also look for bonds to pay on different months of the year so that I will get bond payment every month. This is not a show stopper but it is nice to get payments every month.

8. Price of the bond.

Try to buy bonds at face value of $100 (PAR) or less. If you have to pay a premium then pay at most 1-2 dollars. For example, a 4% bond at $102 will take 6 months to break even. When this bond is called or matures, only the face value is returned to you. If you paid a premium then it will result in a lost of principle. This is not a big deal if especially you are happy with the yield and the interest you received

Let me know if you have any additional questions.

Adam

Also, in the Fidelity muni bond search screen

-Set YTW to min 3.5

-Leave YTW set to max value(default)

-Select your State

-click on show more criterias.

-Set Sinking Fund Protection to All. It defaults to Yes which will display a lot less muni bonds. Sinking just means that the bond issuer will start paying back several years before the maturity date. Sinking sounds bad but it is not.

-Set Zero Coupon to No if you are not interested in them.

As you make these changes the number of munis changes in the “See ### CUSIPs” button at the bottom of the screen.

Adam

Why only go back to 1989? What about 1978-1983? Total bloodbath. I would think that the same scenario is possible seeing how we have held rates so low for so long. If yields on Gov bonds jump to 10-15% you would be toast. And your money is going to California muni probably one of the worst states. The last time Cali got in a bind they gave IOU’s to taxpayers. Your strategy doesnt work on IOUs

You could definitely be right that the world is coming to an end or that the economy is so strong that inflation will just skyrocket making everybody who owns assets extremely wealthy. That’s the beauty of the market. There’s a decision that can be made for everyone.

What are some investments you’re making right now to help protect your wealth?

There isn’t much that provides a yield.

Personally I am doing some hard money lending at 15%. These are 6 months loans but there is a risk of default but you would inherit the property at 60% of market value, which I view as a real possibility if the real estate market falls apart.

I am looking for high yield stocks or bonds in Russia because relations should improve and Russian market is soooo cheap on a PE basis.

OGZPY for example

Russia bonds are paying 10%

I am so bearish tight now that I wouldnt put money to work here. I follow Harry Dent. Cash might be the solution and wait for the correction and be able to buy assets on the cheap.

I did a house flip recently and just bought some PUT options to protect my value just in case.

I like your Russia and emerging markets direction. I own some RSX, which has held up well.

I’m worried about the coastal real estate market coming to a complete halt now that rates have jacked higher. We’re definitely in for a 2 year correction now IMO.

At the end of the day, to build a $850,000 bond portfolio will take time for me. But it’s just a goal now that rates have risen. I’ll try to create as defensive a bond portfolio as possible in a relatively defensive asset class.

Do you feel that the tax cuts will balance out a lot of the effects of higher interest rates?

The potential tax cuts will help, but I don’t think they will help that much. Most of the tax cuts will go to the wealthy. But higher interest rates hurt EVERYBODY. From the home buyer, to the credit card debtor, to the student loan borrower.

The wealthy will be less hurt b/c the wealthy may not have to borrow as much.

The next 4 years should be a good time for people who are wealthy, and unknown for those who are not. And bad for debtors.

I really enjoyed this post. I did a lot of rebalancing this week and sold off some of my stock gains and increased my bond exposure. I am comfortable having a high weighting in bonds and although I didn’t get all of my leg-ins after the recent drop off, I still feel good that I’ve ramped up my exposure. Fascinating insights on AGG and the overall bond market during the crisis. I had no idea!

I think muni’s and preferred shares ETFs are under utilized for most people. They provide decent downside protection, kick off a decent rate of return and are liquid.

Glad to see you post an article like this.

No problem. I’ve written a lot about stocks, private equity, private debt, P2P, RE crowdsourcing, structured notes, but not too much on bonds.

I did write a post after a survey that shows wealthy people are very underweight bonds:

https://www.financialsamurai.com/should-i-buy-bonds-wealthy-people-dont/

I’m not planning to enter into US bonds yet. Mainly because I’m still in the wealth accumulation phase of my journey. I do have some small bond exposure, but it only represents around 5% of my portfolio. The bonds are only held through PCY ETF, which is more volatile than the ones you’re looking at, but on the other hand yields nearly 5%. I’m planning to hold this for at least many years. 80% of its holdings are in at least BB rated government bonds, so although I’m ready for some volatility, I hope it will generate some nice fixed income on the long run.

Any thoughts on this?

I am foregoing bonds at this time in favor of preferred stock ETF’s and very little in PFF as it is all financials. My yield is over 5% and since preferred stock is a blend of stock/bond, the risk is reduced somewhat. Ross Elliot, CFP

Any particular pref stock ETFs you find most attractive?

One amazing thing with investing is: If you have new monies to be poured-in to the market, in addition to having considerable amounts invested in the markets (and with long-term horizon): there is some magic that happens – not many talk about the sweet-spot/synergies:

1) If you have already considerable monies invested (401Ks, IRAs, or brokerages, bonds/treasuries etc) — if market goes up — obviously, your networth goes-up — you ought to be happy!

2) If markets goes down – and you have new-money ammo — you are now “buying low” — the wisdom is: in the long term markets do go up, hence you just happen to have bought “more” stuff when markets were on sale! Isn’t it fun buying high-quality stuff on Sale (ask your not-so-spendthrift spouse :-)

3) The beauty of automated/401k type investing is (hoping – your investments are not sitting in CASH, rather getting invested-in !) — in addition to the “dollar-cost-averaging” preached by market., you keep buying/investing — with brave-heart even when markets do go down (and an occasional reality-check, and dips are actually good – my personal opinion)

As long as your investment horizon is long-term, and got new-monies/money-armies to be able to deploy — you definitely do good. Just gotta keep investing (more during markets go on sale, that is!)

Happy Investing – and Happy Thanks Giving folks!

Thanks

YES! Great attitude SC!

That is exactly how I think about investing as well. There is always opportunity as long as you have the cash generating abilities to put that money to work.

And if you can find a purpose for your investments, it makes investing so much more meaningful than just earning more money from money.

I don’t have a big bond allocation given where rates have been and the fact that I’m still building wealth (so I can stomach a bit more volatility in equities). However, I’m still watching rates to see if anything is interesting.

I have a similar situation to you except on my car loan (financed at 1.49%). For the most part, I’ve mainly leveraged that to invest in the broader equities market.

Will be very interesting to see what happens at the next Fed meeting in December….maybe they’ll finally raise rates again!

The Fed will most certainly raise rates in December. But it doesn’t matter. The market determines the rates (10-year bond). And the 10-year bond yield has already surged by 50 basis points.

For more explanation on the Fed and the bond market, see: https://www.financialsamurai.com/should-i-buy-a-home-in-a-rising-interest-rate-environment/

Since you live in California, isn’t bonds that invest in your state kind of concentrating your wealth in one area? I.E. an earthquake drops California into the ocean, so now your homes and bonds are worthless. (Or some other state wide issue.)

Is there an advantage to investing in California Bonds over another state? Maybe something on the other side of the country.

I guess you would at least get the pleasure of imagining your money staying local and being used to improve the area around you.

Yes, California could drop in the ocean. But I’m hopeful it does not. I live on a hill, so hopefully my house will be left standing in the great Tsunami.

Diversification is generally a good thing for retirees. And that’s what I plan to do w/ my bond portfolio I’ve now started to construct.

How about you? What are you doing w/ your money?

Right now 401K and HSA’s, while saving up for a home. An opportunity came up to move to Texas for work, which I’m taking, which will eliminate state income taxes for a bit. I’m not sure what the best move is with that information.

With the 401k I’ve got about 25% of my yearly income invested in index funds with about 20% of that being international exposure and the rest in the US. I’m aiming to save about 3 years worth of maximum medical expenses in the HSA.

Then in a private account I’ve got individual stocks that I’ve picked (I can already hear the yelling) that are meant to be more defensive if the economy tanks. REIT and metals, and they both pay dividends so I feel comfortable sitting and holding onto them. The company I work for tends to go in cycles so when the economy is doing really good, they are too. But when the economy is doing bad, they feel the pain a lot. So that’s why I have those stocks.

Otherwise I’m just saving what I can. I’m 32.

I’m hoping California never drops in the ocean too! I’ve lived all over the US. I’ve only ever visited California and I would love to live in Northern California for a bit. I just end up investing like the floor will fall out from under me at any given moment.

Is this too simple?

So when bond prices fall then bond yields start going up. In this case it’s due to the anticipated changes in US Monetary policy that will see interest rates potentially rise in Dec 16. So you’re buying into a falling bond price market.

Do you sell the lower yielding bond at a lower yield and buy the lower priced bond for a higher yield? And continue to do this until you reach a “sweet spot” in the bond yield and your passive income breakdown point? Or to build “CD ladder” equivalent with varying bond yields?

What if new US fiscal policies potentially raise inflation too… Do you hedge with inflation-backed bonds too?

Bonds are new to me.

You can hedge with TIPS. And you can hedge by owning real assets and stocks that inflate with inflation.

Remember, the higher interest rates go, the more it chokes off consumption, the largest part of GDP. I believe the equilibrium is ~2.5% for the 10-year bond yield. And I do not believe we’ll get over 3% on the 10-year yield.

But if we do, asset owners should rejoice in the long run.

Don’t confuse my desire to build a bond portfolio as my entire net worth. Roughly 30% of my net worth is in public stocks and bonds.

Great food for thought. I’ve never focused much on munis, but I fit all the criteria that you discussed. Did you do any specific analysis on the finances of California? I imagine targeting the double tax free option could leave you a bit overly concentrated in your home state.

Another option to avoid being overly concentrated in your home state would be to invest half in the state muni bond fund and half in a national muni bond fund. The national muni bond fund would only be federally tax-exempt and not exempt from CA taxes but would provide additional diversification.

I may go this route soon. I currently have ~1/2 of my bond allocation in a 401(k) in a total bond fund and the other ~1/2 in a CA muni bond fund (VCAIX). I’m thinking of moving to having 25% in the CA muni bond fund and 25% in something like VWITX (Vanguard Intermediate-Term Tax-Exempt Fund).

One such low expense ratio national muni bond fund is MUB.

Thanks Sam! I am considering MUB as well for my taxable account.

I like that you’re goal is to make new money to build your bond position instead of selling off stocks. Keeps you motivated to continue improving your financial situation and not get complacent.

For me, my investment goals haven’t changed as I’m still in high growth mode. Like you I have a high risk tolerance, but my goals are for growth as I’m not at a stage where I’m seeking principal protection yet. Therefore, my bond position will stay pretty low.

My risk tolerance isn’t that high anymore. I would give myself a 4 out of 10, with 10 being super risk loving. But within a relatively defensive asset class like bonds, I’m willing to take on more risk for a higher potential return. Key word is potential, since nothing is a guarantee.

The ideal scenario for me would be a 2.5% double tax free yield + 2% annual principal appreciation for the life of the asset. I’m always looking for a return = 2-3X the 10-year bond yield.

But yes. Using NEW money to build a bond portfolio that will pay 100% of my living expenses and then some is a great motivator. It’s about building that Money Army!

It’s not really living for free because you still have to pay the principal, taxes and insurance. In this case you’d be in the same boat if you paid off the mortgage. In the case of buying higher yielding tax exempt bonds there are benefits, mainly that you’re getting a higher return than if you paid off the mortgage. But you’re still not living for free yet. You need about 4% return after taxes to actually be living for free. The thought process is right, but we’re not quite there yet. Hopefully in a few years……

With CMF at a 4.3% gross adjusted yield versus my 2.375% mortgage, if CMF stays flat and continues to pay its interest, a large position does cover just about everything. But it will take time for me to build an $850,000 bond position.

Your after tax return on $850,000 in the CMF your quoting is $1,770/month. That’s not covering your whole mortgage.

The interest rate portion of my mortgage is $1,682/month. Are you saying you’d like my double taxation free interest income to cover my interest rate AND 100% principal? That would be nice, and eventually as the principal portion gets smaller. I see principal as an asset, not a cost.

$1,682/month in mortgage interest is roughly $1,100 a month after mortgage interest deduction based on a 30% effective tax rate.

$1,770/month in CMF interest > $1,100 in net mortgage interest expense.

Do you not itemize your mortgage interest deduction due to the standard deduction?

Tell me more about your investment holdings and where you are in your financial journey. Thx

So we’re on the same page about what you’re achieving here. By investing in safe bonds you’re getting a better return on your money than if you just paid off your mortgage. The title and content of the article implied that you’re covering you’re entire mortgage payment with an $850,000 bond portfolio. To cover your entire mortgage payment you would need the CMF to be above 4%.

At this point in my financial journey I’m 34 and semi retired with just over $7,000/month in after tax passive income, and my wife is a doctor who works 4 days a week. I’m about 1/2 through the CFA program and working on my MS in Finance.

Well done Joshua. Having passive income more than the average household income AND having a doctor wife is recipe for financial independence no doubt! What’s keeping you from fully retiring? What are your main passive income streams?

Hope the CFA works out. You might feel the need to work much longer after you final pass Level 3 because it is such a bear to pass. Is getting an MS in Finance and a CFA just a personal goal if you’re looking to retire shortly?

With a doctor wife, you should read: How To Convince Your Spouse To Work Longer So You Can Retire Earlier

Also, I had similar academic thoughts as you after I retired in: Life After The Private Sector: Should I Get My PhD?

Finally, this post is worth reading if you are having doubts about pulling the rip chord early: The Fear Of Running Out Of Money In Retirement Is Overblown

If there’s anything you’d like me to critique about your financial goals as you’ve so graciously done about mine, let me know. If you’d like to write a guest post about your journey to $84,000 a year in passive income, that would be fantastic! I’m always trying to show others that many people can build passive income, not just a few.

Here’s a passage from the post to answer your final statement on the $850,000.

“But, what I can do is focus on making NEW money in order to build a position in AGG to slowly chip away at living for free. The beauty of this strategy is that there’s a two-pronged attack.

On the one side, I’m building a bond position to get to $850,000. On the other side, I’m automatically paying down the mortgage through monthly payments and random extra principal payments so that I DON’T have to amass an $850,000 live-for-free bond portfolio!”

I think rather then bonds in your position I might suggest a CD ladder and federal EE bonds ( only covering 10 k per individual and 10k for a trust takes you to 30k .). The rest in a set of varying length bank CDs should get you near aggregate bond return but with early withdrawal provisions in case you guessed wrong on interest rates.

Can you elaborate on Federal EE bonds? I’m not familiar.

I’ve got a large position in 7-year CDs yielding 3.5% – 4.1% already.

EE bonds sell at 50% of par. They mature at 20 years. They are also usable tax free for education at maturity. Therefore the 20 year return is 3.5% or around 5% if used for education. Needless to say 20 years contains some interest rate risk. You can learn more at treasurydirect.gov

Thats a fantastic rate on CDs. Where do you find that rate?

Two are from First Republic Bank, a boutique bank here on the west coast. They are expiring in 2017 and 2018. These rates no longer exist, which is why I’ve been doing my due diligence on income generating assets so when the CDs expire, I’ll have a good idea what to replace them with.

Hi,

Just subscribed your newsletter today….and found it very intresting with great investment ideas.

1. I have been thinking of investing in bonds and Munis for quite sometime but somehow due to high prices have not ben able to invest. Any suggestions if this would be a right time to enter the Muni/Bond market and if so how ?

2. I have also read your article on investing in Realtyshares? Wanted to get your views on which is a better crowdsourcing Realtyshares or Fundrise? I understand from some of the reviews that Realtyshares is having challenges in getting quality deals. Also, do you think liquidity is an issue.

Will appreciate your inputs.

Thank you,

Raj

Hi Rajeev,

I invested $260,000 with RealtyShares earlier in the year, and just sent another $250,000 in because they have a great platform and have been choosing high quality deals for their Domestic Equity Fund. Total is $560,000, and I will probably invest another $240,000 in RealtyShares before they close their fund in November. I’m very bullish on the heartland of America, and am diversify away from SF property, which has gone crazy. I’m hoping to get 10% – 15% annual returns over the next five years. We shall see.

Here’s my RealtyShares review post.

I’ve met with the CEO, VP of Finance, and the Marketing team many times in SF before investing. I think they are legit and provide exactly the diversification strategy I’ve been seeking.

Sam