Have you ever wondered why wealthy people are more willing to invest in hedge funds, venture capital, venture debt, private equity, and other speciality funds? These are all actively-run funds that mostly have a history of underperforming the S&P 500. Yet, billions of dollars still pour in each year.

Some of these active funds are also considered alternative assets. Alternative assets tend to be less efficiently priced than traditional marketable securities, providing an opportunity to exploit market inefficiencies through active management. Alternative assets include venture capital, leveraged buyouts, oil and gas, timber, and real estate.

After investing in various actively-run funds with a portion of my capital since 1999, let me share with you the main reasons why I do so by age range. After a reader asked me for reasons in my post on how I'd invest $1 million, I realized my reasons have changed over time.

Why People Invest In Active Funds By Age Range

Our attitudes about money change over time. Let's be aware of them and adjust accordingly. Here are the reasons why people continue to invest in active funds even though they've historically underpeformed passive index funds.

1) Reasons to invest in active funds in your 20s: curiosity, naivety, access

I first invested in a hedge fund called Andor Capital in 1999. The offering was part of Goldman Sachs' 401(k). At the time, Andor Capital had a good track record investing in technology and I wanted in, despite the higher fees.

I was a first-year financial analyst with a $40,000 base salary who couldn't invest in Andor Capital otherwise. Hence, I seized the opportunity. In other words, I invested in an active fund because I had access. It felt good to be a part of a club – like skipping a long line at a popular night club because you know the bouncer.

I didn't care about the higher fees because I wasn't investing a lot in the first place. In 1999, the maximum contribution to a 401(k) was $10,000 and $10,500 in 2000. I was curious to know what this hedge fund could do.

Andor Capital outperformed during the 2000 an 2001 Dotcom bubble bust as it shorted a lot of tech stocks. As a result, I walked away with a positive impression of hedge funds back then.

Further, hedge funds were also some of Wall Street's biggest clients. My boss would often refer to them as “smart money.” When you're young, your limited experiences shape your entire world outlook. If you want to get rich, it’s better to be a hedge fund manager than to invest in one.

2) Reasons to invest in active funds in your 30s: hopes and dreams

As you gain more wealth a decade plus after school, you start dreaming of what it would like to be really rich. On a yearly basis, you get bombarded with stories of so-and-so fund manager crushing his returns, e.g. John Paulson netting $20 billion shorting mortgage-backed securities in 2008.

You realize that those who get extraordinarily wealthy in a relatively short period of time did not do so by investing in index funds. Every rich investor you hear about got rich by making concentrated bets. Therefore, your natural inclination is to follow their lead with some of your capital.

After ten years of active investing, you will finally start to realize some significant gains and losses. For most people, their active investments will underperform the S&P 500 or whatever passive index benchmark. Therefore, disillusionment about allocating more capital to active funds will creep in over time.

However, for those who've experienced greater wins than losses, the enthusiasm for active investing will continue. There might be a situation where an active investor earns a massive percentage return, but a relatively small absolute l dollar return. In such a scenario, the 30-something-year-old you might start thinking, I wish I had invested more!

Your 30s is a time where you long to earn as much money as possible. Investing in active funds or actively investing your money is consistent with your hopes and dreams of one day hitting the big time.

Investing In Unicorns

If you invest passively, you won't be able to outperform the masses that also invest in passive index funds. You won't be able to find that private AI company that goes from nothing to a multi-billion market cap either. To find those hidden gems, you need to invest in actively-run funds.

Here's my conversation with Ben Miller, CEO of Fundrise, about their venture product. Fundrise venture invests in private growth companies in the artificial intelligence, SAAS, prop tech, and data infrastructure space. Personally, I'm investing 10% – 20% of my investable capital in private growth companies to search for the next Google, Apple, and Microsoft.

With Fundrise venture, you can dollar-cost-average with just $10. Whereas with closed-end venture capital funds, you need to commit at least $100,000 and pay much higher fees. I've personally invested six-figures in the Fundrise venture product to gain more exposure to private artificial intelligence companies. We're just at the beginning of the revolution.

3) Reasons to invest in an active fund in your 40s+: security and capital preservation

After potentially twenty years of actively investing, you clearly realize there's a 70%+ chance your active investments will underperform passive index investments. As a result, your exposure to active funds is congruent with reality.

Check out the percentage of institutional equity managers underperforming over ten years. Most active fund managers underperform. As a result, most of your public investments at least, should be allocated toward index funds and ETFs.

The good thing about investing in active funds in your 40s is that you should have more experience, wealth, and wisdom. You have a better idea of where to allocate your private capital. You may also have better access to historically better-performing funds.

In my 40s, I appreciate a fund manager dedicating their profession to looking after my capital. The more experienced the fund manager and the better the track record, the more comfort I feel. Because I already have enough capital to generate a livable passive income stream, I optimize more for peace of mind rather than returns.

If you invest in an index fund, the fund manager has no say in the fund's investments. Instead, the fund manager simply buys and sells whatever company is added or subtracted from the index. But with an actively-run fund, the fund managers have the flexibility to protect its investors if they deem it necessary.

Given you also realize that active funds can also blow themselves up in any given year, you invest accordingly. For example, few invested in Melvin Capital (-39.3% in 2021, shut down in 2022 after being down 20%+ in 1Q2022) for capital preservation. Rather, most of its limited partners invested in the fund in hopes for maximum returns.

Hedging And Diversifying Against Financial Catastrophe

Most people who get wealthier eventually go into capital preservation mode. As the saying goes, “once you've won the game, there's no need to continue playing.” But we all continue to play due to the desire for more. At the very least, we want to keep up with inflation.

We all know too many stories of people who became multi-millionaires overnight and lost it all and then some during a crash. For example, my breakfast sandwich maker made over $2 million during the 2000 Dotcom bubble. Today, he's still making sandwiches (at a store he owns) partially because he didn't sell.

Investing in active funds gives you the potential for better protecting yourself against losing lots of money. But the best way to truly protect yourself from big losses is to diversify your investments. Investing in active funds is just one part of the larger move.

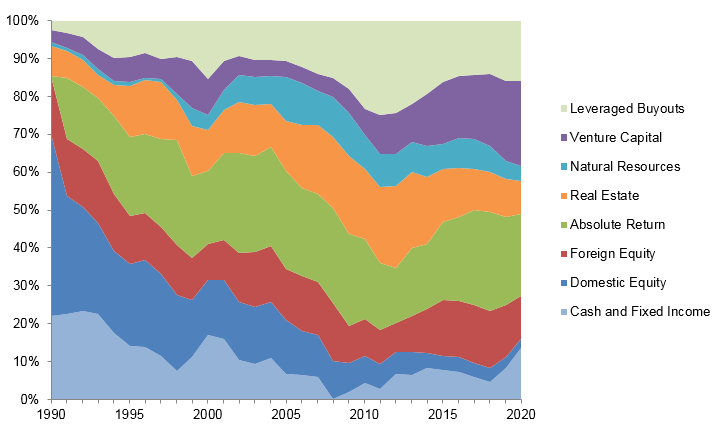

Below is Yale's endowment asset allocation over time. Notice the small percentage allocated toward domestic equity and the large percentage allocated towards various active funds.

Let's Say You Are A Deca-Millionaire

Pretend for a moment you have $10 million in investable assets, the threshold where most believe generational wealth begins. Based on a large Financial Samurai survey, $10 million is also the ideal net worth amount to have at retirement.

Let's also assume your household spends $300,000 a year after-tax, which is enough to live a best life. Finally, let's assume your household has no active income. The couple decided to negotiate severance packages and become starving authors because writing is what they love to do.

Based on long-term capital gains tax rates, earning a 5% return each year is enough to pay for the household's entire annual living expenses. Therefore, there's no need to invest the majority of the $10 million in the S&P 500, to hopefully earn the historical average return of 10%.

Diversifying For Capital Preservation And Lower Volatility

Instead, the household might cut up the $10 million into 40% real estate, 30% into public equities, 20% into active funds, and 10% into risk-free investments.

Real estate is less volatile and has historically paid the household a 7% annual return. The active funds consist of market-neutral funds and venture funds with 10-year vesting periods and historical 6 – 12% returns.

I could easily see this investment asset allocation generating 5% a year with low volatility. Heck, if there were no tax consequences, the household should be happy investing $10 million in a one-year Treasury bond yielding 5.2%.

Because when you have $10+ million, the last thing you want is it to experience a 19.6% drop in value, like we saw in the S&P 500 in 2022. That's a $1.96 million paper loss, or more than eight times the household's annual expenses. This type of volatility creates anxiety and stress.

Diversifying your risk exposure by investing in actively-run funds provides both protection and hope. Here's my recommended split between active and passive investing. I currently have about 25% of my invested capital in active funds and individual securities.

After writing on Financial Samurai since 2009, I've noticed there are two levels of rich. The first level rich are those who are moderately rich. Maybe they have a net worth equal to $1 – $10 million. Not bad! Then there are the really rich people, all of which didn't get rich by investin in passive index funds. Instead, they invested in active funds and built businesses.

Peaceful Living Is What I Want, Hence Active Funds

One Thursday in May, I took my three-and-a-half-year-old daughter to the San Francisco Zoo. She only goes to preschool Monday, Wednesday, Friday, so we spent the entire day together.

First we said hello to the giraffes eating their leaves. Then we visited Norman, her favorite gorilla. On the way to Little Puffer, the steam train, we said hello to Mr. Wolverine.

She had so much fun waving to everyone she passed by on the train while the wind made her hair dance. Without a time limit, we decided to ride the train again. I wanted to hear her squeals of joy once more!

As I put my left arm around her shoulder to ensure that she was safe, I felt love and tranquility. At that moment in time, I wasn't focused on writing or worrying about my investments. All I thought about was how lucky I am to be here with her on a weekday afternoon.

The feelings of peace, love, and tranquility are priceless. They dwarf the feeling of making a higher rate of return on some investment. Given these feelings are priceless, I don't mind paying active management fees to people I trust who might better protect my money.

I'm under no illusion that my active investments or active funds will outperform the S&P 500 index a majority of the time. But I do know that whenever there is a big drawdown in the S&P 500, it will feel great if I don't lose as much money.

As you get wealthier, you may also be more willing to pay for greater peace of mind as well.

Reader Suggestions

One of the most interesting investments I'm allocating new capital toward is Fundrise venture. It invests in:

- Artificial Intelligence & Machine Learning

- Modern Data Infrastructure

- Development Operations (DevOps)

- Financial Technology (FinTech)

- Real Estate & Property Technology (PropTech)

Roughly 35% is invested in artificial intelligence, which I'm extremely bullish about. The investment minimum is also only $10, as Fundrise has democratized access to venture capital. Most traditional venture capital funds, however, have a $200,000+ minimum.

I'm also a fan of dollar-cost averaging in private real estate funds like that ones offered by Fundrise. The funds invest predominantly in Sunbelt residential and industrial real estate, where valuations are lower and yields are higher. I've personally invested $954,000 in private real estate funds since 2016 to diversify and dampen volatility.

Fundrise is a long-time sponsor of Financial Samurai and Financial Samurai is an investor in Fundrise funds.

Join 65,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

The arguments for active investments appear to boil down to a “swing for the fences”. Nothing compelling here to go that direction with anything other than play money.

Indeed. Accept getting average returns based on average risk. Or swing for the fences to see if you can outperform and reach a next level of lifestyle sooner, at greater risk of losing more money as well.

What have you chosen?

Sam –

Thanks. Do you think larger portfolios need alternatives like debt funds or real estate or hedge funds. Could we achieve the same thing with etfs? Is there really alpha to be had with adding asset classes?

Maybe. But your portfolio will likely experience more visible volatility, which may increase stress as your absolute investment amount increases.

Another form of active management that might be worth a discussion is the concept of SMA (separately managed account) management. For equity-style investors that have substantial non-qualified money, owning an SMA that tracks the SP500 or similar presents really meaningful tax efficiency that, depending on your other income, can more than compensate for the additional costs. When you get that 10% year in an ETF or mutual fund that tracks the SP, hypothetically some of the stocks within the index killed it, and some lost money, and you get the aggregate return. In an SMA you can get the same aggregate return and sell the shares that lost money in order to create an ongoing capital loss, even though your account overall made money. Then either have them buy into a cash position or am SP ETF until the wash sale period expires. Although the $3,000/year loss deduction is not that meaningful, storing up those carry forward losses to offset a future large capital gain event like a business or depreciated real estate sale can be pretty huge. These strategies don’t matter that much for qualified accounts, but can be super beneficial in nonqualified accounts. Realize this is a bit different from the private equity and private real estate that is under discussion, but it’s not a topic I often see discussed in the FI community, where VTSAX is like some sort of byword for secret knowledge=D

I invest in some of the funds you mention for reducing correlation risk and/or having more efficient beta. Chasing returns with considering the risk associated doesn’t mean I always need to “beat the market”.

I just started playing in the stock market a little over a year ago and have not bought an etf or index fund. I have been making small gambles on individual stocks ($500 at a time). Recently discovered an ADR that pays a 50% dividend, we’ll see if it goes to zero. Like I said I’m gambling. I have been heavy real estate, buying and selling since the early 2000’s . I am holding onto 3 small apartment buildings, which means I own 35 refrigerators, 35 dishwashers, etc…it’s great until it’s not.

Any suggestions where I can routinely pay into a fund / etf?

SPY, VOO, or VTI. I’ve been putting money in the SPY for over thirty years. I have a weekly deduction from my savings account. After thirty years 2/3rds of the account balance is gains. A good way to get rich slowly.

Given it’s been over 30 years Bill, please tell me you have millions in the S&P 500 index now!

Stealth Wealth Sam

Too many Bills in the world for stealth to be necessary!

Thank you, I’ll start buying next week.

Not Invested in active funds as I don’t believe they can give me better returns -or at least haven’t seen it. I’ll stick with index funds and physical real estate.

I did also want to comment on the new styling for your posts. I thought I liked the old style until you updated- this looks much better. Especially for the comments and replies on mobile. Thanks for always looking to improve the user experience of your site!

I appreciate your comment about the new website redesign! I spent the memorial day weekend updating the site to make it load faster, look better, and be more user-friendly. I also added a search box in the mobile version to help readers navigate easier.

There are still several more things that I need to update. But slowly and surely things will get done. And I hope I won’t have to update it again for many years to come!

I’m a very passive investor and haven’t gone beyond ETFs, mutual funds, munis, and treasuries. But I’m always fascinated by those who have! It’s pretty incredible how many different types of funds and investments there are today compared to 30, 40, 50 years ago. I still remember the days of paper stocks.

I don’t invest overmuch in real estate because I don’t like the headaches that can come with it. I value keeping my life as simple as possible.

I don’t touch bonds, I know what they are for (and we don’t need that; your mileage may differ). I stay away from bitcoin and its friends. That may cost me opportunities but that’s okay. Same deal with investing in China. If fact, I put very little overseas. The ease of owning US dollars, and investing in US concerns (for a US citizen), is something of a privilege, and I use it.

Instead, since I seem to be fairly adept as a futurist, I identify funds that are focused on those areas where I see the future taking us (this does not always mean tech and science), and then I look for fund managers with a long enough track record so I can see how they did in good times, and in bad.

I’m not investing in individual stocks, I’m investing in fund managers, and only in fund managers that are focused on where I want my investments focused. They are way more reliable than individual stocks, especially as they do diversify. Let them do all the work, it’s way too much for just me and they can offer many other advantages as well.

I don’t invest more than a quarter of our portfolio in individual stocks, even though I seem to be fairly adept as a futurist and always beat the market (knock on wood). I also don’t buy anything I am not willing to hold for a least a year.

I don’t touch leveraged funds or sell short or anything else that might force us to sell or buy when we might not want to. This way we never have to sell when the market is down, thus locking in our losses. Then again, we have the luxury of having well over a decade before we have to sell anything (RMDs). Keep playing with the idea of some backdoor Roth conversions to level that tax bite out some.

Took my three year old grandson to the Bronx Zoo last week. We had a great time!

Maybe I’m missing something, but I don’t understand these statements:

“Investing in active funds gives you the potential for better protecting yourself against losing lots of money.”

“But I do know that whenever there is a big drawdown in the S&P 500, it will feel great if I don’t lose as much money.”

Does active investing offer some kind protection against losing more than the S&P500?

Yes. Some active funds short stocks or invest in assets that outperform stocks or go up when stocks go down.

I own some structured notes as well.

Hi Sam,

I just wanted to ask you what your thoughts on bitcoin and cryptocurrency are?

What percentage of the underperformance at 10 years is really just the 1% fees for active management compounded over 10 years? Can you make that estimate?

When market goes up you lose 1%, and even when market goes down you lose an extra 1%… I just hate thinking of that.

Perhaps 10-30%. The longer the holding, the greater the underpeformance as the fees compound.

Check out the chart in the post on net and gross percentage of equity fund managers that underperform.

Hi Sam –

How does this impact Fundrise where the Flagship Real Estate Fund is 1.00% fees all in and the Income Fund is well over 1.00% in fees? Is the opportunity or out performance there that these fees are worth it?

I attempted active investing briefly in my 20s but quickly realized that wasn’t going to work out well for me or my investments’ performance. So I switched over to index funds and am much better off for it.

I have nothing against people who want to invest in active funds or who make single name bets. It just isn’t for me right now. I guess if I accumulated a lot more wealth then I could perhaps see myself diversifying into some active funds especially if I had good connections. Thanks for the article!

Now that I’m retired (my younger wife is still working for health insurance) we have about $800k in a balanced fund. It hasn’t been doing well lately because it’s about 65% bonds. We haven’t needed to use it yet, but I’m not worried about it losing a lot of money. I sleep well.

2022 was the toughest year for bonds in decades. There should be some mean reversion as inflation and rates fade again.

But feeling good about not losing a lot of money once you have a $800,000 but is priceless.

I was a little hesitant with real estate ( Fundrise), with the current short term US Treasuries looking like they will earn good interest, but it won’t last forever. Fundrise- locking up principal for 5 years- is something you have to make sure you do. However, by doing that- it motivates one to cut wasteful expenses. I never thought of it like that. Being open to a new way of investing is how one learns.

Yes, if you invest in private funds like Fundrise, you must allocate your long-term capital to such investments. But the reality is, the longer you invest, the better the returns tend to get. Too many retail investors buy and sell public equities to their detriment.

Take things a step further, and treat your investments like enjoyable expenses. The greater your expenses, the more you will enjoy your money, and the more you will potentially make.

It’s a mental drug that I have used for over 20 years. Instead of spending money on a luxury vehicle, I will spend my money on an $80,000 investment. It feels better!

Hi Sam –

What are your thoughts regarding Fundrise’s new service “Fundrise Pro”? The service is $10 a month or $100 a year and provides the opportunity to invest directly into funds rather than strategies?

If you are into more customization and choices, $10/month or $100/year is a small price to pay. Just getting behind the WSJ paywall to read relevant articles provides $10/month in value.