Some people who critique my various budget charts are annoyed I list retirement contributions and investments as expenses. Therefore, I thought I'd explain my logic in this post.

Once you start treating your retirement contributions and investments as expenses, you will begin to build much more wealth than the average person. And once you build more wealth than the average person, your frustration will subside, and you will feel more free.

The key is to go from a defensive mindset to an offensive mindset to build more wealth. Let's start with a basic understanding of two financial statements.

Income Statement: Investments As An Expense

Below is a sample budget of a household making $350,000 a year.

The below budget can also be viewed as an Income Statement. The Income Statement only has Income and Expenses. Therefore, you must categorize any line item that is not an Income as an Expense and vice versa.

Given money must be spent to contribute to a retirement plan, a 529 plan, a mortgage, and various insurance policies, these line items are expenses. These expenses reduce the bottom line, which is the Cash Flow After Expenses line in green.

To stay consistent with the Income Statement analogy, the Cash Flow After Expenses line item should be labeled as Net Profit, as there is also a Cash Flow Statement in finance. However, nobody calls the money they have left over as net profit.

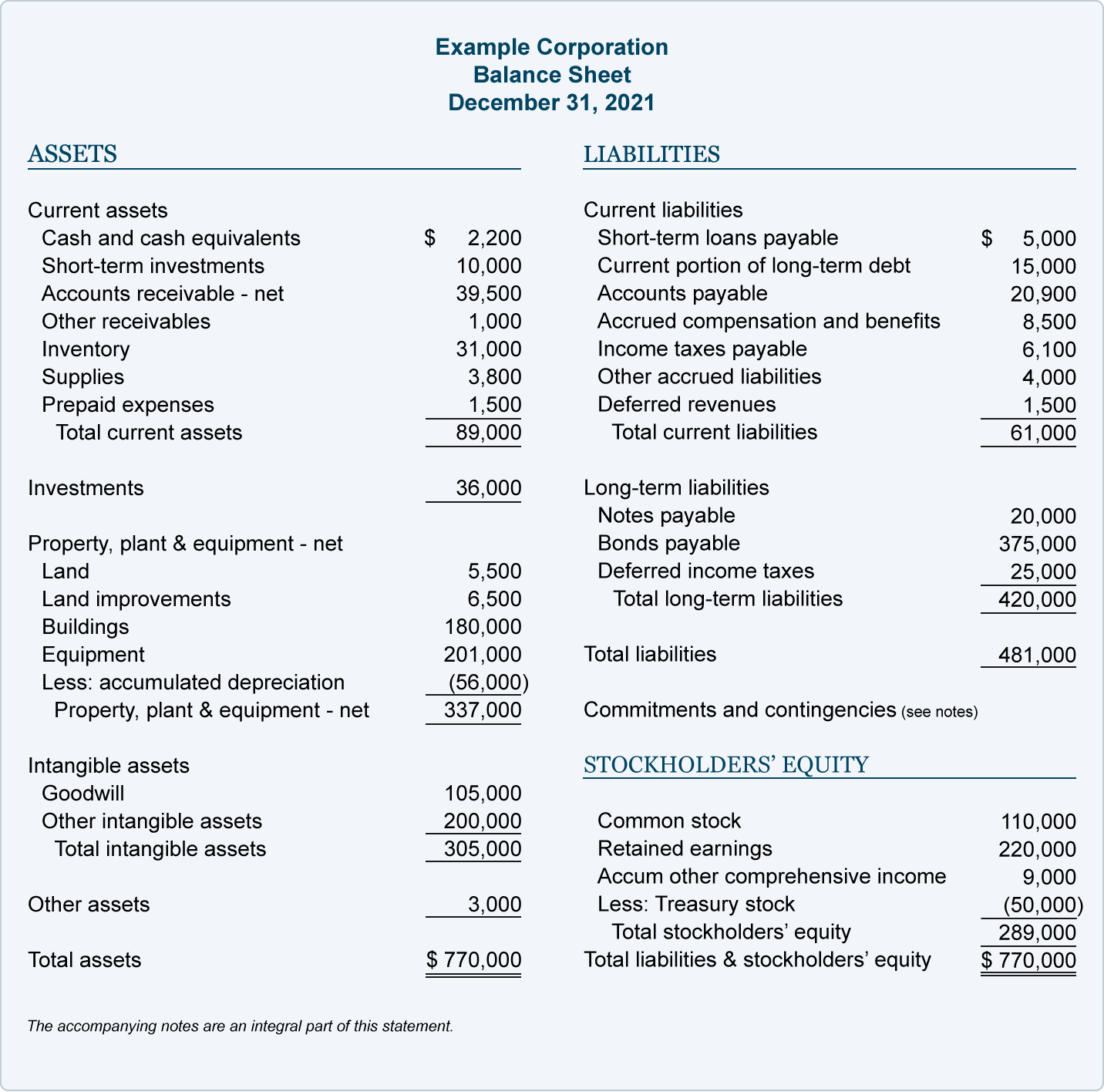

Balance Sheet: Investments Are Considered Assets

Please don't confuse an Income Statement with a Balance Sheet. A Balance Sheet is where you can label all investments and retirement contributions as Assets. Whereas an Income Statement only contains income and expenses.

A personal balance sheet essentially calculates one's Net Worth. And Net Worth is calculated by adding up the value of all Assets and subtracting the value of all Liabilities.

Over time, you hope your retirement funds and other investments like real estate grow in value. If they do, your assets and your net worth go up if your liabilities stay the same or go down.

Even if your investments are declining in value, they are not considered liabilities. Examples of liabilities include mortgage debt, credit card debt, money owed to suppliers, taxes owed, and wages owed.

Below is an example of a Corporate Balance Sheet. You can translate Stockholder's Equity into Net Worth if the below was a Net Worth Statement.

Why People Get Bent Out Of Shape About Investments As An Expense

Not having a fundamental grasp of financial statements is why most people are upset I list investments as an expense.

These folks think I'm trying to trick them into thinking a $350,000 household income family is poor with only $19 a month or $224 a year in cash flow left over. No, they are not poor. You're only tricked by what you see if you don't understand what you're looking at.

At the same time, critics correctly point out such a family is contributing $41,000 a year in their 401(k), $26,400 a year in their 529 plans, and building $25,200 a year in home equity. The total net worth contribution to such expenses is roughly $92,700 a year.

Do you want to achieve financial independence? Then, one of your goals is to minimize taxable income and maximize net worth. Once you achieve a net worth equal to at least 10X your gross income, you are close to financial independence. Once your net worth equals 20X your gross income, you are absolutely free to do whatever you want.

Difficulty Investing For The Future

Another reason why some people don't like treating retirement contributions as an expense is that investing requires discipline and delayed gratification. Sometimes, all you want to do is spend your money on living it up now. Many are logically doing some revenge spending given the pandemic is well into its third year.

Therefore, it may be hard for some people to conceptualize that in order to live a more free life later on, you must first spend by investing. Although there are no guarantees in investing, historically, investments in stocks, real estate, and other asset classes do provide positive returns.

Delayed gratification through investing is an expense. You sacrifice good times now for hopefully good times later. Those who failed the marshmallow test when they were young are likely failing the act of saving and investing enough for their future.

But I'm telling you, when you can get a six-figure capital distribution after investing just $47,000 in a real estate fund, you will appreciate the investment expense you made seven years prior.

Investments As A Luxury Expense

Some people struggle more than others to survive. When you are having a tough time affording gas and groceries, it may upset you that others can. In other words, investing is viewed as a luxury expense they cannot afford.

However, deep down, everybody knows we need to invest for our future. Otherwise, we will end up working long past when we are fully capable or want to.

So yes, investing is considered a luxury expense for those who are having a more difficult time making ends meet. Thankfully, investing in stocks is now free due to zero commissions.

We can buy ETFs and fractional shares with less than $100. We can even invest in a private real estate fund with just $10 to start through Fundrise, my favorite real estate investing platform for all investors.

Hence, investing may not be as big of a luxury expense as some might think. The more we can get educated about the power of investing, the less we will view investing as a luxury expense and more as a necessity.

Insurance As An Expense

Most people won't debate whether insurance is an expense or not. You're spending money to pay for something to protect you in the future in case of a calamity.

I will happily pay $115/month for my new 20-year, $750,000 term life insurance policy I got thanks to Policygenius because I have two young children and mortgage debt. Protecting my family over the next 20 years is paramount. Once my kids are in their 20s, they should be able to fend for themselves. My life insurance premiums are definitely an expense.

Therefore, why would anybody argue that contributing $41,000 a year to two 401(k) plans should not be considered an expense when the contributions are made to take care of the example household in retirement? Few people can and want to work forever. I fizzled out before age 35 at a traditional day job and fake retired. By the time I'm 50 I probably won't want to write as much either.

If insurance is considered an expense to protect your future, then investments should also be considered an expense.

Mad About The Amount Earned And Invested

The final reason why I think some people don't view retirement contributions and investments as expenses is because they are upset by the amounts I've highlighted.

Thanks to inflation, my $300,000 income statement from several years ago has now jumped to $350,000 today. Thanks to the government increasing the maximum 401(k) contribution to $23,000. I bumped the total 401(k) contribution for two to $41,000 in my chart.

However, if I published a $60,000 household income statement and a $3,000 annual 401(k) contribution amount, maybe that would be more “acceptable.” People would think I'm less out of touch with reality, even though we all have our own realities.

Please don't get fixated on the absolute dollar amounts. We all live in different parts of the country with different cost of living standards and tastes. I'm using these figures because $300,000+ is what it takes to live a middle-class lifestyle with two kids in San Francisco. Meanwhile, I'm always a proponent of maxing out your 401(k).

It was tough to max out my 401(k) when I was only making $40,000 and living in Manhattan. But I did so because I shared a studio with a friend. I also worked late so I could eat at the free cafeteria each night. In retrospect, the sacrifices were worth it.

Keep Your Investment Expenses High!

I was going to conclude by encouraging everyone to keep their expenses low in order to quicken their pace to financial independence. But then I realized this was a defensive way to save your way to wealth and freedom.

Instead, I'm a much bigger proponent of spending your way to wealth and freedom, which is the subtitle and core concept of my WSJ bestselling book, Buy This Not That. You should pick up a copy now if you want to build more wealth, make better financial decisions, and achieve financial freedom sooner.

Since we now all agree our investments should all be considered expenses, let me encourage you to keep your investment expenses high! Go on the offensive to win more wealth. This is a critical mindset shift I encourage everyone to adopt.

At the end of the day, you want your investments to generate as much passive income as possible to be free. If you have to live paycheck-to-paycheck to make financial freedom happen, do it. Depending on where you are, your investments could be your largest expense of them all!

Invest In Private Growth Companies

One investment expense I'm excited about is investing in private growth companies post-pandemic. Private growth company valuations have come way down, but the opportunities are greater than ever before.

Companies are staying private for longer, as a result, more gains are accruing to private company investors. Finding the next Google or Apple before going public can be a life-changing investment. I'm spending $500,000 over the next three years by investing in venture capital funds that invest in AI.

Check out Fundrise Venture, an open-ended way to invest in venture capital with five areas of growth:

- Artificial Intelligence & Machine Learning

- Modern Data Infrastructure

- Development Operations (DevOps)

- Financial Technology (FinTech)

- Real Estate & Property Technology (PropTech)

A sizeable amount is invested in artificial intelligence, which I'm extremely bullish about. In 20 years, I don't want my kids wondering why I didn't invest in AI or work in AI.

In addition, the investment minimum with Fundrise is only $10. Fundrise also provides a lot of transparency and lets you see what they're investing in before you become a shareholder. In contrast, most traditional venture capital funds have a $250,000+ minimum and require capital commitment upfront before they launch or reveal current holdings.

Join 65,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009. Treat Your Retirement Contributions As An Expense is a FS original post.

Thank you! I love this post. The behavioral finance posts you’ve put out over the years have helped me tremendously. Tracking my investment expenses on my income statement is perhaps the best!

Many thanks for your points and all your work, Sam. Great insights and always great discussions with your other readers.

Perhaps you can discuss how do you prepare your personal financial statements as well. I still use Microsoft Money even though it’s been discontinued for over 10 years. I just can’t find a better alternative to reconcile the downloaded statements from banks and credit cards—but all the investment part is painfully manual—and export to excel to play with it all. Even the reports and other tools are still hard to beat.

What do you and other readers use?

I’ve used Personal Capital to track my net worth since 2012. It feels good because it updates automatically once I link up the accounts.

Ah, forgot to say that I’m in the UK. Sadly PC is not available over here.

Kubera Offers Functionality Like Personal Capital to UK Citizenshttps://www.kubera.com

I use Banktivity (Mac only). I had used MS Money for a very longtime. I was so disappointment when it was discontinued. If you’re looking for a desktop platform, Banktivity is incredible. It syncs to my iPhone and iPad. I tried 5-6 platform before landing on Banktivity. The capability of different financial web services are much better, but I really wanted something on my desktop

how do you categorize your investment expenses in Personal Capital (Empower)?

I categorize them as investments. But funny enough, in my weekly email, digest from Empower, a lot of my investments are categorized as pending.

Long-time reader, appreciate your transparency through the years and your data-driven and experience-based approach. Can’t wait for the hard copy of your book to arrive at my doorstep.

How would you approach differentiating long-term vs short-term investment and saving “expenses” in the income and expense statement? Example: saving for a second (or third) rental property (short-term via CD ladders, cash in FDIC money market savings, etc) and saving for FIRE (long/mid-term brokerage stocks, long-term bonds, fundrise)?

Also, I don’t see FDIC savings or bond allocations in your expense and income statement. I assume this means these are fully funded and/or no plans on additional contributions to these types?

Love your content, keep it up!

I know you’ve mentioned the 20x gross income figure many times before, and I’ve been meaning to ask about the assumptions behind it. To take an easy example:

1. Someone is earning 100k a year at a full-time job at a company that provides health insurance

2. They have an effective tax rate of 30%

3. They save 20% of their gross income (in this example they could do that all pre-tax).

4. That would leave them with a budget of 56k while employed

If they were to retire,

1. Their effective tax rate would certainly go down- lets be optimistic and assume it goes down to 10% of their income post retirement

2. They are no longer saving 20%

3. But, they now have to pay their own health insurance premiums. Let’s say that’s 20k a year for a family of 3.

4. So, they now spend 56k + 20k = 76k / .9 = $84k

5. $84k/$2M = 4.2% as the effective withdrawal. Maybe doable but seems high especially for an early retiree

So to clarify- what assumptions did you have when you created the 20x gross income rule of thumb?

$2 million is the number I think one will feel financially independent to do whatever. And it actually meshes with my Wealth Reality Ratio if you want to check out it’s assumptions.

20X is based off my own experience, continued low rates and lower future returns of 3-5% per annum, a 90+ median life expectancy, the goal to preserve capital and mainly only spend income, and to not cheat by using a multiple of expenses.

There are so many variables one could use. My ideas to simplify and have each person make adjustments that fit their desires and lifestyle.

Once your net worth is equal to 10 times your annual gross income, that is when you start feeling a significant amount of financial independence and momentum.

I just plugged in my family of 3’s numbers into your P&L model in a low cost of living city (Knoxville, TN). We make almost exactly $350k as a family. My free cash flow was $164k for the year. Biggest variance was housing, (no mortgage, $3k ptax), private preschool ($0=public school) and the 529 plan ($1,200/yr).

Seems like if you can purchase a house in a district with good public schools it’s the biggest return on investment. It’s as if your house is producing $30k of cash flow per year (avoided private school cost).

I should probably boost my 529 contributions to around $4k per year but $25k/yr in the 529 plan would most likely overfund my 4 yr old’s education.

Not bad! Hope you are saving and investing your free cash flow and enjoying life!

Check out this post: 529 Plan As The Ultimate Generational Wealth Transfer Vehicle

Because of your blog I’ve been putting that free cash flow into Crowdstreet. I’ve had the first deal close that amazingly had a 104% return over 14 months in Raleigh, NC. I just wish I would have invested more in the deal. Thanks for the great commentary on Real Estate investing.

Wow! Amazing. I wish I had invested in that deal too Raleigh, NC has been so strong over the past several years. I just got a massive distribution in July as well from my fund.

With the real estate market slowing, the timing for the distributions is good. Now it’s time to be patient and hunt for better deals coming.

With a 104% return in 14 months, I hope you use some of the proceeds to pick up a hardcopy or three of my upcoming book, Buy This, Not That. I think you’ll love it.

I think you’ll find that property taxes in good school districts also tend to be higher. As an example, the suburbs of NYC and Boston have some of the best school districts in the country but also some of the highest property taxes (both in absolute dollars and in terms of % of property value). If you have more than 1 school age child, yeah, you’ll definitely still come out ahead vs private school for sure…but it’s still going to be expensive.

I guarantee everyone who is against your model buys a stock based on????? Everyone should know how to read a income statement and a balance sheet and a cash flow statement. Otherwise index funds are for you. Teach this shit in schools!!!

Sam, thanks for continuing to do what you do.

A few years ago I started generating the basic financial statements for our family (Income, Cash Flow and Balance Sheet); building them dynamically throughout the year and freezing them at year’s end. While they didn’t necessarily change our behavior, they helped clearly show how we are progressing toward our goals. Absolutely agree that adding to retirement accounts and other investments are prioritized expenses.

While I guess I wouldn’t qualify for the “E” in FIRE as I’m now 55, I am set to retire in a few months with investments greater than 20x employment income. Fully contributing to all available tax advantaged accounts (401k max, later transitioned to Roth 401k max; combination of IRAs, Roth IRAs, and when possible backdoor Roth IRAs, deferred compensation, 529, Donor Advised Charitable Account) has been the biggest factor in being in the position we are in.

Thank you again for all of your insight and advice.

20X employment income is the magic number. Congrats! Maybe the one last move you can make before you leave is to negotiate a severance. Or if you have a pension, congrats again!

55 is still early. I hope you retire to something fun and purposeful!

Sam, thanks for the well-wishes. I too hope retirement will be fun and purposeful. Like so many “big decisions” in life – where to go to school, who you marry, having children, where to work, where to live, move when requested, take a major chance or not…. one can’t do control experiments to see how things would have turned out if an alternate path were taken. You make whatever those major decisions you choose to be “correct” and make them successful. With that thought, I have very high optimism for a fun and purposeful retirement.

I did not pursue negotiating a severance for several reasons, but do have a (sadly, much disappearing) lump sum pension (to be rolled over to an IRA) that adds several multiples of income above the 20x to the equation — should be noted that took sticking with the same company for 30 years (also sadly, much disappearing) through good and bad times.

Thank you again.

Ah, I would not go running into the FIRE movement unless you have a back-up for health and dental insurance because Medicare does not kick in until you are 65. Good corporate health and dental insurance is a plus and the ACA coverage sucks! GLTA.

You hit the nail on the head. My wife and I use YNAB for household expenses. Every month I’m crying we don’t have any cash left over. Well, that’s because we have 60+% going toward investments. We got a late start, so here we are. I’m still trying to find ways to cut my food budget and discretionary budget to squeeze out more for investments. Any extra money left over goes to investments. Pay now, or pay later is my mantra. I must admit, I look at my food budget and gym membership/personal trainer as a health investment, so I won’t fool around with it too much. Again, pay for healthy foods now, or pay the doctor later. I love your work Sam! When you take a well-deserved break, it’s going to b tough without you. You give so much added value! thank you!

You’re welcome!

“ I look at my food budget and gym membership/personal trainer as a health investment, so I won’t fool around with it too much.”

I like this! I’m going to change my thought on food and club memberships and stuff as an investment in health. Because I don’t want to pay for being in poor health later.

This thought change should help me eat less and better, while also playing more tennis and using my club’s gym more.

Thanks!

We have similar mindsets regarding food and exercise as a health investment. When I was working through college a few decades ago, I could barely afford to eat, never mind eating good quality food. I swore when I could afford good food, I would never skimp on quality. I had the same exact thought: pay more for healthy, nutritious food now, or suffer later.

I think what actually bothers most people about the idea that expenses includes investments is some combination of:

A. The idea that your investments are not actual things you have bought, but that your investments account is a strange bank account with a variable and sometimes negative interest rate. I’d never call it an expense to move money from my checking account to my savings

account, so why would I call it an expense to move money from my savings account to my super duper savings account?

B. It complicates retirement planning to list an expense you know is going all the way to zero when you retire in your expenses. By this logic every time I increase my annual investment saving by a dollar my amount needed to retire goes up by twenty dollars! Because I’m trying to save 20x my annual expenses- so money that sits idle in a savings account doesn’t increase the amount of money I need to retire, but the money that I spend on the ‘expense’ of investments always increases my account target by 20x it’s size. It confuses the language around multiplication rules.

I think the misunderstanding comes form the terminology. I think “cash flow statement” would be more appropriate than “income statement” in this case.

In a “cash flow statement”, we show all “money in” and “money out” regardless of whether they are considered as an expense or not, and we don’t show revenues unless they hit the bank account.

This is not necessarily “good” or “bad”. This is only different information. The cash flow statement is good for managing our bank accounts. The income statement is better to see how we are doing overall in growing our wealth.

Personally, I also include my investment revenues in my “income statement”, including any gain or loss in value. This help me focus on generating profits on my investments. Obviously, sometime they are up or down for no real reason. But in the long run, I want to make sure they are going in the right direction.

Agree. Investments are costs on the cash flow statement but not on a company income statement, though depreciation is an expense on the latter.

Another good reason to treat investments as expenses is that, as you mentioned in a prior article, when you retire your expenses are automatically lowered because you are no longer saving for retirement but actually loving it. So naturally you should need less income with the same lifestyle and still be cash flow neutral.

I would think anybody that subscribes to the “pay yourself first” mindset would think of investments as an expense. Whether you use that word or not, that seems to be one of the biggest consistencies across all the personal finance resources out there, whether it is the wealthy barber method of take 10% off the top and invest, breaking out as you do in your spreadsheets, Millionaire Teacher or any of dozens of other books, blogs and videos I consumed.

I think people get put off by the numbers because they don’t apply to 95% of the population. I know I’ll likely never make that much for an annual salary at this point in my life, being in my late 40s and living in the mid-west vs a coastal city witth a much higher cost of living. I’m doing fine and simply happy that I can realistically think about retiring one day in the not too distant future. I won’t have the numbers that are regularly talked about here, but I’ll have enough. There are many of the posts here that I feel are not for me, so I move past them. Not worth the time getting mad or frustrated or whatever. As you’ve said many times over, people have different lives based on where they are living and most of your writing comes from your direct experience.

Also, the consistent pushing for maxing out retirement accounts probably gets irritating to some people. I was only ever able to do that once in my 28 year career so far. You can get very far by consistently putting away a meaningful percentage of your income every year. I would argue maxing out your retirement accounts is not desirable if your target is FI, anyway. Sure there are ways you can get to that money before 59 1/2, but it’s much easier to have funds outside of retirement accounts if you plan on exiting the workforce before retirement age.

As always, appreciate the content.

All great points. Thanks Mike.

Rationally, if I want more people to like me or get more readers, I should probably use budgets in the $40,000 – $80,000 range.

However, I’ve also got to stay true to my own experiences and environment as a 45-yo living in expensive SF with a family. Part of the process of writing out an aspirational budget is to work through our household expenses and optimize.

So I need to share more stories and have more guest posts from people of different economic levels and ages.

This is a good post doing just that with someone retiring with $600,000: https://www.financialsamurai.com/overcoming-money-trauma-retired-to-taiwan/

I’ve always aimed to save 30-50% of my gross income. If you treat that percentage as an expense every month, you will be able to stay disciplined and reach FI earlier in your life. Save and invest first, then live on the rest. It’s a simple concept, but yet, many cannot master it. Great article, Sam.

Post FI Doc

It’s funny I never thought about my investments like an “income statement”, but I have always thought about them as expenses that I had to incorporate into my budget. So I totally agree with your logic.

When I was first getting going in my career it was tough to save beyond my living expenses, but I wanted to put my extra cash flow towards my future as much as possible. I didn’t want to ever have to rely on my parents again and financial independence was a huge priority for me. So I had to budget saving and investing into my monthly cash flow. And yes treated my investment contributions as an expense I had to put money aside for each month.

My wife and I are contributing up to $25,000 for my daughter’s wedding. How would that appear on an income statement?

It would be an expense that lowers your cash flow.

Speaking of expenses that feel good…

Every year, when I add up my expenses, whether it’s food, car payment, etc., I cringe a bit, but when I see that my investment family support expenses increased, it puts a smile on my face.

A great way to look at investment expenses! It DOES feel good because even though it’s an expense now, it will hopefully provide rewards in the future.

It’s the same thing when I look back at how much principal was paid down on a mortgage. An expense! But damn it feels good to have less debt and more equity.

Great article Sam! I agree with most of this, though I find your vacations line low and also didn’t see anything about investing after tax income in brokerage accounts or other investment vehicles (eg., real estate crowdfunding, etc.). Can you comment on these things? Would love to see a future post with the personal balance sheet view.

People think they need to invest a lot in order to earn a lot and get disheartened. But you gotta start somewhere. As you pointed out, you can buy fractional shares and put money in your brokerage account on a regular basis to save up enough to buy. It’s about establishing the habit and paying your future self first. When you see things like compound interest and dividend payments working and hopefully market gains, it will motivate you to invest higher amounts.

This is exactly what every company is forced to do. R&D is an expense on the balance sheet, even though it can lead to even greater sales and valuations.

I’m glad you took the time to explain the logic; for someone who might not be familiar with accounting and it’s rules it can help going through the logic.

I 100% agree with investing for the future — deferred gratification — as an expense. As a teacher I never earned more than $75k annual gross. Despite a late start to learning about investing, thanks to generous benefits and a good retirement plan I retired at age 70 with $2M. Thank you for this well-written, well-reasoned article.

Amazing! And well done planning, saving, and investing so consistently over the years.

I hope you will enjoy your wealth to the fullest!

[somewhat sarcastic] Funny people complain about this. If we’re bringing corporate accounting into this, maybe we should include investments as a “below the line” expenditure of cash, like capex

All your posts are always out of touch for most people. What percentage of hh make 350k a year?

It’s around a top 5% household income.

See the sections toward the end entitled:

Investments As A Luxury Expense

Mad About The Amount Earned And Invested

Why does the household income amount matter when treating investments as an expense? How does the example hold you back?

Maybe you will appreciate this post more: https://www.financialsamurai.com/achieving-financial-independence-on-a-modest-income/

This is a great article. I consider myself “investment poor”. I won’t speak for Sam but I visit FS to be with other like minded people that strive for above average wealth. Opposed to being upset it would be better to try to figure out a way to save more and or increase your yearly income.

Good attitude! I could certainly use average or below average income, net worth, and other target figures. But I find it motivating to strive for above average. And if we don’t achieve it, that’s fine. But we will most likely do better than if we strived to be average.

I’m grateful for your articles Sam. Most other personal finance blogs work with lower budgets, but some of us make more and need advice too. As you said, your advice works no matter the quantum so people need to stop being sour grapes and start investing no matter how much or little.

@Salim – Chin up man! did you not see Sam’s paragraph below?

“Please don’t get fixated on the absolute dollar amounts. We all live in different parts of the country with different cost of living standards and tastes. I’m using these figures because $300,000+ is what it takes to live a middle-class lifestyle with two kids in San Francisco. Meanwhile, I’m always a proponent of maxing out your 401(k).”

Try to switch to a positive can-do mindset and focus on the theme of the post. Use whatever numbers make sense for you. Every bit invested counts and will make a difference over time thanks to the power of compounding!