Bonds don't get as much love as stocks because they are considered boring. It's hard to get rich quick off a bond. But it is possible to see a quick windfall if you pick the right high-flying stock.

Despite the lack of sexiness in bonds, if you're serious about achieving financial independence or are already financially independent, bonds are an integral part of your portfolio. Just look at how well bonds have done during the coronavirus pandemic versus stocks.

As my wealth has grown over the years, so has my appreciation for bonds. Bonds have not only provided me tax-efficient income and peace of mind in my post-work life, bonds have also provided me a solid return since I graduated from college in 1999.

Stocks Versus Bonds Performance From 1999 – 2020

Take a look at the Vanguard Total Bond Market Index Fund Investor Shares (VBMFX in blue) and compare it to the Vanguard Total Stock Market Index Fund Investor Shares (VTSMX in red).

Bonds outperformed the stock market from 2001 to about 2013, or for 13 years. Since 2013, stocks have outperformed bonds. In other words, bonds outperformed stocks at about a 2:1 ratio during this 20-year time period.

The way I look at the chart above is that stocks are way above their 20-year trend relative to bonds. Therefore, I'm underweight stocks. You've got to figure out how much you're comfortable losing for the potential reward.

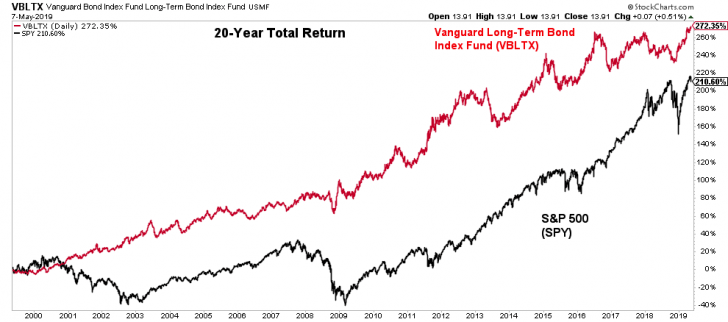

In another chart below comparing VBLTX (bonds) to SPY (stocks), it looks as if the total return (capital appreciation + interest payments) for long-term bonds since 1999 is 272% versus 210%. This shows the power of interest payments as VBLTX currently has a ~3.73% yield. However, it is unclear whether this chart is accurate since it's hard to replicate the performance comparison.

Peace Of Mind In Retirement Rocks

Once you've amassed enough money to not have to work a day job, one of your key objectives is to move your money into the background so you can live your best life without having to worry about money.

As a stay at home dad now, I no longer have the time or energy to do extensive research on my investments and watch the stock market for hours like I used to.

Instead, what little spare time I have left is spent either writing, playing sports, coaching or napping. Sometimes my wife and I will go out for a nice meal or order an in-home masseuse.

At this stage in my life, the certainty of getting a 4% – 6% return is a far more desirable outcome than the potential for getting a 15% return or suffering a 15% loss. It is up to all of you to calibrate how much stress you are willing to feel for your potential return.

Below highlights the worst year for bonds was a 2.9% decline in 1994. The worst year for stocks was a 38% decline in 2008.

A negative 2.9% loss as the worst year means that bonds performed better than negative 2.9% in 2008, the worst financial crisis year in modern history. After adding back the interest payment, VBLX was only down about 1.5% in 2008. I'll take it!

If you are already truly satisfied with your financial achievements, then you should also be finding bonds attractive. If you aren't willing to have a sizable bond portfolio (20% or more of your net worth), it's probably because you are still not as content as you think.

What About The Future Of Interest Rates?

Ever since I started working in finance in 1999 and ever since I started writing online about stocks and bonds in 2009, there's been a plethora of warnings about interest rates going up. And if interest rates go up, bond prices get hit.

I will reiterate my strong belief that interest rates in America will stay low for the rest of our working lifetimes. Interest rates have gone up post pandemic to tame inflation. And now bonds are trading at extremely attractive levels.

I believe interest rates will go down. There is no reversing technology that allows information to flow instantaneously to make better macroeconomic decisions.

It will take beyond our lifetimes for the US dollar to lose its stranglehold as the world's most sovereign currency.

Foreign entities that try to aggressively unwind US Treasuries will suffer self-inflicted wounds to the rest of their US asset portfolio.

Thanks to globalization and immigration, we have successfully imported deflation to make our goods and services more affordable. Electronic goods and manual labor have never been cheaper.

The only real inflationary concern left for consumers is healthcare costs. Looking at how unfit our nation has become, something has to give.

Ripoff college tuition doesn't concern me as much because spending a fortune on college is a choice. And further, people are wisening up that college is increasingly becoming a bad investment.

The Consumer Keeps On Winning

Perhaps there's another reason besides strong performance since 1999 as to why some investors love bonds so much. The stronger bonds perform, the more the investor is reminded about lower rates.

The 10-year-bond yield and mortgage rats keep heading down partially due to stalled trade talks between the US and China, the surprise new 5% tariff imposed on Mexico, the coronavirus and collapsing oil prices in 2020.

I mentioned that I had failed at getting the then lowest mortgage rate possible of 2.875% for a 7/1 ARM with fees baked in. Instead, I had locked in a 3%, 10/1 ARM with fees baked in.

But never one to quit, I called my bank after the recent decline in interest rates and told them I wanted a rate renegotiation down to 2.875% like it had initially teased me to lock with them. If they didn't match a competing bank, I would walk.

In the end, they acquiesced and I actually refinanced to a 7/1 ARM for 2.625%. With interest rates where they are, my bank will likely still be making the same spread it had when it was going to lend me money at 3%.

For those who missed the previous mortgage refinance window, now would be an excellent time to check online for the latest mortgage rates and call your existing mortgage lender.

Credible is my favorite lending marketplace to get pre-qualified lenders competing for your business for free in under three minutes.

Winning Three Times

Consumers should feel like they are at least winning twice. Once as a bond investor making a continued positive, steady return. And once as a borrower who gets to lower their mortgage payment and boost cash flow.

When you can combine making money with saving money, you have hit a personal finance jackpot. Check out the performance of various bond funds as of 2020 below! But of course, bonds ended up crashing from 2022-2023 given the Fed aggressively raised rates.

But there's a third win for bond investors who are also homeowners and real estate investors. That win is seeing your property and real estate investment grow in value as lower rates bring in more demand. After all, a home is like a bond, but with a valuable utility component.

The last thing you want to do is be a renter who does not invest in bonds or stocks or any investment that tends to appreciate over time. You will eventually experience a triple loss as asset prices will likely run away from you.

There's just one big warning sign we should all be aware of. Lower bond yields are correlated with slowing economic growth. The bond market is telling the Fed to stop hiking and potentially start cutting.

The key is for the economy to have a soft landing and for policy makers to avoid self-inflicted wounds. But even if we do have a multi-year recession and the worst trade war in history, the optimist in me says that bonds will continue to do well as investors flee to safety.

Invest In Private Growth Companies

Finally, consider diversifying into private growth companies through an open venture capital fund. Companies are staying private for longer, as a result, more gains are accruing to private company investors. Finding the next Google or Apple before going public can be a life-changing investment.

Check out the Innovation Fund, which invests in the following five sectors:

- Artificial Intelligence & Machine Learning

- Modern Data Infrastructure

- Development Operations (DevOps)

- Financial Technology (FinTech)

- Real Estate & Property Technology (PropTech)

Roughly 35% of the Innovation Fund is invested in artificial intelligence, which I'm extremely bullish about. In 20 years, I don't want my kids wondering why I didn't invest in AI or work in AI!

The investment minimum is also only $10. Most venture capital funds have a $250,000+ minimum. In addition, you can see what the Innovation Fund is holding before deciding to invest and how much. Traditional venture capital funds require capital commitment first and then hope the general partners will find great investments.

Related posts:

The Proper Allocation Of Stocks And Bonds By Age

30-Year Fixed Or ARM? The Choice Is Clear

Refinance Your Mortgage Now As The Yield Curve Inverts

Any bond-investing homeowners profiting thrice or more in this environment? Are you surprised that bonds have thoroughly outperformed stocks since 1999? Why aren’t bonds more talked about in financial circles? How are you investing your money today?

I am retired (for the last 5 years) and have been primarily a tax free muni bond i investor for the last 30 years. My home is paid off but I like your idea of mortgaging my house at the current low mortgage rates. If I mortgage my house, where can I invest the money to get a good return with no risk of losing my investment?

3% on a 10/1 ARM is really really good – when did you get it?, I just got 3.25% for 10 year ARM and I was thinking I got a really good deal.

Wells Fargo is offering incentive based pricing.

You can definitely get a 7/1 or 10/1 arm for under 3% now.

If you buy VBMFX, hold long term, and interest rates stay flat then you should expect earn the yield-to-maturity of the portfolio, which is 3%. At the end of the day, you’ll get a real return of 1% assuming 2% inflation. Bonds have a place in terms of protecting accumulated assets, but without taking on some additional credit risk, you shouldn’t expect bonds to add much in terms of real returns in this interest rate environment. Depending on your views of inflation and short term interest rates, I-bonds/TIPS or savings accounts may be good alternatives to vanilla bond funds.

Staying 1% ahead of inflation with limited risk is all a lot of retirees need.

Check out the 4% rule.

Zero-coupon bonds issued in the U.S. retain an original issue discount (OID) for tax reasons. Zero-coupon bonds often input receipt of interest payment, or phantom income, despite the fact the bonds do not pay periodic interest. For this reason, zero-coupon bonds subjected to taxation in the U.S. can be held in a tax-deferred retirement account, allowing investors to avoid paying tax on future income. Thanks for sharing a great article.

I’m really surprised bonds outperformed stocks in the past 20 years. But then in 1999, the market was red hot prior to the IT bubble busting. It probably wasn’t the best time to get into the equity market then.

I wonder if you dollar cost average every month into the equity and bond markets for the past two years, which one would do better.

Sam, what do you think an investing strategy using REITS instead of bonds? I know REITS are more like real estate flavored stocks, but if you never plan on selling REITS but instead hold onto them indefinitely and use the yield, would you create a similar situation of good cash flow because of the higher yield compared to bonds?

I increased my position in REITS with this buy and hold indefinitely mentality. Because the majority of cash received has to be passed on to investors, I would think that even if the value of the REIT declines, you still would get a decent dividend.

Bonds are overpriced and have been for awhile. Try and find an investment grade bond with a decent coupon or YTM at a discount. You’ll pay a premium all the time. Let’s put things in perspective. Currently, the S&P 500 PE ratio is 20x. It was 40x in 2001 before the bottom dropped and 25x in 1990 when the Dot.com boom ended. In 2009, the S&P PE was well over 30 before the market tanked due to the financial crisis. Stocks historically correct when the PE hits 20 or above and if there is a calamity such as the Dot.com bust or a recession, stocks will decline rapidly. The inverse PE or earnings yield for the S&P is 4.91. That would be the equivalent to a bond yield or YTM which is very competitive to bonds. I don’t think bonds will provide a return above inflation because the government lies about inflation. Second, the fix is in. The bond market is not efficient. It’s been annexed by central banks designed to keep interest rates low to finance a national debt that is beyond comprehension and repair. I think REITS are a great substitute and have been a great long term investment. I would even look at preferred stocks as well. You can get a better yield and usually trade between 23-25 per share range. If you still have over 11 years to go before retirement, I would certainly be comfortable investing in quality dividend paying and growth stocks with REITS and Preferreds. Keep 10% in cash for opportunities. Bonds are broken.

I love REITs. They’ve been a juggernaut over the past 10 years And I expect rates and real estate crowdfunding to continue to do quite well over the next 10 years.

See: https://www.financialsamurai.com/annualized-returns-by-asset-class-from-1999-2018/

Hi Sam,

I closed on a house today in Northern Virginia. I sold my townhouse two years ago for a nice (tax-free!) gain because at the time I was planning to relocate to Boston to be closer to my elderly father. But my job there didn’t pan out, so I will stay here and bring my dad to live with me.

I took much of your advice to heart. Home sale price was $950k, and I was able to put down $300k, and this sum was mostly the proceeds from my town home sale that I had invested in stocks. I got a 7/1 ARM at 3.5%, and my mortgage payment will clock in at just a hair above 27% of my monthly gross income. So I think I bought exactly as much house as I can afford. It feels good to have an asset in which I can live rather than just looking at numbers on a computer screen. Again you can see how your advice has colored my thinking here.

So thank you very much. I’ll be sure to pay it forward. But at the same time I recall NOVA is one area you are considering moving to. So please let me know if you have any questions about the real estate market here, or just want to hear more from one person’s perspective who just bought back in!

Joe

Congratulations and enjoy the home!

> The last thing you want to do is be a renter who does not invest in bonds or stocks or any investment that tends to appreciate over time.

Let’s say I have a “friend” who is renting right now and saving for a down payment to enter the San Diego real estate market. This friend has a time horizon of < 5 years. Where should I tell him to put his money to maximize his savings for a down payment?

I think there is an article somewhere on here about this.

High yield savings or CDs.

Under five (5) years equities and bonds are too volatile. Risk of losing capital is too great.

Also, under a five (5) year window compound interest wouldn’t account for much anyways.

Your down payment will be determined by your ability to horde as much currency as possible without risk.

See: https://www.financialsamurai.com/how-to-invest-your-down-payment-if-youre-planning-to-buy-a-house/

Utilize my search box or type in what you want in Google plus the words Financial Samurai. Chances are higher after 10 years that I have covered the topic. Good luck!

Thanks Sam! You’re actually the best.

I’m 61 now and for all my years of investing have been heavily tilted toward equity index funds. Over the last few years, I’ve made a move toward bonds, REITs and home equity through accelerated payments to reduce our principal.

I’m considering moving some money into CDs that, along with some savings bonds I’ve owned for years, gaining interest of ~3.5%, would cover the balance of my mortgage if our incomes ever took a major hit. CD interest of 3% would be double the return of the remaining interest I have on my mortgage so this seems to make better sense than just paying it off.

For the most part, I’ve resisted the move to safety but at this point in my life, I think it is time to be smart and reduce some of our market risk without giving up too much return.

I am 60 years old and slowly moving in this direction. I think this is a smart move. I want no part of a 2008 equity meltdown to be part of portfolio but I still need my balances grow.

For this I used VBMFX and VTSMX (instead of VBTLX and VTSAX) because that pair has longer price history data and the performance is similar. It is just investor shares versus admiral shares of the same fund.

https://www.portfoliovisualizer.com/backtest-portfolio?s=y&timePeriod=4&startYear=1999&firstMonth=1&endYear=2019&lastMonth=12&calendarAligned=true&endDate=05%2F28%2F2019&initialAmount=10000&annualOperation=0&annualAdjustment=0&inflationAdjusted=true&annualPercentage=0.0&frequency=4&rebalanceType=1&absoluteDeviation=5.0&relativeDeviation=25.0&showYield=false&reinvestDividends=true&symbol1=VBMFX&allocation1_1=100&symbol2=VTSMX&allocation2_2=100&total1=100&total2=100&total3=0

You can get an interesting article out of it. Try the options at Portfolio Visualizer for annual withdrawal or contribution and observe how the performance changes. And you can observe how higher volatility is good when contributing and lower is better when withdrawing.

I didn’t believe it when you said real estate index (VGSIX) outperformed stocks but that one is actually true, this one isn’t.

Regarding your thoughts on Winning Three Times I would suggests that these benefits also apply, and possibly to a greater extent, to real estate investors and not just homeowners.

For those of us that are early into our careers and not settled, high transactions costs and unknown future maintenance costs, make homeownership less attractive. I have relocated 5x for jobs over the past 10 years and would have been foolish to purchase a primary residence at each stop. Renting allows individuals like me to know our monthly living expense and provides maximum flexibility to pursue new and better opportunities as they arise. However, owning rental real estate has enabled me to capture similar benefits while maintaining my overall flexibility.

Another group that this probably applies to are higher net worth individuals whose primary residence maybe a smaller portion of their real estate holdings than the average American. I would imagine this situation would apply to a lot of your readers.

I agree with your points! I focused on stocks when I was young and it paid off pretty well. As I’ve aged and become more conservative in my risk profile, I’ve been increasing my bond exposure and it’s something I feel happy with. There will always be some who believe certain ways of investing are “wrong” but investing is personal and should be. I do believe in the overall logic that more bond exposure is beneficial as one gets older. I’m at a happy balance right now in my allocation and plan to continue revisiting it each year as I get older.

Agree with the overall concept of the article, but I disagree with your assertion that in the long term bonds are a better investment than an S&P 500 index fund like SPY. The graph you show is misleading since the S&P 500 performance over the timeframe you used (the last 20.4 yrs) is only 5.8% (assuming cont. compounding and reinvested divs), but this is well below the long term performance of stocks. If you expand your timeframe to the total return performance of VBLTX since inception in 1994 to present, versus SPY over that same period, you’ll find that over that 25.2 yr timeframe stocks had a total return of 8.9% while bonds were 6.9%. These returns are much more in line with long term averages. Personally, I’d skip bonds and allocate money into REITs and/or direct ownership of RE in place of bonds, with the rest in stocks. RE is a superior bond proxy in my view. If the pot of money is large enough, you can live off the dividends from the stocks and REITs… who cares if the market price is more volatile… they will maximize your net worth in the long run, and isn’t that the goal for financial independence?

Not to mention, that Bond performance includes the biggest appreciation of bond prices in the history of the country. Bond prices since 1980 have gone straight up. They don’t have much more to go but in theory could go down a lot if inflation really took off or defaults ticked up..pension time bomb + healthcare could cause a lot of munis to lose value.

I also would prefer a nice dividend portfolio over bonds, not exclusively REITs but definitely a hefty chunk.

Your comment misunderstands the nature of bonds (and treats them like stocks).

Remember–unlike stocks–bonds have a fixed time horizon. In general, they are short-, medium-, or long-term. They also have a creditworthiness component (e.g., agency, investment, junk). The idea they “could do down a lot” because they’ve gone “straight up” is neither true nor sensical.

Bonds prices (i.e., bond funds) will go down based upon significant credit degradation or a rise in interest rates. But, bonds will not go down due to “a lot of inflation” by itself.

A lot of inflation, however, would be met with an increase in interest rates. That, in turn, would cause the nominal prices of “bond funds” to fall (depending, especially, upon the duration of the bonds, with longer-term bonds falling most), but it would also cause the amount those bonds return to rise. For those with longer horizons (generally, matching the duration of the “bond fund” at issue) or for those holding bonds to maturity, the rise in rates is immaterial.

This discussion also glosses over the anticipation that there will be a material change in interest rates. If you believe, as Sam does, that “interest rates in America will stay low for the rest of our working lifetimes,” then (provided you invest in higher-grade bonds) there’s nothing but upside. In fact, if interest rates stay as low as predicted, longer-term bond funds would be best.

As for the “time bomb” in pensions and healthcare for munis, I think you overestimate its impact. First and foremost, it’s a well-known risk in certain markets so it’s relatively easy to diversify around it and select on higher-grade bonds. Second, it’s not a binary event that will impact all markets nor will it all happen at the same time. And third, what makes you think the governments promising those pensions benefits, for example, will not simply rewrite the deals? It’s already happening. And last, not that I am a proponent of this necessarily, but if the worst happened in the pension market, you can rest assured there would be a government bailout and/or tax increase to bridge the gap. Municipalities need credit and they will not default as casually as a corporate debtor — also bankruptcy is not an option for all municipalities.

As for the discussion of REITs, they’re fine but they have serious tax implications that are materially different from bonds. For tax-advantaged accounts, REITS may make sense, but they are quite volatile and not everyone has the stomach for them. For non-tax advantaged accounts, it’s hard to see REITs as being a big benefit over other choices.

And that brings me to my final point: taxes. Most of the investment wizards online forget about taxes in discussing investment vehicles, but taxes are critical. A municipal bond is treated differently than a corporate bond, and even within the muni range, there are different types of bonds (private activity bonds, for example) which have different tax implications. REITs throw of high yields, but they are taxed as ordinary income. Stocks are fine, but some dividends are QID (qualified income dividends) with favorable tax rates whereas many others are not … Unless you are in the lower tax brackets, these issues are really important and, for some reason, widely ignored.

Trust me, I do not miss-understand the nature of bonds (and other debt such as term loans, CMBS debt, etc). I have done multiple roadshows to sell the damn things to the tune of billions and speak regularly to the credit rating agencies. The single biggest determinate of interest rates of bonds besides credit worthiness is inflation expectations.

Yes, yields will go up if the value of bonds go down but that does nothing if you need to sell a 15 year bond 5 years into holding it that’s had its principal value go from 100 to 80 because interest rates went from 4.5% for close to investment grade to 8% and the company itself has dropped 2 credit ratings. You are going to lose 20% of your principal, wiping out the last 5 years of interest rates. When interest rates are dropping (bond prices rising), you can’t lose unless companies default. You either keep your high paying coupon and gain on your principal.

If you think the pension time bomb is less than I do – keep buying munis. I will avoid them. I wouldn’t touch Chicago or Illinois debt for nearly any interest rate with a 10+ year duration. Yes, taxes are important, but 1) that’s extremely complicated and varies to everyone and 2) dividend stocks tend to increase the dividend ~5% a year whereas your bond coupon is fixed for any notes you own 3) over the long term, equity will definitely increase as well so I’d still lean strongly toward stocks.

How can we assume interest rates and for that matter taxes will remain relatively low for a lifetime? We have deficit spent our entitlements and financed wars to the tune of 20 trillion and counting. Social Security in its early years was an actuarial dream as workers highly outnumbered recipients until now. I can’t think of many private sector funding schemes that could survive the financing scheme set forth by governments. We will pay for all of this. We will pay for it with inflation and higher taxes. It has to happen. We can’t dodge this mess forever. Most stock dividends do qualify for the favorable rate of 15-20% while bonds (and REITS) are taxed at the marginal rate, usually higher for investor folks. Good companies raise their dividends which is an inflation hedge and that is the compounding affect that bonds do not provide. As I stated above, I don’t think stocks are overvalued and earnings have been strong for the last few years. That will certainly end but stocks historically decline once every three years anyway. I have nothing against bonds. I own them. What I do know is they don’t generate the kind of wealth I need to reach my retirement goal.The argument that bonds will go up in a low interest rate environment does not really help retirees! A better strategy is to live off the dividends and not sell your shares. The same should be true for bonds. I should not be selling bonds for distributions but living off the interest which is fine if I can get 3-5% coupon rates which I cannot right now. Selling a bond is tricky as well. Unless you’re an institutional investor, I have gotten burned selling individual bonds. The pricing is simply not in my favor. Therefore the price my brokerage account says my bond is worth is far different than the limit price I sell it for. I realize stocks have trades as well but not at the disparity seen in bonds. Besides, we are already paying a premium for a lousy coupon rate of 2.5%. How much more can bonds go up when they’re selling at a premium. I claim bonds are still overpriced and the bond market is broken.

I don’t disagree with either of your points.

Using different investment timeframes will always result in different outcomes. 20 years is a good long term indicator.

The other thing too is that graphs don’t lie. For sure inflation *may* take off, the economy *may* overheat but that’s not today and a sensible bond allocation does more good than harm.

Sam, you advised young investors in their 20s and 30s to take maximum risk. Your VBLTX vs S&P 500 shows otherwise, which is interesting. What’d you do now if you were a young investor still working on getting to FI?

Sure. Check out: The Proper Asset Allocation Of Stocks And Bonds By Age

I hope I was able to communicate that the attractiveness of bonds increases with age and wealth in this article.

Bonds are the most toxic bubble of all right now: stocks, RE, art, & credit.

Bonds will not be the safe heaven when the great credit contraction unfolds even if CBs try to price control bonds. For if they do then the currencies will break.

Disclaimer: I’ve been holding cash or short the market for over 25 years and missed out on the run. As a result, I’m stuck at a job I hate typing you this comment.

First, I appreciate the honest disclaimer.

Second, to say that “bonds are the most toxic bubble” is, however, simply wrong. The reason it is simply wrong is that, as I’ve said before, it misunderstands the nature of bonds. You cannot lard together “all bonds” in a doomsday scenario. It doesn’t work that way. They are not the same as stocks, RE, or art.

That said, if there is another “great credit contraction” — i.e., worse than the one in 2008 — then nothing is 100% safe. But, these doomsday thoughts are often schizophrenic.

If doomsday comes and credit gets wiped out en masse, what happens? Inflation? NO! Just the opposite. No one will have any money and prices will fall. What happens when we have deflation? Interest rates drop. What happens when interest rates drop? Bond prices go up.

But, let’s say the opposite happens. Let’s say we get 80’s-style inflation because the whole world is awash in money. Everyone is “rich” and prices skyrocket. Then, interest rates get increased. Sure, the “prices” of bonds (and everything else) are forced down (based on the length of the bonds, of course) but the rates go way up! Recall CD rates in the 80s in the teens! Take my money!

And third, bonds are not perfect and they are not the answer for every person. But, for people “of a certain age” or for those who have amassed a fortune already, a healthy helping of high-grade, moderate-term bonds makes a lot of sense.

The 10-year treasury rate has been on a general decline for 35 years now, providing a tailwind for bond prices. How much lower can bond yields actually go from here? Or how much of a decline can rates average over the next 10 years or 20 years? I just don’t see that tailwind on bond prices continuing. Even if rates stagnant at low levels, I prefer dividend paying stocks or REITs for safety. At least those assets will generally increase payouts in excess of inflation over long periods of time. Like someone else mentioned, earning less than 1% after inflation on bonds going forward does not seem like a win.

A couple of points:

* Bond Returns. I earn between 4-5% income/yield on a tax-equivalent basis from my (municipal) bonds, which are predominantly moderate-term, highly-rated. This is aided by the fact that I’m in the highest tax bracket. I am just fine with a consistent 4-5% return. But, my total return on these bonds is even higher in years like this one where interest rates have dropped so rapidly. In that case, it’s more than 6% annually. Sam also suggests he earns 4–6% return on his bonds.

* Stock Returns. Sam observes that, at his stage in life, 4-6% “is a far more desirable outcome than the potential for getting a 15% return or suffering a 15% loss.” Sam is being consistent here for literary purposes, but the real risk/reward ratio for equities is not +/- 15% for any given year. It’s typically higher and “reversion to the mean” for stocks tells you, at this stage, the risk-reward is heavily weighted in favor of higher risk and lower reward (i.e., greater downside risk). Indeed, Multiple experts, such as Vanguard CEO and Chief Investment Officer, Tim Buckey and Greg Davis, caution to expect 4 to 5% annualized for the next 10 years from the stock market. I’ve not found anything, but I’d wager Buffet agrees with that assessment. I think 4-5% is reasonable and possibly generous, but regardless — stocks clearly carry more risk and volatility.

* Risk / Volatility. As Sam notes owning stocks will depend upon your particular risk tolerance (which itself should be determined by your age, assets, and other issues unique to the investor) and your honest ability to genuinely weather a financial storm. There’s no “one size fits all.” So, for some people, the question regarding stocks will simply be “why?” Assuming you do not need more than 4-6% annually, why take on extra risk and volatility? Your answer will depend upon the way you answer the risk tolerance / weather the storm questions above.

* Movement of Interest Rates. I don’t expect much change in interest rates in my lifetime (I’m in my late 40s). And, while I think interest rates could go in either direction during this time, my view is that it won’t be by a lot. Indeed, this time last year some very smart people (like Gundlach) predicted the 10-year rate would quickly rise to 6%, which he said was especially likely after the 10-year yield went above 3.25%. That happened about 6 months ago. Well, just a few months later we instead have a 10-year that is barely hanging on to 2.0%. Moreover, the U.S. has not seen 6% rates since 2000 — almost 20 years ago during the heyday of the dotcom era. Can they rise? Absolutely, but I’d not expect it to happen very rapidly.

* Interest Rates Dropping. Do I see rates dropping more? I’m not much of a fortune teller, but it’s possible — e.g., Germany currently has a negative rate, and the 10-year itself was about 1.3% just 3 short years ago. Moreover, we have a Fed that is, if anything, neutral and/or neutered. After December 2018, they are not raising rates any time soon. If anything they are probably waiting for a recession — which everyone seems to agree we’re overdue for — so they can actually lower rates. In fact, some argue (Mauldin, I believe) that we will indeed see rates go lower and maybe even negative. I’m curious what plausible arguments there are for rates to increase materially? Can you think of any?

* Why I Like Bonds. I like the consistent, predictable income offered by bonds and that, when it comes to munis anyway, the default rates are less than 1% for the last 50 years. Are they immune to risk? Of course not, but they are considered a close second to “risk-free” T-Bills and we know where the trouble-spots are already in the muni arena. And, as I’ve said, I focus on high-quality bonds. Other people can buy Puerto Rico or Illinois bonds. Not me.

* Stocks Are Fine Too, But REITs are Different. I agree with owning some amount (depending upon your risk / volatility tolerance) of high-quality, dividend-paying stocks (especially those that pay QID dividends), but REITs are not in that category due to their tax and volatile characteristics. Is there a place for REITs? I suppose. If, for example, I were in a low tax bracket living in a low or no-tax state and had plenty of other assets / income so the volatility would not concern me -or- if I wanted to compliment an already diversified investment portfolio with additional RE exposure in a tax-advantaged account -or- if I was a student who could reliably sock away, with discipline, that money for 10+ years, then I’d allocate some REIT exposure. As a nearly 50-year-old, however, REITs do nothing but give me an ulcer and take up limited space in my tax-advantaged accounts. I prefer to keep it simple and stick with those less-exciting QID dividend-payers.

Thank you for thoroughly reading my post. A reader taking time to truly digest the content makes me extremely satisfied and happy.

I hope people realize that there definitely is no one-size-fits-all. This is not a 100% bonds or 100% stocks decision. There is always a percentage weighting as well as many other asset classes that I personally invested in.

I published this post to give people or so overweight bonds and who are nearing financial independence or are already retired something to think about.