There’s an endless debate over whether real estate or stocks are the better asset class. Although I'm a fan of both, I just realized the feel-good wealth effect adds another feather to real estate’s cap.

In my post about avoiding the real estate frenzy zone if you want to get the best deal, I highlighted a home that sold 60% over asking, jumping from $2.5 million to $4.05 million. It was an astounding close that genuinely surprised me. I walk and drive by that house all the time and think nothing of it.

After checking in with my real estate agent for some color, she explained that early-year inventory is extremely tight, so demand is massively outstripping supply. The home was remodeled and well-located, so it deserved a strong outcome. Still, it’s not a house I ever imagined breaking the $3 million barrier this year, let alone crossing $4 million.

When I walked by the home again on my way back to the auto mechanic to pick up my car, something funny happened. I no longer felt bad about paying more to fix a coolant leak. I’d already spent about $1,000 replacing the water pump a couple of years ago. Normally, that would’ve irritated me.

After paying the auto mechanic $415 for the oil service and coolant leak fix (replaced a hose for $225), I treated myself to a $10 milkshake, something I never do when getting a burger. Objectively terrible for my weight-maintenance plan. Subjectively? I felt richer so I figured why not YOLO.

That massive house overbid created a real, immediate feel-good wealth effect. $10 for a milkshake after spending another $225 on my car suddenly felt like chump change.

Why the Wealth Effect From Real Estate Feels Stronger Than From Stocks

Since the beginning of 2023, we’ve had a phenomenal stock market run. The S&P 500 is up roughly 80% over the past three years, creating a meaningful positive wealth effect that has translated into higher consumption. I’ve even argued that housing affordability is better than it looks thanks to equity market gains.

Excess stock returns above historical norms have effectively bought us more time, our most valuable asset.

And yet, I’ve come to believe that the positive wealth effect from a huge real estate sale is stronger, deeper, and more durable than even a tremendous stock market rally.

Here are the reasons why.

1) Real Estate Gains Feel More Permanent Than Stock Market Gains

Real estate moves like an armored super-tanker. Even in rough waters, it doesn’t sink. It just keeps chugging along toward its destination. Stocks, by contrast, behave like jet skis: thrilling, fast, and exciting, but one unexpected swell can throw you off and let a great white shark take a bite.

Stocks have no intrinsic utility. They are “funny money.” A stock’s value can get cut in half overnight after a single earnings call. Or some random exogenous shock that causes demand to fall off a cliff could cause years of turmoil.

Real estate provides essential utility. We all need a place to live. In fact, when the world feels like it’s falling apart, housing demand can actually increase. In the extreme scenario of a zombie apocalypse, you’ll crave a defensible home base. Your stocks aren't going to do jack shizzle to prevent you from getting bitten.

Rental income also doesn’t reduce the value of the underlying property. Dividends, on the other hand, are paid directly out of a company’s balance sheet. As a result, the value of the company actually goes down my the decline in cash paid out. Therefore, rental income is superior to dividend income.

The Buoyancy Of Real Estate

We’ve seen how fleeting stock gains can be. In 2021, easy money and massive stimulus sent equities to nosebleed levels. Meta went from about $270 to $376, then collapsed 73% to $99 in 2022, wiping out years of gains in a short period of time. Thankfully it came back.

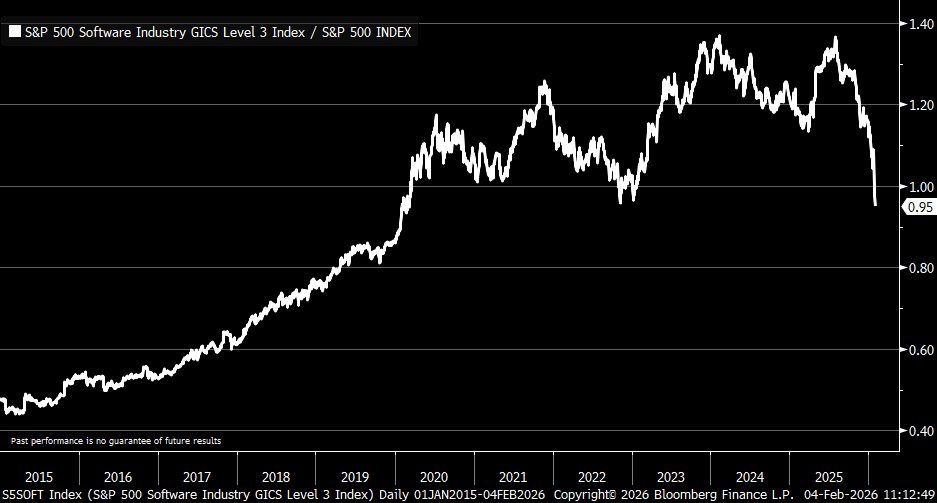

But now software companies in just six months have lost over 6 years of gains relative to the S&P 500, due to fears AI will make SAAS companies and the like obsolete. Bellwether Microsoft, a company I own, has lost almost 20% of its value in just one month. Meanwhile, Amazon, another stock I own guided for $200 billion in CAPEX in 2026 due to extraordinary demand and the stock was down as much as 11% in after hours.

Housing also surged in 2020 and cooled in 2022 when rates spiked. But unlike the 20% S&P correction or the 25% – 70% drawdowns in tech stocks in 2022, national home prices largely stalled. Even in harder-hit regions like Texas and Florida, declines were around 15% after 50%+ gains. You rarely see housing corrections that erase years of appreciation so rapidly the way stocks sometimes do.

In economics, permanence matters. If a gain feels temporary, you save it. If it feels durable, you spend it.

A classic example is not spending more if you think there will be tax hikes after a year of tax cuts.

2) Real Estate Wealth Is More “Visible,” Which Makes It More Spendable

Stock gains live on a screen. They’re abstract numbers that flicker up and down every trading day. You know they can disappear just as quickly as they appeared, so you subconsciously treat them with caution.

Real estate wealth is physical and visible. You walk by it. You sleep in it. Disrespectful neighbors let their dog's poop on its front lawn. Comparable sales confirm it. A $4.05 million closing across the street feels real in a way a brokerage balance never does.

This visibility makes the wealth easier to mentally access, even if you don’t plan to sell your own home. It creates confidence, and confidence leads to spending.

That’s why a neighbor’s record-breaking sale can make you feel richer. The comp just reset your internal reference point. You can't help but compare your home to theirs and bump up your net worth in the process.

3) Real Estate Provides Stronger Social Proof And Validation

When a house sells at a new record high, it becomes a public event. Agents talk about it. Neighbors gossip about it. Appraisers recalibrate their assumptions. Lenders, insurers, and future buyers quietly update what they believe the neighborhood is worth. Price discovery happens in the open, reinforced by multiple independent third parties at once, ideally without triggering a surprise love letter from the property tax assessor.

This kind of validation feels amazing. Real estate appreciation isn’t just reflected on a private statement; it’s embedded into comparable sales, listing prices, and neighborhood narratives. One sale can re-anchor an entire block’s perception of value. The gain feels real because it reshapes what others are willing to pay in the same physical space you occupy every day.

Stock gains, by contrast, are lonely and abstract. Nobody throws a block party because the S&P 500 hits a new high. There’s no shared acknowledgment, no communal recalibration of worth. If you mention a big equity win, people tend to assume you either got lucky or took reckless risk. And since nobody likes a braggart, most stock gains stay quietly hidden behind a login screen.

With real estate, your wealth becomes socially validated without self-promotion. After all, the point of investing in stocks is ultimately to turn paper gains into something tangible and meaningful. For most people, that means buying a home, aside from funding retirement. In a world where most financial wins are invisible, this quiet recognition dramatically amplifies the feel-good wealth effect.

4) Real Estate Gains Take More Effort, Stock Gains Far Less So

Because real estate isn’t a 100% passive investment – normally a negative variable in my passive income rankings – its gains ironically feel more earned. If a remodel was involved, even more so given its one of the most painful processes a person can go through. Real estate rewards patience, discipline, ongoing maintenance, and long holding periods. There’s real work behind the outcome, both physical and psychological.

Climbing the property ladder takes decades. Along the way, you usually save aggressively for a large down payment, then summon the courage to take on a massive amount of debt to buy an extremely expensive, illiquid asset. Portions of your house will break and need to be fixed. That’s commitment, plain and simple.

Stock investing, by comparison, is intentionally frictionless. You click, allocate, rebalance, and wait. That efficiency is financially optimal, but psychologically it dulls the payoff. Returns feel closer to luck or market tides than personal sacrifice, resulting in a thinner, less durable feel-good effect, even when the numbers look great on paper.

Get Neutral Real Estate As Early As You Reasonably Can

If the feel-good wealth effect from real estate is stronger than stock market gains, the logical takeaway isn’t to speculate harder. It’s to get neutral real estate as early as possible.

Getting neutral means owning your primary residence so housing inflation no longer works against you. Instead of rising prices making life more stressful, they begin working quietly in your favor through:

- Inflation protection on your largest recurring expense

- Forced savings through principal paydown

- Long-term appreciation supported by rising replacement costs

You don’t need a portfolio of rental properties to benefit. Owning just one home already changes the equation. By locking in your housing costs, you hedge the single largest expense in your budget. For many households, that alone justifies ownership—even before appreciation or rental income enter the picture.

The psychological payoff is immediate, especially as a parent. When shelter is secured, everything else feels more manageable.

Stocks are essential for liquidity and long-term growth. But relying solely on stocks while remaining fully exposed to housing inflation as a renter is an underappreciated risk.

Real Estate Quietly Wins

The biggest misconception is that stocks alone deliver financial security. They don’t, at least not to the degree people expect. Stocks can grow your net worth on paper, but their volatility makes that wealth feel fragile and reversible.

Real estate works differently. Owning your home converts your largest recurring expense into an asset and turns housing inflation from a threat into a tailwind. Over time, it replaces financial anxiety with a sense of control that portfolios alone struggle to provide.

That’s why the feel-good wealth effect of real estate is stronger. It’s not just about returns, it’s about permanence. No matter what the market does tomorrow, your family still has a roof over its head. That stability creates a confidence that quarterly statements rarely match.

Both stocks and real estate generate wealth effects. But real estate wealth feels more durable, more visible, and more real. As a result, people are far more willing to loosen the purse strings when their housing situation feels secure.

That’s how a record-breaking home sale down the block suddenly makes a pricey car repair feel acceptable, an indulgent lunch feel earned, or even a completely unnecessary $10 milkshake seem like a reasonable life choice – perhaps followed by a $250-a-month gym membership to burn it off.

When enough people feel rich in a stable, grounded way, spending rises, risk-taking becomes more rational, and the real economy quietly starts humming.

Readers, which creates a stronger feel-good wealth effect: a big real estate sale or stock market gains? If you disagree with my thesis, I'd love to know why.

To increase your chances of financial freedom, join 60,000+ others and sign up for my free weekly newsletter. Financial Samurai began in 2009 and is one of the leading independently-owned personal finance sites today.