Although 2018 ended on a down note with the stock market selling off, I feel good about how things unfolded. I'll take the ratio of three good quarters to one bad quarter any year. Here is my Financial Samurai 2018 year in review.

Believe it or not, my theme for 2018 was: back to early retirement life. I pushed myself to the point of burnout in 2017. But the funny thing about hard work is that it's over. I only remember bits and pieces of how difficult 2017 was.

At year-end, it's easy to forget our accomplishments and our failures. With this post, I'm excited to relive the good and the bad in the following categories: Finances, Family, Health, Business, and Odds & Ends.

This post is like a 4-for-1 special. It needs to be thorough so I can prove to my son his old man wasn't a deadbeat when he inevitably starts rebelling or when I'm no longer here to defend myself.

Financial Samurai 2018 Year In Review

Finances – 2.5 3.5 Out Of 5 Stars

At the beginning of the year, I predicted we'd see a slowdown in coastal city real estate, a 10-year bond yield under 3%, and a stock market that would have one last hurrah with a 10% return. I was almost three for three with the stock market up ~8% in September. Too bad it gave up all its gains and then a whole lot! At least I got more defensive starting in March.

My net worth is roughly made up of:

30% in stocks/bonds = +1%. After writing Your Risk Tolerance Is An Illusion in the Spring, I reduced my stock allocation in my House Sale Fund to roughly 52% from 70%. As bonds began to outperform stocks coupled with further profit taking, my end allocation is roughly 40% stocks / 60% bonds.

Owning a bunch of equity structured notes in my other main fund has helped minimize volatility. But clearly I wasn't defensive enough and should have taken more profits during the summer.

My House Sale Fund portfolio was up around 13% at one point until I gave all the gains up in the 4th quarter. Right now, it's holding onto a tenuous 5.57% gain, after the huge rally on Dec 26. Overall, my public investment portfolio finished the year +0.8% after some positive trading days post Christmas. Pretty pathetic.

I'm disappointed with my public investment performance. This goes to show that no matter how concerned you are about an asset class or the economy, greed can override logic.

Here's a good chart that shows how the Vanguard Long-Term Bond Fund has outperformed the S&P 500 since 1999. The next time I start feeling greedy, I need to remind myself that slow and steady wins the race, especially if you've already passed the finish line.

Related: 2018 S&P 500 Return: Worst Year Since The GFC

6% in cash/CDs = +2.3%. Thanks to rising short-term rates, you can now get around 0.45% in a money market (2021 update). Cash and short-term CDs have been 10%+ outperformers against the S&P 500. Hopefully, folks will no longer badger me about the risks of underperforming inflation when the real risk is losing absolute dollar value. Unfortunately, I should have had closer to 15% of my net worth in cash and CDs.

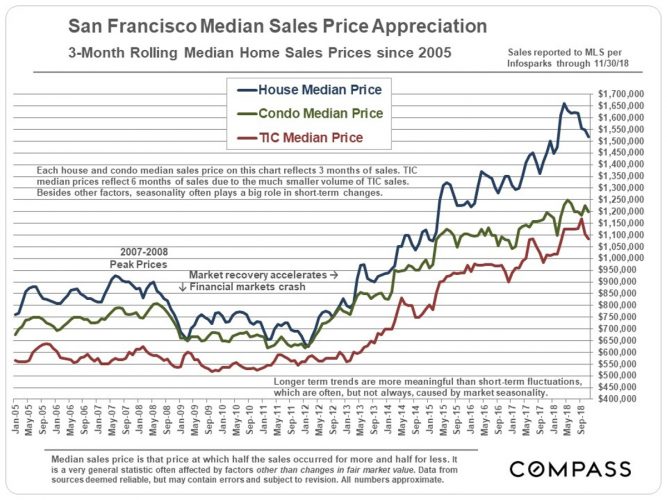

30% in real estate = -5%. The online estimates say my real estate holdings have gone up ~6% YoY, but I doubt it now that the stock market has sold off so aggressively from the peak. Online price estimates and public data are always lagging estimates. I'm investing more in real estate syndication.

Prices did continue to go up until about January 2018, but began falling for the remainder of the year. The chart below shows data months before the 4Q2018 stock market correction. Therefore, I've manually inputted -5% from +6% for a 11% swing.

Even though my real estate holdings are down, I thankfully feel no stress compared to my stock holdings, which is one of the reasons why I prefer real estate over stocks.

One rental property has no mortgage since 2015, my primary residence is providing utility every day by sheltering my family, and my vacation property is generating a positive cash flow. I can’t wait to bring my boy up to Lake Tahoe to touch his first snow in March!

It's unfortunate that I reinvested $600,000 of the $1,800,000 proceeds from my house sale into the stock market. I should have just stayed super conservative. But I suspect the best I could get now for the house is $2,600,000 today versus the $2,740,000 sale price in 2017.

My house was on a busy street next to the busiest street in all of San Francisco. Fringe location properties, even in a good neighborhood, tend to underperform during a market softening.

8% in alternative investments = +5%. My alternative investments in venture debt and real estate crowdfunding seem to be doing well, to the tune of a 11% – 20% IRR. But these figures are probably too aggressive as well, so I've assigned a +5% performance instead. REITs and rental property have outperformed all year as rents are stickier than stocks. I remember back in 2009, my rents stayed flat because by the time the lease was over a year later, the recession was over.

25% in my online business = 0% – 150%. My business is the trickiest to value. Revenue and profits are up 20%+ YoY. Therefore, one might conclude that its value should also be up by 20%+. However, valuations have probably compressed since the stock market sell-off. The good thing is that a peer site with about 35% less traffic sold for 2X the value I assigned for my business in my net worth calculations. Therefore, there's a possibility my site could be worth 2X – 2.5X my assigned value if we normalize for traffic.

From an estate planning perspective, I want my business to be valued as low as possible. It's the same way you want your house to be valued as low as possible to pay less property tax. To prepare for hard times, I've kept my business at 0% growth in my net worth calculation.

Net Worth Growth

Here's my 2018 net worth progression chart according to Personal Capital, where I've been tracking my finances for free since 2012. The chart is a little chunky because of cash recognition delays. But overall, it was doing pretty well until the end of the year.

The main reasons why my net worth is up ~6.5% in 2018 are business cash flow and aggressive savings. I continue to save almost all of my after-tax income because we live on our passive income. If I didn't aggressively save, my net worth would have been flat. As my net worth has grown, it's harder to move the needle as much.

6.5% is OK, but at one point I was up ~11%. Hence, it feels a little disappointing. 10% YoY growth has always been my minimum net worth growth target since graduating from college. Despite the disappointment, I'm glad my net worth didn't go in reverse.

If you're feeling bummed out, it helps to look at how far your net worth has come over the past five or 10 years. When I left work in 2012, I was comfortable with what I had. Otherwise, I wouldn't have left. Having another six years of growth, excluding 2018, has really been a blessing post early retirement.

The key is to not lose all your gains to a bear market.

Related: Recommended Net Worth Allocation By Age Or Work Experience

Family & Fatherhood – 4.7 Stars

I could not have tried harder to be a great stay at home dad. I only have one shot, so I did everything to educate myself about parenthood. I also spent as much time as possible with my son while demonstrating patience and showing maximum love.

My greatest moments of joy all year came from seeing my son's milestones. He started waddling with help at around 11 months and slowly started to walk unassisted at 12 – 13 months. By 18 months he was able to count to 30, say all letters of the alphabet, and identify eight different colors. He’s running around now.

His favorite words and phrases at 20 months old are “hot dog, ketchup, yum, yum, yum” “double wide garage door,” “walk with daddy,” “knock knock,” “verde,” “voila,” and “da hai bao (big seal in Mandarin).”

He's also just begun to sing a couple lullabies, one in Japanese and one in French. We try to talk to him in multiple languages as supposedly that helps brain development. He's hilarious and full of determination. Oh boy is he determined.

When I'm not working on Financial Samurai or managing our investments, I pretend I'm a pre-school teacher and occupational therapist. Because he has a vision issue, I've been helping him track objects, work on his depth perception, and hand-eye coordination. So far he can walk up stairs safely, but he still needs assistance going down.

Now we're focusing more on his fine motor skills, like drawing, holding a pencil, brushing his teeth, playing piano keys, and using scissors. The duties are never-ending, but it's been a blessing to care for him every day and watch him grow.

My greatest sorrows have also all come from my son. Between 11 – 15 months old he would fall frequently or accidentally bonk his head on something hard or sharp. I felt his pain each time and admonished myself for not doing a better job protecting him.

As a result of his accidents, I ended up padding everywhere around the house and padding every wall and table corner. Interior design be damned! Thank goodness we live in a modest size house.

The padding has saved him from injury numerous times, including on Christmas, when he stumbled on a package and hit his head on our coffee leg corner which was padded, hooray!

It turns out that toddlers between 12 – 19 months fall about 17X an hour on average according to one study of 120 toddlers. Only until about age 4 do most toddlers fully master their walking and running skills. That made me feel a little better, but it still made me so sad whenever he hurt himself. Taking him for a walk with a harness has helped tremendously. I'm teaching him to look both ways before crossing the street.

It's also interesting it takes up to 24 months before a toddler's fontanel closes. Therefore, we as parents might as well be as diligent as possible in trying to protect his head before his skull gets to full strength. So much about parenthood the first several years is about survival – from preventing suffocation while sleeping to making sure they don't walk off a ledge.

The better our boy sleeps and the more he is able to communicate his desires, the more rewarding parenthood has become. Because he is so strong-willed, his temper tantrums are quite a challenge.

One of my concerns is that he will hurt himself during these temper tantrums by banging his head on something hard or arching his back and hurting himself on the floor. Doctors say temper tantrums peak by around 24 months, subside, and then rise again at around 36 months. Here's where I need to demonstrate maximum patience as a parent for the next 16 months.

Before my son was born, there was never any whining or crying around the house. But once he arrived, I have heard crying and whining every day, multiple times a day for 20 months in a row.

Unfortunately, there is no logical reasoning with a young boy, except to use a technique called “caveman speak” while voicing what we think he wants to calm him down. Adjusting to this new scenario has been hard.

It's also difficult to write, record a podcast, or mentally relax when there is so much noise. Being able to more easily find a quiet space is one of the benefits of upgrading to a larger house. As a result of needing to find quiet time, I often had to wake up between 4am – 5am to get things done. But I'm proud to say I've never lost my temper around my boy.

I've still got to improve my patience with my wife and not let business stress or stock market stress hurt our relationship. We operate at different paces, and I need to do a better job slowing down. The whole point of financial independence is to be free from money stress to live your best life.

Given my wife is a full-time mom and absolutely does more of the caregiving, the pressure is on me to make sure our finances never go in reverse. As the stock market melted down in 4Q2018, my stress level definitely increased.

Our goal is to both stay full-time parents for at least our son's first two years of life and ideally try to be full-time parents for five years before he attends kindergarten. Fatherhood is the hardest thing I've ever had to do, and perhaps that’s because I also insist on concurrently growing Financial Samurai as much as possible until my energy fades.

Related: How To Survive The Pressures Of Being A Sole Income Providing Parent

Health & Fitness – 3.2 Stars

I'm the same weight as I was in 2017, which is OK. But I gained 5 lbs in 2017, which was not OK. I need to get down to 162 lbs from 170 lbs. At least I exercised 3X a week on average plus took light walks with my son 5X a week on average. Given my goal is to live until 75, or whenever my son can establish himself and find a life partner, it's important for me to stay in mental and physical shape.

Luckily, I've had no serious injuries or medical mishaps this year. I did catch some flu-like virus that knocked me out for 1.5 days in October. My back pain from the beginning of the year subsided by the summer. We did have our first emergency room visit for my son at 5am because he seemed to have come down with a similar virus I had a month later. We also went to an after-hour care facility for some inflammation. Luckily, things got better after 24 hours.

At 41, I still haven't sprouted any grey hairs, which is a surprise since I first got several grey hairs at 33, the year before I left my day job. The only reason I can imagine for this phenomenon is that not working a full-time job is less stressful. It's one thing to say how much better life is after achieving financial independence. It's another thing for the body to show us.

My most fun physical addition has been joining a softball meetup group that plays every Saturday it doesn't rain. I must have played over 30 games in 2018. Ah, now I remember sustaining a left knee bone contusion that hurt for six months. My personal highlight was drafting and captaining a 4th of July softball tournament and winning. Curiously, it was one of my most satisfying life moments!

Finally, I found out in December I wasn't getting bumped down to 4.5 in USTA tennis from 5.0. I did poorly in 5.0 league at the beginning of the year and was hoping to get bumped down after three seasons. When I didn't, I appealed and got denied.

5.0 level tennis is brutally tough. From an ego perspective, it does feel good to be in the top 1% of all tennis levels. Other players give you respect as you puff out your chest and start thinking you're the shiznits. But after you start repeatedly getting beaten by players younger than you, it starts to get demoralizing! Therefore, I always try to make fun of myself to others by saying the computers must have malfunctioned to keep me at 5.0.

Business – 4.8 Stars

I could not have tried harder to build Financial Samurai either. Here are some of the accomplishments:

- Published three posts a week on average

- Published three pages a week on average

- Published one newsletter a week on average

- Improved my short-form writing skills with the newsletter

- Produced over 40 podcasts

- Did several podcast interviews on other platforms

- Launched the Financial Samurai Forum with 1,300 members thanks to my wife who set everything up over a year

- Got mentioned in Business Insider, CNBC, MarketWatch, MSN, Apple News, Forbes, and Yahoo

- Updated How To Engineer Your Layoff with a new forward for 2019

- Increased overall traffic by 20% YoY, with 50% YoY traffic growth between August 1 – December 31

The 50% YoY traffic surge since August 1 seems like an anomaly. It's like suddenly turning into a speedboat after being a cruise ship. But traffic has been elevated for almost four months so far, with December being the highest traffic all year. For years, December has always been a quiet month due to the holidays. Perhaps the traffic increase is due to a combination of more production, search algorithm changes by Google, and content syndication.

Overall, I'm just really happy there's been a correlation with effort and reward. That's all I've ever wanted, hence part of the reason why I left work in 2012. Every year since the birth of Financial Samurai in 2009, Financial Samurai has drastically outperformed the S&P 500 and the San Francisco real estate market. As a result, blogging has surpassed real estate as my favorite asset class to build wealth.

For poops and giggles, here's another net worth chart if I manually input a business value based on recent comparable sales. The 30% spike is nice, but is also dangerous because it brings a false sense of complacency. It's best to stay motivated as the economy softens. Just know that creating next level wealth is all about owning growth equity over the long term.

Life's Odds & Ends – 4 Stars

In May, I helped coach my high school boys varsity tennis team to the Northern California Sectional championship. This was the first championship in the school's entire 40+ year history. This victory was particularly sweet because we had come so close my first year in 2017 only to lose in the finals to a school 3X our size. This was another incredible life moment that had nothing to do with money. I only got paid $3,500 for 3.5 months of work. The relationships I developed with some of the parents were a nice bonus.

My dad came to visit three times and my mom twice. My mother-in-law also visited twice and my father-in-law once. It is always great to see them, and I hope they continue to visit us more often. My dream has always been to have three generations spend as much time together as possible. Unfortunately or fortunately, all our grandparents want to remain independent and live in their respective cities. It's hard to change the older you get, which is why I've been trying so hard to move to Hawaii.

I further strengthened a couple friendships. This is huge because as a stay-at-home dad, it's often hard to make new friends or deepen friendships. There are simply less social events to attend e.g. happy hour. I love having a good buddy to shoot the shit with. I also developed a new in-person relationship with an FS reader, who also so happens to also be a professional athlete on my favorite team. Pretty neat!

I did some decent home maintenance projects this year: caulked the top of our living room window sill to prevent leaks, varnished all our wood planter boxes, rooted the upstairs sink that was clogging, re-roofed the leaking light well (hired someone), maintained the yard, and fixed a leaky faucet at my rental. Man, I forgot about all this stuff until my wife reminded me. Thank goodness I sold the other rental.

Finally, we finalized our will and revocable living trust. My wife also led the charge getting us through this cumbersome and complicated process. There were so many documents to gather and questions to ask the estate planning lawyer that she estimates the whole process took her about 40 hours. But after we finally signed all the documents on December 20, I felt a huge sense of relief that I could die knowing that my wife and son wouldn't have to go through probate court.

Financial Samurai 2018 year in review: 3.5 4 Out Of 5 Stars

Although I didn't decide to take it easy per my 2018 goal, I have no regrets staying consistent with Financial Samurai. I don't think I'll ever change my work ethic until my body starts breaking down. The joy of writing is so tangible because it is an identifiable product that can be eternally consumed.

It's been hard to accept no longer making a positive return on my public investments after nine years of up, up, up. I've got to do a much better job at not letting financial loss negatively affect my mood and my relationship with my wife. Not taking unnecessary risk will help.

During downturns, I envy those in professions that have nothing to do with the stock market. For example, when I asked my estate planning lawyer about what she thought about the stock market collapse in December, she said she had no idea because she outsources all her financial planning to someone else. What a blessing.

I also have zero regrets being a stay at home dad all year. Yes, the days were long and there were many moments of frustration, but just hearing his squeals of joy made full-time fatherhood worthwhile. All I want to do is squeeze and kiss him 100X a day! I'm so thankful my wife has been an amazing mother and partner all year.

Family and Financial Samurai are my two great loves. Everything else comes in a distant second. There was a point where we thought we'd never have a child. So we say a prayer of thanks every evening. Financial Samurai has been a part of me since the bottom of the last financial crisis in 2009. It's like an old friend that has stuck with me in the worst of times.

The key is to not let my two loves collide, but to let them be synergistic. My family gives me motivation to write, while Financial Samurai is a creative outlet that helps ensure we remain stay-at-home-parents until we decide otherwise.

There's always a silver lining to a downturn too.

For Financial Samurai, it's increased traffic as more people are paying attention to their finances. Book sales on how to negotiate a severance are also increasing as savvy employees are trying to get ahead of the layoff curve. Finally, our passive income has also increased due to higher interests rates and my shift towards higher yielding assets like cash, bonds, and CDs.

For family life, it's being less tempted to go back to work because the return on effort has declined. When all is in shambles, why bother dealing with a commute, company politics, difficult clients, and a declining company stock price. I just checked, and my old employer’s stock price is down 55% since I left in 2012!

I hope my boy one day reads this article and is proud of his dad. Although 2018 wasn't a fantastic year, it was filled with many positive milestones.

I'll be sharing my 2019 outlook and goals next. In the meantime, I'd love to hear some of your hits and misses for 2018! I hope you enjoyed my Financial Samurai 2018 year in review.

Related:

The Best Financial Samurai Posts For 2018

Financial Samurai 2021 Outlook

Recommendation: Manage your finances in one place with Personal Capital, the best free financial tool on the web. It's important to stay on top of your net worth, understand your risk exposure, and make sure your retirement plans are on track. Get your finances right the first time. There's no rewind button in life.

Financial Samurai 2018 year in review is a Financial Samurai original post. Financial Samurai 2018 year in review is not to be republished. 2018 was a tough year for stocks, but a good year for life.

Why were you there in the front row seats for the 3rd quarter only of that Golden State Warriors game? Did you pay off those kids for a quarter? lol

Slipped them a $5!

Hi! Really like reading your articles.

I have a quick question for you since you like conservative investments. I like them too, especially since I am planning to retire in 5 years.

What do you think about investing in preferred stocks that are less volatile than common stocks and produce on an average 6% income?

What are your thoughts?

Yhank you!

I kind of new you played tennis from reading other posts but never realized you were rated 5.0!

I’m a 5.0 player myself (played NCAA in 2008-2011). 5.5 at one point and probably also trending towards 4.5 :)

If life ever brings you to Raleigh, NC please reach out. Would love to play some if you are up for it!

Oh great, thanks for the link. I’m new to your blog and was eager to listen to the content. I hadn’t seen the Podcast Page, thanks!

You say you produced 40 podcasts but when I look in iTunes I only see 3 listed. What am I missing?

Good catch! Donno why there’s only 3 in iTunes. Will look into it. In the meantime, you can check out my Podcast Page or click the shows below many of the posts in 2018.

Not sure where the play button went either. Ah, technology.

Great Year Sam! I’m surprised you still had time for household chores and stuff. I’m still following along ever since you recommended your post on “you probably don’t need as much to retire as you think.” Thanks for continuing on with your good work.

Just got to get up by 5am and a spouse has plenty of time to do household chores :)

Sam, when my son was a toddler he also hit his head many times so we ended up getting one of these. Would put it on during this playtime when he was most active or near places that were most risky. https://www.amazon.com/dp/B00RYGIMP8/ref=cm_sw_r_cp_api_i_KBumCb93DHT9H

Hey Sam, sounds like a good year to me.

About your son, not sure what his vision issues are but when i was young i had vision issues. i was slightly farsighted and had issues with changing changing focus on things up close and also moving from close to far. It was discovered when i was learning to read because i couldn’t move from the end of a line in a book back across the page and find my spot. This obviously would have appeared as a learning disability in school or made me appear as a poor reader and really held me back. My optometrist gave me some “eye exercises” that my parents did with me diligently for a year or two and i ended up improving my vision.

Keep working with your son. Some of the weird “eye exercises” that optometrists recommend really do work and can improve minor vision issues. Thought i would let you know there can be improvement based on my experiences.

Glad to read through your year in review after finding your blog this year. Looking forward to 2019!

Sam, what an inspiring article to kick the year off! In all honesty, I admire your work ethics and focus but also, simultaneously, I feel a bit lazy for not doing more within my personal space. I feel I should spend more time with people like you, who inspire me to achieve more.

Happy New Year!

One of the true joys is discovering a great blog and coming across well written content. Thank you Sam for sharing your knowledge generously. I came across Financial Samurai in late Nov ’18 and enjoying reading your content.

Wishing you the best for 2019!

Thanks for reading, sharing, and stopping by! Always nice to hear from new readers.

That’s a very healthy way of looking at the year. For me, I started blogging this year. I need to be more consistent with my blogging. Health was one of my worst years. I broke my foot running in the spring, and its been a long slow road to recovery. I also tore 2 tendons and pinched a few nerves in my neck. Since I on my face at least I did not break any teeth!. Then, though, after finally healing last month, I over did it with strength training and reinjured my knee. All in all, not so smart, but I soon I should be back on the road. Of course I gained 15 pounds of fat.

On the other hand, my choices in getting involved with this community has focused me on my finances in such a way as to get my house much more in order so to speak.

All in all, I think it was a good year.

Ouch! I hope 2019 is healthier for you! Getting old is a drag, especially if our minds and beliefs are still young. I’ve had to mentally slow myself many times, especially during softball.

Happy New Year Sam! Thank you for helping to educate me!

From beautiful Providence!

Kavita

You are such an inspiration on many levels for me. I’m a newer reader and every article I’m amazed at the level of depth you provide. I want to be like you when I grow up. :)

I like how passionate you are about Financial Samurai, and yet you don’t let that take priority over your family. I’m just starting out and I want to make my blog as successful as possible, and but I have to remind myself that the site isn’t the most important thing in my life. I am finding the balance can be difficult at times, but I’m learning communication with my spouse and kids is key.

Hi Chris! Thanks man. The biggest thing is to stay consistent with blogging. Just got to keep on going, no matter what. Also try to develop some good relationships with a fellow bloggers who can help support you all along your path.

I’m lucky that writing comes pretty easy to me. The journey has been pretty fun for the most part since 2009. Find what you love to talk about and write about and it will certainly help you on your journey!

Congratulations on a great year. Your investments performed much better than most. Our net worth is down about 1.5% this year. It’s no good. Great job on FS. The traffic gain is awesome. Also, you’re a great dad. Nice job padding saving your son from hurting himself. The temper tantrums will probably improve. Our son is way better now than when he was 2, but he still throws a fit occasionally.

Happy New Year!

Thanks Joe, I appreciate your kind words. And great job staying consistent with your site as well and raising your boy and going on an awesome adventure to Thailand! I think it’s awesome that you are so much happier now than when you were working. And that everything has worked out since you left.

Congrats on a year with accomplishments. As long as your life is moving forward your good; control what you can! Quick question; that comparison of the bond fund and S&P is shocking. How can a bond (due to its very nature) outperform the stock market over the long term; am I missing something?

Bonds have performed amazing for the past 30 years. We’ve been on in a bond bull market since the 1980s. As inflation comes down.

I wonder if many more people have underestimated the power of bonds over the years.

Equities have not performed very well since 2000. There was the lost decade. As amazing a run as we have had the last 10 years, the overall equity return since 2000 has been mediocre. We haven’t even doubled since 2007 (average returns lead to stock market doubling every 10 years). It’s a little shocking that based on recent history, FIRE supporters plan with a 4% withdrawal rate. You’d barely keep up with inflation since 2007 even with an epic bull run. FIREcalc says ok, but you’d have to bet your life and your family’s lives that future performance will be no worse than past history. Consider China’s competition, US indebtednes, and how much of this bull run was fueled by money printing, none of these factors were presented in the entire history of fhe US stock market.

Hi Sam,

Are you seriously considering going back to a full-time job? At present your after tax savings rate can still affect your net worth to the tune of 7%! If I went back to work, I think my after tax would only budge my net worth by 0-1%, although it would definitely help on the expense side for health insurance. This tells me you are likely making much more than a 9-5 would pay you, unless you are accounting for a home run on any equity incentives. You said that the stock market downturn negatively affects incentive for going back to the workforce, but for a new employee it’s actually a positive. Your starting price will be lower with much more upside! Joining in 2019 would be much better than in 2018.

I always like to thoroughly think about my options before doing anything. I’ll probably first focus on building my blog agency business. It’s actually a big no brainer and I’ve got some pretty big clients under my belt.

I think one fun angle is to put it out there that I’m looking for a nice job in the San Francisco Bay area, and see whether I can get that job or not. I think it’s gonna be really difficult for me to get a job that I want to do. And I think it’ll be fun to bring readers along for the journey.

There is a possibility that I have been overly conservative on my net worth calculation, which is why I’m able to boost my net worth from my income by 6.5% this year.

I just want to have more fun. I’ll make it like a choose your own adventure.

I figure it’s an angle to drum up even more traffic for your website. Smart move and very entertaining!!

The right offer for you would have to be a part-time flexible job over $2 million per year. Less like DIRE, more like HIRE…

Hi Sam. I’m a regular reader and fan. This is one of the most personally appealing articles that you’ve written. Thanks for being transparent, vulnerable, and brutally honest about your year in review. I follow a similar approach and I appreciate learning from the details of your personal situation.

All the best,

Brian

Thanks for reading Brian! I hope you have a great 2019.

That’s a great year you’ve got going on Sam. Too bad for the Q4 equities sell off, but it seems you are coping well.

For me the year has been good too, with a new job and steady savings. I’m nowhere near where you are (turned 25 this year) but I’m on the path. Thanks for putting out all this amazing content!

I don’t have as much money as I had a few months ago; however, I am up for the year. It is so hard to predict this market I hear opinions from real experts that are as divergent as they could be – from the market already pricing in a recession to a true bear market.

I like your honesty. Temper tantrums are not uncommon. Maybe it’s your child’s disappointment in your stock performance.

Probably! Congratulations for being up for the year. That’s a really big accomplishment for such a bad fourth quarter.

Hi Sam, that is a remarkable achievement with teaching your son counting and letters. As a full time dad, how do you let him socialize and play with other kids? I have a 16 month old toddler and live in the northeast.

Hi Esey, we just repeat the letters and numbers to him over and over again. We have letter and number magnets, a couple white boards where we draw and write the letters and so forth. Then we do the whole exercise of “B is for …. ball,” “H is for….. hot dog” etc. When he’s on the swing, we’ll do this exercise, and when he’s on his walk, I’ll ask him to identify the letters and numbers on the doors and license plates etc.

This is where max patience and endurance really is necessary.

We parents shouldn’t stress too much about this stuff b/c eventually, our children will get it. The vast majority will have all the fundamentals down by the time they go to kindergarten as well at age 5-6. So no biggie. I’m just recording these milestones for my own memory, as I know we’ll forget.

Regarding socialization, we take him to the Science museum 3X a week, a swim class once a week, Gymboree once a week, and the playground 3X a week. There are plenty of other kids there. But before 2, there’s really not that much socializing, as kids are still focused on me and mine.

Everything will eventually come. Just takes time. Enjoy your 16 mo as much as possible!

Are you a SAHD too? I’m looking for more SAHDs cuz all my buddies work and tell me how easy fatherhood is haha.

Thanks Sam. I am not a SAHD. His grandma, who stays with us during the weekdays, helps take care of him. As she doesn’t drive and the weather right now is not super nice, we have been looking for ways to get him out of the house without sending him to daycare. Thanks for sharing your routine and the tips on how to teach him numbers and letters.

You are blessed to have a grandparent take care of your child during the weekdays. I wish I had a similar support network. Please make sure to treat grandma with lots of love! And appreciation.

Hi Sam,

Great post! I do agree with some of the comments that you seem a little hard on yourself but that’s why you’ve done so well!!

I’ve only learned about the FIRE community recently and have really enjoyed your older post. Since recently retiring myself my wife encouraged me to start a blog to share how we achieved our results. I’ve read several of your posts regarding blogging as a business. I’ve been approaching this more as a hobby. Do you think its still a viable business for new bloggers?

Thanks,

Ernest

More viable than ever before! People starting now are so lucky to have huge platforms to instantly jump off of, so many ways to share their work, and a much more adopting society that loves to read independent websites versus big media platforms. Congrats on the retirement!

Great! Thanks for your input! I’ve become a little restless even though we’re slow travelling. I went from working full time and completing an MBA to early retirement. Going from a structured and full schedule to a very laid back schedule has been an adjustment. Perhaps structuring more time for the blog is what I need :)

I’ve even thought about going back to work… it’s definitely a possibility. We’ll decide after the year is up.

I started reading FS a few months ago after I saw an article on MSN about how to retire at 40. Reading your articles allowed me to see that I was not putting back nearly enough for retirement (and could afford to!) and that I needed to break up with my “financial planner.” I am now confident in the diversification I have and the track I am on to FIRE. Sam, you’ve been an inspiration to me, and I look forward to working hard to put my family in a similar situation.

The one recommendation I have is to show dates that articles were posted or last edited.

Glad to hear it. Just know that every single Financial Samurai article you read is relevant to today as they are always updated.

Your post reminds me that I should do a quick summary of my 2018 goals and see if I hit them. As an aspiring blogger, can you give any tips on getting media attention? Do you use a publicist?

Happy to take a look at what you’ve written and give some suggestions. I don’t have a publicist.

Do you ever think that past a certain net worth or cash flow amount, money isn’t real? I’m only asking because you said money can affect your marriage. When you are 75 you will realize you worried about money every week of your life and it all ended up being ok.

Not sure. Money will always be real to me because I can use it to take care of my family and help other people.

How are you able to let the loss of money not affect your mood and relationships. I’m always looking to learn from those who’ve been able to master their emotions.

What is your current family and financial situation? And what were some of your hits and misses for this year?

I dunno that people don’t care as much as unrealized losses sting less since they are unrealized.

The expectation is that this will be a mild recession when it happens.

We’ve just had the longest bull run so folks aren’t used to the cycle anymore and unraveling the QE and low rates is necessary.

Plus your assets are sufficiently diverse that you took a lower dollar hit than most folks despite having a higher net worth.

Money beyond a certain point isn’t necessary for happiness but it’s useful to keep score.

What you seem to be concerned with is the standard of living for your family on a dip but that’s because you’re in a very high cost area that you want to be but really don’t need to be in.

$1.2M puts you into this house:

But $800K (which drops the mortgage to $200K in the $5M blog post) puts you into this house:

In this high school:

https://www.hcpss.org/f/schools/profiles/prof_hs_riverhill.pdf

In a county with these demographics:

https://www.census.gov/quickfacts/howardcountymaryland

About a 40 min from DC and 30 for Baltimore and 4 hours from NY.

If you prefer VA there are similar places and your kid would be in state for UVA (#3 public uni) and W&M (#10 public uni)…

That drops that $13K/month budget significantly and more headroom to not worry about cyclical market downturns.

Very cool. I hear The College of William and Mary is one of the best public schools in America, if not one of the best universities overall, including private universities. Every single alumni I have met from William and Mary has truly been impressive.

Every time I think of Baltimore, I think of the TV series, The Wire. It’s hard for me to live on the East Coast anymore after being on the West Coast since 2001.

Do you live on the East Coast? And what is your financial journey look like right now?

My financial journey is another 5-10 years of golden handcuffs…so the current downturn doesn’t bother me much. We’re FI but the finacial benefits of working at just too nice to give up…my wife will get a pension and I get a college benefit for the kids if their grades are high enough.

So definitely more boggle than mmm.

If the East Coast is meh then there’s always the expat life…if I were to have FIRE’d I’d drag the kids to a different country to experience another culture before jumping into college and “The Asian Path”.

I looked into MM2H and schools in George Town, Malaysia. Might still do it for the youngest one if the program still exists in 5 years.

Drop mortgage from your $5M FIRE and replace with $12K rental shaves $45K from your annual budget. Private school is around $15K/year (56K MYR at Uplands)

Food, even eating out every day, likely isn’t $1800 per month.

internationalliving.com/countries/malaysia/penang-malaysia/

Very cool you enjoy the work. That is a blessing, as after 13 years, I had enough. But I don’t regret giving up the income. It’s been a wonderful ride since 2012.

I might live abroad starting in kindergarten. Could be good!

When Is The Best Time To Travel And Live Abroad With Kids

I’d comment in that thread but given its from July I dunno that it would get much discussion going but commenting here seems a bit off-topic.

Have you given thought to creating a forum thread for each blog post?

There are probably quite a few that would get on-going commentary…and thereby traffic…

Anyway the short comment is that the biggest thing for me is that to grow up in a multi-lingual culture tends to make kids multi-lingual.

So Penang Island with the mix of Hokkien, Malay, English, Mandarin, Cantonese was interesting. Was KL a little less mixing pot?

I can tell you that 3rd gen anything will likely not retain much cultural language skills without a huge amount of parental work. Even in SF where my nieces and nephews live.

You really need to provide a useful need for being able to speak another language. The three I have identified so far that has been mildly effective have been TV shows (anime and Japanese, romance TV and Chinese), staying with grandparents in another country and the need to pick up girls in their native language…

My child is a student at W&M (and I know you’re a grad). I agree with your sentiment.