If you want to FIRE, one of my regrets was pulling the ripcord too early at age 34 in 2012. Even though I started writing about FIRE in 2009 with the launch of Financial Samurai—trying to uncover as many blind spots as possible before taking the leap—I still feel like I made a mistake. In hindsight, I should have worked at least five more years until age 39, or even 40 before retiring.

At the time, I didn’t know I’d have a kid five years later, let alone two. Fast forward more than a decade, and with tremendous inflation, skyrocketing college costs, and never-ending healthcare expenses, the squeeze is real. If I had worked a few more years, I probably could have generated at least $60,000 more in passive income into perpetuity.

Although I’m confident I’ll build enough wealth so my two children will never go hungry, I’m not certain I’ll ever reach true multi-generational wealth. To me, that means having enough so that three generations—my family, my children’s families, and my grandchildren’s families—would never have to work soul-sucking jobs to survive.

Multi-Generational Wealth Is Not Necessary (But It’s Nice To Have)

Of course, multi-generational wealth isn’t a necessity. Neither is the need to Fat FIRE. Our baseline expectation should be that our children grow up, achieve financial independence, and learn to take care of themselves.

But after living in San Francisco for 25 years, I’ve seen the opposite play out repeatedly. Every single neighbor I’ve ever had either still has an adult son living at home, or the son lives in a house purchased by his parents.

I’ve gotten to know many of these families. The sons all went to college and worked hard. Yet, despite their education, none of them could land jobs that paid enough to live independently with middle-class comfort. Instead, they’ve relied on ongoing financial support from their parents to make life in San Francisco work.

Given this reality, I’m pragmatic enough to expect that the same dynamic could affect my kids. The world is only getting more competitive, with AI threatening jobs and international students filling up top university spots at the expense of Americans. Getting ahead will become increasingly difficult for the next generation.

Hence, the solution: attempt to build multi-generational wealth.

If my children don’t end up needing financial support because they find well-paying jobs, build businesses, or otherwise thrive, then great. The extra wealth will simply serve as a cushion or be redirected to charity. But if they do need help, I’d rather already have that “insurance policy” in place than scramble later.

Other Reasons To Amass Multi-Generational Wealth

Here are some reasons why you may want to build multi-generational wealth beyond simply wanting to give your kids and grandkids a head start:

- Severe disability or health challenges. You, your spouse, or your child may require extraordinary financial resources to maintain a decent quality of life—think 24/7 caretakers, modified vehicles for mobility, custom housing, or lifelong occupational therapy. A responsible parent's worry is never ending.

- Genetic risks. If you or your spouse carry recessive genes that could appear in future generations—causing loss of mobility, senses, or cognitive functioning—you might want to build a bigger financial safety net.

- Historical inequities. You may come from a community that has been historically marginalized and denied equal opportunities. Even though progress has been made, you may not trust that your children and grandchildren will ever be given a fully fair shake. Generational wealth becomes both protection and empowerment.

- The loud “provider’s clock.” Some people feel an unusually strong responsibility to take care of their family members. Maybe you were the first in your family to attend college, or you lucked into a life-changing opportunity like joining a startup before it IPO’d. Whatever the case, you feel compelled to leverage your luck into a lasting legacy.

- Volatility of opportunity. Opportunities come and go, and not every generation will be fortunate enough to catch a financial tailwind. Future generations may face bigger systemic risks than we did. By building more than you personally need, you’re smoothing the path for your heirs when they face tougher times.

- Philanthropic leverage. For some, it’s not just about family. A dynasty-level fortune allows you to create family foundations, endow scholarships, or shape institutions that last long after you’re gone.

Ultimately, the drive to build multi-generational wealth is usually not about greed. It’s often about love, protection, and creating optionality for the people who matter most.

The Math Behind Multi-Generational Wealth

Imagine a upper middle-class lifestyle for a family of four today costing $350,000 a year before taxes. In expensive cities like San Francisco, New York, Los Angeles, Settle, or Honolulu, this level of spending provides comfort, but it’s hardly extravagant once you factor in taxes, housing, childcare, education, and healthcare.

If you happen to live in a lower-cost city, feel free to adjust the numbers to better fit your situation. The country is vast, and the cost of living varies dramatically. This is simply a theoretical exercise to illustrate how much wealth might be needed to support three generations.

Supporting One Family Of Four Today

Using the 4% safe withdrawal rate, here’s how much capital is required: $350,000 ÷ 0.04 = $8,750,000

That means one family of four today needs $8.75 million in investable assets (not including primary residence) today to generate $350,000 in annual gross spending without depleting principal. If you want to build multi-generational wealth, the decumulation of principal is not the way.

In 20 Years (Next Generation)

Let’s assume each of this family’s two kids grows up, starts a family with two kids, and wants to maintain this same lifestyle. Using 3% annual inflation for 20 years: $350,000 × (1.03)˄20 ≈ $632,000

So what costs $350,000 today will cost about $632,000 a year in two decades.

At a 4% withdrawal rate: $632,000 ÷ 0.04 = $15,800,000

Each child will need about $15.8 million in invested capital to sustain a family of four in 20 years.

Total Required For This Family Of Four And Their Two Children's Families Of Four

- This family of four today: $8.75 million in investable assets

- Child #1 in 20 years: $15.8 million in investable assets (assuming they are a family of four)

- Child #2 in 20 years: $15.8 million in investable assets (assuming they are a family of four)

Grand total = $40.35 million.

And that’s assuming steady markets, no major financial shocks, and no lifestyle creep. To be safe, you’d want a 20–30% buffer, meaning the real target is closer to $50 million+.

In 40 Years (Grandchildren’s Families)

Now that we've got the two children's families and the current family taken care of, it's now time to think multi-generational and figure how how much we need to save and invest to take care of their grandchildren's families. Let us assume each grandchild has two kids and a spouse of their own.

Using the same assumptions:

- Base annual spending today: $350,000

- Inflation: 3% per year

- Timeline: 40 years

$350,000 × (1.03) ˄ 40 = $1,141,000

So by the time the grandchildren are adults, an upper middle-class family of four lifestyle could cost $1.14 million per year. Sounds kind of nuts! But the math doesn't lie.

At a 4% withdrawal rate: $1,141,000 ÷ 0.04 = $28,525,000

Each grandchild’s family of four would therefore require $28.5 million in capital in the future to sustain themselves.

With four grandchildren, the total comes to: $28.5M × 4= $114 million.

The All-In Generational Number

- Family today: $8.75M

- 2 kids in 20 years: $31.6M

- 4 grandchildren in 40 years: $114M

Grand total = $154.35 million.

Add a 20–30% safety buffer for market volatility, higher-than-expected inflation, or health/education shocks, and the real number pushes closer to $200 million.

Holy moly! Coming up with $154 – $200 million is a crazy amount of money. No wonder some high-income earning parents feel the angst of not being rich enough. Only CEOs, unicorn-startup founders, top athletes, or elite hedge fund managers or venture capitalists can amass that type of fortune.

So the sad reality is, even if you don’t FIRE and grind yourself into dust, you still probably won’t amass multi-generational wealth anyway. Hence, think carefully about sacrificing your life to try and achieve an unlikely goal.

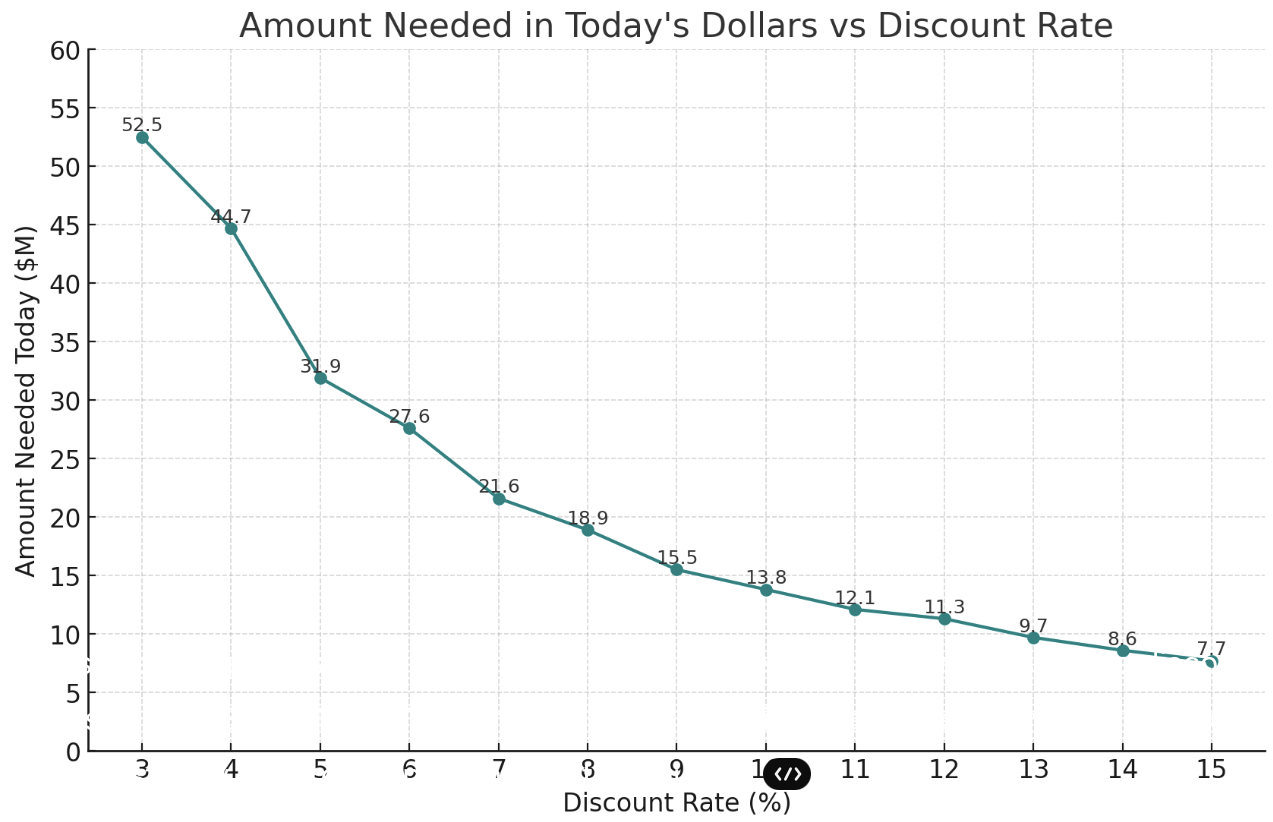

Calculating The Amount Needed In Today's Dollars

But here’s the good news: In this example, you don’t need to save and invest $154 – $200 million today. That figure represents the inflated future capital required to sustain everyone’s lifestyles. What really matters is how much you'd need to set aside in today’s dollars.

- Family today: $8.75M to generate $350,000 a year in gross investment income at a 4% rate of return

- Kids in 20 years (discounted back at 3%): $17.5M instead of $31.6M in the future

- Grandkids in 40 years (discounted back at 3%): $35M instead of $114M in the future

- Grand total = $61.25M instead of $154M in the future

Now, $61 million is still a monster sum, but it feels a lot more approachable than $154+ million. And that’s using a conservative 3% discount rate (equal to the assumed inflation rate).

It gets better when you assume a higher rate of return (discount rate):

Base amount needed today: $8.75 million (no need to discount this number)

Amount needed today based on various discount rates to take care of two more generations, 20 and 40 years in the future:

- 3% (inflation only, base case): ~$52.5M ($61.25M total minus the $8.75M you need today)

- 4% (inflation + 1% real growth): ~$44.7M

- 5% (inflation + 2% real growth): ~$31.9M

- 6% (inflation + 3% real growth): ~$27.6M

- 7% (inflation + 4% real growth): ~$21.6M

- 8% (inflation + 5% real growth): ~$18.9M

- 9% (inflation + 6% real growth): ~$15.5M

- 10% (inflation + 7% real growth): ~$13.8M

- 11% (inflation + 8% real growth): ~$12.1M

- 12% (inflation + 9% real growth): ~$11.3M

Although $20.05 ($11.3 + $8.75 needed today) to $61 ($52.5 + 8.75 needed today) million is still an enormous sum, it’s far easier to wrap your head around than $154 million.

Generating a 5%–8% annual rate of return is quite reasonable. 20-year Treasury bonds yield about 5% risk-free, while stocks have historically returned around 10% per year. My venture capital investments in private AI companies could potentially generate even higher returns.

Working Obviously Helps Increase Your Chances

If you want to build multi-generational wealth by continuing to work, each year of saving and investing will further strengthen your returns. For instance, saving and investing $87,500 in a single year would raise a base of $8.75 million by 1%. That 1% boost can either accelerate your path to the target or provide a valuable buffer during downturns.

Think about this type of calculation as a Coast FIRE calculation for multi-generational wealth creation. You don't need all the money today. Instead, you need enough money to grow at a reasonable rate of return beyond your consumption rate to support your future indefinitely.

How To Run Your Own Multi-Generational Wealth Calculation

If you’d like to stress-test your own plan, here’s a framework:

- Start with your desired annual household expenses today.

Example: $X per year for your current family size. - Estimate your children’s timeline to adulthood.

How many years until your kids have families of their own? Call this N years. - Apply an inflation assumption.

Multiply today’s expenses by (1+i)N(1+i)N, where i = inflation rate.- Conservative: 2%

- Realistic: 3%

- Pessimistic: 4%+

- Apply the safe withdrawal rate.

Divide the inflated annual expense by 0.04 (or your preferred rate). This gives the capital required for one family. - Multiply by the number of families you want to support.

For example, two kids who each have two kids = six families total (including your own). - Discount back to today’s dollars.

Use a discount rate that blends inflation and expected returns:- 3% = inflation only (very conservative, “real dollars”)

- 5% = inflation + 2% real return (reasonable base case)

- 7–9% = higher real returns (optimistic, but still possible)

- Add a buffer.

Because nothing ever goes perfectly, tack on 20–30% to your target. - Come up with a realistic number more years you're willing to work.

This framework lets you plug in your own numbers. If your annual expenses are $80,000 in a lower-cost city, your target will be much smaller. If you think inflation will run hotter than 3%, your target will balloon.

The Most Realistic Way To Build Multi-Generational Wealth

Now that we’ve run the numbers, let me share the most straightforward way of building multi-generational wealth: real estate.

Once you’ve gone “neutral real estate” by owning your primary residence, aim to buy at least one rental property per child. Ideally, you purchase one when they’re born or even years before, giving yourself more time to pay down the mortgage and let the property appreciate as your child grows into adulthood.

The next step is to acquire additional rental properties based on the realistic number of grandchildren you expect. Since the average family has about two children, you can multiply the number of kids you have by two to set this new goal.

With affordable housing locked in, life gets much easier. If you can reduce your housing expense to 10% or less of your income, financial freedom becomes almost inevitable. After all, food, clothing, and shelter are relatively inexpensive compared to housing costs. Here's my housing expense guideline for financial independence if you want to get more in the details.

Over a lifetime of saving, investing in other risk assets like stocks, and paying off multiple mortgages with leveraged gains, you’ll give yourself a strong chance of creating multi-generational wealth. And even if you fall short, you’ll still leave behind the most important foundation: paid-off shelter so your children and grandchildren will always have a roof over their heads.

Reconciling FIRE With Legacy Building

This is the hard truth: FIRE and multi-generational wealth are competing goals. FIRE is about quitting early to maximize your time. Multi-generational wealth is about working longer and compounding capital across decades.

You can’t maximize both at once unless you’re an ultra-high earner or build a billion-dollar company. For the rest of us, the trade-off is clear:

- Retire early, and you cap your wealth potential.

- Work longer, and you expand your wealth potential but sacrifice time freedom.

I’ve made peace with the fact that I may never hit multi-generational wealth to fully fund my grandchildren’s futures. And that’s OK.

My first job is to provide for my kids and raise them to be financially independent. If I can also build a cushion for my grandchildren, wonderful. If not, I’ll leave behind values like hard work, frugality, and investing – traits that may end up being more valuable than money itself.

After going through this exercise, I've realized there's no way I’d be willing to work another 20 to 30 years just to build multi-generational wealth for my grandchildren’s family. I'll leave that responsibility for my kids, if that's what they want to do.

Final Takeaway

FIRE may make building multi-generational wealth impossible. But that doesn’t mean FIRE is a mistake. It just means you need to be clear-eyed about the trade-offs. Retiring too early cuts off the compounding engine that dynasties rely on.

The best we can do is strike a balance: build enough wealth to enjoy freedom today, while still setting up a foundation for the next generation. Anything beyond that is gravy.

Readers, what assumptions do you use for inflation, investment returns, and spending in your financial independence calculations? Do you think about building multi-generational wealth, or do you believe kids should be fully on their own? Why do you think people get upset at others for running financial simulations to see how much wealth they can build over a lifetime?

If you see any math or logic errors with my above calculations, please feel free to point them out and I'll correct them.

Free Financial Analysis Offer From Empower

If you have over $100,000 in investable assets—whether in savings, taxable accounts, 401(k)s, or IRAs—you can get a free financial check-up from an Empower financial professional by signing up here. It’s a no-obligation way to have a seasoned expert, who builds and analyzes portfolios for a living, review your finances.

A fresh set of eyes could uncover hidden fees, inefficient allocations, or opportunities to optimize—giving you greater clarity and confidence in your financial plan.

The statement is provided to you by Financial Samurai (“Promoter”) who has entered into a written referral agreement with Empower Advisory Group, LLC (“EAG”). Click here to learn more.

Subscribe To Financial Samurai

You can learn how to build multi-generational wealth by reading my USA TODAY national bestseller, Millionaire Milestones: Simple Steps to Seven Figures. I’ve distilled over 30 years of financial experience to help you build more wealth than 94% of the population—and break free sooner.

Listen and subscribe to The Financial Samurai podcast on Apple or Spotify. I interview experts in their respective fields and discuss some of the most interesting topics on this site. Your shares, ratings, and reviews are appreciated.

To expedite your journey to financial freedom, join over 60,000 others and subscribe to the free Financial Samurai newsletter. You can also get my posts in your e-mail inbox as soon as they come out by signing up here.

Financial Samurai is among the largest independently-owned personal finance websites, established in 2009. Everything is written based on firsthand experience and expertise.

We will be under some form of Universal High Income/Goods & Services deflation due to AI (best case) or in an environment in which property rights and the dollar doesn’t exist anymore (worst case) well before the time your grandchildren are raising families.

Multi-generational wealth is not a goal of mine. I like the idea of helping our kids to the extent they will be able to do anything they want. However, if they have millions just handed to them, they have the option of doing nothing. Not good. If we can fund their education and help them with a down payment on a starter home, that’s more than enough!

I see how in the Bay Area how internationals are taking spots from Americans because of this I’m planning on leaving our child a total of 15m-20m If they continue to work the principle will supplement their earning. Thus they will live a good life. Money matters and I hope they marry well.

$15-$20 million per child should be good enough with a 5-8% rate of return. Good plan!

I definitely don’t want to leave generational wealth to my daughter or any future family she may have. I raised her for 18 years, paid for her college and when my wife and I visit her we fill her car with gas and take her to Fred Meyer and let her fill up the shopping cart on us. When the time comes we’ll probably help with a house down payment and if we’re fortunate enough to have grandkids we’ll start a college fund for them. Everything else left over my wife and I are gonna try and spend before we die. If we don’t we’ll leave it to causes that we believe in.

The last thing I want to do is rob her of the joy and heartache my wife and I went through in order to achieve financial independence.

I would like to leave my children together the same amount inflation adjusted that I inherited. Of course, each will only receive half of what I got. OTOH, my baseline projections show they will likely get more than that.

“Character cannot be developed in ease and quiet. Only through experience of trial and suffering can the soul be strengthened, vision cleared, ambition inspired, and success achieved.” —Helen Keller

Personally, I have witnessed if kids have everything setup and not taught the hard work way, it does not matter how much money you leave them, they will squander it. Kids from an early age should be taught the value of money and hard work. A friend of mine (despite her husband’s and family’s protests) got her kids to do simple household tasks from the time they could walk, and they would get treats and later pocket money. She never increased their pocket money and at age 10-12 yrs her kids took extra chores for their neighbors to add to their pocket money. By age 16, they all had part time jobs and worked through college. They did not get jobs post-graduation despite decent grades so worked their part time jobs and took unpaid internships part time until they were offered full time paying jobs. My friend had migrated from a poor country and worked hard to make a better life for herself and eventually married a local man and was well off. But she got scared for her kids when she saw most of her neighbors supporting live in grown up kids. Her kids still had a much better life than she had, living in a warm house, eating good food, having good clothes and having a good education. She did expose them to hunger by imposing as per her religion, fasting 12hr days/fortnight and also doing charity work once a fortnight so they can see what poverty looks like and how people got there. We do no favors to our kids by sheltering them and leaving them money they did not work for. In addition, 2 of her kid move to different areas, one pursuing love, the other a simpler kind of life. Most of us will live in a different place to the one we grew in up and so will our kids. Hey, the world could end in 20 years, and money would be useless so what your kids will do then? Make them capable not comforted.

As noted, the numbers are a bit padded in that they plan for the worst case where the descendants 1) earn nothing 2) marry people with nothing 3) still have 2 children and 4) continue to live in highest cost of living locations.

As you go on to conclude- FIRE isn’t about ensuring multiple generations are taken care of. Most people would have to work into their 70s to come close. But your FIRE is very different from the Mr Money Mustache type FIRE, where people live frugally, rely on ACA subsidies that will go away, and can’t tolerate any bit of misfortune. That’s Happy Path FIRE. You and your children could sell the SF properties and continue to live well somewhere else. (but not Honolulu, sorry)

I liked the latter half where you propose the next level goal is to provide or facilitate housing for the next generation. Far less expensive, but a dramatic opportunity creator to give them. So many of our age group got their first home by benefit of a 20% down contributed by parents. Even HENRYs struggle to get that first home. But once the housing cost is fixed and becomes a partial investment, wealth follows.

I think you have actually way-over estimated here. The reason is that you have not considered one key aspect of how families with multi-generational wealth conduct themselves – specifically they are very careful with who they marry. Marriage is not only for “love” but also a “business relationship” that maintains that multi-generational wealth. In your calculations you are assuming financial responsibility not only for your children and grandchildren, but also for their partners. In a family with multi-generational wealth your children and grandchildren would be expected to “marry well”. Assuming they do, you should be able to halve all the numbers above as half their wealth should come from the family they marry into. And if any if your children or grandchildren do not “marry well”, then you better increase your numbers A LOT, because a poor partner will drain the wealth faster than you can ever earn it. What is the saying? The first generation earn it, the second generation enjoy it, and the third generation loose it.

“ into. And if any if your children or grandchildren do not “marry well”, then you better increase your numbers A LOT, because a poor partner will drain the wealth faster than you can ever earn it.”

Is this part of your statement a contradiction to the First part of your statement?

We can all hope that our children marry well. But love is some thing hard to manufacture. And then there are obviously plenty of divorces.

Maybe it is a contradiction. Maybe it is not. The point is that inter-generational wealth requires a number of things in addition to the wealth itself – it requires that you have handed down discipline and skills to manage and grow wealth and it requires that your children/grandchildren have life partners have this same mindset and contribute to the wealth. There is a lot of things that have to go right – which makes estimating how much wealth is required an almost impossible task. BUT, we can say that if we achieve all of those things that successful multi-generational wealth families have achieved in the past, then the wealth requirement is about 50% of what you mention above as the partners or your children and grandchildren will contribute wealth. AND we can also say, that if the other key ingredients to multi-generational wealth are not present (the skills and discipline of both your children/grandchildren and their partners), then forget about building the wealth part, as no amount will ever be enough.

Sounds good. My hope is to teach my children all about finances so they have the knowledge to build their own wealth.

It would be nice if the partner brings 50% of the wealth to the table. Is that what you’ve seen your children’s spouses bring?

I like to be conservative and expect nothing.

For my child who is about to marry, yes, is the answer to the question above. While it is fine to be conservative and expect nothing, if a wealthy person marries a person who brings nothing (financial) to the table, what is the likely long term (financial) future of that couple? High chance that the wealth will be squandered or there will be arguments that deal a fatal blow to the marriage. If the partner can bring nothing, it tells you a lot about the partner and/or the partners family, right? That is why, as a generalization, you see the wealthy marry within their “class”.

As a counter to this point, I married someone with less than nothing because they have to take care of their parents and have been doing so for a long time. The upside is that they are incredibly hardworking and honorable. The downside is that it detracts from our ability to build intergenerational wealth and has caused some stress in our marriage over conflicting priorities. Because we both have good jobs, we’ve still been able to set aside enough for our kids to go to whatever college they want, and I have some real estate investments that could help them get started, but there probably won’t be money for lavish weddings or home downpayments. I have also encouraged my parents to bypass me with any current or future gifts and pass them directly to our kids. I think it’s okay to encourage your kids to think about financial compatibility when they get married, but it’s about more than your partner’s family of origin (though, definitely consider it). I have plenty of friends who married “well,” but their spouses have codependencies with their in-laws that cause conflict in their marriage.

Thank you for sharing this counterpoint! With ~35% of marriages ending in divorce and the uncertainty how how one finds love, I can’t assume that my kid’s future spouses will be financially strong when they come into the marriage. As a result, I’ll just assume the worst-case financial scenario (coming in with debt and a negative net worth).

The planning doesn’t mean GIVING them money and letting them know exactly how much multi-generational wealth I’m building. That is to be kept secret. It is just a fun goal that is also an insurance policy, just in case.

There is another solution… simply don’t have kids! :-)

Honestly for today’s middle class, that is the option to partial freedom and late burnout. Kids themselves are great beings and raising them is like raising one’s hurt inner child again if the parents are conscious. I have little confidence in the world future and don’t think amassing large amount of wealth to the kids would make them happier and more fulfilling. Chances are few middle class could make that much even grinding themselves to death and at the same time too tired or burnout to be present with the kids. Kids need unconditional love, conscious parenting and company, which is lacking because parents are stretching too thin. The basic living conditions which most middle class families could provide already don’t make a huge difference in my opinion. And with the AI or whatever, there is simply no point in get into some elite college to be the future workforce. Who knows what is gonna happen? Just enjoy what we have today and not worry about the future with our own assumptions. By the way, this is an Asian parent here.

How often does a child outearn his or her parents in SF? If you are the son of wealthy, likely dual-income parents, where you are still residing in their highly appreciated real estate, I’d say that kid won the wealth lottery. I would not move either!

(Un)fortunately for me, I grew up in rural Missouri and the sky is the limit when it comes to potential for creating a life better than one’s parents had.

(Tongue firmly in cheek.)

I used to live in “Misery” and while it seemed easier physically to do better than one’s parents, the mentality was very fatalistic. So while the bar was low, most people were too busy complaining about its existence rather than getting busy surpassing it.

In the current political climate, I should point out that international students don’t actually take college spots “at the expense of” Americans; rather, they pay full tuition and allow colleges to have more domestic spots.

Columbia University’s student body is 40% International students. Are you saying Columbia is making extra space for international students and doesn’t take away spots from Americans? I don’t think that’s happening.

The seats are limited. I’m building more wealth because it gets hard for my kids. Are you?

I think they have two separate quotas for international/domestic. So it’s probably more competitive for international students to get in vs. other international students, NOT versus domestic applicants. Source: my friend who worked in their admission office (we both attended said university).

I’m not building more wealth for my kids because I’m done. I luckily crossed that financial finish line, now it’s time to actually live life and find real purpose beyond chasing dollars. Good luck to your family!

The main reason why acceptance rates are declining is because applications are going up will class sizes stay fixed. Internstional students may be paying full tuition like plenty of American students, but they certainly take spots away from qualified Americans.

What is your argument otherwise?

I guess all of the links that get kicked back when you google search “do international students take spots away from americans?” Fair enough that I didn’t dive into the data deeply, but the number of links it’s citing suggests this isn’t a false AI summary.

I believe international students are good for the academic environment to inject more global perspectives, so that’s the source of my annoyance at Sam vilifying them.

Sorry I’ve annoyed you. I didn’t realized I vilified international students.

I didn’t realize universities like Columbia etc were expanding their number of seats, making more space for international students so that there are still the same number of seats for domestic students. I thought with the relatively fixed number of seats, it is a zero-sum game if one seat is taken by an international student, there is one less seat for a domestic student. Otherwise, why else has the acceptance rate dropped so much besides the increased number of applicants?

If you think getting into university is getting easier, I’d love to hear the argument. That will provide readers with relief and we can worry less and save less. Are your children in university now? If so, are they at one of the top 25 universities?

I don’t think saying one seat taken by an international student means one less seat available for a domestic student is vilifying. It’s just a reality. How would you word it to be less offensive? As someone who is not easily offended, and take things as they are and tries to take action accordingly, it would be helpful to shine a light on a potential blindspot of mind.

With the topic of FIRE and multi-generational wealth, why do you think you zeroed in on this statement? I’ve found over the years, when commenters don’t focus on the main topic or get fired up about something, it’s often a reflection of something going on with them. So I’m curious to know what’s going on.

Thanks! And please let me know if there is anything else offensive about this post!

Sam, your statement is not offensive at all. People who are very sensitive, highly emotional, and into politics will try to make anything into a political issue.

As an admissions officer had a top university, you are absolutely correct that the number of seats have hardly grown compared to the amount of demand. It’s not even close. And yes, I see that goes to one student means there is one less seat for another student.

Plenty of domestic students who pay taxes that go to these universities pay full tuition as well.

I should add, like with migrant workers, don’t blame the foreigners – blame the hiring/admitting authorities for giving those jobs/spots.

Sam, it’s very endearing to see that you are so forthright in admitting your regret on retiring too early. I also believe you should have moved out of the SF when u quit since it’s one of the most expensive places to live, especially with a family. I understand wanting to be in a vibrant city with intellectural capital; however, you can blog anywhere. You would be much better off in a lower tax state with good public education options. Would love to hear your thoughts on that?

Thanks. After our visiting over 60 countries and living abroad for 13 years while also working in international equities, I feel like San Francisco provides the best balance of opportunity, weather, diversity, and wealth building opportunities.

But I’m also looking forward to relocating to Honolulu Hawaii and doing long travel with my family.

I think it’s just fun to have a challenge, and trying to be financially independent in one of the most expensive cities in the world is a great challenge.

How about you? Where are you on your financial independence journey and do you think about multigenerational Wealth building? Where do you live?

I lived in SF for 20 years then moved out to Pasadena at 51 when I decided to retire and move closer to my aging parents. I have 2 kids and my net worth is roughly $25 million all liquid (I dont’ own any real estate or businesses). I loved living in SF but I feel like the suburbs are more conducive to families and cost effective. For example, private school is 1/2 the cost, and there are much more grocery and family outing options in SoCal. I feel like you should only live/retire in SF if you have a ton of money or have to work there.

Cool, thanks for sharing. Are you interested in building multigenerational Wealth? $25 million is a good foundation to help you get there.

I really enjoy the excitement of big city living. And San Francisco is not a big city, but a small big city with a tremendous amount of growth and activity.

Related: Why It’s So Hard To Leave San Francisco

I believe multi-generation wealth produces less productive kids. I plan on helping them invest in themselves in education, health costs, housing costs etc… but I don’t plan on leaving them money. My money will go toward my foundation.

Thank you for pointing out children with disabilities, which require tremendous amount of financial resources to properly take care of them. Our family spents about $150,000 a year on our daughter, who is a quadriplegic with severe mental disabilities. She is 35.

My husband and I are 68 years old now and we constantly worry about who and how we are going to take care of her in the future when we are also old and need caring for or gone.

I’m not sure people with regular health and regular healthy children realize how fortunate they are to not have to worry about providing for our loved ones with severe disabilities. But we feel blessed to have our daughter and other children all the same.

As parents, we just need to plan to care for them. Thank you for such a thoughtful, in-depth case study on building wealth for our future generations.

Thank you so much for sharing your story. It really highlights how different each family’s financial journey can be, and the tremendous responsibility parents face when caring for children with severe disabilities. $150,000 a year is an enormous expense, and I can only imagine the emotional and logistical weight that comes with planning not just for your daughter’s care today, but for her future when you and your husband may no longer be able to provide it yourselves.

Your daughter is blessed to have such caring and dedicated parents. One of my previous neighbor’s children needed extra care as well, and it was great to see them always there. The father would take her to the Pomeroy Rehabilitation Center, where I would take my son to swim. He’d be there for her from start to finish every time.

If we start to think beyond ourselves, the idea of building multi-generational wealth may grow more common. Thank you again for reading and for adding such an important dimension to this discussion. Your comment will stay with me.

I agree that our job is to provide for our kids when they are minors and raise them to be financially independent. The best gift we can give them is our values, like hard work, frugality, and investing. The next best gift is a fully funded education.

Multigenerational wealth isn’t just unnecessary; many thoughtful people believe it shouldn’t be the goal. Adults who achieve financial independence experience the deep satisfaction that comes from personal accomplishment. Regular financial handouts can create patterns of learned helplessness that ultimately aren’t in your children’s best interests. Additionally, if your adult child develops destructive patterns like overspending or substance abuse, your financial support could inadvertently enable these behaviors. Giving your children substantial money might also make them targets for partners with ulterior motives, potentially leading to relationships that aren’t built on genuine love.

I love this start exercise! It is kind of crazy how much money is needed in the future to sustain your current quality of life. Or conversely, it’s also amazing to know how much your invest investments can grow over a 20 to 40 year period.

Seeing the potential gains is very motivating to me to continue to save and invest for my family‘s future. Whether I get there or not is kind of besides the point what I think is most important is deciding how much time I’m willing to sacrifice to provide for my loved ones and descendants beyond what might be necessary.

So many of us are continuing to grind away to make money that we probably don’t need. So unless you’re trying to accumulate well for future generations, it doesn’t make sense to work at a job you don’t enjoy for 40 years.

It’s interesting to think about such a far reaching long term horizon. I’ve frankly never factored financing grandchildren into my financial plans. I suppose I have indirectly though since I am aiming to have surplus funds and assets to hand down to my children which in turn will aid any future grandchildren I may have. I suppose age also plays a factor here. Those who already have adult children who are preparing to have their own kids or who already do would naturally think about this more. That seems only natural as I know my overarching financial goals and aspirations have changed at different stages of my life. In any case, good food for thought. Thanks!

Kids should be prepared to be totally on their own. My father, through parental pressure, made certain that I’LL be able to repay my college loans (NOT HIM) by taking a major that I didn’t like but was marketable (engineering) that although I did for several years I went back to obtain my MBA and APPLY the concepts from engineering, which I loved when they were applied to finance.

This is a fun thought exercise. If I were to consider it seriously, I would probably factor in some kind of expectations for my children’s and grandchildren’s families’ income — continuing the SF example, maybe they can each earn $200K, meaning that they would only need an extra $150K per year from us instead of the full $350K.

In the case of my family in the SF-Bay Area, and perhaps others that live in high cost-of-living areas, I think it’s best to accumulate as much as possible, and then transplant your family to an area with lower cost of living… and hope your kids don’t want to move back some day. It certainly makes the math work out much better.

Sam thanks for all your insights. This post has made me realise that I am no longer a relevant audience for your newsletter. We can blame inequality or anything else, but this entire post went way over me and my aspirations and made me realize that I already have everything I need. Peace, brother.

Having everything you need is wonderful! Congrats. Having supreme confidence in your future and your children’s future must be a great feeling.

Given thinking is free, I love to think about multiple scenarios and planning for the future. For some reason, I find financial planning fun and rewarding.

All the best!

Agree 100%. This article has pretty low relevance to most of Sam’s readers. (I believe anyway)

I have enjoyed Sam’s insights and believe my family is better off since I found him. Having said that, I have zero interest in assuring generations of our descendants are guaranteed a level of security. Heck – while I hope my descendants are great people, real life experience tells me some likely won’t be. Some of them might even be Democrats!

I recognize that part of any good writer’s role will be to challenge the readers so nothing wrong with this article per se. It just doesn’t resonate or motivate me.

No worries. Not everyone article can resonate with everyone. That’s why the world is so fun and unique.

“Some of them might be Democrats”. Yep. And some might be convicted felons. And others might spend their whole life lying and abusing woman. And others may become presidents and destroy what for 250 years had a great country.