As someone who plans to re-retire by December 31, 2027 after grinding during the pandemic, I've been thinking about how much investment risk to take in retirement. You see, once you retire, your goal is to stay retired and enjoy the rest of your life free of financial worry.

After all, first rule of FIRE (Financial Independence Retire Early) is to never lose money. The second rule of FIRE is to always try to negotiate a severance package. If you were planning on quitting your job anyway, there's no downside in trying to walk away with money in your pocket.

Tone down investment risk if you're no longer going to be earning active income. Active income is a bigger buffer for downside risk than you realize. Further, with how strong stocks, real estate, and other risk assets have performed since 2020, let alone 2009, it may be prudent to reduce risk. But how by how much is the question.

If you are wondering how much investment risk to take in retirement, I will offer up various portfolio compositions to consider in this post.

Retirement Should Ideally Be Peaceful And Free From Money Worry

Once you retire, you don't want to take excessive risk. Instead, you want to enjoy life to the maximum thanks to your steady passive income streams.

In 2012, I retired from the the finance industry. I thought I had enough to provide a humble life for a family of up to four in San Francisco. But once I stopped receiving a bi-weekly paycheck, reality hit home. Maybe my ~$80,000 a year passive income and side hustle income wouldn't be enough.

The fact that I tried to sell my primary residence in 2012 to live in an apartment 65% smaller and cheaper shows that I had reservations about early retirement. But I was determined to provide a free life for my wife and I both before the age of 35.

In early retirement, I concluded I needed to take the least amount of risk necessary to maximize my chances of never having to go back to work again. At the same time, I was still pretty young and it looked like the economy was recovering.

Therefore, I ended up constructing a 60%-70% stock and 30% – 40% bond portfolio. I hoped to achieve a 4% – 6% rate of return each year. Doubling my investments by the age of 50 seemed like a good enough goal to have.

But thanks to a bull market in stocks and bonds since 2009, my public investment portfolio returned more. And thanks to a strong recovery in San Francisco real estate, everything has turned out fine so far. I wasn't smart, I just stuck to an investment framework that fit my risk profile.

But I “Missed Out BIG TIME” On Making More Money

In 2017, my public investment portfolio returned 15.9%. Given my annual return objective was only 4% – 6%, I was feeling pretty good about the performance. Then of course a reader left this lovely comment after reading my investment lessons from a surreal 2017 post. I wrote that due to uncertainty, I didn't pile into stocks at the beginning of the year.

You missed out BIG TIME then. Seemed pretty obvious that the stock market would soar once Trump was elected despite what many so called experts said. Regardless of accomplishments, investors gained trust in the market again once a businessman was elected as opposed to another career politician (on either side).

Isn't it interesting how all investment decisions are obvious in hindsight? Yes, my combined stock and bond portfolio underperformed the S&P 500 index by about 3.5%, but my stock only exposure outperformed since I was heavy in tech. I didn't invest my entire portfolio in the stock market because I wasn't comfortable with the risk.

Thankfully, I made up for my underperformance in 2020 when my investment portfolio rose by a surprising 40%! 40% compares favorably to the S&P 500's 18% return. Then of course the bear market happened in 2022, but the S&P 500 is back to an all-time high.

How Not To Feel Bad About Portfolio Underperformance In Retirement

For those of you who may feel bad about your investment performance or were criticized by others for not doing better, let me share some following thought gems.

1) You're already free.

Money is a means to an end. If you're able to earn or accumulate enough to be free to do whatever you want every day, you win. It's much better to only be up 10% and do your own thing than be up 50%, but still have to report to someone.

The most valuable resource is time. If you have freedom, you are a “time billionaire.” To be able to do what you want when you want is priceless!

Sure, if I could rewind time and retire all over again, I probably would have worked a couple more years. My original goal was to work until age 40. However, I was burned out and was able to negotiate a severance package that paid for five years of living expenses. So I figured, now or never. I could always go back to work if I failed.

2) Don't forget the absolute dollar return.

As someone who is close to retirement or in retirement, you've likely already got way more capital than someone who is still far away from retirement. Therefore, the absolute dollar amount you return is also much greater. It's much better to be up $1 million due to a 10% return than be up $100,000 due to a 100% return.

Being up $1 million sounds like a lot, and it is. But it's possible if you retire with the $10 million, the ideal amount people say they'd like to retire with on Financial Samurai.

3) Don't forget all your other assets.

You likely have a wide assortment of investments as part of your net worth compared to most Americans who have most of their net worth in their primary residence. Even if your public investments underperform, your other asset classes such as coastal city real estate, private equity, venture capital, real estate crowdfunding, venture debt, fine art, etc might outperform.

Personally, I'm investing in Fundrise Venture, to gain more artificial intelligence company exposure. Roughly 75% of the Innovation Fund is invested in artificial intelligence, which I'm extremely bullish about. In 20 years, I don't want my kids wondering why I didn't invest in AI or work in AI!

The investment minimum is also only $10. Most venture capital funds have a $250,000+ minimum. You can see what the Innovation Fund is holding before deciding to invest and how much. Traditional venture capital funds require capital commitment first and then hope the general partners will find great investments.

I'm happy to invest in startup founders who have everything to prove and are not yet financially independent. Instead of me doing the work and taking all the risk, I'd rather invest in those who do!

4) More money won't make you happier.

After you earn more than ~$100,000 a year in a non-coastal city or ~$300,000 a year in a coastal city, you won't be happier. The same can be said with building a greater net worth beyond what you've deemed necessary to retire on.

But if you want a specific net worth number, I will say anything above a $3 million net worth won't make you much happier if you are truly free to do what you want and don't have to make your partner work to enjoy your lifestyle. $3 million is the beginning of being a real millionaire thanks to inflation.

Here's another datapoint on money not being able to buy happiness. In 2023, I took advantage of real estate market weakness and bought my forever home. It is a sweet home in San Francisco with views and lots more land than the average home. But I'm no happier despite buying the nicest home I could afford. I feel more satisfied, but not happier.

5) It's great to sleep well at night.

All retirees know what it's like to lose money because we've been through enough down cycles. When you can combine the freedom to do what you want with not having to worry about ever going to work because your investments are generating enough income, you feel like the luckiest person on Earth. Not only have you won the game, you get invited back as a VIP with front row seats and all you can drink and eat privileges.

Retirement Investment Risk Levels

Now that we've got a lot of the FOMO side of the investment equation out of the way, let's talk about how much investment risk to take in retirement. Ideally, our investment income generates enough to cover our desired retirement lifestyle expenses.

Alternatively, we can also consider investing returns surpassing active income as a good indicator for living a low-risk retirement lifestyle.

Zero investment risk in retirement

Your baseline investment goal in retirement is to at least beat inflation. You can easily beat inflation with no risk if you invest all your money in Treasury bonds.

Treasuries usually yield more than inflation, providing real returns. So long as you hold your Treasury bond until maturity, you will get all your principal back plus the annual coupon.

You can also invest in CDs where the FDIC guarantees up to $250,000 in losses per person. The problem is finding a CD with a high enough interest rate to comfortable cover inflation. CDs also have early withdrawal penalties.

Minimal investment risk in retirement

The next investment you can make is to invest your entire liquid net worth in a portfolio of the highest rated municipal bonds in your state.

AAA-rated municipal bonds have default rates under 1%. In 15.5 years, you'll double your money. So long as you hold your municipal bond until maturity, you will get all your principal back plus the annual coupon, if the municipality doesn't go bankrupt.

Moderate investment risk in retirement

The Barclays U.S. Aggregate Bond Index provides about a 5% annual return each year, depending on which 10 year time frame you're looking at. You can take more risk buying individual corporate bonds, emerging market bonds, or high yield bonds. But overall, buying the aggregate bond index is a moderately risky investment.

If you buy an index fund, you have no guarantee of getting your principal back. You are riding appreciation or depreciation and collecting coupons. Corporations can default or corporate bonds can lose principal value if a corporation experiences financial difficulty.

There are no guarantees. If you bought Venezuela sovereign bonds you'd be down big as the government is in disarray and inflation is sky high.

Higher investment risk in retirement

The stock market has returned anywhere from 8% – 10% a year on average, depending on the time frame you are looking at. Just like in the bond market, you can buy all sorts of different stocks with different risk profiles.

For example, for investors under 40, I recommend investing more heavily in growth stocks. It's better to try and rapidly build your capital base while you are younger and have appetite for more risk.

For investors over 40, I recommend investing more heavily in dividend stocks for passive income. When you're older, you won't want as much volatility given you will have much more money and more responsibilities. Generating enough passive income to cover your living expenses is the holy grail of personal finance.

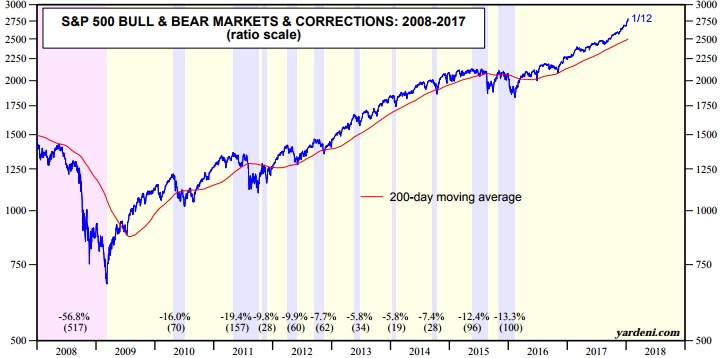

But as we know, the stock market can have violent corrections. See the recent number and magnitude of corrections below in the chart. Then of course, we had the 32% one-month correction in March 2020 and the 19.6% correction in 2022.

As a retiree, it's OK to sell stocks to pay for life and things. Otherwise, you'll never be able to enjoy your stock gains.

Retirees will have a combination of different types of risk levels. The question to ask is what type of investment weightings one should have in each based on their risk profile.

There is no right answer because everybody's risk tolerance is different. But we can start by looking at the risk / reward metrics of different types of portfolios.

Income Based Retirement Portfolio

Income based portfolios are what the typical, truly satisfied retirees should focus on. There's minimal risk to principal and only modest medium-to-long term growth of principal. Given retirees are generally in a lower tax bracket, an income based portfolio is also usually more tax-efficient.

Even with a super conservative 100% allocation in bonds, your average annual return would be 6.1%, beating inflation by roughly 3.6% a year and twice the current risk free rate of return. In 14 years, your retirement portfolio will have doubled.

With a 30% allocation to stocks, you could improve your investment returns by 1.1% a year. But if you are already satisfied with the amount of money you have, who cares about an extra 1.1% a year? Your stock allocation matters by bond yield.

The improved performance will make no difference in your lifestyle. With a potential improvement of 1.1% a year, you increase the magnitude of a potential loss by 40% (from -10.1% to -14.2%) based on history.

Related: The Proper Asset Allocation Of Stocks And Bonds By Age

Balanced Retirement Portfolio

A balanced-oriented investor seeks to reduce potential volatility by including income-generating investments in his or her portfolio and accepting moderate growth of principal. This type of investor is also willing to tolerate short-term price fluctuations.

For most retirees, allocating at most 60% of their funds in stocks is a good limit to consider. An average annual return of 9.1% is more than 4X the rate of inflation and about 5X the risk-free rate of return. But you've got to ask yourself how comfortable you'll feel losing over 20% of your money during a serious downturn. If you're over 65 years old with no other sources of income, you will likely be sweating some bullets.

For the first two years after leaving work, my public investment portfolio was around 60% stocks / 40% bonds. Once I got out of early retirement mode by working on my online business, I got more aggressive in stocks because my business income began to surpass my investment income.

Growth Based Portfolio

To be comprehensive, let's take a look at the risk / reward metrics for portfolios with 70% – 100% allocations in stocks. These portfolio allocations are mostly for those who are looking to build a retirement nest egg you've already built.

Even with a 100% allocation in stocks, the average annual return is only 10.3%. But there have been 25 years of losses out of 95 years, and in the worst year you would have lost 43% of your money. Losing 43% of your money is fine if you are 30 years old with 20+ years of work left in you. But not so much if your goal is to spend the rest of your days cruising around the world.

Unless you retired before the age of 50, have a variety of passive income streams, run a lifestyle business, or have a net worth equal to over 30X your annual expenses in retirement, I wouldn't have greater than a 70% allocation to stocks.

Related: Target Net Worth Amounts By Age Or Work Experience For Financial Freedom Seekers

Eliminate Financial Worry In Retirement

Below is a chart that shows how much investment risk you should take in retirement, depending on your age and risk tolerance.

Now that you know what the risk/reward metrics are for the above portfolio compositions, you can decide on an investment strategy that best suits your needs. The ideal financial scenario in retirement is low volatility and steady income.

Don't let money get in the way of a wonderful retirement. Your investments should be a relatively worry-free tailwind that ensures you never have to return to the salt mines again. If you are starting to worry about your risk exposure, then dial down risk. Raise more cash or rebalance more towards treasury bonds or top-rates muni bonds.

Yes, it can get annoying if you underperform your respective benchmarks. But you've got to remember that you've already won the game. Every single dollar you make above the rate of inflation is gravy. During bull markets, you'll sometimes be able to return a greater amount from your investments than you would make at your job.

The pain of losing money is always much worse than the joy of making money. If you've already got all the money you'll ever need, there simply is no point taking outsized risk.

Free Tool To Track Your Finances Carefully

Sign up for Empower, the web’s #1 free wealth management tool to get a better handle on your finances. In addition to better money oversight, run your investments through their award-winning Investment Checkup tool. It will show you exactly how much you are paying in fees. I was paying $1,700 a year in fees I had no idea I was paying.

After you link all your accounts, use their Retirement Planning calculator. It pulls your real data to give you as pure an estimation of your financial future as possible using Monte Carlo simulation algorithms. Definitely run your numbers to see how you’re doing.

I’ve been using Empower since 2012. As a result of better money management, I have seen my net worth skyrocket during this time.

Diversify Your Investment Risk With Real Estate

Investing in retirement doesn't only mean buying stocks and bonds to diversify investment risk. Many successful retirees invest in real estate as a way to minimize volatility, earn income, and growth capital.

Real estate is a core asset class that has proven to build long-term wealth for Americans. Real estate is a tangible asset that provides utility and a steady stream of income if you own rental properties.

I've personally invested $957,000 in real estate crowdfunding across 18 projects to take advantage of lower valuations in the heartland of America. I feel much less stressed investing in real estate than I do investing in stocks. Further, I can earn much higher yields from real estate.

Personally, I like investing with Fundrise, which offers real estate funds that invest primarily in the Sunbelt region. Valuations and rental yields in the Sunbelt are higher. Fundrise manages almost $3 billion and has over 350,000 investors. Financial Samurai is a six-figure investor in Fundrise funds and Fundrise is a sponsor.

Invest In Private Growth Companies

Finally, consider diversifying into private growth companies through an open venture capital fund. Companies are staying private for longer, as a result, more gains are accruing to private company investors. Finding the next Google or Apple before going public can be a life-changing investment.

Check out Fundrise's venture capital product, which invests in the following five sectors:

- Artificial Intelligence & Machine Learning

- Modern Data Infrastructure

- Development Operations (DevOps)

- Financial Technology (FinTech)

- Real Estate & Property Technology (PropTech)

Artificial intelligence is clearly the defining technology today. Better to invest in a diversified fund near the beginning to hedge against an unknown future for our children. Fundrise is a long-time sponsor of Financial Samurai and Financial Samurai currently has over $400,000 invested in Fundrise.

How Much Investment Risk To Take In Retirement is a Financial Samurai original post. All rights reserved. Join 60,000 others and subscribe to my free weekly newsletter to help you achieve financial freedom sooner.

The threading was too much above, but seeing how little my father lived on because of his annuity was painful to watch. Even more painful when I went through his paperwork and learned that all the principal ceased to exist upon his death. He technically retired early, but also did not get many years of retirement. Had he known how short his life would be, I imagine he might have chosen to just eat into his accumulation. He would have had a less bare-bones lifestyle.

I’m writing this just after the stock market dived over 1,000 points and I couldn’t be happier! I just look at it as another opportunity to buy the lows. It never felt right to me to lower my risk as I approach retirement and I have no intention of changing my portfolio from 100% indexed stocks in my 401K. I know that might seem crazy to everyone but I already have been receiving a pension and have a rental property and no debt. I’m still a few years out from early retirement (55) but may go until 60. I have no immediate need for the 401K so it will probably will be given to family over the years so I think I withstand any corrections. Please let me know your thoughts.

Love your guts of going 100% equities at 55!

If you’re not feeling bad about a 1,200 point one day decline, then you’re good. Only you know your needs and risk tolerance.

I am not Sam but I would tell you that a 100% allocation to equities at your age is usually fine since you have enough time to recover from any bear market. However, the overlay is your individual risk tolerance. If you think you would move any $ out of stocks if they fell 30% tomorrow (an arbitrary number), then move some now. That way you will be less tempted to do so later.

I’d stay strong and ride the course if that were to take place. As you mentioned, I’m young enough to ride a few economic cycles.

Hi, Sam,

You mentioned that you wouldn’t have more the 70% allocation in stocks… This caught my attention, which leads me to ask, is there an age-consideration for this? I’m a 31-year-old Hospitalist and Physician advisor, and I contribute the max to my 401K, ~$25K per year to my solo 401K, max out my Roth IRA (backdoor), and have a few other saving vehicles. For my employed 401K, I have 100% allocated in VINIX, and VTSAX for my solo 401K. I figured I’d give it till 35 or so, and then shift my allocations to a 90% stocks – 10% bonds… But you made me question plans w/ the aforementioned. What are your thoughts?

I had to laugh at the ‘missing out’ comment. Those guys always seem to be the same ones who lose 45% in the big drawdown, sell, and then miss the ride back up.

We had a roughly 70/30 portfolio that I manage, and had the exact same return as you had, due to overweighting international/EM a bit. Our benchmark earned 14.9%, so we were happy. Like Jeff Miller says when considering an investment, I always start by considering my risk.

I do wish I’d been as eager as you were to achieve FI. I never really even considered the possibility. I’d like to back you up on the idea that it’s not just your retirement funds that get you to the finish line. We have a second house (bought for in-laws) and a modest business. When our 401Ks stall, something else usually takes off. In addition to investment returns, I measure net worth CAGR… I settled on a 7 year rolling average as a metric. Only twice has it dipped below 10%, which means we’re doubling assets roughly every 7 years, and our net worth CAGR is higher than our investment CAGR, which I really didn’t expect. It’s the balance of different assets that keeps the whole thing moving forward with amazing consistency, even when events like 2008 hit.

Agree John. When I see comments like that, it reminds me of 1999 when I heard 2 plumbers in my house discussing the market. They were talking about Internet stocks and the one said to the other, “if it goes from $100 to $50, don’t worry about it, buy more. It always goes back up.”

In all likelihood that is an emotional investor who will enjoy the ride up and sell when “things look bad”. Seen it a million times. It is the reason why the market will never be perfectly efficient.

When everybody* is talking about being in the market, it’s likely to be at the top of the bubble!

*everybody = the plumber, cab driver, waiter, barber, etc.

I may point to a lesson from ‘security analysis’. It talks about the bond/stock allocation and how an investors risk profile may be influenced by the total amount of money they have in the portfolio.

A young person may want to go %100 stocks to maximize portfolio growth. A widow with many millions may also want to go %100 stocks as she can wear a 50% downturn and still be FIRE. It’s that middle ground which is appropriate for a split.

When it comes to generating income, I don’t understand why people don’t use options. One can simply use covered calls on stocks they own and could double triple their dividend yields annually. And it doesn’t require much work.

Using more complicated options strategies, one could even increase returns and reduces risks and that has allowed me to have a return of over 500% in 6.5 years and has propelled me to the top one percent status. But I believe that is not what we are talking about here. We are talking about lazy-man couch-potato strategy that one only needs to review his/her portfolio every 30-45 days and make adjustments accordingly. That should consistently produce effective annual yield of 8 to 12% with very little work regardless of the market condition.

Options can backfire.

It is no more risky than owning stocks if you know what you are doing. If you are selling covered calls against the stocks you own, it could even carry less risks than if you just own the stocks outright without options.

In fact there is a blogger who owns Early Retirement Now web site and who does a different version of covered calls. He sells weekly SPX puts to get additional income. Definitely it is very achievable for an average Joe like myself. I plan writing a book about my journey to get there. Nobody can become a multimillionaire or in the top one percent category overnight without an inheritance or winning a lottery. But with the right tools and the diligence, anybody can. Yours truly is a one good example. Enough said.

Multi, I’m curious why SPX and not SPY when covered? When a sold put goes against ya you can get the shares, then sell calls on them until the sold calls go against and then back to puts. SPX is cash settled.

How far out do you go in time and price? I’ve been selling a few puts 6 months out and 5% down, but stopped due to the current highs.

I don’t trade SPX options because of its low liquidity. However, SPX enjoys 1085 contracts tax treatment where one has the benefit of 60% long term and 40% short term capital gains treatment. You have to ask the blogger of Early Retirement Now why he only trades SPX options. It can be fairly involved in terms of strike and expiry selection. Long story short, the optimum choice is perhaps use OTM strikes with 30 delta and about 45 days to expiration.

Multi – I have written covered calls, puts and spreads as well. Yes, a nice source of income. I have looked into more complicated strategies but they all seem to be very high risk with a low chance of getting a high reward. Any links you could send me to that would help me understand those strategies in greater detail?

I will say that options are only for those who wish to be very involved in their portfolios. Even call and put writing. For instance I had 2 covered calls on Apple with a Feb and April exp date and a strike of $175. I always close early if I can keep 40% of the income within a month. That happened when Apple hit $179. I closed out and made great money for such a short time frame. However, had I not, I would be at a loss now since Apple shares have declined into the mid 160’s. Again, only use options if you are willing to monitor the portfolio.

The other key is that a person should be SELLING options, not buying them. At least for the majority of trades.

Actually closing out early with 50% max profit without waiting until expiration gives you the most optimum P&L per day. We usually seldom buy options unless a trade goes against me and I have to adjust the delta to the long and short side. The other advantage of options is the flexibility of mitigating the risks for a trade that goes wrong to turn it back to profitability over time.

I plan on by the time I retire, I will craft out a strategy with some of my funds engaged in relatively straightforward covered calls arrangements for stocks I want to own. I believe it should produce enough to cover all of my expenses and then some without ever touching the principals. The downside is I will have to pay income taxes on the capital gains.

Thanks! I really think this is an area where active management can work. My issue with SPY is that the premiums are just so low now. I have made really good money using AAPL.

I always love Sam’s post. A caution though on bonds. We have begun to see a normalization of rates but we are probably far from done. Obviously, it is much better to be in at today’s rate of 2.7% on the 10 year than it was when the rate bottomed at 1.4%. However, treasuries are NOT a safe spot for those contemplating retirement today. The old argument always was that the coupons will be reinvested at higher rates so you will be OK. That was true when rates were at a higher starting point. It isn’t true when rates are this low. The % loss is just too great.

It also appears that rates will be trending up for some time. I would rather be in cash for non equity, non real estate money at 1.5% which will adjust upwards when rates rise without reduction in principle. I would be OK with the usual MPT advice of having a certain % in bonds if the bonds had not just come through of being artificially price through the manipulation of central Govs world wide.

I currently have 27% in cash. I have no issue with that whatsoever. Should the stock and bond market correct, I will be ready to increase my % into both asset classes. I have 5% in bonds today but one with TIPS as an insurance policy against unexpected inflation.

I believe it is too risky for new retirees to be in that high of a bond portfolio right now. I would wait for 3 or 4 more rate increases and for the 10 year to be at least 3.5% to feel comfortable that the normal rules of MPT would apply.

Just a thought.

I know there are a lot of people writing your strategy of being low risk with lots of bonds and only a minority in Shares / ETFs for indexing in Shares is the best way when you have reached your goal.

I´m now in the same situation like you that I can easy live from my assets. Most of it is invested in shares at the moment and the main income are dividends. I don´t plan to sell any shares to get money for the living. I know, a dividend is not that secure in the height of paying like I have a coupon which generates me a fixed income of say 3.5%. On the other hand my experience is, that the average growth of my dividends is around 5%/year with around 3 – 3.5% yield. Even in 2009 I had a growth, but due to some decreases this was not that high as in normal years. I do not care a lot about the course of the shares. So I´m quite passive because I do not often sell shares. On the other hand I´m still working a bit, but this is for my personal fun only and money is not important.

So I could decide, I change most of my shares to bonds and do not care a lot in the future. There is one thing I´m worried about. The interest rates are very low, the policy for the money is not strict and we have a very low inflation. This is the same in Germany like in the US. This can change in the future. Lets say, I will buy bonds with 10 or 15 years transit time. What will I do if the interest rates are increasing to 7% and the Inflation to 5%? I do not know if this will happen, but there is a chance. With this I will have a big problem when I have invested the majority in bonds. When we have higher interest rates, the next problem is, that the share market do not perform a lot as well, because many people are investing in high yielding bonds. For this I can get into troubles and if this takes too long, I´m may be not FI at some day.

What do you think about this situation? At the moment I do not have a must to decide which will be the way to invest immediatly or to change everything now. But this is a long term question. If we have a situation with high interest rates I probably would buy a lot in bonds. But with the situation now I don´t think this would work for me. But if this works for you, everything is OK.

Thanks & regards

Oliver

Awesome post! It’s not always about how much you could have made compared to what you did make. Especially since when most people’s portfolios outperform their expectations they begin to fear moving it back to their previously determined asset allocation. Another victim of the FOMO bug.

CDs are the only things I still “play” with these days. While I’m quite diversified, I keep my mutual funds and such running on “auto pilot” and won’t touch them until I need them. I “ladder” several CDs since they’re Reliable (value of a CD changes like a bond? Huh? What? They’re fixed % rates) though the interest rates are abysmal, at least I’m getting Something for my money as opposed to leaving it laying around. I don’t factor in inflation, as I’m hoping it’s rather negligible (people kept ramming down my throat “pennywise, dollar foolish” throughout my life anyhow). And I do them at local banks so I’m dealing with living humans not online scam fests.

Reading this great article you created Sam made me realize that I should be better off just by investing in some bonds to diversify risk and to be less exposed than I am in the stocks.

I am really glad you have all of this insight, but as much as I would want to be able to increase my net worth aggressively I don’t want to risk it.

Indeed “I missed out big time…” of the recent equity rallies because I literally cashed out to soon in August 2017. But I rationalized that I’m about to hit my USD5 mn goal networth and I was prepared to cash in the chips. As Sam said I won!

Sure it stung that I probably missed another 15% upswing (maybe this could have added another 150k to NW)…I’m sitting on tons of cash/ liquid assets (USD1-2 mn) and ready to allocate slowing and cautiously where to place the investments. I also realize from Sam’s previous posts that I’m now entering my 50s (still working) and I should now emulate a dry run on FIRE (need to create a nice passive income stream)…to see how it feels. It also occurred to me that my kids are 6-8 years away from University and it’s best that I prepare for this. Why take extra risks on the kid’s tuition when you have enough already.

Nice break down. We’re 80/20, but that doesn’t include our rental properties. I’m comfortable with that, but will likely lean more conservative as the stock market climbs. FOMO is pretty strong for me at this point because I’m 44. There is plenty of time to recover if there is a big crash.

Once I’m 55, I’d be a lot more conservative.

What are your thoughts on investing in CD’s vs bonds as far as safe money goes? When I look up CD and bond rates on Vanguard, CD’s provide a better interest rate and they are FDIC insured. Why isn’t this the best safe money option?

They are a good option as well for super conservative investors. I have one remaining CD myself. The problem is finding a CD with a high enough interest rate to cover inflation and they have early withdrawal penalties. The value of a CD also changes like a bond, you just don’t see it. The assumption with the CD is that you hold until expiration, whereas with the bond, you have the option to sell earlier than the duration without penalty if there is attractive principal appreciation.

If you’ve found 7 to 10 year CDs at 3% or higher I’d love to check them out.

Related: https://www.financialsamurai.com/cd-investment-alternatives-why-im-no-longer-investing-in-cds/

HI Sam,

Terri in Hermosa Beach here, Water and Power CCU has just offered a 3% 48 month CD with only a 90 day loss of dividend if you break the CD. I believe it is offered to any zip code that they serve or employees of course. Also Connects CU which is easy to join for $5 is offering a 3% 5 year CD but I believe the early penalty is 6 months. Think I’ll put a bit into the 4 year today!

Cheers

Correction: Connexus CU. Spell check gets me again!

Indeed, with a 3% yield 4year CD and a 90day interest loss (i.e. 0.75% loss) it’s a no brainer over the 10y TBill, where you’d have to either hold to maturity for 10y at 2.85% or face potentially selling at 10% or so loss in an interest upswing.

Holding the TBill to maturity in all circumstances is a fool’s sense of security. If you buy the 10y TBill at 2.85% and then inflation rises above 2.85% then you’d be losing money every year — potentially for ten years!

EE savings bonds. After 20 years you are given 4%. The young folk can toss in 10k a year. If you cash out early, much smaller return but no principal risk, well, inflation.

Would be great and indeed it would beat every CD on the market if the interest rate were indeed 4% EVERY year (the interest penalty being 90days interest like the typical CD).

The problem is that the 4% return is ONLY if you hold it to the 20y maturity. If you cash in earlier then there’s no principal risk (unlike TBills) but the interest rate is puny, about 0.1% currently, it seems.

So, in summary, seems like there’s no free lunch on the risk reward curve! — And, as I described the general situation in an earlier comment, the return for low risk has been suppressed to negative by our economic masters (the FED and its monopoly power on interest rates). The return on the higher risk portion of the curve they have not been able to suppress (yet?) but the final chapter in those who took that higher risk (stocks and other assets that ballooned) …has not been written yet…

Brilliant article! What I think is challenging for people in the accumulation phase to wrap their heads around is the marginal utility of money. If you are not going to inflate your lifestyle because you already realize that spending more doesn’t make you any happier, keeping your risk at level 100% is really only about ego and keeping score. I completely understand people who hated their careers and pull the plug the instant they get to 25X their expenses have to keep their risk exposure high, but those who have been fortunate/diligent enough to see their nest eggs grow to 50X-100X+ taking unnecessary risk only really matters if your plans include donating a building or something to your alma mater or for some reason feel its necessary to create generational type wealth where their kid’s kids won’t need to work. It is nice not to have a care in the world about how the markets perform.

Well said.

By the same token, if you have accumulated x50-100+ yearly expenses then you need not worry about ever ruining out of money regardless of how the markets do, even if you are 100% stocks. So why not let your money work harder in the higher risk stock allocations (which benefits more the rest of the world BTW) and go for a great intergenerational transfer, especially now that the threat of inheritance taxes has retreated further into the background?

Wonderful advice as normal. Would you still say close to 100% in stock is sensible for someone close to 25? Saving for a house deposit, and this has been a great bull run so far.

Any thoughts appreciated!

DM

The 100% stock guy has 1 extra loss year per decade than the 100% bond guy and makes double the money. It’s a no brainer. I can deal with that. In the next 20 years the 100% stock guy has 2 more loss years than the 100% bond guy. Not bad imho.

Doesn’t the bucket approach mitigate most of this perceived risk of losing it all? If you have a portfolio of 80% stocks and 20% cash/ST bonds, and the 20% is sufficient to fund 5-6 years of living expenses, doesn’t this make your portfolio fairly bullet proof in that you can ride out most any correction/bear market? Historically this time frame has been sufficient. Assuming you can sleep well at night why is this not a sound strategy? Plus, if your a “relatively” early retiree…say 50-55, this positions you to enjoy an increasing portfolio over time…upgrade from a very good to a great retirement over time, and leave a nice legacy to change generations. It seems to me that a total return approach is the safest. In this rate environment bonds certainly have their risks.

This is an excellent post, Sam. The scenario analysis you cited in the para below is exactly what I mentioned in my comment to your previous article: https://www.financialsamurai.com/things-to-do-before-making-any-investment/

“For most retirees, allocating at most 60% of their funds in stocks is a good limit to consider. An average annual return of 8.7% is more than 4X the rate of inflation and 3.3X the risk free rate of return. But you’ve got to ask yourself how comfortable you’ll feel losing over 20% of your money during a serious downturn. ”

Having lived through 2008-09 and 2000-02 downturns, and importantly, having “won the game” as someone said, I lightened up a lot recently. In hindsight, I took a big risk with 100% equity portfolio in 2012 but it paid off for the past 5 years. There is no smarts, purely luck because I assessed my employment situation back then and told myself, I will be secure for next 5 years, so I can afford to heavily invest in the stock market. Looking back, it wasn’t a valuation decision as much as a personal finance decision! I feel that’s how each one of us should assess our risk tolerance, because it keeps changing with age and circumstances.

Going forward, there isn’t such a need for me to take that kind of risk because I am contemplating taking it easy within the next couple of years so the active income I am so used to till now, appears to have an end in sight! Warren Buffett said it nicely “Don’t risk what you have and need for what you don’t have and don’t need”! I can’t match his eloquence even if I tried.

Sam I love these quotes:

“Be assured that only boring people get bored.”

“The pain of losing money is always much worse than the joy of making money. If you’ve already got all the money you’ll ever need, there simply is no point taking outsized risk.”

I type this after a 30 minute commute. I’m exhausted and disheartened by all the offensive attitudes on the road, everyone fighting for their piece of tar “My car is bigger so you just move out of the way for me” attitude.

To all the retirees out there who missed out on BIG money and are living just comfortable, from my point of view, you guys won in ways that you can’t put a price tag to. It is awful at the salt mines, AWFUL! And if ever you forget mail me and I can send you updates on the working world’s regression!

I can’t wait until I can retire where the biggest attitude I’ll ever receive is “You missed out big time”.

So what if I missed out big time? My house will be a little smaller, my car a little cheaper but I’LL BE FREE! I’LL BE MASTER OF MY OWN TIME, MASTER OF MY OWN ACTIONS! I won’t HAVE to associate with anyone I don’t want to. I’LL BE FREE!

Wow it’s really confusing out there right now. Suddenly, I feel over exposed to stocks with this big run up the past few years. I have a portfolio that’s 90% stock funds and 10% bond funds worth about $1m and about $250k of it is gains. Started investing back in late 2014. And there’s $500k in cash that I’m looking to invest as well as a paid off SF condo rental worth about $1m. I know these are amazing problems to have and I appreciate my situation. Everything is going to my niece and nephew and I want to do what’s best for all of us! Ideas anyone?

Everyone should be investing for a reason. Not simply to seek the highest return possible.

If you are young with a long time horizon you should be taking risk in my opinion. If you are retired early you should still have adequate risk so you don’t run out of mula later in life.

If you are older and have a fat stack no need to take the extra risk. Financial independence has to be more enjoyable when you have something coming in. I would struggle to just draw from investments.

For me earning some money would help me stick to a plan and be confident. I hope to have some sort of active income alongside other streams I am building.

What about real estate? Notes, rentals? What’s the opinion on these assets?

My thought too. Not passive but I’m retiring not dying. :)

Or even some private business holdings, smallish business with a good team can give you a nice 20%+ return a year.

This sounds interesting. Have you done this and care to share an evaluation process where the market is to find businesses for sale?

Bizbuysell.com is one starting point – not great but ok to start.

I helps to have some industry specific skills but lots of businesses will cycle through. I do this mostly with industrial products but am watching for an accounting firm as that would be fun.

I like your #1 thought gem, “You’re already free.” Since you don’t have to work anymore you should be happy and should not tie happiness to money. Freedom is the ultimate goal of most people in the FIRE community. You are free to continue working on your own schedule or stop entirely. You can pursue a passion or contribute by volunteering. The choice is all yours andit must be a great feeling!

I wish I started investing earlier. the net worth is not yet million dollars. So, retirement is not in the immediate future. I like to learn from the people already FIREd.