The higher your credit score, usually the lower your mortgage rate. Every time I went to apply for a new mortgage or refinance an existing mortgage, my mortgage lender would first ask for my credit score. If I said anything lower than a 720, they would politely tell me to look elsewhere.

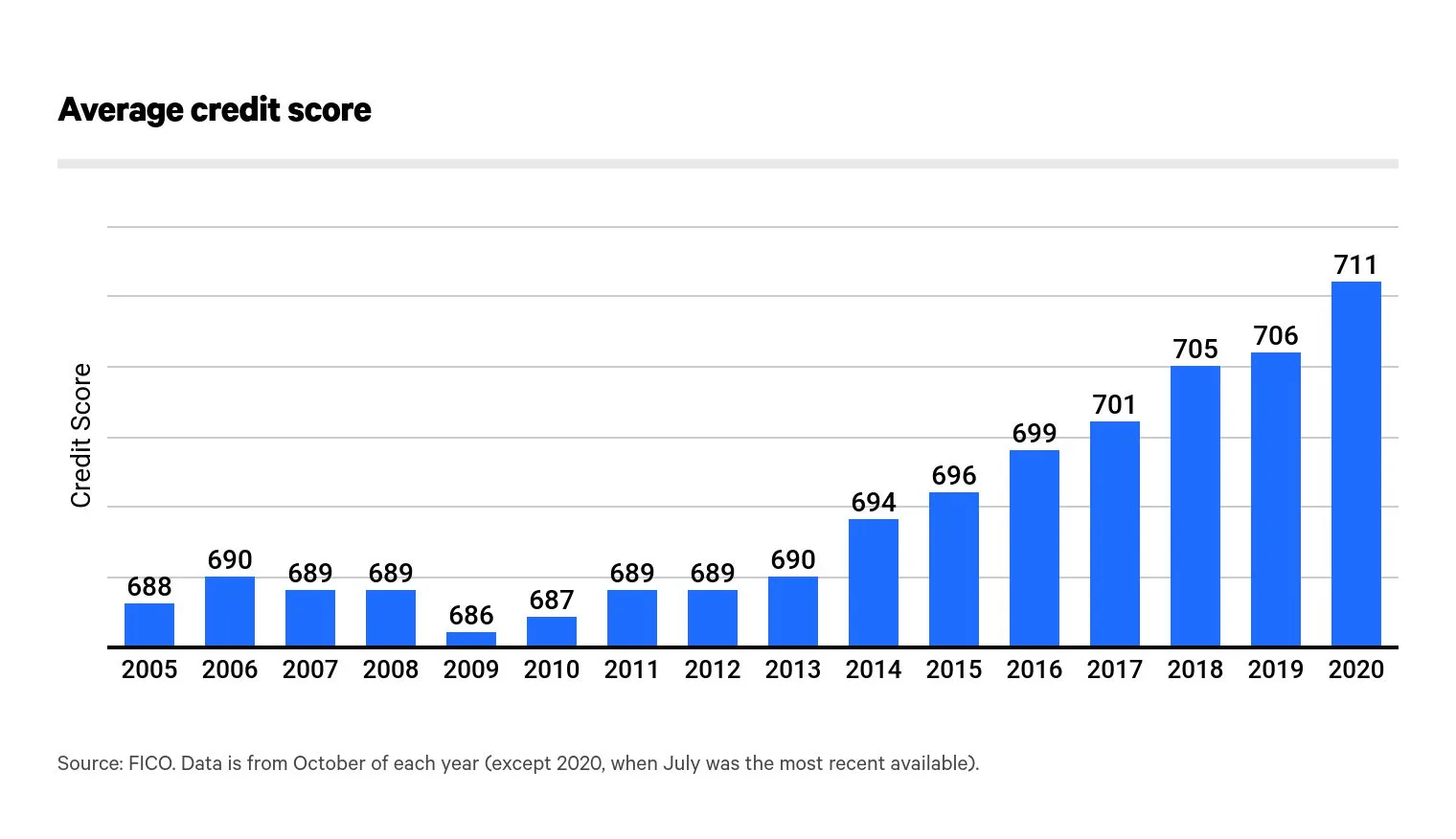

Before the 2008 global financial crisis, a credit score of 720 and above meant borrowers could get the lowest mortgage rate with the lowest fees. However, after about 2012, to get the lowest mortgage rate with the lowest fees often required at least an 800 credit score out of 850.

As a result, I decided to pursue strategies to get an 800+ credit score in order to save money. On September 6, 2013, I finally broke 800 and have stayed above 800 ever since.

An 800+ credit score enabled me to purchase a new property at a competitive rate in 2014. Then in 2018, I refinance the property to an even lower rate. More recently, I was able to buy a forever home in mid-2020 with a 7/1 ARM at only 2.125%. Being a responsible borrower has paid off.

But what if borrowers with higher credit scores had to pay higher fees? At the margin, it would disincentivize homebuyers from being responsible borrowers. As a result, lower-credit quality homebuyers would enter the market, thereby increasing the risk of another housing crisis.

This doesn't sound great, but maybe there is a silver lining to this perverse incentive structure.

Higher Credit Score Now Means Higher Mortgage Rates

The Federal Housing Finance Agency (FHFA) has recalibrated the fee structure for loan-level price adjustment (LLPA) by lowering fees for some borrowers and hiking those for others.

Before May 1, 2023, for example, if you had a credit score of 740 or higher, on a $500,000 loan, you would pay a 0.25% fee, or $1,250. After May 1, you will pay as much as 0.375% – or $1,875 – on that same loan.

Paying up to $625 more in fees seems significant. It is a 50% increase from what you would have paid before the FHFA changed the rules.

In another example I saw, homebuyers with credit scores of 740 to 759 – considered “very good” – and putting 20% down will face a new LLPA of 1%, compared with 0.5% previously. For the purchase of a $500,000 home, that means the fee doubles to $5,000 from $2,500.

Would you be OK paying $2,500 more? I wouldn't. Below is an example of various mortgage refinance bank fees.

If No Higher Fee, Then A Higher Mortgage Rate

If the homebuyer isn't explicitly paying a higher mortgage fee, then the fee will get rolled up into a higher mortgage rate. The lender has to make money somewhere. Hence, don't be fooled by a “no-cost refinance.“

The below graphical example shows someone with a 740 credit score paying a 0.25% higher mortgage rate than someone with only a 660 credit score. A 0.25% mortgage rate difference is significant.

In my experience of aggressively shopping around for mortgages, 0.25% is the biggest discount a competing lender would ever give me. And sometimes, I could only get a 0.25% lower rate by transferring assets and relationship pricing.

Lower Credit Score Now Means Lower Mortgage Fees Or Rates

If everybody is getting squeezed with higher fees and higher mortgage rates, then getting squeezed is easier to take. However, the Federal Housing Finance Agency has also decided to lower the fees for people with lower credit scores.

For example, starting in May 2023 a homebuyer with a credit score of between 640 to 659 and who has a down payment of only 5% will incur a loan-level price adjustment fee of 1.5%, down from 2.75%.

This means that someone purchasing a $500,000 home would now “only” pay an LLPA fee of $7,500, down from $13,750 previously. The original LLPA fee of 2.75% sounds egregious. So this is a significant benefit for these lower credit score potential homebuyers.

A 1.5% LLPA fee a lower credit score borrower pays is still 0.5% higher than the highest LLPA fee a high credit score borrower pays.

However, the lost 1.25% in LLPA fees is now being made up by homebuyers with higher credit scores. People with lower credit scores are either being rewarded or being given a break. Your view depends on your philosophy.

Mortgage Originations By Credit Score

The absolute percentage increase in fees higher credit score borrowers will now pay isn't as great as the absolute percentage decrease in fees lower credit score borrowers will pay. However, the difference should be made up by volume.

People with higher credit scores make up the majority of borrowers.

Starting around 2010, the majority of mortgage originations came from homebuyers with 760+ credit scores. Then starting around 1Q2020, those with 760+ credit scores started to really dominate mortgage originations (light blue bar).

The main reason for these changes is tighter lending standards after the 2008 global financial crisis and the pandemic.

Given home prices have also boomed since 2010, wealth has mostly accrued to those with the highest credit scores. Meanwhile, those with credit scores under 660 have largely been shut out of the housing market since 2009 (yellow and dark blue).

The federal government looked at this data and decided to change the fee structure in the name of equitable access to home ownership. The wealth gap between homeowners and non-homeowners has grown too large. All the fee changes is doing is creating more parity between what high and lower credit score borrowers pay.

You can read the Federal Housing Finance Agency's clarification statement defending its new mortgage pricing.

Overall Implications Of Fee Changes Based On Credit Score

Once high credit score homebuyers know they must pay this higher fee, they might negotiate harder with their lenders to get a greater discount. Shopping around for a mortgage is always a good idea. But this also means there will be further strain on the lending industry, which has already seen volume dry up due to higher mortgage rates.

If you work in the mortgage business, you probably feel like you're getting kicked after you've already fallen down. Rationally, lenders will start pursuing homeowners with “fair” credit scores of 660 or less by pitching lower fees.

In addition, high credit score homebuyers may negotiate more aggressively with home sellers to get price concessions. More negotiating usually means longer closing times. Longer closing times often increase the chances of a deal falling through.

Higher fees for higher credit score borrowers mean lower lending and home sale volume at the margin. As a result, commissions earned in the real estate industry will also decline. Therefore, I should add unknown new government regulations as a risk to my positive real estate call for 2023. But it's now 2024, and real estate continues to march higher, especially with mortgage rates set to decline.

Then again, if the lower mortgage fees and rates bring in more homebuyers, there could be upward pressure on home prices. This, in turn, would enrich existing homeowners even further. And if more people are richer, there will be less crime and less strain on the government to provide.

Unintended Consequence: Hurting Asian Americans

Whenever the government decides to pick winners and losers, there are sometimes unintended consequences. Here's one that I hadn't thought of.

One “unintended” consequence of getting higher credit score borrowers to subsidize riskier borrowers is the disproportionate negative impact on Asian Americans. I put the word unintended in quotes because the government obviously sees all the data.

As an Asian American who grew up in Japan, Taiwan, Malaysia, and the Philippines for my first 13 years of life, I understand how Asians view debt: not good. As a result, Asian Americans tend to save more aggressively and pay for more things with cash.

Therefore, it was no surprise when I learned Asian Americans have an average credit score of 745. Below is the average FICO score by race according to the U.S. Federal Reserve data. Every race gets at least a “Good” trophy.

Mortgage Application Rejection Rate By Race

Asking safer borrowers to subsidize riskier borrowers who've largely gotten left out of the housing boom is one thing. Enabling more Americans to own their primary residence is good for the nation, if borrowers buy within their means.

But what if you asked a group of people who were experiencing higher mortgage rejection rates than the baseline White borrower to also subsidize this riskier group? That would seem unfair.

According to a 2021 study by the Urban Institute, Asian Americans have a lower homeownership rate (60%) than White Americans (72%), despite having a higher median income.

One reason for this disparity, the study found, is that Asian Americans have higher mortgage denial rates than White Americans.

“We found that the denial rate for Asian mortgage applicants is 8.7%, compared with 6.7% for White mortgage applicants,” the authors of the study wrote. The authors studied the Home Mortgage Disclosure Act (HMDA) data.

“Asian applicants are denied more frequently than White applicants at all income levels,” the study reports.

“In 2019, median income was $107,000 for Asian applicants and $82,000 for white applicants. For Asian applicants with annual incomes below $50,000, 16.3% were denied a mortgage, compared with 11.3% of White applicants in that income bracket.”

Why Are Asians Getting Rejected At A Higher Rate Than Baseline?

Nobody knows the exact reason why Asians are rejected at a higher rate for mortgages because the study also did research on rejection rates in big cities with large Asian populations. It feels like no matter how hard you try, it's kind of hopeless – like getting perfect grades and a 1,500+ on the SAT and still getting rejected by most colleges.

The reason could be as simple as more first-generation Asian American applicants do not have the necessary documentation to get through the mortgage application gauntlet. I've been rejected before because I did not have at least two years of sufficient freelance income after I left my day job in 2012.

Always refinance your mortgage before leaving your W2 day job please. Once you no longer have a day job, you are dead to lenders.

In a different study, according to the Home Mortgage Disclosure Act data, 20% of Black and 15% of Hispanic loan applicants were denied mortgages, compared with about 11% of White and 10% of Asian applicants. So perhaps the rejection rate isn't so severe for Asians after all.

Solution For Asian Americans And All People With High Credit Scores

If you don't own a home yet, then your only course of action is to understand what's happening and negotiate with your lender, real estate agent, and seller. Who knows. You might end up negotiating so effectively that you end up saving even more money. Too many people are too afraid to negotiate when it comes to buying a house.

Borrowers with high credit scores still get the lowest mortgage rates and pay the lowest fees. Such borrowers will simply have a slightly less good deal than before. Therefore, I wouldn't try to game the system by purposefully tanking your credit score before applying for a mortgage.

If you are an Asian American looking to buy a home, you may need to get at least a 760 credit score, if not a 800+ credit score to have the same chance of getting a similar mortgage as other races. I haven't seen anywhere that people with 800+ credit scores will have to pay more fees, only those in the 740-799 range.

Keep your debt-to-income ratio as low as possible (30% or less). This is the most important ratio when trying to get a mortgage or refinance one. For more, I wrote a detailed post about how to reduce mortgage fees and get the best rate possible.

If you feel you are being treated unfairly, speak up! This way, you'll increase your chances of getting a competitive mortgage rate.

Trying Harder Is The Way

Personally, I welcome the challenge to earn more, increase my credit score, pay down more debt, and work harder to take care of my family. I will teach these lessons to my children as well. Trying harder and being financially responsible tends to pay off.

At the end of the day, having a higher credit score and being in better financial shape makes life easier. If other people who are struggling are getting a break, then good for them. The amount of homeowner's equity homeowners have accumulated since 1990 has been enormous.

Real estate makes up about 50% of my passive income. And passive income is what enables my wife and I to live more freely. I want everybody to experience this type of freedom as soon as possible, hence why I write on Financial Samurai.

Since 1999, I've also been paying a significant amount of taxes each year to help subsidize the ~50% of working Americans who do not pay any federal income taxes. Hence, paying another several thousand dollars in higher mortgage fees, if I decide to buy another house, is not that big a deal.

After thinking things through, it feels like an honor to help others also achieve the American dream. I was able to come to America in 1991 for high school and build my fortune. I hope many more people get to do the same as well.

Reader Questions And Suggestions

What are your thoughts on the Federal Housing Finance Agency charging higher fees for those with higher credit scores? What are the implications of this new policy to the housing market? Are you for or against potentially homebuyers with lower credit scores getting to pay lower fees?

To invest in real estate more strategically, check out Fundrise, my favorite private investment platform. It offers multiple funds for different investment objectives such as income, growth, and balance. Fundrise primarily focuses on residential real estate in the Sunbelt, where valuations are cheaper and net rental yields are higher.

We're at the beginning of a multi-year interest rate cut cycle. As a result, it would be wise to build your real estate portfolio now before prices go up too much. Fundrise and Crowdstreet are Financial Samurai sponsors and Financial Samurai has invested over $300,000+ in Fundrise so far.

I’m not sure if this has already been asked, but if this is a fee how come it isn’t equal (% or flat) across all mortgages?

I suppose it revolves around the use of the funds generated by the fees?

Per TheMortgagereports dot com:

Loan-level pricing adjustments are the government’s way of raising prices for “riskier” borrowers without putting a penalty to “safer” ones. Similar to an auto insurance policy, a person loaded with risk will typically pay a higher premium.

So what I’m essentially reading it’s PMI.

All of this does nothing but distort interest rates, to bring the “advertised” rates between a high-risk and low-risk loan closer together

I don’t see this policy change mattering much. It is good branding for the administration, but my gut is that it will have no real effect, it’s just symbolism like most everything else. Savy buyers will negotiate around it.

As a millennial I can tell you that the thing preventing people my age from owning homes is 1) keeping the same job for 2 years, and 2) coming up with the down payment cash.

Many people will never own a home just because of those two things. With rent prices so high, I totally see how tough it is to save money especially on an average salary. My wife and I lived in a trailer on vacant land for 2 years to save and prepare to buy our first home (living expenses we’re about $400/month and we make $160k combined a year). We live in California. It was an effective way to get into our first house, but the reality is most people will not do something like that.

At the end of the day I think home ownership should be difficult to achieve because it is so amazing once you earn it. The feeling of freedom and self reliance is unmatched, and that’s the American dream to me!

Strange game, the only way to win is not to play.

Unfortunately, that’s not an option for everyone, and certainly not at every point in their lives. For folks looking to retire, however, it should be a goal.

We own our home (and cabin) outright and will never again buy with a mortgage; even if we buy another, we will sell one. We buy cars with cash (used, because what the roads and parking lots here do to a new car would make me cry). We also pay off all our charge cards every month. I assume that’s why we are perpetually stuck at an 830 credit score.

Or maybe beating that mark requires being a double digit millionaire. If I live as long as my father has. I’ll probably find out, but I can wait. He lives the same way we do, if not a bit better, but then too, I can recall when he was an airman in Viet Nam and our dining room table was a card table with a tablecloth over it.

It’s fascinating to see some of the commentators here say they are being “punished,” when the fees are just a simple closer alignment.

If you feel punished, then go ahead and lower your credit score to feel rewarded. You’ll still pay a higher fee than if you had a higher credit score. The desire for more, more, and more when you already have a lot is concerning.

Playing victim by using the word “punished” or feeling punished shows how weak and helpless you are. There are so many ways to save on a mortgage and save on a home price. You make it seem like this is the end all be all. How sad.

This is a philosophy argument Derek. Many of us believe success should be rewarded. This mandate goes directly against that. How sad.

I think it’s important to STOP feeling like a victim. There’s nothing you can do about this new rule change except make more money, lower your debt levels, and negotiate harder.

Being a victim is no way to live.

I believe the outrage is more over incentivizing poor behavior. Note that previous program’s for first time home buys via tax credits or down payment minimums have not met the same outrage. Especially less than 20 years removed from 2008 that pain is still fresh for many. I see it as a sign of DEI initiatives penetrating our economic policy.

Spoken like a true Lefty. I may disagree with what you say, but I’ll fight to the death for your right to say it.

I check in here occasionally, having fled CA and everything it stands for in 2021 for a sane state. I like Sam’s analytical nature, but this kind of thing dovetails with other things he’s said over the years that only a deep blue voter could support. “The government should require travel after HS”, “Look at this BART janitor’s earnings, what’s your excuse?” (dude was napping in the closet for hours, I knew it before the cameras were revealed, because, common sense.)

Now we learn that since homeownership is a societal net positive, it should be encouraged for those who don’t have a history of responsible behavior or paying their bills. The lender is NOT shouldering the responsibility, they sell those (government backed) loans. We all know where this ends. I only wish folks would learn from history/study human nature. It’s frustrating doing the same thing over and over, expecting different results.

Where did you go? And how is it going?

“ who don’t have a history of responsible behavior or paying their bills.” – these people would not qualify for a mortgage.

The lower mortgage fee is for average to slightly below average credit score holders.

I wonder how many people are confusing people with the worst credit scores, who are a responsible borrowers to the target credit score holder that is able to qualify for a mortgage.

Maybe it’s just human nature to think in extremes. Banks, at the end of the day, are still in the business to make money.

Florida. No trash on the streets, no armed gangsters invading homes/stores (like our former Bay Area region), School system does not embrace CRT, my kids are safe, happy and haven’t worn a mask in 2 years.

Only takes 580 (or lower with caveats) to qualify for FHA loans. I own apartment buildings and once you go below a 630 it’s about a 50% chance they require eviction. Under 600… well, I don’t go that low anymore. Too much damage/theft/courts.

Again, I understand the pursuit of equity, but many people have neither the mindset, nor long term ability to own a home, no matter how much we think it “should” be a societal positive. Credit score is a good filter of those folks and perverting that market via subsidies and redistributed fees has been tried before.

Got it. That’s great Florida is crime free and trash free.

It’s hard to afford to live in SF and the Bay Area and live comfortably. If you don’t have enough, then you will have to make some sacrifices to live here, like living in a dirtier, more dangerous neighborhood. So I’m glad you took action to better your situation.

Too many folks complain about their situation and do nothing about it.

Ha, I suppose it is more local. But exponentially better in both categories. I asked some deputies, when I was out here scouting (I’m a former Bay Area cop), “What do you do out here when ppl steal?” They looked at me like I had two heads and replied that they go to jail. Nirvana!

You couldn’t pay me to live in Florida. A backwards state that has high crime, low-class people, hurricanes, a petty governor, plenty of racists, oppressive humidity, lots of bugs, poor public transportation, and a weak healthcare system.

There is no way I am bringing my children up in Florida.

Brother, I think we’ll both be happier with you elsewhere :-P

So glad that you pointed out that Florida has plenty of racists. I too avoid them like the plague, as they are the reason for every problem that exists in society (especially the crushing national debt). And like you probably did as well, I checked the national index of racism and what do you know.. Florida is at the top of the list and California is at the bottom.

I’m a proud Floridian…….(currently displaced)

And Greg…….

No lies detected.

I would probabaly raise kids in FL, it was a fun childhood.

Go Gators.

“No trash on the streets, no armed gangsters invading homes/stores”

Clearly you’ve never been to Miami.

My credit score dropped 180 points after refusal to pay a $780 bill once a couple of years ago. It remains derogatory, but the score climbed back the 750-800 range.

I haven’t tried to borrow any money, but if I did, this legislation means I’d get some help on fees?

Probably not. Once you get above 740, it seems like you will have to pay a higher mortgage for you if you were to buy a new property with the mortgage.

Same thing happened to me. Unbeknownst to me, we owed like $16 on an unpaid electricity bill, and the landlord sent us to the collection agency. But it was square it up later. So it’s good to always check your credit score at least once a year, or at least six months before you plan to buy a property with a mortgage. Need time to fix it.

Actually I knew it would hit my credit and I could see what happened to the score each month through my bank account. So I watched the changes in real time as sort of an experiment. Now that I can more clearly understand how the score is manipulated and how long recovery times are I could see how this legislation could get convoluted despite its proposed ethical purpose.

There are people who don’t make a lot of money, but have tried hard to save and have used credit wisely. And have created great credit scores. They could be penalized by this new system. That’s unfortunate. I know there are people in the middle or lower income brackets that have very good credit. Do they need/deserve extra fees?

Here’s my podcast episode on this topic with some more nuances.

Apple podcast

I was thinking of starting a finance blog. However, my writing skills as well as my knowledge of finance are far behind Financial Samurais. It simply is not fair. The government should mandate that my blog is placed higher on Google search results than Financial Samurai.

I guess I could work harder but I don’t have the free time that Sam has. That’s not fair either!

Thankfully, we have a administration that punishes all of you high achievers out there.

I’ll get off my soapbox now and go practice my writing as soon as I finish the 4th season of Stranger Things.

Good example actually. I can’t control what Google does, but I can control what I do. Since 2009, I’ve written the best I can about things that I think matter. If Google wants to reward my work, great. If not, then fine.

I don’t write for Google, although hiring freelance writers to write search engine optimized posts is definitely a big business only. But I am thankful there is a Google in the first place to drive some traffic.

I will never stop trying my best in the things that matter to me. Don’t let new regulations change what you can control either.

I saw a defender of this policy on CNBC the other day, and he left everyone’s head spinning. He argued that people with higher credit scores might pay their bills on time but are riskier credit because they spend more money on things like jet skis because they have more resources and access to credit. Then when he started losing that debate, he fell back on institutional racism. I don’t care much if the govt wants to subsidize a few hundred bucks on a $200,000 purchase, but one of the absolute truths I grew up with was that responsible financial decisions resulted in a higher credit score which lowered lending costs. It was as fundamental as gravity. That is no longer true.

Those who are financially irresponsible likely won’t get qualified for a mortgage in the first place. I think you may be conflating the lowest credit score borrowers who would not qualify with the average to slightly-below-average credit score borrowers.

Are you willing to tank your credit score now to save on potential fees you aren’t sure exactly what they are? I’m not.

This is more of the same from the Marxists who are running our country, punish success. Do you think this will end only with mortgages? Next will be auto loans and other types of loans. Those of you that feel good with helping someone else can do so voluntary. I already pay enough taxes because I have worked very hard to earn my success.

I am loathe to wade into the politics of this on a financial independence website. On the other hand, you asked for our opinion, Sam. :D

There are a lot of folks out there wringing their hands about moral hazard every time policymakers make a minor attempt to “even the playing field.” It seems that some readers even view this as *gasp* Marxism! Speaking as a Marxist myself, that cracks me up. The entire 30-year mortgage system in the United States is a function of state intervention in the economy precisely designed to serve the interests of capital. This specific intervention is no different.

If the United States wanted to get serious about housing inequality, we’d push for generous social/public housing policy and fix the artificial supply constraints caused by decades of single family zoning restrictions. Instead we goad banks into slightly modifying lending standards to slightly benefit people with lower credit scores. The purpose is to keep bank lending barely functional as a road to homeownership. Unfortunately, it does nothing to fix the supply issues and in the end won’t significantly reduce housing or wealth inequality, which is much more entrenched than just lending standards.

Another issues with this approach: as you point out Sam, the effect is an extra “tax” on those with higher credit scores, not those with higher incomes/wealth. Such a blunt instrument will tax poor families with high credit scores just as much as wealthier families. That is, unfortunately, regressive taxation.

A better approach would be to institute a 1-2% annual wealth tax on estates above $50 million similar to Elizabeth Warren’s proposal. Use the proceeds to fund beautiful, modern social housing similar to what they’ve got in Europe. All American’s could be eligible to live in social housing and never pay more than 28% of their income. The remainder of the assets could be invested in a sovereign wealth fund that delivers a “people’s dividend” to every citizen, which would go a long way to solving the wealth inequality issue. Alas, that is “socialism” so I guess it will never happen in America, but it is the solution to the problem that no one wants to accept.

Lol

Some good points. The problem with taxing those with $50+ million even 100% is that the government will run out of their money in under a year.

There’s a big distrust regarding the efficiency of the government in spending the people’s tax dollars. Not only is government spending less efficient, there is also distrust due to cases of insider trading, corruption, and side dealings.

And this is understandable, since it takes a special someone with a tremendous ego to want to be a politician.

Being a Marxist and reading personal finance blogs……. Very ironic. I would assume if your smart enough to take time to read material like this, you wouldn’t be so dumb to be a Marxist

Clearly like the dude who’s never been to Miami, you have no idea what a Marxist actually is. Just the funhouse mirror image conjured by the American Right.

Marx was one of the most perceptive students of Capitalism and he admired it’s organic nature and how flexible and adaptable it is. He also was terribly naive in thinking he could create a better replacement, one that defies human nature at its core Anyone who’s dealt with monopolies like cable companies (or AT&T, pre-1984) know how terrible such things are.

So sad, , I have lived in south Florida, Miami, broward for the past 43 years and it’s like every city good sections and not so good parts of the city. Unfortunately it’s all about money. If you have it you choose the best part of town, with the best schools, etc.

Go suck off bernie more pal

The fact you “think” Bernie is a Marxist proves your ignorance. Go back to report to your Russian trollmasters.

“Think,” because it’s what passes for it with you, but actually doesn’t involve thought.

Do these extra mortgage fees apply to conventional loans too? If not, people with strong down payments and good credit scores could just get a conventional loan instead of a FHA loan.

I think so.

Yes, there are solutions. Get a 800+ credit score, as that level seems to not be as affected or affect by the higher fee. Have a lower D-to-E ratio and put down a larger down payment are all workarounds.

Can you explain that further, Sam? I’ve recently topped 800 and am struggling to understand the nuances.

This issue is very personal to me, as I’ve been chasing the carrot of home ownership in the BA for EVER. This just feels like a slap in the face to all the folks who have worked hard and played by the rules to save up a huge down payment and build a strong credit score. BOOM! No cookie for you!

You just mentioned in an earlier comment you already bought a house in 2012. Was this not in the Bay Area?

If not, then, I guess you are right. No cookies for you or anybody else with high credit scores. Since demand from high credit score holders will collapse, then home prices will collapse. At that time, you can buy a Bay Area home for much cheaper.

A win!

Yep, the rental is in the valley. As you know, the Bay is completely different beast.

But again, what do you mean when you say, “Get a 800+ credit score, as that level seems to not be as affected or affect by the higher fee.” Why would an 800+ score be less affected?

I have not seen any example so far where mortgage fees have increased on those with over a 800 credit score yet. But maybe it’s coming. Or maybe it’s only a tiny amount that isn’t noticeable.

Let’s wait to see what happens bc out of all the conversations i’ve had with mortgage lenders, they offer the most optimal terms for those with over an 800 credit score. So if you have 800+, you may not notice any fee differences or rate differences.

So you bought a property at the bottom of the market in 2012, and it’s worth 2 1/2 times more. And you are angry about potentially a slightly higher fee if you are to buy another property, with an 800+ credit score?

Why wouldn’t you feel thankful? You would still be paying a lower fee than someone with a 660 credit score. Just not as low as before. Why the fear and the scorn?

This is why the government gets involved. Left to people’s own devices, people are selfish, and won’t be willing to help people less fortunate as a result.

Who’s not thankful? Not me. But gratitude about that successful rental purchase has zero bearing on my anger about the current situation. Errant juxtaposition.

Buying where I bought my rental is light years removed from attempting to buy in the area where I was born, raised, and have family, an area that evolved before my very eyes into one of the most expensive on the planet. Accepting that reality, I didn’t complain, just put my nose to the grindstone to work toward eventually buying here.

“OK, these are the rules; I’ll play by ’em,” said I.

As others have noted, an 800+ credit score doesn’t automatically denote an enormous income, and not everyone can be as financially savvy and entrepreneurial as Sam. Buying in the Bay Area for average earners is a stretch, and yes, as a matter of fact, those “slightly higher fees” can potentially be the proverbial straw atop the dromedary.

So am I angry that the rules are being arbitrarily changed and the goalposts moved for ideological reasons? You bet!

Granted, I don’t know just how much more those additional fees will be; perhaps they really would turn out to be trivial. But the dollar amount is actually somewhat immaterial. It doesn’t feel good to work for years, doing everything “right” and playing by the rules, only to effectively be punished for it. This is effectively a tax on good behavior, implemented by unelected bureaucrats.

“This is why the government gets involved” speaks volumes.

Home ownership helps people feel planted in their community and increases overall participation. When ppl own homes they are more likely to start families and pursue careers. This productivity boost is good for capital markets.

Even though I am in the 800+ CR bracket I feel like this is a net positive.

If a person of lower credit needs help with the fees, how the hell are they supposed to afford the mortgage?

They won’t. Hence, the lowering fee is just a side benefit for a lower credit score borrower who has ALREADY qualified for a mortgage.

We’re not talking about poor credit score folks who would be denied a mortgage, but the average to slightly-below-average folks.

Do you think it’s possible that lenders will simply portfolio the loans of the extremely credit worthy, and get the FHFA guarantee only on risky borrowers?

If so, it’s possible the fee structure will not pencil, and will require larger and larger subsidies by the credit worthy (or lowering the discount to subprime).

You’ll have to explain with an example what you are talking about.

Every security has a price someone is willing to pay.

Using your example in the post, if I’m reading this correctly:

740 – 759 credit score with a 20% down payment purchasing a $500,000 home:

0.375% fee, up from 0.25% – $625 additional cost

LLPA increase from 1%, up from 0.5% – $2500 additional cost

I’m not sure if these are two separate examples, or cumulative, but the result would be somewhere in the range of $2500 – $3125 of additional costs for this one home purchase.

Is that enough incentive for the lender to offer the loan at, for example, a $2300-$3000 fee without a government guarantee? They would pick up the additional fee and just hold the loan.

The additional fee would not be paid into the FHFA system to cover the discount offered to the less credit worthy.

Essentially; is it possible the policy’s inverted incentive structure creates enough behavior change to force the fee structure to be adjusted. And if it gets adjusted further in the same direction, that would create more behavior change.

Hi Matt – a government guarantee for what exactly? The bank does its underwriting and then decides whether to lend or not based on the financial history and details of the customer.

What I’m gathering from your questions is that I do not understand how the mortgage industry works, and what service the FHFA performs. Perhaps I’m confusing FHFA with FHA.

I am presuming that since the FHFA is setting the fee structure and limits for conforming loans, they must have their finger on the scale and thereby creating a price for mortgages that is less than what the free market would set.

If the fee’s are increased on the most highly qualified buyers, could that create an incentive for lenders to create mortgages targeting these customers purely in a free-market system without any government involvement?

As a borrower, I am going to seek the lowest cost mortgage and I do not consider the involvement of the FHFA, Fannie & Freddie, or any government entity.

Quick Example: I purchased a home in 2019 and after shopping around I found a lower rate on a Jumbo loan I could get with a conforming loan. As a result, I minimized my down payment to qualify as a Jumbo and then made a $300,000 payment the first month and recast the loan to reduce the payment.

I am still scratching my head as to why a Jumbo loan would have ever been cheaper than a Conforming loan. But the incentive is clearly there for lenders to keep the costs of a loan low to entice more borrowers. If policies are put in place to artificially increase the costs to the borrowers, the lenders have an incentive to work around that cost increase.

Sorry if this is rambling. I’ll be the first to admin I’m not well versed.

Maybe my presumptions were wrong:

Are these fees mandated by the government no matter what? It didn’t occur to me that the law could apply to literally every loan from the top down.

I don’t know what my credit score is; I wish you had a “don’t know” or “don’t care” option in the poll. :-)

What you have reported here is troubling, because it seems that it fits with the Marxist idea of punishing success, in order to equalize outcomes. But to me, this news is also one more reason that credit scores don’t make any sense.

If you asked me who I would trust the most with handling money, I would look for someone (1) who has a good track record of saving and investing money, (2) who has a good income and good job security, (3) who has consistently paid bills on time, (4) who has avoided debt for the most part (especially credit card debt), and (5) who has paid back loans consistently and on time when/if the person has borrowed money. But a credit score, as far as I know, measures only one of those five things (the last one — paying off debt). So to me, a credit score is not a very good measure of the ability to trust a person with money, and I have refused to play the game of trying to maximize my credit score.

Most of these things are captured during the loan process and evaluated in addition to credit score.

1) necessary for a down payment

2) part of every loan application to set the maximum loan

3) if you fail to pay bills, it will be on your credit report as a derogatory

4) total debt is part of your credit utilization, a major component of credit score.

5) Also a part of credit score

What’s a better measure besides the credit score and the credit report?

Sam,

You mention that “20% of Black and 15% of Hispanic loan applicants were denied mortgages, compared with about 11% of White and 10% of Asian applicants.” Doesn’t his mean that Asian Americans are the lowest group in terms of those rejected for mortgages? Or is there something I’m missing?

Yes, you are right. I wanted to highlight this different data from the Home Mortgage Disclosure Act versus the Urban Institute. So perhaps the rejection rate isn’t so severe for Asians after all.

The reality is, nobody really knows what the exact rejection rate is, just like how nobody really knows how many people there really are in America etc.

I do know that Asians in New York have the highest poverty rates (23%) among all Asians. So one of my goals is to point out that Asians are not a monolith.

I wish they would have made some adjustments on the PMI requirements as a part of this policy. When I was first time home buyer, the PMI essentially put me over my budget on house payments so I saved longer and got creative for the 20% down payment. Mandatory PMI is a “guilty until proven innocent” scenario. I would like to see PMI be optional unless the home buyer defaults on any two payments and remain on the note until the mortgage balance reaches 80% of the home’s original value (when it can, conceivably, be dropped). According to Nerdwallet, PMI rates range from .58% to 1.86%. It seems like there was a lot a room to work with to save moderately higher risk borrowers money on mortgage fees than a blanket policy that takes more fees from lower risk borrowers.

Good point on the PMI payment for those who don’t put down at least 20%. “Guilty until proven innocent” is right, but it’s probably best for the health of the real estate market to minimize non-payments.

The reason why the government requires employees and employers to pay taxes out of every paycheck is because it knows if it lets 150+ million working citizens pay at the end of the year, many won’t pay.

Then our budget deficit and our economy would be screwed. It’s hard to trust people to do the right thing consistently when left up to their own devices.

Generally true (human nature on some level and all), but taking taxes out as we go is just paying something we owe anyway. The payments collected by the US Treasury go towards our tax bill, not an insurance premium that essentially buys snake oil while we still owe the taxes.

While PMI provides peace of mind for the lender, it is mostly a burden and a barrier to entry for the borrower. You could tighten up my generous idea of missing two payments to being allowed only one missed payment so it then becomes a ‘zero-tolerance’ condition to avoid PMI. I can envision these ‘low down payment loans’ having a higher rate, but then, the borrower would likely also have a more robust tax deduction. Wherein, they end up deducting only the mortgage interest instead of the mortgage interest plus the income-adjusted deduction that PMI premiums have historically been. This new policy they’ve come up with just seems like a back door way to “tax the rich” instead of helping the banks innovate their way to equal lending practices. With the current PMI policies, it seems like the lenders simply found a loophole in the ECOA/Fair Lending rules and practically count on PMI customers forgetting about it and not trying to cancel it until a refinance is done. The need for the “PMI Cancellation Act” practically shows that lenders/PMI brokers are predatory and not interested in helping people gain home equity.

Even harder to trust the government

Sub-Prime Mortgage Crisis, Part II

Sorry, Sam, I don’t share your equanimity with this. This is just plain wrong.

No problem. At the end of the day, the lender will determine using its underwriting methodology whether they want to take the risk in lending or not.

The thing is.. all these fees are kinda made up anyway. I’m not sure the reduced fee will be enough to get a lower credit score borrower a loan without having all their financials in order. So if they do, then that means they are deemed creditworthy.

…or else the lender is worried about their ESG score.

From each according to his ability, to each according to his need.

Bingo.

Providing discounts to those with good vs very good scores, ok. Providing discounts to those with fair scores vs good or very good, sure. But, now charging those with strong credit more to subsidize those with bad credit, sorry but I’m not a fan. Punishing good behavior doesn’t sit well with me.

I had that initial reaction, but then I realized all these fees are somewhat arbitrary.

I don’t see it as punishing good behavior, but helping people who’ve struggled save some money so they can more easily afford to buy a home.

Seems like an oversimplification “helping people who’ve struggled to save some money.” We all make choices in life and there are many who are struggling for a reason. Your blog mentions is an example of making better choices. You have to ask why so many are struggling before applying broad statements.

Sure, do you have any suggestions or solutions? What are some of the things you are doing to help promote financial education? Thanks.

Work hard and take responsibility for your financial situation and life is one solution. Seeing people on government programs who don’t work and drive expensive cars is common where I live. Personal responsibility over marxism is the solution

Great. Sounds like you agree with me. From my post.

“Personally, I welcome the challenge to earn more, increase my credit score, pay down more debt, and work harder to take care of my family. I will teach these lessons to my children as well. Trying harder and being financially responsible tends to pay off.

At the end of the day, having a higher credit score and being in better financial shape makes life easier. If other people who are struggling are getting a break, then good for them.”

re: Always refinance your mortgage before leaving your W2 day job please. Once you no longer have a day job, you are dead to lenders.

My significant other always wanted to purchase a rental property. I resisted the idea for many, many, MANY years. Who needs all that extra work when we both were working full time? One of us worked nights and the other worked days. How would we find the time to manage a rental property?

When my SO retired in 2005, I still resisted the idea of rental property ownership. I was warming up to the idea as I was closing in on my “early” retirement at 55 in 2013, and we started thinking seriously about finally purchasing that rental property once I did retire. Then the housing market crashed, and two thoughts became focused in my mind: 1) prices will probably be higher in August 2013 when I was scheduled to retire, and 2) how hard would it be to obtain a mortgage when neither of us are collecting W2 income?

We ended up buying our one story detached SFH rental property in March 2012. As it turned out, I think that month was the bottom (or near bottom?) of the So Cal housing market at the time. Probably the only time in my life we made a purchase of anything at the bottom of any market. LOL

Oh, and regarding refinancing:

We wanted to refinance the mortgage on our primary residence to get a lower interest rate. But I only had two years left of my five year period certain pension. Despite providing statements showing the balances of my 401k, Fidelity Rollover IRA, and Vanguard Rollover IRA, (which when combined were more than sufficient to pay off our existing mortgage – but who wants that tax hit???), the loan underwriter STILL required me to write a letter stating my intent to make retirement account withdrawals equivalent to the pension amount I had been receiving – and still would be receiving for two more years! *SIGH* Such a hassle to go through the mortgage / refinance process!

Yes, buying in 2012 was pretty close to the bottom of the market! Good job!

I was close to selling my home in 2012 as well. I tried for 28 and didn’t get any good offers, so I pulled it. PHEW!

Congrats on the good timing, Kat! Similar story for me—purchased my rental in February 2012. I tend to be financially cautious to a fault (alas!), but that’s one time I took a chance and it really paid off; the winter of 2012 truly was the bottom.

Now the place is worth 2.5x what I paid, and the cash flow is steady and comforting. Only wish I could have picked up a second one before the market rocketed back up!

I think anyone that feels at a gut level that this is wrong, would benefit from reading THE COLOR OF LAW, which shows historical evidence of purposeful discrimination against people of color when regulating housing zones, lending standards, infrastructure development (read highway through your demolished neighbourhood) and police action/inaction in certain neaighbourhoods. The law here is VERY generous to landlords and people who already are in the “made it” group (tax incentives, etc) and I personally benefit from those. But for many descendants of the vicitms of discrimnation in redlining, those shut out from mortgages and loans for further education, this is a tiny kickback that I am happy to subsidize. Kudos for the empathy and kindness, Sam

Thanks for the book suggestions. I’ve been reading A LOT of books now that I’ve published one myself. I appreciate books so much more now given I know how much time it takes to write one.

We all know that compound interest and time are two of the most powerful forces for wealth creation. If you’ve been SHUT OUT of the housing market due to discrimination or other factors, you’ve likely fallen far behind financially.

Offering those people who have had more trouble buying a home a discount seems like a good thing if they buy responsibly and lenders don’t overextend their credit.

re: After thinking things through, it feels like an honor to help others also achieve the American dream.

Sam –

Thank you for your empathy towards others. It is quality rarely seen these days.

Thank you. The immediate knee-jerk reaction is to question the policy. But the more I wrote, the more I feel this new legislation will help those who need the most help.

Once I saw the chart on the mortgage originations by credit score, I realized exactly how long folks with lower credit scores have been shutout of the housing market. And missing the housing bull market for so long is disheartening.

Real estate is one of the most straightforward ways the average person can build wealth. And I feel lenders and borrowers have become more prudent since the 2008 global financial crisis.

Actually, apparently there are economists (and even some native Americans) who believe that part of the reason for the endemic poverty on American Indian reservations is due to the fact that living on a reservation means they can’t actually own or mortgage the parcels they live on, which critically impacts their ability to build wealth. I haven’t seen any way to fix it suggested that won’t make many people unhappy.

Those with lower credit scores often have those scores for a good reason. In 2008 it was not those with high credit scores who were defaulting on their loans. Why is it going to be any different this time? I can understand incentives to encourage first time home buyers but not those who have a record of bad credit.

Rather than seeking “equity” why doesn’t the govt focus on teaching basic finance to our young people such that they have the tools to pursue happiness?

It might be the chicken or the egg.. or framing.

I don’t think the government is REWARDING people with bad credit or lower credit scores. Instead, it’s look at people with lower credit scores and cutting them a fee break so help them eventually improve their credit scores.

Once you’re in a negative financial situation, it can be tough to get out of it given you will have to paying higher interest rates and fees. That’s the irony. Those who need money the least often get the best terms.

So this is one move to potentially help break the cycle.

I hope I’m doing my part to help teach people personal finance basics and more, if they so choose to learn.

I get why they did it, but punishing good behavior by equating responsibility with greed is the pathway to hell.

I think a better solution is raise the barriers on owning non-primary residences. In my state, you get a homeowner tax exemption up to 50% (max $125k) on your primary home only. It makes primary residency the core purpose of development, it discourages individuals from buying up properties to be used as rentals, and it makes ownership a much easier transition from renting.

That’s a good idea. Reduce speculation, reduce demand for second homes, and maybe make homeownership more affordable for first-time buyers.

But that would hurt those who invest in real estate for retirement income.

It would probably hurt everyone who invests in real estate, but it would be offset by the amount saved on property tax on the primary residence.

Investors would still do well on new developments, house flips, and renovations, where the properties are probably better served by a professional anyway.