Even though a no-cost refinance sounds great, there's really no free lunch. A no-cost refinance has costs. The costs are just not visible upon closing. The refinance costs are baked in by charging the borrower a higher mortgage rate. Here are all the mortgage fees in a no-cost refinance.

It's like marrying someone for their money. You might think you're getting a great deal, but you'll probably have to put up with your partner's controlling, narcissistic, and disgusting ways. If you're not physically attracted to them, then that's a whole other set of problems to deal with.

OK, a no-cost refinance isn't as bad as that. But there are always costs even if you can't see them. When it comes to borrowing money, don't ever think you're getting a free lunch! Banks always find a way to profit off you somehow.

What Is A No-Cost Refinance Loan?

A no-cost refinance is a loan transaction in which the lender pays all the refinance costs.

Refinance costs includes: processing and underwriting fees, the appraisal fee, loan origination fees, title and escrow fees, notary fees, and courier fees.

These fees can easily add up into the thousands of dollars, making potential borrowers hesitate as to whether to go through with the refinance or not.

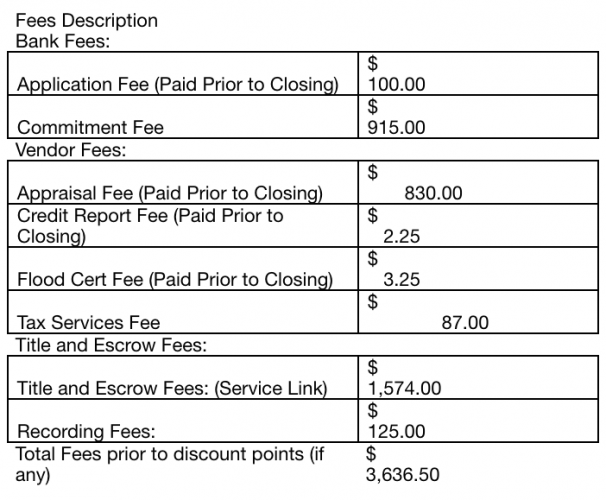

See some of the fees below I had to pay during my last refinance some years ago, but was mostly covered through credits.

To boost business, lenders entice potential borrowers by covering all the fees so there is no out-of-pocket cost to the borrower.

If the borrower gets a lower mortgage rate without paying any fees, then the decision to refinance becomes easier. The only factor to really consider is the time and effort it takes to refinance.

Getting A No-Cost Refinance Means A Higher Mortgage Rate

Lenders aren't in the charity business. In fact, publicly listed financial firms have some of the largest market capitalizations in the entire S&P 500 index because they make so much money.

The way lenders make up for covering all refinancing costs is by simply charging a higher monthly mortgage interest rate.

It's the same thing as the employer making you, the employee, feel great about their generous 401(k) matching and free or highly subsidized healthcare benefits. You might be getting great benefits, but it's costing you in terms of a lower salary.

Mortgage rates are set in increments of 0.125% e.g., 2.5%, 2.625%, 2.75%, 2.875%, 3%, etc. Therefore, instead of paying 2.5% for a mortgage refinance with fees, your bank might charge you 2.625% or 2.75% instead if you want to go the no-cost route.

The longer you take to pay off your mortgage, the more interest income the bank will make. Banks know that on average homeowners own their homes for ~12 years. Therefore, they can calculate their potential expected profits with relative ease once they have enough mortgage customers.

No-Cost Refinance Loan Fine Details

There are different types of no-cost mortgage or refinance deals as well. It's important to ask your lender about every variable and read the fine print.

Some lenders may just cover lender fees like origination, underwriting, and processing. While others may also include third-party costs like title and appraisal, title, escrow and so forth.

If you plan to go the no-cost mortgage refinance route, then you might as well keep things simple and ask for the lender to cover all costs. Why makes things overly complicated?

You want to stay away from lenders who attempt to nickel and dime you by covering certain fees and not covering others.

If you can't get the lender to cover all your fees, the other option is to simply add on the fees to your mortgage balance. Over the long run, you will pay more money. But at least in the short run, you'll be more liquid.

I'm not a fan of increasing your mortgage debt by rolling up the fees. The whole point of refinancing is to save money.

Example Of A No-Cost Mortgage Refinance

Option A) No cost refinance: 4% mortgage rate, NO fees.

Option B) Standard refinance: 3.75% mortgage rate, $5,000 in fees.

Which option do you choose?

The decision depends on the size of your loan and how long you plan to keep the loan until it is paid off. How long you plan to keep your loan depends on many life variables and your view on future interest rates.

Let's say the loan size you want to refinance is $1 million and you plan to keep the loan for 10 years before paying it off. You plan to turn your home into a rental and build your passive income portfolio.

Calculate The Costs Of Your No-Cost Mortgage Refinance

A 0.25% difference in interest rate is $2,500 a year in interest savings on a $1 million loan. From the bank's point of view, if they charge the higher rate, they'll get to make up to $2,500 more in interest income a year, depending on their cost of capital, for the life of the loan.

Over a 10 year period, if you choose Option B with the lower 3.75% rate, you will save $25,000 in interest expense. Therefore, it's clear Option B is the right financial choice assuming all else being equal.

In a different example, let's say you only plan to borrow $300,000. It's your first home in a city you plan to live in for four years after which you plan to sell it and go to graduate school.

A 0.25% difference in mortgage rate is a savings of only $750 a year on a $300,000 loan. Over the four year period, you will have saved $3,000 in interest expense by selecting the 3.75% mortgage that cost you $5,000 in fees.

Given saving $3,000 is less than the $5,000 mortgage refinance cost, going with a no-cost mortgage at a higher rate makes more sense all else being equal.

Only if you decide to stay or keep the property for at least 7 years does it start making more sense to go with Option B, the lower mortgage rate with $5,000 in fees.

Should You Do A No-Cost Refinance?

Psychologically, it feels GREAT to pay zero fees out of pocket. If your new mortgage rate is less than your existing rate while not having to pay any fees, going the no-cost route is the better way to go. You'll feel like you got something for nothing, even though you know nothing is really free. In the event that you need to sell your property sooner than expected, it's no problem because you don't have a break-even period to achieve.

If you’re planning on moving, upgrading, or downgrading homes within five years, or if you believe rates will move lower during the duration of your homeownership, paying upfront costs for a lower interest rate is not an optimal financial move. A no-cost refinance is more appropriate if the numbers make sense.

Imagine paying $5,000 in loan fees to save $750 a year in interest expense only to sell your house one year later for a great job opportunity in a different city. You will feel pretty stupid, maybe even to the point where you decline the job opportunity that might make you a multi-millionaire. Going the no-cost route would have been a much better option.

Who Is Most Suitable For A No-Cost Refinance?

A no-cost refinance is also good for a borrower who plans to pay down their mortgage quicker. Even though the rate is slightly higher, you might save on mortgage interest expense over the long run if you have the cash flow to aggressively pay down principal.

A no-cost loan isn't inherently good or bad. A no-cost loan is simply an option to help banks generate more business by meeting borrower demand. If your main reason for taking out a no-cost loan is because you can't afford the fees, then you're likely borrowing too much and/or buying too much house.

Related: Biggest Downside To Paying Off Your Mortgage Early

Always Negotiate A No-Cost Refinance

I strongly recommend everyone make at least a 20% down payment for a property plus have a 10% liquidity buffer. This total of 30% is part of my 30/30/3 home-buying rule. In other words, if a property costs $500,000, the most you should borrow is $400,000 and still have $100,000 left over in cash or securities that could be easily liquidated. Downturns do happen.

Follow my 30/30/3 home buying rule if you want to buy and own with confidence. Overextending yourself with debt is generally not a good idea. Good times come and go.

Companies like McDonald's long ago figured out that once they allowed for credit cards, their customers would spend on average $7 versus only $4.50 when using cash. A 55% increase in spending is huge and great for business. But spending more money is often bad for the consumer's finances and waistline.

Refinance Your Mortgage Today

Never be afraid to negotiate your mortgage interest rate and your mortgage fees. The first quote is seldom ever the best quote a lender can give.

You can utilize online mortgage lending platforms where lenders compete for your business to shop rates. Rate aggregators offer real quotes from pre-vetted, qualified lenders in minutes. The more free mortgage rate quotes you can get, the better. This way, you feel confident knowing you're getting the lowest rate for your situation. Further, you can make lenders compete for your business.

No-Cost Refinance Loan is my favorite type of refinance if you can instantly start saving money each month. Also check out the 15-year fixed-rate mortgage if the rate is lower than an ARM. Although the payments are high, it's worth taking advantage.

Invest In Real Estate More Strategically

Real estate is my favorite way to achieving financial freedom because it is a tangible asset that is less volatile, provides utility, and generates income. Stocks are fine, but stock yields are low and stocks are much more volatile.

The combination of rising rents and rising real estate prices builds tremendous wealth over the long term. Meanwhile, there are more ways to invest in areas of the country where valuations are lower and net rental yields are higher thanks to crowdfunding.

However, getting a mortgage or doing a no-cost refinance takes time. Instead, why not invest in real estate without debt and more surgically in lower cost areas of the country? That's what I've done by investing $954,000 in private real estate investments.

Take a look at my two favorite real estate crowdfunding platforms

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eFunds. Fundrise has been around since 2012 and now manages roughly $3 billion for over 350,000 investors. The platform predominantly invests in Sunbelt real estate where valuations are lower and yields are higher.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations, higher rental yields, and potentially higher growth due to job growth and demographic trends. Just make sure to do your own research on the sponsor, location, and terms before investing in individual deals.

Both platforms are sponsors of Financial Samurai and Financial Samurai is a six-figure investor in Fundrise funds. Fundrise is my favorite platform largely because our philosophies about real estate are closely aligned.

Hmmm confusing. my instincts tell me there is never a free ride, but several commenters say there really is no fee when going from a 30 fixed to a 15 or 10. Which is exactly what I would like to do. My principle is app. $238,000 which I plan on paying off in less than 2 years when I retire. Even though I might squeeze out a lower monthly payment, 2 years is going to come fast.

Oh, I do have to roll in a $20,000 balloon payment when I pay off the house. I got on the Freddie Mac loan deferment plan during Covid. Saved my home. Wonder if it will make me ineligible. I could use my 401k to pay the balloon but didn’t want to. Retiring is the best thing ever but sheesh all I think about is money lol. I don’t mind it can be fascinating (and profitable) but I’d rather get it over with and think about other things. Very blessed.

Yes, banks will charge you a higher mortgage rate in lieu of absorbing the refinance fees.

We last refinanced using a no cost option where the cost was paid for by a slightly higher interest rate then market. The point was a planned payoff in the short run with a lower rate then currently set and a backdrop if for some reason we had to back away from the early Payoff plan. No cost as you noted is just another tool. Eyes wide open it can still be a good thing.

In a no cost refinance, can the lender credits go towards prepaid interest, insurance payments, or property taxes?

I do feel the “no cost” refinance is a misnomer used to trick the public. There always is a cost, it is how you want to pay it, upfront or over time (which typically is the more expensive option).

But by using “no cost refi” in bold letters, the banks know they are likely to get more clients. And in most cases it is a win-win situation for the banks with more clients and more money over the long run.

A great topic. I’ve done 3 no cost refinancings of my current mortgage over the past 15 years and have paid a rate premium of approx. 1/8 % for each refinance. Each refinance reduced my mortgage rate by .5 to 1 %, ultimately getting to 3.625 % on a 30 year loan. My rationale for doing these refinancings was that they cost me nothing and they reduced the total cost of the loan (I kept my payments constant). One factor that I did not adequately consider was that each refinancing reset the term of my loan to 30 years – on my current payment schedule, I won’t pay off my mortgage until I am in my mid-70s. It would have been smarter to refinance to a 15 year term.

I did the same (in terms of the slight premium at no cost) but went from 30 down to 15 and ultimately down to 10 while locking in a 2.75 fixed. There truly is such a thing as a no cost refi.

We refinanced from a 15 year 3.5% to a 15 year 3.0% with no cost. Additionally, we continued making the same payment as previously, so we would finish the loan faster than previously for less interest. No cost is actually a useful exercise as long as the amount you are paying in extra interest is small and you are not extending your loan term.

Everybody should read this article before they refinance! Great stuff in here and you explain it all so well. I’m sure there are a lot of people out there who don’t understand this on their own. Thanks for writing such helpful pieces and raising awareness on the market timing for refinancing with the drop in rates!

Hi Sam, thanks for explaining. I find it always good to know how stuff works in other countries. In this particular case, I am not sure how refinancing works here in Switzerland… will ask around…

I like the 401k example. Similarly, new startup benefits usually suck, but they provide higher compensation to offset this. There are always two sides.

What about recasting instead of refinancing? Wouldn’t that be a cheaper option (in terms of fee) to save big on interest payments as well as drive down monthly payments? This is especially viable for those who recently came into big cash by the way of selling a rental or inheritance.

Hi Sam – I’ve started looking into re-fi based on your previous article. With the 10-year having gotten crushed, mortgage rates are looking very attractive now.

I’m working with Citi on a few portfolio loan options. With $1mm in assets deposited with them, they are quoting 2.875% on 10/1 ARM, no points on a primary home. For a multi-family rental property, they also quoted 3.25% on 10/1 ARM, no points and 1/8 point refund at closing if the rate lock is 45 days long.

Good luck with your negotiation on pricing. There are a lot of good deals out there. Especially if you are willing to use your balance sheet in negotiating with some of the lenders.

I don’t know. I paid no fee and locked in a 2.75% 10 year fixed when I refinanced my 15 year loan. Did the same when I went from 30 yr down to 15 year. Rates are for refinancing of existing loans with no cash out. I have had brokers tell me they can’t touch their combo of rates/no fee refi options. My entire family uses them.

Assumptions

Rates and terms are subject to change without notice. Actual rate will be determined after application and prior to execution of loan documents. “No Closing Costs” loans are subject to terms and conditions of Fremont Bank’s Application Fee Agreement, which lists the specific costs and fees the borrower will not pay. An application fee may be required after a loan application is submitted, which will be refunded (credited) at loan closing.

Borrower is responsible for paying all fees and charges imposed by an existing third party lender (such as, a payoff demand statement fee and/or a reconveyance fee) as well as any prepayment penalty imposed by any third party lender or Fremont Bank.

First Mortgage Rates are for refinancing of existing loans with no cash out and no subordination of non-Fremont Bank liens or encumbrances and is based on a loan amount of $400,000. Maximum loan-to-value ratios: 30-year fixed is 60%; 15-year fixed is 60%; 3-year ARM is 60%; 5-year ARM is 60%.

Rates apply to owner occupied, single-family properties only in California.

Minimum loan amount $100,000; Maximum loan amount $484,350.

All credit applications are subject to credit qualifications and Fremont Bank’s underwriting requirements. Adequate property insurance (which may include flood insurance) is required. For adjustable-rate mortgages, rates are subject to increase after the initial fixed-rate period. The term of the loan is 30 years.

6 years ago I got a sweet real zero cost refi from 4.65 to 3.65% from 30y fix to 15y fix (exactly my plan)

I do agree indeed that banks are there to mke money and to offer you the most advantageous plan…for them…!

Good article. There is no such thing as a free lunch. The cost has to come from some where. In a “no cost” refi, they just build it into the loan.

We are obviously the ones skewing the average length of time a person stays in a house. We have been in one of our houses for over 40 years – my wife has herself psychologically chained to the front door and she is not selling. We have put enormous amounts into the house we will never get a return on. All her memories are here and she is not leaving them.

Is that somehow poor thinking? NO. She is more than willing to pay to stay near those memories and it will increase our longevity.

For those among you for whom every house you own is a commodity and not a home, maybe you’re living in the wrong place.

Memories are indeed priceless and the psychological aspect of keeping them is a personal choice. But keeping them is neither a poor or good thinking; it’s simply preference. So to each his or her own.

Because why can’t you treat your place as both a commodity and a home? People buy homes for a variety of reasons. Some buy to be deeply connected to their community. Some buy to speculate. Some buy because it’s within the zone of a great public school. Some buy so they can build their wealth. The reasons are endless. As long as there’s a goal in mind – it’s never the wrong place.

I bought a condo in 2015 and chose the 30 year fixed (at 3.99%) because it aligned with my long-term plan of keeping the condo for as long as possible, before converting it into a rental, then eventually gifting it to my daughter once she graduates college so she won’t have to worry about rent expenses as she kicks off her career. But that’s more than 15 years away…

But your recent posts on refinancing got me thinking about my options.

At my relationship bank, I have about $150,000 in cash but it likely won’t be enough to sway them to give me a better rate, but there was another bank that could offer 3% on a 15-fixed with about $4,000 in costs.

I don’t want to increase my monthly expenses at the moment, but what do you think Sam? The 15 @ 3% will increase my payment by around $700 a month, but it’ll cut down on interest expense by a significant margin.

Good post. I’ll drop by my bank to negotiate. Their 10/1 ARM is 3.75% at 0 point. That seems high. Maybe I need to shop around more. 3% sounds really good. I’d sign up for that.

Terrific! This answered my question from your last post. Makes much better sense now why you would go with the no-cost vs pay up front. I’ve decided to go with the no-cost refinance, which will save me .5% and 160/month. Perhaps I could have done better by paying the costs up front (they offered and additional .25% for $500), but I like the mental win of paying nothing now and saving some 160/month for the next 30 years.

I knew I was going to be in my house for a long time, so when I chose to refinance a few years ago I just shopped around for the lowest APR, which should level the playing field when trying to compare interest rates and closing costs.

Great post. I am actually working a local credit union to look at refinancing. We bought our house in August 2018 for $300K, with 20% down, 4.75%, 30 year loan. The credit union yesterday offered me a 20 year loan at 3.875% no points. I will cover closing costs either by rolling it into the loan or paying upfront.

I hadn’t really considered a 10/1 ARM though…We are not planning to stay in our house for longer than 10 years.

Thoughts?

If you don’t plan to stay in your house or own the house for more than 10 years, it makes no sense to take out a 30 year fixed loan that has a higher rate. It’s best to match fixed duration with the length of ownership.

A potential problem is the cost of refinance for you on the size of your loan.

I never even considered a 10/1 ARM until a couple months ago when I read one of your articles.

Yes, the refinance costs are going to be about $5K. I have $234K left on my loan.

$5K is on the higher end for refinance costs. I don’t recommend more than a 24 month break even… 36 at most if you plan to own for 10 years as you never know what will happen.

I’d negotiate them harder.

See: ARM > 30-Year Fixed All Day Long

I shopped around the last few days, and it seems like the ARM is only more attractive for larger loans. For the 300k range as she is considering, it seems like 30 yr fixed is lower than 10 or 5 yr arm oddly enough. Just my observations and could totally be wrong. I ended up locking a no cost refi (lender credits) 30 yr fixed at 3.8 for a similar 300k size loan. Rates got better the higher the loan value.