Something crazy just happened. FTX, formerly the second-largest cryptocurrency exchange, collapsed overnight. It went from a valuation of around $16 billion to a negative valuation due to a liquidity crunch and debt. How did this happen?

FTT, a crypto coin that the FTX exchange issued, plummeted in value because Binance, the largest cryptocurrency exchange, said it was liquidating FTT. FTT then proceeded to crash, thereby causing a crisis of confidence in FTX as clients withdrew billions of dollars.

Binance, which caused the panic in the first place, then said it had signed a non-binding Letter of Intent to purchase FTX. But after reviewing FTX's books, Binance backed out and has left FTX to collapse, thereby eliminating one of its largest competitors.

FTX Misappropriated Funds

Given it's an exchange, it's difficult to understand how FTX could collapse. Apparently, FTX now owes billions to its clients and doesn't have the money to pay up. Where the hell did its customers' funds go?

Supposedly, FTX's founder, Sam Bankman-Fried's hedge fund, Alameda Research, owned a bunch of FTT, the coin FTX created. FTT was posted as collateral which enabled FTX to use its client's funds to invest in something else. When FTT collapsed, FTX was left with a massive liability.

This is akin to brokerage Charles Schwab using your cash and investments to invest in something speculative in a Schwab family sister company, losing it all and not being able to make you whole. You wouldn't allow it unless you gave permission and were paid a high-enough fee.

How do you move $10 billion in client funds to your trading firm, Alameda, without anybody knowing? Supposedly FTX built a “backdoor” into its accounting software, which SBF used to move billions without triggering alerts to other staff and auditors, according to Reuters.

Shaken Investor Confidence In Crypto

I'm not sure how the cryptocurrency market comes back from the FTX and FTT meltdown. Sam Bankman-Fried was supposed to be the “savior,” according to early investor Sequoia.

Bankman-Fried is also thought to have invested $80 million in the midterm elections, donating to both parties evenly, which means he was supposed to have become a puppet master of politicians. Maybe a bailout is coming, but I doubt it. Bankman-Fried's net worth is now potentially negative after being worth about $16 billion last week.

If regulators uncover fraud, which seems likely, then things could get even worse for Bankman-Fried. His power has faded and celebrity endorsers and politicians will now stay as far away from him as possible. Funny how people lose status very quickly once their money disappears.

Although I've only got one remaining crypto-related investment, HUT, in my portfolio, I no longer want to spend much time in the space. Just within the past 12 months, LUNA went to $0. 3AC went from $18 billion to $0. Celsius and Voyager went bankrupt. And now FTX and FTT have collapsed.

At this moment, cryptocurrency seems completely uninvestable. FTX and Sam Bankman-Fried has so many investments, surely there will be a tremendous amount of unwinding.

If you own cryptocurrency, for the love of god, transfer your coins into your own wallet. Leaving your coin on an exchange is like receiving an IOU. You may never get it.

Lessons Learned From The FTX Collapse

Now is as good a time as any to review some lessons learned and the lessons we should learn from this debacle. SBF was finally arrested on Dec 13, 2022. He posted $250 million bail and will go to court in January 2023.

Due to his actions, SBF will likely go to jail for over 10 years given Elizabeth Holmes got an 11.25 year sentence. How much would you pay for freedom?

1) Keep speculative investments to no more than 10% of your investment portfolio.

A speculative investment can range from investing in a startup to investing in a head-scratcher, such as an NFT. If you lose all your money, at least you still have around 90% of your remaining portfolio left. However, if you make it big, having up to 10% of your portfolio in such assets is enough to move the needle.

Speculative investments can also include micro-cap growth stocks, high-yield junk bonds, and of course, crypto. But sometimes, investments you think aren't speculative will also collapse like some of the most speculative investments. Examples include Facebook, Redfin, Affirm, and Upstart.

Due to investing FOMO, chasing the next hot investment is inherent. But we must maintain control of our risk exposure and our emotions.

As such, diversification is important for capital preservation. You want to diversify your net worth so that when one asset class declines, another asset class increases or at least significantly outperforms. I wouldn't allocate more than 50% of your net worth to one asset class.

Here are SBF's thoughts on the whole situation, which is still playing out.

2) Turn funny money into real assets.

One of my classic posts is called, How To Get Rich: Turn Funny Money Into Real Assets. I originally wrote the post in 2014 to remind readers and myself to occasionally spend our investment gains on real assets and experiences. It was five years after the global financial crisis and the good times had returned.

Funny money is any investment that has no utility. Funny money is essentially anything you can't touch that also doesn't generate income or provide utility. Stocks, cryptocurrencies, and even bonds are considered funny money. Although stocks and bonds that generate income are less so.

Real assets, on the other hand, are any asset that you can touch that also provides utility and potential income. The most common real asset is real estate. If you've ever wondered why some really rich people buy $100 million mansions with 18 bathrooms, it's because they are trying to enjoy and protect their wealth.

Given much of their net worth was built upon funny money, they also know their wealth can easily evaporate overnight like Bankman-Fried's did. Hence, rich people end up buying lots of real estate, fine art, expensive wine, yachts, rare books and other collectibles to protect and enjoy their wealth.

Remember, money is meant to be spent so you can increase your lifestyle. Hence, if you can spend your money on something you can enjoy that also has the potential to increase in value, you've got yourself a winner.

The money I invested in 2020 to buy our existing home is much more rewarding than every other intangible investment I've made since. As a father, it makes me proud to be able to shelter and provide for my family. The potential price appreciation of the house is secondary.

3) Debt can be a killer

With manageable debt or no debt, you will most likely always be fine in a recession. FTX would not have blown up if it didn't lending out billions to its sister company who then proceeded to invest in speculative assets that blew up.

It's the people who violate my 30/30/3 home buying rule, go on excess stock margin, and have a lot of revolving credit card debt that tend to get crushed.

Even if your stock goes down 50%, you're fine if you're not on margin. But if you're on 50% margin and your stock goes down 70%, you lose everything and now owe the brokerage.

One guy I know, in 2021, bought at least $250,000 worth of Tesla stock on margin when the stock was much higher. The thing is, he already had $700,000 worth of Tesla stock. As a result, his $700,000 is now worth closer to $250,000.

But what's worse, he didn't properly quantify his risk tolerance. He makes about $100,000 a year, which means he has to work about 55 months to make up for his Tesla losses. As someone who just had his first kid, taking this type of risk was excessive.

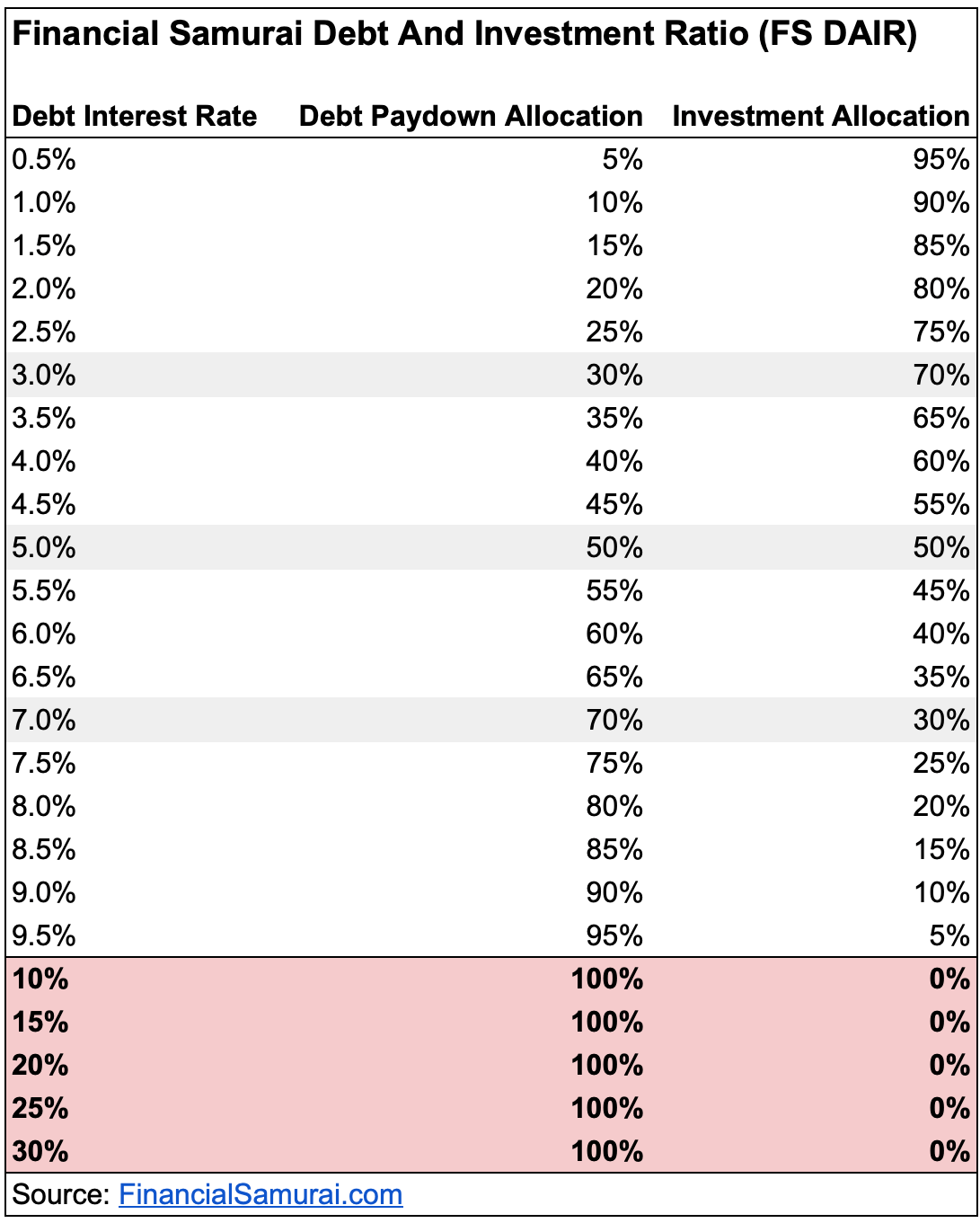

On your financial independence journey, please continuously work on paying down debt and investing using my FS-DAIR formula. If you're always paying down debt and investing, you're always winning no matter the economic situation. For folks who paid down debt instead of investing in the stock market at the beginning of 2022, they are winning by at least 25%.

4) Lots of cash creates lots of temptation to do stupid things

The more cash you have, the more temptation you might have to spend it on unwise things. This temptation is why you should always pay yourself first by investing as much as possible before spending.

Paying yourself first is one of the main reasons why buying a house with a mortgage tends to build more wealth than the average renter who is supposed to save and invest the difference. Automatic mortgage payments build equity as home prices generally rise over time.

One of the reasons why I've been aggressively buying Treasury bonds is because I'm forced to transfer the funds to my brokerage account. Once the funds are in the brokerage account, I can't use the money to buy anything wasteful. Instead, I buy various Treasury bonds which get locked up between three months and three years.

If you own a business and have a lot of cash on the company balance sheet, you may also be tempted to misappropriate funds. It's best to reinvest the money in your business or pay the money out to employees and shareholders as distributions.

Example Of An Almost Terrible Investment Due To Having Some Cash

In mid-2022, I stumbled across my dream home. It had a gated front yard for my kids to play in. The lot was over 9,000 square feet, which is 3.5X larger than the average lot size in San Francisco. The home was recently remodeled and spanned about 4,300 square feet.

I was feeling some intense real estate FOMO because a buddy of mine was looking at even nicer homes. I figured, if he was looking for nicer homes, so should I!

Buying this home would have been incredibly stressful because I would have had to take out a huge loan. Further, I would have had to convince my family to move after just two years of living in our current home. I didn't even have the full 20 percent down payment. I would have had to borrow money from a friend, which is always dicey.

If I had bought the home for asking, I would be down about 5% just five months later. The house was overpriced to begin with, but I really wanted it. Being down plus having all the extra debt would sour my daily mood. Finally, due to the house's floorplan, it might have been too noisy for me to peacefully write.

Thus, to eliminate my constant addiction to buying single-family homes, I only keep six months' worth of expenses in cash. Only when I envision our family seriously needing a new home within two years will I start raising more cash.

5) Trust is everything in investing, and FTX lost everybody's trust

One could argue that FTT and all other cryptocurrencies are Ponzi schemes. Even Sam Bankman-Fried inferred his yield farming business was a Ponzi scheme on the Odd Lots podcast earlier this year.

Once trust is lost, businesses tend to unravel. Nobody dares to deposit any funds with FTX due to what has transpired. Clients thought their assets were safe, but apparently they were not. It's kind of like Bernie Madoff all over again.

A bank run happened with Silicon Valley Bank on March 10, 2023. This bank has been around for 40 years and was the 16th largest bank in terms of deposits as of year-end 2022. But because it invested too much in Treasury bonds near the top of the cycle in 2021, it experienced huge losses. Confidence was shaken and Silicon Valley Bank went into federal government receivership.

If you stomp on a business's demise and then share internal e-mails publicly with an “I told you so” attitude, like the CEO of Jefferies did on Twitter, you also likely won't garner the trust of prospective clients. Keep private communication private.

With Financial Samurai, if I don't write from firsthand experience, it's harder to believe what I say. If I just write about how everything is hunky dory on my financial independence journey, would you really believe me? Probably not because life is full of ups and downs.

Related posts:

Perpetual Failure: The Reason Why I Continue To Save So Much

The Negatives Of Early Retirement Nobody Likes Talking About

6) Invest in only what you understand

If you don't know what a company or product does and can't easily explain your investment thesis to a friend, then you probably should not invest in it.

It is very hard to wrap my head around how FTX could be worth so much one day and then implode overnight. From the creation of crap coins to the process of yield farming, it's hard to explain what exactly is going on.

You can certainly take a punt on a speculative investment with a small portion of your portfolio (lesson one). But having a core position in something you don't fully understand is unwise. If you do such a thing, you are leaving your investment returns entirely up to luck.

Either thoroughly understand the investment or invest with someone you trust who thoroughly understands the investment. We'll still get some of our investments wrong. But that's the price we pay to earn returns.

Related post: The Recommended Split Between Active And Passive Investing

7) You don't have to be a great investor to get rich

If you want to achieve financial independence faster than the average person, all you have to do is become a good-enough investor. A good-enough investor knows thyself and has the property risk exposure.

Bad investors have incorrect risk exposure and risk assumptions. They are delusional with how much risk they think they can withstand. As a result, the chances of them blowing themselves up is much higher.

It is impossible to consistently be a great investor. You will have likely have to make investing your full-time job. And even great investors often underperform their respective indices. Therefore, for the average person, it's much better to try and hit singles and doubles on you way to great wealth.

FTX's Collapse Is Scary Stuff

I haven't been this shaken by what seems like financial fraud since Bernie Madoff's $50 billion Ponzi scheme was exposed in December 2008.

I'm pretty sure we're going to look back on 2021 as the most bubbliscious time in recent history. 2021 was crazier than 1999, 2000, or 2007. Now the hope is the overall downturn won't be as deep or as long.

But based on the declines in stock prices like Facebook and other tech companies, and the collapse in FTX and other crypto-related assets, the downturn has already been just as bad for many.

Let's just hope investors aren't so rattled by FTX's collapse that they drag the stock market don't further. The silver lining of this bear market, besides an easier time to generate more passive income, is more investors embracing the concept of turning funny money into real assets.

As a result, I continue to prefer real estate as my favorite asset class to build long-term wealth. Sure, real estate prices can and will decline as the economy slows down. But I'll be looking to buy more real estate at more attractive prices in the future.

Finally, as I wrote in my most bullish indicator article, I think the worst of this bear market is over. October inflation came in below expectations as I predicted. I'm hopeful the trend will continue. Time will tell if I'm right or not.

Reader Questions And Recommendations

Readers, what are your thoughts about FTX's sudden collapse? How could something like this happen so quickly? What are some other lessons we should learn from the FTX debacle? What are your thoughts on the future of cryptocurrency now?

Pick up a copy of Buy This, Not That, my instant Wall Street Journal bestseller. The book helps you make more optimal investment decisions so you can live a better, more fulfilling life.

For more nuanced personal finance content, join 55,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

Warren Buffett said it best this year at his annual meeting. Farm land produces food. Apartments produces housing. Bitcoin does not produce anything therefor he would not invest in it. Thanks Sam for a very informative article on bitcoin!

Yep. There are a lot of ways to make good returns on your money in ways that are easy to understand. Why on Earth put your money into things you don’t understand? And nobody understands crypto; they may think they do, but they don’t.

Writing that reminded me of a something the noted physicist, Richard Feynman, once said, “”If you think you understand quantum mechanics, you don’t understand quantum mechanics.”

The same could be said of crypto-currency.

Thanks for the reminder. I’m picking up my cold wallet today at BB…

I have less than 10% of my portfolio in Crypto, but I continue to DCA in Bitcoin and Ethereum because I believe these two will both stay. They have enough network power and survived so many bear markets that I don’t see it disappearing with this fiasco.

Of course. They count on people like you for it!

This illustrates the problem with coins in general. Anyone can create one with just a few lines of code. The argument for a long time was that “BTC was finite. More won’t be created which isn’t the case with fiat currencies.”

But no one talked about the fact that though they aren’t creating more BTC, people are constantly creating coins. Which is exactly what Sam did. Create coins from nothing, swap them for something of real value in the broad market (client money) and then attempt (badly) to invest in real assets. One wonders why, if his coins were so valuable, Sam wouldn’t have done everything to hold on to them. Instead he was selling them and putting the money into parts of the economy that were generating value. You can criticize CZ for announcing his sell off (I imagine many people will lay blame on him. Sam has tried with his “well played” comment), but why should CZ hold these coins when Sam himself was essentially dumping them via the swap?

Not enough praise is being thrown at the feet of CZ. Instead he’s getting blame. He’s down low acted as a whistle blower in this situation. Ironic given the shade he received for his company being “chinese owned” . He is canadian btw. If Bankman’s fraud had been allowed to continue, he would have been struggling to cover his losses forever. Just like Madoff. And the fraud would have been enabled by the strong regulatory and political connections he had. Just like Madoff. And the fallout to the economy would have been worse.

This illustrates the problem with coins in general. Anyone can create one with just a few lines of code. The argument for a long time was that “BTC was finite. More won’t be created which isn’t the case with fiat currencies.”

But no one talked about the fact that though they aren’t creating more BTC, people are constantly creating coins. Which is exactly what Sam did. Create coins from nothing, swap them for something of real value in the broad market (client money) and then attempt (badly) to invest in real assets. One wonders why, if his coins were so valuable, Sam wouldn’t have done everything to hold on to them. Instead he was selling them and putting the money into parts of the economy that were generating value. You can criticize CZ for announcing his sell off (I imagine many people will lay blame on him. Sam has tried with his “well played” comment), but why should CZ hold these coins when Sam himself was essentially dumping them via the swap?

Not enough praise is being thrown at the feet of CZ. He’s down low acted as a whistle blower in this situation. Pretty damn ironic considering his company was thrown shade for being Chinese owned (he’s canadian) while Sam’s company was supposed to be “solid and american” given all it’s political connections to the democrats. If CZ had not exposed this, this fraud would have been enabled for decades by the regulatory environment Sam had connections in. EXACTLY like Madoff. He would have been covering early losses forever until he couldn’t anymore…exactly like Madoff. And the damage to the economy would have been worse.

I tried out Coinbase for a while just so I could understand it. Going through their endless videos so people could promote some weird new coin for $2 of it felt like sitting in a time share sales seminar for a Disney ticket. All of them angling to sell the veracity of their coin by wrapping themselves up in something that was usually “woke” and attempting to guilt you into the product versus being a good product in and of itself. The fees were insane. Once I saw a number of financial influencers like Graham Stephan pumping it and the money they spent at the super bowl, I knew it was time to bounce. The fact they keep pumping it with FOMO/larry david commercials when the thing is 13 years old and hasn’t produced much value made me even more of a skeptic.

Clawbacks are probably coming for people that cashed out of this early and think they are safe.

It’s no coincidence this happened the day of the election, when it could do little harm to the results. How far will they bury the fact this guys mom is Hilary Clinton’s lawyer? Or that his girlfriend had some pretty auspicious regulatory ties through her father?

For a product invented to escape the corruption of banks and the fall out from ’08, it’s rooted deep in corruption.

Broadly speaking, a lot of this has happened because of the fed pump since the tech bust in 2000. Asset misallocation. People need a return and in the environment of the last 20 years where wages haven’t kept up with housing or medical, people have been looking for returns in crazy places. One could even argue that things like Meta dumping everything to the metaverse has been a misallocation of too much cash and no where to put it. Remember they tried Libra coin for a while.

Maybe its a good thing in some ways. A lot of fiat is disappearing from the market without the fed having to do it. It’s hard to unwind trillions of liquidity. These clowns just took out a chunk for us. Last year I speculated at least one exchange would be a black swan in the market. Now I wonder what else is out there. Anyone have a guess?

S Dawg – kick butt piece.

This crypto king thought he was smarter than the proverbial crypto system. He wasn’t. Especially in an immature market with little regulation.

I have many anecdotal examples of people making suboptimal decisions in regards to crypto. Or concentrated speculative investments. It all boils down to this:

Caveat emptor

Boom goes the dynamite!

Overall I think this fallout is very good for the long term of the Crypto industry. More regulation will definitely come out of this and hopefully will see a lot more scrutiny and holding crypto companies to higher standards. There will be short term pain but will bounce back just like all the other industries that went through something similar. DLT technology is here to stay overall, and the technology is really disruptive. Most folks screaming see Crypto is a scam, etc., don’t understand that but it does need to be regulated and the industry needs to go through the pain of maturing. If you are investing – make sure you adhere to the “Not your keys, not your crypto” – lots of buying opportunities in solid things and companies that have integrity in the space now and will be for next 6 months. Just make sure you do your due diligence on what has integrity and trust – there a lot of scams out there – and good advice Sam on only doing a small % like 5-10%.

Seriously man.. at some point you have to open up your eyes and see what is a delusion and fantasy. “Solid things out there” really? I can accept that you want to continue to gamble and make high risk bets on speculative assests.. but dont continue to claim that these tokens and made up virtual schemes are “Solid”.

The underlying blockchain technology has some value… but there is nothing that is solid or safe in crypto currency market..

Upvote.

99% of people in coins are there because their friends are in it. They don’t understand it.

One day we will look back on it as the finance product that was only made possible via social media.

If its regulated, then its not Crypto anymore, right?

My involvement in crypto was short. Back in early 2017, a friend told me about investing in bitcoin. He bought 100 coins at $1k each and said he would hold until his profits were enough to buy a beach house, which in southern CA at the time was about $2.5m. I invested a few grand in BTC and it promptly went down. I then doubled down at the lower price. Within a couple months my investment had doubled! I figured easy money and cashed out. The rest is history and of course it went on a tear, maxing at $69k a year ago. Turned around and crashed and now $16k. Ran into my friend recently. Rather than sell at $26k as planned, he got greedy and bumped his target up to $100k. Oops. Of course, he’s still sitting on a $1.5m gain but could have been a $6.8m gain. He doesn’t follow it closely and figures it’s a small piece of his total and he’s playing with house money. I couldn’t stomach the volatility along with the fact that you’re purely speculating on something backed by nothing. To each his own I guess!

What is the dollar backed by?

Aircraft carriers and nuclear weapons.

Absolutely fascinating! Thank you for highlighting this and explaining it in such an easy way to understand. I don’t own any crypto directly. I have a very small amount of exposure through an etf but I’m glad that’s it. Even though I have “missed out” on some of the huge gains some crypto investors have had, I am ok with that because I don’t want the risk or pain of the huge losses that many have suffered.

Wait, you mean my money I transfered to a random made up virtual account run by a 30 y/o kid and his friends in the Bahamas isn’t 100% secure?!?!!

Give me a break. Seriously.

I think the best analogy for crypo is penny stock frenzy in the 1980s. You had the trading desks, and boiler rooms, and brokers creating and pumping up these worthless ticker symbols. Ultimately there was almost no value except for what other people would pay at that moment.. some people made alot of money, alot of people also lost it all. Its the ultimate highest risk investment trading off pure speculation and greed with no underlying fundamentals. So if your an investor then you know this. If you really think that these made up chuck-E-cheese tokens like Luna, and Ripple, and Etherium, and Thether, and Cardano, and the 100s of other made up derivatives and “stable”coins are going to take over the worlds currency.. you are an idiot…

As long as there are people who want to get rich quick there will always be people inventing new schemes for them to try…

Sold all my BTC. Tether may be the next domino.

“I’m pretty sure we’re going to look back on 2021 as the most bubbliscious time in recent history. 2021 was crazier than 1999, 2000, or 2007. Now the hope is the overall downturn won’t be as deep or as long.”

I agree with you except I would say 2021 was the worst bubble of all-time. Crazier than 1636, 1720, 1929.

1636 : Tulip Mania in Amsterdam

1720 : South Sea Bubble in London

1929 : The Stock Market Bubble in New York

I don’t think the downturn is over. Many stocks and all cryptos will have to go to zero before we reach the bottom.

This was very obvious this would end that way. Cryptos are like lottery tickets, except you determine how much you win / lose based on the day you decide to buy / sell, that is, if you can sell, because there is no guarantee you can sell Bitcoins or any other cryptocurrencies if there is no willing buyers at that time. This is a very basic market rule many traders seems to have forget recently. No buyer, no transaction. For those who have a loan to pay back in addition to this, that will be a loss not only for the speculator, but for the lender as well …

For those who want to play lottery, that fine. Everyone else should sell all their cryptos immediately.

Anyway, that’s just my view on cryptos. Anyone is free to agree or disagree with me. But I’m know I’m right. So, at least, please you all be careful with your hard-earned money !

I can only compare what I have experienced. But you might be right on the other bubbles. Hard for me to know!

Some stats on historical bubbles…

https://fortune.com/2022/11/11/crypto-bubble-bitcoin-fifth-biggest-all-time-bofa-ftx/

You’ve been on a roll of great articles. The personality one was my favorite. Developing a good personality goes hand in hand with understanding who you are and how others see you. A derivative of this is your point 6, invest only in what you understand.

Virtual assets are an alchemic byproduct of cloud computing, fools gold. Not that speculating in it couldn’t be profitable but the mania is reminiscent of the British South Seas Bubble – what’s old is new when it comes to financial scams.

Cash flow RE is done until rates or values plunge. A huge bearish signal for rents I saw recently was new construction in South OC – 4/4 SFR in a gated community – renting for $5100. A realtor on this board also warned of significant inventory in Irvine coming in the next 6 months from FCBs looking to cash out their rentals. SFR rental listings in my Silicon Valley neighborhood are numerous – the remnants of lots of would be flippers caught by the rate and liquidity squeeze. Like you I’ll be a buyer but not until the median in my target area for a 2nd home has declined minimum 30%.

Crypto was and is a Ponzi scheme. The libertarians will howl that “so is fiat currency” but they are missing the key differences including the obvious backed by government taxes and regulated. There is no underlying value of crypto, only whatever the next guy will pay.

This was taken to the inevitable conclusion, with folks over leveraging a fake asset. The game was done when all those celebrity ads started running.

If you can still get something out, you should. Sam, your lesson a learned points are spot on.

There is definitely “some” underlying value to crypto, but it’s somewhat hard to quantify.

The main thing, despite what anyone tells you, is that it’s a medium of exchange first and foremost. Yes, it’s value is volatile, and maybe even designed to mathematically increase over time if you believe the hype.

But the most important characteristic is that is “stable enough” to maintain it’s value over periods of 1-2 days. And it is unabashedly simple to send that monetary value ANYWHERE, to ANYONE, FOR ANY REASON, and nobody can do shit about it. I can pay my neighbor for last nights drinks, or I can pay off a russian oligarch who is planning on helping me unload my Gazprom stake. And none of you will necessarily know the difference, or be able to stop it.

Is that a good thing? I’m honestly not sure. But is there value in systems that allow monetary value to be moved and managed in ways that are evolving too quickly for governments to control?

Is there value in systems that can move large sums directly peer to peer, oftentimes in less than 1 hour, if not seconds (and not “we’ve received your payment; here’s a credit and we will take care of settlement on the back end”)?

I would argue yes, but the value is almost entirely dependent on how much we trust/need the government system, and how large that government allows alternative markets to grow.

Excellent post, Sam!

Wow! “Funny Money” indeed! LOL! you know who I’m thinking about? Miami, and their bright idea to let this guy name their stadium the “FTX Arena”. Man! they’re looking like Wil E Coyote right about now.

Hey Sam! Do an article on fake net worth! Like, how can guys like Sam Bankman-Fried and Kanye West be worth billions last week and penniless the next week? I know markets go down, but I don’t see how anyone can lose billions in a matter of days if it were REAL wealth.

I look at all these “celebrity net worth” individuals and think, “are they really worth that much”? The actions of some of these so-called billionaires just doesn’t match what they say their net worth is.

This is a fascinating topic. I request you do another one. Or, as Humphrey Bogart said, “Play it again, Sam”

Here you go: Why cash flow is more important than net worth

Do you wonder how the Miami economy will get affected by the cryptocurrency meltdown. But these things take time to work its way into the economy.

This is going to be bad. Think of all the billions that were lost. This money came from individuals and corporations. This will be, what I call, a NEGATIVE “trickle down effect”

I feel bad for people who will end up losing money held at FTX. But damn, if you have even the slightest hint of experience with crypto you’ve heard the phrase “not your keys, not your coins” and seen the warning to get your crypto off exchanges and into a private wallet.

There is simply no reason beyond laziness to keep funds on a crypto exchange…and no reason at all to do so with an unregistered exchange based outside of U.S. jurisdiction FOR THE SOLE PURPOSE of avoiding U.S. regulations (hint: “regulations” are held up as being evil by people who very much want to take advantage of you…).

So, against the most basic advice to every crypto investor, many people left significant amount of crypto on an unregistered and unregulated exchange that then used said funds without the owners’ consent for its own purposes…”secured” only by “collateral” in the form of a shit coin created by none other than FTX.

It’s a sad story, but one that was totally avoidable by anyone with a modicum of commonsense.

Sold the rest of my GBTC today at a healthy loss. Lesson learned again

We always think about the acceptable minimum level of returns, but never the maximum level. Up is up, and if “some” is good, “more” is better, right? But for every outpaced gain, there’s an outpaced loss that follows. And for every 1 Tesla that we remember, there’s 10 Carvana’s that we forget. This is probably doubly true for things that are nearly impossible to valuate intrinsically, like crypto.

Great article and explanation.

Binance is probably next. All these exchanges operated outside of ANY jurisdictions is guaranteed to take advantages of that lack of oversight, you’d be an idiot not to: like lending money to win whale clients, using clients holding to sell short & arbitrage, does anyone even know where FTX or Binance is actually located? Dubai? Qatar? Bahamas?

A few more lessons I gleaned from the collapse of FTX:

(1) Don’t pick a fight with someone you can’t win against in business. Unfortunately, SBF alienated CZ, the CEO of Binance. And CZ retaliated by waiting for the opportune time to destroy SBF.

(2) Do not leave any significant amount of crypto with an exchange. Store your coins using a cold wallet.

(3) The risk with investing in crypto is that we might be too early as opposed to being too late. Remember the early days of search engines before Google like Lycos or AltaVista. No one under the age of 30 knows those early companies now.

(4) Practice stealth wealth – even as a multi-billionaire. SBF was constantly in public hobnobbing with politicians and celebrities. Due to his high profile, I’m sure he created many enemies and people jealous of him. They can’t wait for him to stumble or be taken down.

(5) When a business is built on a house of cards, it doesn’t take much for the business to collapse. Make sure to build a business the right way with a strong foundation.

These things tend to lead to bottoms in the crypto/ BTC markets. BTC has been declared dead over and over, but has proven resilient after multiple > 85% drawdowns. It is when you see articles such as the one you have just written, that you know a bottom will be coming soon.

Are we at the bottom now? Probably not. But- especially for the uninvested, it is a good time to begin Dollar cost averaging in to BTC/ maybe ETH…while folks such as yourself declare crypto dead.

can buy bitcoin at 45% discount with GBTC shares, Cathie Wood may have bought it a little too early

great article Sam. binance , their chief competitor, possibly triggering the collapse not something i have heard on media. heard about them stepping in to rescue but not the first part. very interesting.

this is just another reason not to invest in individual companies unless you own them. i have moved mostly to mutual funds for stocks for these reasons.

I saw SBF post that FTX US was not impacted. Thoughts on that?

Bitcoin, held by you not on an exchange, fixes this.

You’re right. Transfer your coin to your wallet folks! Keeping Your coin on an exchange is like getting an IOU.

Does your comment apply to FTT ? For me, Bitcoin, FTT, they are all the same .. Totally worthless !