It's been thirteen years since planting my financial independence flag in 2012. I want to share with you some thoughts on how life has been after financial independence. I originally wrote this post eight years after retiring early.

Before neutering my day job income, I feared whether I was doing the right thing financially. What I realized is that the fear of running out of money in early retirement is completely overblown because we are adaptable and resourceful.

Nobody here is too proud to work a minimum wage job if disaster strikes. Nobody here is too selfish not to help out a family member or friend in need. Surely, nobody here is too lazy not to hustle. You will find ways to make things work. Do not worry.

Here are three main points I want to share after achieving FIRE.

Life After Financial Independence: Lessons Learned

1) You change for the better.

There's this wonderful term called “F U Money” out there that's idealized by people who can't wait to have it. Who doesn't want to have enough money so they can tell their micromanager or high school bully to shove it where the sun doesn't shine? I know I did.

But the reality is that having enough money makes you more empathic towards other people's struggles. Your insecurities melt away once you've achieved your goals.

If you look at the Financial Samurai archives between 2009 – 2012, you'll notice a more irreverent tone with lots more comments on each post.

Now, despite the site being 10X larger, there are fewer comments on each post partly because less people are agitated by what I have to say. I've spent much more time listening to other people's perspectives and taking them into consideration when writing a post. I've also spent a lot more time responding to comments with less snark. You'd think the opposite would happen.

Having money makes you care more, not less.

2) You realize financial independence is just one stop.

Life is like a juicy mystery novel. You don't want to die before reaching the last chapter because that's where you THINK the excitement and satisfaction lies. What a shame to never find out whodunnit.

The reality is the greatest excitement resides right in the middle where you're struggling to get ahead. It's just hard to recognize that when you're in the mix of things.

The last chapter in Volume 1 is rarely satisfying because you realize there's Volume 2 to look forward to. You simply put your past behind and look forward to a new challenge. In my case, when I first wrote this post, the next volume was starting a family. And now I'm doing everything possible to be a good father to my two kids.

Now that I've been a father for seven years, I admit it is the hardest job I've ever had. The joys are amazing and so are the sorrows.

3) The greatest reward is helping other people.

Once you achieve financial independence, making more money starts feeling like a game. It's fun to tinker with new income generating methods because there is no downside. But sooner or later you'll find the joy of making more money to be meaningless.

It's why there are plenty of unhappy rich people. They haven't fully tethered their wealth towards a cause they are passionate about. The best thing about retiring early is greater happiness for longer. It took me ten years of early retirement to realize this truth.

I want to help as many people achieve financial independence ASAP before and after I die. The internet is the best way to achieve this goal because access to my site is free and the content will live on forever. Everybody has something valuable to share.

Don't worry if you can't afford $50,000 a year in college tuition where only the wealthiest or smartest people with the most connections get to attend. Today is about giving access to everyone who wants to learn.

My desire to help people achieve financial independence is the main reason why I wrote a new personal finance book. Buy This, Not That, an instant Wall Street Journal bestseller, is the best book about building wealth and making better decisions you will read.

Words Of Thanks Keep Me Going

Every single comment or e-mail from a reader who says how an article I wrote helped them lead a better life gives me a “power up” to keep on going. It's easy to do nothing once you've taken care of yourself and your family. But I see the readers here as an extended family.

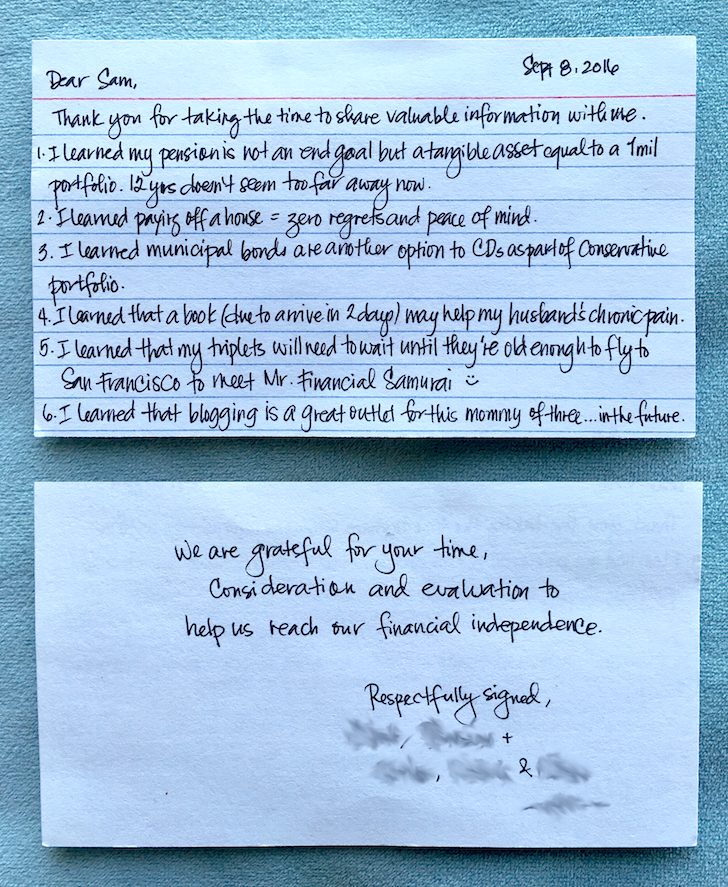

Here's a handwritten note I received that I'll cherish forever. I know financial independence is an inevitability for her and her wonderful family!

Keep On Fighting For Financial Independence

Life after financial independence is great. The sacrifices you make today will be worth it. I have no regrets sharing a studio with another fella in my early 20s in order to save money. Yes, it was embarrassing bringing people over at times, but who cares.

I have no regrets waking up by 5 am to work on my side-hustles before work in order to one day break free. Yes, hearing the alarm go off when it's pitch black outside while you're in the middle of a lovely dream is painful, but you'll get used to it.

Yes, I started the modern-day FIRE movement in 2009. It's been a wonderful journey. But what I realize fourteen years later is that you don't need to FIRE to live a good life.

In fact, early retirement / FIRE is becoming obsolete because many have more flexibility to earn in ways that are more enjoyable. Thanks to the internet, nobody is stuck with just a day job they don't like. No college degree is necessary to make money online!

You will regret more of the things you don't do than the things you try. Once you find that wonderful purpose, you'll go on forever. Keep on fighting!

Recommendation To Build Wealth

In order to optimize your finances, you've first got to track your finances. I recommend signing up for Empower's free financial tools so you can track your net worth. You can also analyze your investment portfolios for excessive fee, and run your financials through their fantastic Retirement Planning Calculator.

Those who are on top of their finances build much greater wealth longer term than those who don't. I've used Empower since 2012. It's the best free financial app out there to manage your money.

Negotiate A Severance To Retire Early

Never quit your job, get laid off instead with a severance package! If you plan to retire early because you've achieved financial independence, nothing feels better than leaving with money in your pocket.

My severance package paid for five years of living expenses after I retired in 2012. As a result, I felt more relaxed and free to do what I wanted.

In my latest edition of How To Engineer Your Layoff, you'll learn how to negotiate a severance to live the life that you want. Use the promo code ‘saveten‘ to save $10. The book is now in its 6th edition and was recently updated with new case studies and more.

For more nuanced personal finance content, join 60,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009. Life After Financial Independence is a FS original post.

Your blog inspire me more and more each day. My husband and I decided we want FI when we got married at 27, the plan is to retire at 38 yrs old. If we cant completely retire at 38 years old, atleast we already have passive income and wont be afraid to lose our 9 to 5 job. The journey is not straight though, we dont have any idea how we can achieve it at first, we tried stocks, tried to acquire real estate but having a very little money to start, and no finance background, we saw very little movement in our net worth. But the compounding is really powerful, we just realized this year that it’s achievable to retire when we reached 38. But since it’s still 4 years ahead, my question now is how to enjoy your journey while waiting for your FI. I tend to be impatient and was thinking about it everyday.

When calculating net worth are planning retirement, how do I value a $43,000 a year pension with a 50% survivorship and COLA? I see this as being of great value. If my company were not providing this I would be tempted to buy an annuity as part of my income stream.

Could you reply to my e-mail I listed when making this comment please?

Hi NOAL,

Here’s your answer! I wrote the post just for you and others with pensions.

See: How Do I Calculate The Value Of My Pension?

Sam

I’ve recently discovered your site, and find your frank and personal discussions helpful. Thanks a ton.

I’m a 52-year-old lawyer and have worked 6-7 days a week for almost 30 years, working myself to the point of some very lucrative years (just into 7 figures) in the past ten. But now the work is less rewarding, and frankly I’m less busy. That would have freaked me out in the past, BUT in the past five we have paid off our house and invested more than half of my income. We have like $4.5M invested and $6M net worth (Chicago, not SF, so a decent modest house doesn’t cost $5M!). (I also have a 529 holding $325K for my 11-year-old son, so I think he’ll be fine for college.)

So I’m kind of calm about working less, and am thinking of just NOT working for a while instead of sweating about re-tooling myself. I love the idea of more time with my son while he enters the challenges of junior high and high school. Your site is calming, because it gives me the confidence to know that if you plan well, you CAN stop working and focus on living.

I frankly don’t know any other lawyers who have quit this way, and I wonder why. I do think most get caught up and spend too much, so maybe nobody can afford it. Keep up the good work. Whether I can convince my wife it’s cool for me not to work is another question….

Great to hear! Very honorable and impressive of you to work 6-7 days a week for almost 30 years! I could only last for about 13 years before I had to press the eject button. Please spend time reading all the older posts and going through the Retirement category etc.

Focus on living! See: The Fear Of Running Out Of Retirement Is Overblown

And for fun, see: How To Convince Your Wife To Work Longer So You Can Retire Earlier

I’m sure she’ll enjoy the read!

I have actually begun suggesting that my dear wife could go back to work (she’s been taking care of our son) in her science field. To be honest, she isn’t very receptive! No surprise. But it’s possible. I think it would soften the blow of having me around the house all the time. We’ve never lived like ALL DAY with each other all the time. It will be stressful for a while, guaranteed.

Thanks again!

Inspiring stuff Sam.

I have zero regrets about quitting my job this year and pouring my heart and soul into my blog and other pursuits.

None.

My own mother just decided to walk away too from full-time work to work on a part-time gig. She’ll keep working on the side for the time being.

Good luck in ’17!

I have not yet reached financial independence, but I am sure it will make me a better person too – I guess you can really relax and do what you love after you don’t have to think about money anymore.

Work stress may equal burn out. Before I moved to Northern California from New Orleans for a better job opportunity I was cranky, fatigued, and quite edgy. It did not make for a good home life (and forget about work life)…FI is the goal though I find the Joneses always creeping into my life a little at a time. So small goals- first pay off school debt then follow your aggressive mortgage payment strategy…hopefully that with continued savings will lead to FI in 10 years (not quite as young as you but still young). Thanks for the continued and regular posts- Its a joy to read.

One of the best posts ever on Financial Samurai!

I’m looking forward to reaching FI asap. I must admit I still call it FU Money (or FU Number) and I can’t wait to have it.

Thank you for your amazing articles.

Sam, longtime lurker here. I’ve always enjoyed your writing, especially your net worth by age posts as well as car posts but have only commented a few times. But this post spoke to me deeply so I had to comment.

I totally agree with your points, especially #3 about helping. So much of our talent and energy is spent making money that when money has been met, if we let our ambition and talent rot, then it leads to depression. Instead, if we can redirect it to helping others, amazing things can happen.

When I FIRED some years ago, it didn’t feel any different at first. Then, as I thought out the implications more of not needing to work for money, I realized years afterward that I had closed the book on Volume 1 of my life as well, and that Volume 2 could be the opportunity to really make a difference.

So, encouraged by your posts on blogging, I finally started one in August of this year with the purpose of helping parents their children (and themselves) about money. Along the way, my goal is to give $1 million to charities and research that help solve problems I care about. (If curious, I write about it here:

This is all to say that I agree with you wholeheartedly. Not only that, your advice sparked a big goal of mine that I hope will make a dent for good in the universe. When I think about others you’re inspiring to do the same, you will have created more good in this world than can be measured!

-JT

The hand-written letter is straight from the heart. Point #5 speaks to the power of human connection that blogs admirably fill in the absence of face to face interactions.

It is those little things that speak loudly to us in a world otherwise full of too much noise.

Really enjoyed reading this post and the messages within.

I’m working toward becoming Fiscally Free (See what I did there?) for my family. Between work and my commute, I barely see my daughter during the week, and that is not OK.

I also feel like the commute and the company I work for are not-so-slowly draining my life force.

That is such a precious note! We’re very close to reaching financial independence and besides traveling and not worrying about an alarm clock, we have a few ideas in mind to help others in need. I think education will be a priority after early retirement. Great post!

Great answer, and one that spoke to the question that’s been on my mind for a few weeks: how does it feel to have finally “made it’?

It seems that it really does come down to helping others – and if we can begin with the end in mind, I think the journey to financial independence becomes not only more rewarding, but it becomes faster, too. I think of those companies that are overwhelmingly customer-focused and oriented, even if it means losing a few bucks occasionally for product returns, versus those companies that are clearly fly-by-night and in it to skin a few cats and leave. I know that there are companies I’m loyal to, and I’ll pay a premium to someone I believe is truly interested in helping customers. It’s that “1,000 true fans” – helping 1,000 people goes a long way.

Speaking of, Sam, I can only echo the sentiments of your correspondent and say that the depth of content and wisdom you’ve shared here has been invaluable and inspiring.

That is an incredibly sweet note.

I want to achieve financial independence so I can focus on my business only and stop working FT for other folks. My business helps the LGBT community and brings me enormous personal satisfaction. I want to continue using my brain and my empathy to help others. Even when I don’t financially need to.

Great inspiring post of what life can be like when youre financially free. I agree that helping others is something that goes a long ways whether youre financially free or not but I cant imagine the good that can be done once you have a lot more time on your hands.

Cant wait to be financially free, spend more time with my loved ones and really put in more effort to just help others in need.

Hi Sam,

I have a long way to go before reaching FI…..but it doesn’t seem all that great once I’m there based on what you’re saying, hmmmm. Anyway, I think it is important to, along this journey, take time to stop and smell the roses (i.e., as you said “You will regret more of the things you don’t do”). I try to reflect every now and then the experiences that I have not yet pursued (some type of volunteering, traveling to a new place, or trying a new type of cuisine) and plan to undertake those as time and money allows.

What’s great is being able to do what you want to do and not have to listen to anybody. The downside is that you will start to get bored if you don’t have a purpose. But I think everybody will eventually find their purpose if they look hard enough, whether it is with family or for a cause.

The money is nice, but you’ll adapt to it quickly. Here’s one example where money helps:

I used to feel bad ordering what I wanted to eat at a restaurant due to cost. I didn’t even want to order more than lemon water. Now I just order whatever looks great, regardless of cost. But I still look at the price. Recently, I’ve taken it a step further and order an extra entree to share with my dining partner if the entrees look amazing. We’ll just take the leftovers home. Money buys more choices. That’s a nice option to have.

OMG this read was sooo timely… . I just got FIRED TODAY from the company I worked at for the past 6 years. I was quite comfortable and grew psychologically dependent on the 100K salary, and now at 30, unmarried/ no kids, not sure what to do for a day job. Should I even have a day job?!?

I work weekends as a real estate agent, this year about 235K in take home commissions; and the rental portfolio of 13 units nets around $75K/year. Plan on keeping both of these income streams and increasing the rentals with annual acquisition.

I know I don’t NEED the day job. But I am just super worried that I will be bored, or be in a malaise, or even get up before noon everyday. What does one do 9 – 5 Mon thru Fri without a day job?

Feeling anxious I want to prep a resume and get back in the job market… but is that just conventional wisdom shoving the daily grind down my throat? I worked so hard to achieve this foundation for FI, but suddenly losing my day job, this feels WEIRD.

HELP!

Sorry to hear about the loss, but if you are pulling in $300K/year as a single guy, life can’t be that bad! I’d enjoy your time off and see what life is like without a day job. I’m sure you can fill your time with other things you enjoy more than work.

I’ve taken my time to look for sweet FT gigs before and they never pan out b/c I’m so, so picky now I’m not willing to sacrifice anything to go back to work.

What’s your end goal? Maybe finding someone will bring about new purpose and happiness!

Related: The Fear Of Running Out Of Money In Retirement Is Completely Overblown

I have always wanted to get my PhD and be an Economics Professor, but never pursued that career since its not financially rewarding. I think that this job loss just made my inner nerd twitch again….

And you are right, life ain’t bad at 300k/year but it was even better at 400K. I will probably cut some expenses, like my second car (BMW i8) and possibly cable.

So GRE here I come I guess.

But I will admit one thing. Life does get better at over $500,000 a year, especially if you have dependents. At $500,000 a year, you will finally feel relatively rich.

See: What Income Level Is Considered Rich?

Good luck with your next challenges. Starting a family is always tough, but it’s much easier when you have more time. FI is a great goal to have. I don’t think anyone will ever make it regret that goal. Personally, I need to improve on #3. I’m helping some people though my site, but I need to do more locally.

Wow, awesome fan note! Congrats on changing someone’s life and making it better.

I absolutely agree with you that once you have F-U money, it’s much more rewarding to help others rather than to make more dough. It changes your entire outlook on life.

Since becoming FI, I’m much happier, healthier, and have zero regrets. I’m also really glad you started this site, because having you as my inspiration was very helpful and encouraging. So thanks for that!

Couldn’t agree more that the next chapter in the book is really exciting to think about. I think helping others is the real benefit though. Thinking about all the opportunities I have to even be able to achieve financial independence, when most people in other countries in the world don’t have that opportunity, makes me motivated more to help others. Great post – thanks for the thoughts.

Excellent post Sam. The lady who wrote that letter has beautiful penmanship, which is rare in today’s keyboard world. The contents of that letter showed her genuineness. I can imagine how great you must feel about this letter. If I feel so motivated already after reading positive comments on my articles, this kind of handwritten letter could keep me going for weeks! As to your article, this fits nicely with what I often say: Achieving FI is mandatory, but RE is optional

It is interesting to read other people’s views on financial independence. It never really came to my mind that once I reach financial independence, I would stop working all together. I actually rather enjoy my corporate work and am happy to be do what I am doing until I learned all the ins and outs of running and managing a business. The best part is I am getting paid to learn how to run a business on a detailed level and a big picture vision, and at somebody else’s risk. The reason for me to seek financial independence is to provide enough for my family, and then I can start my own business without worrying about daily household operating expenses, lol.

Great post as always. Your perspective on what really counts, is what keeps me coming back to FS.

For us, FI means more freedom, more security & most of all, more options. I also see it as one step, as we transition from employee to investor. The final step is philanthropy through giving away our time and money.

Hi Matt – As your site grows, there will be this awesome connection you will have with readers. We’re all growing in different ways, trying to do the best that we can. It’s fun to go along the journey together!

What an awesome post. I’m so far from financial independence maybe that’s why it seems strange to me that once you get there you stop worrying. I can’t imagine a time when I won’t be worried, or at least concerned that the money will run out.

Sam, you are like a favorite Uncle we turn to for advice. Your experience and your integrity are all over your articles like a watermark on a photograph. Thank you for continually inspiring us!

I like that! I’ve always wanted to be a good Uncle, but I’m not doing a good job as my nephew is in NYC. Thanks for your kind words!

agreed, your tone in older articles was much more aggressive. the old articles did have very good content though… the content seems to be on a slight decline ever since that april fools joke about quitting FS. there have been a lot more “this is how my finances are doing this week” kind of articles, and not as much of the reflective / self improvement type of stuff i guess.

this was definitely one of my favorite articles i have read recently. I thought it was very insightful, in sort of an elderly, reflecting back on life, kind of way. Which i am totally into, being in my mid 20’s.

agreed, in a different wording, Life is about the journey- not the destination.

Ah, to be in my mid 20s again. Just remember, if you’re not producing, you’re consuming. You will have the most energy you’ll ever have in your life right now. Utilize your energy to the maximum!

“Today is about giving access to everyone who wants to learn.” This is everything to me. While I definitely am learning more or as much as my readers, I still think that is what keeps me blogging. The hope that people learn from my words…even if they’re mistakes not to make. Thanks for helping someone who’s only at the start of her journey understand the other side more clearly.