The 2023 Charles Schwab Modern Wealth Survey highlights the many paradoxes of wealth in America. Over 1,000 individuals of all different backgrounds filled out the survey.

Overall, the survey, conducted between March 1 and March 23, 2023, says it takes a net worth of $2.2 million to be considered wealthy in 2023. The net worth amount is the same as it was in 2022 but up from $1.9 million in 2021.

If there's one positive thing a bear market does, it's that it lowers wealth expectations.

In this post, I'd like to look more closely at the data and point out the wealth paradoxes. Americans don't seem to understand what it means to be wealthy. We also don't seem to act according to our financial goals and personal beliefs!

Wealth Paradox #1: Inflation Is Not As Bad As It Seems

The first paradox of wealth is Americans' inability to accept reality. Americans believe inflation is a big negative to lifestyle quality.

High inflation is why the Federal Reserve has aggressively raised interest rates since 2022. However, despite inflation reaching 40-year highs, the amount of net worth necessary to feel wealthy has not increased.

With inflation up between 4% to 6.4% YoY in 2023, it would be logical to believe the net worth required to be wealthy in 2023 would also rise by 4% to 6.4%. If so, the net worth range in 2023 should be between $2.288 and $2.34 million. But paradoxically, the net worth amount stayed flat.

So maybe, the threat of inflation to American livelihoods is overstated. Just as life goes on whether you take action or not, inflation goes on whether you're accumulating more wealth or not.

Wealth Paradox #2: Feeling Wealthy Despite Not Having Enough

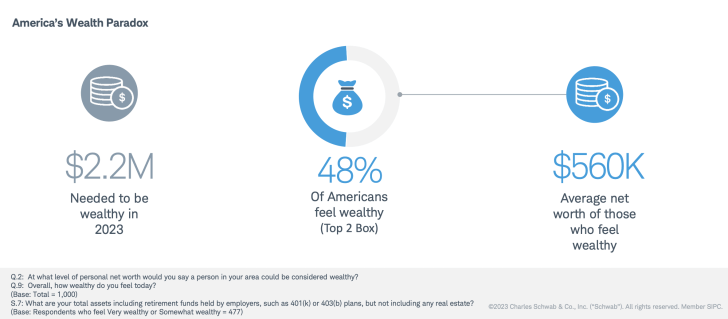

48% of Schwab's Wealth Survey respondents feel wealthy, yet the average net worth of those who feel wealthy is only $560K. Yet, we just learned that $2.2 million is the net worth considered by survey respondents to be considered wealthy! A $1.64 million shortfall is huge, especially in terms of percentage.

Therefore, either the respondents are lying about the amount needed to feel wealthy, lying about their net worth, or are inexperienced about how much it really takes to feel wealthy. Or maybe Americans are simply delusional about money.

As a personal finance writer since 2009, I believe most people overestimate their needs due to fear and uncertainty. At the same time, most people underestimate how much wealth they can achieve over time through consistency and compounding.

It's hard to know how much money you really need until you are put in the situation. It's also hard to know how you'll feel once you get to your target net worth figure.

The differences between the imagination and the reality are why I try to write every article on Financial Samurai from firsthand experience.

Wealth Paradox #3: Feeling Of Wealthiness By Generation

Another paradox is that Millennials feel the wealthiest among the four major generations. Yet, the mass media consistently rags on Millennials for being the unhappiest, loneliest, and poorest generation.

Despite making up nearly a quarter of the population, Millennials — defined as those born between 1981 and 1996 — own a scant 3% of the country's wealth, according to the Federal Reserve's Survey of Consumer Finances.

In the survey, 57% of Millennials feel wealthy compared to only 40% of Boomers. Yet, in another wealth paradox, it is the Boomers who are actually the wealthiest generation in history given they saved and invested over the longest bull market in history.

Below is one of many charts you can find that highlight the percentage of U.S. household wealth by generation. Boomers are dominating the amount of wealth in America, followed by Gen Xers, Millennials, and Gen Zers.

Why Do Millennials Feel The Wealthiest And Boomers The Least Wealthy?

So what explains why more Millennials feel wealthier than other generations? My hunch is that American Millennials have more perspective than the mass media gives them credit for. They grew up with the internet and know how lucky they are relative to billions of others who didn't grow up with their same privileges.

Millennials are also in the prime age range for earnings and health. Because they are making career-high incomes, they are most hopeful about accumulating more wealth than when they were in their 20s. And because they are also still healthy, they get to feel physically good while enjoying their wealth at the same time.

As for why Boomers feel the least wealthy, I think the answer is time is more valuable than money. When you have the least amount of time left in your life compared to other generations, then you feel the least wealthy. Boomers also have more health issues and regrets regarding what they could or should have done when they were younger.

But yet in another wealth paradox, studies have shown happiness tends to increase the older one gets. In fact, I've argued that greater happiness is the best reason to retire earlier!

Wealth Means Having More Money Than Time: No Paradox Here

I didn't have to even look at the Time vs. Money question to know that most Americans feel that having time is more important than having money. I've felt this way since I was 13 when my 15-year-old friend passed away in a car accident.

As you can see from the chart, Boomers have the greatest number of members who believe time is more valuable than money at 67%.

But curiously, Millennials have the lowest percentage of participants who believe time is more valuable than money at 56%, despite not being the youngest generation surveyed. I'm not sure why.

The stronger you hold the belief that time is more valuable than money, the more motivated you will be to save and invest for the future. You will also be more motivated to retire earlier or find a job you also enjoy doing.

My strong belief in the value of time is the reason why I left my job at 34 and have not returned. So far, I have yet to find any full-time job that is more valuable than my freedom.

My strong belief in the value of time is also why I didn't find it difficult to regularly save over 50% of my after-tax income for over a decade. For me, the reward of buying back time in the future was well worth it.

Those Who Believe Money Is More Valuable Than Time

Despite 61% of all generations believing time is more valuable than money, that still leaves 39% who believe money is more valuable than time. To me, 39% is a shockingly high percentage because while we can always make more money, we can never make more time. I think the percentage split should be closer to 80% / 20%.

But I also recognize why a large percentage of people would say money is more valuable than time in a wealth survey. First, the survey is focused on money, so there may be an invisible hand of persuasion. But more importantly, if you feel you do not have enough money, then you will logically choose money over time.

Describing Wealth Shows More Paradoxes

The final paradoxes of wealth are what the survey participants describe as what wealth means to them.

- 72% of participants believe having a fulfilling personal life and a healthy work life balance are the most important aspects of wealth, yet Americans are the most overworked people in the world. Americans work more hours a week and take the fewest number of vacations a year.

- 70% of participants believe not having to stress over money is more important than having more money than most people they know. Yet, the long-term median saving rate in America is only 5%. If Americans truly believed wealth is not having to stress over money, Americans would save a greater percentage of their income.

- If 63% of survey participants believe being in good health is more important than being successful, why don't Americans eat better and exercise more? Americans have the highest obesity rate in the world.

- If 64% of survey participants believe in paying for experiences to spend time with family now over leaving an inheritance, then why is there more than $50 trillion in wealth set to be transferred from the oldest generation?

Not Acting According To Our Beliefs: The Biggest Paradox

It is clear that many Americans do not act according to their financial beliefs. Here's another wealth paradox about retirement expectations according to a North Western Mutual survey. The difference between how much money people expect in retirement versus how much people have in retirement continues to remain constant their entire lives!

As a result, many Americans will suffer from dissatisfaction, regret, and unhappiness as they get older.

To all Financial Samurai readers and listeners, I encourage you to act more congruently with your thoughts. Don't be that person who puts off starting a business, writing a book, traveling, joining a different industry, or finding love someday. Because if you never take action, someday tends to never come.

My Current Wealth Paradox

I'm currently experiencing a wealth paradox because I'm finding it difficult to spend a lot more money to decumulate, despite accumulating more than I need. Instead, I continue to save and invest at least 20% of my after-tax disposable income every year to provide for my family.

After 24 years post-college, I find it hard to change my financial habits. I'm constantly hedging against an unknown future that could include bear markets, illnesses, thefts, and accidents.

Now that my family has stabilized at four, I should be able to model out more aggressive spending patterns. For the second half of my life, I plan to eliminate my wealth paradox by giving more, spending more, and investing less.

Wanting to give more is partially why I continue to write so much on Financial Samurai, despite the time it requires. I want to help more people to obtain the financial courage to do more of what they want.

It Takes Two In A Married Household To Spend

The other problem I have is that even if I want to spend more money, I still face the challenge of getting my wife on board.

For example, I know the easiest way to decumulate is to buy a more expensive home. With higher property taxes and maintenance costs, it's easy to spend down your wealth on a nicer primary residence.

But upgrading homes has proven to be a challenge, so we let that funny money stay invested in stocks, bonds, and online real estate. Over 10 years, the probability is high our investments will be worth even more, which further compounds my wealth paradox!

Just as saving money requires intentional effort, spending money requires an equal amount of intentionality. However, given the path of least resistance is to do nothing, it's much easier to just let our investments compound to greater wealth.

Reader Questions And Suggestions

What are some wealth paradoxes you notice in America or your country? What are some wealth paradoxes you recognize in your own life? Why don't more people take action to get what they want?

If education is priceless, why not pick up a copy of my book, Buy This, Not That, on Amazon for less than $20 after tax? The book is the most comprehensive personal finance book with action steps to help you build great wealth.

If wealth is important for providing more happiness and freedom, why not sign up for a free net worth analysis with one of Empower's wealth advisors? Getting a second opinion from a professional can be very helpful. You just need to link up $100K+ in investable assets in their free wealth management tool.

If you want to gain more financial knowledge, join 60,000+ others and sign up for the weekly Financial Samurai newsletter and subscribe to my podcast on Apple or Spotify. They are all free.

The conclusion that I would draw from the biggest paradox of not acting according to our beliefs is one or both of the following:

1) Children aren’t as fulfilling as society has convinced us that they are, but the large majority of people don’t want to openly admit that so they say that one thing is important to them because they feel like that is what they are supposed to say, but they don’t behave accordingly.

2) Once in the thick of it and past the point of no return, people realize that if they don’t put a significant focus on building wealth now at the expense of spending time with their families then they put themselves at risk of having to rely too heavily on their children who may or may not be willing and/or able to do so when the time comes.

I would say for 1), my children give me incredible fulfillment, more so than personals the average person my age, because I have a lot of time on my hands given I don’t have a day job. They fill the void of purpose.

I’m what ways are your children not fulfilling, if you have them?

I do not have any children, but am around lots of friends and family members that have them and this is what I have generally observed. Many of them say something along the lines of “I love my children, but…”, which may not necessarily mean they don’t feel fulfilled but some of them certainly don’t seem very happy. I feel like #2 plays a bigger role because if you can permanently solve the money part of the equation (to the best of our knowledge and foresight) then it seems like it would be a lot easier for children to feel fulfilling. None of those that I know with children are completely financially independent and some are downright broke, and that seems to be playing a major role.

It’s definitely harder to raise children if you are struggling financially. Tough enough with finance stability.

I say give children a go! They will surprise you!

https://www.financialsamurai.com/older-parents-having-kids-late/

Thanks for the insight, Sam!

As someone whose parents divorced at 9 (similar to Carlos), I wonder if there isn’t a fair amount of cognitive dissonance on his part in terms of the effect that had on his son. I 100% agree with your assessment of waiting to have children when you are older and financially stable (preferably independent). With money fights/problems being the #1 cause of divorce in North America and being honest with ourselves about the effects of divorce on our children, we would certainly be remiss to not give that full and proper consideration.

It’s just hard to know what you haven’t experienced. And having children is a life-changing experience.

For example, it’s hard to discuss the positives and negatives of homeownership if you’ve only just rented for your entire life.

We are naturally biased for the decisions we make, in order to feel better about the decisions we make.

Absolutely fair point. I try not to be biased and certainly don’t think there aren’t positives to having children. Hopefully Carlos’ son turned out great and was relatively unaffected by his parents’ divorce. BTW, I can tell that you are a great father.

Thank you George! I try my best.

It’s strange they use the term “net worth” in the survey, but the question used it seems is “What are your total assets including retirement funds held by employers, such as 401(k) or 403(b) plans, but not

including any real estate?”. So two issues:

1. Not including real estate will definitely result in a lower number;

2. This is not net worth…this is only total assets excluding real estate, which may be overstated since no liabilities are factored in.

With time, you can (theoretically) produce infinite money, therefore money has no value in contrast to time. With more money, you can never buy back months or years of your life which just goes to show the 39% of people who choose the money fundamentally don’t understand life or existence. They will always be paying the lifestyles of those who do.

It is easier said than done to align your actions with your thoughts & beliefs! Insightful and helpful examples to consider. Thank you!!

Regarding your de-cumulation conundrum, spending money does not equal happiness or leisure. As you have observed, spending money is a lot of work. And time is more valuable than money. You could consider going the Warren Buffett route and work at figuring out how to give away your money to a worthy foundation. Or you could create a foundation and employ your children to run it. Hopefully they would be more likely to run it according to your values.

I decided to create a “foundation” by writing on Financial Samurai and recording my podcast episodes for as long as I live. It is the best way I feel I can get back. Because giving just money often times is ephemeral and go into a black hole. Helping people achieve more financial courage so they can do what they want, in a free manner, feels great!

Do you have any well paradoxes you’d like to share?

Hi Sam,

I think there’s a lot of potential explanations here. Some could be related to the instrument but there’s lots of other ways to slice how wealthy people feel. I encourage you to check out https://americancompass.org/2023-cost-of-thriving-index/ for their cost of thriving indexes. Really interesting stuff that might spark more conversation among your readers. TLDR: people make a good deal less against their needs than they used to a generation or two ago.

Cool, will check it out. If you have any personal examples of wealth paradoxes or thoughts on why there are paradoxes, I’d love to hear them.

Thanks for this link! As we all know, the BLS has fundamentally tinkered with and continues to tinker with the way CPI is calculated. So the trend line is unreliable and the number is now more or less meaningless. This COTI index is so much better. Thank you! I didn’t know about it.

You wish to decumulate yet consider returning to work from previous posts to fund your childrens’ education. What’s wrong here?

A wealth paradox indeed. But I’d like to also fill the time void with more purpose and camaraderie mainly once both kids are in school full time, hence why the job doesn’t have to be one that pays the most.

Related: Sadly Giving Up On Early Retirement

Ahh yes,!The Dumpster FIRE movement:

Save every possible dime from meaningless high-paying work you don’t enjoy so you can quit as soon as possible and pursue the passions you don’t have because you live an uninspired life.

Hi Jay, what is it that you do and where are you on your FI journey?

So far, I’ve been very happy with the way things have turned out. It’s the optimization of freedom that’s the biggest challenge.

Perhaps Millennials feel more wealthy despite their lower net worth because they lack a certain perspective due to inexperience. Many of them probably haven’t run into expensive house repairs or contemplated the cost to put their children through college, or dealt with expensive healthcare issues. Whereas Gen X and especially Boomers understand how expensive life can get when you’re in the thick of it.

My take here. If you’re an immigrant from the less industrialized world, naturalized in USA then you feel wealthy with waaaaaay less than the average American. Your childhood experiences teach you how easy it is to get by with little, and most of us (I am one said immigrant millennial) would be content with less and still feel wealthy. I see my brother struggling to pay bills in Argentina on a teacher’s salary of 600 bucks a months. I make 5k a month which is peanuts to many readers, yet I feel wealthy. I know I’m on track to retire happy at all agree that I’ll still be able to enjoy retirement. And I’ll see my kids grown up with exponentially more than I had. You’re in USA? You’re already wealthy oh a global level…

Makes sense from an immigrant’s POV if the immigrant comes from a poorer nation. Having perspective is wonderful for feeling wealthy.

I’m not there’s a high percentage of new immigrants in the 1,000+-person Schwab Wealth Survey though. I’ll see if I can find out.

There might be no paradox regarding people’s net worth. The reason is in the survey question itself. If you read the fine print (which I ALWAYS do!) you will see:

S.7: What are your total assets … but NOT including any real estate?

Since the majority of people’s net worth is likely their primary residence, assuming they own one of course, it would be interesting to learn how many of the 1,000 survey respondents owned real estate. For my household personally, our real estate holdings (I.e., primary residence, vacation home, and rental property; market value less outstanding mortgage balances) comprises 50% of our net worth. Depending upon where those survey respondents who are also property owners own their property, their actual net worth could be much larger than what they’ve reported in the survey.

Also, if people are investing in REITs or other real estate based investments, they might not have included those assets in their reported net worth based upon the wording of the survey question.

That could be the case. But chances are the question asking required net worth to be wealthy is consistent, and also excludes one’s primary residence. Do you see that anywhere perhaps?

But even if it wasn’t, and we included 100% of $420,000, the rough median home price in American, that still leaves over a $1.2 million shortfall from what folks have and what folks expect is wealthy.

Excellent point, great catch! Similarly I’d respond at a net worth 60% lower myself under that parameter. Plus most of those holding said real estate longer than before 2020 saw massive appreciation in the last few years as well. So knowing we own valuable, well-appreciating real estate, perhaps at or near record low interest rates too, can only manifest in the data as a “feeling” if not an allowable part of the numerical calculation of net worth under the survey’s rules.

My take on the difference, as the survey goes on to prove, is that

Q1: If money is the only thing that creates happiness, how much networth do you have to have to be wealthly? Survey says 2.2M.

Q2: Assuming you can describe wealth, as any of things in Q6, work from home, experiences, travel, loving family, work/life balance, if you could consider those things as well, do you feel wealthy? GENZ: Yes I do, even though I’m only worth 414k, I feel wealthy because I’m a professional Influencer, who spends my life doing what I want….etc etc etc

Interesting article. This definitely reminds me of Bill Perkin’s book – Die w/ Zero.

My guess on why the Millennials feel wealthier is that the Great Wealth Transfer is happening in real-time and they’ll technically have more time, but who knows.

Maybe! A huge generational wealth transfer is happening now. $50+ trillion in assets.

Personally, I’ve never expected to inherit anything from my parents.

When I think of myself, it makes sense why 48% of respondents feel wealthy, while the average net worth of those who feel wealthy is only $560K, well below $2.2 million. I consider having $20M as being wealthy, but my net worth has not yet reached $20M. Yet, I am a millennial who feels wealthy. I think the reason for this paradox is that “feeling wealthy” comes from what one sees around her in her life and among peers, while I think being “considered wealthy” requires a comparison to the population at large, including older groups and those outside one’s circle. When I look at the circle of interactions in my life, I feel very wealthy (including monetary and non-monetary factors noted in this article). I seem to have more money and time in combination than almost everyone I know. However, my basis for feeling wealthy is limited to mostly other millennials or people in my ordinary circle. In order to be “considered wealthy,” the basis certainly needs to be expanded beyond my ordinary circle. I have a neighbor over 70 years old who has a net worth well beyond $20M, and I consider him to be wealthy. However, even compared to him, I still “feel” wealthy because I expect to reach or exceed his net worth when I am his age.

Finally, I think being “considered wealthy” will always be an elusive status for me. When I reach $20M net worth, I think I will still feel wealthy but most likely my number for being “considered wealthy” will increase to $50M or some number that I believe will allow a next-level lifestyle. Whatever I have always seems to be ordinary. I went through this 10 years ago when I reached a milestone for what I considered to be wealthy. When I was nearing the milestone, my benchmark went up. It’s not as tragic as it sounds, however, because I still “felt” wealthy.

That makes sense, comparing your wealth to your peers. So if you have $560K at a median age of 37, then you are relatively wealthier than the median wealth in America of about $110K.

I’m guessing a huge part of the issue here is defining the definition of wealth. For these examples it could mean anything from feeling comfortable now to having a house paid off and being debt free. I wouldn’t define being wealthy without a minimum consideration of how much money it would take to not work again and live in comfort. I also wouldn’t define being wealthy as having the minimum to do these things.

If I were to define being wealthy I’d say it is at a minimum of $12 million dollars of net worth with 80% of it being liquid and/or real estate that is generating enough revenue to pay for itself.

Having said that, I’m in a much better financial position than I was a decade ago. I’m working towards a comfortable retirement and am debt free.

2021 was the first year I made 7 figure profit in the stock market. 2022 was the first year I lost 7 figures in the market. So far in 2023 I’m up 7 figures again. The paradox for me is that even though I’m way ahead, the majority of time I’m thinking about my 2022 loss and how to avoid that from happening again. It’s like gambling at a casino, the big losses hurt way more than the big wins feel good. I think that’s why the survey respondents answers differ than what they actually do. We’re protecting ourselves from the losses by not even trying. If you don’t try you can’t lose.

Those big swings are painful. I felt it as well in 2022. Even with ~30% of my net worth in public equities, it still hurt.

But I don’t quite get it. We don’t try so we can’t lose so we feel wealthy even though we want much more?

Boomers-Gates, Jobs, et al.;Gen X-Musk,Bezos;Millennials-Zuckerberg, et al.; a lot of wealth there. As the boomers die, all that wealth will be transferred down. GenX will become the wealthiest generation ever, and followed by Millennials. Millennials probably don’t value time as much because they are young. This probably will change as they age.

Wow. That’s fascinating about millennials feeling more wealthy versus boomers. Your explanation makes a lot of sense. With the chart showing how much happiness declines in old age, we really gotta be intentional and mindful to beat the curve.