In the good old days, several friends and I liked having beers after each softball game. We got to discussing what is the one ingredient necessary for achieving financial independence early.

Here were some of their responses:

- Saving aggressively

- Investing in stocks

- Investing in real estate

- Earning side income

- Taking bigger risks in our careers

- Leveraging the internet

- Working ungodly long hours

- Relocating to areas with huge job growth despite the higher cost of living

- Starting a business

All of these ingredients are important for helping all of us achieve wealth and financial independence.

However, the #1 ingredient that drove me to FIRE, which nobody mentioned, was FEAR.

More specifically, the fear of failure. The more you fear something bad happening, the more you take action to make sure it doesn't come true. The more complacent you are, the less likely you will take action to change.

Let me share some examples to explain what I mean. Then perhaps you can share your own examples in the comments section below.

The One Ingredient Necessary For Achieving Financial Independence: FEAR

Fear is all around us, especially today. Many still fear getting a virus that incapacitates us. We fear losing money in our investments when the economy goes into a recession. Some of us even fear living a life full of regret.

Fear can be debilitating if we let it overwhelm us. However, fear is also a fantastic motivator for change. The key is to absorb just the right amount of fear to get going instead of keeping us paralyzed.

Here are some examples where fear of failure played a huge role in my life. Without such fear, I wouldn't have broken free of work at age 34.

Childhood Expectations – Fear Of Disappointing My Parents

My parents told me at an early age that academics was the main way to a better life because I wasn't going to become a professional tennis player. They instilled in me a fear that if I was a C-student, I'd only be able to live a C-or-worse lifestyle.

Not only did I fear living a mediocre lifestyle as an adult, I also feared disappointing my parents. I was always getting into trouble as a kid. Each time I did, I saw the shame in their eyes. I finally stopped being a degenerate once I went to college.

Throughout my childhood, my parents worked long hours. I especially felt bad for my mother who didn't particularly enjoy the work she did in the U.S. Foreign Service. Foreign service work was my father's dream, not my mother's.

My Dear Mother

When I was 12, I remember visiting my mother one day at the US Embassy in Kuala Lumpur as a surprise. I didn't quite understand what she did, only that she worked in the cultural attaché department.

She was always so chipper at work, and her colleagues always sang her praises. It felt like a wonderland to roam around the halls of what seemed like a fortress at the time.

When I arrived, she was tidying up the magazines on the coffee table. Instead of working in her own office, my mom worked in the reception area outside of her bosses big office. Oh, I got it now. My mother was the assistant, not the officer.

She told me how she had sacrificed her dream of becoming a biologist by foregoing a graduate scholarship from Duke University to marry my father. She still had what most would call a great adventure, working around the world. But I knew deep down she will always wonder what could have been.

If my mother was going to give up her professional dreams for her children, I damn well wasn't going to disappoint her!

Growing A Career – Fear Of Wasting Money And Time On College

Working in the financial services industry from 1999-2012 always made me paranoid about losing my job. The industry is highly cyclical, which means during down cycles, there are always multiple rounds of layoffs. Without a job, I would feel like a failure. And without a steady paycheck, I wouldn't be able to pay my mortgage on time.

The fear of being one of the thousands of people let go during the dotcom bust and the 2008 – 2009 financial crisis led me to work extra long hours. I needed to add as much value as possible to my firm. There was a lot of misery getting into the office by 5:30 am and getting berated by clients all day.

Whenever I felt miserable working at 10 pm to catch my Asia-based colleagues, I always reminded myself of friends who had lost their jobs. Then I'd just gut it through one day at at time.

It wasn't until I started listening to the lifestyles of other people working in other industries did I realize how abnormal it was to always be in fear of losing your job.

Perpetual failure made me save 50% – 80% of my paycheck every year for 13 years. The fear ingredient made me figure out the best way to invest my money in order to one day generate enough passive income to confidently leave my job.

If I was comfortable at work, I'd ironically still be working.

Sustaining A Successful Website – Fear Of Public Failure

I enjoy blogging. I really do. Every morning kind of feels like Christmas because it's always so fun to read what other people have to say.

However, there's really no good reason to continue publishing 3X a week anymore. Today's posts reach 100X as many people as they once did in 2009. But because I publicly made a commitment to write 3X a week, however, I fear being labeled as weak or dishonest if I don't follow through.

I've wanted to just pass out by midnight many times since my kids were born, but I forced myself to write to keep up my streak. All habits die hard.

I have this fear of letting you down, especially those of you who may be going through a difficult time financially. I remember how comforting it was to read and interact with other folks during the financial crisis.

For the longest time, I've sent the message to never fail due to a lack of effort because hard work requires no skill. Therefore, if I stop working hard, then I'm just another hypocrite who doesn't follow his own advice.

Modern Day Society – Fear Of Not Being Good Enough

While I was working, it felt harder to get ahead when there was hardly anybody who looked like me in leadership positions. For example, I worked in Asian equities and for half my career, all my bosses were white.

When I lived in various Asian countries growing up, I was the majority. Everything felt normal. But when I arrived in Virginia as a high school freshman in 1991, the contrasting reality of being a minority instead of a majority became apparent.

Overnight, it seemed I had to address stereotypes, listen to racial slurs, and endure various forms of discrimination that I had never encountered while living in Taiwan, Malaysia, or Japan. The ingredient of fear began to sprinkle in my mind at age 14.

I feared being pigeon holed as an Asian guy who was only an academic. Therefore, I also worked hard on my athletics. I went to a liberal arts school was to become a more well-rounded person.

Perhaps one of the reasons why I'm so against the pursuit of prestige and status is because getting these amorphous things is hard for me. Instead of working hard to elevate my pedigree, it's easier to just look down upon those who do. It's also easier to not try.

The Fear Of Poverty

Ever since I lived in Malaysia as a 11-13 year old, I've been hyper aware of the haves and the have-nots. To see some of my friends live so poorly really wigged me out as a kid. I often questioned why life was so unfair for so many people.

As a result, I made a promise never to take any job or financial opportunity for granted. I wanted my kids to grow up being able to study and play rather than being forced to work to help support the family.

After you've achieved your retirement number, will you continue to work as hard? For most folks, I think the answer is logically no.

Due to my fear of never having enough money, I'm afraid of getting complacent. As a result, I like to start over each year and pretend I have nothing. In fact, I blew up my passive income in 2023 so I can have the motivation to find work again once my daughter goes to school full-time in September 2024.

Growing up seeing poverty on a daily basis made me afraid of losing everything one day. You're always wondering when will your luck run out. The longer you go without any unfortunate events, the more you brace yourself for cataclysmic disaster.

Physical Fitness – Fear Of Dying Before My Kids Are Adults

At age 46, my health is not as good as it once was. It seems like the asthma I had as a kid is slowly making a comeback. My colds have gotten longer and my muscles take longer to heal.

If you have dependents and liabilities, for the love of god, please get life insurance. Your health will eventually catch up to you, no matter how healthy your lifestyle. One of my regrets is not getting more affordable term life insurance before I had kids.

I finally got an affordable 20-year term life policy during the pandemic. I cannot tell you how much better I feel mentally. The anxiety of dying early has declined. That's worth far more than my monthly life insurance premiums.

The reason why I haven't let myself go is not due to vanity. When you're no longer in the dating scene, who cares about having four-pack abs? I try to stay fit because I fear an earlier than normal death. My two young children are depending on me until they become adults.

No Longer Caring As Much About What Others Think

A single friend once told me he enjoys food more than he enjoys the chance at a healthier life. “If I die early, so be it! I'm not going to deny myself my greatest pleasure just for the unknown chance of living until 90.” He clearly didn't believe in the ingredient of fear as a motivator to stay in shape.

This type of thinking is actually quite freeing. To not have anybody depend on you can be a great blessing. To not care how you look to other people is also amazing.

However, as a parent, I don't have such luxury. Therefore, regular exercise and not over-eating continue to be necessary habits. I hate working out. Thankfully, I've found a fun sport in pickleball to help me stay in shape nowadays.

Who knows whether staying in shape will extend my life. However, I want to give myself the best chance at survival by being more risk-averse with my health.

Comfort May Be Our Greatest Enemy For Achieving Financial Independence

Perhaps one of the worst things that can happen to you is if you are born with everything.

Your parents are rich so you don't appreciate money. They buy you a car, a house, and pay your credit card bills. Why bother even trying to be financially independent?

Let's say you are born good looking. Everybody is much nicer to you as a result. But your looks will eventually fade. If you don't work on your personality in the meantime, you might end up lonely and depressed when everybody begins to stay away.

Or let's say you were giving things based on your identity and not based on merit. You start cruising because you believe society will always give you a helping hand. But one day, the elites might decide you and your people are no longer worthy of special favors. When that time comes, you might struggle to compete based on skills alone.

It is impossible to fully appreciate how good we have it if we don't go through some suffering first. The longer our suffering, the more appreciative we will be.

We need a steady dose of uncertainty to keep us hungry. Therefore, perhaps this pandemic will motivate us to change poor habits. Motivation is so important for building wealth and staying healthy.

I remember as soon as I paid off one rental property mortgage in 2015, my motivation to hustle went away. I decided to drop all my consulting clients, travel through Asia for 8 weeks, then go to NYC to watch the US Open for 2 weeks!

Comfort prevents us from trying harder.

Fear: The One Ingredient For A Better Life

As time passes, I've been able to be less fearful of failure. Academics, work, and societal fears are behind me now. It feels good not to be beholden to anyone. To speak your mind and do what you want is a blessing.

My main fear now is not being a good enough father. Even though a parent can only do so much to teach their children right from wrong, I still worry how they'll turn out. There are some really messed up people in society who probably had caring parents.

Although less, money fear still persists because I've now got three people depending on me This fear is tempered through a proper net worth asset allocation, keeping expenses under control, and finding ways to earn supplemental income.

Don't let fear paralyze you. Instead, embrace fear as the key ingredient for achieving financial independence. The fear in our heads is often greater than reality!

A Conversation About Harnessing Fear To Get What You Want

In a Financial Samurai podcast episode, I talk to award-winning podcaster Farnoosh Torabi about harnessing fear to build more wealth. Have a listen, subscribe, and rate my podcast on Apple or Spotify if you enjoy it.

Achieve Financial Independence Through Real Estate

Real estate is my favorite way to achieving financial independence because it is a tangible asset that is less volatile, provides utility, and generates income. By the time I was 30, I had bought two properties in San Francisco and one property in Lake Tahoe. These properties now generate a significant amount of mostly passive income.

In 2016, I started diversifying into heartland real estate to take advantage of lower valuations and higher cap rates. I did so by investing $810,000 with real estate crowdfunding platforms. With interest rates down, the value of cash flow is up. Further, the pandemic has made working from home more common.

Take a look at my favorite real estate crowdfunding platforms, Fundrise. With Fundrise, you can diversify into real estate through private funds. Fundrise has been around since 2012 and has over $3 billion in assets under management and nearly 400,000 investors.

Fundrise is a long-time sponsor of Financial Samurai and Financial Samurai is an investor in Fundrise funds.

Stay On Top Of Your Finances

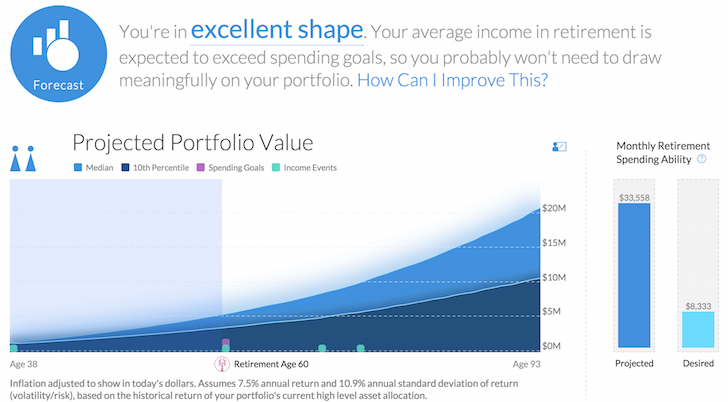

To achieve financial independence you've also got to track your finances like a hawk. To do so, sign up for Empower, the web's #1 free wealth management tool.

In addition to better money oversight, run your investments through their award-winning Investment Checkup tool. I will show you exactly how much you are paying in fees. I was paying $1,700 a year in fees I had no idea I was paying.

After you link all your accounts, use their Retirement Planning calculator. It pulls your real data to give you as pure an estimation of your financial future as possible using Monte Carlo simulation algorithms. Definitely run your numbers to see how you're doing.

I've been using Empower since 2012. In this time, I have seen my net worth skyrocket thanks to better money management.

To sign up for my private free newsletter, join 60,000+ others, and click here. I've been helping people achieve financial independence since 2009. I share all the ingredients necessary for achieving financial independence.

Being more of a hippie type in my youth, and with parents that didn’t force anything on me or even have much expectations (except to finish college), I was free from a lot of cultural pressure, thankfully. And I know a bit about poverty, at least 1st world poverty. I got caught up in the downfall of the steel industry in Buffalo, NY in the early 80s. But it became a perfect example of Napoleon Hill’s, “Seed of equivalent Benefit”, and everything changed for me. I wrote about it if you click my name.

Yeah no question fear is a critical motivator, however the term fear generally has a negative connotation. I certainly don’t want to live my life constantly in fear of something. I guess early on in life fear can help people be successful, however later in life especially if someone is financially independent I certainly would not want to live in fear. However, many people who are financially independent still seem to live in fear, and even Sam I have seen some of your posts express fear or worry about supporting your family financially. I guess that may be valid, but I think an unbiased independent analysis would indicate that your fear about supporting your family financially is misplaced and exagerated. I don’t mean to pick on you as an example, but if you have fear about supporting your family financially then how can many of us who do not have the same resources expect to not fear supporting our families financially? Another way to put it is, how can we drop the fear or not have fear after using fear for so long to become successful and financially independent??

Not sure. Maybe because I don’t see fear as a negative connotation but as a positive? I’m very thankful for fear to give me the tingles to do something about a suboptimal situation.

If you don’t feel fear about supporting your family, then you should also feel blessed because you have enough and don’t have financial worry.

Please share with us your situation, and what do you fear. If you fear, nothing, how were you able to get to this state? Thanks

I fear lots of things, but sometimes I wonder if I fear too much. For example I fear losing my job even though it is quite secure in academia. I fear getting sued for some mistake and having my house or resources taken away.. I am not financially independent yet so I guess these are not unreasonable fears.

My dream though if I was financially independent would be to setup some sort of actual blind trust which owned my residence and paid property taxes and also spun off enough funds for utilities and food. I think then I could live without any fear! :)

Fear, in the biological sense, is there to ensure survival in the sense it leads to action. Doesnt matter if that action is running away from a predator or diversifying your portfolio to endure economic volatility. In that sense fear is a very good thing.

If fear leads to paralisis and inaction, then its not so good.

(of course, it can be said that not doing anything is also an action)

Fear is the path to the dark side … fear leads to anger … anger leads to hate … hate leads to suffering.

Master Yoda, how did you conquer your fear and gain the motivation to succeed?

Sam,

The late Reverend Paul Osumi of Hawaii, once wrote this thought in the Honolulu Advertiser back in the day.

Charles Schwab give the following commandments of success:

1. Work hard. Hard work is the best investment a man can make.

2. Study hard. Knowledge enables a man to work more intelligently and effectively.

3. Have initiative. Ruts often deepen into graves.

4. Love your work. Then you will find pleasure in mastering it.

5. Do your best. The man has done his best has done everything.

Wouldn’t it be nice to achieve financial independence in a solid foundation and build your financial future. Thanks Sam for all you intelligent financial information.

This reminds me of tiger mom Amy Chua’s triple package, where a sense of insecurity is one of the three main factors (aside from superiority complex and impulse control) driving success!

I independently came to this same conclusion, except I’ve labeled it “Productive Anxiety”.

The One Ingredient Necessary For Achieving Financial Independence: MONEY!

Good night folks!

I totally hear you on fear. A certain amount of fear can be extremely motivating. It certainly drove me to do well in college. I was determined to get a reliable job after graduating because I had a fear of otherwise not being able to support myself financially.

Sure, too much fear is debilitating and can lead to being frozen. But some fear can have a lot of positive benefits. Great points!

Fearing death or long Covid from Covid is definitely one of the reasons why I have tried to stay in shape for the past two years.

Americans have definitely gained weight over the decades because life has gotten much easier over the years. Rational, but causes earlier deaths if you look at the mortality charts.

Sam,

Thanks for writing this post. I think the more we as a culture face our fears, the better off we will be. All too often, we don’t challenge ourselves to take risks, and it leads to mediocracy. One thing I would add is that for me, determination drove me to achieve FIRE. I wanted it so badly that I would not let anything get in its way, so I made it a reality.

I came to the same conclusion a few years ago. I termed it “Productive Anxiety”. I focus on what I’m worried about; finances, health, or home maintenance. Then I ask myself what steps I could take to battle that worry. Then I pick some small “win” like upping retirement savings 1%, swapping out junk food lunches for salads at work etc…

Over time these incremental changes have led to better habits and I’m at a 50%+ savings rate, good health, solid house, and a healthy position to retire in my 40s.

It really is using the “weakness” of an anxious mind and Judo-flipping it into an engine for success.

Judo-flipping it into engine for success indeed!

For example, so many folks are now up in arms over food inflation. But how about using higher prices as a way to eat less and eat differently? Getting mad isn’t going to solve any problems. Personally, I’m going to practice intermittent fasting and/or eat only a piece of fruit until 12noon, until food inflation gets back down to 3%. Might even lose some weight! :)

Sam,

Thanks for all your articles- especially during this pandemic. You’ve written many helpful and relatable articles in these past years. These articles are like a personal finance bible to me.

Cheers!

You’re welcome! It’s been a pleasure to reflect, write, and serve during this time of uncertainty. It has also helped me think things through more clearly as well. Thanks for reading and sharing!

Becoming a parent is certainly a game-changer. My best wishes for the most important job in the world: being a great hubby and parent.

Thanks! And you too. Once a parent, it’s easy to focus on what to do every day: take care of your children. There is no more boredom or lack of purpose anymore.

The best work in anyone’s life comes from inspiration, not from fear. After nearing financial freedom my goal has been Personal Freedom first and foremost, and oddly, that has attracted more professional success than ever before.

Here’s to inspiring your readers to follow zero-fear goals!

I wonder what I could have done if I grew up not seeing so much poverty and having a really easy childhood with no school suspensions and run-ins with the law etc.

Perhaps you can share more about growing up without fear of failure and what your financial situation is now at what age?

You might enjoy this post: Confessions Of A Spoiled Rich Kid

My dad lost his job when I was 5 and my mom was an administrative assistant her whole life. While they combined only made $40,000 per year, we didn’t feel poor. I still had family living in the inner city Chicago and life for them was so much worse. So, I like Sam always feared to do better. Even after 20 years of working and a $7M net worth, I fear it is not enough, so it keeps me humble and working hard. Maybe I relax at $10M, but now I am still focused and fearful.

Any color on how you made it to $7M of net worth after 20 years of working? The S&P returned 7.41% annually from 2000 to 2020. Assuming you started with no significant net worth when you started working, you’d have to be saving $150k annually on average to go from $0 to $7M in that time.

I totally get where you are coming from and can relate to much of what you said. However, I might alter your thesis just a bit re: the role fear plays in achieving financial independence.

To my way of thinking, fear can be a great motivator to achievement but it is not the driving emotion for people becoming FI. The reason? People who are truly fearful are not risk-takers. In general, they don’t start businesses, they don’t buy homes, they don’t invest in stocks and they minimize all risk whenever possible. Why, because of fear, not necessarily in spite of it. My parents were like this. They were hard-working and wanted to achieve through their efforts but they were conservative and slightly mistrusting of anything that appeared to them to be too good to be true. They both came from poor families and carried a certain scarcity mentality. They eventually did achieve FI but solely from frugal spending and investing only in CDs and money market funds.

My point is that fear absolutely plays a role in our motivation but to tie it to “the one necessary ingredient that drives financial independence”, at least for me, doesn’t quite hit the mark.

Perhaps it’s a spectrum then. Truly fearful people who end up not taking action are the minority. And if they do achieve a comfortable financial situation, it is likely during a conventional retirement age after 60.

So for early financial independence, there has to be an inherit drive.

If you are coming at it from the perspective of FIRE then I see your point. My main focus was always on the “FI” part and never on the “RE” part. I think that is just inherent in my baby boomer genes ;)

Although, I did retire at 57 but that was more out of fate than from the desired plan. The good news is we were financially prepared for it even though it wasn’t anticipated.

Gotcha. Yes. For example, fear of dying early may motivate you to retire early to enjoy more of your life.

Your post is coming up BTW!

Samurai, the fear that you reference is one that I also suffer from. I have this irrational fear that has grown exponentially since having children that at any minute, we may be out on the streets. We do okay, mortgage is paid off, max out 401K, contribute monthly to 529, invest in after tax IRA using dollar cost averaging, and are engaged with crowdfunding (due to diligently reading your site). Over time though, I have noticed that the fear is gradually setting into a steady state of “unease” which I’ve found is a happy medium to keep on keeping on. While going through your fear and using it to produce quality content, please know that what you produce on this site has provided me and my family a blueprint to channel the fear into meaningful and actionable steps to provide us with a financial safety blanket. Hopefully, the knowledge that you are helping countless others will be just as much of a motivation for you to continue producing quality content on this site.

Great article, I agree, fear is one of the biggest motivator. Perhaps the ONE. I do think there is a complementary motivator: the desire to move towards a concrete goal. When I was 14 years old, I saw a movie where Einstein was discussing with other scientists in his garden in Princeton. At that point, I knew that’s what I wanted to do: being with other scientists in an Ivy League environment and discussing science. Low and behold, I just gave it my all, and made it to Princeton without really planning to go there. I just had that picture of Einstein in his garden in my mind.

Something else: check out Tennis Troll Channel on YT. If you are a 5.0, you might as well just play a game on his channel. Money raised goes towards a good cause, and you’ll spread the word about this webpage.

Sam, I have never commented before but this article really touched me and I want to say that I regularly read your posts and I have learned so much from you. Keep up the good work.

Hi Milena, I appreciate your readership! Thank you

Hey Sam, thank you for writing another well written article. I don’t think you should hold yourself to absolutely writing 3x per week when it sometimes means staying up till 2:30am even though your body is telling you to get some rest. It’s noble of you to honor your commitment to write a certain amount of times every week but if it’s affecting your health, then it will also start affecting your happiness and other aspects of life. I believe the first requirement of happiness is to have a healthy body to enjoy life. If you have $100MM but poor health, it’s going to affect your quality of life and you may be much less happy then the middle-income person who prioritizes good health. Just my 2 cents.

I enjoyed reading this post and the comments! I agree with Sam about fear being a great motivator. For me, the fear of spending the best years of my life climbing the corporate ladder without having enough time to pursue interests that I find meaningful and fulfilling has motivated me to save more, invest more, build passive streams of income so that some day (well before typical retirement age) I will no longer have to depend on my job in the corporate world. Freedom of time is my ultimate goal!

When I look across our friends who are college educated, own their homes, have high paying jobs, healthy marriages, 1 or 2 kids, etc., there is only one thing that separates them from additional financial success/FIRE: Risk Aversion.

Most people are too conservative with their investments. Even though they understand historical returns and volatility or they’re “interested” in starting their own business or investing in real estate, most people never take meaningful steps to accomplish that goal. It’s scary to leave the safety of a steady paycheck or plunk down large sums of money that can be lost (even temporarily on paper).

These people are fairly well off and will have a comfortable retirement at 60 or 65, so I can’t really fault them for not taking additional risk. They will be better off than the vast number of retirees.

However, if we’re talking about average or low income earners, I don’t think the answer to the question is as simple as risk aversion or fear. There are too many factors to consider.

Sure. What are some factors and solutions?

All things being equal, overcoming one’s fears and embracing risk can be the difference between FIRE or not. However, life isn’t fair and people have varying levels of challenge. Many people have lot more challenges than simply overcoming fear:

1. Mental, emotional or physical disability. Some people have experienced severe trauma or respond to trauma in a more negative manner.

2. Divorce. Most of my friends have stable marriages; divorces are financially and emotionally draining.

3. Religious or cultural beliefs. Not everybody is raised with a focus on material success. Many cultures emphasize harmony and balance not continuous improvement.

4. Socio-economic factors. Every country has an oppressed class of people and barriers to elevating them.

I definitely agree with “use fear as motivation to do better”. Everyone can do better, but not everyone can achieve FIRE.

Much of our success is based on luck, as you’ve written in past posts. This luck includes where we’re born, what gifts or defects we possess, the color of skin, the quality of parents or mentors throughout our lives. So although I am successful beyond my expectations, driven in large part by fear, I place much greater weight on numerous other factors, including luck.

Indeed. Life happens. There are so many difficulties we must overcome and navigate through. Thanks for sharing your thoughts!

ITA. This is why immigrants do well- fear. Americans know there is welfare, food stamps, Head Start etc.

The truth is a bit harder then that. Immigrants know welfare, but they also know where they come from and why they left and came to the US. They have drive and purpose, some can not go back and have to make it. They tend not to have a large social friend group to fall back on and they tend not to have rich parents that can catch them when they fall…..or simply put they have more drive.

Fear is the strongest emotion humans have and hence the biggest motivator. It is motivation that carries you forward, many Americans have lost motivation.

Search an article in NYT: what-drives-success

Interesting article along the same lines. The 3 ingredients of success: superiority complex, insecurity and impulse control. Strange combo but it works! It is the opposite of what the young generation is taught today…

Interesting. Superiority complex, as in thinking you are better than someone else, therefore, you need to prove it so?

I get impulse control… the marshmellow test and insecurity.

read the NYT article, it does make sense

Thank you, Sam, for a wonderful, insightful, post. Your writing skills are superb. I’ve been afraid much of my life. Rational fear has been a great asset: it drove me to college, encouraged me to join the United States Air Force for a career, and prompted me to invest early in rental property. Now, in my old age, I see many factors in my life story, but fear has been one of the most valuable.

Good post, Sam, still very applicable in this pandemic-driven world! I did not come from money and my Dad died a few days after I turned 12 and I started working all the time at 15 and ever since. I often find it useful to look at how far I have come and to conduct a thought experiment telling myself if I lost it all today, I could still go back and climb the mountain again. I would not have so much time left, but it provides a feeling of strength and resilence for me

Geoff

Well said Sam because for me the fear is “poverty consciousness” that drives me daily. It seemed like not too many years ago(it was actually well over 20 plus now and thank you Lord) I didn’t have a credit card that would be accepted or a bill that wasn’t an Everest to overcome. Now, live WAY below your means and make more in Passive income than you could for 5 years of work!