After publishing my post, Here's How Much Money You Need To Retire Early And Live In Poverty, several readers were offended because the definition of poverty was too high. They commented that my premise was absurd and that they live quite comfortably or think they can live quite well on the income levels I highlighted.

I simply used the Federal Poverty Level guidelines and worked backwards to figure out how much capital was needed to earn government-determined poverty-level incomes.

I also wanted to demonstrate, thanks to a decline in interest rates, how difficult it is to accumulate enough capital to earn a reasonable amount of retirement income. I'm certainly feeling the strain.

Don't shoot the messenger folks!

The negative feedback made me question whether the current government's definition of poverty was appropriate. Perhaps it is simply too high and encapsulates too many people?

Perhaps if we lowered the poverty income levels for various-sized households, we'd not only save the government a lot of money, but we'd also insult fewer people who make poverty-level or near-poverty-level incomes.

Let's review the official government definition of poverty and debate whether their levels are truly too high or actually too low.

The Definition Of Poverty

Below is the 2020 definition of poverty by household size according to the U.S. Department of Health & Human services.

I'm pretty sure that most of you would agree that these income levels per household size would make independent living truly a difficult task.

For example, if I only earned $12,760 a year as an individual, I would be forced to live in my mom's basement, eat grilled cheese sandwiches every day, and pass on almost every outing with friends.

But given I can earn $13/hour flipping burgers at my old employer, McDonald's, I should be able to earn at least $24,000 a year as an able-bodied citizen.

Today, we are a family of four. There is simply no way we could afford to live off only $26,200 a year. To my parents' utter dismay, we would have to move in with them. Sending our kids to preschool would be out of the question because preschool, alone, costs about $24,000 a year. Worst case, we would be forced to rely on my parents for childcare as we both try and earn a combined $48,000 a year at minimum wage jobs.

So I got to thinking, perhaps the definition of poverty needs to actually increase across every household count, not decrease.

The New Definition Of Poverty

Some politicians argue all day long that we need to raise the minimum wage because it is currently not enough to provide for a basic standard of living. Raising the minimum wage will likely decrease job opportunities and raise prices for consumers. However, if you want to see change, you've got to pick your poison.

Only being able to earn a minimum wage income, no matter where you live in America, seems like poverty to me as well. Therefore, let's use the minimum wage as the definition of poverty. After all, nobody is expected to earn the minimum wage forever. With more experience and training usually comes higher wages. If you are stuck earning a minimum wage income for more than several years, you should be considered trapped in poverty.

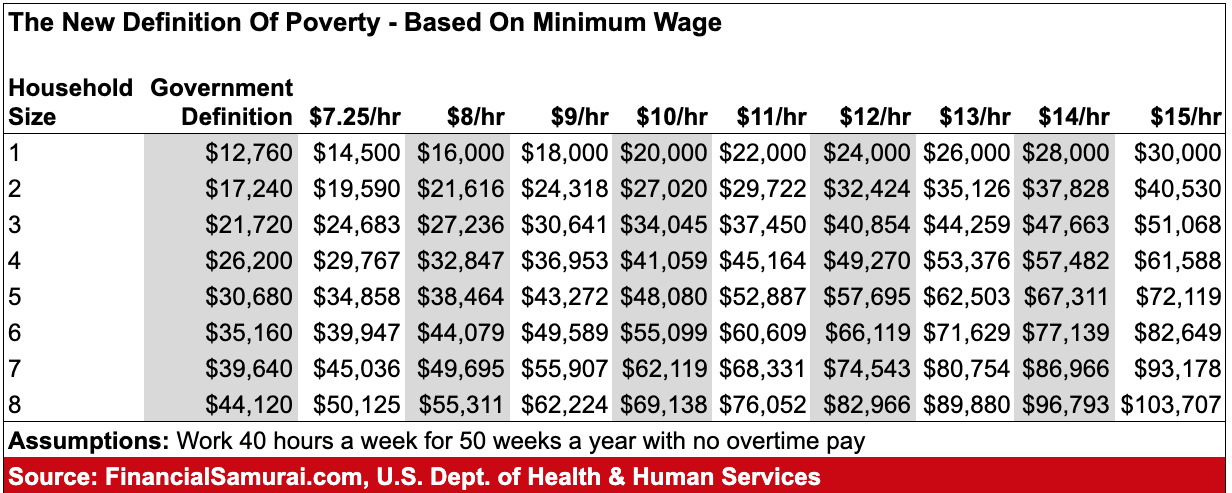

We can use the minimum wage as the baseline poverty level for one person and then use the same percentage increases by household size the government uses in its current definition of poverty.

As of 2020, the federally mandated minimum wage is $7.25/hour, although the minimum wage varies state by state. The District of Columbia at $14/hour, Washington at $13.5/hour, Massachusetts at $13.75/hour, and California at $13/hour currently lead the nation in minimum wage levels.

Based on a 40-hour, 5-day work-week, and 50 weeks of work a year, a $7.25 hourly wage comes out to $14,500 a year compared to the existing $12,760 figure to determine poverty for one person. The absolute dollar difference is not huge, but a 13.6% difference is.

I've gone ahead and created a table that highlights the new definition of poverty by household size according to various minimum wage rates. Using minimum wage rates between $7.25/hour to $15/hour is fair because the cost of living is quite different from state-to-state.

Using my new methodology, my family of four in San Francisco could earn up to $53,376 a year and still be considered to live in poverty. Given the median two-bedroom, two-bathroom apartment costs about $50,000 a year to rent in the City, we would certainly need some type of government subsidy in order to minimally survive.

Subsidy Eligibility Is Key

It's important we recognize why the definition of poverty is so important. The government uses its Federal Poverty Limit guidelines for determining who gets government assistance when it comes to food, housing, healthcare, education and more. In fact, there are over 30 government agencies who use the FPL to determine subsidy amounts for households.

For example, under the Affordable Care Act, the federal government provides healthcare subsidies for households that earn up to 400% of the Federal Poverty Limit.

If you want the government to expand its government assistance programs, then you absolutely want to increase the income figures that define poverty. Given politicians say currently minimum wage levels aren't high enough to provide for basic living expenses, it's reasonable to at least increase current FPL to minimum wage levels.

If you want expanded government assistance, you will also want the government to increase the percentage figure based on FPL for determining who gets subsidies. But it seems highly unlikely voters would support subsidies for Americans who earn over 400% of FPL.

As of now, a family of 4 earning up to $104,800 can get healthcare subsidies under the existing definition of poverty. Using a $13/hour wage to define poverty, a family of 4 can then earn up to $213,504 before healthcare subsidies are cut off. Not bad, however, $213,504 seems like too high of an income to still get help from the government.

If you want smaller government and believe most people can at least find a minimum wage job, then you should want to keep the existing definition of poverty or reduce the income levels further. You'll end up saving the government a ton of money.

By reducing the income levels that define poverty per household size, you also increase the pride and dignity of millions more Americans. With greater pride and dignity, perhaps more Americans would be motivated to learn new skills, work longer hours, take new career risks, and invest more aggressively to build passive income streams.

Break Through Poverty Minimum Wage

While I acknowledge not all of us have the same abilities and opportunities, hopefully, nobody will have to permanently stay at minimum wage-defined poverty levels.

The Socialist in me hopes that all Americans can at least earn a high enough wage to pay for basic living standards: food, clothing, and shelter. If an American cannot due to a disability, an accident, a health issue, or some unfortunate circumstance, we should absolutely pitch in to help our brothers and sisters out. And one way to do so is by arguing for higher income levels that define poverty by household size.

The Capitalist in me believes the government is inefficient and mismanaged. He prefers the government to shrink in size. Allowing people who earn between 300% – 400% of FPL to still get healthcare subsidies, among other things, seems overly generous. But if the government wants to provide subsidies for households that have over $1 million in investable assets that can generate on average $25,000 – $50,000 a year in income, I guess a Capitalist shouldn't complain.

In conclusion, I wish everyone can make as much money as possible so that they can pay plenty of taxes and never have to receive any government subsidies. It is an honor and privilege to be able to contribute to the well-being of others. But if you do receive government subsidies, there is no shame because that is what they are there for.

Hopefully Financial Samurai along with other free personal finance resources can help folks build greater income and wealth over time.

Readers, what do you think about the government's existing definition of poverty? Should we increase the income levels to provide more subsidies? Or should we decrease the income levels to reduce subsidies and increase the dignity and pride of millions of Americans?

Related: Spoiled Or Clueless? Try Working A Minimum Wage Job As An Adult

*illusion

Sam, I disagree with the premise that minimum wage should equal poverty. The point of minimum wage, in my opinion, is to bring people to a “livable” wage where they are not in poverty. It should be enough that even if it does not increase because of a dead end job, it still pays the bills. Yes, it shifts the burden of helping people from the govt to the consumer, but in reality, both are the same since taxes pay for govt help. If you make enough with 2 incomes to support the family, you would need less help from the govt.

Now whether artificial wages will cause an increase in cost of living and therefore create a spiral of increasing costs and artificial wages, is another question.

I don’t think most people can provide their basic needs on the existing $7.25/hour federal minimum wage. Do you?

Ahhh, I should have mentioned that I live in MA. Every state has their own minimum wage needed to get to a livable wage. MA definitely needs a higher one than many other states. I take the federal one to be a joke, but maybe it is the amount needed in some parts of the country, but definitely not for everyone.

Also, this article does not show up on your front page as latest posts. The last article I see up in latest posts is Why It’s Harder To Get Rich Off Stocks Than Real Estate. Not sure is there is a glitch or if its my browser.

That is quite interesting how the federal mandated minimum wage comes out to more annualized than the actual definition of poverty. I would have thought they’d be in line with each other. You raise good questions on increasing the definition of poverty to allow more people to get help versus lowering it to try and get more people motivated to do more since they would’t be classified as in poverty. Me thinks the former would probably have better results to hopefully help those scraping by to fall into fewer traps like high interest debt with the help of government aid, but one could also argue that may just make more people lazy. Hard to say

It’s definitely interesting to me that the Department of Health and Human Services has not broken down the higher cost of living areas within the states other than Alaska and Hawaii. It’s almost like living in a different country when you compare the cost of living of someone living in New York City, Los Angeles or San Francisco to people living in Fort Wayne, IN, Toledo, OH or Topeka, KS.

Hopefully in the future, the government will update the cost of living areas to at least rank the states, especially when they are trying to rank poverty.

Don’t stop on the numbers, even if they aren’t always relevant to everyone. They are what sets a financial blog apart from an self-improvement advice blog.

Simply telling and retelling people to “Buy cheap and sell dear,” “Live below your means,” “Plan a household budget,” “Leave time to have fun,” etc. is not what keeps a blog alive.

Sam,

I really enjoy your blog and your thoughtfulness. I wonder if you are aware of a bias or blind spot that exists in your writing. There are two passages in this past that demonstrate this bias.

First:

“There is simply no way we could afford to live off only $26,200 a year. To my parents’ utter dismay, we would have to move in with them. Sending our kids to preschool would be out of the question because preschool, alone, costs about $24,000 a year.”

It should go without saying that a $24,000/year preschool is out of the question. In nearly every part of the country this is an affluent family indulgence. I get that you live in a high cost city, but this expenditure shouldn’t even belong in the same discussion as the poverty limit. Most families at the poverty limit likely can’t afford to send their kids to preschool or they look for a cheap/free preschool option provided through public school facilities (yes, these exist). Holding it up as something that would have to be sacrificed demonstrates a high level of entitlement. You should know better than to use this as supporting evidence that the poverty level is too low.

Second:

“Using my new methodology, my family of four in San Francisco could earn up to $53,376 a year and still be considered to live in poverty. Given the median two-bedroom, two-bathroom apartment costs about $50,000 a year to rent in the City, we would certainly need some type of government subsidy in order to minimally survive.”

When the median apt is not affordable, why is the first solution a government subsidy? Do we really expect someone at the poverty level to consume at a median income level? The analysis would be more helpful if you included data about the size and distribution of the housing stock. What is the median apt price of the bottom quartile of the apartment stock? If someone makes relatively less money, they should be looking for the less expensive housing. This retains the incentive to work for promotions and raises so one can afford the median apt.

Like you, I would love to see poverty eliminated and all people enjoy a high standard of living. Government subsidies are rarely the right path to achieve that. You have been tremendously successful in building wealth and securing a great quality of life for your family. I think you would benefit from understanding how the less fortunate sacrifice and use their ingenuity and resourcefulness to try to do the same.

I have many blindspots, that’s why they are called blindspots. I rely on other people to tell me my blindspots so that I can see them and improve.

For example, I thought I was doing financially OK until many readers pointed out that I was an early retirement failure. As a result, I looked at the California Association of Realtors numbers to see how much I needed to live a middle-class lifestyle and concluded that I was a failure and wrote about it. See: https://www.financialsamurai.com/why-i-failed-at-early-retirement-a-love-story/

Now I’m going to do my best to try to get back to early retirement by the year 2022. See: An Early Retirement Masterplan: FIRE By 45

Regarding preschool, maybe this is a blindspot as well. I have been listening to a lot of politicians argue for universal basic preschool access for all as a family right. If preschool is a foundational right, then I don’t think it’s a privilege. Do you see otherwise? Or does the $24,000 a year cost throw you off because that’s what it costs where I live?

I’ve been experimenting with not including real numbers because it often short circuits people’s thinking who come from different cost of living areas. And instead, to use general numbers or lower numbers or percentages. If I use the lowest figures, then nobody can say anything. It’s the same reason why I think I will go back to basics and talk about saving and frugality bc it can be done by most everyone versus trying to earn more.

Are you keeping your kids at home for the first five years until kindergarten? If so, perhaps that is considered a privilege to have someone take care of them full-time.

I’d love to know more about you and whether you would like to contribute to some solutions through a guest post. I think that would be great based on your second response.

Thx!

It’s certainly not a right. 24k a year wow what a joke. My wife and I live on 19k annually very easily and live a great life.

What if preschool cost $$8,000 a year like it does in other parts of the country, would that be more OK?

How do you provide for two young kids, or even just one kid, on $19k/year? I’d love to see your budget.

Thanks!

I’d love to know how you raise kids off such a low salary as well.

Unless you’re giving them the worst life possible through abuse and neglect, I don’t see how $19,000 a year is enough.

My wife and I do not have kids.

Our budget:

Housing: $750

Food: $350

Transportation: $300

Miscellaneous: $100

Cell Phones: $83

Monthly Total: $1583

Annual: $19000

It is a great life… I was lucky to he born in the USA.

My first thought was to add, “living in a cave on public land in the jungles of a third world country,” but I realized that was unkind.

Then again, you don’t provide any details about how the two of you manage this or where, and what you consider essential to living a great life (and what you don’t consider essential).

My daughter in college only earns about 12k a year and has what I would have thought, when I was her age, was a great life.

It wouldn’t be so great if I did not pay for her tuition, books, car, car insurance, medical insurance, and the lion’s share of her apartment.

I think you have got to be careful sharing your reality because other people cannot accept other people’s realities as different.

They have the inability to convert $24,000 a year for preschool into $12,000 a year in lower cost areas as this reader has demonstrated.

It’s much better to write from the lowest common denominator and go up if you want to avoid getting criticized.

And don’t worry, my family of four can’t live on $24,000 a year either.

Yeah, I was hoping the post, The Courage To Be Disliked, would help readers realize that people have different realities, and to try and accept different realities. But I’ve still got work to do. Further, most visitors (not sure about commenters) are first-timers and haven’t read much of my stuff yet.

“None of us live in an objective world, but instead in a subjective world that we ourselves have given meaning to. The world you see is different from the one I see, and it’s impossible to share your world with anyone else.”

I might disagree that preschool invariably costs $24,000 where you live. I suspect you’re getting a luxury product.

https://www.mercurynews.com/2019/02/03/you-think-bay-area-housing-is-expensive-childcare-costs-are-rising-too/

($1,500/month x 12 months = $18,000. Still a lot of money.)

While the family highlighted in this article currently doesn’t benefit from it, there are also half-day options open to all families, regardless of income, that are offered for free and there are income-based subsidies in SF. Sadly, the waiting lists are long. (Source:

Clearly there are structural problems with the current preschool system (namely, the supply doesn’t meet the demand) and improvements need to be made. However, preschool doesn’t need to cost as much as you seem to assert.

I paid for my kids to attend preschool because they were ready and eager to learn at that age, enjoyed the social setting, and I wanted to provide them with the best opportunities (like most decent parents). According to the article above, the cost/benefit of child care doesn’t pan out. They would spend more on child care than they would make at their job. I don’t really see this as a huge problem. The alternative of having a parent in the home caring for and teaching their children may actually be a better social outcome than one more parent that is absent from the details of their child’s life. Why do the wealthy (and early retired) treat staying at home with their family as a luxury while the “poor” treat it as a limitation? For the last three years we have alternated between public school and home schooling – for a variety of reasons. I am glad we have this luxury, but it has helped me realize that universal public school is a great option but not always the right answer.

I think you are also conflating two issues here: child care and education. The former meets their basic needs and should cost less, the latter actually seeks to help them advance in life and the quality (and cost) of that educational benefit can be highly variable. Some of this is a luxury and/or virtue signaling and should not be paid for by the government. But it’s no secret that not all public schools are created equal and schools in affluent areas probably overpay for their facilities and faculty. Education needs to catch up with technology. But, that’s probably a debate for another day…

I’m afraid I don’t have many solutions, but I do enjoy a healthy discussion.

Sounds good. Maybe I will forward the preschool administrators your article and see if I can get the price down to $1,500/month. That would be as much savings as my recent mortgage refinance.

Although I have a feeling they won’t go for it, given San Francisco prices are higher than average Bay Area prices, it may be worth a shot. Never hurts to try. Thank you for the suggestion.

Sorry you had to alternate between public school and homeschooling for the past three years. Hopefully your child can find a steady educational environment. I think home Schooling is a great idea if a parent has the patience and the financial means to do so.

My children have actually been active participants in the decision to alternate between public school and home school. The changes have not been due to problems with either method, but a choice about the advantages of one over the other. The flexibility is actually more advantageous than stability (which we all imagine to be very different things). Stability might be essential for some kids to thrive, but not all.

I have also been wanting to mention that I disagree with those who think you are an early retirement failure. Using the median asset/housing/consumption levels as a benchmark may be too stringent. Naturally you will want to retain your purchasing power. However, it’s no secret that we live in a culture that is highly oriented towards consumption. When I arrive at early retirement, I envision a calmer, simpler, less expensive version of life. I’m already making steps towards this goal. You shouldn’t let the expectations or esteem of others set your agenda. You’ve succeeded. Live life on your own terms. That’s the only benchmark that matters.

Love your posts. Keep it up!

Increasing subsidies encourages people to work less. Also, there is a segment of the population that are able bodied but refuse to work and expect the taxpayers to support them.

On the flip side, there are people who could become more productive members of society if they worked less: a single parent with two jobs might simply lack time to upskill. Having multiple menial jobs and no safety net can be extremely tiring and stressful, and that can make it difficult to exceed expectation at your jobs to get promotions, creating a vicious cycle.

There is also a segment of the population who are not fully able-bodied, especially mentally/emotionally, but may not qualify for disability (and there’s already people who game disability, so expanding the coverage there still hits your criticism). Without social nets we condemn those people and there dependents to stress, strife and physical pain.

If we have strong social nets, some people will absolutely take advantage of them, while other people will use them to get back on there feet. If we have weak social nets, some people will be incentivized into improving themselves, and others will be ground into an early death by poverty. Strong safety nets can lead to people teaching their children to be lazy. Weak safety nets lead to poverty and non-productivity perpetuating itself when children can’t focus in class because they’re going hungry.

To my mind, it’s ultimately a trade-off. I have to work harder to support some people who are capable of working hard on there own. But I also benefit if the lack of extreme poverty helps other people raise productive children. And I’m glad to work harder to support the subset of people who legitimately need help and would be going hungry or freezing in the streets otherwise.

I think it’s totally fair for each of us to have a different opinion about how best to balance those two, and different assumptions about how many leeches vs disadvantaged people exist. But it feels like lazy thinking when somebody only offers the optimistic side (look at all the hunger we can solve!) or the pessimistic side (people are taking advantage of subsidies), because social nets have very important benefits, as well as very real costs.

Great thinking. Nothing is black and white.

I would think the vast majority of people would gladly want to make more and not receive any subsidies.

But there is an early retiree segment who are very wealthy and are receiving all sorts of subsidies and paying minimal taxes. This seems off. Not sure how others feel.

I’ve always found the concept of “stepped-up basis” a little strange. If all gains had to be realized sooner or later, then who cares about a rich person minimizing their taxes this year? They’d pay their share sooner or later. It’s not just early retirees avoiding taxes, and while there’s always going to be loopholes, we could do a lot more to close them.

Subsidies are harder to fix when a wealthy individual is living off of low income, because wealth is so much harder to track/measure. One solution is basic income. Another is wealth ceilings on subsidies: as you have more and more wealth, it becomes harder to hide all of it, and at a certain point it’s cheaper to just pay your insurance bill rather than all these offshore accountants. Or, if there were fewer tax loopholes then we might just shrug and say “The taxes you pay over your lifetime on all that wealth is worth a lot more than the subsidies you’re getting, so thanks for generating wealth and paying for public services. We’d have preferred you not take the subsidies, but we won’t look a gift horse in the mouth.”

We should have strong social safety nets. The problem is that we have the wrong entity – the government – providing the net.

For most of human history, your family was supposed to provide this function. If you got into trouble financially, or you suffered an injury that prevented you from working, your family provided a backstop. And family had the best information if someone was a deadbeat and needed to get cut off from freeloading. Those people without a family structure (“widows and orphans”) were the ones eligible to receive special care from society.

Now that the institution of the family is disintegrating everywhere and so many people live in isolation, that natural safety net is gone.

The government must paint broad strokes on who does/does not qualify for aid, and to what extent, and it cannot do that job efficiently enough. It appears we are doomed to find this out over and over again.

We need to cure the family if we want to cure the downstream effects, like overpriced, ineffective safety nets.

FS, you touch on so many hot button issues and admittedly even the facts belIE our belief systems.

That said, governments have always subsidized the general populace in some form of another or suffered the consequences- ala “Let them eat cake.”

It is true that some millionaire early retirees live off government subsidies, just as multi billion $ corporations often don’t pay taxes, but on an individual level I see no less productivity from an early retiree than Amazon hawking more shit we don’t need. Again, the argument between subsidy or tax is real but if companies aren’t paying taxes, those that do subsidize that company.

So, safety nets are necessary and I would argue that forcing unproductive folks to work, decreases overall productivity just as keeping zombie businesses alive does.

So, capitalism must be tempered (first by making rich people pay more, and no not all) but also by subsidizing the most needy and only parts of the economy as necessary.

And why the richer? One, because they are the ones that can but also because at the end of the day we are not units of supply and demand, we are human beings, social animals that must make society work or suffer the icing on top consequences. Bonsoir!

Great article and you point out one of the major flaws of poverty level is depends on where you live! In the middle of the country 100K is a upper middle income lifestyle, with you owning a home, couple cars, and a vacation or 2 a year. On the coasts that would be enough for you to getting by. Hawaii and Alaska have different FPL numbers it is obvious to me that it needs to be adjusted at the state level.

On the ACA medicaid is available till 138% of the poverty level in the states that have adopted it, so the feds did recognize that you need free insurance above the poverty level. You are correct the subsidies do go to 400% but the amount given drops off significantly after 250% FPL. 85%+ of all people receiving subsidies on the exchange are below 250%. Above 200% you receive no help on copays and deductibles which can be up to $8,150 per person on top of your monthly premium. In the end ACA really only helps people below 250%, or who have so many health issues that when they add up premium and out of pocket insurance coast is cheaper than self insuring.

It is interesting how the government breaks out Hawaii and Alaska, but not other higher cost areas of the country. It’s as if the government is just focused on geography, not actually cost of living.

But yes, where you live matters.

I suspect the decision to break out those 2 states had everything to do with needing Senatorial votes

While I agree with the majority of your article, what’s the solution?