This post is dedicated to those who refuse to welch on their mortgage debt, even if they bought at the wrong time or got into a high interest rate mortgage that cannot be refinanced. I know your pain and frustration.

I've got a confession. I've been reluctant to pay down my 4.25%, 30-year fixed vacation property mortgage because it makes me face the truth that I bought a two bedroom, two bathroom vacation property at an inopportune time. Instead of attacking the bad mortgage with laser focus, I wanted to forget all about it.

I've been so reluctant to pay down the principal that I paid down my 3.375% rental property mortgage in 2015 instead. Illogical right? My rationale was the following:

Why I Didn't Pay Down Mortgage Debt Quicker

1) I already did something positive. The vacation property mortgage was originally a 30-year fixed at 5.875%. Back in 2007, that was considered OK. In December 2012, after not turning in the keys like so many people did during the financial crisis, Bank of America contacted me for a free loan modification down to 4.25% with the same payoff schedule.

It was like a reward for being good! I'm sure the Justice Department fining BoA $10B+ had something to do with it too. I had been trying to refinance the loan for years, but couldn't because I was current. Curiously, only those who were delinquent could get some reprieve. The loan modification lowered my total payment from ~$3,200 to $2,497. Score!

2) Not 100% sure of keeping the property. My Lake Tahoe property ranks last in importance in my real estate portfolio. Most vacation properties do. If the world was going to end again, the vacation property would be first to go if I had no more money. In such an impending scenario, it would be unwise to pay down extra principal.

I knew with 100% certainty that I would never foreclose or short-sale my properties in San Francisco because they are way in the money and highly cash flow positive. After such a strong recovery with much more stringent lending standards, I'm confident we will not go back to hell.

3) Investment opportunities. After the financial crisis, I felt it was time to invest more rather than pay down more debt. My net worth was rocked by ~35% and in order to get back to even or reach new heights, I felt strongly the need to put more capital to work. As a result, I've been investing six figures a year since 2009.

I also put down $248,000 for a fixer upper in early 2014 and spent another ~$170,000 on home improvements. Only in 2015 did I decide to aggressively save cash and pay down my other rental property mortgage because I couldn't find as many attractive investment opportunities. Besides, the 2/2 condo mortgage in SF was supposed to have been paid down by 2013.

Things Are Different Now With Interest Rates

It's been almost 10 years since Bank of America lowered my 30-year fixed rate to 4.25% and I feel like it's time to accelerate my mortgage payment due to the following reasons:

1) Mortgage rates have crept up. Now that mortgage rates are higher due to inflation, holding onto a bad mortgage is relatively more attractive. The reason is because my mortgage rate of 4.25% isn't so bad now that the average 30-year fixed rate mortgage is 5.825% or so.

2) No feelings of regret. Before paying off my rental condo in Pacific Heights in 2015, I wasn't quite sure how I'd feel. I was worried about tying up too much cash in an illiquid asset worth ~$1M. What if the market crashed? Or what if my business shut down? What if I needed a million bucks to go to Vegas and bet it on black like professional athletes?!

It's been over a year since the mortgage was paid off and I feel zero regret. Instead, I feel immense satisfaction knowing there will never be a mortgage payment again. I'm fortunate that my cash hoard has also grown to overcapacity again.

3) Lack of investment opportunities. It's been very hard finding attractive investment opportunities with the stock market at record levels. I found an interesting S&P 500 structured note with 30% barrier protection and 150% uncapped upside participation. There are also some interesting ETFs that try to make money in an up and down market like the ETF, HTUS, Hull Tactic Fund.

If someone asked me how much of my liquid assets I'd be willing to invest for a guaranteed 4.25% return, I'd say 80%. With the risk-free rate at only ~1.7%, 4.25% is a fantastic return. That said, I really like investing in private real estate investments now.

4) A decision to keep the property forever. Now that it's been almost 10 years since purchase, the Lake Tahoe property is less than 10% of my net worth. From a net worth allocation perspective, it feels more reasonable to pay it off. I've always dreamt of one day taking my family up there for a month to enjoy the hiking, skiing, fishing, rafting, biking, pools, hot tubs, spas, restaurants, and lake.

Lake Tahoe is the perfect place for SF Bay Area residents to vacation, and The Resort At Squaw Creek is my favorite place in Lake Tahoe. I have a feeling my dream will finally come true within the next several years. Keeping the property forever is the most important reason why I've decided to accelerate payments.

5) A desire to always have a financial goal. I'm a finance junkie. Financial goals are extremely addicting. Without concrete financial goals I feel lost. Heck, part of the reason why I want to pay down the mortgage is so I can write this post! Creating a goal to pay down a 4.25%, 30-year mortgage early is not only fun, but a wise decision for my own balance sheet. The key is to pay it down without risking too much of my liquidity.

Paying Down The Mortgage In Chunks

Interest rate: 4.25%

Term: 30 year fixed with 20 years 6 months remaining until $0

Payment: $2,494.70 with $1,042 going to principal and $1,452 going to interest

Loan Balance Remaining: $393,233.25

Original Loan Balance: $536,000

Value Of Property: ~$550,000

Purchase Price (I'm the second buyer): $710,000

Initial Sales Price: $810,000

I thought I was getting a great deal in 2007 when I bought the property for $100,000 below where the buyers bought it in 2006. But the property value probably fell to $400,000 during the depths of the crisis! Recent comps have the property selling for anywhere between $500,000 – $600,000, which I think is not bad given the property can easily generate $70,000+ a year in gross rent.

If I do nothing but pay my mortgage, the $393,233 balance will fall to $0 in 20 years, right before my 60th birthday. That sounds a little depressing because I might not live that long. Further, paying down a mortgage by age 60 is completely uninspiring. As a result, I've come up with a plan to pay this sucker off by a spritely 45 years old in 2021! This way, I can die knowing my heirs will likely get a mortgage-free property.

The Decision To Pay Down A Mortgage

In the past, I've paid down a random amount of principal whenever I felt like it. For example, on 8/12/2016 I cut a check for $2,000. A month later on 9/12/2016, I decided to go bigger and cut a $15,000 check after publishing the post, Investment Ideas At The Top Of The Market. The post made me focus on opportunity cost. Receiving a 4.25% return for 5 years (the duration of the structured note) would yield a guaranteed 23% return. Not bad for being risk free.

From now on, I'm going to be much more disciplined in my mortgage pay down approach if I'm going to achieve my goal of being vacation mortgage free by September 2021. The best way to pay off a mortgage early is to simply figure out how much extra principal to pay down a month using a mortgage calculator to get to your target date.

Given I've got 20 years left on my mortgage, I need to figure out how much extra I have to pay to shorten my mortgage repayment by 15 years. The answer is $5,300! $5,300 a month is totally doable based on my cash flow. Notice the $159,733 in total interest savings if I proceed with this plan.

If I want to pay down my mortgage in three years, I need to contribute $10,000 a month. $10,000 feels like a lot because I normally invest $5,000 – $20,000 a month. I'd have to start digging into my cash hoard, which starts to feel a little painful. You don't want to feel pain paying down a bad loan because you already made a bad decision.

Initiating Mortgage Pay Down #2

Being able to generate an extra $2,497 in monthly cash flow after this mortgage is paid off is meaningful. I will certainly commit to paying off the mortgage by at least September 2021. Or, I may decide to allocate a large portion of an expiring CD in 2017 if I can't find any better uses for the money.

The key to paying down a bad mortgage is to make it painless. You want to pay extra principal amounts with money you won't really miss. Even paying down an extra $100 here and there towards principal will help. If it doesn't hurt, you won't remember the extra principal payments, but you will benefit from the accelerated payoff time frame.

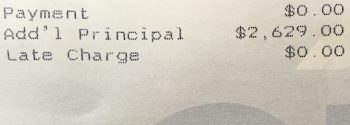

Just the other day, I went to get a haircut at 11:30am but my barber told me there was a 30 minute wait. Instead of just sitting there reading magazines, I simply went to the bank to pay down some mortgage principal to kill time. I paid down a random $2,629 because I had $207,629 in savings. There's no difference between $207,629 and $205,000 in savings. Now, I've only got $2,671 to pay down for the month to stay on track!

Just remember that before you decide to accelerate a mortgage pay down, especially a bad one, you must be certain that you plan to own the property forever. If not, it's better to invest your money in more liquid investments so you have more flexibility. The last thing you want is to throw good money after a bad asset you aren't planning to keep.

Bad Mortgage Pay Down Recap

1) Know how many years left you have until your mortgage balance goes to $0 if you make no extra payments.

2) Decide how quickly you want to pay the mortgage off within reason based off your cash flow. An easy target is choosing an age or a milestone, such as when your kids start middle school. One personal finance client chose her husband's 45 birthday. Awesome.

3) Calculate how much extra principal is required a month on average to achieve your target. Memorize it.

4) Throw extra money towards your principal whenever you can. Every dollar counts. While waiting for a friend or going out for lunch, pay your bank a quick visit. Consider increasing your autopay so you don't even have to think about it. Make it a fun game where you can only win if you hit your monthly target. Know that sometimes you lose, but at least you tried.

5) Write down your progress either in a word document or in an excel spreadsheet. Check your balance online each month. Remind yourself that paying down debt is a guaranteed return. Go find other people with similar financial goals to keep you motivated.

Invest In Real Estate Wisely

If you don't have the downpayment to buy a property, don't want to deal with the hassle of managing real estate, or don't want to tie up your liquidity in physical real estate, take a look at Fundrise, one of the largest real estate crowdsourcing companies today.

Real estate is a key component of a diversified portfolio. Real estate crowdsourcing allows you to be more flexible in your real estate investments by investing beyond just where you live for the best returns possible. For example, cap rates are around 3% in San Francisco and New York City, but over 10% in the Midwest if you're looking for strictly investing income returns.

Sign up and take a look at all the residential and commercial investment opportunities around the country Fundrise has to offer. It's free to look.

Shop around for the best mortgage rate. Check the latest mortgage rates online. You'll get real quotes from pre-vetted, qualified lenders in under three minutes. The more free mortgage rate quotes you can get, the better. This way, you feel confident knowing you're getting the lowest rate for your situation. Further, you can make lenders compete for your business.

Couldn’t you just go long on this investment property and wait until the market comes back up? I agree with many of the comments here when they say that valuations in CA are insane at the moment. I don’t think I would buy here right now until you can get a modest home for under a million. I’ve been looking for investment properties lately in different parts of the country which have higher yields.

One of the simplest ways to pay extra is to “round” up as well. Making an $1,100 payment on a $240,000 loan at 3.25% instead of a $1,044 one saves 2 years of payment and $13,000 in interest on a 30 year loan. Add in making it bi-weekely brings it down to 5 years early. In Sam’s example I’d likely add an extra $100 since $6 wouldn’t make a ton of difference. Plus that makes a nice round number moving out of my bank account monthly.

One thing that a lot of people don’t know is about the recast. Some mortgages have it written in that if you pay 10, 15, or 20% at once the bank will recast your mortgage for a new amortization schedule. In this case, you could get lower payments without a refinance which would allow you to pay down the mortgage quicker.

It’s fascinating to see that people who’ve achieved FI still find some past financial decisions painful. I like having cash on hand to invest when I see a deal, but I also am much farther away from FI. I wonder how my investing preferences will change in that time. Thanks for another great article.

Thanks for commenting Sam. That makes sense to have a plan. It’s tempting to just pay down the mortgage but you are right it would only leave us with 35k. I also didnt mention that we have a second mortgage for the house we currently live in. I think a solid plan to maybe pay off early is the way to go. We are currently getting 1900 in rent which will hopefully rise over time. Our break even is roughly 2200 at this point. I also like your idea in a different commoner about having powder dry just in case. Keep up the great blog. I read it at lunch every day while at work between my class I teach in high school.

I appreciate your ability to refinance this mortgage is limited. Would it hurt too much to take equity out of either of your other SF rentals (into a 5/1 ARM as others have suggested) or primary residence and rid yourself of the 4.25% Tahoe headache? Presumably this arbitrage would save you 1% tax-free annually – and net debt or rental income wouldn’t change.

Ripped through your Sept ’14 post “Why I’m Paying Down My Mortgage Early And Why You Should Too” as well as the post in May ’15 outlining the mortgage closing fees – yet you didn’t publicly consider the benefits of paying down the Tahoe place against paying down the mortgages of your other rentals. You’re too engaged and thoughtful in personal finance not to have considered this option at that time.

We’re aggressively paying down the mortgage on our primary residence at the moment despite an unbelievedly low rate. In the past we were slow-playing (slow-paying?) it and seriously considered taking out equity as it accumulated in the form of an auto-advancing HELOC to invest in the markets – a strategy called the Smith Manouveur that transfers non-deductible debts (a mortgage in Canada) into a tax-deductible investment loan.

Recently we’ve refocused our goals to wanting to acquire a family house in 2-3 years for when kidlets arrive and are using our existing mortgage to stash away these funds in lieu of the low returns of other conservative assets.

You bring up a good idea about taking out a home equity line of credit from one property at a cheaper rate to pay down this 4.25% mortgage. It makes paying this Lake Tahoe property mortgage off more palatable since it’s more like accounting versus bringing new money to the table to pay down debt.

For a HELOC, I think rates are around 4% – 4.5%, so it wouldn’t be worth it right now. BUT, I haven’t checked HELOC rates in a while, so let me do so now!

Smith Manouver sounds like a good move.

I don’t know, Sam. I struggle with this somewhat. I do plan to pay off our personal home mortgage just before retiring early in 2020. However, I’m on the fence about paying down the mortgages on our rental homes. Seems like a good use of “other people’s money” if you go along with the leverage side of it. Plus, if anything crazy happens from a liability perspective, the bank still “holds the bag”.

For 10 years, I’ve had the mentality of “the bank still holds the bag” when shit hits the fan for not paying down more principal sooner. But eventually, you’ve got to make a decision that you’re happy to hold on forever or you need to sell. Once you make that decision,your next decision about paying down the mortgage will be much easier.

Great article. Hits very close to home for me. My wife and I decided not to rent when first married and bought a condo in 2007 in the suburbs of NYC. Fast forward to now when it is worth roughly 80-100k less than when purchased. I did refinance it at one point down a 4.5% 30 year which was good at the time. This allows us to rent it and lose roughly 250$ per month as we have moved to a house nearby. I have been paying extra principal every month in hope of paying the loan down quicker. We are in our mid 30’s and have roughly 200k in cash and 90k in stocks. Would it make sense to put a huge chunk of that cash to pay off the remaining 165k on the condo loan? It would hurt too much to sell the condo in my opinion as we would have to bring too much money to the closing. Thanks for any advice Sam or any commenters.

When there’s uncertainty, it’s important to come up with a plan and take smaller steps towards executing your plan. You don’t want to go all-in and pay the sucker off, only to be left with 35K left. The cash flow doesn’t improve until the entire mortgage is paid off, hence it’s a balancing act you’ve got to walk.

I wouldn’t sell if you don’t have to. Stick around to read an upcoming post about the cost of selling.

Finally, having $200K in cash with a mortgage of only $165K is awesome. Just come up with an accelerated pay down plan like I have done. Seems like you can well afford to own this property of yours.

We moved our rental property from a 30-year to a 15-year mortgage. This is the property that went down in value nearly $100K because of the housing crash.

The quicker pay down and a rebounding market should allow us to net about $50K when we put it up for sale in the spring. Of course, the entire thing has still been a loss, but we’ll use that $50K toward buying a new family home once we move next summer.

Aside from not saving enough early in my career, this house is the biggest single financial mistake I’ve ever made.

Nice job being able to refinance! I wish I could as well, but can’t. So I’ll just accelerate the debt payoff.

It’s interesting to hear your desire to sell the house to buy a new house next summer. What is driving this decision? Quality of life?

A few things:

1) It is in WA state, far away from where we are settling;

2) I see too much evidence that some in the neighborhood aren’t keeping up their properties;

3) The HOA is developing a reputation as a bit of a nightmare. Interestingly, they don’t seem to be doing much about 2), but instead are targeting responsible homeowners;

4) We need the money in the short run to get our next home’s mortgage down; we plan to be in that home for at least 10 years. We also need the cash to either start a business, use as a bigger down payment, have some churn money, etc., depending upon how things go in the next few months.

5) We will look to build our stable of rentals close to our own home, so that we can handle the bulk of the repairs, keep a better eye on things, etc.

Awesome job tackling a problem that you didn’t want to deal with. I know too many people during the financial crisis that handed in their keys and told the bank that it’s their problem now even when they could make the payments.

I guarantee once you make the final mortgage payment you will feel like a weight have been lifted off you. I know it did when I finally paid off my mortgage.

Thanks! What I’ve also noticed is that interest in investing, wealth management, personal finance dips when the stock markets correct b/c nobody wants to check out their portfolios or face the fact they may have lost a lot of money.

It’s HARD to face poor decisions in personal finance! I hope this post helps elucidate this fact that many people make suboptimal financial decisions, and it’s healthy, cathartic, and financially beneficial to face financial problems head on and come up with a PLAN.

Sam, we’re still on the fence about whether we’ll keep our current property (primary, and only, residence) forever or not. So I’m hesitant to start paying down extra. We’re on a 30-year fixed at 3.625% — so it’s not a “bad” mortgage by any means.

The thing that kept popping into my mind while reading this article was why you haven’t refinanced this property into a 5/1 ARM like you’ve written about previously and done for your other property(ies?).

You had me convinced to do the same, and had plans to by early next year, but now you have me wondering…

The condo-tel mortgage died. It can’t be refinanced unfortunately.

I would refinance into a 5/1 arm in a heartbeat and then pay it off in the fifth year if I could.

Sam, my apologies. I picked through most of the comment after commenting and noticed you stated the same thing ad nauseam. Sorry for wasting your time and making you do it again.

Now, something I am interested in though is the condo-tel space. I’m curious what made you buy this place initially, who operates the rent for you when you aren’t away, etc. Is it you still or is it down by the condo-tel themselves?

I stayed in The Village at Squaw Valley last year for a friend’s wedding. The room was reasonable and I know owned by someone. But I forget how we booked it (I think it was through the Village, but not sure).

This might make a good post. I’m interested in adding more real estate holdings, but not sure I want to be a landlord. If a condo-tel takes the burden off the landlord side of things that’d be interesting to me. Not to mention it’s a place I could vacation.

So I’m curious how that all works for you.

No worries. Repetition is part of my job as a blogger. It also helps me realize where I wasn’t clear in my writing, so I can get better.

I bought the place initially because I simply loved the location and the area. It really is that simple. I had a good income back then and knew with high conviction I wanted to own the place forever.

In my mid-20s, I dreamed of having a lifestyle based off three favorite places: San Francisco, Honolulu, and Lake Tahoe. Then in my early 30s, I had a dream of leaving Corporate America in order to spend more time in Honolulu, Lake Tahoe, and travel around the world again.

So perhaps that’s the key: having a dream and working towards making things happen. No dream, no goals, then you might look back and wonder what happened?

Makes sense, Sam. I love Tahoe too, and my plan is to have a place up there someday. I suppose it’s my inner Michigan… born and raised there in a very small rural town and grew up on 20 acres of woods and fields.

And the wife would love a place in Hawaii, so seems like we have similar tastes :-)

Still very interested in the logistics of renting out your Tahoe condo-tel, but probably something I could learn about with some research outside of Financial Samurai if you haven’t detailed it previously. Thanks!

Cool post, particularly interesting that you paid down a mortgage with a lower rate before the mortgage with a higher rate! It’s a great insight to how the mental side of investing is just as important as the analytical side. I think a lot of finance bloggers act like they are debt paying, money saving robots but the reality is everyone has their own quirks.

For me, I am a total failure at saving UNLESS I have debt to focus towards. If I don’t have a payment of some kind to make, my spending expands to take up all my available cashflow. The discipline of having monthly payments to make seems to provide me the motivation to get my finances in order and focus for some reason. As a result I always carry at least a small amount of debt to keep me aimed in the right direction.

I can certainly think of worse things to do with money than pay off the mortgage on a beautiful property in Lake Tahoe!

“my spending expands to take up all my available cashflow” – very true. Having a goal is so important in the saving or debt pay down realm, especially saving b/c with a mortgage, you’ll eventually pay it off through amortization.

Cheers!

I don’t understand why people invest in bonds but keep mortgage debt on the books. Makes no sense to me its negative 3% interest rate arbitrage.

I’m also confused by that but I think it has more to do with keeping your credit score high which apparently is a good thing.

I’m highly allergic to debt and to me a mortgage is the hole in a leaky boat (FIRE boat :) ) Pay it off and plug the leak.

A family friend had a mortgage on their house. Their sons were running a small vending business and every day at the end of the day, they would go to the bank and pay the bank. However the money was just paying out the daily interest.

My mother said that they had to save the money and pay it off at the end of the month, then some of that money would go towards the capital. I still don’t understand how that works and why paying daily didn’t accumulate towards the monthly amount. But then banks are always trying to squeeze us.

What about selling the vacation property for a loss and putting the money in stocks… If that condo won’t appreciate in the next 5-10 years, it would be an opportunity cost lost from other investments.

Many stocks have doubled or more in the past few years and you could have recovered that loss.

I just love the place Joe. So many great memories. It makes me so happy every time I go back during the summer, or during a powder day in the summer. I want to take my family up there and work out of Lake Tahoe for a month or so. That is one of my dreams.

The Lake Tahoe place is less than 10% of my net worth, so it’s not that big of a financial burden/or impact anymore. As such, the mortgage is becoming more of an annoyance, hence the paydown plan.

Investing in stocks brings me no joy b/c I’m already free and have strong cash flow.

Yes, an emotional attachment to a home makes people reluctant to sell. I know you’re very pro real estate and have done very well in the SF market. But it shows there’s other places where real estate may not be as good a choice, esp once prices drop below what you paid and don’t recover.

It’s great that this is a very small % of your net worth so all your other asset appreciation cover whatever loss you had here.

You don’t have any positions in stocks right now? I thought you were heavy in Apple and other tech stocks a while back. Facebook has gone up 4-5x in 4 years! Tesla was on a huge run until lately. Even Google has almost tripled.

If you find one 5-10 bagger that would make up for this condo!! but like always it’s a big crapshoot with stocks. Apple taking a big nosedive now.

About 35% of my net worth is it stocks. And yes, I do have positions and Facebook, Tesla, Amazon, and Google for sure. It’s been a damn good ride. Just hoping things don’t crash and burn.

You mention that you might use some of the money from your CD to further pay down the principle if you can’t find a better use for the money.

However, what about just doing nothing? That is, if you think the market is quite overvalued (whether it’s the stock market or the real estate market) you don’t have to do anything with the money. Why not just build cash until a really good deal comes along? Obviously there’s nothing wrong with a guaranteed 4.25% return, but wouldn’t you expect to do MUCH better than that in the next correction?

In the next correction, I will be riding the correction down since the majority of my net worth is invested. I may only have at MOST 10% of my net worth ready to deploy to take advantage of a correction.

I have been doing nothing mostly for about 10 years. Now I’ve decided to do a little more something now that I’ve reached a steady state in terms of cash flow.

People forget that being an entrepreneur is not that easy. It took me almost 3 years to replicate what I was making for an average total income in my day job. I’m almost 5 years out now. Better to take normal steps, not giant steps imo b/c you just never know the future.

Well, given your substantial allocation to real estate, I’m guessing that 10% of your net worth is a significant percentage of the money you have invested in equities. So, having 10% ready to deploy when the good bargains are available will probably give your stock investments a nice pop as we come out of the next downturn.

And I completely agree about being conservative during a life transition. There was no reason for you to get aggressive with your investments as you were building your business. Now that you’re more established you can afford to up your risk.

This is a tough one, because when you are paying a huge mortgage payment that you know is a waste (because you bought at the top of the market) you know that money is just disappearing. I would say refinancing would be the best option, taking advantage of these unreal interest rates.

In my opinion, this could have been completely avoided in the first place. This is why I buy all of my rental properties in stable markets that are not as volatile. Places where the rent more than covers your mortgage, taxes, insurance, management, maintenance and all other operating expenses, and still gives you a decent positive cash flow.

For example, I feel that values in California are getting to the point where I would consider them overvalued again. My tiny 1,248 square foot, 3 bed 2 bath home in California is now worth around $300,000. At the top in 2007 the home was worth about $340,000. I bought the house in 2013 for $195,000 and I felt that we bought it at a fair price. Now prices are just stupid. I simply would not buy a home in California at this time, with these ridiculous valuations.

On the other hand, I am currently under contract to purchase a triplex in Utah for $120,000. The property will bring in about $1,600 per month in rents, and my mortgage payment (including taxes and insurance) will be around $650 per month. After all other operating expenses are paid I should see about $500+ positive cash flow every month. Based on this, I could care less what the market is like. Good luck finding cash flow like this in California right now.

Thank you for sharing your thoughts on what I should have done. Unfortunately, I can’t go back in time.

It is great you have made all the right decisions so far. I’m trying to learn from my mistakes and hopefully help others who are in a similar situation and help those avoid what I did.

What are your suggestions on what I should do going forward? Thx!

I don’t get it. If your savings account is yielding less than your mortgage rate, you should just drain the savings account and funnel the funds into paying down your mortgage. Why futz around with $2000 here and $3000 there for 5 years? Apply the full ~$200K now and you mortgage balance is more than halved.

That savings account may be your emergency cash fund but whatever amount above your emergency cash level should to siphoned off to the mortgage immediately if you have decided to pay down your mortgage.

The are only 2 reasons to have a mortgage. 1) You don’t have the full purchase amount available to buy the property so you have to borrow the remainder. 2) You have the full purchase amount available to buy the property but you believe you can gain a return higher than the mortgage rate (with the tax implications taken into account). You borrow money at x% and you invest that money at y% where y>x. Y-X is your effective yield.

You appear to have taken out the mortgage for reason #2 initially and now you believe that #2 is no longer achievable but once you have come to that decision I can’t figure out why you would wait five years to pay off the mortgage if you can pay it off today.

If asked, my advice would be to look at all those interest & dividend yielding accounts in your passive income stream. If the yield for any of them are less than your mortgage rate, liquidate that asset and apply the proceeds to paying down your mortgage. Repeat until a) your mortgage is paid off or b) all the yields are greater than your mortgage rate.

My reason is because I don’t know the future. Lots of things could happen over the next five years. It may be nice to have some dry powder.

What are the reasons that make you so confident about the future and where are you investing your money today? Thx

You have made the decision to pay down your mortgage early…so why waste time? The next 20 years are more uncertain than the next 5 years so by your reasoning, you shouldn’t attempt to pay down your mortgage early because it’s better to keep your power dry for 20 years than 5 years. If you believe there will be or may be better investment opportunities over the time horizon of mortgage, you shouldn’t be paying it off early.

I paid down my mortgage because it was a bird in the hand rather than 2 in the bush. Did I pay it off in one chunk? Almost. I had to wait for a CD to mature and for some dividend dates to pass so I could get the quarterly dividend. From the time I made the decision to the time I paid it off completely was about 2 months. My feeling was that once I got rid of the monthly outflow of cash to the mortgage company, the quicker I could start replenishing my powder

Everything has an opportunity cost but in this case your 5 year timeframe seems arbitrary and self-contradictory.

They say I’m a walking contradiction!

And that’s the beauty of personal finance. Not everything is a straight line to financial freedom.

With the mortgage paid off are you retired currently? How old are you and what was your path to financial freedom? Cheers!

I’m 46 and not retired. One thing I’ve learned from reading these FIRE blogs is that FI or FF is more of a state of mind than a calculable amount or definable set of conditions. I don’t consider myself FI but realize that is subjective.

Two principles in life where taught to me at an early age by my parents.

a) cash in > cash out and it’s easier to reduce cash out than increase cash in. Never violate this rule unless a family member’s life depends on it.

b) find something you enjoy doing and get a job doing that. There is a caveat: that job’s salary must allow a) to be achieved. If your dream job doesn’t pay enough to achieve a) then find a job doing the second most enjoyable thing in your life. Keep going down the list of jobs until a) and b) are both achieved.

Nowadays, people are urged to follow their dreams but dream jobs are like winning the lottery – a small minority gets the winning ticket but most of us have to settle for something less. I see all these kids spending so much time and money in their quest to live their dream – musician, pro athlete, actor, model, etc. When I meet young people like this, I think “I hope you have a Plan B.”

I like to play with numbers so it’s been easy to adhere to a) and b) but the job was my second choice. When younger, I wanted to write fiction but quickly determined I also liked not worrying about making rent or bouncing a check.

I don’t think it’s too late to go for your dream job Dan. 46 is still relatively young.

I truly people believe people will regret doing the things they don’t do, rather than the things they try, even if they fail. Why not just write fiction on the side?

Wasting time is not paying off my mortgage in five years versus 20 years. If anything, that is either wasting money or saving money, however way you look at it. Wasting time is going to a job you do not love out of fear or security. That is real time wasted.

While Dan makes alot of good points what is lost in the analytical analyis is the freedom and bonofide risk reduction that implementing your plan over time provides.

say paying it off over time costs you 12k in interest charges over paying it off immediately. You gaIn alot of piece of mind AND IMPORTANTLY flexibility to change plans in exchange for this.

This calculation is different for everyone but for you it may well be worth it.

It’s funny isn’t it Dave? In some people’s eyes, I’m foolish for waiting five years to pay down the mortgage with my game plan. In other people’s eyes, it is a good move.

Everybody has to make their own decision. I’ve decided to take a middle ground. Pay down the mortgage more aggressively while also investing for the potential to earn greater than a 4.25% return, and just as importantly, have money invested in a more liquid asset.

just pay it off.

You still have earning years ahead.

Less bills, less headaches. More energy+resources refunnel back to baby.

Hi Sam,

As always, I love your tactics. My wife and I purchased our home around the same time you purchased in Tahoe. It wasn’t the best moment to buy, but it was good (as shown by the 2006 buyers you mentioned).

My wife was an officer in the military and as such we were a little bit everywhere. Knowing her commission may end at some point, we threw almost everything we had at the HELOC we had created to purchase our home. It was very aggressive but worked out like a charm when her commission ended. From the money we saved and reduced stress, it was a genius move.

Now we have an automatic principle payment every month that will have the house paid off by the time I turn 57. Ironically, that’s also when my 75% Cop pension starts paying out. Almost as if I planned it that way. :)

Sounds like destiny Jack! At the end of the day, if we are planning to own the property forever and enjoy it forever, then things aren’t so bad, especially if we can afford the carrying costs.

Sam,

I was wondering if you had any thoughts on paying down a mortgage if you are planning to sell a home in a 1 yr time frame? Like you I am starting to hoard cash and can’t decide if paying off a 3.25% mortgage makes sense. We are planning to try to take the profits off our home sale and scale up in a different market. Hopefully putting a lot of cash down to keep the monthly mortgage cheaper. I enjoy your blog because it helps me set financial goals and think more about putting my money to work. Thanks!

Hi Daphne, I would definitely not pay down extra principal if you plan to sell your home in a short period of time. The value of cash is in its optionality.

If you put money in your home, you might not ever get it back if you don’t get what you want in selling price.

We have just one mortgage, and it’s a pretty good one.

I think one of the most painless ways to accelerate paying down a mortgage is to set up bi-weekly payments, which is what we did. Bi-weekly payments will cut five years off our mortgage and save about $60,000.

Biweekly payments is definitely a good idea and a no-brainer if the cash flow can afford it. I just raise my total mortgage I pay automatically each month to do basically the same thing.

Hi Sam:

Firstly I enjoy reading your blog. Thank you for sharing your knowledge!

Similarly I own 4 rentals in SF, only one with a mortgage ($323K balance). I am now retired at 50. I’ve considered accelerating payments but have not for the following reasons:

1. The $1875 monthly mortgage at 3.875% 30-year interest rate is very good. Pay off in 2043.

2. The value of $1875 decreases over time due to inflation.

3. Extra monthly payments would reduce my retirement spending budget.

WWSD? (What Would Sam Do?)

If it was me? I would throw extra principal and pay it down faster because I have a goal of being debt-free completely by age 60. Also, a 3.875% return is pretty good in this apartment as well as that is 2% above the risk-free rate of return.

You should do what feels best for you!

Where do you get the 2% risk-free rate of return and what is the timeframe?

Luckily I don’t have a mortgage that makes me cringe paying off. On the other hand I only have one mortgage to pay currently and it’s not in beautiful Lake Tahoe! I like your honesty in this post. We can all learn a thing or two.

The thought of a refi now by folks above is one i agree you should consider.

I have a very similiar situation to you with a vacation rental property. Its really hard to stomach the large paper loss, but whether real eatate or another investment all you can do is evaluate where that investment is today and “where to go from here”. What follows is my suggestion….

The gross income is 70k as you stated above. Your total expenses should be no more than 50% of that ( one hopes!). So you have say 35k net operating income. Your total payments including principle are 30k per year so the property nets you say 5k cash return yearly, plus principal. It sounds like after sales costs you have 100k equity in the property so your cash on cash is 5% while your total return including primcipal paydowm is 15%. These numbers are the return you are getting from your current equity and should guide the decison on stay sell refi etc. that total return includes zero appreciation, whereas the total will get much much better if you even get 2 percent a year in appreciation.

Given the above you are right to keep it, but i would seriously consider a refi to lower wasted interest payments. A 15 year or 5 year arm would probably be best. Just evaluate the potential reduced interest vs your risk acceptance on havign to make the higher payments.

Look on the bright side, even though you lost money since you bought it, YOU ARE MAKING MONEY NOW! And you have a kick but 2nd home in a premier location.

Unfortunately I’m on able to refinance this mortgage because the condo hotel mortgage right up. But you are right about the cash flow. It is cash flow positive and I love the property.

I was just up there last month for six days and it was magical. There’s so many good memories and so much in the stall shop there that I never want to sell it.

We’re in a situation where we have a house that we’ll probably live in for 5 more years or so, and then likely rent it out. We’re 6 years into a 30 yr mortgage, meaning this house would be mortgage free when we’re in our 50s.

Been thinking about whether we might want to consider paying a little more to get it paid down faster and get some more cash flow out of it. I have this idea that we could have rental income paying for the mortgage of a new home at some point .

Sam,

Thanks for your inspirational post. Like you, I bought at the wrong time and refused to welch on my mortgage debt. Its reassuring to know there are others out there.

Unlike you, I have no desire to keep the property and it is currently for sale. It will likely be on the market for up to 6 months and I will probably have to bring cash to closing. Would you attack the debt while the house is on the market or just keep saving in a cash account until it sells? The interest rate is 4.875 and I can put about $4k towards principle each month.

Thanks,

Steven

Hi Stephen, thank you for not well welching on your debt! If you are selling, then I would definitely not throw any more money towards paying down principal. Keep liquid and keep your options open.

Thanks for the reply and advice Sam. Here’s hoping this thing sells fast so we can move on with our FI goals.