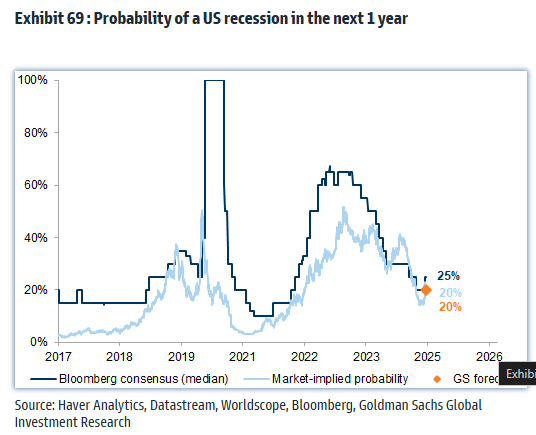

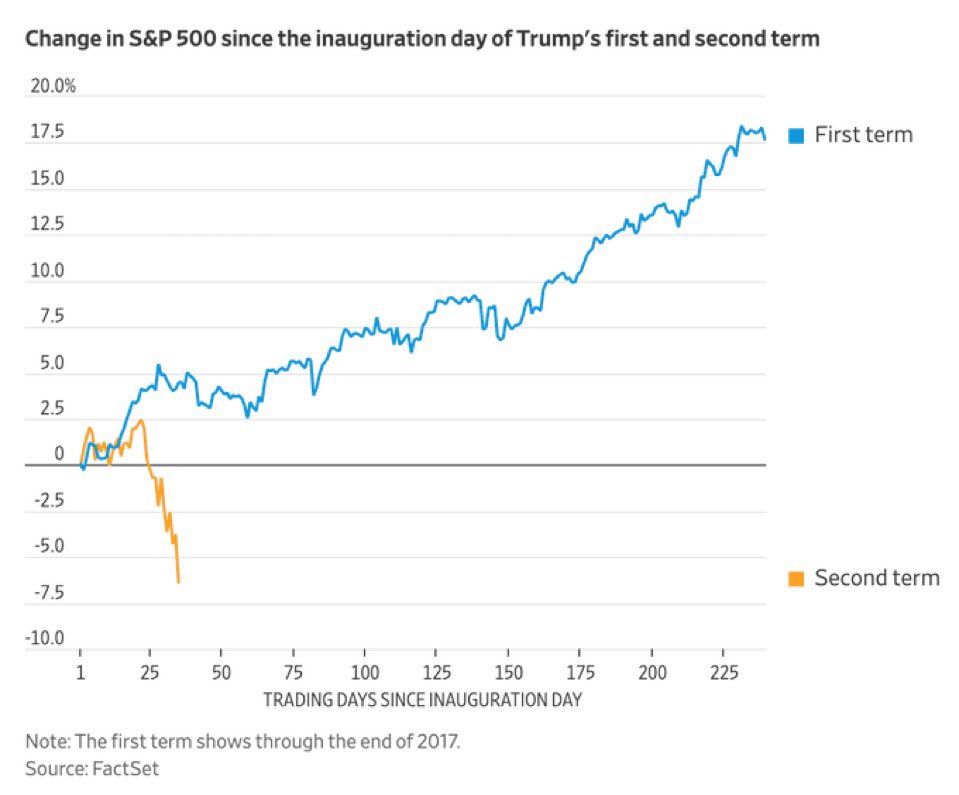

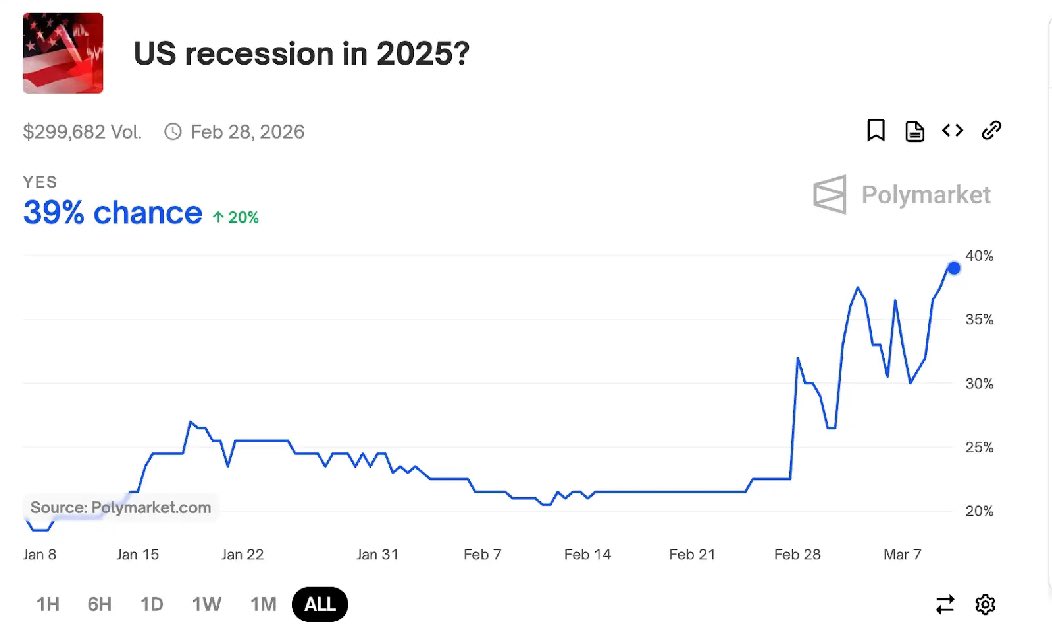

Unfortunately, the chances of another recession are increasing, largely due to the uncertainty set forth by the new administration. When uncertainty rises, we collectively tend to spend less and save more. As a result, corporate profit growth may slow, stock prices could fall, and layoffs may increase.

Losing money in your investments and then your job is a double whammy nobody wants. That's more like a depression. Many experienced this pain during the 2008 Global Financial Crisis, the first half of 2020 when COVID hit, and now in 2025 with mass government worker layoffs. What’s even tougher is that without active income, you also miss out on investing at bargain prices.

Nobody but short sellers or extremely wealthy people with ample cash want a recession. However, if another downturn is on the horizon, let's focus on some surprising positives. Perhaps this perspective will help soften the blow of losing a boatload of money very quickly.

The Great Things About A Recession

Recessions are a part of life. Live long enough, and you'll experience several. The key is to accept them for what they are, seize the opportunities they present, and stay optimistic that better times are ahead.

1) You May No Longer Need To Work As Hard

Imagine a booming economy with a pro-growth administration. Friends are getting raises and promotions, and you feel compelled to grind harder to keep up. Meanwhile, the surging stock market encourages you to save and invest aggressively given the window of opportunity never lasts forever.

In a recession, the opposite often happens. As layoffs increase and your portfolio declines, working harder may no longer yield better results. That raise and promotion simply aren't going to happen. Since your company's share price won’t magically recover through your individual efforts, you may rationally decide to focus on your Return on Effort (ROE) instead.

Instead of overextending yourself, you might decide to do just enough to avoid getting laid off. After all, the harder you work, the lower your ROE. This mental shift can free up time for rest, hobbies, and family—potentially improving your mental health and happiness.

2) Young Adults and Children Have a Greater Chance of Building Wealth

A bull market is tough for young adults and children because rising prices make investing feel out of reach. Conversely, a recession gives them an opportunity to invest at lower prices.

Most young people have minimal savings, meaning they aren't losing much in a downturn. If they can earn and invest during a recession, they may build meaningful wealth in the years ahead.

During downturns, parents can gift and invest more for their children. They can also match any Roth IRA contributions their children make. While they may not become millionaires before leaving home, this latest correction increases their odds of children accumulating significant wealth by adulthood if they take action.

3) Greater Relative Wealth for the Middle Class

When the stock market tumbles, the richest people in the world tend to lose the most. For example, when Tesla stock corrected by 50%, Elon Musk’s net worth dropped by over $130 billion. As a result, 99.9% of us became relatively wealthier compared to Elon.

As the wealth gap narrows, there’s often less social unrest. When inequality shrinks, society can feel more stable and harmonious.

4) Less Crowding and Traffic

During a booming economy, popular destinations can feel unbearable. I was in Palisades, Lake Tahoe, one weekend in March, and the crowds were overwhelming. Daily lift tickets were $215 – $270, lodging ranged from $400 – $2,000 a night, and my wife almost got run over on the mountain a couple of times. A recession would reduce the number of visitors, making ski trips safer, cheaper and more enjoyable.

With fewer people working, rush hour traffic jams from 7:00 to 9:30 a.m. and 3:30 to 7:00 p.m. will start to ease. This reduction in congestion can lead to less road rage, lower stress levels, and fewer accidents — ultimately saving lives and money.

Theater shows like Hamilton may no longer get away with charging $350 for upper-deck seats, and NBA games might become more affordable than $250 per ticket. Best of all, you might finally be able to book a reservation — or even just walk into — one of your favorite restaurants. Now that would be a welcome change!

A recession helps reduce the heavy consumption patterns of non-personal finance enthusiasts, who don't save aggressively for their futures. In turn, day-to-day life gets much better for the rest of us.

5) Easier Access to Childcare and Schools

With more people unemployed, more childcare providers at a lower price become available. At the same time, as more parents stay home to save on childcare costs or due to layoffs, daycare spots become easier to secure.

If you’re eyeing private schools for your children, competition may ease as families switch to public school or homeschool to cut expenses. This can provide much-needed relief for parents navigating the admissions process. More time at home raising your children might also mean better relationships with them in the future.

I remember the frustration of getting rejected by six out of seven preschools in San Francisco in 2019. Wealth created enormous demand for spots, and even so-called lottery-based admissions favored the rich and well-connected. A recession could restore some balance to these systems.

6) More Deals on Luxury Items and Other Things You Don't Need

During a recession, the first things to hit the market are vacation homes, luxury cars, watches, jewelry, boats, and other non-essential toys. If you've been eyeing any of these items, a flood of supply will likely drive prices down.

This is your chance to channel your inner vulture investor — lowball distressed sellers who overextended themselves with debt. By seizing these opportunities, you can accumulate valuable assets and potentially enrich your family as the economy recovers.

Enormous fortunes have been made by savvy investors who bought distressed assets during the 2008 Global Financial Crisis and the March 2020 downturn. Meanwhile, those who couldn't hang on will likely never catch up to those who did.

7) Stronger Family Bonds and Community Support

Tough times often bring people closer together. Families may spend more time at home, bonding through game nights, cooking meals together, or enjoying simple activities like family walks. Communities may also become more tight-knit, with neighbors supporting one another.

The shared experience of navigating financial hardship can strengthen relationships, reminding us that wealth isn’t the only path to fulfillment. Nothing is more important than friends and family. A recession might just shake us into remembering this truth.

8) More Encouraged to Spend and Enjoy Your Wealth

If a recession is going to wipe out a chunk of your wealth, you might as well spend some of it and enjoy life! Watching your portfolio take a beating is one of the best ways to truly appreciate your money. It’s like a near-death experience that makes you want to live life to the fullest.

The more money you lose, the more you'll value what you still have—your family, friends, health, wisdom, and, of course, your safer assets like cash, bonds, and real estate that keep generating returns.

Now let me leave you with the absolute greatest benefit of a recession.

Greatest Benefit Of A Recession: The Courage To Change Your Life For The Better

Recessions have a way of pushing people to reevaluate their priorities. Over the years, many have used downturns as a catalyst to stop wasting time on things they don’t enjoy. When the profit motive disappears, all that’s left is whether you genuinely find fulfillment in what you do.

If you’re stuck doing something you hate, a recession can be the nudge you need to make a change. Rather than looking back with regret, take this opportunity to pivot toward something more meaningful.

After losing 35%–40% of my net worth in just six months during the greatest recession of our lifetimes, I decided I had enough of working in finance. I plotted my escape by first entertaining a compelling offer from a competitor, which forced my existing firm to come close to matching it. Then, a year later, I came up with the idea of negotiating a severance package so I could leave with money in my pocket.

If the Great Recession of 2008–2009 had never happened, I'm certain I'd still be stuck in the corporate meat grinder today. My health would certainly be worse, I'd be grumpier more often, and I wouldn't get to spend nearly as much time with my kids as I do now because of all the work travel. Thank goodness a recession shook me out of the desire for constantly more money and status!

When you’re miserable enough, you will find a way to change. And if you don’t, then maybe you’re simply not miserable enough yet. In retrospect, losing more than a third of my net worth so quickly was a small price to pay for 13 years of freedom so far.

Embracing the Silver Linings Of a Recession

Nobody wants a recession. But if one occurs, focusing on its potential positives can help you stay grounded and hopeful. By adjusting your mindset and seizing new opportunities, you may emerge from a downturn stronger, wealthier, and more fulfilled.

As someone with about 28% of my net worth in stocks, I’m certainly feeling the sting of this latest market correction. However, I’m continuing to dollar-cost average into stocks since I’m aiming for a 30%–35% stock allocation. At the same time, I find comfort in owning a paid-off home and having roughly 50% of my net worth in real estate.

It's kind of ironic, but all this uncertainty and chaos is exactly what real estate investors have been hoping for. The decline in interest rates is a sight for our sore eyes after the relentless rate hikes since 2022. It’s nice to finally see more capital rotate into real assets.

For these reasons, I can’t say I’d be entirely upset if we enter a mild recession once more. Let’s just hope things don’t get too bad because losing a lot of money ultimately means losing a lot of time.

Readers, what are some other ways a recession could positively impact your life? Let’s hear your thoughts as we navigate this period of falling stock prices — and for some of us, job losses too.

Diversify Your Assets

My favorite asset class to own during a recession is real estate. Investors gravitate toward the stability of real assets that provide utility and generate income. Unlike stocks, real estate valuations don't just vanish overnight.

If you're looking to invest in high-quality residential and industrial commercial real estate, consider Fundrise — my favorite private real estate investing platform. I've invested over $300,000 in Fundrise, and they're also a long-time sponsor of Financial Samurai.

To fast-track your journey to financial freedom, join over 60,000 others and subscribe to the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance websites, established in 2009. Everything is written based on firsthand experience and expertise — because money is too important to leave in inexperienced hands.

It will be a miracle if the economy doesn’t fall into a recession this year. A continued trade war with virtually everyone and an isolationist policy will hurt the economy, there is no way around it. A relatively similar example is Brexit a few years ago. The UK has fallen behind France now that they have left in both growth and GDP per capita.

The upside I see for a recession will be lower interest rates and bargain prices stocks.

A miracle would imply a more than 99.9% chance that a recession occurs and it doesn’t happen. But that would be too extreme.

And that’s the thing I’ve learned over the years as an investor. Being able to more accurately estimate risk and reward is very important.

So much emotion is involved or people thinking binary terms. But it is not binary at all.

Yes, a miracle implies almost impossible, so my choice of words is mainly emotional. However, the Atlanta Fed forecasts the first quarter GDP at -2.8%, and consumer sentiment is at a 3-year low (I can see it in my own DTC sales). So, an expected recession by this summer seems reasonable because of all the negative momentum and the lack of confidence generated from the top. I have sold all US stocks (with the expectation of a bear market) and am all in China/HK and Brazil. Having real estate in the US is enough exposure to the American economy.

I am interested that you mention your equity portfolio is about 28% of your net worth. That is lower than what many “financial advisers” would recommend. Do you keep it that low as you don’t have the cash flow from a job? I ask this because it interests me as I also am retired and have a low-percentage equity to net-worth. Mine was 23%, but in mid-January I felt markets were over-valued and there were high risks with the new administration so mid-January through to the end of January I sold ~40% of my equity portfolio. I now have equities as ~15% of my net worth. And I am now holding a LOT of cash, but am not buying the dip yet. I believe we will see the S&P off 20% from it’s highs before any meaningful rebound will occur.

What do financial advisors recommend as a more appropriate weighting? Checked out my Recommended Net Worth Asset Allocation Post

What’s your net worth?

I thought the industry standard was 100% minus your age. So if you were 48 years old, 52% in equities. In my case Net Worth $5m and age 60.

That is definitely one of the classic for stocks and bonds, which I have the model in my post.

But I retired from traditional work at age 34 with $3 million in 2012. And I decided to be more aggressive with private equity and entrepreneurship.

Isn’t it interesting that the top of the US total market, lately, was February 19-20th, 2025? Do you remember when the Covid crash began in 2020? It was February 20th, 2020. The Covid pandemic and whatever we will call this decline, while having seemingly different causes, actually have the same basic cause. Mass psychological effects of fear and tens to hundreds of millions of people being threatened and forced to do what they don’t want to do. Apparently, it takes about 30 days of a large segment of the population eating sh*t under force, for something to break. I am also predicting a new pandemic. It ought to be coming out any day now.

Another pandemic may happen, but I think this time around, the impact will be muted and the vast majority of people will just get on with their lives. The systems are in place to work from home, so it will be much smoother the next time around.

I enjoy listening to our pessimistic outlook. Have you also retired and don’t really care what happens to the economy/assets? I’ve been noticing more of this outlook recently (one guy said happy to lose 75% of net worth), which seems quite bullish because that means more people have a lot more money.

Yes I retired, but I agree with you, I don’t want to see my net worth decline by 75%. In no way would I be happy about it, but there’s not much I can do. Like you said though, there could be many benefits. Work done on my house without months of waiting, traveling more with fewer crowds, cheaper prices on everything. Overall, this time, I don’t really want to focus on buying more stock at lower prices. I’d be happy to divert money into living, traveling, doing things, just not selling my old investments, which would have to go down a lot more to “lose” money. Probably a lot of people are like that. There are also many more people this time around who are less fearful than the last pandemic. Despite my dire prediction, it’s impossible to know how it will actually turn out.

Loving my real estate holdings and rental income right now. Ah, the reliability of real estate through thick and thin is simple the best.

I’m nibbling on stocks now too.

The much maligned (in most personal finance forums) paid-off home definitely brings peace and comfort during times of uncertainty. It also makes it easier to keep investing in stocks during the downturns.

Yes, indeed! The funny thing is, it’s also easy to take for granted a paid off home with no monthly mortgage payment. We just get used to it.

But then we are reminded when stocks crash, how lovely it is to not have a mortgage. And then every month when our income hits how much cash flow we’ve got!

Although I don’t want a recession to happen, I will do my best to push through one if it does. We’ve made it through past ones, and painful as they can be, they do teach us a lot about ourselves, our priorities, and our resiliency. I like how you are so good at looking for the silver linings in things and helping us focus on the positives of challenging financial situations. Thanks Sam!

We’ve been in a recession for the past 3+ years. We were just lied to about it in every metric published and it was covered up by money printing and federal spending.

In fact, lets not make this political, lets agree that the economy has been skewed by government spending by the uniparty for decades.

I’d take a 75% haircut on every asset I owned with a smile on my face if it means elimination of our $37T federal debt and complete elimination of social program giveaways. Yes, including Medicare and Medicaid. Social security is not an entitlement program as we’ve actually paid for that!

Yes, fixing a corrupt system will cause asset prices to drop, but it will allow true price discovery and create opportunities for many more people across a much wider spectrum of society.

It is not the governments job to house, feed, or clothe people. It’s not the job of USA to send our money all over the world to support other places or to promote democracy.

Every American must become more self-reliant and provide for themselves and their own families and not depend on our taxpayers via Uncle Sam to do it for them. Man up, step up, and earn what you receive. Or don’t eat.

2 Thessalonians 3:10

“ I’d take a 75% haircut on every asset I owned with a smile on my face if it means elimination of our $37T federal debt and complete elimination of social program giveaways.”

Bold stance. Could you stay retired if you are currently retired? Or if you are working, how many more years of work would be required for you to retire?

Personally, I wouldn’t want to take a 75% net worth haircut. I took a 35% – 40% haircut in 2008 and that was enough to change my life.

I’m ready to retire financially but still enjoy the work. I just turned 40. True price discovery and wide open playing field would energize me for another decade or two. There is a great adrenaline rush in deal making, and real estate and business M&A are two of my favorite areas for finding and making deals.

It (asset haircuts and price discovery) would also make me feel better about my children’s future, and that of their entire generation, to have the same opportunities that I’ve enjoyed.

When I was still an adolescent, my grandfather, a USMC veteran and factory worker, told me very bluntly that he expected my father to be more financially successful than he was, and that they would both expect me to be more successful than my father. I have a hard time putting that burden on my own kids seeing the cost of everything going up so dramatically in the past 3 years.

That’s great you love what you do and are willing to work for the next 20 years!

In my classic post, The Dark Side Of Early Retirement, I discuss one of the reasons why people want to FIRE is due to not finding a job they enjoy.

this is so completely over the top.

According to Copilot...In the last five years, the average price of gas in the USA has remained steady between $2.74 and $3.29 per gallon. Where is the inflation?

Last week I went to Buffalo Wild Wings for lunch and it cost $14 – 10 wings a side salad and ice tea. Two years ago the same thing (I go there all the time and order the same food) was….$14. I looked it up in my Empower to confirm.

Three years ago we added a bathroom to our house – 35k. I just got a quote to gut another bathroom, and redo it – essentially the same size and stuff as the last one…quote was $33k.

After a prolonged doubt with inflation for about 2 years due to COVID, inflation has been very close to or below historic norms (3%) for the last 2-3 years. The elevated prices in some niche areas – read eggs – is very much anomalous.

It’s the new, completely ridiculous, explanation from the right to justify turmoil and the ridiculous trade war the President has launched. It’s an attempt to recast the significant market gains of 2023 and 2024 as merely a mirage all the while ignoring that consumer confidence has cratered and corporate America has no idea what the future holds. It’s a dumpster fire with no extinguisher in sight.

And that is why it is my view that we will see a lot more than a 10% hair-cut on stocks and it is not yet time to buy the dip. Until late last year there was more-or-less a perfect economy and what you may refer to as the Golden Age. In not even 4 months that has changed totally and the economy is facing ruin due to a mad-man with ego and no clue about the impacts of what he does.

Will, last I checked Medicare also comes out of my paycheck – so I’d put it in the category of something I paid for as well. Unless you are heartless, you must understand we need programs like Medicare to care for those who can’t care for themselves. I myself am not interested in loosing 75% of my portfolio. It took a long time to build up that much debt, we don’t have to correct this severely and cause so much pain.

Will obviously has no money or kids

I use to live in the tony Marin County area and it was hard to get a hold of contractor, and when I did, their estimates were insane – we called it the Marin County tax. Then came the 2008 recession. Man, it was sweet, I got so much work done on my house from job-starved contractors. So that’s a silver lining for consumers who have the cash at that.time. Not so much for the contractors!

A good and RELIABLE contractor is priceless!

I don’t want to deal with contractors anymore, which is why I’m trying to reduce my physical rental property exposure.