The rich are frequently criticized for not contributing their fair portion of taxes. However, when examining income taxes, it becomes evident that the wealthy actually contribute more than their fair share.

Here's a chart displaying the proportion of income taxes paid by different income groups from 2001 to 2021. In 2001, the top 1% contributed approximately 33% of all income taxes. By 2021, this group contributed around 46% of all income taxes.

You might wonder, “Isn't it natural for the wealthy to contribute a significant portion of income taxes? After all, they earn the highest incomes!” However, when we discuss fairness, true equity would entail the wealthy paying the same proportion of all income taxes as the proportion of all income they earn.

The Rich Shouldn't Be Vilified For Their Portion Of Income Taxes

In 2021, the top 1% of income earners in America accounted for “only” 26% of the country's total income, yet they shouldered 46% of the total tax burden. This indicates that the wealthy paid 15% more than what would be considered their equitable share.

Consequently, perhaps we should reassess our tendency to vilify the rich specifically concerning income taxes. On average, their tax rate stood at 24%.

We operate under a progressive income tax system, where the marginal federal income tax rate increases with income levels. Here's a quick overview of the 2024 income tax brackets to refresh your memory: The lowest federal marginal income tax bracket starts at 10% and gradually rises to 37%. Additionally, there are state income taxes for residents of states that impose such taxes.

Likely Under A Lot Of Stress If You Earn A Top 1% Income

If you find yourself in the top federal marginal income tax bracket, chances are you're dedicating a considerable amount of time and effort to your work and are likely under a significant amount of stress.

I've encountered numerous households earning between $500,000 and $1 million dollars in W2 income. These individuals include doctors, bankers, lawyers, small business owners, executives, and techies, many of whom work 50-80 hours per week, leaving little time for leisure.

While their high income serves as a reward for their hard work, they often find themselves heavily taxed for their efforts. After working 12-hour-days for 20 consecutive days healing people, you might not be pleased with forking over more money to the government than you get to keep!

During my time working in investment banking, I was among those individuals for several lucky years. Despite the substantial income, I found myself facing chronic stress and experiencing physical discomfort, including back, leg, and jaw pain, which ultimately affected my overall happiness.

I highly recommend everybody try to earn a top income to pay the top marginal income tax rate to see whether it’s worth it or not. This way, you will gain firsthand perspective.

What About The Bottom 50% Of Income Earners And Their Taxes?

The bottom 50% of income earners collectively earned just 10% of the total income in 2021, yet they only contributed 2% of the total income taxes, with an average tax rate of 3%. That's quite a favorable ratio!

Ultimately, I made the decision to leave my finance job and join the bottom 50% income for the sake of my health and happiness. Making a high income just wasn’t worth it.

Initially, the drastic reduction in income, approximately 85% less during the first 12 months, was a significant adjustment. However, thanks to hedonic adaptation, I gradually became accustomed to the change.

Moreover, after experiencing relief from chronic physical pain within six months, I realized that sacrificing the higher income was a blessing. My body healed. The health benefits of early retirement are priceless.

Looking back, I found being a bottom 50% income earner to be enjoyable, even though I knew what it was like to earn much more. Not only did I pay a reasonable amount of income taxes, but I also gained a newfound sense of freedom.

Instead of rushing to catch a flight on Sunday afternoon for a brief client meeting in Denver, I could leisurely spend my time lounging in Golden Gate Park, indulging in a good book.

The Ideal Federal Marginal Income Tax Rate: 24%

As time passed and with the help of a bull market, I gradually accumulated more passive income and online earnings. Through this process, I found that the optimal federal marginal income tax rate to pay was around 24%.

At a 24% tax rate, you're contributing a substantial amount to the country's development without feeling excessively burdened. Simultaneously, you're earning enough to sustain a comfortable lifestyle.

For the tax year 2024, individuals within the income range of $100,526 to $191,950, and married couples earning between $201,051 and $383,900, fall into the 24% marginal income tax bracket. These income thresholds are typically adjusted annually to accommodate inflation.

Maintaining an upper-middle-class lifestyle with an income of $300,000 per year is comfortable. Moreover, it allows you to steer clear of the 8% jump in federal marginal income tax that comes with entering the next tax bracket of 32%.

Related: How Regular People Can Pay Less Taxes Like The Rich

Wealth Is What You Want To Build To Minimize Income Taxes

It may not be readily apparent, but the top 0.1%, the truly affluent, don't amass their wealth primarily through income. Instead, they accrue their fortunes from owning equity in businesses, including their own.

As long as they refrain from selling any assets, they can avoid paying capital gains taxes. To access their wealth, the ultra-rich often borrow from their assets to finance their lifestyles.

As of 2024, the estate tax threshold stands at $13,610,000 per person, or $27,220,000 per married couple. Essentially, this means that an individual or a married couple can pass on this amount of wealth without incurring an estate tax, typically set at 40%.

Various strategies exist to manage estate taxes at these thresholds, such as a GRAT, dynasty trusts, and other methods. You could even relocate to one of the nine no state income tax states to save.

However, the most straightforward approach to avoid estate taxes upon death is to gradually spend down your wealth or gift as much of it away while you're still alive. Oh, and of course, die in a state that doesn't tax estates or inheritances.

Get Busy Building Passive Income To Replace Active Income

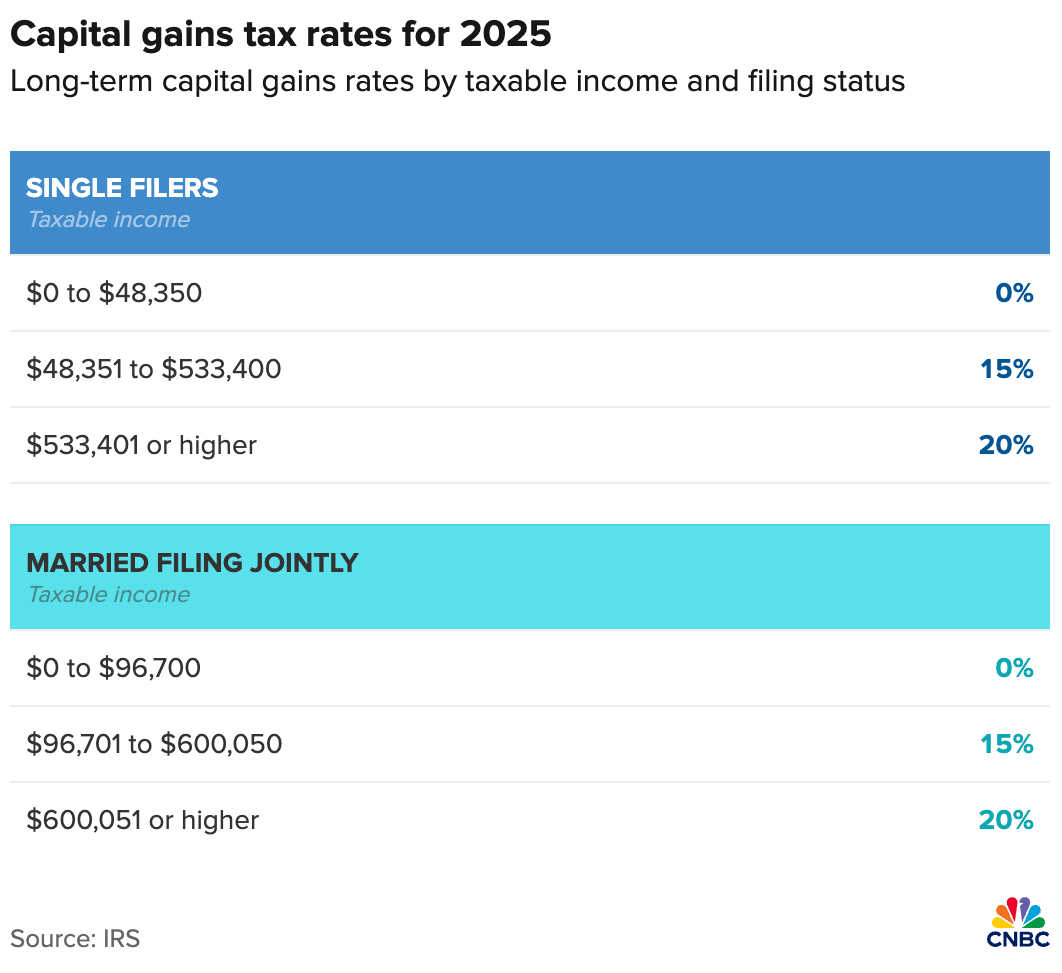

If you amass sufficient wealth, your distributions and asset sales will be subject to lower capital gains tax rates if held for more than a year. Your qualified stock dividend income and bond income will likely be taxed at a lower rate as well. This serves as another incentive to boost your net worth over maximizing income.

The most significant contrast lies between the W2 federal marginal income tax rate and the long-term capital gains tax rate, which stand at 32% and 15%, respectively. Ideally, you accumulate enough capital to substitute for an income in the 32% bracket, enabling you to earn passive investment income and incur only a 15% tax rate.

$300,000+ is what I'm shooting for after blowing up my passive income in 2023 to buy a new home. I will need three-to-five years to recuperate my $150,000 passive income loss.

About Half The Working Population Doesn't Pay Income Taxes

We often point fingers at the rich for various issues, but what about the approximately 47% of working Americans who pay zero income taxes? While they do contribute through sales taxes, FICA taxes, and other levies, so do those who pay income taxes.

It's worth considering how much stronger our nation could be if those who currently don't pay income taxes contributed even a modest amount, like $500 a year regularly. If so, more people would care about our country as everybody would have skin in the game.

With approximately 167 million employed Americans today, if just 78 million of those who don't pay income taxes contributed $500 each annually, it would generate $39 billion. Doubling that to $1,000 per person would yield $78 billion, which could be allocated to addressing homelessness, providing jobs for unemployed veterans, supporting child services, and other critical needs.

While the rich already shoulder a significant portion of income taxes, they also face hefty estate taxes upon their passing. Instead of fixating on the wealthy, perhaps we should focus on ways to increase our own tax-efficient income and build wealth.

Build Wealth By Investing In Private Equity

The rich build their wealth by owning equity in private and public businesses. The richer people get, the greater their portion of business equity as a percentage of their net worth.

Check out the Fundrise venture capital product, which invests in private growth companies in the following five sectors:

- Artificial Intelligence & Machine Learning

- Modern Data Infrastructure

- Development Operations (DevOps)

- Financial Technology (FinTech)

- Real Estate & Property Technology (PropTech)

Approximately 75% of the Fundrise venture product is invested in artificial intelligence, which I'm bullish about. In 20 years, I don't want my kids wondering why I didn't invest in AI or work in AI while living in San Francisco!

The investment minimum is also only $10, compared to most closed-end venture capital funds that have a $100,000+ minimum. You can see what Fundrise is holding before deciding to invest and how much.

Track Your Wealth Diligently

To better manage your net worth and estate, use Empower's free financial tools. I've been using Empower since 2012 to manage my finances to great success. I especially like their Retirement Planning tool to calculate expected cash flow and expenses. You don't want to leave too much of your retirement up to chance.

Subscribe To Financial Samurai

Listen and subscribe to The Financial Samurai podcast on Apple or Spotify. I interview experts in their respective fields and discuss some of the most interesting topics on this site. Please share, rate, and review!

For more nuanced personal finance content, join 60,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

““only” 26% of the country’s total income”

You mean of reported income, of course. The higher the income bracket the more likely that it is income that is self-reported – and we know how accurate that is!

And, of course, capital gains are taxed at a lower income than much wage work.

Really, get a grip.

Why grip so hard? How much other people pay in taxes shouldn’t affect you, especially if they are paying a lot more. Best to focus on your own earnings and how to make it more efficient.

Surely, there are underreported incomes at all income levels. You’re always free to pay more taxes if you want.

If you calculate annual income taxes paid as a percentage of wealth (or net worth) you would conclude that the wealthy don’t pay their fair share of taxes. Especially since many of them minimize or avoid estate taxes by the use of sophisticated trusts and gifting much of their wealth to foundations and endowments, which pay no income taxes. While I agree with you that the bottom half should pay at least a nominal amount of income tax, we cannot make a meaningful reduction in our deficits without the ultra wealthy paying more. I also am supportive of a VAT, provided it isn’t accompanied by income tax cuts.

I think we could tax all the billionaires and centimillionaires in the world 100%, much to help our budget deficit. Government spending is a great issue.

Biden and Harris just released their tax returns and the numbers are simply not believable. Neither had any capital gains and nearly all of their claimed income was W2 income. Both families are far wealthier than the average American family. Could it be they have their assets in blind trusts and they simply cannot be seen by the public. Based on the returns they released they certainly are not paying anywhere near a fair share! Any insight as to how they hide their true income would be appreciated.

Great question. I’m curious too. The news said Bidens paid 23.7% tax rate on $619,976 earnings.

Didn’t see that. But if so, 23.7% is a very reasonable effective tax rate on that income. I’m impressed.

The detail is now online. Highlights: $485,985 in W-2, approx $100,000 in pensions and SSA, $40,000 in investment income (not capital gains) and $20,000 in charitable deductions. Straightforward/basic return. I would never have guessed that an almost $500,000 W-2 salary would have an overall tax rate of 23.7%.

KAren, guessing AGI is ~$626k, taxable in range of $575k, assume the 23.7% Fed Tax? you mention is being measuredagainst W2 only, which bumps the math up, don’t now the amount of tax, to see how it looks vs $575k total taxable income, but 23.7% against $486k W2 is $115k, so only 20% which sounds right.

For people who are interested in this issue of taxes and how much people pay I would encourage reading “The Triumph of Injustice”. The authors attempt to map all taxes paid to individuals, and summarize the results by income groups. For example, we all pay taxes via income tax, but we also pay taxes via sales and property taxes, and also through taxes on business profits for the public and private investments we may hold. While it’s true that Jeff Bezos or other billionaires may have paid zero income taxes, they may have paid substantial taxes on the profits of their businesses, but those profits are taxed at lower rates than income taxes.

For those that don’t read the book, the authors find that when you add up all taxes paid, the effective tax rate is almost completely flat. The progressive nature of the income tax largely offsets the regressive nature of sales tax, creating a flat tax across nearly all income brackets. The only exception is at the top 0.01%, where that group pays a substantially lower tax rate than everyone else.

Good topic to discuss as most people are absolutely clueless about how the tx brackets work and who pays in America. Progressives always talk about Europe, but don’t understand the tax system there taxes EVERYONE, so there is more overall equity and shared burden as well as shared benefit. However, this is paid for by lower overall incomes and net incomes with a collective system vs US’s more individualistic system.

It is hard to know what is cause & effect in each tax system, but fairness ultimately goes both ways for lower and upper income people. We could go to European-style system, but the math says EVERYONE has to pay, not just the small # of wealthy people.

Only 756 billionaires exist in the entire United States, and that is what everyone is always complaining about!? Seriously,

who cares!

The fact is that the US tax code is ridiculous, complicated, and unfair, and that is 100% on purpose.

We the people could demand a more balanced and simplified tax system, we could also easily fund better social programs and true universal healthcare, but we don’t. Tax preparation, tax planning, and the financial services industries are all massive US employers, and that’s exactly how we want it. Just like Defense, Homebuilding, and Energy….Tax time is a massive chunk of our economy. So learn the games, pay your lowest legal share and move on. I have argued with people my whole life about taxes, paying taxes simply does not bother me. The loudest often earn high W2 incomes, which I will argue was their choice. Read some IRS publications, learn the rules, follow the rules. We reward job creators, housing providers, and retirement savers…..act accordingly. People will always vote for two things, other people working for free (or for far less; see Realtors most recently), and other people paying higher taxes. These same people however will raise holy hell if anyone ever hints about them working for less money/being grossly overpaid or dares suggest they start paying a dollar more in taxes. People are dumb, dangerous, and mostly full of “poop”…act accordingly.

Right on Sam!

It’s worth considering how much stronger our nation could be if those who currently don’t pay income taxes contributed even a modest amount, like $500 a year regularly. If so, more people would care about our country as everybody would have skin in the game.

I’ll go a step further. If you don’t pay income tax you don’t get to vote precisely because you have no skin in the game. You just vote to spend other peoples money, and we all know how well that works.

I actually believe that if income taxes existed when the Constitution was written, it would have been a requirement to get a vote.

BRAVO Sam! I love that you tackled a controversial financial topic with straight facts. I have said this for years. It is interesting to watch the people in the comments go immediately after the handful of billionaires (just like the left politicians). It’s an easy talking point but you are talking about the top 10, 25 even 50 percent of tax payers. It is the doctors, lawyers, software engineers, financial advisors etc that went through tons of school, endless hours of work that make 250k to 1 mil that shoulder such a heavy burden.

Interesting how politicians use billionaires as talking points but crank the taxes way up on every day hard working people that make 250kish or more. If you stole the money from all of the American billionaires we would still be tens of trillions of dollars in debt. The real problem isn’t that taxes aren’t high enough folks. There’s a spending problem with the government, it’s not rocket science. It’s basic math.

Who do you think is controlling all the politicians in government? The .01% billionaires basically control them with bribes and close room deals. They have to parade them in front of congress occasionally to yell at them like children. But it’s all for show. I’m in the $250k-ish range and our federal taxes were 17% this year. Sure it sucks.. but it’s hardly obscene. Sure the government has inefficiencies and waste… but at least that waste of money in theory should be going to citizens who work for the government and government contractors. The US government is the largest employer of our citizens. So it’s not much different than the billionaires who choose to give out huge salaries and work with their colleagues and friends.

Plenty of people in congress are approaching that Billionaire status as well and will reach it in their lifetimes. So they are all one in the same.

What you are saying is not wrong. The government and billionaires are all the same, they are all buddies behind closed doors. The problem is the left has gone so far left they are trying to create clas warfare mostly between the upper middle class and working or lower class. Use the oldest trick in the book, envy. They have more and you should be able to take it. That aside, just saying oh well the government is inefficient let’s just keep ballooning the government power, budget, debt etc is loser talk. If more money stayed in the hands of private citizens like the founding fathers intended, there would be way more small business owners, they would employ people instead of the government and you’d see real growth again in this country. We have to stop government control and spending.

The best explanation for why the top 10 percent have to shoulder the majority of the tax burden is from a previous comment eluding to the fact that it stops the uprising, appeases people. Sad but true. Unfortunately the radical left is becoming more and more Marxist. Remember, the government isn’t going to take your freedoms and money all at once but slowly over time. Don’t let it happen.

Look focusing on personal and individual taxes is going to cause a lot fo heated discussion and arguments. What about a basic minimal tax for businesses. That is a much more pressing issue. Large Corporations go to extreme ends to shield and hide tax burden, like Apple having their international headquarters in Ireland! (This was Actually True). Its ridiculous and insane, so there needs to be a global minimum tax for corporations. This will save tons of headache, and lawyer hours, and put some money back into the systems which help build the companies. Dont get me wrong I am definitely pro corporate America and large and small companies drive tremendous growth and innovation, but there needs to be a minimum tax they pay. Fortunately the Inflation Reduction Act imposes a 15% minimum tax on the adjusted financial income of large corporations now.

The numbers here are based on income tax brackets..NOT income tax PAID. We don’t actually know how much income tax people pay because that is private information. BUT we do know from the IRS files that were leaked that for example, Jeff Bezos paid ZERO income taxes in 2007, a year in which he was worth 3.8 billion dollars. Also in 2011 a year in which he was worth 18 billion he paid no income tax and he claimed and received a $4000 dollar child tax credit filling with his then wife. We do know also for example that from 2016 to 2018 George Soros paid zero federal income taxes.

Tax avoidance is legal and there is nothing wrong with it. What is wrong is defending the false idea that the wealthy shoulder the biggest tax portion based on income tax brackets. That idea is absolutely wrong and people need to stop propagating it.

What is the truth then Todd? Feel free to share so we can rid this world of opaqueness. Thanks

The truth is that you can assume that the wealthiest people actively avoid paying taxes and there are many many ways to show zero income for federal income taxes. So since that is the truth then the truth about the tax burden is that it really falls on the middle class. Evidence? Look at how the recent tax code changes made it even less likely that you would have itemized deductions. Who does that affect? Middle class wage earners with W-2s. Wage earners are subject to the income tax brackets not people who put their money in trusts and show no income. (Recall that Elon Musk said under oath that he was cash poor. He owned nothing to be sued for. All his wealth is in stock which he borrows against.) The point is that the 100 richest billionaires in reality individually pay less Federal income tax than any middle class wage earner who does not own a business so really we should stop protecting the idea that they bear all this tax burden. Hey I am a red blooded capitalist, I have nothing against it. What does bother me is people leaning on the Income Tax bracket numbers to pretend that rich people are paying more taxes than the average person. They are not. Going forward the middle class will continue to have to pay for these ridiculous government hand outs. It won’t be Warren and George and Elon etc. It will be Betty Jo, Billy Bob, Tammy and Fred like it always has been.

You’re looking at snapshots of individuals for one year and drawing and quartering them for not paying as much tax as my father the carpenter. I’m a tax accountant and old, I’ve been preparing returns for small businesses and small farmers since 1973. As long as the taxpayer keeps borrowing and growing their <$10mm business they probably won't pay what my Dad did. But if they're successful after 15-20 years and decide they're as big as they can stand; trust me they will start paying. All that debt repayment is NON-DEDUCTIBLE, got it Todd? Now they're going to be paying10 or 15 times what Pop did and the business is going to keep on doing so…. At least until the next generation screws it up. With the advent of the earned income credit lots and lots of folks started not only not paying ANY (FEDERAL) tax they started getting a check at tax time….. And should they have a kid or two they can get refunds approaching 30-40% of their W2 earnings. Granted the W2 ain't a ton but add another $6-$7k to their kitty come February-March…. That's a chunk… Maybe even see a Family Ski Trip… Snapshots don't tell the tale…. You need a full lifetime length movie. Until then don't live in a glass house.

Hey Sam,

This is a good, well thought out opinion piece, but I have to disagree. To each their own of course. I think it’s interesting to pick now as a time to say the wealthy pay more than they should in taxes, when the upper tiers of the income tax ladder as well as corporate tax rates are the lowest they have been in the history of this country. They are also lower than almost any other developed country. Corporate profit margins in the past 10-15 years are the highest they have ever been in history.

Looking at the amount of tax someone pays in terms of absolute dollars is not a fair comparison. If someone makes $1 billion per year and pays $100 million in taxes, that is just a 10% rate. You still have $900 million left to spend, and if you can come up with a way to spend all of that more power to you.

As many have said, the working class spend the majority of their income on basic necessities and taxes in all forms (not just income tax). I am saying this as a family who is well into the 24% federal bracket and does well income wise.

Of course many of the most affluent will vote for whichever politician promises to lower the income tax and corporate tax rates the most, but few stop to question how sustainable that is, and what they are trading off by voting only for their perceived bottom line net wealth.

Who says someone who makes $1 billion in one year pays only $100 million in taxes? They’d pay at least $238 million with 20% long-term capital gains tax and 3.8% net interest income tax.

Are you willing to pay greater than a 24% effective tax rate to help the 47% who don’t pay any income taxes? How about 32%? 24% seems low, you can do better.

I never said they would only pay $100 million. I was just using that as an example for easy math.

Are you insinuating that $762 million annually is not enough to live on? Most Americans live on $50k/year or less.

Saying that the wealthy pay too much taxes is nothing more than an opinion, as there is no right answer. It is all subjective. One thing we can compare though is what tax rates were historically, and what they are in the rest of the developed world. Our country’s tax rates are the amongst the lowest in the world, as well as compared to our own history.

Making up a number to fit your narrative is dishonest. Follow the tax code to make a fair argument.

If someone made $1 billion in W-2 income, they’d pay over $500 million in taxes. Is that not fair, especially compared to how little you paid?

What is it that you do for a living to make you think you’re better than others?

“If someone made $1 billion in W-2 income, they’d pay over $500 million in taxes.”

No, they would not, so long as they avoided living in California. The top marginal income tax rate is 37%, which is assessed on every dollar over $731,201 in taxable income for those who are married filing jointly. If all $1 billion were in W-2 income (i.e. no net investment income), they’d pay just under $370 million in federal income taxes/FICA taxes (i.e. Social Security and Medicare), plus whatever state income tax rate they paid. The highest marginal state income tax rate is California at 13% (payable on income over $1 million). But even there, because of how marginal rates work, you’re still ending up shy (albeit ~ less than a $1 million) shy of $500 million in total state/federal taxes on wages. And that’s ignoring the things someone with $1 billion in W-2 income might do to reasonably lower their tax liability — max out their 401k, max out an HSA, contribute the max to 529s, deduct mortgage interest, charitable donations, tax loss harvesting — all of which would considerably/significantly reduce their taxes further.

Of course, the example you postit is ridiculous, because NO ONE receives $1 billion in W-2 income. If you’re “making” $1 billion in a year, a large portion of it is in unrealized capital gains (stock going up) that you don’t have to realize as income, so you defer the taxes (and when you do realize it, it’s taxed AT MAXIMUM at 23.8% representing a 20% long term capital gains rate plus the 3.8% net investment income Medicare premium). The insanely rich don’t EVER realize their capital gains. They instead “buy, borrow, and die” — they have a ton of stock assets, use those assets as collateral for loans for their living expenses/whatever they want to spend money on (loan proceeds are not taxable income), and then when they die their heirs pay off the loans using estate assets (taxed one time at 23.8%) while getting the remainder as inheritance at a stepped up basis (meaning there is no capital gains at all to be taxed anymore).

Thank you for your answer. This whole discussion is completely ridiculous. Your answer should be the end of this discussion.

I have never claimed to be better than anyone. We are all equal. You are clearly pretty fired up and are resorting to attacking me personally (your screen name says it all) as well as projecting your insecurities onto me. I’ll just leave things here rather than engaging further as this will not be productive. I wish you the best.

You are not alone in your desire to raise people’s taxes and signal to the world the rich are greedy, yet you are not willing to pay more taxes yourself. It is normal to act this way.

I hope you find a job that you will be proud of that helps the world, instead of working mainly for the money. Your soul will grow stronger and you’ll feel more proud if you do.

You are doing it again. I work in healthcare (pediatrics) and make a positive difference daily. I certainly don’t it just for the money. Be careful with your assumptions, and go forth and prosper my friend.

A conservative estimate is that companies owned by the current 735 U.S. billionaires likely represent somewhere between 15-25 million jobs in total across the country and globally.

I find it interesting that you bring up the history of this country. There was no income tax until we needed them to fund wars in the mid and late 1800s and they were around 1-5 percent then repealed when the war was over. Supreme courts made it unconstitutional and a confiscation of private citizens money. Then it came about again on a more permanent basis in early 1900s. Of course introduced as simple and less than 5 percent of your income. This is my point, the more we allow the government to steal from private citizens the more they will be insatiable in their spending and power. It’s not conspiracy. It has happened many times in history and it has happened already to a certain degree in America. I mean we have people that think this is “historically low”…that’s simply not accurate.

And the politicians brag when they burn thru our tax dollars (or, worse, borrow on the future) telling us about all the great things they, the government, ‚give‘ us.

Sam,

This is an old tired argument which conservatives lost during the Great Depression. Taxing isn’t about paying the correct portion of the taxes. Taxes serve one purpose and one purpose only and Americans have forgotten about that. Taxation makes sure the markets function properly and don’t create massive bubbles that hurt everyone. Having billionaires in a democratic and free society does not serve anyone and does not make any sense whatsoever.

Corporations in America would be much bigger and do more incredible things for society if they spent more money on their employees and R&D. The greatest time of innovation in the history of this nation was in the 1950s to the 1970s. Think of what the nation accomplished during those years. The nation can’t match those achievements now because we aren’t spending enough on R&D. Why? Because the rich are buying super yachts and large mansions they don’t need instead.

Taxation is about reducing inequity and human suffering and if we taxed excess capital and spent on innovations and the public owned more of those innovations everyone including you Sam would be better off. We have got to stop playing the pie game. The American economy is not some fixed economy where the pie stays the same size. Everyone acts like if someone takes a piece of the pie that it will somehow effect someone else. The American economy makes unlimited pies and it is time that we use those resources to build abundant beautiful lives for everyone and not just for a few billionaires who got there because of their connections.

Billionaires are not self made. They use infrastructure and resources that everyone including the lowest paid workers in society helped pay for. The government paid for the first computers and they certainly paid for the first internet connections. Private companies did not have the resources to buy the first computer chips because they were too expensive and did not at first provide any economic value. Bottom line the rich need to spend more of their capital on innovation and improving the human experience or the government should raise the tax rates to either encourage the capital spending or take the money in taxes and pay to improve all of our lives. What is going on now is silly and definitely immoral.

By the way half of the population doesn’t pay federal taxes but they pay a huge percentage of their income in FICA taxes, gas taxes, sales taxes and utility taxes that rich people don’t care about. Bottom line we have a regressive tax system in this country and all of us should definitely worry about the massive inequality in our nation and the impacts of that on our long term sustainability as a nation.

Can you say normative economics vs. positive economics?

What are some of the things YOU are doing to reduce inequity and human suffering? Let us know your effective tax rate and your job. This way, we can see if you are doing what you say or just virtue signaling.

So much focus on income tax, when the rich don’t make their wealth (and more importantly, power) through their income. They make it through asset ownership, namely real estate and stocks.

While most Americans pay a wealth tax in the form of property tax every year whether or not they realize their gains, certain types of property do not get taxed this way – which is odd, especially considering you need housing to live. You don’t need stocks to live.

The rich then use their assets as collateral to take out low interest loans, which they use to make all their big purchases. And when they die, they take advantage of tax loop holes to *literally* pay no taxes on inheritance received by their children.

So no, the rich do not pay their fair in taxes, especially when you consider it how much more power the rich hold in America, and how much they benefit from th current system, which is screwing over the average worker.

You talk about how executives and owners work a lot. So does the average American. The average American makes, on average, 0.33% of what their company’s CEO makes. And that’s just in INCOME, not assets, which is where their real haul comes in.

So no. The rich don’t pay their fair share. They disproportionately use and depend on all of the services our society provides, including protecting of property, medical care, transportion, roads, utilities, all while buying politicians to make the laws even more in their favor, and lowering their taxes. They also do this while moving their jobs overseas and union busting.

So what is your suggestion? What is the correct tax policy so that the rich pay their fair share? If nothing specific, then you’re just speaking out of envy.

Exactly. We PRIVILEGE capital income with favored (i.e. lower) tax rates, tax loss harvesting, massive estate tax exemptions and stepped up basis upon death. We PUNISH labor with higher marginal tax rates than capital and a regressive FICA tax process, and no income equivalent to “tax loss harvest.”

For example, if I make over $800k MFJ in year 1 (an awesome problem to have), I pay 37% marginal on every dollar over $731,200 that I earned (plus the marginal rates that filled the lower tiers) — a total of $222,125.50. If the next year I make $80k and land in the 12% bracket, I pay $9,136 dollars in federal income tax. So my total taxes paid were $231k, roughly.

But the IRS doesn’t “equal it out” and consider that I made $440k across 2 years with a 32% marginal rate, which would be equal to $96,173 each year in taxes, or ~$192k in total.

But with capital, tax loss harvesting carries over year to year, and cancels out gains on a dollar to dollar basis.

So much focus on income tax, when the rich don’t make their wealth (and more importantly, power) through their income. They make it through asset ownership, namely real estate and stocks.

While most Americans pay a wealth tax in the form of property tax every year whether or not they realize their gains, certain types of property do not get taxed this way – which is odd, especially considering you need housing to live. You don’t need stocks to live.

The rich then use their assets as collateral to take out low interest loans, which they use to make all their big purchases. And when they die, they take advantage of tax loop holes to *literally* pay no taxes on inheritance received by their children.

So no, the rich do not pay their fair in taxes, especially when you consider it how much more power the rich hold in America, and how much they benefit from th current system, which is screwing over the average worker.

You talk about how executives and owners work a lot. So does the average American. The average American makes, on average, 0.33% of what their company’s CEO makes. And that’s just in INCOME, not assets, which is where their real haul comes in.

So no. The rich don’t pay their fair share. They disproportionately use and depend on all of the services our society provides, including protecting of property, medical care, transportion, roads, utilities, all while buying politicians to make the laws even more in their favor, and lowering their taxes. They also do this while moving their jobs overseas and union busting.

The lack of ‘skin in the game’ is THE problem in a democracy. If 50% plus don’t pay income tax, why would they care about increasing the tax on the 49% or less that do. I believe you to be a liberal but I also believe you are ‘progressing’ towards the red pill (Matrix).

The bottom 50% of no income tax payers think and feel they pay taxes.. (and they do as a percentage of income.. 10% on every purchase in CA). How the masses feel is more important than the reality. The wealthy can’t stay safe and wealthy with an unhappy, angry lower class. Unless you forsee a Hunger Games style future for us all. Keep the masses distracted and happy and pay your taxes in order for that to continue and stop complaining that you live a better life than 99% of the world and are paying more than your “fair share”.

In reality, in a decade Universal Income will become a reality of the bottom 50%. AI and automation is going to be off the charts in a decade. So stop complaining and get used to paying a lot extra to be a priviledged top 1%. Consider it a .. “Dont’ eat the Rich, please…” tax.

Due to your passion and enthusiasm for the Fundrise Innovation Fund I have invested $20000 of my daughter’s money in that fund. I hope I made the right decision. What type of return do you anticipate from this investment and over what time frame will I recoup my initial investment and expect a profit.

My plan is to invest for 10 years and outperform the S&P 500. I invest as a hedge against AI taking over the world. If AI does, the fund should do well. If AI fizzles out, then AI investments won’t do as well.

As always, there are no guarantees with any investment, and investing in private growth companies is riskier than investing in the S&P 500 or in real estate. I like to allocate between 10% – 20% of my capital into private investments.

What I do know from speaking to Ben Miller, CEO of Fundrise in person (new podcast episode coming out, be sure to subscribe to Apple or Spotify as the episode with hime is coming out) is that there are names in the fund which they cannot publicly disclose. But knowing their trajectory, I think they will do well.

Why can’t they publicly disclose the names of the AI companies? Are they working on top secret AI for the military or something? I can see thousands of applications for AI in the militaries around the globe and if they can’t disclose for that reason this innovation fund would be worth a look. Otherwise it might be a pump and dump scheme by Fundrise.

I would not invest in any fund unless they can fully disclose where the money is going. There are too many get rich quick schemes out there these days. I have seen the Fundrise CEO on CNBC. Seems like a nice person and this innovation fund seems highly speculative with a chance for high losses. Maybe ordinary investors need to be mindful of that upfront unless I am missing something?

Definitely don’t invest if you don’t feel comfortable with a fund or investment. The thing with open ended venture capital funds is that there’s a lot more disclosure compared to private venture capital funds, where you don’t know what the fund is investing in until the capital call.

Yes on AI/tech for military. And for some reason, several of these private companies want to keep their cap table/investor base private. But there are public documents for disclosure.

You’ll enjoy the upcoming podcast episode with Ben.

Excellent, I will definitely listen to that podcast. I have been learning as much as I can about the new AI models and hardware of various types that are coming online, some of the stuff I have seen is so cool. I definitely think it is awesome that ordinary investors can buy into these pre-IPO companies and share in some of the rewards. Things are changing fast and there has never been a better time to be a financial investor in the history of the world.

I am mentoring my family members on investing and they are having a hard time being patient, but there is literally not enough stock equity to go around and if young people invest now they will be richly rewarded in the future that is for sure. AI is the biggest investment opportunity of our life time and maybe our children’s and grandchildren’s life time. The possibilities are endless.

Thank you again Sam for your great thought provoking articles!

Will

The solution is fairly easy, which is raising the min wage, not raising taxes.

The truly rich (0.1%) have money in corp stocks (not W-2), Walmart family for example etc. Raising the min wage decreases corporate profits therefore lowering the overall wealth of billionaires. It also addresses the bottom 50% don’t pay taxes line of thinking as raising their income would then allow for tax contributions at a higher income bracket.

In California we raise the minimum wage for fast food workers to $20 an hour in 2024, and that resulted in a lot of workers getting fired. So I’m not sure it’s that straightforward.

Tech fired a lot of workers without such a bill. Linking the bill and the firings also isn’t straightforward.

Wow – lots of lively comments! The tone of many comments has inspired me to double down on paying as little tax as I possibly can, and to ensure the same for my heirs. Thanks folks – occasionally I need a little kick in the booty like that! Last year I paid multiples of the U.S. median household income in taxes – gotta stop that madness!

Water flows to the lowest point, and money flows toward lowest cost with best return (ROI). If the U.S. uses taxes to increasingly loot the rich, the rich will do what they’ve always done around the world, which is to increasingly shift money to tax sheltered investments or locations, and/or simply reduce investment until tax structure shifts back in their favor.

I’m no tax expert, but I like solutions that are efficient, fair, and simple. Along those lines, I’ve seen proposals over the years that seem promising. For example, I’d be curious what folks here think of a flat income tax rate on all income accompanied by a national sales tax and expansion of the earned income tax credit that helps protect the lowest earners. With that model, what flat tax rate makes sense? 17%? (above 15% long term cap gains rate and 12% 2nd 2024 marginal income tax rate level, but below short term cap gains rates and 3rd 2024 marginal income tax marginal rate of 22%…)

This is the typical example promoted in support of the “the rich pay too much in taxes” position. However, it is misleading as it is narrowly only focuses on “income tax”, while excluded all the other taxes people typically pay – such as FICA (where it is capped for the more wealthy W2 earners), sales tax, property tax, etc.

I believe the more appropriate approach is to look at overall “tax burden” for people in each of those tax brackets. I don’t have the precise numbers (maybe Financial Samurai will redo his analysis to include?) but someone with a gross income in the lower quartile, say $40K/year, typically pays a higher portion of their “free income” in taxes compared to someone in the upper quartile, say $300K+/year.

For example, someone making $40K might pay close to nothing in income tax, but 100% of their income is FICA taxed (compared to ~50% for the 300K person, reducing toward <1% for super high earners). Plus, a larger portion of their free income goes toward daily expenses (food, gas, etc.) which are taxed again – so perhaps 50% of their after-tax money is taxed again at another 6-8% depending on the state. While the $300K earner maxes out his 401K, 527, etc. which are not taxed and also spends much more on discretionary items like nice vacations, nicer cars, 2nd homes, etc. (these are taxed but are not critical for someone 'just making' it today).

Taking such points into account, the tax burden is notably closer, and I would argue, more burdensome for lower income persons who are one paycheck away from bankruptcy.

Having said all that, I do agree, we still have an overall regressive tax system. But that is kinda the way it should be, right? Those who benefit the most from capitalism, should be willing/happy to pay the most. Such tax structure is typical of all productive and successful countries over the years and also the countries who have the happiest societies as a whole. Back in the Rockefeller days, Americans were proud to pay their taxes for being successful (extremely regressive at the time), yet today we've been taught to feel like the govt. is ripping us off.

By the way, if someone can think of a better govt. structure than ours taking in less tax while providing a high standard of living and the rule of law, let us all know! Just like large companies which unavoidably have waste, our govt. may not be perfect, but it has worked well enough for over 200 years now.

During the Gilded Age/Rockefeller era, the top marginal income tax rates were actually extremely low (around 7% at the federal level) compared to today’s standards. So while the wealthy paid taxes, the burden was relatively light.

However, there was less of a broad-based federal income tax system hitting the middle class at that time. So the wealthy disproportionately shouldered what federal taxes existed.

If i am served a large pizza i will eat two slices and be full. i would like another two slices to “save” for a rainy day. But the other half of the pizza is much more than i really need. i won’t miss the other half. i’m full.

if you put a slice of pizza in front of me for my meal and you then take three bites out, not a lot left for me. i’m still hungry.

the wealthy should pay much more in taxes for the benefit of society. it’s simply the moral thing to do. its nice to talk about the rich creating jobs but mostly they find ways to store and hoard their wealth. just about every religious tradition warns about the love on money for a reason. half of the laws our government does manage to pass are related to protecting the wealthy’s hoard.

when i started my career i made 40k and paid about 6k in taxes. now i make 800k and pay about 300k in taxes. why complain when i still have 464k more in my pocket? i’ve never bemoaned about paying taxes.

I didn’t read this post as the Rich complaining. Instead, I read this post as other people are complaining about the rich not paying their fair share, when they pay a greater percentage of taxes than their income. The rich also create jobs, and donate the most to charity.

Let me ask you this question, would you rather decide where you; $300,000 in taxes go, or would you rather let the government decide?

Sure, be happy paying your $300,000 in taxes. But let’s say you were asked to pay another $100,000 more to the government. How would you feel?

What does it even mean to decide where my 300k in taxes go? It is such a tired argument that somehow we should pay less taxes (or none) because we don’t like how it gets spent. What the heck would it even look like to do that? 300 million of us filling our a checklist each year and submitting to ANOTHER gov agency, which would need to be huge, to divey it out? How would it be implemented? How would this pie in the sky be implemented?

There is no country/civilization in history that didn’t levee taxes on the general population. At least today we know they aren’t going to build self-aggrandizing temples in every city and pyramids. Think real hard and ask yourself if you really want a system of no or very limited taxation that relies on individuals to fund all this stuff it takes to live in a society – medical costs, disease prevention research, infrastructure building and repair, welfare programs, national defense, and on and on. You really want to rely on the goodness of peoples hearts? If so, then I guess you wouldn’t mind having to run with your kids through a begging street leper colony on the way to your next broadway show from your parking garage?

I mean seriously, 60 percent of my fed tax dollars go to basically charity – medical care and research, social security, and welfare programs. What is so wrong with that? I’m not just some moral high-ground guy. Basically I’m contributing 180k of that 300k to worthwhile causes/charities that also (Selfishly) improve my life. I don’t really feel like having every crossroads filled with homeless tent communities and beggars outside every grocery store. If we dump SS are you ready to invite poor elderly into your home to live on the main floor (they can’t get up and down stairs well) while you live upstairs or in the basement?

I just ask that you think it all through…..

Taxes are a must and should be paid by all civilized societies. There is a reason we don’t know of any that flourished and didn’t have taxes…because they didn’t survive long! And yes there will be waste and ALWAYS better and more efficient ways to spend the money…just like if you give directly to the red cross or your church, some of it goes to waste. And if you are more inclined and it really bugs you, then become a politician and you can work for greater efficiency of tax dollars.

And finally the “rich create jobs” is a highly questionable hypothesis in its own right that you can google many papers on. I am one of those who creates jobs and pay considerable taxes. And one thing I can tell you is if my taxes go up I am not stopping my business and taking a 100k job working for someone else because I am tired of paying taxes.

I think there is a simple solution to the tax issue. All should be taxed on ordinary income (W-2, K-1, and exercised stock options) as follows:

0 to 50k – no taxes

50k to 150k – 10%

150k-300k – 20%

300k – 1 mill – 30%

1 mill – 5 mill – 40%

5 mill and up – 50%

“It’s worth considering how much stronger our nation could be if those who currently don’t pay income taxes contributed even a modest amount, like $500 a year regularly. If so, more people would care about our country as everybody would have skin in the game.”

While I kinda of agree about your “skin in the game” analogy, you give too much credit to the mindset of the masses. Realistically you are trying to squeeze blood from a turnip. Those people you are trying to milk a modest $500 from… are already living life at a negative net worth and living paycheck to paycheck. That $500 would come out of Walmart’s profit margins to purchase basic necessities and probably cause a hit to our consumer driven economy staple stocks, while funneling more money into government pork projects.

Even though it’s unfair, taxing the wealthiest 1% even more is the only way to increase federal income, while not upsetting the economic jengo board we current reside on. If AI takes off.. and replaces more human workers. We will be talking paying the peasants a living wage vs. taxing them anything… just to keep the system afloat.

But are there enough one percenters to Tax to raise enough money for all our spending?

The ultra wealthy 1% have the power and political means to rig the system in a way that they can set their own salary at whatever they like. They can essentially negotiate a higher salary or signing bonus to offset whatever higher taxation is set for them. So even if they raised tax rates to 90% of your salary, the end result would be everyone salaries in the top 1% skyrocketing about 6x what they are now to offset the 60% increase in federal taxation. CEO salaries would skyrocket or their bonuses would skyrocket in equal amount to the increased taxation.

Meanwhile, the upper middle class get squeezed toward the middle and lower class.. because they have less control and power of their salaries. CEOs get their salaries rubber stamped by board members they are in bed with. Occasionally it get challenged like Elon Musk’s did recently, but they always find a way to get paid.

It would be great to expand the percentage of working Americans who pay income taxes. Everybody pitching in is the American way.

I’m not sure why people vilify the rich when the rich create companies which create jobs. The rich also donate the most to charity.

I think rich people know how to better spend their wealth, then the government, which is incredibly wasteful.

Darth, they are one in the same. There’s too many congressmen to count that have net worths in the $100 million to half a billion range. Don’t pretend they aren’t all in bed with each other. Any waste in government is tied directly to wealthy bribes and pork projects that are negotiated by the ultra wealthy.

I was curious about the net worths of congress so I did some quick research. Per the link below (wikipedia), I only count only 11 congressmen with net worths in the 100 to half a billion range, which is certainly not “too many to count”.

https://en.wikipedia.org/wiki/List_of_current_members_of_the_United_States_Congress_by_wealth#:~:text=As%20of%202020%2C%20over%20half,database%20website%2C%20maintained%20by%20OpenSecrets.&text=118th%20Congress%3F

Interestingly, the median net worth for congress is only 1 million, which is way lower than I expected, especially given that that the median age is quite old at 57.9 years. The salaries shared in the link appear fairly low too.

I”m curious if that net worth includes their spouses? I doubt it. And it’s so easy to funnel money to your spouse. A quick google search factors in the net worth of all their spouses to at least match their net worth.. Mitch McConnell’s wife Ellen Chao net worth is $30 million… Paul Pelosi has north of $100 million net worth. You can effectively easily double every congress members net worth to get a more accurate number. And then all the gifts and real estate they funnel to their kids and grandkids isn’t included in that.

Pelosi is one of the 11 congressmen that I counted with a net worth between 100 million and a billion. McConnell is not listed in the link, since he is part of the senate, and would not typically be considered a “congresman”. However, the median net worth for the senate is quite similar for the senate as it is for house (~ 1 million). And of course, McConnell is near the top in terms of net worth for senate and would in fact be on the list of people between 100 million and a billion. However, both the Pelosi’s and McConnell”s are top leaders in Congress and have been there for so long that I consider them to be the equivalent of C level executives of government. Someone who is 75+ and has worked as C level executive in the private sector for some time should have a 9 figure net worth if they are any good.

Doubling the listed net worth means that the median net worth of a congressman is 2 million. Again the median age of congress is also 57.9 years, which is fairly late in life where one should have accumulated some amount of wealth. Moreover, two million is not a lot of money for someone nearing retirement age, though maybe it’s enough to cash flow ~ 100k and retire like an upper middle class worker. I would guess that the author of this blog has a larger net worth than 2 million. Like most, my expectation before doing this research was that the typical congressman (i.e. median) had a net worth 50 million+, but I guess I was wrong.

A good goal is to accumulate enough assets to hit financial escape velocity, then reduce income enough to sink your tax rate and get income-related benefits like government subsidies for health insurance.

Currently my family of 6 has an income high enough that we get zero health care insurance subsidy. I don’t have a W-2 so we buy our insurance on the government-controlled “exchanges.”

Without the subsidy our lowest-level bronze-tier health insurance costs >$24k/yr (after tax dollars) with a >$30k aggregate family deductible. If I can get our household income under $130k so it’s highly subsidized and costs virtually nothing. There’s more government subsidy goodies where that came from too, all legally kosher because they are based on income and not assets.

If you reduce your passive income and put more into appreciating assets that do not pay passive income, you can control exactly how much capital gain/income you get each year and calculate taking just enough to keep you under income limits and eligible for government subsidies. Another angle is real-estate-related ways to lower taxable income, all totally legal. Still figuring those out.

This is obeying the laws that the government has created. I don’t make the rules, just follow them.

This sounds like more a problem of our health care system than a general point on taxation.

Everyone in America deserves decent healthcare. It’s a shame the political parties don’t have the backbone to get something done vs. all the special interests throwing money their way in this regard.

I guess America knows something all the other rich countries who provide universal healthcare to the citizens don’t (and they do it at a lower per capita cost than America)

The ACA is the best system the Democrats could get. Most Democrats support a single payer Medicaid for all system and it could easily be paid for if the rich would pay FICA on every dollar of income the way workers do. It is really immoral and outrageous that people blame the government for our health care system when it is the private sector that lobbies Republicans that control the system and cause these high deductible plans in the first place. If we had Medicaid for all or Medicare for all the costs would decrease and every dollar spent on health care could go the doctors instead of private health providers that pay quarterly dividends to shareholders. We are the only country in the world that runs our medical system this way and it is immoral and wrong, but Republicans don’t care to change it and never have.

When I was young all of the private insurers in this country would not sell me an insurance policy at any price because I was born with a minor health issue. I still can’t see how that was legal but it was. We need to tax everyone to pay for better and fairer health care including long term care for seniors. We have the money to do it, we just lack the decency and moral courage to do it. The ACA is a big improvement, but definitely not good enough. If you can’t afford your health care you need to vote for candidates who will change the system and lower costs over time. That is the only long term solution. We need to take the profit out of health care. Non-profits can and will lower costs and pay doctors better as a result.

ACA was simply a means to transfer taxpayer dollars to the private insurance industry much like Medicare Advantage Plans. I have no idea why you believe the Dems favor single payer – their donors certainly do not. The wealthy already pay Medicare taxes on their overall income as it does not max out like social security

Healthcare is awful in the US but single payer will not fix that. A system that actually rewards unhealthy behavior over healthy behavior is always doomed to fail.

All we have to do is copy what other countries are doing well in terms of their health care systems and we actually already cover a lot of people in a single payer system. We just need to provide that single payer system to young people and problems with access to care would be solved. My parents are on Medicare and they have the best health care in the world. They can see any doctors they want and they pay until they reach their affordable deductibles and then they pay nothing for the rest of the year.

Medicare for all would work awesome, but Republicans block every attempt to do that in this country. Not to protect doctors, but to protect the pencil pushers who receive dividends and share buy backs for denying care to people. Also Medical school should be free for students and we should allow more people to go to medical school in the US to drive costs down. I have a family friend who went to Med school in the Caribbean because she was not accepted into Med school in the US even though all of her test scores and other standards put her in the top tier of possible med school candidates. Needless to say she is a successful doctor in the US now, but why are so many qualified students rejected for no reason?

We have a costly broken system and it is going to get much worse before it gets better I am afraid.

I suspect you do not travel very much. Medicare is far from being the best healthcare in the world and there are many doctors who will not even accept it. Your parents undoubtedly have not been very ill. My father had Medicare and while the bills were paid, the level of care was awful.

I have lived in several states during my life and so have my parents. My niece had life saving health care from Medicaid and the services she received were world class. My parents have received care for all kinds of things including cancer and the treatment options again were world class and the bills for the care were minimal.

You are right about one thing, some states are awful at providing care all around. When I lived in the South some of the medical facilities were God awful. Waiting rooms were packed with people and the lack of attention to detail was evident in everything. It was difficult to find good doctors, but we found them in every area we lived in sometimes through word of mouth and trial and error.

Bottom line I would trade my overpriced basically worthless private health care insurance policy for Medicare any day of the week. I pay an enormous amount of money in premiums and get very little in return. Expensive medicines are not even covered on my current plan and if I want any of them it is thousands of dollars out of my own pocket. Other countries simply handle prescription drug benefits better and I would like the US to implement those models.

There is way too much fraud, waste and abuse in our private health care system and I have family members who are direct beneficiaries of the current system and even they are uncomfortable with the people they work with denying people care at times to pad profits. People in the US need health care not health insurance and one day this nation will have a good system again.

Unfortunately Medicare is just another form of insurance and is not healthcare as such.

It simply pays private providers at a govt fixed rate.

I definitely do not want that as my only option

Medicare has worked well for me, especially when coupled with Supplement and not Advantage plan, no trouble at all choosing any doctor, no bills to deal with and low cost Part D Prescriptions, not bad for $175/mo + supplement $119 which includes free gym membership.

Sorry Sam, but I totally agree with CHADNUDJ here on his take (his posts are well worth reading) and feel like you are really missing the mark here.

First, your title of “Rich Pay More Than Their Fair Share” has the ability of excellent clickbait and for egging on discussion (and I leap into the trap :-) ) but it doesn’t stand up to real scrutiny.

Your definition of rich is the first thing that is off the mark. 20 or 30 years ago it was fine to just say the ‘top 1%’ but income and wealthy inequality has grown so much in the USA that you have to distinguish between the top 9.90% and the top 0.1%. Your words strike clearer if you are talking about the more mass affluent rather than the rich:

“The top 1% of taxpayers (AGI of $682,577 and above) paid the highest average income tax rate of 25.93% in 2021.”

The US is an anomaly in the developed nations: “In contrast, studies have found that the top 0.1% of income earners in other developed countries like the UK, France, and Germany typically pay average income tax rates around 30-40%”

The mass affluent, those making over $200K to $600K+ (which might seem like rich to many, but really isn’t versus higher tiers) are paying about 25% on average. I know some commentators are putting in 50%+, but they are confusing top marginal rates with averages.

If you want to make a case for the mass affluent to be paying their share and perhaps more then I could believe it to a point, but not to the part where they are “paying more than their fair share”.

I have often seen the argument of how little the “poor” pay of taxes and the “rich” pay too much. This is an ugly statement that directly implies that the “poor” aren’t doing their part in our capitalistic society. If you look at some statistics this seems to shallowly back this reasoning:

“The share of income taxes paid by the bottom 50% of taxpayers has fallen from 7% in 1980 to just 2.3% in 2021, as the tax burden has shifted more towards higher income earners. Numerous tax credits and deductions, such as the Earned Income Tax Credit, have allowed millions of lower-income Americans to pay little to no federal income taxes”.

So this is bad? We should go back to where there was less support for lower earners? Yes, there are always going to be individuals who scam the system, but the majority need the help. Society is supposed to help the weakest and most vulnerable, even at the cost of abuse by some.

Why direct your ire at the poorest levels? I believe that you should be looking upwards and not downwards, as written before:

“In contrast, the White House Council of Economic Advisers estimated that the 400 wealthiest families (the top 0.0002%) paid an average federal individual income tax rate of only 8.2% from 2010-2018.”

Many people admire Elon Musk for many accomplishments, but tax fairness shouldn’t be one of his shining virtues: “According to ProPublica, Musk paid only 3.27% in taxes relative to the growth in his net worth from 2014-2018, which is much lower than the average household tax rate. Musk does not take a salary from Tesla, but instead borrows money against his Tesla stock holdings to fund his projects and expenses. This allows him to access cash without realizing taxable income. ”

Not to pick on Musk alone, but this is systemic. Some point out that he will have to pay taxes once he sells his shares. Ok when? And what happens to that tax owing on his estate? Or if he moves to a lower tax rate state, after accruing all sorts of advantages from California?

Again, not to just pick on Musk but this is throughout the system and the growing inequality of wealth and income is well documented between low and high and between 1% and 0.1%.

So your rallying cry ton how you positioned your post, Sam, rings hollow to me:

“You might wonder, “Isn’t it natural for the wealthy to contribute a significant portion of income taxes? After all, they earn the highest incomes!” However, when we discuss fairness, true equity would entail the wealthy paying the same proportion of all income taxes as the proportion of all income they earn.”

When a portion of society own and control a larger share of a country’s wealth and that portion is geometrically growing utilizing the tax system, (or as some would say weaponizing it), to come out and say they are paying too much misses the mark in the real world.

You are not differentiating the vast differences between those earning $500K and those worth hundreds of millions+. I pity those earning “merely” $500K, especially in expensive cities.

But to turn your sights on the lower income group instead doesn’t seem right to me. We have a progressive tax system in order to help groups and individuals. But that progressive tax system is broken. Not by the bottom end, but by the top end.

I respect your writings and part of this post has my agreement, but not the title and not what you believe is the problem.

Open to criticisms.

It’s always funny how people say things like “That bad guy Musk isn’t paying taxes!” Lol – he paid $11 billion in 2021, the most paid by an individual, EVER. And you are complaining? How much did you pay in 2021? Is $11 billion in one tax year not enough for you? Attitudes like yours are revealing to say the least.

Even if what you said were true, why blame Musk? He is just following the tax laws as written by Congress. If he’s breaking the law, ok fair enough. But if he’s following the law shouldn’t you be directing your criticism towards Congress?

SCOTUS established many years ago that citizens have no obligation to pay more tax than they lawfully owe. Somehow you think they should pay more that they law says they owe. It’s very generous of you.

Elon paid that money because he sold something (his stock), not because he paid tax on any income he earned. That’s a big difference. And, he paid only long term capital gains rate. So, $11bil tax bill sure would suck, but, in perspective, he happy.

I think he used it in the process of acquiring Twitter(?). So, he’s lost a bit more than that on his decision!

I think one important mistake I think almost everyone makes about our income tax system is that everyone pays the exact same amount (in theory) for the same income. That is two guys making $40K and $400K, pay the same tax rate for that first $40K of income, etc. Given that general thought process, I am pretty sure, that guy making $40K would be more happy to pay a bit more tax if he could double his income to $80K, and a bit more to double it again to $160K, etc. However, once we get up to those higher incomes and look back, we feel it becoming more ‘unfair’.

I am fortunate to be in the top 1-2% of Americans and my taxes hurt every tax season, but taken in perspective, I’m happy to be where I’m at.

Hey Charles, Elon is a prime example of reducing taxes so it is a obvious to use. If you want to replace Jeff Bezos or many other billionaires who use similar tax strategies then go for it. I did write ‘systematic’ in my original post.

How much did I pay? Less than $11 billion. But this means I can’t question my ‘betters’? More importantly the entire conversation has been based on percentages and not $$ figures because everything is relative. So a big figure like that can seem huge, but what is that as % to the income & wealth figure?

It is not just about Musk, but a pattern amongst the super-rich: “Other billionaires like Jeff Bezos and George Soros have also paid little to no federal income tax in certain years, using legal tax strategies to minimize their tax burden.”

While we are throwing around large figures we have to also point out a huge tax savings that the super-rich (and less) can save using totally legal strategies:

“In total, if Musk is able to complete his full $55 billion compensation plan from Tesla while residing in Texas instead of California, he could save over $7 billion in state taxes.”

The point of all of these conversations is not that anyone is breaking the law, but instead how a class of citizens have ‘weaponized’ the tax system to pay considerably less versus the top 99.9%.

Democratic societies want to make a more equal society. So America has changed and adapted its laws towards this goal.

To deny there is an issue or to broadly say that the ‘rich’ is paying too much tax is mathematically wrong. We have to be careful on who is labelled as rich.

Enough on this.

Dude – “weaponizing tax law”? “Weaponizing?” Lol you’ve been watching too much CNN.

Bezos, Musk et al are FOLLOWING THE TAX CODE WRITTEN BY CONGRESS. Moving to lower-tax FL or TX away from high-tax WA or CA is totally fine. They are under no obligation to pay more than the law requires, and they are free to move.

You say you’re upset that different income sources (e.g. wages and cap gains) are taxed at different rates. Have you ever sold stock? Did you make sure you paid the same % on the cap gain as you paid on your W-2 income, even though the cap gain tax rate is lower than your W-2 tax rate? The IRS gladly would accept an extra conbribution. No? You are weaponizing the tax code!!!

Sorry, I cannot take you seriously. You are your own satire. Thank you drive thru.

One must remember that Elon reinvests much of his income which creates jobs and thereby by default increases tax revenue. Would you rather the govt or someone like Elon manage his resources? I for one have no desire to see nearly 100 billion of taxpayer funds go towards war as we saw this past weekend. It was sickening to watch them cheer. The govt should be focusing on peace initiatives like that of Ireland in years past. I mention the war funding because Elon is opposed.