Trump's middle class tax hike affected millions of Americans. This article was written to help prepare for Trump's middle class tax hike. Now that Trump is no longer President doesn't mean his middle class tax hike isn't here. The Tax Cut And Jobs Act Lasts until 2025.

With Joe Biden as President, taxes shouldn't go up for the middle class, only the top 2% making over $400,000 a year. However, it's too soon to tell what's going to happen.

How To Prepare For Trump's Middle Class Tax Hike

Higher interest rates are already a tax on consumers through higher mortgage rates, higher student loan rates and higher consumer loan rates. Is the economy strong enough to withstand a sudden ~30% increase in borrowing costs? Hopefully yes, since the actual rate we pay takes time to adjust higher, e.g. 5 years for a new 5/1 ARM to adjust.

Given the market determines rates, we can't fully blame Donald for making borrowing more expensive for everybody. But what about Donald Trump's plan to increase taxes on the middle class? Let's learn what's going on here and help find solutions for millions of Americans who are increasingly getting squeezed.

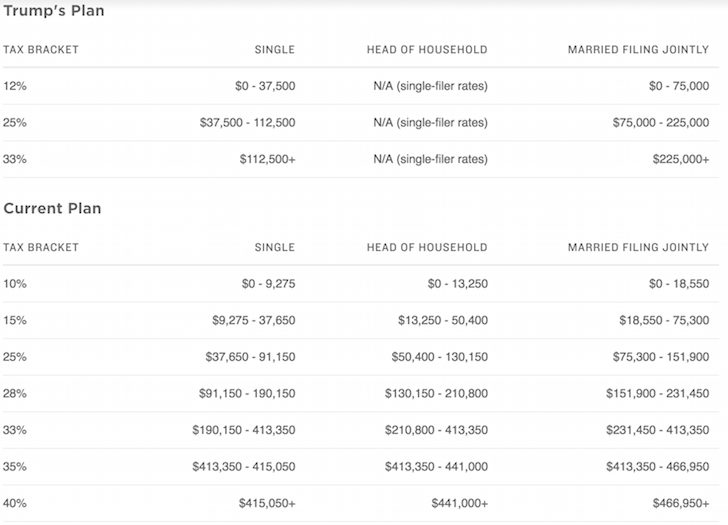

Below is a comparison on Trump's PROPOSED tax plan versus the current plan. Can you spot the tax hike?

Individuals who make $112,500 – $190,150 will see their federal marginal income tax rate go up by 5%, from 28% to 33%. The closer you are to making $190,150 as an individual, I estimate the closer you are to paying ~$3,000 more in federal income taxes.

The math is simply $190,150 – $112,500 = $77,650 in income now taxed 5% higher at 33% rather than 28%. Therefore, $77,650 X 5% = $3,882.50 more in taxes.

However, due to the the tax cut for income between $9,275 – $37,650 (15% to 12%) under Trump's plan, you get a savings of about $851.25. Therefore, the Modified Adjusted Gross Income after deductions that is subject to taxes really is between $130,000 – $190,150.

Some of you might be thinking $112,500 – $190,500 isn't a middle class individual income, but I absolutely believe it is for 50% of the country who live in expensive coastal cities and other large cities such as Denver and Chicago.

If we believe we shouldn't responsibly spend much more than 3X our gross annual income on a home, then all an individual earning $112,500 – $190,150 can afford is a $337,500 – $570,450 home.

With the median home price over $1M in SF and NYC, you've got to earn closer to $330,000 just to buy something mediocre! Even with a $190,150 salary, you can barely afford the median $505,000 Boston home. You're certainly stretching to afford a $594,600 median home in Seattle as well.

The Democratic rhetoric has recently been that any individual who makes over $200,000 is deemed rich and should be subjected to higher taxes. The Republican party rhetoric has recently defined individuals who make over $400,000 to be rich. Therefore, it is baffling there is a 5% marginal tax hike for those individuals who make essentially HALF these amounts.

Half of $200,000 (Democratic rich) – $400,000 (Republican rich) = $100,000 – $200,000. Half = middle. Middle = middle class. Why is the middle getting penalized?

Why The Tax Hike?

I'm not sure why Trump wants to raise taxes on the middle class. It's good to hear he plans to abolish the Alternative Minimum Tax (AMT) and the 3.8% Net Investment Income tax on individuals/couples who make more than $200,000/$250,000. But those benefits accrue mostly to individuals who make more than $190,150.

It's nice Trump doubled the estate exclusion limit (death tax) for individuals to $11.4 for 2019. Getting taxed again after you already paid taxes on your wealth sounds like robbery. But given most of us don't plan to die within 4-8 years, any changes to the death tax don't really matter because they'll surely be changed again.

A 5% tax hike on the middle class and a 6.4% tax decrease on the top 1% income earners who make over $415,050 is not helping the majority of people keep their hard earned money. In fact, it's estimated that the top 1% will enjoy ~50% of all the tax benefits.

Related: How To Live Like The Top 1% Without Being In The Top 1%

Why aren't more middle class people upset about this tax hike? Is it possible that most people making between $112,500 – $190,500 are simply unaware they will be paying more a year in taxes? Or maybe the middle class is actually doing just fine and is happy to pay higher taxes? You tell me savvy readers.

After surveying more than 25,000 of you, more than 45% make over $100,000 a year and will likely be paying more taxes.

Below is a realistic budget for a single father with a child. He works at Mega Corp and will see his year-end money buffer decline to only ~$2,000 a year after paying ~$3,700 more in income taxes under the new Trump tax plan. One miscellaneous expense or mishap and he's in the red.

Below is a more complicated example of a single mother with two children earning $200,000. She saves 15% of her gross annual income a year through her Solo 401k. Her biggest expenses are childcare assistance and healthcare, which is spiraling out of control for those who have to pay 100% of the monthly premium. I've estimated her effective tax rate goes up by 3% after Trump's tax hike, leaving her in the red each month.

Before you complain about the accuracy of the numbers, they are just rough estimates. Each person has different deductions allotted to them. The bottom line in that the closer you get to $190,150, the closer you will pay the $3,882 in increased taxes. The 3% tax savings on income between $9,250 – $37,650 is only $852. If you want to save on taxes, you really shouldn't make more than ~$130,000 per person.

The Solution To Lowering Your Taxes

If you are one of the millions of Americans who is facing an impending 5% federal income tax hike, your solution is to get married and make no more than an modified adjusted gross income of $225,000 combined. This way, you can keep on paying a 25% federal marginal income tax rate and benefit by paying 3% less than the existing system on income between $151,900 – $225,000.

Under the current tax plan, household income between $151,900 – $231,450 is taxed at a 28% federal marginal income tax rate.

Here are some sample marriage income combinations for the perfect tax minimization solution:

1) Stay At Home Spouse

Spouse 1: $225,000 income

Spouse 2: $0

2) Two Professionals Who Met At Work

Spouse 1: $115,000

Spouse 2: $110,000

3) Public School Teacher And Private Industry Professional

Spouse 1: $55,000

Spouse 2: $170,000

Of course, you can make more than $225,000 by the amount equivalent to your mortgage interest deduction and property taxes. If you run your own business, you can make more than $225,000 by the amount equivalent to your expense deductions.

The key is to not stay single. It's bad enough you've got to compete with DINKS, and DINKS + their parent's money to buy a home or pay for other big ticket items. To add on higher borrowing costs and pay higher taxes is just too cruel.

Related: When Does the Marriage Penalty Tax Kick In?

My Solution To Paying Less In Taxes

As an individual, I've either got to kill myself to try and make as much as possible over $415,050 to take advantage of the new 33% marginal federal income tax rate. Or, I've got to limit my individual adjustable gross income to $112,500 to pay a reasonable 25% marginal federal income tax rate.

Which is harder to do?

The Strategy For Making Less

Because ~70% of my traffic on Financial Samurai is from search engines like Google, the traffic is very passive. In other words, if I do nothing all year my online income would still be greater than $112,500, the individual income level where taxes go up from 28% to 33%. Passive income is one of the beauties of having an online asset. I just write a lot because it's fun and there's always something interesting going on to learn about.

I could sell all my dividend paying stocks and hold cash, but that still leaves about $200,000 in passive income that cannot be reduced immediately because there's an early withdrawal penalty for CDs, tenants with signed leases, and private investments with multi-year commitments.

One solution is to just sell Financial Samurai once new tax legislation passes and call it a nice eight-year run. That way, I'll have no more taxable online income. Let's say I can sell Financial Samurai for $10,000,000 after taxes. I can just hoard cash earning 0.2%, which equates to $20,000 a year. $20,000 + $180,000 in passive income = $200,000. I can then deduct about $40,000 in property taxes and mortgage interest from my primary residence to get to a $160,000 taxable income.

As time passes, I can slowly convert all passive income assets to cash, thereby further lowering my income. Paying taxes on <$160,000 equates to about a 26% effective marginal federal tax rate under the new plan. Not too unreasonable, especially if I can just plunder my cash to live.

Of course, I can actively give money away to reduce my taxable income further while helping other people in the process.

Related: Focus On Building Your Net Worth More Than Growing Your Income

The Strategy For Making More

Making a lot more than $415,000 is not easy. But it's possible with some planning and extra labor.

1) Don't sell Financial Samurai, but continue to grow it. Minimum $150,000 income.

2) Keep passive income portfolio as it is. Minimum $200,000 income.

3) Do more corporate consulting. Minimum $120,000 income.

4) Do more 1X1 personal finance consulting. Minimum $30,000 income.

5) Get a J.O.B. Minimum $150,000 income.

Total baseline income = $650,000

Unfortunately, doing 3, 4, and 5 will require an extra ~50 hours a week, which means my total weekly work hours would sky rocket to 70+. I'll also gain weight, get stressed, start getting gray hairs again and be more bitter at the world.

The tax savings from making $650,000 would equal ($650,000 – $415,000) X 6.4% = $15,040. When I put it this way, working an extra 50+ hours a week to “save” $15,040 in taxes doesn't seem worth it at all! Further, at $650,000, I'll have to pay 13.3% California State taxes instead of “only” 10% on income up to $250,000.

The reality is, if my baseline income is $350,000 ($200K passive + $150K online income) for ~20 hours a week and I add 50 hours a week to get to $650,000, I'm really paying ($650,000 – $350,000) X 33% = $99,000 more in federal income taxes. It's the whole “buy more save more” mental scam. Given I'm already paying over $100,000 a year in total taxes, paying another $99,000 a year in federal taxes + another $53,200 in state taxes would actually start to piss me off.

It seems like highway robbery to have to pay over $250,000 a year in taxes when you're killing yourself and not using massive public resources. And for what? To one day live a better life that's more free and less stressful? I'd rather just kick back, pay less in taxes, and be free right now! After all, happiness does not increase with an income over $250,000 a year.

Obvious decision made: It's much better to go the easier route by making less money to pay less taxes and live more freely. I believe in enjoying life to the maximum because I'll never be able to make another minute of time. I know plenty of deca-millionaires who are no happier than an average person still looking to save for retirement.

For those who object to going the easier route, answer me this: Are you willing to work 50+ more hours a week to try and make $300,000 more just so you can pay $100,000 more in taxes? If not, then you've caught yourself in an incongruent state of mind.

Latest Marginal Income Tax Rates

Here is are the latest Federal marginal income tax brackets to understand a future tax hike. Thankfully, they aren't as punitive as first proposed. That said, there have been plenty of reports saying those who earned between $60,000 – $150,000 in 2018 are paying more in taxes.

The good thing about the latest tax brackets is that it essentially eliminates the marriage penalty tax for singles who make up to $300,000 a year and decide to marry.

Middle Class Americans, STAND STRONG!

Being middle class is the best class in the world. But we're now getting squeezed by higher taxes and higher interest rates. First the government wanted to raise taxes on those making over $400,000 a year. Then they went after individuals making over $200,000 a year. Now they're going after folks making even less. See the pattern?

Eventually, the government will come for us all. Everybody needs to make some pro forma calculations of their annual total income and decide how hard or how smart you want to work.

The only beneficiary of higher interest rates and higher taxes I can think of are those who take advantage of higher savings and short-term CD and bond rates.

If you aren't maxing out your 401k, definitely start doing so ASAP to shield as much income as possible from the impending tax hike. You'll be amazed at how much you can accumulate if you stick to the program. Max out for 10 years in a row and you should easily have over $200,000 for retirement.

Wealth Building Recommendation

Manage Your Money In One Place: Sign up for Personal Capital, the web's #1 free wealth management tool to get a better handle on your finances. In addition to better money oversight, you can run your investments through their award-winning Investment Checkup tool to see exactly how much you are paying in fees. I was paying $1,700 a year in fees I had no idea I was paying.

After you link all your accounts, use their Retirement Planning calculator that pulls your real data to give you as pure an estimation of your financial future as possible using Monte Carlo simulation algorithms. Definitely check to see how your finances are shaping up as it's free.

I've been using Personal Capital since 2012 and have seen my net worth skyrocket during this time thanks to better money management.

Updated for 2021. Trump's tax plan hurt coastal city income earners the most due to the SALT deduction cap of $10,000. However, with President Biden, there could be a SALT cap repeal, which would help expensive city residents. Just watch out for the income tax hike and capital gains tax hike.

The secret to not paying more taxes is to get married? Hah. That’s a good one. Even though current tax law fixed some of the marriage penalty it’s still very there. You even noted if you earn $200k as single you are subject to 3.8% cap gains tax but if you are married you can only earn $175k per person! So you pay 3.8k more on 50k if you are married. If you make over $500k (which is very possible at middle class in coastal city), your partner has little incentive to work as their income will be taxed higher. I don’t understand marriage tax rates at all. All taxes should consider everyone individually!

Well here we are in 2020 tax season…. Just like many who have spoken out. My son who I have claimed as a dependent joined the military, therefore I can no longer claim him. My taxes went from getting a tax return to owing taxes. This is huge for me because I am a single father and the difference was $6000. I am completely at a loss as to how our tax laws are still gouging the middle class worker who busts their asses off to make a living…. When will our lawmakers STOP giving our hard earned money to foreign countries and look at the monetary crisis right here in the USA…..

Man, that seems wrong. Hopefully it is an error and you can get that $6,000 difference down.

Seems like tough times are back again with the stock market melting down and the coronavirus slowing the economy.

Hang tough folks!

We just did our taxes and I instantly took to google because I didn’t know what was going on! This new tax law has hit us hard! We made 137,000 combined which is not rich at all, but we owe 2,000 in Federal. My daughter graduates college this year so next year will be even worse. My wife and I both claim 1, but will now go to 0 and possibly still not break even!

Worst is the SALT Credit. If my wife and I were divorced and filed separately we would both get the credit, but since we are married we get 10,000 combined? What a way to promote the sanctity of marriage. The Tax law is broken and needs fixed!

My wife and I are not rich. We busted our ass to raise two great kids. We have never had a handout and for years I worked two jobs. I understand there grown now, and we lose those deductions, but to get a double whammy by this new tax law is upsetting to say the least!

Thank you for you great article. I know it’s a older write, but you predicted the future! I never thought I needed a financial adviser at our income but I will get one now because they are after all our money, and not just the rich guys!

Just did my taxes and have to pay about $1,000 more on virtually the same fixed income. Retired with social security and annuity income. Married filing jointly 2017 about $75,000 income, $23,000 itemized deductions(mostly health expenses and premiums) and paid about $3,400 in fed taxes. Same circumstances in 2018 as far as income and deductions (new standard deduction was used as it was a bit higher) but because of the loss of the two personal exemptions my new fed tax is $4,350. Thanks for the tax rate cut as it would have been worse.

You may want to add to your examples that anyone who had itemized deductions between $16,000 and $24,000 will pay more taxes on the same income despite the higher standard deduction-it does NOT make up for the loss of the $8200 personal deductions for my wife and I.

Wished that I had read this article back when the new law was enacted. I was hit with the double whammy of less withholding and loss of deductions, including SALT, and Education expenses. My wife and I have a combined income of $175K (which puts us at 24%) and are paying $5000 more in tax for 2018. I’ve already taken steps to decrease my allowances and increase contributions to my tax-deferred retirement plan. I’m still contributing to charities but this has got to affect charitable giving.

I didn’t even vote for the guy wonder how some of supporters feel about him now.

I think the income examples forgot a couple of things on the tax side of things.

Childcare FSA

Health FSA

Health insurance deductions/healthcare deduction % of gross income

Mortgage interest deductions

Property taxes etc.

It doesn’t refute the main point though, but it does change the numbers a bit.

My tax liability went up $500. My son’s went up $12,000. Thanks for nothing, Mr. Trump!

My tax burden went up almost 20%, From 14K in 2017 to 17.5K in 2018. Everything was same, but i lost 21K in deductions. Thanks Trump, you orange clown. Look, everyone with a modicum of intelligence knew the middle class was getting screwed to pay for trumps buddie’s tax gift, i just hope the “normal” republicans who think Dems just want to tax them so they vote R, i hope this tax increase wakes them up.

Losing deductions is a slap in the face for my husband and myself. I may not even vote this next election what does it matter, Trumps tax plan is a farce and what the Dems proposed seemed on the surface worse but the final outcome may have been better. We are also paying much more in taxes and see no end. We might be better off to rent not own and work minimum wage that way we could pay our bills. We get NO breaks full price for our kids college, now that they are grown a child tax credit doesn’t help. We are not in any position to retire especially not now. This stinks!!! Retirement in another country maybe?

Currently, I am a stay at home spouse with a spouse that earns $40,500 annually.

We reduced the items claimed on the tax form to 0, and still have to pay in.

According to the guide lines from the IRS an income at $40,000 is taxed at 22%.

How do they arrive at this number, when you are saying we should only be taxed at 15%?

Are those brackets and %s correct in the article?? I thought it was 10%, 12%, 22%, 24% 32%, 35% and 37%?

Single

Tax rate Taxable income bracket Tax owed

10% $0 to $9,525 10% of taxable income

12% $9,526 to $38,700 $952.50 plus 12% of the amount over $9,525

22% $38,701 to $82,500 $4,453.50 plus 22% of the amount over $38,700

24% $82,501 to $157,500 $14,089.50 plus 24% of the amount over $82,500

32% $157,501 to $200,000 $32,089.50 plus 32% of the amount over $157,500

35% $200,001 to $500,000 $45,689.50 plus 35% of the amount over $200,000

37% $500,001 or more $150,689.50 plus 37% of the amount over $500,000

Married filed jointly?

10% $0 to $19,050 10% of taxable income

12% $19,051 to $77,400 $1,905 plus 12% of the amount over $19,050

22% $77,401 to $165,000 $8,907 plus 22% of the amount over $77,400

24% $165,001 to $315,000 $28,179 plus 24% of the amount over $165,000

32% $315,001 to $400,000 $64,179 plus 32% of the amount over $315,000

35% $400,001 to $600,000 $91,379 plus 35% of the amount over $400,000

37% $600,001 or more $161,379 plus 37% of the amount over $600,000

I can’t really feel bad for those who voted for trump and now have to pay more taxes. I feel bad for myself because I’m caught up in that. I hope by 2020 the democrats will grow a spine and revert EVERYTHING that trump has made.

My husband made 20K less in 2018 than 2017 yet our refund is much less this year under Trump’s “tax reform”. I see they are robbing from the lower middle class with no child dependants to give the new double rate to all the welfare and anchor babies. Robbing from the lower middle class to give to the poor entitled losers who refuse to work and to the top 1% in tax cuts. THIS IS INFURIATING

Here in MD, if you itemize, the new tax law will likely have you picking standard deduction, which is a loss for us from previous years, especially since this year we bought a new house (high interest payments by 4x previous).

Middle class person here. I checked the updated tax bill, and I’d come out ahead from it by a lot! Most people will get a tax decrease here, I’m pretty excited.

Thank you for saying something positive

single; no kids; 2 properties in a high tax state; high income tax. I am being robbed

by this new tax. 12K is nothing. I want to live in a cardboard box by the side of the road

or just go to jail for noncompliance. :(

Seems like the latest bill negates this, and everyone gets a tax reduction for an equivalent taxable income.

Of course, those who itemize are unlikely to have an equivalent taxable income. It seems clear that all of those who live in california and have enough mortgage interest and property taxes to justify itemize will get a tax hike under the latest proposal (due to loss of state tax deduction).

Those who earn $12,000 single or $24,000 married pay $0 taxes under Trump’s plan. So it has a positive impact for low income earners. So this changes nearly everything and makes most of your assumptions wrong.

That is great right?

Why shouldn’t the super wealthy do their part since they are usually the greatest polluters with private jets, gas guzzlers and huge homes that produce children that do the same while manipulating our elections and laws for their own benefit! We need to keep the estate tax to even out the damage they do to our Country and planet! As far as home values/expense/mortgage payment to income ratio don’t tell the facts!1st $150,000@$650 home with $100,000@$8,333mth income vs 2nd $200,000@$900 home with $150,000@$12,500mth income ($650/$8,333) ($250/$4,167mth) Payment to income ratio increase) vs 3rd $300,000@$1,300mth home $300,000@$25,000mth income ($650/$16,667) & ($400/$12,500 payment to income ratio increase over each previous figure) vs 4th $400,000@$1,700mth home $400,000=$33,000mth income

$150k home $100 income to $400k home $400k income ratio increase ($1,050/$24,667) 2nd 300k to 400k ratio($800/$8,000) Not very fair ratio comparison or a wealthy person’s rational!

At one time Trump was proposing the “1-5-10-15” income tax policy consisting of the following:

* Those making up to $30,000 will pay 1 percent.

* Income from $30,000 to $100,000 results in a flat 5 percent.

* $100,000 to $1 million income will be taxed at 10 percent.

* On $1 million or above will be taxed 15 percent.

https://www.thepoliticalinsider.com/donald-trump-unveils-his-bold-income-tax-proposal-this-is-a-big-deal/

But if I am understanding the situation, now all that is out the window. (Is Trump just another lying politician?) Now many will get a tax increase including single tax filers making between between $112,500 and $190,150, or joint filers earning between $225,000 and $231,450.

If the above applies to you, you’re going to be kicked into a 5% higher tax bracket. You will also being paying more on capital gains.

Those in states like California already have to deal with high state income taxes. In California the people above are already in a 9.3% marginal tax bracket. Combined with Trump’s increase they are looking at a whopping combined 42.3% tax bracket!

You could be paying thousands of dollars a year more than when the DEMOCRATS controlled the House, the Senate and the White House. Yes, more than you did under Obama!

How can we stop this?

What can we do besides write or call our Congress Critters?

Under the Trump plan I would have paid ~$2,300 less in taxes this year. Single, $89K.

That is great!

I did do the math before voting and didn’t vote for him. I’m unmarried, income of $173,500 living in an expensive area with a child due in 2017. I’m paying student loans at 6.875%. I could refinance them, but there are only rate savings on variable rate loans and you’d have to be a fool to lock student loans in to a variable rate product. With Clinton, I had a fair chance at federal refinancing and wasn’t looking at increased taxes. Granted, her childcare proposal is 10% of income wasn’t helpful, but otherwise she was a much better outcome for me personally. Great post, Sam.

Another solution I would like to add for those individuals earning $112k or more… start your own business. Under Donald’s tax proposal, you would only pay 15% tax rather than 33%. Trump has stated that under his tax plan, all businesses whether fortune 500 companies or small home based freelancers will pay no more than 15% tax.

Exactly even if it is party lite or any deduction. That is what he is encouraging from what I understand the benefits to that are amazing!

To those single individuals earning over $112k, I suggest getting married! Between my wife and I our taxes will actually be going down thanks to Trumps tax plan, from 28% down to 25%. Thank you Donald Trump!

The tax code is nothing more than a system of incentives. The government wants you to get married and is willing to give you a tax break for doing so. You should listen :)

Also I can’t express enough how excited I am about the corporate tax being slashed down from 35% to 15%. The US will finally have a globally competitive corporate tax rate. Here are the corporate tax rates of a few other countries:

Ireland 12.5%

Canada 15%

Germany 15.83%

Switzerland 8.5%

Paraguay 10%

Cyprus 12.5%

Qatar 10%

Iceland 20%

Montenegro 9%

Liechtenstein 12.5%

Albania 15%

Get ready for businesses to start popping up left and right.

It doesn’t make sense for single people to marry for a tax savings because Trump’s married brackets are twice what they are for singles. The only time it makes sense is if one partner doesn’t work, or if kids are involved because head of household is going away. Trump really isn’t giving a handout to married people…its more of taking a benefit away from single parents which I’m all for. Nothing against single parent’s…but I don’t see why I should have to subsidize someone else’s life choices like that.

As a single guy making six figures if I married a woman with an income close to mine, we wouldn’t save anything as long as we both continued to work.

If middle class taxes do increase I think it’s more important than ever for people to get a handle on their personal spending. There are some things we can control financially, and beyond writing letters to our Congresspeople, taxes ain’t one of them.

But we can go through our budget line by line and try to eliminate or minimize whatever we can. I’m fairly certain the vast majority of Americans have not done this within the past year. Money saved would more than make up for any extra taxes paid for the year. If you’re going to pay $3,000 more in taxes for the year you just have to save $250 per month. That’s pretty much cutting cable and getting cheaper car insurance.

And listen to Sam don’t buy a car that’s more than 10% of your income. More expensive car means more sales tax paid and usually higher insurance premiums!

Syed, a lot of people are already maxed out. I’m not sure why you would think that they can eliminate more. $250 a month may not be a lot to you but it is a lot to them. Even if they could eliminate to save $250, $100, or $300, they be able to keep the money and contribute to a 401k for THEIR future instead of always being expected to give it away via taxes?

As I said, I’m fine and I could find that $250 but because I already pay a lot I think I pay enough. Besides, in my case not only am I putting money away for my elderly years, being that we are a sandwich generation we are also having to help OUR OWN elderly parents and believe me that takes a chunk of money. Hillary and Trump talked about the elderly living in poverty (elderly people who make too much to get government help but not enough to be able to take care of their medical bills). Why should we always have to give our money to government instead of being able to take care of our own.

I do however agree with your last statement.

If people don’t save and invest for your future today, then you become tomorrows poverty.

Just because you make enough to live on today doesn’t mean you should be required to give away extra money instead of using your money to build your own wealth to take care of yourself when you can no longer work.

The biggest expenses are medical bills and taxes. We need affordable healthcare and a reasonable tax system. Both of these need to reform, if not, the working class and below will still live on the edge regardless which party is running the country.

This topic talks about taxes however, people in this wage group are paying full ticket price for their healthcare insurance. My premiums went from $450 a month pre-Obamacare to just below $1,200 a month this year with double the deductible. And if you can’t afford the premium you pay a “tax” based on your income. The Obama economy, taxation and policies are a real mess!

yes, when I pay more taxes, I can eliminate all discretionary spending- and how will the small businesses like it when I NEVER eat out, NEVER buy new clothing, NEVER travel, NEVER get anything dry cleaned, NEVER hire any workers for home maintenance….how will that benefit the economy? Thanks Trump. Simple = stupid.

Marginal can go up and you can still pay less in taxes. For the single tax payer:

Old plan: $18,558.75 + 28% * ($112,500 – $91,150) = $24,536.75

Trump: 12% * $37,500 + 25% * ($112,500 – $37,500) = $23,250

Next, to your point, taxes are 0.05 higher per dollar of earned income.

$24,536.75 – $23,250 = $1,286.75 difference

So, another $25,735 ($1,286.75 / 0.05) until we hit the breakeven point.

$112,500 + $25,735 = $138,235

So singles making $138,235 – $190k pay a bit more. Honestly, that’s a pretty decent income for a single.

Thanks for doing some math. I wish more people did their own math to see what their pro forma tax bill will be.

$138-$190K pay is not bad, if you don’t plan to have a family and buy a median priced home in an expensive coastal city.

No it isn’t bad income but who are we to judge how much income is justified. There are different situations.

It’s comparative to people who don’t want to make the pie but want a piece after the pie is made.

For example, people who gave up years of working to go to medical school, accumulated large debt to go to med school and now because they make good money they are expected to pay higher taxes. What about people who took risks, took on large debt to start a business and once they become successful (and many times they employ others) but because they make good money they have to pay high taxes.

Again, people who don’t want to make the pie but want a piece after the pie is made.

In the case of living in NY. A friend of mine lives in NYC and he has to make higher income to live there yet he pays federal taxes based on the same income scale that I do in PA.

Believe it or not, the same issue exists for the elderly where benefits are based on income. A lot of middle class people think there is a safety net for them but they don’t realize how low the income limits are to qualify for help. $1.00 above that income limit and you are disqualified from receiving benefits. In other words the middle class is heading for a train wreck in their elderly years.

That is why it’s wise to build wealth, understand at minimal the difference between high income and wealth as well as taxation and in the middle class / low middle class case income limits. People seem to be fine letting life just surprise them instead.

“So singles making $138,235 – $190k pay a bit more. Honestly, that’s a pretty decent income for a single.”

take out the property tax and State income tax and Social Security and State unemployment/disability from the salary and you will see that the $138,235 – $190k

is not really what you think it is. Then subtract out the cost of health insurance and

you will see that number get smaller yet.