Investors and particularly homebuyers are wondering when will the Fed finally start cutting rates? After 11 rate hikes so far since 2022, investors and homebuyers are starting to feel the strain of higher borrowing costs.

The longer the Fed Funds rate stays high, the more negative impact it will have on the economy. Ideally, the Fed wants to avoid another U.S. economic recession. However, if the Fed keeps rates high and does not cut by the end of 2024, there will likely be much tougher times ahead.

For homebuyers, pent-up demand will continue to grow. At some point, life must go on, as people are forced to buy homes due to the birth of a child, a change in jobs, parents moving in and more.

However, the average rate for a 30-year fixed-rate mortgage is over 7%, up from roughly 3% at the beginning of 2022. This has deterred prospective homebuyers from buying and made existing homeowners reluctant to sell their homes and buy another. As a result, inventory remains low and home prices remain high.

Although housing activity has fallen sharply, much of the rest of the economy seems to be chugging along. Households’ excess savings and real wage growth have temporarily blunted the impact of higher interest rates. However, the shields are forming holes.

High-Interest Rates Benefit The Wealthy Most

Ironically, high-interest rates have helped rich investors get richer at the expense of the middle class and the poor. This makes sense because most of the Fed Governors are rich and people have a tendency to address their own needs first.

The rich are less likely in need of a mortgage to buy a home. Therefore, the rich can get better deals with no financing contingencies.

The rich also have more excess savings, which benefit more from higher Treasury bond yields, money market fund yields, and CD rates.

Finally, the rich have seen their stock portfolios rebound the most in 2023. With their net worths back to near all-time highs, investors are feeling even more secure in this high-interest rate environment.

Managing Inflation Back Down From Its 2022 High

Inflation peaked in mid-2022 and has trended downward since. Therefore, the Fed's rate hikes are working to slow down the economy.

The main question now is when will the Fed begin to cut rates? Once the Fed starts cutting rates, bond prices should increase and mortgage rates should start to head back down, if not beforehand, due to the anticipation of further rate cuts.

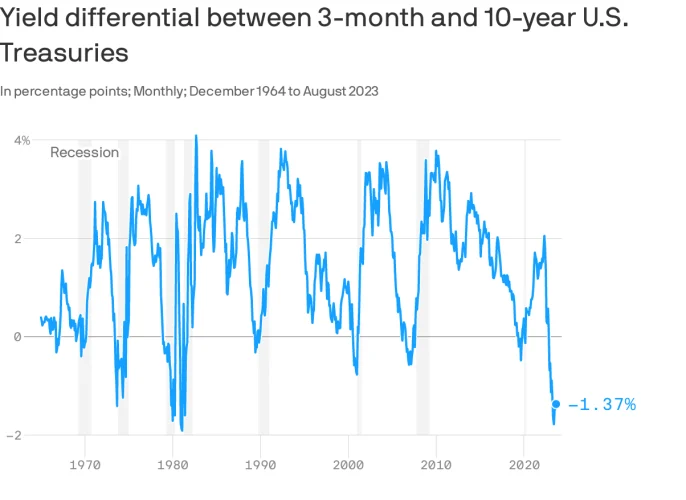

In addition, the yield curve will likely steepen as at least the short end of the curve finally declines. The Fed Funds rate is the shortest of the short end.

Cutting rates will help prevent a hard-landing economic scenario that drives the unemployment rate up and pummels risk assets. Cutting interest rates will help the middle class the most because high-interest rates hurt the middle class the most.

Let's review some predictions from various economists, money managers, an bankers regarding when the first Fed rate cut will be. I'll then share my prediction and why. Please fill out the survey at the end and share your reasonings why as well.

Fed Rate Cut By End Of 2023 According To JPAM Chief Investment Manager

Bob Michele, J.P. Morgan Asset Management's chief investment manager, said the Fed could pivot and cut rates by the end of 2023.

“They're going to tell us that they're going to keep rates higher for longer until inflation is at their target,” he said. “But the magnitude of the slowdown we're seeing across the board tells us that we'll probably still be hitting recession around year-end, so they'll be cutting rates by then.”

Currently, the consensus is for no rate cuts in 2023 and a 50% chance of one more rate hike.

Fed Rate Cut In February 2024 According To Morningstar Economist

On August 31, 2023, Preston Caldwell, a Morningstar senior US economist, wrote in a post he expects the Fed to start cutting interest rates in February 2024, the first Fed meeting of 2024.

Caldwell argues,

The Fed will pivot to monetary easing as inflation falls back to its 2% target and the need to shore up economic growth becomes a top concern.

1) Interest-rate forecast. We project a year-end 2023 federal-funds rate of 5.25%, falling to about 2.00% by the end of 2025. That will help drive the 10-year Treasury yield down to 2.50% in 2025 from an average of 3.75% in 2023. We expect the 30-year mortgage rate to fall to 4.50% in 2025 from an average of 6.75% in 2023.

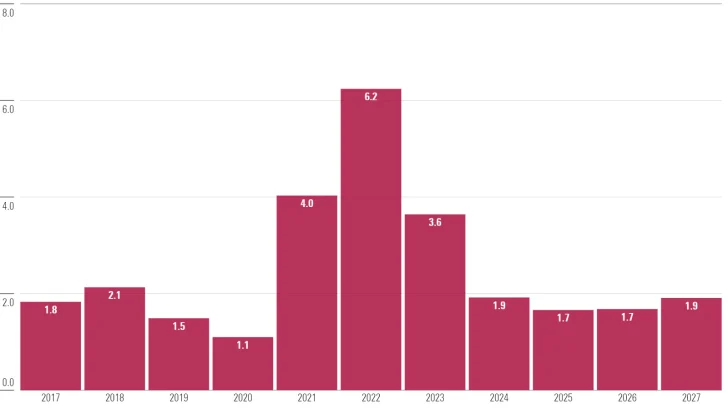

2) Inflation forecast. We project price pressures to swing from inflationary to deflationary in 2023 and the following years, owing greatly to the unwinding of price spikes caused by supply constraints in durables, energy, and other areas. This will make the Fed’s job of curtailing inflation much easier. In fact, we think the Fed will overshoot its goal, with inflation averaging 1.8% over 2024-27.

We expect that GDP growth will start accelerating in the second half of 2024 as the Fed pivots to easing, with full-year growth numbers peaking in 2025 and 2026. The resolution of supply constraints should facilitate an acceleration in growth without inflation becoming a concern again.

Source: Morningstar

The Fed Won't Cut Rates Before April 2023 According To A Hedge Fund Manager

David Einhorn, the founder and president of the hedge fund Greenlight Capital, wrote that he didn't expect the Fed to cut interest rates until March 2024.

“We continue to believe that the market is over-anticipating rate cuts and we have extended that view through March of 2024,” he said.

David Einhorn is famous for shorting Tesla and losing a bunch of money during its 1,000% run-up. Regardless, David is still a very wealthy man given hedge funds make tons of money.

Cutting in February or March 2024 is about the same. I'd buck them together.

Fed Rate Cut In May 2024 According To KPMG Economist

Following the release of August's inflation report, KPMG US's chief economist, Diane Swonk, wrote in her piece, Inflation Reheats, the Federal Reserve might not be done raising interest rates. She writes,

The Fed needs to see quarters, not months, of fundamentally cooler inflation to cut rates. We are not even close. Our forecast for the first rate cut in May 2024 holds.

“The path down on inflation is littered with potholes. We hit one in August, which is one of many reasons that the Fed will pause but leave the option to raise rates again in November on the table at its meeting next week.

The message from the Fed will be clear. It intends to hold rates high for longer and will not hesitate to raise again if inflation gets stuck at year-end. The Fed needs to see quarters, not months, of fundamentally cooler inflation to cut rates. We are not even close. Our forecast for the first rate cut in May 2024 holds.

Fed Rate Cut Between April and June, 2024 According To A Reuters Poll

In a Reuters poll of 97 economists, the consensus prediction is that the Fed wouldn't cut interest rates until at least April 2024. Here are more details from the Reuters article.

Nearly 20% of the economists, 17 of 97, predicted at least one more rate rise before the end of the year, including three who expected one in September.

Though we continue to expect the Fed to remain on hold at the Sept. 20 FOMC meeting, we would not be surprised to see most officials continue to project one more rate hike by year-end in their updated ‘dot plot,'” said Brett Ryan, senior U.S. economist at Deutsche Bank, referring to the interest rate projections released by Fed policymakers on a quarterly basis.

Of the 87 respondents who had forecasts until the middle of 2024, 28 put the timing of the first rate cut in the first quarter and 33 had it in the quarter after that. Only one said the Fed would cut rates this year.

Around 70% of those respondents, 62 of 87, had at least one rate cut by the end of next June. Still, all but five of 28 respondents to an extra question said the bigger risk was that the first Fed cut would come later than they currently forecast.

A serious economic downturn could justify an earlier rate cut, but that is looking less likely. The economy was expected to expand by 2.0% this year and 0.9% in 2024, according to the poll.

The median view from a dwindling sample of economists who provided responses on the probability of a recession within one year fell further to 30%, after tumbling below 50% for the first time in nearly a year last month. It peaked at 65% in October 2022.

Goldman Sachs Believes Rate Cuts Will Happen In 2Q 2024

Goldman Sachs chief US economist, David Mericle, said he expects the Fed to cut rates in 2Q 2024. On the Goldman Sachs Exchanges podcast episode (Apple), he also believes the Fed is done hiking rates in 2023.

“We have the first rate cut penciled in for 2Q of 2024. The threshold that we have in mind that's met at that horizon in our forecast is core PCE falls below 3% YoY and below 2.5% on a monthly annualized basis.

I don't feel terribly strongly about the rate cuts because I don't think it's right to say the Fed needs to cut. I see it sort of optional. I can certainly envision a scenario where we get there and inflation doesn't come down quite enough, or even if it does, Fed officials say to themselves, ‘This is a strong economy with a historically tight labor market, just coming off a scary inflation surge, what exactly is the point of cutting, what problem are we trying to solve?' and decide it's just not worth it.

Why do I think the right baseline is for the Fed to cut? Because a 5.5% nominal funds rate, a 3%+ real funds rate will feel high relative to recent history for most Fed officials. We have penciled in in our forecasts 25 basis point (cuts) per quarter. We have it ending in the low 3s, not at the 2.5% number the FOMC has written down.”

American Bankers Association’s Economic Advisory Committee Expects Rate Cuts After May 2024

The latest forecast from the American Bankers Association’s Economic Advisory Committee said it expects the Fed to hold off on cutting rates until sometime between May and the end of next year. They expect the Fed to cut the Fed Funds rate by 1% in 2024. The ABA compromises of economists from the largest banks such as JP Morgan, Morgan Stanley, and Wells Fargo.

“Given both demonstrated and anticipated progress on inflation, the majority of the committee members believe the Fed’s tightening cycle has run its course,” said Simona Mocuta, chair of the 14-member panel and chief economist at State Street Global Advisors.

Source: Morningstar, U.S. inflation rate (PCE Index, %)

Vanguard Believes Fed Rate Cuts Will Begin In 2H 2024

Everybody's favorite money management company, Vanguard, published an article believing the Fed may need to raise rates further. From the article,

Josh Hirt, a Vanguard senior economist explains, “Monetary policy is still working its way through the economy, trying to constrain activity even as the impacts of supportive fiscal policy have kicked in. This is one of the reasons we believe the economy faces a period of higher sustained interest rates than we’ve grown accustomed to seeing.” Vanguard believes that the Federal Reserve may need to raise rates further and keep them at their highest levels for an extended period in the face of continued economic resilience.

Recent Vanguard research concludes that the “neutral rate of interest”—a theoretical rate that neither promotes nor restricts economic activity—is higher than many may have thought. That finding and our related policy analysis support our view that the Fed may need to raise its federal funds target rate by a further 25–75 basis points before ending a rate-hiking cycle that began in March 2022 and has totaled 525 basis points. (A basis point is one-hundredth of a percentage point.)

The Fed’s rate target currently stands at 5.25%–5.5%. We don’t foresee the central bank cutting its target until the second half of 2024.

“We believe the catalyst for easing would be either a recession or inflation falling while economic activity remains strong (a ‘soft landing'),” the team said.

2024 Fed Meetings Schedule

Now that you have a good idea of when the Fed will cut rates, let's go through a forecasting exercise of our own. Let's pretend to be an economist and make our own Fed rate cut timing prediction.

One of the ways to determine when the Fed will cut rates is to look at the upcoming FOMC meeting schedule.

There are eight scheduled Federal Reserve meetings for 2024. Let us assume with certainty the Fed will cut rates in 2024. Therefore, we have a one-in-eight or 12.5% chance of guessing correctly when the Fed will begin cutting rates.

We must also assume there will be no surprise rate cuts off schedule.

Improving The Odds Of Our Fed Rate Cut Forecast

We can throw out the January 2024 meeting as a potential for a Fed rate cut because:

1) It is too soon after the Fed potentially makes its last rate hike in 2023. Cutting rates so soon after would make the Federal Governors look foolish.

2) January is also too soon given we're just starting the year. Fed employees are just getting back to work and there may be too much economic distortion during the holiday period,

By eliminating January, we now have a one-in-seven, or 14.28% chance of correctly forecasting when the Fed will cut rates.

We can probably throw out December 2024 too. The lag effect of the Fed rate hikes should be in full effect well before December 2024 as unemployment rises, corporate earnings slow, and GDP growth slows.

With six Fed meetings left to cut rates, we now have a 16.7% chance of correctly forecasting when the next rate cut will be. All we've got to do is choose a meeting date and then write about why we think the date is the correct one.

Hooray for some good old-fashioned deductive reasoning!

When I Think The Fed Will Cut Rates

As we finish 2023, all the economic data and consumer sentiment surveys point toward a slowdown. Delinquency rates are ticking up, housing demand is way down, and inflation has rolled over. The October payroll numbers of 150,000 can in below the 180,000 expectation, which means wage pressure and the job market are also moderating.

Yes, there is a risk inflation will reaccelerate given rising oil and gas prices. However, I believe the bigger driver for the price increase is an artificial reduction in supply, not accelerating demand. Gas prices have been coming down consistently since August 2023. See the image below.

Given how important the U.S. housing market is to the economy, it's hard to envision the Fed hiking once more in 2023 (<30% chance). Roughly 66% of Americans own homes. If transaction volume continues to stay at multi-decade lows, related businesses such as construction, furniture, loan origination, architecture and design, and many more will suffer.

The new year always brings about new demand for goods and services. As a personal finance writer since 2009, I always see a pickup in traffic during the first quarter of the year. I expect 2024 to be no different. People are most motivated to take action in the first quarter of each year.

June 2024 Or Later Is The Target Date For Cuts

We could see a rebound in economic activity in 1Q2024, partly due to pent-up demand from the holidays. If so, strong-than-expected consumer spending will delay inflation getting down to the Fed's long-term target of 2%. In turn, this will also reduce the Fed's need to cut rates because it will delay a recession.

As a result, the soonest the Fed will cut rates is May 1, 2024. But I'm going to go with June 12, 2024 as the earliest meeting/month when the Fed will finally cut. By June 12, 2024, the Fed will have had two months to digest the 1Q 2024 data. It will also have had two months of 2Q 2024 data.

If the Fed does hike again in 2023, then it strengthens my belief further the Fed will cut in June 2024. The logic is that another rate hike in 2023 will slowdown the economy further.

My Fed rate cut views parallel those of Goldman Sachs' economist, David Mericle, and the American Banker's Association.

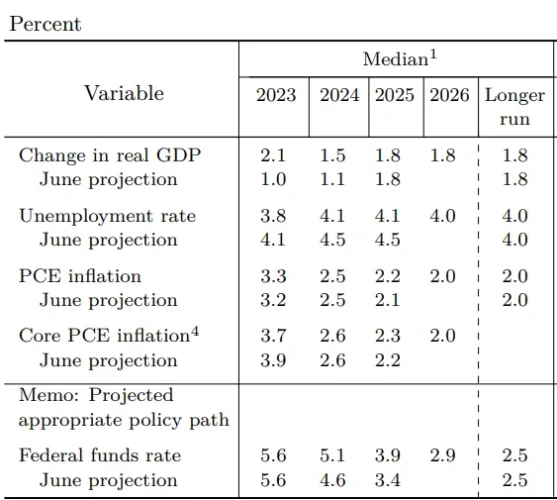

Please note that after the September 20, 2023 FOMC meeting, Fed officials see the Fed Funds rate at a median of 5.1% at the end of 2024, up from 4.6% in June. The median Fed funds rate expectations for 2025 is now 3.9%, up from 3.4% in June.

Fed Rate Cut Probabilities By FOMC Meeting / Month

Here are some probabilities for a Fed rate cut I assign by FOMC meet. As we know from investing, there are no absolutes. Therefore, we must assign probabilities and prepare accordingly.

January 2024: 20%

February 2024: 5% (no meetings scheduled, so this would be an intra-meeting cut, as believed by Morningstar)

March 2024: 25%

April/May 2024: 40%

June 2024: 60%

July 2024: 55%

September 2024: 50%

November 2024: 40%

December 2024: 30%

2025: 10%

According to CME Group's FedWatch tool, below is a snapshot of the target rate and probabilities in June 2024 after the September 20, 2024 FOMC meeting notes were released. It says with a 34% probability the Fed funds rate will stay the same at 5.25 – 5.5%, and a 42.8% probability there will be a 0.25% cut by June 2024. Fascinating stuff!

Exciting Times For Cashed-Up Investors

Let's enjoy these higher risk-free rates while they last. As we patiently wait to find great deals in risk assets like real estate, we'll strengthen our balance sheets with each passing month.

The key to making more money will be to take advantage of deals BEFORE everybody can find cheaper financing. Hence, some people are putting some capital to work now. While some will be trying to find deals in 1H 2024.

Once the Fed does cut rates, there may be a rush of laggard buyers IF the economy doesn't crash with a surge in the unemployment rate. Notice in this chart how recessions (grey bars) almost always follow after the Fed begins cutting rates. In other words, the Fed often raises too much and cuts too late to prevent a recession from occurring.

But risk assets can perform during recessions. It just depends on how bad and long the recession will be.

It's not so much the initial rate cut that will be driving buyers as the discount will be miniscule. Rather, it will be the relief felt that the Fed will no longer be hiking rates and that future interest rates are likely.

The only people who lose are big spenders with little cash and weak cash flow. They'll either get beat up by a worse-than-expected recession or miss out on the buying opportunities. Be prepared!

Reader Questions and Suggestions

When do you think the Fed will finally cut interest rates and why?

Real estate is currently going through a downturn due to high mortgage rates. As a result, dollar-cost averaging now provides a better entry point for long-term growth. To invest in real estate more strategically, take a look at Fundrise. Fundrise primarily invests in residential and industrial properties in the Sunbelt, where valuations are lower and yields are higher.

Listen and subscribe to The Financial Samurai podcast on Apple or Spotify. I interview experts in their respective fields and discuss some of the most interesting topics on this site. Please share, rate, and review!

For more nuanced personal finance content, join 60,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

You mentioned there would likely be a recession after the Fed starts to cut rates. What would happen to housing prices if we enter into a recession after the Fed cuts rate?

Depends how bad the recession is and which location. There’s a lot of pent up demand. So I’d rates collapse, I feel like demand will come back strong.

I don’t expect National home prices to decline by more than 5% in a potential recession. There’s already been 5%-20% price declines in some areas.

Well let’s see…

1. After the great financial crisis of 2008, the Fed cut rates, and then left them near zero for…..14 YEARS!!!

2. 15 months ago the Fed was forecasting…..ummm, NOTHING!

3. Cramer had it right back in the day, “THEY KNOW NOTHING!”

I predict that “higher for longer” really means around a 4.00% 10Yr UST for at least 5-10 years, OR we need a massive spike in unemployment to blow off all the excess cash that is sloshing around. So will the Fed cut a little here or there, sure, maybe, who cares….any cut of less than 200 basis points will be political IMO (election year) and not at all based on actual math.

Cramer has one of the worst track records of any pundit in the media. Check out the Inverse Cramer Twitter account.

4% on the 10-year yield is reasonable. Especially for all folks who have mortgage rates under 3%. Living for free!

It feels like you are missing my point on the Cramer quote…..but anyway, you are correct, 4.00-4.50% on the 10yr is perfectly reasonable, it also means no material rate cuts from the Fed as far as the eye can see.

April/May. Earlier in the year to get two quarters of lower rates leading up to elections

1. When does US debt reset?

2. Why is debt ceiling suspended to 2025?

At the start of this year I sure did not expect that there would be more raises up to now. I really thought there would be at least one rate cut. And before reading your article, my guess was Jan/Feb for a rate cut. But I can see now how May/June could be a new feasible timeline. I just hope there won’t be a long, severe recession in the near future.

Question on behalf of the landlords out there. When rates come down, should we anticipate a correction in rent prices?

What is your logic behind that situation? Thanks

I’ve been buying small SFHs with all cash the last few months. I’ve been doing some rehab on them, and then throwing 9-10% mortgages on them afterward (with no prepay or one year prepay). I feel like these purchases are a free call option on lower rates and increase appreciation starting in q3 2024. I could be wrong and perhaps have to sell at small losses in q1 2025, but I think these are “free spins” right now as long as you can find the deal, and can stomach the mortgage paperwork.

My vote is November 2024. As long as the unemployment rate remains this low people still have money. When people have money they spend money. Inflation remains until people run out of money.

Anecdotally, employees still have the power. Not as much as last year but still more power than normal. I see this in my business and my friends businesses. As long as they have the power they feel comfortable spending money. I think this will last at least a year longer.

THANK YOU for this insightful piece. Being on the verge of getting a construction loan for a new house build, and the fact that construction loans are 1-2% higher than traditional mortgage rates (my local bank offers 8.75% construction loans), this is certainly something I’m watching closely. It will be an interest-only loan until we finish the build (12-18 months later), which is unnerving since we won’t know the rate at that point. Is there any reason to believe that rates could (god forbid) go any higher in the next 18 months than where they currently are?

I am thinking April / May meeting, for reasons you cited, yet this desire to achieve the mythical soft landing that has been discussed. Since history shows too high for too long, a contingent of the Fed will lobby the more conservative members to cut sooner than they would have otherwise.

I believe 10 year Treasuries have not been this high since 2007. I’d like to increase passive income as a 53 yo retiree. Given your thesis on long term low rates, I’m starting to wonder more and more about a significant investment in 10 year Treasuries. As a RE investor with a number of properties with below 3% rates, we will use the bond buying opportunity to lock-in rates that we are not likely to see for some time and continue to benefit from the spread. Thoughts on this approach?