Are you wondering whether you can save too much in your 401(k)? After all, if you save so much in your 401(k), you might not have a large enough taxable investment portfolio to generate passive income before 59.5.

However, the reality is, you can't save too much in your 401(k) if you follow my guidelines. The more you can save in your 401(k), the better.

When you're in your golden years, it's better to have a little too much saved in your 401(k) than too little. With Social Security and passive income, you'll be able to live a much more comfortable retirement lifestyle.

You Can't Save Too Much In Your 401(k) For Retirement

One of the reasons why I started the Financial Samurai Forum was to extend the number of wonderful discussions we have on this site. Instead of letting me dictate what we talk about on any particular day, the community gets to decide what it wants, whenever it wants.

The FSF is like reaching financial independence for your inquisitive mind!

For example, a Financial Samurai Forum member David is wondering whether it's possible to have too much in his family's 401(k) account. Here's what he writes:

My wife and I are both around 50 years old. We want to be able to retire at 55. We max our 401(k) contributions each year and have a pretty good chunk in 401Ks – approximately $2.5M currently.

Further, we are in the max tax bracket, so reducing our income with 401(k) contributions is appealing.

Finally, we have about $700K in after-tax accounts and $100K in Roth IRAs.

My current thoughts are to convert at least some of the 401(k)s to rollover IRAs, then to Roth IRAs over time after we retire and have lower income.

For now – are we better to continue to max the 401(k)s, or stop making 401(k) contributions and start making Roth 401(k) contributions (which will cost us 37% tax on $52,000 of extra taxable income), but may benefit us in the future?

Save Too Much Or Too Little In Your 401(k)

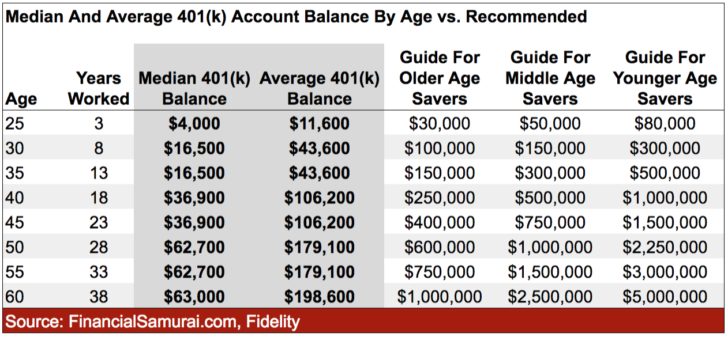

For starters, congratulations to them on accumulating a $2.5 million combined 401(k) balance at 50. According to my recommended 401(k) guide, this couple is doing extremely well.

If you are a younger saver (35 or younger), you can follow the younger saver guide. Between 35-50? You can follow the middle age guide. If you are 50 or older, then you can follow the older save guide.

The difference has to do with historical maximum 401(k) limits and returns.

Over the years, I've received so much pushback from younger folks who think my 401(k) by age recommendations are unreasonable. But as these younger readers grow older, they realize what's possible with time, compounding returns, and company matches.

So for all you young guns out there who are simply making excuses for why you're not there or why you don't want to save more, please get your heads on straight. Otherwise, you might wake up 10 years from now bitter you have no options given your lack of funds.

Max Out Your 401(k)

Not maxing out your 401(k) is something I never thought about before because I always believe more is better up until at least the federal estate tax limit. Currently, the federal estate tax limit is $11.58 million per person. Therefore, there's plenty of room for most people to keep on accumulating before they have to pay a 40% federal death tax.

It's much better to retire with a little too much versus a little too little. The last thing you want to do in your 60s and 70s is to have to go back to work.

The thing is, you can't save too much in your 401(k) because there is a maximum contribution limit each year. The maximum contribution limit in 2021 is $19,500. Expect the maximum contribution amount to go up $500 every two or three years.

Further, to achieve financial independence, everyone should be saving way more than $19,500 a year! Therefore, you can't save too much in you 401(k).

Let's hear a couple of great perspectives from two FS Forum members on this subject. Then I'll conclude with my final thoughts.

Yes. You Can Save Too Much In Your 401(k)

Here's a response from Money Ronin who believes you can save too much in your 401(k).

The answer is “yes, absolutely” although what counts as too much is dependent on your personal tax situation now and in the future.

The obvious downside is that you will eventually need to pay taxes and no one can predict future tax rates. Also, you will be forced to take a required minimum distribution (RMD) at 70-1/2 even if you don't need the funds.

Finally, this is what really made me think twice about maxing out my 401(k) going forward. I met with a an estate planner. He mentioned everything I own gets a step-up in tax basis when I pass away, the 401(k) and traditional IRAs do not.

If retirement plans are funded with pre-tax dollars, they are 100% taxable to my heirs once they start tapping into the funds.

The estate planner's advice was that if I planned to bequeath anything to charity, bequeath the 401(k) first and avoid the taxation issues.

Personally, I like to spread the taxation risk by putting my money in various retirement accounts, IRAs, 401(k)s and Roth IRAs.

I'm not a tax or estate planning professional so hopefully other people can confirm or deny this information.

No. You Can Never Have Enough In Your 401(k)

Here's another perspective from Fat Tony who says you can't save too much in your 401(k).

Congrats on the great accumulation! I'm sure you know about the Roth IRA conversion ladder and all the associated calculators on the net.

If you plan to retire in five years, even given your current lopsided ratio of tax-deferred vs. tax-upfront savings, I would still make regular 401(k) contributions if you are in the 37% federal bracket.

Your $700K after-tax investments are unlikely to generate too much income and you will likely be in a super-low tax bracket after retirement to do plenty of 22% and 24% bracket Roth IRA conversions (2% dividend yield on stocks = $35K/year mainly qualified dividend income).

Tax brackets aren't slated to go up until 2026, although who knows what the future holds – it's just unlikely that married taxpayers under $100/150K get a huge hike to above 37%, so you should be fine doing Roth conversions for a while and come out ahead if you defer the taxes.

Tax diversification is useful, but I think this close to retirement and at the max bracket the calculation is simple. What is the tax risk you're willing to bear vs. the amount you are willing to pay upfront?

You can try to create a simulation with various tax bracket outcomes throughout retirement, although this is going to be an exercise in crystal ball-ism.

Related: The Disadvantages Of A Roth IRA: Not All Is What It Seems

Keep Contributing To The 401(k)

Based on these two well thought out responses, the wise move is for this couple to continue maxing out their 401(k)s. In five years, their 401(k)s will be bolstered by at least another $190,000 of pre-tax contributions that would have been taxed $70,300 if they didn't contribute.

Once they retire at age 55, they can simply live off their $700,000 in after-tax investment accounts until 59 1/2, when they can start withdrawing from their 401(k) penalty-free. $700,000 will only generate $28,000 a year in income at a 4% rate. Therefore, the couple would likely need to eat into principal.

Rule Of 55

Alternatively, the couple could follow the “Rule Of 55” if they do not want to wait until 59 1/2 to begin taking money out of their plans.

The Rule of 55 allows an employee who is laid off, fired, or who quits a job between the ages of 55 and 59 1/2 to pull money out of his or her 401(k) or 403(b) plan without penalty. This applies to workers who leave their jobs at any time during or after the year of their 55th birthdays.

The Rule of 55 only applies to assets in your current 401(k) or 403(b)—the one you invested in while you were at the job you are considering leaving at age 55 or older. If you have money in a former 401(k) or 403(b), it's not eligible for the early withdrawal penalty exemption.

Of course, if you're smart and really need the money, you would simply combine your other 401(k) plans into your main plan before enacting the Rule of 55.

Rule 72(t)

Another strategy to consider is Rule 72(t), also known as as the Substantially Equal Periodic Payment or SEPP exemption.

To use this type of distribution rule, you would start by first calculating your life expectancy and then using that figure to calculate five substantially equal payments from a retirement plan for five years in a row before the age of 59 1/2.

The final strategy is to negotiate a severance in order to provide a financial runway into retirement. With $2.5 million in their combined 401(k)s, it is likely this couple has been with their respective employers for a significant amount of time. If there is no company pension, then they are prime candidates to receive a severance due to their years of loyalty.

If you are going to quit your job anyway at 55 with no pension, then you might as well attempt to negotiate a severance. A severance package usually equates to 1-3 weeks of pay per year for each year worked.

If the couple together earned $700,000 a year and worked at their jobs for 20 years, they could potentially receive 25 – 75 weeks worth of salary equal to $269,230 – $807,692 plus subsidized healthcare.

Build Passive Income As Well

Always max out your 401(k), especially if you are in a higher marginal income tax bracket. Take advantage of tax-deferred compounding and company matching. You have plenty of financial options before you face tapping your 401(k) early with a 10% penalty.

At the same time, build your taxable investment portfolio and rental property portfolio if you want to retire before the age of 59.5. The key to financial freedom is having a bevy of investments that produce passive income!

Below is a snapshot of my latest passive income investments. Rental properties and real estate crowdfunding are my favorite investments currently.

Analyze Your 401(k) For Excessive Fees

Stay on top of your 401(k) by signing up with Personal Capital. PC is a free online tool I've used since 2012 to help build wealth.

Personal Capital's 401(k) Fee Analyzer tool is saving me over $1,700 a year in fees. Utilize the Investment Checkup feature to analyze your 401(k)'s asset allocation as well.

Finally, there is a fantastic Retirement Planning Calculator to help you manage your financial future. There is no rewind button in life. Leverage my favorite free financial too to build wealth!

Related post: How To Reduce Excess Fees In Your 401(k) Immediately

Readers, anybody feel strongly against maxing out their 401(k)? If so, why? For more top financial tools, check out my page. You can also sign up for my free newsletter here. 100,000 people have already!

Does the guidance change for people contributing 58k/year via mega backdoor roth? Maybe it doesn’t change anything since I can withdraw the unappreciated portion of Roth before 59?

How exactly does save 80k (26.6k/yr avg) in a 401k by age 25 when the contribution limit is only 19.5k/yr?

Performance and company matching.

For individuals grossing over 100k per year income with a 4% employer match and yielding back to back market returns above 10% that is a great target to aim for.

I realize in the bay area 100k per year income may not be uncommon, but most places it is. Especially For an entry level job a 25 yr old could get without an advanced degree. The other 70% of us with a combined household income of 100k per year or less will not be able save this much in our 401k’s. It’s not a matter of being lazy or making excuses, it is not mathematically possible.

I suspect that is why you are getting a lot of pushback from young adults, because most people will not earn six figure income until later in life.

We have always maxed out 401ks for a different reason: if one is sued that money is untouchable whereas lawyers can go after and win the after-tax accounts. As doctors (and drivers!) we consider the 401ks an insurance policy even though we also carry a big umbrella policy.

If the senate and Trump approve the new retirement SECURE act – will you be rewriting this article? I know that I would not have saved as much as I have in my 401K (at the end of my career now) if I had known they would change the rules and put an inheritance tax on my heirs by shortening the stretch period down to 5 or 10 years. Too old to have meaningful $ in my Roth but I will be doing conversions up until age 70.5 or 72 or whatever the new age becomes.

Also, this law is a big giveaway to the financial services companies and insurance companies by allowing annuities to be sold within the plan. Both sides of the aisle are guilty this time as far as I am concerned.

Always happy to write new articles with new analysis and new perspectives when new money rules are enacted. Keeping an open mind is one of the foundations of Financial Samurai.

I’m grappling with a similar issue. We have about half our savings in retirement plans.

When we retire our pensions and tax advantages will keep our take home pay from dipping. The problem (yeah, I know it’s not entirely a bad problem) is when we hit 70.5 and RMDs begin.

This will initially double our income (and way more than double our taxable income) and escalate rapidly thereafter. If it works as I expect, even at moderate rates of return and without inheritances, our net worth and taxable income will be increasing for as long as we live after that. But paying taxes on that much RMD seems wasteful. I really can’t imagine us doubling what we spend.

But for now I think we want to keep maxing our 401k plans as we need to keep our AGI down in order to keep making contributions to Roths.

Converting to Roths, on the other hand, feels like robbing Peter to pay Paul, and we can’t even start doing that until age 59.5 as the state income taxes would be ridiculous (at 59.5 we can draw 20k each, each year, without paying state income taxes) and a few short years after that we plan to move to a state with no income taxes.

Thoughts?

It’s important to remember that stock market returns aren’t consistent year after year. You can’t deny that someone who is age 50 benefited from a extremely favorable stock market timeline. Someone starting in their 20s now may not see such results.

I started my career around 2009, I benefited early on from the most recent boom. However, upon closer examination, the negative side is that the first decade of my career was spent buying stocks at rapidly increasing prices. This may well bode poorly for my returns over the next two decades.

Agree 100%. I am in the same boat. I started investing in late 2010 shortly after starting my career.

Okay, Sam, I’ve been meaning to ask this question for a long time, but can you please explain to me that 401(k) recommendation chart?

I look up my age, move to the right past the average and median balances, and I find columns labeled as guides for older, middle aged, and younger savers? What do these mean? What column am I supposed to be looking at here? I’m one age, so how can I have to choose between older, middle aged, or younger saver?

Also, I’m in my lower thirties with a $103,000 401(k) balance. How am I doing? ;)

Sincerely,

ARB–Angry Retail Banker

This is an excellent question. The columns are not automatically understood. I recommend the chart be updated to include a decipher key.

Sure. If you are a younger saver (35 or younger), you can follow the younger saver guide. If you are between 35-50, you can follow the middle age guide. If you are 50 or older, then you can follow the older save guide.

It’s up to you provide more flexibility.

The difference has to do with historical maximum 401(k) limits and returns.

This seems to be a discussion about the most tax advantaged way to save as much as possible. I will say that for you high income earners that you absolutely must invest in real estate for the tax advantages alone. This goes for folks who will be withdrawing $75k+ per year from taxable retirement accounts to fund their lifestyle. Obviously, if you have no debt at retirement, you can afford lower withdrawals thus lower tax rates. Real estate depreciation is a very powerful tool to minimize tax burden. In todays world, you can invest in syndications, crowdfunding, and other truly passive investments that have no silly RMD’s and produce protected cash flow. You can also cash out refi on properties with equity tax free, as well as a nice step up basis when you die, 1031 exchanges, the list goes on. To pay 35%+ federal plus state tax on your hard earned cash is just insane with the available tools out there today.

I’m on the side on having too much on your 401K account. I continue to max mines every year and been doing it for a while. For me I didn’t really contribute a lot to it when I first opened it. It wasn’t until five years ago when I realized I need to put more in my 401K and eventually maxed out my contributions.

I feel you can’t have enough in there which is why putting as much as you can is the way to go.

I only put 15% into my 401k (company puts a further 4%, which ramps up to 10% over time with tenure) since I plan on retiring at 44ish (I’m 23 now). I throw a little something into my IRA as well whenever the market dips. The rest of my investments go into a taxable DRIP account with Robinhood. Here’s how I see it. I’m a minimalist (lean FIRE). What’s the point of throwing all my money into an account where I can’t get it till I’m 59 1/2? I prefer to get a big pile of dividends rolling in now (because my income is quite modest, the dividends are mostly tax-free and the ones that are taxed are only at 10%).

I don’t want to make a pile of money in the tax free account and then gradually draw it down until I’m 59 1/2, instead, I want to get enough in there to where the dividends cover my living expenses. That way that principle won’t ever be lost. Whatever is in my 401k is just bonus fun money when I’m retired.

For those Canadians in the crowd. I found the best method was to invest in your TFSA until your tax bracket is high enough to make RRSP contributions worthwhile. Then with your banked RRSP room you can get some huge rebates while your TFSA is growing tax free.

Bingo bango, early retirement.

Plus health care is covered in Canada so planning is easier!

All i can think is “never rely your money with big gov”.

I cannot trust these guys.

I wonder how long the Roth conversion ladder is going to be around.. I’m only 25, so hopefully a while!

I’m hoping I’ll have enough business income here soon to start putting a lot into a SEP IRA or solo 401k. Thanks for the detailed breakdown! I’ll continue to put as much as I can into my 401k!

With people who retire early I think the best strategy is the Roth Conversion ladder mentioned in the post.

My plan is to have maybe 3 years of living expenses on hand (potentially more) and then try and convert as much as I can into ROTH IRAs. The main thing would be to reduce the RIMD that will hit at 70.5 which could bump you up several brackets and also change your premiums for medicare etc.

Hey – I feel famous! I was the original poster of the question. Just to clarify a little bit – it’s not so much “can I have too much money in my 401K”, its is my allocation too far out of wack between ROTH, aftertax accounts, and 401Ks, with the bulk of my retirement savings in 401ks, and not enough in ROTHs or aftertax accounts.

Some people asked how we got 2.5M in the 401Ks at age 50. Just checked our balances – I have $940,000 and my wife has $1,567,000. Lost a little bit this week. My wife’s match is pretty generous 5% match with some extra discretionary match that has been pretty good. We’ve always tried to max them since starting work at age 22.

The gubermint will change the rules. You’ll end up having to own Treasuries with negative real yields to maintain tax benefits.

Remember they have the guns.

Well the answer to that really depends on what your annual expenses will be. If your taxable and post-tax investments will cover you for the 5 years while you do the Roth conversion ladder, you should be set! If not, you may need to get creative with other options, but there are still many of them.

Congrats on making it this far with such a healthy balance!

Thanks. My goal over the next 5 years is to continue to max the 401Ks and also save enough in post-tax investments to cover the time period from age 55-60 or slightly more and start doing Roth conversions in that time period with a lower income and tax base.

David, I would look at your expenses. Clearly you make good income to put as much as you do into retirement accounts but not sure why you don’t have enough in your post-tax investments to cover 5 years.

I am 46, 4 years behind you. We have $1.85M in retirement accounts, but also $2.1M in post-tax accounts. At current annual expenses of 170K/year (family of 4), post-retirement cushion would last us over 12 years, although we have no plans currently for an early retirement.

I have been strategically intentional on diversification. Our equity in our primary residence after mortgage is $1.5M, in our commercial real estate it is $3M, and our business (currently generating about $2.2M/year) is appraised at about $7M. Fine art/jewelry/cars at about $700K. We have not yet received anticipated inheritance from either set of parents.

Bottom line is we don’t have to feel so dependent on our retirement accounts to take care of us (under 15% of NW, we’ve accumulated the other 85% to augment covering our needs), especially as the next major market correction comes. That’s the value of diversification. While the markets and housing were tanking 2008-2009, our business was expanding, now to a current take home income 7 figures. Always looking for ways to diversify even further – maybe a Monet!

Most people at higher incomes are generally less dependent on retirement accounts due to contribution limits and access to collateral resources.

I guess not. They would pay 37% tax now, or if they choose later, it would be 24% tax or less so that’s a substantial savings.

2.5M (their current 401k balance) @ 7%. It will be 3.5M at age 55 without further contribution. 7% of 3.5M is 245k. If they did a Roth conversion of the 245k growth each year it would leave them in the 24% tax bracket.

Assuming they can add 40k/year, it will be 3.8M at age 55. Because 5 years isn’t a long time, it basically just adds the extra principal while the 2.5M starting amount compounds. That would produce 266k/yr which is still the 24% bracket.

The “or less” part is if the tax deferred amount is eventually distributed among multiple heirs, the taxes owed would be less because each person would pay tax based on a fraction of the amount.

“Two-legged stool” cases are common these days and the recommendation there is to max out the 401k. “Three-legged stool” cases that include a pension are more rare and should be examined to determine if additional 401k contributions are worth it.

I can’t recall, but do you have a recommendation chart for total account balance (pre-tax and post-tax) by age, years working etc.? Thanks!

We’re both 45 and have about $1.4M in our retirement accounts (traditional and Roth.) We still max out our 401k every year. I’m firmly in the camp of having too much is better than too little. It’s not a huge problem if you have too much money. Once Mrs. RB40 retires, then I’ll probably stop contributing. We’ll be in a lower tax bracket then.

For now, I’ll keep maxing out. Good discussion.

This is a typical balance in mid 40’s for people maxing out. 46, 45 we have $1.85M (down from $1.93M a week ago) in retirement accounts. With annual contributions of about $110,000 and market returns, we expect balance around $2.5M age 50 barring a significant downturn.

Although a much smaller amount, we are also maxing out HSA accounts about $7K/year and teenage kids working, maximizing Roth contributions.

All of our market investments total about 15% of net worth, so certainly not too much. Our other major investments are in commercial real estate and our business with their own tax advantages – investing over $500K/year there.

All God’s blessings.

How do you put $110k annually into retirement accounts?

A solo 401k allows up to $56,000 per year (or more if you’re over 50). They might have something like that setup for each of them in addition to IRAs.

SEP-IRA 2018 contribution max was $55K per spouse. People often confuse 401(k) with IRA. 401(k) has lower limits.

https://www.kiplinger.com/article/retirement/T047-C000-S003-sep-ira-contribution-limits-for-2018.html

I agree with you and continue to max out my 401k as I always have, but I still regularly second-guess whether it makes sense because I’ve got enough saved in my 401k now to have a comfortable retirement at 59.5 if I don’t save another dollar, and all of my money is tied up for old age and can’t be enjoyed today –

– Can’t access 401k until 59.5 (or 55 as you outlined). Current 401k/IRA balances at 4% real growth with no additional contributions, plus a very conservative assumption about social security, would fund an adequate retirement.

– I have 2 investment properties that will be paid off at the current rate no later than age 55, but will probably be paid off quite a bit sooner because I currently reinvest all net cash flow into principal pay down. These 2 properties alone would completely fund a comfortable retirement once the mortgages are gone.

– Social security withdrawals start in 60s.

– Primary residence mortgage paid off in 50s (assuming no extra payments on primary mortgage due to low rate and tax efficiency)

It’s funny how the fruits of your work and sacrifices don’t payoff until so much later in life, when you might be too old to still hike kilamanjaro or the Milford Trek, kayak the galapagos or really enjoy heli skiing in Alaska! I’m on track to be way more comfortable in old age than now, because now (1) my tax rate is high; (2) my mortgage payment is high; (3) kids are expensive (but will leave have left the nest by my 50s); and (4) I’m simultaneously saving for kids’ college and retirement.

I often wonder if I should just stop saving in my 401k, keep saving in 529 as the second one is not fully funded, leave the real estate alone but continue to reinvest cashflow into principal paydowns, and just spend the rest of my W2 income on life now! If I stopped saving in my 401k, I could take my family could take an extra trip to Hawaii and Europe each year.

Obviously, if you’re in a high marginal tax bracket, the money saved in your 401k is not the same as the money you’d get today from stopping contributions. I’d get $11,020 per year more today ($19,000 less 42% marginal rate) and give up a $25,000 annual contribution ($19,000 pre-tax contribution plus employer match). That seems like a terrible choice!

A lot of moving parts, but sometimes I think about the old “enough” term. If you really have more than enough by age 55 to retire, using your calculations and accounting for all expenses, padding those expenses, inflation, etc…you maybe are at a point to start saving into taxable accounts right now with no restrictions.

Sure, it may not be the optimum for return on investment but at some point it can get a little silly. And having the money available before 55 to function with a two step retirement plan is not a terrible thing.

I’m not saying to do it as I have my own comment in this thread where I’m struggling with not maxing our 401ks at the moment, but I also know my expenses relative to our savings projected out at only 4% are way more than we should need. Of course, many, many factors in our decision making as well.

GF and I are already millionaries in our mid 20s. We probably do about 25-30k a year into 401k’s (me)/SEP IRA’s between us. We don’t see the point maxing out the accounts when we’ll be retired in under 15 years anyways. We own multiple pieces of real estate outright that have strong cash flows.

We make 500-700k a year (depending on businesses we own and investment performance) and save 25k+ a month (not including asset appreciation) which we reinvest into business/real estate to grow cash flows. As such 401k/IRA has low priority because the money isn’t good to us if we want to retire at 40 and have 1-2 million there… but having 5 million on properties that pump us 10-12% cash flow un-leveraged is worth it’s weight in gold plus businesses cash flow seems better for those trying to FIRE.

Retirement accounts take away flexibility to invest and grow businesses and retire early. They do provide a safety net which is why we still put in a few thousand a month there just to be safe but a retirement account won’t enable early retirement in late 30’s and early 40’s without the crappy 10% penalty – no thanks.

Making 500-700k a year in your mid twenties?

Doing what, exactly?

I work tech for a large employer and own two companies on the side. My gf works in healthcare and owns one company that she runs full time. Our main comp puts us around 500-550k. Our investments bring in around 150-200k from cash flow and appreciation (based on market comps) but I say 500k as the lower bounds in a worst case where it all went to 0 which is very improbable. Getting a few decent sized contracts can make you a ton of money if you’re willing to work 60-90 hour weeks in locations with limited resources to hire from. So we don’t have much to spend money on besides constantly investing everything we make.

Questioning,

My wife and I were earning about $350K at ages 27,26 starting out our careers as a pharmacist/physician couple. That was 19 years ago, and would translate to about $500k/year at today’s pay scales. This would be even higher for a physician-physician couple. It’s doable.

Now, 2 decades later, our annual income is comfortably 7 figures and net worth 8 figures.

I also had the same question when I spoke with a financial planner in an introductory meeting. When should I stop contributing to my 401(k) because I don’t have access to the money for about another 20 years. My wife and I have over $2 million in our retirement accounts. We are in our late 30s. Should we stop contributing soon to have more cash flow we can use now to fund our current lifestyle? The financial planner just ignored the question.

I think the question becomes a trade off of do I want more money in retirement or more money now. Either way the person has a first class problem.

Great advice! I don’t have a 401k anymore but I maxed it out most of the years I had it. It really made a difference to max it out and get the max company match. I couldn’t really picture how it would grow until the numbers started adding up and then I became addicted to contributing and watching it compound.

I’m curious how that couple at age 50 can have over $2M in their 401K? Did they provide more details? I’m sure they both worked and put the max in their 401k’s- they must have had a great company match, etc. We are both over 50 and we don’t have near that amount and we’ve contributed every year plus had some good market runs. Just curious…

How much do you guys have and how long have you been contributing the maximum?

We started contributing in our mid 20’s (we put ourselves through college & had to pay off loans first). We have about 600K each. We are both 52. I’m reading other people’s comments and cannot figure out how they are getting to $2M+ when we all contribute the same amount max to our 401k’s. Maybe their investment performances are better and their companies matched their’s dollar per dollar?? Ours did not.

I’m 25 and I have $135k saved in my 401k from 3 years’ contribution (indiv + company match) and 11% yoy roi. If hypothetically* I can avg 8% return I expect to have ~$1M in 10 years with compound interest. It should be even easier as I start tapping into after tax retirement.

*I know this hypothetical situation will be an interesting one given the near-guarantee recession in the next 10 years. But that’s besides my point which is that with company match and compound interest over a long period of time it is feasible to be 401k multimillionaires by 50.

For additional context: I am 52 and have done my best to contribute the maximum I could beginning @ 25. I didn’t hit the max contribution until about 42 regularly. As of this writing I have about 1.4m. Projections are I should be able to count on 2m @ 60 when I start drawing 4%. I plan to exit workforce @ 55 living on aftertax accounts until I start drawing @ 60 (or later).

We don’t all contribute the same max.

As business owners, we personally contribute $110K to SEP IRA’s annually plus HSA $7K annually. With SEP IRA’s, we can essentially invest in any funds – even the most risky but lucrative. In an 401(k) you’re limited to the safe bets your employer or boss limits you to (big brother not trusting you can invest wisely), which over time means lower returns magnifying the difference over the years. Some of my funds have hit over 100% 1 year returns (instead of the usual 7 years to double), more than once, during good periods.

We’re at $1.85M retirement funds ages 46, 45. An additional $120K invested per year over the next 20 years (to full retirement age) is an additional $2.4M before actual market returns!

Meant to say employer or 401(k) administrator.

Their 401k results are consistent with mine: I’m almost 47 years old and have been maxing out my annual contributions for 20 years with 3-4% company matches along the way. My 401k total (mostly pre-tax, some Roth) is currently $1.1M.

We max out both of our 401k’s with a dual income family making around 300K. When I was single and a lower tax bracket making 100K I was a huge advocate of Roth 401K. Once I got married and a couple raises for each of us and now everything is traditional 401k. Roth 401k are the way to go when you are in your 20’s till late 40’s. Most people in there 50’s are at their max income, and probably also at your maximum tax rate. If I retire before 59 1/2 I can convert my Roth 401k to a Roth IRA, or do the 55 rule depending on family income and tax rate. Great article and love having different opinions representing both sides! I thought both had great points.

Great post Sam. I get no company match yet try to max my 401k out every year because I love seeing the NW go up faster! Not entirely rational based on my goals of making more money in retirement than now, but I also consider this play a hedge against me not achieving the goal of making more money in retirement than I do now.

My wife and I are thinking about this stuff now in fact. We are at 15K each to our Roth 401ks. The debate is trying to max out the Roth 401k contributions, consider maxing out overall contributions by doing the remaining 4K each to traditional 401ks, or see how our cash flow goes this first 12 months of our new contributions and overall lifestyle change, and then decide what to do.

Weirdly, we’ll probably still wait until at least fall before changing course at this point. My hope is to max out the Roth 401ks. But I do recognize it as a struggle. I’ve read the Roth IRA info here and on a few other blogs I’m sure. I guess with about 850K in traditional 401ks now, and about 150K in Roth IRAs, we’re taking a gamble that tax rates will go up from what they are now. Certainly we could be wrong on this and the traditional 401k plus saving all the extra money may end up being the better path.

Good “problem” to have but I still struggle with it. Thanks for the note that it’s nearly impossible to save too much to a 401k. Only 11 years to 55 for me so I may have just answered my own question here….max the 401k at least in some fashion.