FICA stands for Federal Insurance Contributions Act and consists of a Social Security tax and a Medicare tax. Social Security tax is 6.2% and Medicare tax is 1.45% for a combined FICA tax rate of 7.65%.

FICA tax is very important for everyone to understand because so often we only think about federal tax rates and state income tax rates. The FICA tax is a big percentage of your total tax bill, especially for those making under six figures a year.

When I was making big bucks in finance, the tax bill was equally big bucks. The only saving grace was seeing my after-tax paycheck increase after the maximum taxable income threshold for Social Security was breached each year.

The tax amounts were jolting based on how inefficient the government was and still is with regards to spending our money.

Maximum Taxable Income Amount For Social Security Tax

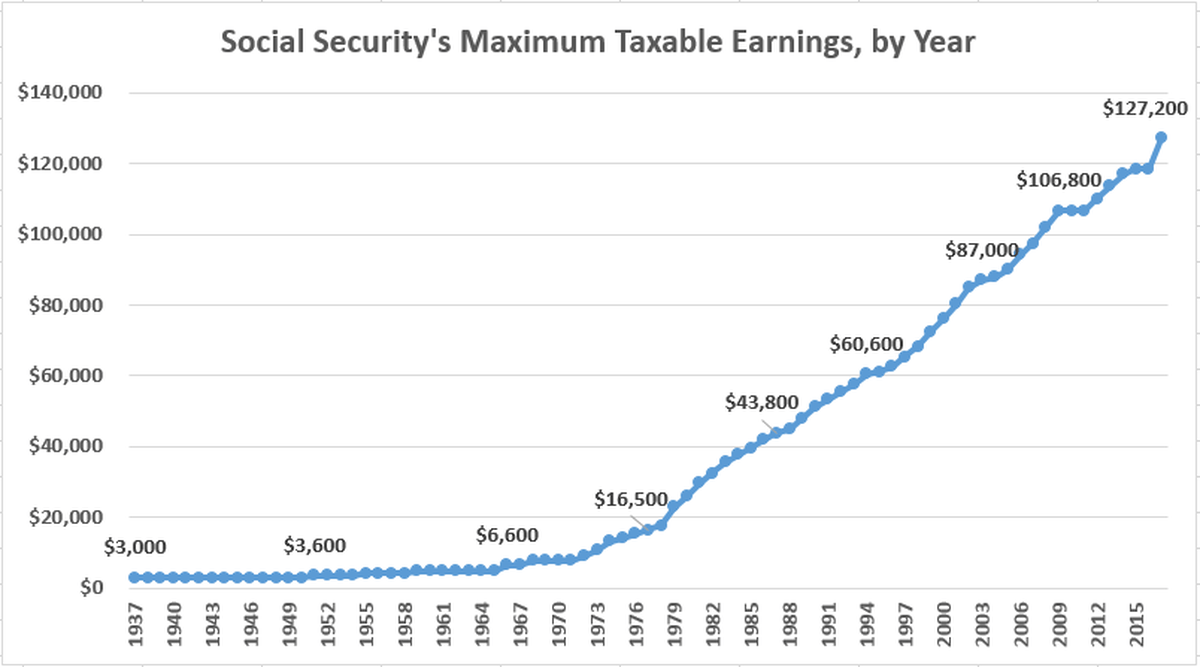

In 2024, employees are required to pay a 6.2% Social Security tax (with their employer matching that payment) on income up to $168,600, up from $160,200 in 2023, up from $147,000 in 2022, and up from $142,800 in 2021. The maximum income amount for Social Security tax tends to follow inflation up every year.

In other words, if you make $168,600, your maximum FICA tax will be $10,453.20. But don’t forget. You also have to pay a Medicare tax rate of 1.45%. Therefore, your total FICA tax rate is 7.65%. 7.65% X $168,600 = $12,897.90. If you are self-employed, you have to pay double (15.3%)!

Below is the historical maximum income amounts that that must pay Social Security Tax. FICA stands for Federal Insurance Contributions Act, which includes 6.2% for Social Security Tax and 1.45% for Medicare tax.

The flip side of this is that as the taxable maximum increases, so does the maximum amount of earnings used by the SSA to calculate retirement benefits.

Maximum Social Security Benefit Amount

The maximum benefit depends on the age you retire. For example, if you retire at full retirement age in 2024, your maximum benefit would be $3,627. However, if you retire at age 62 in 2024, your maximum benefit would be $2,572. If you retire at age 70 in 2023, your maximum benefit would be $4,555.

The maximum monthly Social Security benefit that an individual can receive per month back in 2021 was $3,790 for someone who files at age 70. For someone at full retirement age, the maximum amount is $3,011, and for someone aged 62, the maximum amount is $2,265.

The Best Income To Earn

Given we have a progressive tax system in America with Alternative Minimum Tax (AMT) and deduction phaseouts, I've calculated that the optimal Adjusted Gross Income is roughly $250,000, +/- $50,000. At $250,000, $112,300 of the earnings is free from the 6.2% FICA tax.

Meanwhile, you still get most of your mortgage interest deduction, and only have to pay a slight amount of AMT, depending on the person. A $250,000 income is also high enough to live relatively comfortably in any part of the world.

Here are the 2024 tax brackets and 2023 tax brackets so you can plan how much time and energy you want to spend making money. Contrary to popular belief, earning as much income as possible may not be the best income due to taxes.

If You Pay More Social Security Tax, You Earn More Social Security Benefits

Some might argue that the Social Security tax is regressive because it caps out. Why shouldn't rich people pay more? Here's the thing people might not understand. Social Security benefits cap out based on the maximum amount of Social Security tax contribution as well.

It's not like someone who is making $500,000 gets FICA-taxed on all of his earnings and then gets capped on Social Security benefits. He's just getting the maximum Social Security payout amount when it comes time.

The $500,000 income earner is already paying the highest marginal federal tax rate of 37% plus state taxes, if applicable.

The Medicare Tax Rate

The Medicare portion of the FICA tax is 2.9%, of which half (1.45%) is paid by employees and the other half by employers. Unlike Society Security, there is no limit on the amount of wages subject to the Medicare portion of the tax.

Also, the 6.2% Social Security tax is only half of the total tax amount. Employers actually have to pay the other half for you (6.2% employee + 6.2% employer = 12.4%), which means employees can look on the bright side and view the 6.2% employer's tax portion as a “subsidized retirement benefit.”

If you're self-employed, you're really hosed because you are responsible for the entire FICA tax rate of 15.3% (12.4 percent Social Security plus 2.9 percent Medicare).

Business Owners Establish S-Corps To Lower Their FICA Tax Liability

Having to pay the entire FICA tax rate is why some elect to establish S-Corps. S-corps allow owners to pay themselves a smaller salary in order to take as many distributions as possible. Again, distributions are not subject to FICA tax.

However, S-Corp owners with salaries that are too low in comparison to their total distributions run the risk of audits and penalties. Therefore, check with your accountant for guidance on your specific situation. The general income/distribution recommended ratio I've seen is 50%/50%. Remember, the government wants as much tax dollars from you as possible.

Meanwhile, if you earn over $200,000 as a single employee or over $250,000 as a married taxpayer, you are subject to an ADDITIONAL 0.9 percent Medicare tax with the Net Investment Income Tax (NIIT).

In other words, the employee now must pay 2.35% of his/her earnings to Medicare beyond $200,000/$250,000. The employer paid Medicare tax remains at 1.45%.

Historical Maximum Taxable Earnings For Social Security

As you can see from the above chart, the maximum taxable income has stayed the same during difficult years (2003-2004, 2009-2011), but always goes up over time.

Here's another great chart on the historical Social Security's Maximum Taxable earnings, by yar.

A Strategy To Pay Less FICA Taxes

There's a problem with the FICA tax because Social Security and Medicare are so poorly run by the government. The government itself estimates that Social Security is underfunded by around 25% – 30%. Either payouts must decrease by 30%, or the minimum age to start receiving Social Security must rise from age 62.

The government currently considers 66 as the full retirement age. You will get 75% of the monthly benefit if you elected Social Security at age 62. The reason bing you will be getting benefits for an additional 48 months before turning 66.

Given it's unlikely the government will reduce corruption or improve operational efficiency in our lifetimes, the goal for everybody should be:

1) To pay as little FICA tax as possible, while also saving as much money as you can for retirement. Social Security is underfunded.

or

2) Make as much money as possible beyond the maximum taxable income limit for Social Security tax.

All About Earning Passive Investment Income

The way to pay as little FICA tax as possible is to make as little wage income as possible. Earn money through investments, dividend income, annuities, CD interest income, distributions and so forth. Only earned income faces the Social Security and Medicare tax.

Developing passive income streams provides a better return for your buck thanks to no FICA taxes and lower long-term capital gains tax rates.

The way to make as much money beyond the maximum taxable income limit as possible is why you're here at Financial Samurai. Financial Samurai is all about making more money and growing your net worth.

Savings is great, but it is not enough. There are numerous industries and jobs that pay multiple six figures a year.

Real estate is an incredible asset class that is quite tax advantageous. And entrepreneurship income is not as limiting as employer income if you want to really try and make it big.

The people who pay the least amount of taxes as a percentage of their income either don't make much money or thoroughly understand the tax rules way beyond the average person. Definitely spend a good amount of time studying your local state or country's tax rules. It'll save you a lot of money down the road.

Related post: When Is The Best Time To Take Social Security?

Wealth Building Recommendations

1) Manage Your Net Worth For Free.

In order to optimize your finances, you've first got to track your finances. I recommend signing up for Empower's free financial tools so you can track your net worth. You can also analyze your investment portfolios for excessive fees.

Finally, run your financials through their amazing Retirement Planning Calculator. Those who come up with a financial plan build much greater wealth over the longer term than those who don't!

2) Diversify Into Real Estate For More Passive Income

In addition to investing as much as possible in your tax-advantaged retirement accounts for as long as possible, also consider diversifying into real estate. You can buy your primary residence and you can also invest in private real estate funds for further diversification.

Fundrise runs private real estate funds that predominantly invests in the Sunbelt region where valuations are lower and yields are higher. Its focus is on residential and industrial commercial real estate to help investors diversify and earn passive returns.

Fundrise currently manages over $3.5 billion for over 500,000 investors. I've invested $954,000 in private real estate funds since 2016 to diversify my investments and make more money passively. After I had children, I no longer wanted to manage as many rental properties.

Another private real estate platform to consider is CrowdStreet. Crowdstreet is a marketplace that mainly sources individual commercial real estate deals from various sponsors around the country. This way, you have more customization to build your own select private real estate portfolio.

Make sure you diversify your portfolio and do your due diligence on all the sponsors. Look up their track record, their management, and whether they have had any blowups before. You can build your own select real estate portfolio with CrowdStreet. I've met many of their people in person before and like what they are doing.

For more nuanced personal finance content, join 60,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009. Everything is written based off firsthand experience. Maximum Taxable Income Amount For Social Security Tax (FICA) is an FS original post.

Once an employee reaches their maximum amount of contribution to Social Security with one job, loses that job, starts another job, can that current Employer take out Social Security contributions even though this employee has reached the maximum amount contributed with his last employer?

If I understand your question, the answer is Yes. Not only can they, they will, they have to. Your new employer won’t know what you made previously, and they can’t trust people to report it correctly even if it was allowed. While you’ll end up paying more than the maximum amount required for a year, you will get it back once you file your taxes for the year.

Question? I was part of the Verizon sale to Frontier in April of 2016. My pay exceeded the FICA limit of 118,500 a few months ago, however I’m still having money taken from my check. Last time I looked it was over 9k vs. the 7.2k max. Frontier is saying that when our transition took place it’s like I started at 0 on April 1, ignoring the gross amount I made Jan through Mar 31? Is this true? This was Not a job change ..we were acquired. Bottom line I’m still paying into FICA and I don’t believe I shoukd be. Please advise

You will get the amount paid that is over 7347.

Great post. Very helpful. Do deductions reduce the income on which FICA must be paid? Or is FICA paid before deductions?

Is there a specific reason why there is no cap on the Medicare tax as there is for the Social Security tax?

Pingback: Gay Marriage Rights, Financial Benefits, And Tax Penalties | Financial Samurai

Pingback: Candid Advice For Those Joining The Startup World: Sleep With One Eye Open | Financial Samurai

Pingback: Social Security Will Make Us All Millionaires In Retirement | Financial Samurai

I feel that as long as you are working you should pay Social Security tax it doesn’t matter how much money you make you should pay for a full year. The people who make large amounts of money don’t need to worry about the Social Security tax anyways.

Only people who don’t make more than 118k feel this way. Why would anyone want to pay more money for something they will not have returned, ever. Seriously ever. You could literally change this to why don’t “rich” people just burn their money. You want to keep your money and so do the wealthy, there is no difference. By no means am I implying that you are not wealthy but must assume you are not self employed making over $118 and paying a minimum of 15.3 % of your income while encouraging others to pay more. If you want to donate more of your income by all means volunteer but I am sure you do not. Take the feeling of someone telling you to donate a higher percentage of your income to social security (which is not a charity by the way) with little to no guarantee of return…remember the offense you feel before you make statements like this. I gladly pay my giant disproportionate amount in taxes from the income I EARNED by working very hard for a very long time. I also have no problem paying social security taxes to pay for others retirement but I will never ever volunteer to pay more. That is not greed. Donating money voluntarily is generosity. Giving additional money to the government is a poor investment.

Gotta agree, I make more than the cutoff by August every year. I am glad it stops being withdrawn, as I have worked hard to get where I am and just because I made something of myself doesn’t mean I need to take care of those who haven’t. It already sucks we who pay the max will never get that much back. Not our job to pay for the unmotivated

Thank you! I did this for years, because I had nothing to write off, no Mortgage, and all my children grown. I was making over 150k and taxes were eating me alive, and I paid when I file, is why I gave more so not to have to pay a large amount upon filing, I am ignorant when it comes to taxes, but I don’t mind paying whatever so that our roads and and schools, and whatever else it is use for can operate smoothly. Now reading your comment I’m feeling foolish lol

Pingback: Mortgage Refinance Failure: Lending Standards Remain Very Tight | Financial Samurai

Pingback: Tax Penalties For High Income Earners: Net Investment Income, AMT, Medicare | Financial Samurai

Pingback: How To Make Six Figures A Year And Still Not Feel Rich - $200,000 Income Edition | Financial Samurai

While I get it that taxes are necessary, they still bite! The self employment tax of having to pay both sides is totally lame, but we know all too well there are so many ridiculous ways the government takes in double taxation (especially in CA!). It’s really helpful to pay attention to all these taxes that come out of our payroll even if they do make us sick to our stomachs. I knew that social security had a max, but I didn’t realize that Medicare doesn’t. ¡Ay, caramba!

I guess I always look at money as freedom. If I have enough money, I have the freedom to do what I want to do, when I want to do it. I like to see people saving half there income etc., but if it comes at the expense of not really LIVING….it’s not worth it! That being said, as my personal tax rate goes up with my income, it really doesn’t motivate me to make more money at all, but rather get into chill mode! lol

Pingback: How To Save More Than $100,000 A Year Pre-Tax: Open A SEP-IRA Or Solo 401k | Financial Samurai

Great article Sam. I believe that the FICA limit will continue to increase at a faster pace in the future. In order to not completely bankrupt our government, I think we’ll reduce Social Security payouts for those with an AGI over $250k (inflation adjusted in the future) and will continue to increase the age that full payments can be received.

I’ve been searching online with no luck to the following question. I know that for singles the FICA maximum is $118k this year. When married filling jointly is this limit exactly double ($236k) or is it kind of like marginal tax brackets that it would be around $200k (less than double the single amount)? An example, is if I made $175k this year and the wife makes $70k, I believe my paycheck would stop taking out FICA at $118k. However, at the end of the year, am I on the hook for more?

Thanks if anyone has the answer to above. I’m had no luck finding my answer after many a Google search unfortunately.

Mark,

You are probably right about the maximum taxable income limit for FICA increasing more and more.

Good question. Given the government used to believe $200,000 + $200,000 = $250,000 after a couple gets married to face the same tax rate, I can see the government NOT allowing for a doubling of FIC maximum for a married couple to $236,000 if they stayed consistent with their stupid logic…….. BUT, the government WANTS as much FICA tax as possible. Hence, you can be assured that the government will tax you up to $236,000.

Remember, the rules will ALWAYS favor what’s good for the government getting more tax revenue. So in your example, you will max out at $118,000 in the FICA tax, but the left over income will be added to your wife’s income and tax your overall income accordingly.

It is hard to escape. If there are tax professionals out there, please correct me if I’m wrong and help clarify!

thx

FICA (and the FICA max) is tied to the worker. So, if both spouses are working and making at least $118k, then the max is effectively double. But if one spouse makes $200k and the other makes $79k, the first spouse gets to shield $82k but the second spouse has to pay FICA on the whole $79k of income.

Hi Mark. I am in the exactly same situation as you had mentioned and I have had no luck finding the answer for this except your comment. What happened with your case. Did you have to cough more social security tax at the end of the year while filing tax return ?

Hi Karthik, Claire was spot on with her response above that thankfully the social security cap is on an employee level not per couple. If you made $200k and your wife made $50k for the year, you would pay 6.2% up to $128,400 and your wife would pay 6.2% on $50k.

https://finance.zacks.com/cap-paying-social-security-taxes-joint-return-8329.html

Great topic, per usual. I’m a bit torn on this issue. I’ve paid the “max” in for several years…enough to reach the second “bend point” ( thanks Finance Buff ) at age 43. There’s a school of thought out there that removing the max all together would make future payments “whole” vs. the estimated 75% @ 2030. That sounds somewhat reasonable IF people who “took care of business” aren’t punished with BS means testing. Many of us here want to take some sort of early retirement…or will be forced to due to job market, failing health etc. SS could be an essential ” bucket” to draw from in our later years.

The failure to allow a privatization option for SSI during the Bush administration is one of the most disappointing government failures in the last 20 years, in my mind. RoI on SSI has historically barely met inflation at ~2%. The only way you end up “winning” in this game is living into your late 80s early 90s, and even then you probably would have done better had you invested in a simple S&P index. The best solution to this situation isn’t one that is being talked about now, and that is the suggestion that was floated in the 90s. Give younger investors the option to privatize (with the employer’s match), older investors can stay in the system if they want. The government is going to be far less likely to raid individual account holders than the SSI pool. Probably not what is going to happen though.

More likely:

1. CPI (COLA) measures will be tweaked to lower SSI increases, decreasing the value of the payout for future beneficiaries annually (this is the chained CPI debate from 2013-14).

OR

Benefits will be cut, similar to the pension scenarios recently in the news.

2. The FICA will be raised.

3. The payout age(s) will be raised.

Truly, I expect all 3 to be implemented. Yet it would be far better for anyone with even a rudimentary understanding of finance to be personally investing that money, imo. The most fervent opposition of my position nearly always immediately state that the average American is too stupid to handle their own money.

I think that both you and I can guarantee a negative return on our investment here Sam. That is highly disappointing to me, and I’m sure to you as well.

You could also form an LLC and elect S-Corp status with the IRS. This makes a lot of sense in a high income scenario.

I suppose you could also form an LP or GP and establish a corporation to act as the General or Managing Partner. The LP/GP would pay G&A to the corporation and your distributions likely would be pass through to you individually as a partner/limited partner.

I’m assuming that the optimal income of $250,000 is for a single earner. What are your thoughts for a dual earning household?

Take a look at this post on when the marriage penalty tax kicks in. From there, you can decide what is optimal for a dual earning household!

You did not happen to mention a critical part of the Social Security calculation that makes it a highly progressive tax. The tax, itself, is 6.2% (or 12.4%) up to the maximum. As a fixed percentage, it is neither progressive or regressive.

However, the retirement benefit formula replaces 85% of average salary for low-paid workers, but slides down to a marginal income replacement of just 15% of pre-retirement income for higher-paid workers.

This extremely progressive formula tends to get overlooked (an intentional feature inserted by the program’s architects) since you don’t see it on every pay stub. It means that Social Security is actually a very good forced savings program for low-paid workers, but a horrible deal as a forced savings vehicle for higher-paid workers.

That social security is underfunded by 30% does not prove that social security is “poorly run by the government”. People are living longer, retiring earlier and less children are being born.

Now is Medicare poorly run – I think ther is more evidence that that statement is true. Over and over again they pay millions or billions for fraudelent claims – often for durable medical equipment.

It is poorly run. A well run program would anticipate things such as longer lifespans (it’s been happening for centuries) and lower returns.

The results are the results. If I’m a basketball coach with a 5-15 record, I am failing. I can’t blame the opponents for recruiting better players or having better plays.

…it would be poorly run for a profit-making enterprise…but it is not. It is a government program, ultimately funded by the government.

The government has the monopoly on the currency and can choose to fully fund SocSec forever. If the government eliminated the taxes paid into the program, the result would be inflationary, but it would not bankrupt the program.

Governments with a monopoly right to a currency can create inflation, but they can’t go bankrupt. As long as the US Gov can effectively tax its citizens, then inflation can be controlled.

In your analogy, the government basketball coach can improve his record by giving himself more points. Points are unlimited to him.

I like the analysis you put in to determine the the optimal Adjusted Gross Income at ~ $250,000.

The S-Corp solution is a good one, especially for sole proprietor professionals.

This is my first year doing my own tax returns – good thing I took two painful semesters of tax law in law school! I’m starting now so that I have them right by April, 2015. I’m hopeful that the process will help me be a better and more thoughtful investor going forward.

Share with us all your tax knowledge as it comes up! I’m a tax enthusiast. thx

Thank you for all of the great information. I truly love reading your blog! It’s one of my favorites out there.

I was wondering if there was a book out there that you’d suggest as a way to learn more about tax advantages.

Hi Jessica,

Any book about tax advantages will probably be the driest book on Earth. I would go through my Tax Category where I try to find out the truth and make things as interesting as possible so you don’t fall asleep! :)

The tax book is like 70,000 pages long… it is crazy!

Sam

Given a large chunk of the population, particularly those in physically demanding occupations, continues to take their SS at 62 to have a shot at living a longer life (which many surveys continue to demonstrate), it is unlikely they will change the entry level to collect SS. I would love to see them restructure the system to go back to it’s original point and not pay for all the disability and other tag-on’s that have been added over the years, but I doubt that will occur. So I suspect the following:

1. They will continue to raise the age for collecting “full” SS. It’s 66 now and is already slotted to go to 67 for those born post 1960 if I recall correctly. Makes sense they stretch receipt of full benefits to 69 or even 70. This way the entry level stays but the amount per year increase is reduced to full retirement age, creating a situation where more people will likely take SS earlier and not get their full benefits to begin with.

2. They will, since it is a minority being affected (e.g. <10%), raise the maximum taxable income at some point. By how much and how large an amount, I don't know, but it wouldn't surprise me if it went up significantly.

3. They will raise the SS tax over a period of years, from the 6.2% to probably something like 7-9%. They may call it something other than a "tax", but that's what it will be.

4. They will develop a "means" test of SS for those who have been higher earners and invested more. I envision they'll do something similar to the current income test, so for every $2 you receive above a set amount from a 401K or investments, etc. during the year you will lose $1 in SS. Much like the current earnings test I suspect it would disappear after a certain age. The point being if you have other sources of support you don't "need" to rely on SS so much, or at least I suspect that will be the argument put forward. The test may also relate directly to what you have in 401K balances and investment assets, so they could base it on an assumption of what you "should" withdraw whether you do so or not. It would more likely be initially used for those who have still have pensions coming to them who can also collect SS then eventually be expanded to 401Ks and investments.

Any way you look at it the system will have to change even if it doesn't change radically. From what I've read, minor changes (raising full retirement age, raising the rate to 7%) make big differences especially if implimented sooner. If they aren't willing to take the money from other areas of the budget, then it comes down to raising taxes or creating "fees" to cut their expeditures. In the end I expect to recieve less than projected from SS, I use 50% in my calcs.

Very welll written!

It makes total sense that the age to receive SS should be increased as we are living longer and longer. However, as you stated, the vast majority of people continue to take the benefits at 62 years of age. Thus, raising the age of retirement does not due much, they also increase the penalty for getting benefits early.

It would be great if Social Security did not include disability – however, as you stated – its not likel that this benefit will be taken away.

I’d probably take benefits of 62 years of age as well. What if I get hit by a truck at 63? Waiting is tough for most people, including myself.

MEANS test? Typical government. Punishing good behavior and rewarding bad behavior.

What message does that send to the next generation? Don’t bother to save or you’ll never get back all the money you paid into SS.

You save and plan for the future, you won’t get your money back. The guy who earned just as much as you but spent it all … collects!

Of course there should be some sort of means testing. Unless we decide to eliminate the cap altogether as I have advocated for several decades. Those folks (in the high ranges making most of their money from investments. They have taken advantage of the tax system don’t really need any of the additional benefits. They have already gained a decided advantage from the tax rules for investment earners.

I don’t think we should be forced to pay into Social Security at all. The government is worthless when it comes to managing money, and as it stands we don’t even get back all we paid into the program. I’m pretty confident that I can manage my money a whole lot better than our wasteful government can. Hell, they’ve proven for decades that they’re already terrible at it.

The thing is, Australia has their Superannuation system which is like a SUPER Social Security Tax with higher rates, and their average inheritance amount is $500,000 vs. $180,000 here in the US. Singapore has a great country retirement system too. There is something to be said for big government!

No, I don’t think we will receive full SS when the time comes. I also don’t think they should raise the $118K cap. However, I do think they need to raise the retirement age, since we are living longer lives.

What about worker displacement due to automation and offshoring? What kind of jobs will there be for us geezers to work at in 30 or 40 years?

I think most people making more than the SS cap would prefer to save for themselves rather than have the government do it.

I love all your posts, but I really enjoy posts such as these. I think you should find accountants to guest post and share more knowledge to us readers.

I don’t think you should pay more. You get the same amount out, so why put more in? I think the “more” you’re putting in is the up to $118k which is over double what the average family (note – two earner) makes in the US. That’s the extra already in my opinion.

I’m all for raising the age at which you can draw. The age at which you can draw should be tied with life expectancy at birth and our government has fallen short in doing that.

Jay