There is a dark side of early retirement I want to tell you about.

I originally wrote this post in 2011 when I was strongly considering retiring early from banking after 12 years. I was burned out and stopped caring about climbing the corporate ladder or making a lot of money. At the time, I felt similar to the way quiet quitters are feeling today.

I ultimately did retire a year later in 2012, at the age of 34, and have stayed “retired” ever since. After 13 years of early retirement, or fake retirement as I fondly call it, I've updated this post with lot more perspective. The pandemic also gave me a gut-check regarding whether I'm spending time in a meaningful way each day.

Early retirement is generally great. You can do what you want when you want. But there is a dark side of early retirement that people need to be aware about. Let me share the negatives with you today.

The Dark Side Of Early Retirement

If you look carefully around the web, you'll read scores of articles about the desire to retire early or how fabulous the early retirement lifestyle is. The FIRE movement (Financial Independence Retire Early) has grown rapidly since I first began writing about retiring early in 2009.

The reality is, there is a lot of downsides to retiring early nobody talks about. Take it from me, someone who left their corporate job for good in 2012 at the age of 34. I'm now 47 years old with a lot more perspective.

I agonized with the early retirement decision before I left. I also experienced some negative surprises that I did not anticipate until after I had already left Corporate America.

Leaving a stable job, especially during times of uncertainty is tough. As a result, many employees end up suffering from the “one more year syndrome” for far too long. If you decide to retire early and realize six months later you want to come back to work, there may not be a job to come back to!

Let me be clear. I love early retirement. I'm happier because I retired early. However, there are some things I would have done differently if I could rewind time.

Namely, I would have retired closer to 40 years old and had children while working, to take advantage of parental leave! But other than these two things, I have no regrets.

Let us explore several reasons why people want to retire early, why they exist, as well as understand why we should all think twice about pulling the ripcord too early.

Why People Want To Retire Early

You would think the reason why people want to retire early would be obvious: the desire for freedom. However, life is much more complicated than wanting to do what you want, whenever you want.

The below reasons why people want to retire early might sting, but thy are the truth. It is the dark side to early retirement that not enough people are talking about. I want to be honest and upfront about the negatives of early retirement so you can make a more informed decision.

1) Haven't found the right job.

The number one reason why people want to retire early is because people haven't found a job that gives them enough fulfillment to do it for the rest of their lives. Nobody quits a job they like. If there was a job paying $80,000 a year to hike in the mornings and get massages in the afternoon, I'd do that forever!

2) Easier way out.

If you are a sub-optimal performer, you tend to experience a sub-optimal lifestyle. It's easier to just give up as a result. Let's say you are a research scientist who after 10 years never produces any relevant research and finds no cures.

Instead of going on with failure, you decide to give up and get out of the game. Early retirement is like the cowards way of not having to be the best any more. Some even liken it to suicide.

3) Some people want shortcuts in life.

Society has shifted our ideals from hard work and thinking long term to instant gratification. Nobody has the patience to work for decades before being eligible for a pension.

Look at our pathetic <6% saving rate before the pandemic began in 2020, and now today in 2025. We all think we know more than we do and deserve to be the rich boss now. When we don't get our way, we quit, rather than letting people know we couldn't reach our potential.

We also make up new definitions of FIRE (Financial Independence Retire Early), a movement I helped launch in 2009. Instead of traditional FIRE, we say we are Lean FIRE, Coast FIRE, or Barista FIRE to make ourselves feel better about our progress. But the reality is, if you don't have at least 25X your expenses in investable assets, you are not really FIRE.

Personally, I think Coast FIRE is one of the most dangerous types of FIRE subtypes there is because it lulls you into complacency. There's really no difference between Coast FIRE and a regular worker saving for retirement.

4) A feeling of hopelessness.

During the downturn a tremendous number of people began writing about location independent lifestyles that allow one to break free from the 9-5 and “really doing what you want.” In actuality, we all know that what they really wanted was to have a good job and be accepted by society.

It's because of the downturn of 2008-2009 that so many were displaced with nowhere to go. If they did, perhaps they'd think differently. In an economy where everybody is losing money left and right, what's the point of working some think. I suspect the same thing may happen in 2020 as well.

5) Realization that time is precious.

The median lifespan hovers around 80 years old. Thus, you only have 20 years of retirement to enjoy your life if you retire after 60, when most people do. People in this camp have a heightened awareness of time. Therefore, they do everything possible to make sure they are financially stable sooner, rather than later.

I'm a strong believer in this thought process. But at the same time, I don't want to cut short my potential. The worst is running out of money and being too old to do anything about it.

The Dangers Of Early Retirement

Here are more reasons why you might not want to retire early.

1) Oops, you change your mind.

Imagine retiring at 37 after 15 years of work after undergrad. You spend the next 3 years traveling the world, living a leisure lifestyle and experiencing new things.

At age 40, you realize the reason why travel and play is so fun is because of work! You have the urge to get back into the game. But who's going to risk hiring a 40 year old with a 3 year employment gap?

The employer will suspect you are rusty, and that you may just bolt after a year. As a result, the employer simply chooses to hire someone with no gap in their employment, or someone else from another firm.

If I could retire all over again, I would have waited another five years to earn more, save more, and have children while working.

2) You run out of money in early retirement.

No matter how conservative we are in our retirement money needs, something unforeseen may happen. Maybe you have a medical disaster, or your house blows down. Maybe your investments tank due to a massive economic downturn. Who knows what the future holds, which is why the proper safe withdrawal rate is dynamic.

But if you partake in “normal” early retirement, without the mega-millions windfall, you may find yourself needing more one day. Again, a large employment gap is perceived as riskier by the employer. So you may be unhireable if you need to return.

If you want to retire early, the most you should be out of the workforce is three years, but preferably two years. After two years, you should have enough taste of the early retirement lifestyle to figure out if never working a normal day job is right for you.

Here's a savings guideline by age you should consider before retiring early. The fear of running out of money in retirement is overblown, but it helps keep you motivated to keep track of your finances and save more.

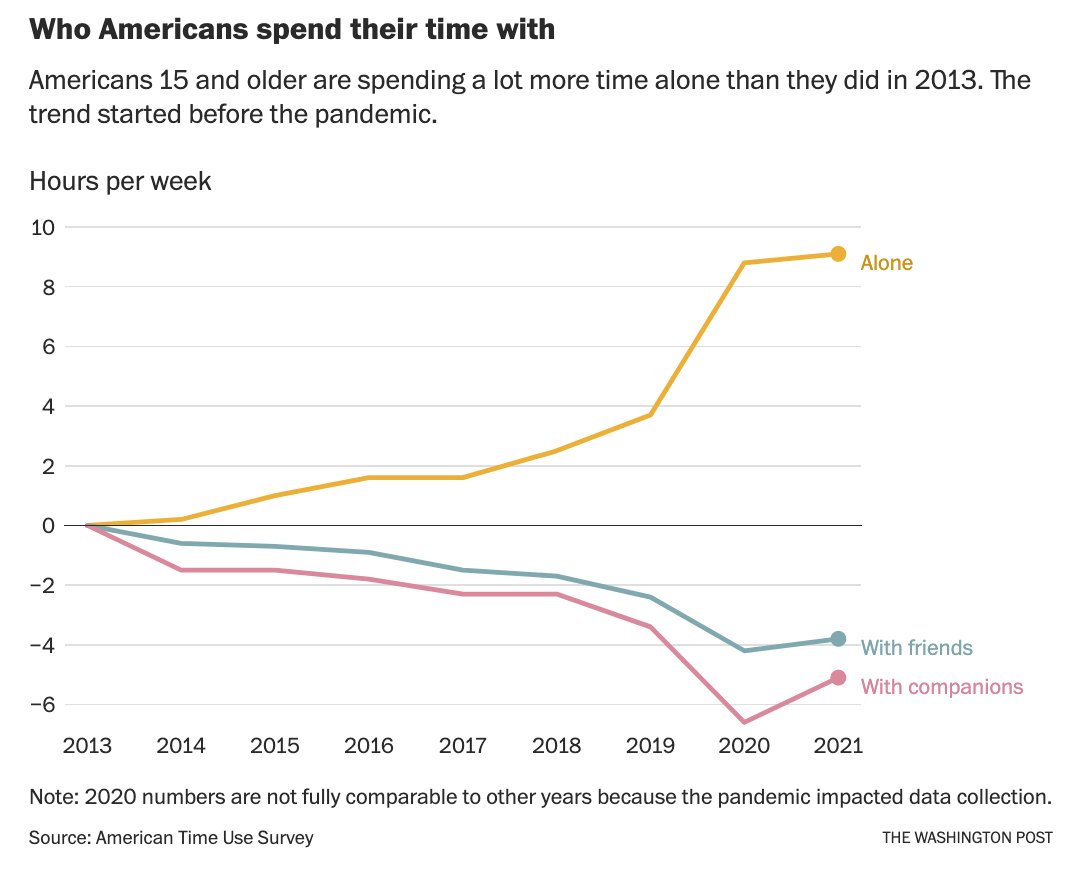

3) You lose touch with friends and family after retiring early.

It's nice to have all the time in the world to do whatever you want. But, if your friends and loved ones are busy working all day, they can't join you on your midday hike or adventure to Bora Bora.

They may also have a family to tend to during the evenings and on weekends. If you've ever taken a staycation by yourself, you'll soon realize how lonely it is when others are busy leading their own lives.

There's a loneliness epidemic that is spreading across the world, partially accelerated by the pandemic. Work from home is nice, but it is also causing people to lose vital connections for a better life. If you retire early, you will feel more alone if you don't have any hobbies or friends outside of work.

4) You may find it difficult to start your own family when you don't earn enough.

Unless you retire with a tremendous amount of money, having a child and raising a child may be too expensive an endeavor to undertake as early retirees. In big cities like New York City and San Francisco, you might have to spend around $1 million to raise your child from birth through college.

Even if your household has a $5 million net worth, it's not easy to sustain an early retirement lifestyle with two kids in a big city like Los Angeles. Interest rates are close to all-time lows, which means the relative income generated by your retirement investments are also likely at all-time lows.

Finally, your focus on saving and investing enough money to retire early might make it more difficult for you to have kids if you wait too long.

I know so many couples who were so focused on keeping expenses down in order to retire early, that by the time they started trying after 35, it was too late. They had to go through IUI, IVF, and all sorts of expensive and arduous procedures, many to no luck.

5) You may lose your own self-respect, and the respect of others.

Unless you're out there helping the poor, fighting racism, or trying to make a positive difference in people's lives, you might start getting depressed you are contributing very little to society. You need purpose in retirement, otherwise, it's hard to stay retired.

Others may stop respecting you because you aren't doing anything productive either. Traveling the world and writing about how great your life is, is a very unproductive endeavor.

A great many rich early retiree friends from the first dotcom bubble in 2000 have mentioned they wish they didn't get rich so quickly. Instead, they wish they worked a little harder for their money.

During the first year of early retirement, I was bored out of my mind. I would wake up automatically at 6 am every morning and just twiddle my thumbs until my wife woke up at 8 am or later. It was when I committed to writing on Financial Samurai every day where I found my purpose in early retirement.

Related: Once You Retire Early, It's Hard To Stay Retired

6) You may feel overwhelmed by doing too much

One of the surprising aspects of early retirement is how often I feel overwhelmed. With endless options to fill your time, it can be more stressful than having just a few. This is the paradox of choice: too many possibilities can weigh on your mental health as you constantly face decisions and second-guess yourself. Without setting clear boundaries, you might unintentionally recreate the same grind you left behind at work.

Once you retire, you don't have to do everything you've always wanted. And if you do, come up with a plan of attack so you don't feel overwhelmed in retirement.

Careful Who You Listen To About Early Retirement

The dark side of early retirement is real.

Early retirees will croon about how great their lifestyles are. In some ways they are spot on. But notice how they seldom write about the hardships they face.

They can't, because it's important they continue highlighting how awesome everything is, to justify their decision to no longer work. It might not even be their decision to retire early as they may have gotten laid off.

The louder you have to brag about how great your early retirement lifestyle is, the less great it probably is. Just like how confident people don't brag about their achievements, people who are busy living great lives aren't telling the world about how great their lives really are.

Leverage Your Education To Work On Something Meaningful

Can you imagine spending 16 years going to school (grade school + four years of college) only to work for 10 years? Some would surely say that's a waste, would they not?

Perhaps the worst that could happen is some aspiring scientist, musician, lawyer, or teacher decides to give up their careers because they believe traveling around the world on a shoe-string budget is so glamorous.

Years later, they realize their fingers don't remember the notes anymore and the chemical formulas are one big haze. Maybe they would have made it as a concert pianist, or helped discover the cure for seasonal allergies, ACHOO!

What a shame they never reached their full potential. Perhaps this is the real dark side of early retirement.

Early Retirement Can Be Selfish

I think back upon my childhood years and remember how much effort my parents put into raising me. My mother would spend hours explaining mathematical equations after dinner every day. My father would read all my essays and fix all the punctuations and grammatical mistakes.

As a parent now, I appreciate how much time and effort it takes to raise children. To work less years than you went to school doesn't feel right. It feels like I wasted some of my studies and my parent's efforts.

To not want to be a productive member of society when I know I can is selfish and lazy. Again, this is one of the main reasons why I've committed to writing 3X a week on Financial Samurai for the past 10 years. If I'm not going to be a laborer, then I want to at least help more people reach financial independence sooner.

By stopping work early, you are also depriving the government and society of your valuable tax dollars. Taxes are used to help fund schools, roads, libraries, Social Security, Medicare, defense, and more. I was paying over $100,000 a year in taxes for 10 years before I retired in 2012. Then I stopped paying as much for the first several years to help society.

In addition, there is a stinginess about financial independence that I've observed. I notice most people who've retired early do not give much or at all to charity. They also don't volunteer much of their time either. It's quite selfish and sad.

Look Beyond The Smoke And Mirrors

Early retirees sometimes like to pity those who have to work. Yet perhaps we should empathize with those who are lost and haven't found something they truly love to do (point #1).

It's impossible to all be great humanitarians working tirelessly until the age of 65. It's easier just to give up and tell the world how fabulous your life is, and how you've retired on your “own” terms.

But what are early retirees really running away from? What is the dark side of early retirement they can't face? Once you recognize the truth, your career path and your life will be much clearer.

The best thing you can do is work at a job you'd do for free. Sometimes, it takes doing your own thing to truly find what makes you happy.

So long as you have purpose, whether you are working or in early retirement, everything will turn out OK. It often just takes finding what that purpose really is in life.

Personally, I'm sick of writing so much and trying to earn supplemental retirement income online. After a long and arduous pandemic, I'm happy to re-retire again.

I plan to spend my days writing books and spending as much time with my children as possible. More than 80% of the time we will ever spend with our children is during their first 18 years of life. I don't want to waste a moment.

Order My New Book: Millionaire Milestones

If you’re ready to build more wealth than 90% of the population and retire earlier, grab a copy of my new book, Millionaire Milestones: Simple Steps to Seven Figures. With over 30 years of experience working in, studying, and writing about finance, I’ve distilled everything I know into this practical guide to help you achieve financial success.

Here’s the truth: life gets better when you have money. Financial security gives you the freedom to live on your terms and the peace of mind that your children and loved ones are taken care of.

Millionaire Milestones is your roadmap to building the wealth you need to live the life you’ve always dreamed of. Order your copy today and take the first step toward the financial future you deserve!

Retire Earlier With Real Estate

Real estate is my favorite way to build wealth and increase your chances of retiring earlier. Real estate is less volatile than stocks, provides utility, and generates higher income.

The combination of rising rents and rising capital values is a very powerful combination over time. By the time I was 30, I had bought two properties in San Francisco and one property in Lake Tahoe. The income from these properties helped give me the confidence to leave work in 2012 at age 34.

In 2016, I started diversifying into heartland real estate to take advantage of lower valuations and higher cap rates. I did so by investing $954,000 with real estate crowdfunding platforms. With interest rates down, the value of cash flow is up. Further, the pandemic has made working from home more common.

Favorite two private real estate platforms:

Fundrise: A way for all investors to diversify into real estate through private funds with just $10. Fundrise has been around since 2012 and manages about $3 billion for 350,000+ investors.

The real estate platform invests primarily in residential and industrial properties in the Sunbelt, where valuations are cheaper and yields are higher. The spreading out of America is a long-term demographic trend. For most people, investing in a diversified fund is the way to go.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations and higher rental yields. These cities also have higher growth potential due to job growth and demographic trends.

If you are a real estate enthusiast with more time, you can build your own diversified real estate portfolio with CrowdStreet. However, before investing in each deal, make sure to do extensive due diligence on each sponsor. Understanding each sponsor's track record and experience is vital.

Both platforms are sponsors of Financial Samurai and Financial Samurai is a six-figure investor in Fundrise funds. I like funds better for diversification purposes.

Stay On Top Of Your Finances

One of the best way to become financially independent is to get a handle on your finances by signing up with Empower. It is a free online platform which aggregates all your financial accounts in one place so you can see where you can optimize your money.

Before Empower, I had to log into eight different systems to track 25+ difference accounts (brokerage, multiple banks, 401K, etc) to manage my finances on an Excel spreadsheet. Now, I can just log into Empower to see how all my accounts are doing, including my net worth. I can also see how much I’m spending and saving every month through their cash flow tool.

A great feature is their Portfolio Fee Analyzer, which runs your investment portfolio(s) through its software in a click of a button to see what you are paying. I found out I was paying $1,700 a year in portfolio fees I had no idea I was hemorrhaging!

There is no better financial tool online that has helped me more to achieve financial freedom. It only takes a minute to sign up.

Subscribe To Financial Samurai

The Dark Side Of Early Retirement is a Financial Samurai original post. As one of the founders of the FIRE movement, I'm always trying to share with readers as much real-life perspective as possible.

Here are the reasons to reject not retiring early (to actually go for it) from another man who did.

For more nuanced personal finance content, join 65,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

To get my posts in your inbox as soon as they are published, sign up here.

I plan to retire at age 45 or 50, but as of now, I am building my life. I work, save, and invest so I can still earn income when I choose to retire early.

i am not sure why people think retiring later doesn’t bring the same problems. I am turning 70, still work, and when I am asked why I don’t retire and “enjoy life,” I ask them if they would like to retire at 40! Do they not need income? Do they have enough to do to fill all those extra hours in a day? Do they like the idea of no longer being a part of the business world and being on the sidelines? You can only travel so much, read so many books, take up so many hobbies. And, guess what? I do all of those things even though I still work! Now, if you hate your job, I understand. But, if you don’t, it makes little sense to abandon that and then take up watching the 100 best movies of the century (although I did that during COVID) as a replacement.

All of like to be involved, relevant, and challenged. Yes, some people love retired life….puttering, gardening, going to Olive Garden and taking cruises…but many of us don’t find this the kind of life that suits us.

Thanks for sharing your insights Pat. I’m glad your work provides meaning. For many, their work does not.

I don’t even consider this retirement. Retiring is something that happens after a lifetime of working. Something that is earned. Sounds like you just hit the mid-30’s and didn’t want to work. Nice luxury to have. I’m glad it seems to have worked out but it is definitely not an option for most.

Thanks. I definitely retired from a traditional day job and I haven’t been back to work since 2012. Instead, I decided to travel and work on my creative side as a writer on this site.

Finally, I have a podcast and I have a new book coming out called Millionaire Milestones: Simple Steps to Seven Figures.

It’s been a fun and rewarding early retirement journey. Now that I’m 47 years old, I don’t regret one bit seizing life by the horns and trying to do my own thing.

What’s with this author’s productivity fetish? It’s so clear they are from the US. The universe doesn’t care if you’re productive or not. If you care so much about what others think of you, you will never have a happy (early) retirement. Do whatever the hell you want. Lay on a beach and drink coconut juice if you wish. Have you ever heard the saying “live your life productively”? No, but you might have heard “life your life with no regrets”. You choose which is better to stick to.

Personally, I love being productive. It’s what enabled me to retire at 34 2012 and I don’t regret it at all. It’s been a great ride.

That’s fair. Getting to retirement by being productive is one thing. My point is about the pervasive productivity culture and caring about what others think. Staying productive is one of many ways of deriving meaning. Thinking about lack of productivity as selfishness, laziness, with the consequence of losing respect of others sounds unhealthy to me. Almost as if one is so soaked in this mindset that they’re unable to think outside the box anymore. We don’t need to fit into a specific culture or mindset to be happy – create your own!

Sounds good. When did you retire and how long did it take?

Personally I try to stay low key, but it can be hard given the longevity and the size of this site.

People are free to

Do whatever they want. But if they want to retire early, they have to earn more, invest more, and be more productive. After all, retiring, early means squeezing more more production into a shorter amount of time.

Great information on early retirement. I experienced a few of the pitfalls outlined here when I retired at 43. But, I quickly realized I needed a new purpose for my day-to-day. So I found two hobbies that I enjoy. I spend many hours per day engaged in those hobbies. My personal finances are secured, so my main struggle has been boredom. It was and can be challenging to find things to keep busy. Five years later, I still rather be retired than in the workforce.

I am 35 and on the brink of early retirement, but absolutely terrified of the prospect of plunging into the unknown. Really appreciated this thoughtful unpacking of all the fears I’ve been grappling with.

You’re welcome Cory. You may enjoy this post as well. It was written after I retired and updated every year since 2012.

https://www.financialsamurai.com/the-negatives-of-early-retirement-life-nobody-likes-to-talks-about/

Also, if you can negotiate a severance, it will put you over the edge to finally leave work behind. Getting a severance package was my number one catalyst for leaving banking at age 34.

I had years of living expenses paid for by my severance package. And if I got bored or things didn’t work out, I could always just go back to work.

I updated How To Engineer Your Layoff in 2023. It’s now on its 6th edition and has helped thousands negotiate a severance to break free.

Here’s my perspective as someone who really wants to retire as soon as possible.

The big reason is I’m not even sure how work can be fulfilling. I was raised hating the idea of work, am surrounded by people who don’t like their jobs, hated all but one of every job I’ve had so far and haven’t been paid much in any of them either. I also don’t understand the idea of having potential to be a great employee or why I have to be paid in order to contribute to society. To me, work has significantly more negatives than positives and I want to retire as soon as possible because it’s the only part of my life that gives me great discomfort and stress.

Thanks to the events of 2020, I had the longest period without obligations in my life and absolutely loved it. I have always had hobbies and suddenly had the time to really dive into them. My health was improving, I learned better ways to take care of myself, and kept finding new things to do. Now that I’m back at work, I’m only ever happy during my days off.

After reading the article, I understand that this puts me under reason #1 for why I want to retire early. It’s just very hard to wrap my head around a job that I can be happy with as it goes against everything I know while retiring early feels like the correct option.

I’d love to understand more about what liking a job feels like to see what I’m missing if anyone would like to talk about it.

Hello Sam, I am a 67 year old man that has been retired for about 5 years. My wife retired 2.5 years ago. Finances are not a problem for us and we have no debt. I retired from a job that was demanding with a lot of pressure. I enjoyed my job up until about 6 months before I retired as I got tired trying to find employees who wanted a career more that a check. I never had any hobbies, cabin, fishing boat as most people do so being retired, I find retirement to be a real downer. My wife does not want me to get a job of any kind so I just sit here and exist here every day sound small tasks. Any suggestions ?

Hello James,

You and I are are same age and I retired 5 years ago and moved to a new city to be near the grandkids, so I am now a professional grandfather, so to speak.

However, I too have a lot of free time that is spent inside my own head, thinking my own thoughts and realizing how hard it is to just sit with my own thoughts and emotions without giving in to the urge to find some distraction to pull me away. I tend to gravitate toward snacking, drinking, or mindlessly web surfing and indulging in the recreational outrage and negativity so pervasive online. I came to realize how ultimately destructive to my own contentment and happiness this is.

I don’t give advice, so please don’t take what I’m about to say as any sort of prescription or correct way to live your life in retirement. This is simply what I have done that I enjoy and that has been of benefit. I was compelled to respond to your post as a way to clarify my own thinking as much as by the hope that it might be of some help to you. I am certainly no expert in these matters beyond what seems to work for me personally.

What I’ve been doing that has helped me enormously is to engage in a brief but consistent 20-30 minute daily practice of yoga, not only the postures and stretches, but breathing exercises and allowing whatever comes to my mind to pass through without getting wrapped up in it. Mindfulness, some people call it. There are a ton of online resources that can help point you in the right direction.

I find sitting and meditating a bit of a challenge so I walk instead, pretty rapidly, and listen to podcasts devoted to all sorts of self help and health related issues. I quit consuming more that 5-10 minutes of news daily, just enough to keep up with current events, started eating a healthier diet, gave up the booze, found things in my daily life to be grateful for and I also keep a journal that I fill with whatever random thoughts I want to record. I’ve also started learning to read music and attempt to play the mandolin. I’m pretty unaccomplished, but it’s getting better. I try to connect with nature, going outside, gardening, digging in the dirt, hiking or just walking down the street to chat with whomever I happen to meet. Being in a new city I’ve had to make the effort to make new friends, an ongoing challenge.

If I don’t feel like doing any of this, I may skip a day or two, without guilt of self-judgement for doing so, but I do find the daily routine and consistent engagement in them to have allowed me to just relax and be grateful for this time in my life where I have to freedom to disengage from the pervasive cultural momentum of productivity and achievement. I’m learning to allow the day to unfold, without any particular need to plan and control, but to be open and positive toward whatever comes my way. I must add that this takes effort, as for many years I was a busy, over-working, anxious professional and that is my underlying personality, conditioned by my upbringing and education.

I realize that much of what I’ve said is internally directed and meant to change the way I experience the moments in life. It is a skill to be developed, no doubt, like any other skill, and that gives me meaning and purpose.

I wish you the best!

Very inspiring. I have found similar insights into living a better life. Enjoy!

Yes! Explore hobbies. Try art, woodworking, writing a book.

Take classes.try on line classes. In person University classes. Local mom and pop shops’ classes (like a pottery place, a cooking class at a William Sonoma). Teach a class for fun by getting a booth at the farmers market, etc., and doing impromptu classes right there.

Volunteer. Work for the scouts, a hospital. Proof read a resume for college kids. The small business association needs people to help others get started with a business plan.

Join a local club like for hiking, canoeing, toastmasters, gardening.

Be mindful about getting into shape.

Learn how to eat right. What we were taught as kids re nutrition has changed in 60 years.

Read Happy Money (a book on why some people are successful retirees and others aren’t.) Learn about Blue zones which has entire communities living well into their 120s. And happily and healthily living that long.

Was your work your calling? If so how can you still participate in that field without having long term commitments( meaning promising someone you will be at a place for X amount of hours every. Single. Morning/day.)

What about you “going back to work” has your wife aflutter? Address her needs.

If your career wasn’t your calling which aspect had you loving it? Was it helping others? Organizing info? Starting from scratch and seeing the building process through to completion? How can this desire translate into something else?

What did you wish you could do when you were working but you never had the time/money? How did you spend your time as a kid that you couldn’t wait to get out of school to go do?

Treat your locale as if you’ve never been there. Go exploring. I bet you don’t realize half the new businesses that have popped up around you. I’ve lived here all my life and never knew about the pig races 25 mins away (I’m in Houston) nor there was such a thing as goat yoga. Lol.

Research a place you want to travel to. Go. Can’t go? (War torn, societal collapse) there are online “tours” that let you explore at least parts of the town.

If you’re bored with reading for example, try to spice it up. Get a kindle. Read on your phone. Listen to audible. Don’t just read at home. Make your lunch and go read at the park. Waterproof kindles are great at the pool.

Try new tech. Get an oculus or a Tesla. Buy a curved 49” monitor, smart appliances.

Or go the reverse. Try off-gridding your daily activities. Like hand grind your coffee beans. Buy wheat berries and grind them, make bread from scratch. I bought old fashioned sponge rollers and the overhead hairdryers my grandmother had and now I sit with my morning drink for 30 minutes instead of standing and blowing my hair straight for the same amount of time.

Power and water outages are more and more frequent. How can you make your house so that you’re less inconvenienced if you can’t get water from the city or you start having rolling brownouts for hours a day.

What is your love language. Your wife’s? Kids? Grandkids? Best friend. How can you be a better friend to the people in your life knowing this info?

I could go on and on. Lol. You’ve got this. You have a whole new world of experiences I

Open to you now.

Surely you have some hobbies that are shared by others? I fill my time playing pickleball nowadays where I meet dozens of people with the same passion.

You must find connections in common interests.

See: Solutions to the loneliness epidemic

I would say now that you are retired and you don’t have to hire employees who want a paycheck rather than a career. You could help people who only want a paycheck to help them understand why they want to have a career. I also wonder if you helped understand why these people want a paycheck rather than a career you could see their perspective. I can tell this isn’t going to work for you so the best advice I could give you is advertise your services if you are looking for a career and not a paycheck contact me and I will help you. If you are only looking for a paycheck do not contact me. You people only looking for a paycheck made my life miserable for last 6 months before retirement and I don’t want anything to do with you. I also feel compelled to show you this person Alec cook his story is impressive. I think you would say from 5 years old he wanted a career not a paycheck.

I feel like Mr. Financial Samurai may be expressing some slight buyer’s remorse. Even after reading this article and it has some good reminders, I still feel the need to FIRE. I am turning 46 this year, worked, saved and invested all my life. I’m married but no kids yet, though we are trying. I am at a point where I don’t find any joy doing what I am doing anymore. Thought about changing to something I am more passionate about but then I might have to deal with new office politics, as currently I love my team, just not what I am doing. I feel like I have been running a long long marathon, and I just want a break, a long long break. I enjoy playing table tennis, traveling and would love to go stay in Asia for a few years. Take it easy and maybe when I am rejuvenated and will come back on my own time and pace. The only thing preventing me from saying I quite is I just sold my house and we are in rental right now and wife always wanted a house so she could feel a little secure but I am ok renting, much less headache compared to when I was a homeowner. By the way, I live in LA, so houses are no pocket change here. Financially I can FIRE, but caveat is I will be renting.

I don’t think I have buyers remorse. I left in 2012 at age 34 and really appreciate the freedom and journey since then.

It is definitely scary to retire early. It’s one of the reasons why I wrote this post in the first place, to reveal any things I hadn’t thought about as I planned towards leaving work.

It’s been a fun journey! And, I’m excited to share my new book out this summer with you. It’s called Buy This, Not That: How To Spend Your Way To Wealth And Freedom.

https://www.financialsamurai.com/btnt/

I hope you order it and enjoy!

I have found this to be a very helpful and enlightening read about early retirement. I have to confess I come from a different perspective. Early retirement actually does not appeal to me. I have spent substantial periods of my life unemployed, so I already know about the feelings of boredom and lack of direction. I am now in my 50s, and whilst I am in a good state financially, I currently do not feel any desire to retire whatsoever. My current job is not my dream job, but it is satisfactory. It keeps me active both mentally and physically. But it is a physical job, so I cannot do it forever.

But it is interesting that your article has focused on the psychological side of it, rather than the financial side, and to hear your first hand perspective.

Thanks. Boredom is a big issue that I experienced for a while. It takes time to get in a different groove. After about one year of early retirement, I decided to “go back to work” by writing more on Financial Samurai.

It is important to do work that provides meaning.

ER can be a way to tap out for burnt-out individuals. However, I do not see ER as selfish; instead, I see it as a poor reflection on our society. What does it say about the traditional 40 hour work week that so many people are disenfranchised enough to quit and walk away from it? I would love to see a societal transformation of the labor system in the US, and I am hopeful the pandemic will provide this to a certain extent. Allowing workers to remain remote and live where they want is a powerful way to keep employees satisfied, plus it adds back hours to their life to spend with those around them since commuting is no longer necessary.

Hi Sam,

I’m reaching out to say how much I liked your article.

I’m in a bit of a similar situation, where I was able to stop working at 35 and move down to South America with the goal of learning Spanish and experiencing a different culture.

I think you really hit the nail on the head with the article and I totally resonate with the downsides you’ve mentioned. It’s been the best decision of my life, but when people ask I tell them you still have good and bad days and your problems don’t all go away once you take work out of the equation and change locations. It was really interesting to see someone write an article talking about the same thing!

I count myself as really lucky to have been hit with those realizations at 35, though. I think they’re bound to come at some point in life, so better to learn these things about yourself and about life at this age than to work your whole life at something you hate and then be hit with that feeling of purposelessness and regret at 65.

Anyway, great piece! I’ve sent it to a number of friends who are in the same boat and who I’ve had similar discussions with.

All the best,

John

I would say this Sam hasn’t actually retired…he’s just switched jobs. Yes, he doesn’t work for corporate America anymore, but it says in his bio that he earns 250, 000 from passive income. To me that’s still work…and therefore not retirement. You’re still working…even if you work for yourself.

I think that there is no “one size fits all” to retirement, and there shouldn’t be. You stop working when you are ready to slow down, and your financials are (hopefully) taken care of. I have been working since I was 14 and now, at 45, I am looking forward to that next phase of my life. I have 10 years left in the rat race…but I am counting down each day! I know that I am lucky…I have a great pension waiting for me and in 5 years I will be debt free, except for my mortgage. It took a lot of work to get here…but I am grateful that I am…not everyone is as lucky as me, I know.

Good luck to all who decide to go “early.” Just make sure you are setting yourself up for success, and don’t worry about what the cranky pants people say.

Very interesting feedback that you think earning enough passive income to pay for my family’s living expenses is considered work.

To me, financial freedom and early retirement is all about generating enough passive income to live your desired lifestyle.

Can you expand on why do you think my passive income is switching careers? I do have to spend some time occasionally managing my rental properties. Generally they are pretty automatic because I screen well.

Retiring after only 12 years in the workforce, I have to wonder if you were born with money or given a lot of money by your parents or something . I’ve been working since I’ve been 14 years old and plan to retire at 60 years of age. I don’t know what kind of profession would allow a person to retire after only 12 years of work. Presumably you had to pay for your education unless that was paid for by someone else? this post sounds like it’s coming from a person with a whole lot of privilege and wealth early in life. Not realistic for my world.

To be fair to the author, it is totally possible if you work your butt-off in financial services. I grew up in a trailer park, was the first in my family to go to college and left with more than $100K of total college/post grad debt. I got a job at a big bank in 2000 and after working 70+hrs/week for 18 years, I retired early with more than $3M in the bank and several passive income sources. I am not married and don’t have kids, which certainly helps bolster savings. Not a life for everyone for sure, but it is possible to have financial success and not come from wealth.

Thanks Michelle for sharing your story. Hope you are enjoying early retirement! Not a day goes by where I’m not thankful for getting out. It’s been fun to write on FS and travel.

It would have been nice to make and save more money, and in retrospect, I probably should have worked a couple more years. But that’s life! Onward!

13 years actually post college, and did odd jobs here and there before graduating.

I went to William & Mary for $2,800 a year in tuition. I paid my parents back within five years after college.

Here’s a relevant post you may be interested in: The First Million Might Be The Easiest

But you are absolutely right about privilege and luck in getting ahead. I was privileged to come to America for college and work and have two parents.

Spoiled Or Clueless? Try Working Minimum Wage Jobs As An Adult

You certainly made some good points. Having been in the advice business for 30 years it is certainly the goal of 99.9% of people to stop working as soon as possible. All of my clients had to wait until their 60’s to achieve it but I can certainly attest to the fact that they would have immediately pulled the pin on employment if they had suddenly won the lottery or inherited a large sum of money!

Now in saying that, retirement didn’t seem to represent to them a move to a state of perpetual nirvana where freedom of choice and an escape from the mundane was the goal. Rather it would seem, it was to end the drudgery of their employment and all the machinations it entailed. The continuous corporate intrigue, the weird assortment of personalities amongst work colleagues, poor management and leadership, a lack of feeling truly needed and respected for their efforts (even though that was the constant message being pumped to the masses). Right down to the never-ending repetition of a 3-hour daily commute come rain or shine.

Retirement, for them it seemed, was really an escape from a career choice made at a very early stage in life that they obviously felt condemned to continue. And in order to live a ‘normal’ life and raise a family remained committed through thick and thin. Lifes major role model and followed by the majority it would seem favours the attributes of conforming to a world of 9-5 with all that entails.

I strongly suspect a complete change of occupation into a far more satisfying and stimulating role suited to the individual’s needs, would have changed the whole ball game so to speak and would have had people remaining happily occupied in economic activity well past their normal retirement ages. But fear, lack of confidence and no doubt, the norms society projects onto people kept them shackled and dreaming of a better time to come.

Yes, yes and yes. If a career choice is made early in life, like you say, and one has a solid work ethic and deep commitment to the family that they have chosen, then you will probably go ahead and work those 30 or 40 years. And it’s true, fear of striking out on your own, and the carrot that keeps being dangled in front of your paycheck, will keep you working too long for someone else’s dreams.

Wow dude. You really didn’t make any friends with this post. What I don’t get is how you can call early retirement “selfish,” but you yourself has retired at 34? Hmmmm… interesting perspective.

I don’t buy into the whole workaholic rat race my job is my life mentality. As for contributing to society? What makes you think that every company anyone works for is beneficial for society or for the planet? Do you know what I do for society and the planet? I don’t eat meat, and I chose not to have children.

I wrote the post a year before I decided to retire early to make sure I could gain as many different perspectives as possible.

I got a lot of insight. But did miss some.

See: https://www.financialsamurai.com/if-i-could-retire-all-over-again-these-are-the-things-id-do-differently/

I came over here from the Harvard article but found this confusing.

#3 for example; “You lose touch with Friends and Family” because their lives are spent slaving away and yours aren’t, I guess? While I can kind of relate from the time I left the hamster wheel/stopped caring, I wasn’t talking to them much before, either. What are you missing out on exactly? People who won’t socialize with you because you’re not stuck like they are? May be a matter of financial class?

Or the self-respect point of#5? May be a generational gap but I never really got an ounce of self-respect from where I reported for a paycheck. Sure, I’ve tried to aim for the options that do the clear public good, but in general, I view it all as a bs construct designed to force me to waste the time I’d rather be spending on other things just so I don’t have to sleep on the street. I’m guessing your Gen X or a Boomer.

Online, early retirees are everywhere. I get beat down and chastised for “still working in my 40’s like a dumb ass” whenever I comment on an article about retirement online. Yet in real life, I have never met one person who retired at younger than mid-50’s. Where are all these young retirees in actual, everyday life? I’m asking because they seem to be a dime a dozen online, yet nowhere to be found in real life. I’m close to a half a century old. That is a long time, and if early retirement were so prolific, then I would think that I would have met at least one early retiree by now. This has always made me wonder…I’ll just say that.

I’m 63 and don’t make enough to even retire, not early and not ever. My wife wants to retire at 65 (in five years) but that will not help our bottom line. In order to put food on the table and pay our bills, I will have to keep working until I’m physically incapable of doing so. I find it extremely selfish of my wife to be insisting on retiring… because she refuses to sit down and look at the numbers with me. She is hell-bent on retiring… she has likely told her friends of her early retirement plan, and having told them this as if to brag, now she has painted herself into a corner from which in her stubbornness, we will not be able to escape. When she realizes that I am serious about not retiring, she is going to be so angry at me as to make life unbearable, then I’ll have to get a divorce and that will make things even worse for me.

Divorce won’t make things worse for you. Might make them better. Read about “Conscious Uncoupling”

That might work if she really wanted anything from him, however since it entails regarding the other as “teacher”, and a drastic change to the unilateral nature of the relationship, meaning even in the best of times it was fundamentally estranged. Not saying he can get out of it even if he should. A lot of us are stuck in a hurtful daily grind from which there is no escape, through our own lack of decency or honesty when it counted, this conscious uncoupling sounds like a lot of mumbo jumbo. Get a hobby, a cheap one, buy a second-hand guitar off craigslist. Divorce will undoubtedly make it worse. Then sit back and watch the end-times unfold as the melt-water covers up the island paradises inhabited by the early retirees.

Your wife wants to retire “early” at 65 and you are not happy? I do not know your circumstances- but could you sell your house and downsize? Retiring at 65 isn’t so far fetched unless you’ve only been married just a few years? If you’ve been married for at least 20 years, your wife should be able to retire at 65 or at least let her dream of it. So much could happen in 5 years. Unfortunately, your wife probably would not mind a divorce if this is the way you feel towards her. Again, I do not know your entire situation. At 55, women are considered “old” in the workplace. (men too, but they do not realize) I do not agree with this, but it is sadly true, I have lived it. Yes, I have the haircut, clothes, thin, the whole trying to hold on thing going on. Your wife may be feeling the same things. Die or retire?

Sorry you didn’t marry well . . .

Became financially independent and cut work to 5 hours/week for 36 weeks/year at age 52. Not because I’m lazy, or didn’t like my job, like this condescending piece of crap “article” states, but b/c my life isn’t defined by work. Working less gives one more control over ones life; what one does with that additional freedom depends on ones values. Why all the judgement?

Right there with you on this article! And the guy who wrote this retired in his 30s! Go figure.

Retiring is selfish? What a stupid ass comment! Since when does a retiree have to give a shit about what the rest of the world thinks about that?

Just wanting to live as opposed to dying for a noble cause could be and is selfish.

Not wanting to get married and have a family can be selfish too.

And I’m guilty of both in addition to retiring early.

The world doesn’t owe me anything and I don’t owe the rest of the world anything either.

While I’m at it I want to say that just as there are those who didn’t plant too well for thier early retirement there are those who I’m sure have done so.

I’ve read about some of them already.

I agree with you….I’m retiring in 20 working days at 56, not sure if that is early, but I’m doing it!!! Who cares about going back to work for someone else? Reinvent yourself and work for yourself, we are all talented in some way…Cheers!

“The world doesn’t owe me anything and I don’t owe the rest of the world anything either.”

Maybe you could explain this to me. I don’t know what country you live in, but if you live in America I would beg to differ. I am a US history teacher. You are young. You have lived in an unprecedented time of peace and individual freedoms – a peace bought by veterans of foreign wars (75 million deaths in World War II worldwide.) There were 600,000 in the American Civil War alone which eventually ended slavery.

Democracy is everybody’s responsibility or it will be gone. Without fair and safe elections we will be no better than the dozens of countries under fascist regimes. What are you doing to prevent that? I am teaching high schoolers history. I have done it for 33 years old because without an educated populace we will have no democracy.

I am not saying retirees young or old have to teach, reform or become politically active. I am saying that it might be enough to be grateful to not have been forced to make a choice so many young men and women had to make that has allowed me to enjoy an incredible life of individual rights, freedom to live with the most advanced medical technology ever, and to enjoy a world unimaginable 100 years ago.

The definition of parasite: A parasite is an organism that lives on or in a host and gets its food from or at the expense of its host. Parasites can cause disease in humans.

Sound familiar?

“I have done it for 33 years old because without an educated populace we will have no democracy.”

Well said and well done!

I am a housewife and love every minute of it, but don’t get me wrong…. I work waaay harder than I ever did when I was in the working world. I not only do more, I also work around the clock. I know it sounds cliche but housework is never ending. I keep up the laundry, clean the house, mow the lawn, shop for groceries, cook all meals. I don’t get a paycheck, but my husband makes more money in one day than I did in one week. Please be assured I am still contributing tax dollars for roads, schools etc through my husband.

I totally understand how you feel about it because I’m in the same boat. That 24/7 household work never ends.

I left my work as a doctor simply because I couldn’t tolerate all of the stress it caused me. That was driving me mad. My job was stressful and loaded by nature, but add to that tons of internal stress to remain successful, and tons of family related responsibilities. I decided to quit, but then early retirement came up as an option.

My brother had a stressful job as well which caused him uncontrolled hypertension & eventually he died with renal failure. Having the same perfectionist personality & the same genetic predisposition, I just learnt a lesson. My workload was greater than I could tolerate, but that never meant I was weak..

At the moment my only challenge is the decision about having a part time job where the load is tolerable, yet sufficient to polish my experience.

Hi,

I really appreciate the amazing work women staying home do. My wife decided to do that 15 years ago in spite of being an Architect by profession.

My only concern is that such decisions when taken by the male counterpart who is the only earning member is seen in a different light and not allowed.

A lot of hostility in the comments section. Mainly from those that retired early. Early retirees need to understand, not everyone is in the same boat. It’s awesome that you got to hang it up early and head home and your life is all yours. I understand that to you, working is a waste of life. But, you have options. You either have a ton of money, or you are getting paid without having to work. Good for you. That is not the case for most people. I am on the fence about retirement. I may do it and I may not. Working is not that bad for me. I like my job ok. Do I love it? Well…I wouldn’t go THAT far. But, I like it. Right now, I am NOT sold on the idea of retirement. Well, not until I get to be a much older age, anyway. It’s like Bobby Bowden, longtime head football coach at Florida State said just a few years before he retired. “There is only one big event left after retirement”. That statement applies to everyone. Early retirees can be dead within a few years just as quickly as someone who didn’t retire until they were 70 plus. I would probably die within a year if I retired now. And I don’t want that. Here is something else that I don’t get. Why am I even considered to be retirement age? I am not even 50 for crying out loud!! Yet, I have people looking at me like “when are you going to hang it up?” Is it because I am not 20? And yet, two of the people that I work with are 66 and 72. And yet…nobody ever asks them when they are going to hang it up. They both have GREAT grandchildren and they are still in the workforce and I am considered the dinosaur in my mid-40’s? What gives? Now, don’t get me wrong. I am not of the mindset of “they are old and they need to get out of the way so that young, vibrant people can have those jobs”. I don’t think that way. I’m just curious why I am looked at as the old man who needs to have an exit strategy in place soon. Like I said, maybe I retire one day, and maybe I don’t. But at any rate, it is NOT happening in my 40’s. And if it did happen now or within the next 2-3 years, I would sink into a horrible depression. And before anyone shouts “it’s because you don’t have a life”, I do other things besides work, believe me. But, for one, it would not be enough to cover me all the time and fill the void left by no longer working. And two, I have seen people retire and run out of things to do very quickly. There is only so much travelling, gardening, stamp collecting, gabbing with the neighbors, porch swing sitting, etc that one can do.

Not me. I love not “doing” anything. Why can’t people just be? Why do we always have to be ” doing”?

I love this topic especially because I am in the same situation. I have decided to do the same, retire at an early age. Not by choice though but because of ill health, a result of prolonged high stress high pressure and getting in out of hospitals. I need a break. I would rather retire early than die early and leave my children and grandchildren that love me and are still enjoying being with me, than holding on to a job where I feel, I have reached a point where I cannot wake up in the morning without having those dreaded feelings, thinking about the environment of where I am going to. Forcing yourself to do this even when you know you have had enough result in negative implications, to the company and to your yourself, specifically your health and performance suffers. Rather leave, especially if you are over 55 or you are working for a company that does not have ideal benefits that encourage you to stay or correct employee support structures.

Yes, people do die after retirement. Simply because they have never thought of another life outside their jobs. They have no social structure except the one they had at work. At work the relationships that you build, are for work purposes only. Yes, you might end up with one or two real friends but ideally you need to have a social life outside your work. You also must have thought of what options do you have once you are out there. Without these you feel lost when you get out. Even those few friends that you may have made at work are busy and do not have time to baby sit you. Boredom kicks in, depression builds up because you do not know what to do with yourself. Problem is you never thought about what you will do if you ever leave, so you become idle and without adrenalin pump things turn bad for you, especially if your loved ones are gone too. I believe before leaving you must have thought about some ideas, what else you can do with the skills you have acquired.

I read that one or two people are saying taking early retirement is being selfish and/or lazy. I do not think that is a fair statement especially when you never walked in these people’s shoes. Somebody said “different strokes for different folks” and I agree with him/her. We all have choices. Early retirement can have the dark side I agree, inadequate financial payouts that does not take into consideration the fact that cost of living is very high (as a friend of mine would say, “there is so much month after the money” loosely translating to the length of the month from one pay day to the next). Unless supplemented “there is so much life after the payout” The retirement payout shrinks day by day. You cannot live on it forever, but if there is a thought out plan I believe it does not have to intimidate.

I am 57 and contemplating early retirement. I agree that it is unfair to call someone selfish for wanting to retire early. We get so hung up on work and advancing in our careers that we forget to live. Then when you find yourself at retirement age, you are too old to finally enjoy the LIFE you have worked to achieve.

I was reading your article to see a devil’s advocate view. While digging around the web, I found an article that was all rose colored glasses from 2016: https://www.forbes.com/sites/laurabegleybloom/2016/06/29/how-to-retire-early-and-travel-20-insider-tips-from-a-33-year-old-retiree/#39bff0517642

Then in 2018 the same person who was the subject in the first article was interviewed, and she talks about the negatives, that she did not expect. fourpillarfreedom.com/money-buys-freedom-but-freedom-doesnt-guarantee-happiness/

My company’s CEO is against early retirement, sees it as selfish for the same reasons you listed above, but he also feels it is a danger to yourself. For him, he worries about disengaging your intellectual brain from the daily trials that are required to run a business. Without that stimulation, he feels it will atrophy.

I am new to your site, do you have any other favorite negative articles about early retirement?

Yes. This one went viral:

https://www.financialsamurai.com/the-negatives-of-early-retirement-life-nobody-likes-to-talks-about/

Live and let live. What people do is none of my business. I am 69 and work. My wife, who loves me, says I can’t stay home with her. I would drive her crazy. She is right.

At 69 the world doesn’t want me or need me. Because I am self employed, I have the privilege of having a job.

If I retire, I am just an old man. Period. Trust me when I tell you when you get old, you will wish you had a job.

My sentiments well put!

i’m 45 and recently got married and became a full-time housewife and i love it!! love not having to follow someone else’s schedule, wake up at the crack of dawn for someone else, etc…my husband makes more then enough for both of us to live and eventually retire on. i have no friends and i don’t travel, yet i’m never bored or lonely. this authors “excuses” are just pathetic attempts at scare tactics.

Agreed!

I agree! I’m 62 and retiring In 5 months. I get up at 4:30 am M-F and don’t see my husband until 4:15 and probably only spend about 5 hours a day with each other. Sometimes less if I take a cat nap because I’m tired and sleepy. I want to spend at least 20 years hopefully more, with my husband who is retired. Life is to short, especially these days.

I am 78 and happily still working . No debts ,several million in assets . Why work ? It gives me purpose . Allows me and my wife of 53 years to provide tens of thousands of scholarships each year to deserving students . Mentoring them keeps us young .

Good work is a blessing .

I am afraid for our country that millions of these selfish lazy people retiring at 55 will cry to the government eventually that they have run out of money and are too old to work . They will b a horrible drag on our grandkids future .

People who retire early don’t usually just sit around. They do it so they can do things they love. And be happy and have freedom. What a bogus article and everyone here agreeing are folks who will never retire early.

I’ve been retired since 2012 and have traveled to 25 new countries, wrote a severance negotiation book, grew Financial Samurai to a large personal finance site with 1.5 million pageviews a month and featured on all the big media outlets, and have been a stay at home father for 23 months and counting.

Why do you think it’s bad to think about the dark side of early retirement before retiring? What is the downside of careful planning before taking a big leap of faith?

Because you are not just here sharing objective things and actual experiences people have had. You are here being a moralistic prick and making value judgments.

Telling people about increased risk of depression, loneliness, suicide etc. is great. But when you call it “selfish” it’s a fundamental moral judgment. You don’t owe society anything. None of us actually ask to be born, but since we are here, the least we can hope to do is try to live a life on our own terms without assholes thinking we owe society an unpayable debt to society. A debt that they think will only be quenched by working till our knees are weak. God forbid someone manage to get out with some semblance of youth still left. BuT yOu OwE soCieTy YoUr lAbOuR cOmRadE!

I’m assuming you’re mostly talking to the FIRE and personal finance crowd, 99.9% of whom aren’t born with an inheritance that they can retire on and actually work/save/invest to get there). If someone has enough resources to retire early and manage a lifestyle they want, then they HAVE done their part. Most of them made little sacrifices EVERY DAY. Stuff that doesn’t seem as big in the moment to an outsider, but would bleed most people dry by a thousand cuts. EVERY DAY people who want to retire early wage war with their very human desires and temptations. The temptation to not eat out. The temptation to not buy the latest iPhone. Or to get a new car. Or a luxurious house. A lot.

And they do it, simply because they have a vision for their lives. Instead of spending their money little by little, they are saving to cash out at once and finally live a life on their own terms, doing whatever they want. Absolutely whatever, without judgmental assholes interfering with their lives. You like writing books? You like managing a personal finance website? Fucking GOOD for you. Your website probably helps people, but if you were to shut down tomorrow, pack up, and go chill in the Bahamas, no one has a right to say anything to you. You don’t owe your labor to anyone. And neither does anyone else owe it to anyone else. If you can up and leave today, and live the life you want, that’s great. Hell, you are already doing that, so easy to preach, right minister?

Moreover, climbing a mountain, or learning a language isn’t “not” selfish. Just because it takes effort doesn’t mean it’s as selfish. If a retiree is doing it for fulfilment, for their own self-interest, it’s ethically equivalent to them watching TV all day, or chilling on the beach for their fulfilment. Seriously, what IS it with you and expecting people “owe” you something? And if someone does not want to reach their “potential”, it’s absolutely none of your damn business. You don’t have the “right” to watch someone who’s gifted with the piano, become the next Mozart, even if she could. You just are not that important. No one is. If you have something that may convince them, good for you. But you don’t get to act like pissant because someone doesn’t want to live their life by your definition of productive, or useful.

Thanks for sharing. Sounds like you are pretty fired up about the topic.

Can you share something about yourself and why you care so much? I’m trying to understand where your fire is coming from.

I agree, nobody owes anybody anything. We’re free to do what we want. We just have to be happy with whatever we choose. Everything is rational.

Life has been really great for me since retiring early in 2012. I just encourage people to think things through before making big changes in their lives.

Related: https://www.financialsamurai.com/if-i-could-retire-all-over-again-these-are-the-things-id-do-differently/

Im retiring at 65 in a month. I’m not rich ( whatever that looks like because it certainly is subjective) but I’m not poor either. Don’t view Life liberty and the persuit of happiness as a selfish, unproductive course of action unless, of course you are seethingly envious of other’s abilities to exercise their freedoms. If you have done the numbers and they work and you choose to exit something that is weighing you down year after exhausting year then my advice is to not tell anyone because you will certainly be met with many a gloomy and discouraging response and very few congratulations. I know because I have been experiencing it mainly from my own age group. Do them and yourself a favor and secretly transition into retirement and reinvent yourself.

+1

+1

I have worked for the same company for 28/29 years (I’m 47), will work for another 10 and I’m walking….at 57. Yep have a degree, but really they’re over rated! lol. I do like some aspects of my job but in general at this point hate it, even more so starting this past year. Just a roughly painted picture, I have worked every Christmas and new year the last 6 years and not by choice. The ONLY reason I do not transfer to another agency or go to a different sector is I’m within 10 years of shedding this job. I hear folks all the time who do talk of staying as long as they can. Witnessed folks with 50+ years service retire and die 6 months later. For me, when I hear folks talking about continuing working past SS minimum age, I think what a sad existence to not have dreams of spending as much time as possible with their families or enjoying “everyday is Saturday” or just so darn greedy that after 50 years they cant pass up OT! Really?. Very SAD! Nope, retiring early is not “selfish”. Working into your mid to late 60’s even 70’s is selfish. Really, what are you doing for ANY company productively in your late 60’s? Lets exclude business owners, I’m just talking about the majority of us who work for someone else. Gratefully I have had a retirement plan to invest in this whole time, however financially ready or not at 57, done. If 38-40 years of service/work and saving doesn’t give me enough to live on at 57…..I’ll go on the dole with the other 49%! So for the next 10 years, I’ll continue to tell myself each day that I’ll be riding into the sunset and 90% of the folks I work with, can kiss my arse! I’ll do it all with a smile on my face and nobody but you, my family and I will be the wiser. If, and that’s a BIG IF, I get “bored”….guaranteed I’ll find something to take my mind off of my boredom.

Wow. I could have written your post 10 years ago as I will be 57 this year and have 35 years in at a company as an engineer. My work is interesting but stressful at times. Sooo many things are out of my control nowadays with regards to work. Too many projects, too little funding, not enough time to do the job properly. People who are in charge have never created product, tested product, or done anything tangible. They have “managed” programs which means they provide status on hours spent. I have saved my entire life. House paid for. Ready to throw in the towel, but am worried about will savings last…….. then I look at how hard the mid 50s to mid 60s are on people and how much they age over this period and I think I would be “nuts” for staying longer. I still haven’t pulle the trigger, but I agree with eveything you say in your post. Getting bored in retirement is not an option. Too many things to see in the USA, too many causes to volunteer for, spend quality time with wife, family, and friends…………..

Wow! You sound like you are talking about me concerning how people want things much faster these days, but don’t care about the quality. They want things done right now, and not done right!

I started working professionally right out of high school at the age of 17. My first job paid for my school. I worked hard, saved, and retiring at 50 years old in November. My work is no longer enjoyable. I am in IT and these days everything is getting offshored to India, or to Indian consulting firms. Innovation is not their specialty. They are better used for repetitive task like support, but companies these days only see $. Believe me, they will eventually see they are losing their edge and losing creative employees in time. This is one of the contributing factors to the recent issues with Boeing. In any event, I am going to retire, but will not be touching my retirement savings until I reach retirement age, but instead use other savings account I called my bridge money. I love to travel, as well as doing volunteer work. My father and grandfather died before 60 years old from heart attacks. My job was stressful until I turned my 5 month notice in. I am very active and will not be sitting around. I will probably do some consulting work, and volunteer work. The key to being able to do this is save, save, and then save. I have not had a car payment since 2002. I am frugal with my spending, and value experiences more than things. Less is more in my book, except when it comes to saving.

wow, you sound like me. I’m reading about people retiring in their 40s; can’t believe I’ve been debating if I’m retiring too early at 58!. I’ve worked almost 30 years in the same stressful “billable model” type of consulting companies, where everything is a hot deadline. I’ll be 58 in December. I’m retiring in November. If I get bored after a few months staying home, I’ll get a part-time job doing anything but what I’ve been doing the last 30 years. I won’t have a mortgage payment, as I’m selling my house soon to buy another house that will allow me to be mortgage free. I’m not working til I’m 65 at my current company….I’d prob have a stroke at my computer!

Yes indeed! To hell with the rat race!

Sam, what is it you do with all of your free time besides Financial Samurai? I have “retired” on disability income and am having difficulty figuring out something productive and interesting to do. I am only 34 years old.

I like to write. I publish 3X a week on Financial Samurai to keep my mind active. I also started the Financial Samurai Forum as well to build community. It feels great to stay involved. You should check out the forum at least!

Thanks for getting back to me! I should put together a website on something as well. I will check out your forums! It sounds like I should get an investment strategy underway anyway.

It’s best to retire prior to dying. Extra credit to those who’s retirement is > not