Taxes are our largest ongoing liability. As a result, it behooves us to optimize our taxes as much as possible. This post will discuss all the smart money-saving tax moves to make by year-end. It gets updated once a year to follow new tax laws.

After fake retiring in 2012, my desire to make maximum income went away. Instead, I wanted to shield as much income from taxes as legally possible. Paying six figures in taxes a year for more than a decade felt good enough. My goal was to limit total individual income to under $200,000.

After ~$200,000 per person and $250,000 per married couple, the Alternative Minimum Tax kicks in. Meanwhile, deductions start aggressively phasing out. Even in expensive San Francisco, there's no need to make more than $200,000 a year to live a comfortable lifestyle.

Income Target And Tax Optimization After Kids

Thanks to lifestyle inflation, economic inflation, and the need to now support a family of four, I've got a new household income target of up to $400,000.

$400,000 is certainly not a necessary household income to live well. It's just my ideal income level where you earn enough to do what you want, but aren't getting crushed by taxes.

A 25% – 30% effective tax rate is high enough to feel like you're contributing to society. But it's also not so high where you're feeling robbed by the government.

After about $200,000 per person or $400,000 for a family of up to four, I've noticed there is no incremental increase in happiness. Instead, making more money often creates more misery due to more work and more stress.

For hardcore tax optimizers, the ideal household income may be closer to a MAGI of $340,100 based on 2022 income tax rates. Up to $340,100, a married household's marginal income tax rate is a reasonable 24%.

The majority of actions to reduce your taxes must take place during the calendar year. So if you want to pay less taxes, it's time to get cracking.

Money-Saving Year-End Tax Moves To Make

Here are all the smart money-saving year-end tax moves to make. I revise the suggestion every year due to constantly changing tax laws and input from readers.

1) Donate More To Charity

Being able to give your time and money away to worthy causes is one of the best benefits of being financially independent. No longer will you always feel conflicted about whether you should save and invest your next dollar versus helping someone in need. You just tend to give more because you can.

Guidelines to claim deductions on charitable donations:

- You'll need to itemize deductions and file Form 1040.

- The charity organization must be qualified with the IRS and be actively tax exempt. This excludes political candidates and organizations, as well as individuals.

- Used items such as housewares and clothing must be in good condition or better for them to be deductible.

- Donated vehicles can be deducted at fair market value if you meet certain requirements. For example, the charity must sell your car well below market price to a person in need, or the organization must make major repairs to increase the car's value. Alternatively, you could qualify if the charity will use the car for purposes such as delivering meals to needy individuals.

- If the total of your non-cash contributions is greater than $500, you'll need to file Form 8283.

- You'll need a written record of all cash donations with the date, amount, and charity name.

- And if you receive goods or services for a donation, you can't deduct your entire contribution. The value of what you received must be less than your donation, and you can only deduct the difference.

- If you are volunteering and performing services for a charity using your car, you can deduct mileage.

- Travel expenses can be deducted if you go on a trip with a qualified charitable organization and you're “on duty in a genuine and substantial sense throughout the trip” per the IRS.

- Donations of property are generally deducted at fair market value based on what they would sell for on the open market.

- You can avoid capital gains on appreciated stocks held over a year if you donate them to a charitable organization. The amount you can deduct is determined by the stock's fair market value on the contribution date. Consider setting up a Donor Advised Fund for greater impact.

Giving Percentage Rates By Income

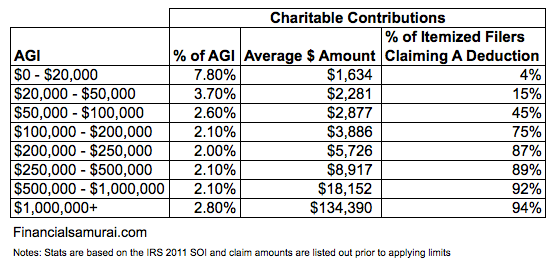

Here are some interesting statistics on average charitable contributions based on income for individuals claiming itemized deductions.

It is great to see the sub-$20,000 income group give away such a high percentage of their income. When I was working minimum wage service jobs, we tended to tip well to fellow minimum wagers. At lower income levels, it's all about giving and helping each other survive.

Here's another giving by income chart from the National Center For Charitable Statistics. It's interesting to see the income groups that give the least earns between $200,000 – $1,000,000.

The reason is likely because this income group pays the most in taxes and earns the majority of income through W-2 income. After all, paying taxes is a form of charity since your tax dollars get redistributed to help others.

I've written a lot in the past about how households making $300,000, $400,000, and $500,000 a year in expensive cities are just living regular middle-class lifestyles. Part of the reason why is because a huge percentage of their income is going towards taxes.

Once you get over $1 million a year in income, a greater percentage of income tends to come from investments. And investments are taxed at a lower rate.

Accelerate your charitable contributions to the current year if you want to lower your tax bill. One way to give is to strategically use your credit card when making a donation. Deductions are based on the date your card is charged, not the date you actually pay your credit card bill. In other words, you can make a donation via credit card on December 30, 2022 and not have to pay it off until January 2023.

2) Capitalize Losses On Bad Investments

If you own securities or property that have been declining and you're below your cost basis, consider liquidating before year end if you don't anticipate a recovery. This is called tax-loss harvesting and is particularly common with stocks. You can offset like-for-like capital gains with capital losses. Any carryover losses is $3,000 a year.

Losses on property held for personal use can't be deducted. Only investment property losses can be written off. And you'll also need to look at the net of your capital losses and gains. If your gains are higher than your losses, you'll owe money on the difference.

Under the tax code, an individual may deduct up to $25,000 of real estate losses per year as long as your adjusted gross income is $100,000 or less and if you “actively participate” in managing the property. The deduction phases out as an individual's income approaches $150,000. Individuals whose adjusted gross income exceeds $150,000 are not eligible for this deduction. This income threshold hasn't changed for a while.

Note that you cannot deduct rental losses to your active income (e.g. day job income). Rental losses can only be deducted from passive income. You report your rental income and deductible expenses on IRS Schedule E. The IRS reports that roughly half of the filed Schedule E forms show losses.

Your big stock losses can offset any big gains in the calendar year. Any further losses can be carried over to the tune of $3,000 in capital loss deductions a year.

3) Increasing Expenses During Good Years

It's good practice to anticipate and prepare for changes to your income in the upcoming year.

You should also increase your necessary expenses during a great income year. If you are having a bad income year, then defer such expenses until income improves. This is one of the best year-end tax moves to make for business owners.

If you are an employee, you can ask your employer to pay your year-end bonus in the following year if you want to defer income. Just make sure your employer will be around to pay you in the future.

4) Contribute To Tax Advantageous Retirement Accounts

You can make additional contributions to your 401k before year-end if you haven't already maxed it out. The 2023 401(k) maximum contribution amount is $22,500. If you are a sole-proprietor, don't forget to contribute the maximum to your solo-401(k).

In addition, you can make current year IRA and Roth IRA contributions until April 15 the following year. Or, you can wait to see what your modified AGI will be and then contribute accordingly.

For those of you who have experienced a particularly difficult year due to a job loss or other reasons, it may be beneficial for you to covert your traditional IRA into a Roth IRA. The Roth IRA conversion is a taxable event. However, the idea is to convert your traditional IRA when your marginal federal income tax rate is at its lowest point. Once taxes are paid on a Roth IRA, it grows tax-free and can be withdrawn tax-free.

Roth IRA Is For Retirement Diversification

In general, I'm not a fan of paying taxes up front with a Roth IRA, especially if you are in the 24% marginal income tax bracket or higher. If you are struggling financially, it may be even more difficult to bite the bullet and convert, despite being in a lower tax rate.

For high-income individuals looking for a workaround for the income limits on Roth IRA contributions, the backdoor Roth conversion is a solution. A nondeductible contribution can be made and then converted tax-free to a Roth IRA. This works because there are no income limits on non-deductible traditional IRA contributions or on Roth IRA conversions. However, be careful of the pro-rata rule.

The deadline to do a backdoor conversion is Dec. 31. Congress seems highly motivated to eliminate the backdoor conversion in the future. Hence, you may want to shift retirement accounts from tax-deferred to tax-now before 2026, when negative changes may take place for the Roth IRA.

5) Deduct property tax

Property tax is an expense against rental income. Therefore, don’t forget to deduct it. Your primary mortgage property tax is also a deductible expense on your taxable income.

6) Business Tax Moves

A business which is cash-based, not accrual-based, can defer taxable income to the following year by sending December invoices at the very end of the month. The reason this can work is the business won't receive payment for those invoices until January or later, and the business' taxable income isn't captured until the date the cash comes in.

Companies and sole proprietors can also reduce taxable income in the current year by charging business related expenses in 4Q that they'd normally take in Q1 of the following year. If you expect your business to grow rapidly in the following year, then wait until the following year to load up on capital expenditure.

If you're having a great business year, wait until the new year to cash your November and December checks in January. Although, there's always a risk the vendor might disappear or go bust before you can cash your check. Make sure you know what the time limit is for cashing in a check as well.

Maximize Business Expense Deductions

One of the best year-end tax moves to make include maximizing your business deductions. If your business needs a vehicle and also is having a great year, consider buying a 6,000+ SUV or truck by 12/31. Let's say you buy a $90,000 Range Rover Sport and use it 100 percent for business. Tax law allows you to deduct $90,000 (or a lesser amount if you would like – in this case, you use Section 179 expensing).

If the Gross Vehicle Weight is 6,000 pounds or less, your first-year write-off is limited to $10,000 ($18,000 with bonus depreciation as limited by the luxury auto limits). You can learn more about the tax rules for writing off a vehicle here.

Finally, a great private business strategy is to hire a close friend or relative who is in a lower tax bracket than your business tax bracket. Your friend or relative earns money while your business reduces its taxable income and receives services.

For example, you could hire your high school son for $6,000 to redesign your website. His $6,000 in earnings is tax-free given the standard deduction is much higher. Meanwhile, you reduce your taxable income by $5,000. Further, you hopefully get a slick new website while teaching your son about work.

The $6,000 earned by your son can then be invested in a Roth IRA. The income goes in tax-free, compounds tax-free, and gets to be withdrawn tax-free. As a result, opening up a Roth IRA for your children is a no-brainer! Both sides win.

Related: 10 Reasons Why Starting An Online Business

7) Review Your Flex Spending Account (FSA)

Another great year-end tax moves to make is to make sure you don't lose any money in your flex spending account. Check with your employer if your plan is eligible for a rollover of unused funds until March 15 of the following year.

If you've already run out of funds in your FSA but have things like medical work or fillings to do at the dentist, try to postpone them until next year if they aren't urgent. That way you can save on taxes by allocating enough funds in next year's FSA to cover those expenses.

If you're planning on leaving Corporate America next year, get your physical done this year (usually free under preventative care). Also consider going to specialists to treat specific injuries. Maybe you need an MRI for a bum knee. Maybe you should finally see a pulmonologist for your asthma or COPD.

Try and get your money's worth when it comes to healthcare. Don't neglect physical ailments that are bothering you. They might get worse and more difficult to fix in the future.

See: Is A High Deductible Health Plan Worth It To Save In An FSA?

8) Consider Revising Your Withholding

Even though you probably submitted your W-4 form to your employer ages ago, you can still file a revised form to make adjustments to the remaining pay periods left in the year. If you anticipate you haven't withheld enough taxes so far this year, you can increase your withholding to help reduce penalties and fees when you file your taxes.

Check if you've already paid 100% of your current tax liability this year. If so and your AGI is less than ~$150,000, you should be able to avoid being charged a penalty. But you'll need to have paid 110% of your current tax liability in the year to avoid getting dinged if your AGI is above ~$150,000.

This safe harbor method is generally the easier option to avoid paying a penalty. The alternative is to have withheld 90% of your tax liability, which can be difficult for freelancers and independent contracts to calculate.

If you are earning both W-2 wages and 1099 income, bumping up your January 15th estimated tax payment to compensate for having underpaid in previous quarters doesn't work. Each quarter is treated separately with estimated taxes. However, withheld taxes on paychecks are treated as if they were paid throughout the whole year.

9) Review Your Retirement Contributions To Date

The maximum 401(k) contribution limit is $22,500 for 2023. You should max out your 401(k) if you are in the 24% marginal federal income tax bracket or higher to save on taxes. Maxing out your 401(k) every year is one of the best year-end tax moves to make.

Even though this is the season of giving, don't forget to pay yourself first. Take a look at how much you've contributed to your retirement accounts so far to date. Then make additional contributions to the maximum.

Check your paystub to see how much you've contributed to your 401(k) plan to date. Now contribute the difference between the maximum contribution and what you've contributed.

10) Set Up A Revocable Living Trust

If you haven't talked to an estate planning lawyer yet, please do so. Setting up a revocable living trust is vital if you have dependents. Not only does a revocable living trust help protect your assets, it also helps with the orderly distribution of assets in case of your untimely demise. Finally, a revocable living trust is usually cheaper than going through probate court. The public has access to all your finances in probate.

While on the topic of estate planning, please put together a Death File as well. The Death File is like a hyper-detailed will that includes all your accounts, passwords, important people to contact, and your wishes. You should also include audio and video recordings in your Death File as well, so there is less ambiguity.

11) Maybe Finally Get Married

The marriage penalty tax has all but disappeared after the Tax Cuts and Jobs Act was passed in 2017. If you've been on the fence about marrying due to a higher tax bill, you really don't have to worry any more.

It's only married couples making over $500,000 who will likely pay more taxes together than as unmarried individuals. If one partner earns an income in the $200,000 – $400,000 range, while another partner earns income below $100,000, there will likely be tax benefits if the couple gets married.

12) Start A Business

Starting a business might be too late as a year-end tax move. However, there's always next year!

You can either incorporate as an LLC or S-Corp or simply be a Sole Proprietor. As a sole proprietor, no incorporation is necessary. Just file a Schedule C and 1040.

For 2023, every business person can start a Self-Employed 401(k) where you can contribute up to $66,000 ($22,500 from you as an employee and ~20% of operating profits from the business). In other words, to contribute the maximum to a Solo 401(k), your business needs to make around $240,000 in operating profits.

Further, all your business-related expenses are tax deductible as well. If you want to go to Hawaii to see a prospective client, you can deduct your travel-related expenses. If your parents so happen to live in Hawaii, it's like getting a discounted trip to see them.

The first step is to launch your own website to legitimize your business. The next step is to obviously go try and make some income! Most expenses related to the pursuit of such income should be considered a business expense. Below is an income statement example from a sole proprietor.

13) Contribute To A 529 Plan

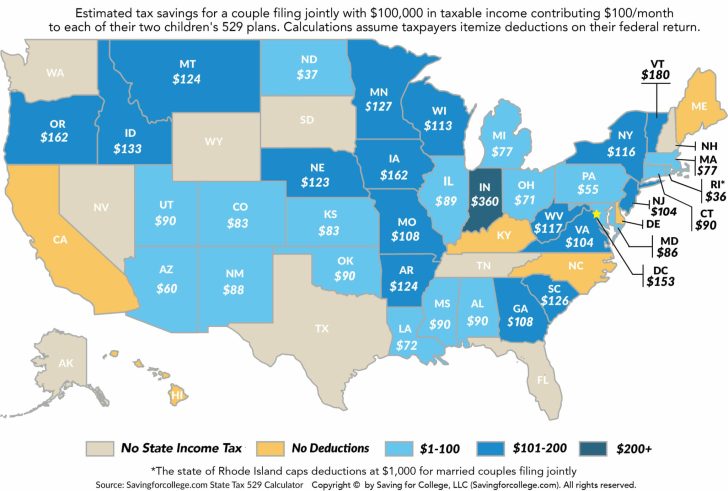

Over 30 states, including the District of Columbia, currently offer a state income tax deduction or tax credit for 529 plan contributions. For example in New York you can deduct $10,000 in contributions per year from state taxes.

At a 6% state tax rate that would save you $600 in taxes. Then, of course you get tax-free growth as long as the funds are spent for college. The 529 plan is one of the best tax-efficient ways to transfer wealth across generations.

As a parent, I'd rather give the gift of education rather than money. If I'm blessed with being a grandparent, I will superfund every grandchild's 529 plan.

Study Up On The Latest Tax Rules

We all need to spend several hours each year reviewing and understanding the latest tax rules. Given the tax code is tens of thousands of pages long, spending several hours a year learning them is the least we can do.

Every year, there are many new propositions and tax laws that pass that may affect your future tax liabilities.

For example, California recently abolished Proposition 58 in place of Proposition 19. The new proposition reassesses the value of a rental property to market rate when it is passed to a child. This way, California can charge higher property taxes. For a primary residence, the value is also reassessed to market rate with a $1 million buffer.

Pay Attention To The Latest Estate Tax Exemption Amounts

Perhaps the most interesting tax information we should pay attention to are changes in the estate tax exemption amounts. If you are fortunate enough to have a household net worth higher than the estate tax exemption amount, more intentional spending and giving is in order.

By 2025, the Tax Cut And Jobs Act will expire. Under Joe Biden, there’s a high chance the estate tax threshold may go back down. For 2023, the estate tax exemption amount is an impressive $12,920,000 per person and $25,840,000 per married couple.

Let's say the estate tax threshold per person declines to just $5 million per person in 2026. You currently have a $10 million net worth, the ideal net worth amount for retirement. If you die in 2026 and your net worth stays flat, you will have $5 million in estate tax exposure, or an estimated $2 million tax bill!

Please make realistic net worth and mortality projections. Paying a death tax on wealth you've already paid taxes on is a true waste.

Hopefully this article has given you some good year-end tax moves to minimize your tax liability. Here are the 2024 marginal income tax thresholds so you can better plan for the future.

Pay Your Taxes With Pride

For those of you who are paying more in taxes than the median household makes a year (~$75,000 in 2023), feel proud that you are contributing to society. Paying taxes could even be considered a form of charity after a certain amount.

Taxes are used to pay for defense, healthcare, infrastructure, food and shelter assistance programs, public schools, and more. If these things are considered good, then paying taxes should also be considered good.

It's understandable that some people want to raise taxes on others without having to pay more themselves. Most working Americans don't pay income taxes. However, if you are one of them, change your mindset.

Hopefully these great year-end tax moves will help you save money!

Reader Questions And Recommendations

Readers, what other smart money-saving year-end tax moves do you recommend making before year-end? What are some new tax rules for 2023 we should be aware of?

Pick up a copy of Buy This, Not That, my instant Wall Street Journal bestseller. The book helps you make more optimal investment decisions so you can live a better, more fulfilling life. BTNT is on sale on Amazon right now.

For more nuanced personal finance content, join 55,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

What happens if you’re a “freelancer” oscillating between 401k-contributing W2 work and zero-benefits 1099 work? I managed to contribute a large chunk to my steady W2 client 401k this year but the job ended short of the year. I worked some 1099 earlier in the year.

What do I about the shortfall in max allowable contribution? Can I hastily create a SEP IRA that functions like say, a Roth 401k (I read you preferred a Roth 401k due to anticipated rising taxes in the future..). Thank you!

“ is great to see the sub-$20,000 income group give away such a high percentage of their income.”

I suspect that a large portion of the low income contributions are tithings/contributions to churches.

For those like myself who don’t think it’s patriotic to pay income taxes, some states like AZ have income tax credits for charitable donations. Essentially, you can get a dollar for dollar income tax credit by making donations to charitable organizations, foster care agencies, private schools, and public school. In AZ, you can receive credits up of to $1,644 (if you file single) by donating your income tax liability instead of paying it to the state.

very helpful reminders, thanks! The weeks of December practically dissolve into thin air and it is so easy to forget to do so many things re our finances with so many distractions due to the holidays. I plan to make a few more charitable donations over the next week and then I’ll feel pretty rounded out for the year. I already maxed out my retirement contributions so I can sleep easy on that. Too bad the markets are just crap these days and bound to get worse next year. But in times like these, I just try to remind myself to stay focused on the long game. Happy Holidays!

Great tips!

Another idea for some people would be to put money in a 529 plan for college savings.

Many states have a state tax deduction. For example in NY you can deduct $10k in contributions per year from state taxes.

So at a 6% state tax rate that would save $600 in taxes. And of course you then get tax free growth as long as the funds are spent for college.

Good one! Will add as we don’t have the 529 deduction in California.

Hi Sam,

I have been reading your posts for the past few years. Thank you very much for publishing this useful content!

Given recent news about inflation, I have been wondering how can I protect my family’s net worth, my portfolio and maybe make some smart moves given this evolving reality. Would you have any inputs or an inflation-to-do list to share with the community?

Thank you!

Inflation is generally great for your investments. Personally, I plan to allocate more dollars to real estate due to rising rents and asset values.

We’ve got negative real interest rates.

One thing to consider is that if your married your standard deduction is 25k. You only get to deduct charitable contributions that are over the 25k mark. So if you give away 30k your deduction is only 5k.

But people who have the ability to donate $30,000 probably have itemized expenses they can deduct. But good to know.

for this year (and last), you can deduct 300/600 (single/married) in cash contributions without itemizing. That was a covid provision and it’s set to expire on the 1st. It does strike me as good policy (though a large portion of chartable contributions are to churches, which could either be used for the community, or for Leer jets).

There is NOTHING prideful or Patriotic about paying taxes. The government is a terrible steward of what is steals. This country was literally founded on not wanting to pay taxes.

This country was *literally* founded on not paying taxes without representation. Slight difference.

The extreme RT wing/libertarians don’t want to pay taxes, so what happens about police, fire, roads etc? I guess we all carry guns and shoot at will, let our houses burn down, hope we have money to pay for medical treatments and use a horse and buggy, no good roads needed.

To IndianMama . If I am paying taxes, that means that I am making a taxable income, or in simpler terms that means I am gainfully employed. I carry a concealed weapon with a permit to protect myself and my family, and if needed to also protect you and yours. I notice that the motto is ” To Protect and Serve” but as we saw in the Texas Elementary school shooting, none of the Officers were willing to enter the building until the threat was eliminated. Sometimes somebody will have to step up and lead the way.

It isn’t that people don’t want to pay taxes, it’s what the tax money is being used for. There is tons of waste and ridiculous programs that aren’t helping our country.

Roads, police, and fire departments have been around before income taxes were a thing in this country.

Sam – the following sentence in the bullet under charitable deductions needs to be updated to reflect the changes for 2021:

“Following special tax law changes made earlier this year, cash donations of up to $300 made before December 31, 2020, are now deductible when people file their taxes in 2021.”

I think the special provision for 2020 was an above-the-line deduction from your income prior to the calculation of your adjusted gross income (AGI). For 2021, I think cash donations are considered a below-the-line deduction from AGI, and if you are filing jointly, each person can donate and deduct $300 for a total of $600.

Updated! Thanks

This is no longer relevant in 2022, correct?

Hey Sam,

What are you thoughts on transferring some of my earnings this year i.e. 50k into a new charity that I will start (new entity, hasn’t created)?

Not only for tax purposes, but also I am increasing doing more animal rights activism work, it would also nice to have my own charity focusing on that purpose.

Thanks

I think that would be great!

I just want to add some clarification to your point around the $3k maximum capital loss deduction. That only applies against earned income. If you have capital gains during the year that will add to your tax burden, then any capital losses can reduce those gains dollar for dollar. It is only once you have exhausted your capital gains to apply the capital losses against does the $3K limit come into play.

This year I have had a lot of capital gains (first world problem, I know) that I am desperately looking to harvest some capital losses against. The problem is that I don’t want to loss those stocks I have the loss with, but might need to sell them and buy them back later. The joys of being an investor.

Hi Chucky,

Are you sure about that?

For example, let’s say I sold a stock for a $50,000 capital gain. Are you saying if I sold another stock for a $50,000 capital loss, this loss offsets the $50,000 capital gain? As a result, I pay 0% capital gains tax?

What if I have $50,000 in capital losses and only $20,000 in capital gains on a stock one year. Can I carry over the $30,000 in losses to reduce my capital gains by up to $30,000 the next year?

Thanks,

Jack

@Jack, yes to both your situations. Here is a link to a Motley Fool article that spells that out. One of the points I will highlight is:

“If you have sold other investments at a profit during the year and therefore have capital gains income, then you can use an unlimited amount of capital losses to offset the gains. For instance, if you have capital gains of $12,000 and capital losses of $11,000, then you can use all of the losses to reduce the amount of gains you have to report, leaving you with a net gain of $1,000”.

https://www.fool.com/retirement/2017/02/15/what-is-the-capital-loss-tax-deduction.aspx

Hello Sam, Great article! If you work over 700 hours at your real estate business, can’t you deduct the mortgage interest, not limited to $25,000 plus any loss associated? The 25k is just for personal taxes correct? My husband and I have 2 single family rentals and have been losing out on deductions, only postponing the loss due to salaries. I’ve since left my job and consult and can take on the hours of managing our properties as well, making it a business and not passive. Thx for sharing your knowledge.

“Under the tax code, an individual may deduct up to $25,000 of real estate losses per year as long as your adjusted gross income is $100,000 or less and if you “actively participate” in managing the property.”

Sam and co-readers, I saw the note on FSA health spending, but missed mention HSAs. There is a LOT packed into this blogpost, so I can see where my minor tidbits would be accidentally orphaned. Please be aware that HSAs have several advantages when a HDHP is one’s health insurance of choice:

Unlike FSAs, HSA accounts are yours and not a company holding account; therefore those contributed dollars stay with you until you spend them or die and your heirs get the funds (reader, you do have a will, right?) HSA accounts are not forfeit at the end of the year (FSA account are ‘spend it or lose it’).

Only two rules to contribute to a HSA account: (1) be enrolled in a HSA-qualified HDHP, (2) the contributor need not be on Medicare (=65 and still employed, you still qualify.

A HSA-qualified HDHP will have similarly lower premiums as a FSA, and a whole lot cheaper than the vastly more expensive standard options people choose without evaluating cost/benefit.

A HSA-qualified HDHP allows one to open a HSA savings or investment account. Contributions per year are capped (similar to Roth caps).

Funding your HSA can come from pre-tax pay deduction that lowers ones taxable income (like a 401k) or you can fund with post-tax money. After-tax contributions are fully tax-deductible from one’s FEDERAL taxable income using form 8889 and Sch1. This translates to CONTRIBUTIONS are TAX-FREE at the Fed level. Most states also consider this tax-free, but there were a few exceptions when I last read up on tax advantages.

Unlike 401(k)s and some other tax-advantaged accounts, the funding for an HSA doesn’t have to come from earned income — or even YOUR income. You can take savings, investment proceeds, whatever’s under the couch cushions or even gifted money as you panhandle at the traffic light and flow it into an HSA. It is not employment-dependent. Hence this year’s unused contribution rolls over and compounds to next.

HSA earnings are tax-free (like a Roth).

The insured may dip into HSA funds for qualified medical bills at any time (usually include most Dr visits, emergency services and hospitalizations, optical and dental needs, script drugs — look into the coverage before you sign up).

Some financial advocates design interesting investment plans wherein all qualified medical expenses are paid out of pocket, documented, and kept — allowing the HSA funds to grow unmolested to further tax-free gains — as a wealth-building vehicle.

HSA funds can be used to pay medicare premiums.

HSA funds can be used for non-qualified expenses without penalty after age 59-1/2 — but withdrawals of earnings are taxed as ordinary income then. So your HSA account can pay for that “I’ve made it to 60 vacation/porsche”.

Got a real non-medical need for that stash before you are 59-1/2? Well, yes, you can pull out — but there are tax fees involved.

I said earlier that HSAs can go to your heirs. There are some weird rules on how that beneficiary role works for spouses, non-spouses, estates, revocable trusts and such. You can even build a chain of beneficiaries.

There are tons of websites, podcasts, books and perhaps even some older posts here with Sam re HSAs to learn more. So why should you look into this now, before the new year? Because your window to contribute is annually — and like a Roth, you can wait to the Ides of April (or whenever you file) to contribute to the prior year. Read up or find a decent financial advisor (for the love of Darwin, don’t rely on me).

I personally cap off my family’s investment acct early every year just to get it off my plate, dumping it 70/30 into VTI and AGG — but I’m not a sophisticated investor. Seems crazy not to take advantage of as many of these tools as you can.

Can anyone get a HSA? Is this through an employer? Just recently learned about them.

To open and contribute to a HSA, you need to have a HSA-qualified HDHP. Check with your health plan. These can be through an employer or self-insured.

With my employer plans, ALL of them have the same catastrophic cap on annual out-of-pocket. So the minor extra I pay in Dr visits from choosing the low-premium HSA rather than the much higher premium ‘best’ plan is very small for a family of four.

My daughter had an emergency appendectomy last year. Total revealed bills came to $43000. My cap with the HSA is $12000. That’s the same cap for the ‘best’ plan. I would have been out the same cash either way — and having an HSA for 15 years meant I had all the cash to pay the OOP. Unrelated: I asked the hospital if they had any no-interest payment plans. They do, and I have a low monthly payment while my HSA balance continues to grow.

Some goggling will bring a plethora of information. Work out how much you paid on average for medical costs for the last five years with your current insurance, plus your premiums. Then calc out what you would have paid if you had a HSA-HDHP vs what it would have saved in premiums, in taxes for maxing out HSA contributions, and what those contributions would have earned since 2015 as a savings Acct or an investment account say with VTI as the sole component.

> HSA earnings are tax-free (like a Roth).

California taxes you on your annual gains. Like with the use tax, they rely on you to report it, but since annual contributions are reported on your W2, you won’t be able to ignore it for long.

That doesn’t detract from its usefulness. While to date I treat it as an extra retirement account, it does have 45k now in it for a really bad day at the hospital. Provided I can avoid that, it will pay for coverage between retirement and turning 65.

What’s your opinion on using donor-advised fund for charitable contributions?

I think they are great. I should write a more detailed post about it.

Donor advised funds are the most popular giving vehicle today next to people writing a check or using a credit card for donations. However, keep in mind that not all donor advised funds are created equal and many are under pressure to not give to selected organizations. make sure you select a donor advised fund that reflects your value system.

Hi Sam, if I maxed out my 401k from my regular corporate job, and I opened my own side biz (hopefully in 2021), could I still qualify to open a Self-Employed 401k?

Yes you can! Check out this post:

How To Save Over $100,000 In Your Pre-Tax Retirement Accounts

Thank you, Sam!! Will definitely look into this.

I think the best thing you could do is print out this article and every comment and go through each one with your CPA, to make sure they are evaluating each item for your tax return.

Corrections

#6 Even with a cash basis accounting you cannot exclude taxable income when all restrictions to your claim on that income have been removed. Even if you have not physically received the check before the end of the year its still taxable income.

for what its worth that’s my 2C

Hi Sam,

Lot of good stuff detailed all in one place here. However (got be a however), it seems to me that there are two distinctly different categories of retirees, those with sufficient means and those with insufficient means (to maintain their chosen lifestyle until death).

Of these two, the first category can be split again into two additional categories, those whose total income (passive income plus investment growth and income) is greater than while working (typically, this would mean their net worth was growing) and those whose income is less than while working (which would typically mean their net worth was decreasing). The difference between the two can be a very sharp line and should have some sort of a name if it does not already, something like “the takeoff point,” or the “retirement Rubicon,” or something like that.

These latter two categories are likely to see things very differently when it comes to 401k plans and Roth IRAs and it seems that sometimes you are advising one group and sometimes the other.

1) “In general, I’m not a fan of paying taxes up front with a Roth IRA, especially if you are in the 24% marginal income tax bracket or higher.”

Who is this advice targeted for? If we do as you have suggested many times, and secure a suitably large passive income, along with a big enough portfolio to continue getting serious returns, then we should cross the takeoff point and a Roth IRA is the best thing going.

2) “The maximum 401k contribution limit remains at $19,500 for 2021. You should max out your 401(k) if you are in the 24% marginal federal income tax bracket or higher to save on taxes.”

Again, passive retirement income for the win (in accordance with your own advice elsewhere). Given that every projection I’ve made shows our own retirement income is already going to increase when we retire, and then keep on increasing up to age 72, when RMDs kick in and jump us into a higher bracket (or two) if I can’t manage enough partial Roth conversions in the meantime. Then it rises drastically into our nineties. Even so, we have no plans to run out and buy a 7 bedroom McMansion in Sun City or southern Florida.

Roths comes first, if for no other reason than to reduce the burn of paying higher taxes later due to high RMDs.

This makes the main reason for 401k contributions become the fact that they can be converted to our Roth plans in big chunks, in between retirement (and moving away from high state income taxes) and age 72, a limited window, unless we are willing to go up a tax bracket to convert even larger sums (unlikely).

A secondary reason would be a minor one, but potentially still worth doing, which is that the deduction for 401k contributions could reduce taxable income to a point where an annual contribution (max of 7k) to the Roth account(s) could be made where it otherwise could not.

For some reason, I love reading into taxes, particularly how to minimise the amount you pay each year. This post is no exception and has some great ideas, so thanks very much!

Great list thanks! I’m trying to figure out if I should do anything in regards to Prop 19 in CA. Technically we have until Feb 15th of next year, but I need to think things through sooner rather than later. It’s so annoying when there are complicated tax changes like this, but it’s important we understand them because there can be significant ramifications.

Rather than raising taxes on incomes above $400,000 deductions should be completely phased out. If one wants to give to charity, that is a good thing but a tax deduction is simply the equivalent of a government subsidy to the charity. I still remember in 2016 seeing Hillary Clinton’s tax return where it showed she donated $1,000,000 to the Clinton Foundation, which resulted in a loss to the taxpayer of over $350,000.

Could purchase a vehicle weighing over 6K lbs for business by 12/31 to get a huge write-off. For example:

Say you buy a $47,000 crossover vehicle that tax law classifies as a truck. Say further that you use the crossover truck 100 percent for business. If the GVWR is 6,001 pounds or more, tax law allows you to deduct $47,000 (or a lesser amount if you would like—in this case, you use Section 179 expensing).

Spreading the tax deduction. If the GVWR is 6,000 pounds or less, your first-year write-off is limited to $10,000 ($18,000 with bonus depreciation as limited by the luxury auto limits).

In this example, the combination of (1) truck status and (2) GVWR of 6,001 pounds or more produces a potential $47,000 first-year tax deduction, whereas failing either truck status or GVWR threshold limits the first-year regular depreciation write off to $18,000 with bonus depreciation.

Great tip and reminder!

Let’s hope folks mainly buy the truck because they need to though.

Sam – Have you ever looked into buying into a partnership that specializes in buying and converting the land into a conservation easement?

This was recently brought on my radar this year when I finally found the CPA I’ve been looking for for years.

I actually bought a couple of units into a deal myself spent $68,600 and that bought me a deduction worth $343,000. This particular deal has a 5:1 ratio of donation (of the purchased land) to deduction (based on the highest and best use appraisal).

My CPA helped calculate how much I should invest to maximize the maximum the IRS allows in terms of deductibility against your AGI. In this case, we calculated that the largest deduction I could utilize in 2019 based on my projected AGI of $350,000, which translated into two units at $34,300/unit. This will save me about $140,000 in taxes and net of the donation is an actual savings of $71,400 (greater than a 100% return).

It’s a great option for high earners in high marginal tax rates. It doesn’t make sense at every income level.

Dom

I’ve heard of it! But haven’t done so. Will look into it. Sounds like a great tax shield. Maybe you want to do a guest post about how to do something like this.

Those conservation easements are subject to IRS scrutiny in recent years. Expect the partnership to get an audit.

Careful with conservation easements. These are a huge red flag to the IRS and will almost guarantee an audit. In my experience most of these audits are not resolved at the IRS audit team level but instead get elevated to IRS Appeals. Even if the taxpayer prevails after the audit, the taxpayer will incur thousands in legal/CPA fees and an inordinate amount of stress.

-Tax lawyer who charges clients $400 to defend IRS audits

If one is doing the easement with a group or LLC, won’t that bear the expenses for the audit, rather than an individual?

This is an audit flag due to the rampant abuse of the deduction. It takes the IRS a few years to do its work but $68K makes you a “smaller fish” therefore more interesting to IRS enforcement. Other than the criminal division, the bigger taxpayer you are the more you can fend off IRS. Never used to be that way but now the IRS is outmanned and outgunned by sophisticated taxpayers.

It is all a matter of proportion and paying $68K to get a deduction of $343K on an AGI of $350K would seem like your return will get flagged for sure. In a few years, please let us know how this turned out.

Regarding your statement: “If you’re not subject to AMT, you can also consider paying property tax installments and state taxes in the current year that aren’t due until next year. Accelerating these payments may help you benefit every other year and lower your tax burden for the current taxable year.”

Doesn’t the IRS now limit people to $10,000 in SALT … State and Local Taxes – that’s all taxes including property taxes, etc.

Sam, I would also recommend to look into the Opportunity Zones investment program. On one hand it helps you save on taxes and on the other hand helps to revitalize parts of the city whicg would otherwise not have seen investment opportunities.

Of course, one needs to run the numbers to make sure the deal makes sense and not let the tax tail wag the dog.

Good reminder on Opportunity Zones! I had written about the topic in the past. Haven’t taken the plunge yet because I haven’t found the perfect vehicle to do so yet.

Not only are they good investments, IRS lets you roll over cap gains into the Opp Zone. Similar to a 1031 exchange.

There are also other tax advantages if you keep the money in there for 5-7 years.

Got 3 more less-known tax saving strategies:

1. If you got family/friends you are supporting financially (who’s likely in a lower tax bracket), consider gifting them long-term appreciated (capital gains) stocks. The transfer is direct – with no changes in cost basis. When they sell, they likely will pay 0% capital gains tax rate where you might have paid 23% federal + x% state rate.

2. Similar strategy as above but for charities – gift appreciated stocks to a Donor Advised Fund (that you control). You can also time it so that you gift it all in one year when extra deductions help and not donate in other years. You can then control when the fund actually distribute money out to charities – so to charities you donate money to yearly anyways, it’ll remain the same for them.

3. If you’ve got 1 property you’re renting out and has no mortgage and you’re living in another primary residence with a large mortgage (and interest deduction), but you’re still pretty close to the $24k total standard deduction limit, consider swapping (move into the no-mortgage place and rent out the with-mortgage place). This way, you still take the $24k deduction, but now your mortgage interest can be used to be deducted from rent. For example, you’re in California – maxed out your State Tax deduction of $10k. Your primary residence has a mortgage where you’re paying $14k interest a year. But your other rental has no mortgage. You’d have itemized deduction of ~$24k – which is useless. But if you swap the 2 residence, you’ll still have standard deduction of $24k. But now you can deduct the extra $14k from rent income.

Great tips! If I buy this new property close by, I will pay cash and rent out my existing property with a mortgage that I just refinanced.

James – Did you mean to address Property Tax? The SALT limit is $10k, but mortgage interest is maxed on a $750k mortgage.

I was indeed talking about Federal Income tax. In my example, the $10k SALT deduction already included property tax. But yes, it could make a difference if the 2 properties have vastly different property tax. For example, assuming property A (currently your rental) still had $0 mortgage interest deduction and property 2 (your primary residence) had $14k mortgage interest deduction.

Example #1. Property A Property Tax = Property B = $5k. Then Property Tax makes no difference. You’ll still have an extra $14k deduction if you swap.

Example #2: A Tax = $3k. B Tax = $8k. Your State income tax is $10k (reaching the SALT limit – which renders itemizing deduction of property tax useless). If you swap, you get an extra $5k in deduction – making it $19k total.

Example #3: A Tax = $8k. B Tax = $3k. State income tax is $10k. If you swap, you lose $5k in deduction from property tax – making it only $9k in total deductions benefit.

Example #4: A Tax = $8k. B Tax = $3k. State income tax is $7k. Without swapping, your itemized deduction will be $24k total and rental deduction will be $8k for a total of $32k. With swapping, your itemized deduction will be $24k still (due to $10k SALT limit) total and rental deduction will be $17k for a total of $41k. So looks like still just $9k in total deductions benefit.

Thanks James.

In your original comment, it read to me like you were confusing SALT and mortgage interest, so I was just clarifying.

The idea of swapping properties to deduct the higher property taxes is a cool point though.

Cheers,

Ben