The best gift any parent can give a child besides unconditional love is a great education. A 529 college savings plan is a solution that is designed to help families tax-efficiently save for future college costs.

You contribute after tax money with the benefit of paying zero federal and state income taxes on the profits when it's time to use the funds to pay for college.

If your child does not end up going to college, all is not lost. You can either name a new beneficiary (different kid) or just pay the taxes on profits.

My goal is to max out my son's 529 college savings plan before he turns 18. I want him to focus on his studies and graduate with zero student debt. By the year 2036, a 4-year private university education will likely cost over $725,000 all in.

The various complaints I read today about young adults with student debt are disheartening. The struggles range from saving for a house, saving for retirement, accepting a low-paying job, to starting a family.

Below are the most important pieces of information you need to know about making the best 529 plan decision. Feel free to provide feedback at the end on anything that I may have missed. I've tried to cover all the questions I had before opening up an account.

529 Plan Contribution Limit

There are two questions to answer here. The first is what is the total maximum you can contribute to your 529 plan. The second question is how much can you contribute each year to your 529 plan.

Total Maximum Contribution To A 529 Plan

To qualify as a 529 plan under federal rules, a state program must not accept contributions in excess of the anticipated cost of a beneficiary's qualified education expenses.

For example, 1 year at a mid-priced college for an in-state student can run around $24,000. A year of private school can cost around $45,000. Further, it is assumed that the average student would take no longer than five years to graduate.

Therefore, the average 529 plan limit is roughly $300,000, depending on the state. When the value of the account (including contributions and investment earnings) reaches the state's limit, no more contributions will be accepted.

For example, assume the state's limit is $300,000. If you contribute $250,000 and the account has $50,000 of earnings, you won't be able to contribute anymore. The total value of the account has reached the $300,000 limit.

These limits are per beneficiary. Thus, if both you and your father each set up an account for your child in the same state, your combined contributions and earnings can't exceed the plan limit.

Otherwise, a kid could possibly end up with multiple 529 plans worth millions. Just imagine parents, both sets of grandparents and long lost aunties and uncles making contributions to the same child. Here are the 529 plan contribution limits by state.

529 Plan Annual Contribution Limit

You should only contribute a maximum of $19,000 a year for 2025. Anything more involves filing a 709 federal tax form taking a deduction against your lifetime gift-tax exclusion limit.

However, 529 plans allow you to superfund. In other words, you can gift an individual a lump sum of up to $95,000 in a single year (5 years X $19,000). That's up to $190,000 for joint gifts. Superfunding does not count against your lifetime exclusion. This is provided you make an election to spread the gift evenly over five years.

In other words, once you gift $95,000, you strategically shouldn't gift more money until the sixth year. This is a valuable strategy if you wish to supercharge the 529 immediately.

Who Can Contribute To A 529 Plan?

Anyone can contribute to a 529 college savings plan account and can name anyone as a beneficiary. Parents, grandparents, aunts, uncles, stepparents, spouses and friends are all allowed to contribute on behalf of a beneficiary.

There are no income restrictions for the contributor. The maximum contribution limit applies to the beneficiary, not the individual making the contribution. Balances designated for a specific beneficiary cannot exceed the maximum allowed by the state's 529 plan.

Can You Open A 529 Plan Before Your Child Is Born?

Yes you can. But to do so, you need to initially open a plan under your own name. Then, transfer the plan to your child after birth due to the need for a social security number.

But before you open a 529 plan for your unborn child, max out your 401k and IRA first. Make sure you also plan to have kids or are able to have kids. Sometimes nature has a way of changing outcomes.

Personally, I'd wait to open a 529 college savings plan until your child is born. Just make sure to set yourself a reminder. Sleep deprivation from a newborn is a given and could cause you to forget.

While you're at it, you might as well open up a custodial Roth IRA and custodial investment account for your children too. To contribute to a custodial Roth IRA, however, required a child to have earned income.

Does A 529 Plan Affect My Financial Aid Package?

When you apply for the Free Application for Federal Student Aid (FAFSA), it'll try to ascertain your income and total assets. Logically, the higher your income and higher your assets, the less aid you will receive.

Assets in a 529 plan owned by the student or her parents count against need-based aid. Those in a plan owned by anyone else (including grandparents) don't.

But once grandparents or other relatives start taking money out of a plan to help pay those bills, the reverse is true. The withdrawals can hurt you even more than if the plan was owned by the student or parent for next year's financial aid package.

The 529 plans owned by college students or their parents count as assets. Thus, they reduce need-based aid by a maximum of 5.64 percent of the asset's value. That means if you have $50,000 in a college-savings plan for your daughter, her aid would be reduced by roughly $2,820.

Learn more about how to navigate the financial aid system and get free money for college. You really need to be strategic with your income and assets for two years before your child attends college.

Have Grandparents Be Owners Of The 529 Plan And Grandkids As Beneficiaries

If the 529 plans are held by grandma and grandpa, they won't appear on the FAFSA as assets. Instead, as the money is withdrawn to pay for tuition or other educational expenses, that amount must be reported on the next year's financial aid forms as untaxed income to the student. It can reduce the amount of aid by 50 percent.

Let's say that same $50,000 529 college-savings plan was owned by the grandparents. If the student withdrew $10,000 from it one year, that withdrawal could increase the amount the family is expected to pay for college (and reduce the aid) for next year by about $5,000.

The Name On A 529 College Savings Plan Matters

Therefore, the logical conclusion is to either have the 529 plan under your child's name or your name. This will minimize the reduction. Or, draw down the 529 plan under the grandparent's name in the very last year of college.

It's worth investigating how to reposition assets and income two years before your child applies for financial aid. Although it may not be worth it due to tax and performance consequences.

Here are the different ways to pay for college. A 529 plan is one way, a Roth IRA, and from cash flow are other ways.

Can You Change The Beneficiary Of The 529 Plan?

If the existing beneficiary no longer needs the funds in your 529 account (e.g., he or she gets a full scholarship, decides not to go to college, or passes away), you may want to designate a new beneficiary instead of pay the taxes and penalty. Just fill out a change of beneficiary form and submit it to your 529 plan administrator.

If the existing beneficiary needs only some of the funds in your 529 account, you can also do a partial change of beneficiary. This involves establishing another 529 account for a new beneficiary and rolling over some funds from the old account into the new account.

The new beneficiary must be a family member of the old beneficiary in order to avoid paying taxes and penalties. According to Section 529 of the Internal Revenue Code, “family members” include children and their descendants, stepchildren, siblings, parents, stepparents, nieces, nephews, aunts, uncles, in-laws, and first cousins. States are free to impose additional restrictions, such as age and residency requirements.

Note, if you have a lot of funds, you can even use the 529 plan as a generational wealth transfer vehicle! A 529 plan is probably one of the best ways to gift money without gifting money.

What If You Have Money Left Over After Your Child Finishes College?

If you are really focused on contributing to a 529 plan, you might end up contributing too much. Luckily for you, I've figured out when to stop contributing to a 529 plan. You stop when the 529 plan has grown large enough to fund 4 years of public or private college today.

There are plenty of options if you have money left over from a 529 plan. You can save the money for graduate school or transfer the remaining funds to another child. In addition, you could keep the money growing tax free for potential grandchildren. Or pay the 10% penalty and taxes on the profits.

The exceptions relate to withdrawals made on account of the beneficiary's death, disability, receipt of a scholarship, or attendance at a Unites States military academy.

A very small handful of 529 savings plans, and nearly all of the 529 prepaid tuition plans, impose a time limit on your 529 account. If you bump up against one of these limits, you can look to move your funds to another 529 college savings plan via a qualifying rollover.

New 529 Plan Rollover Rules Due To Passage Of Secure 2.0 Act

Money withdrawn from a 529 plan must use for qualified educational expenses. If not, you’ll pay ordinary state and federal income taxes (at the beneficiary’s tax rate) on the money, as well as a 10% penalty.

Now, the penalty can be waived if your kid wins a scholarship, gets into one of the U.S. military academies, receives support from an employer or for several other reasons – but that’s just the 10% penalty. You’ll still need to pay the tax bill.

You used to be able to get around that penalty by transferring the account to another beneficiary – even yourself or a spouse – in your family or extended family, including in-laws. But without an eligible recipient to use the money you were stuck paying both the tax and penalty – until now.

Rolling Over A 529 Balance Into A Roth IRA

The rollover allowance starts in 2024 and comes with several limits. First is that the amount rolled over can’t be more than the Roth contribution limit, which is $6,500 this year. You also can’t roll over more than $35,000 total in the beneficiary’s lifetime. You also can’t roll over contributions or earnings from the past five years.

Another condition is that the 529 plan must have been open for at least 15 years. Experts are unsure whether changing the account beneficiary requires a new 15-year waiting period. Also unknown until the IRS issues rules is whether withdrawals of earnings from 529 plans transferred to a Roth account will be subject to the rule that requires earnings to remain in the Roth account for at least five years.

However, the rollover contributions aren’t subject to the Roth IRA income limits of $153,000 for single filers and $228,000 for joint filers this year. Families who’ve contributed to 529 pre-paid tuition plans – where they purchase tuition credits at the current rates – haven’t had to deal with the issue, since those plans refund only the contributions, which are made with after-tax money.

Why The 529 Plan Rollover Is Now Allowed

“Families and students have concerns about leftover funds being trapped in 529 accounts unless they take a non-qualified withdrawal and assume a penalty,” a summary statement from the Senate Finance Committee said.

“This has led to hesitating, delaying, or declining to fund 529s to levels needed to pay for the rising costs of education. Families who sacrifice and save in 529 accounts should not be punished with tax and penalty years later if the beneficiary has found an alternative way to pay for their education.”

Do You Need to Get A 529 Plan From Your State?

No. Every plan allows the profits to be withdrawn federal and state tax free if the funds are used to pay for higher education (e.g. college). If the funds are not used for college, then normal taxes on earnings apply. There is no tax due on contributions as the 529 was funded with post-tax dollars.

The reason you may want to choose your state's 529 plan is due to state tax deductions on your contributions. But some states, like California, offer no state income tax deduction. Therefore, it makes sense to search around the country for the best plan possible.

You can use your 529 from whichever state to pay for college in any state.

What Is The Penalty For Withdrawing Early From A 529?

If you withdraw the funds early to pay for something other than higher education for your beneficiary, then you must pay a 10% tax plus normal federal and state income tax on the profits.

However, if there are no profits, there are no penalties and taxes to be paid. For example, if you funded $20,000 and due to a bear market you now only have $15,000, all withdrawals are penalty and tax free.

Can You Dictate A Certain Percentage Of The Contribution To Be In Cash?

Let's say you plan to jump start your child's 529 plan with $75,000, but you're worried about a stock market correction. You can't tell the administrator to only invest $30,000 and keep the $45,000 in cash until you see better opportunities.

The solution is to just fund what you are willing to invest. For example, you can send five different deposits totaling $75,000 in a two year period up to five years.

Can you Spend The 529 Plan On Grade School Tuition?

Under the latest tax plan, up to $10,000 of a 529 college savings plan can be used per student for public, private and religious elementary and secondary schools, as well as home school students. In other words, a 529 plan isn't just for college tuition anymore. This is HUGE!

If you plan to send your children to private grade school and pay the big bucks, then a 529 plan becomes even more valuable.

Who Manages The 529 Investments?

Once you understand if there are any tax deduction benefits for choosing your state (e.g. state tax deduction), then you should go about identifying which state has partnered up with the best money management firm.

Given I live in California, there are no state tax deductions. Thus, I decided to focus on which states use Fidelity, Vanguard, and TIAA-CREF because I believe they are the best firms.

I've used Fidelity for the past 16 years due to them administering my company 401k and now my Solo 401k and SEP-IRA. As a result, I'm comfortable with their service, products, interface.

Vanguard is obviously a top choice due to its low expense ratio. Finally, TIAA-CREF is another money manager I've worked with in the past. My colleague of 13 years is a Managing Director there. And, they started off as a Teachers Insurance and Annuity Association—College Retirement Equities Fund (TIAA-CREF).

Here's Fidelity's various 529 plan strategies with expense ratios.

Fidelity's Age-Based Strategy includes portfolios that are managed according to the beneficiary's birth year. The asset allocation automatically becomes more conservative as the beneficiary nears college age.

Your beneficiary's birth year will help determine the Age-Based portfolio in which you'll invest.

This strategy offers a choice of three types of funds:

Fidelity Funds – 1.04% average expense ratio

- Seek to beat a combination of major market indices over the long term

- Portfolios invest solely in Fidelity funds.

- Managed by dedicated Fidelity portfolio managers

- I would invest only in index target date funds, not managed target date funds due to the high expense ratio

Multi-Firm Funds – 1.2% average expense ratio

- Seek to beat a combination of major market indices over the long term

- Portfolios invest across multiple fund companies, offering an opportunity to diversify your funds.

- Managed by dedicated Fidelity portfolio managers

Fidelity Index Funds – 0.13% expense ratio

- Seek to closely mirror the performance of a combination of major market indices over the long term

- Portfolios invest solely in Fidelity Index funds.

- Passively managed; securities currently held in the respective index determine investments.

Beware Of Management Fees

I hate spending money on excessive management fees because most fund managers underperform their respective indices.

As an example, for 2016, the performance for each category was 16.32% Index Funds, 18.33% Multi-Firm Funds, 19.34% Fidelity Funds. This means it may make sense to pay 0.91% more in fees for the Fidelity Funds due to the 3.02% outperformance.

However, over a 10-year period, it's unlikely the Fidelity Funds will outperform. Whereas you are guaranteed to pay 10% more in fees during that time period. Hence, I'm always going to select the Index fund route for a 529 plan.

Another important recommendation I have is to go with an INDEX target date fund and not an actively-managed target date fund. Given it's hard to outperform the index over a long period of time, you might as well save money by choosing the INDEX target date fund route. An Index target date fund has much lower management fees.

But perhaps better than an index target date fund is just investing directly in an S&P 500 index fund. I’ve been investing in a 529 plan since 2017, and the target date fund has tremendously underperformed the S&P 500. As a result, my 529 plan is likely not enough to pay for college.

I need to invest aggressively outside my children's 529 plans or switch the allocation more toward the S&P 500. Luckily, I've purchased a rental property for each child, which will both be paid off by the time they graduate high school.

The Best 529 College Savings Plans

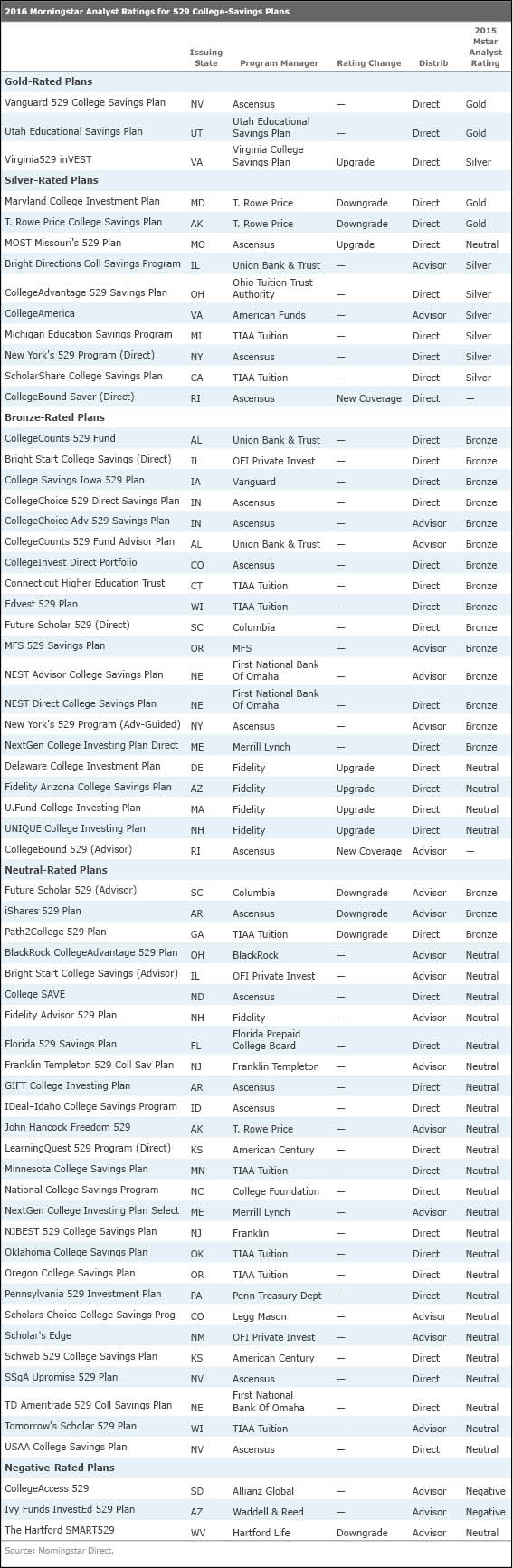

Given you're free to choose any 529 college savings plan you want, focus on the best. Let's look at a list of the best 529 plans determined by Morningstar, one of the most trusted financial rankers.

As you can see from the chart, you might as well choose a 529 plan from Nevada, Utah, Virginia, Maryland, or Arkansas. They are rated gold or were once rated gold.

In my opinion, the Nevada Vanguard plan looks like the #1 choice, followed by the California TIAA-CREF plan since I'm not familiar with T. Rowe Price or the other plans. I'm disappointed the Delaware Fidelity plan is only rated a neutral since it would be so easy for me to just go with them.

As written by Morningstar, “These plans follow industry best practices, offering some combination of the following attractive features: a strong set of underlying investments, a solid manager selection process, a well-researched asset-allocation approach, an appropriate set of investment options to meet investor needs, low fees, and strong oversight from the state and program manager. These features improve the odds that the plan will continue to represent a strong option for investors.“

Related: How To Analyze And Reduce Excessive Fees In Your 401k

Profiling TIAA-CRF's 529 Plan

Here's a quick snapshot between the California TIAA-CREF 529 plan and the Nevada Vanguard 529 plan. Sorry the font size is so small. Just zoom in. Based on the comparison chart, there doesn't seem to make that big of a difference, especially if you are just buying index funds with similar expense ratios.

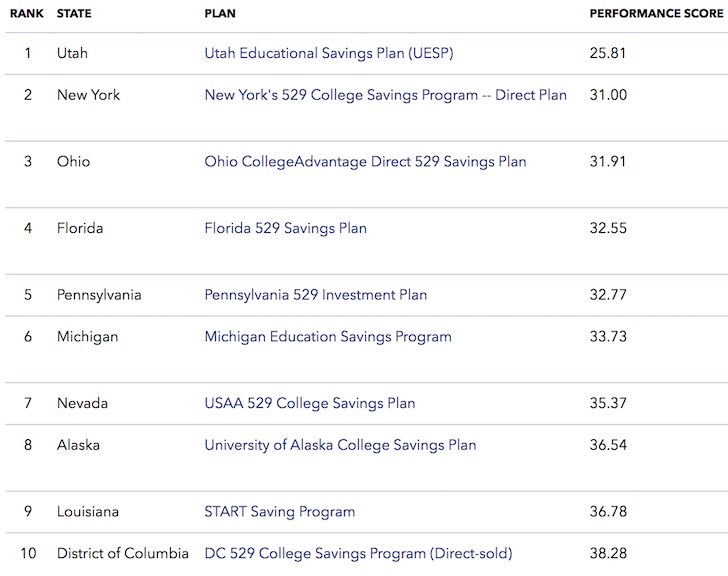

Here is another popular ranking by SavingforCollege.com. I'm looking at the 5-year and 10-year track record rankings instead of just the 1-year to iron out any anomalies.

Find A Plan You Like And Enroll

Once you've determined what you like, you can enroll directly with the plan. Simply Google the plan name or apply through your existing brokerage like Fidelity who has plans in Arizona, Deleware, Massachusetts, and New Hampshire.

They'll give you more information like I have provided in this post to make an informed decision.

Wealth Planning Recommendation

College tuition is now prohibitively expensive if your child doesn't get any grants or scholarships. Therefore, it's important to save and plan for your child's future.

Check out Empower's new Planning feature, a free financial tool that allows you to run various financial scenarios to make sure your retirement and child's college savings is on track.

They use your real income and expenses to help ensure the scenarios are as realistic as possible.

Once you're done inputting your planned saving and timeline, Empower will run thousands of algorithms to suggest what's the best financial path for you. You can then compare two financial scenarios (old one vs. new one) to get a clearer picture. Just link up your accounts.

There's no rewind button in life. Therefore, it's best to plan for your financial future as meticulously as possible and end up with a little too much, than too little! I've been using their free tools since 2012 to analyze my investments and I've seen my net worth skyrocket since.

Pay For Your Children's Education Through Real Estate

In addition to investing in stocks and bonds in a 529 plan, I recommend diversifying into real estate as well. Real estate is a core asset class that has proven to build long-term wealth for Americans.

Real estate is a tangible asset that provides utility and a steady stream of income. If you buy one physical property when the child is born, it could fund your child's education after 18 years. You can either take out the equity in the property or pay for college with the rental income.

If you want to invest in real estate hassle-free, then take a look at private real estate investing.

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eFunds. Fundrise has been around since 2012 and manages around $3 billion and has over 380,000 clients. It specializes in Sunbelt single-family homes. Investing in a diversified private real estate fund is a way to earn passive income.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations, higher rental yields, and potentially higher growth due to job growth and demographic trends.

I've personally invested $954,000 in real estate crowdfunding across 18 projects to take advantage of lower valuations in the heartland of America. My real estate investments account for roughly 50% of my current passive income of ~$300,000.

I've invested $300,000+ in Fundrise so far and Fundrise and CrowdStreet are sponsors of Financial Samurai.

Grandparent-owned 529 accounts do NOT count against financial aid when withdrawn. This is a positive change for 2024 making it very attractive for grandparents to own and fund a 529 account for a grandchild.

Though the tax benefits may seem good for some states, the risk of the government screwing up is too high for me to enroll in my state (Maryland’s). They miscalculated balances for years and then froze withdrawals – often meaning students could not pay their tuition and were at risk of not being able to enroll in classes. I’m using a financial institution such as Vanguard which I trust more over the possibility of saving some on state income tax. The counter-party risk is too high. https://wtop.com/maryland/2023/01/error-not-accurate-calculation-may-be-why-md-529-funds-seem-frozen/

It amazes me that there is such a low percentage of people with children that even know about 529 accounts, and even less that utilize them. These are great ways to take advantage of compounding interest without taxes.

Great article Sam, need your expertise on tax issue. 529 contributions are after-tax, so why can’t I claim AOTC tax credit on taxes if I paid my daughters college tuition using 529 funds? So many articles on the internet claim that it is double dipping, if so, how?

Thank you,

Imran

Sam, great article. Any advice for superfunding if in a state with a 529 state tax deduction? Georgia will offer an $8K state deduction (married) starting in 2020. The advice online is that you may not want to superfund if giving up a generous state tax deduction. But I’m wondering if married couples might be able to superfund and get the state tax deduction at the same time. For example, only husband superfunds for $75K in year 1. Wife contributes annually in years 2-5 up to the gift tax limit (currently $15K) to get the state tax deduction. Do you know if this hybrid approach is permissible?

We set up two 529 plans for our two children. One has since graduated and that plan has a $0 balance. Our son is in his third year. We are projecting money will be remaining in that account at graduation.

Our has stafford loans she needs to pay off. I though I could transfer the remaining balance to my daughter’s account and use the balance to help pay off the stafford loans faster. Our 529 Administrator said this is not a qualified distribution. My question is why? The fact she has loans from college proves that money was used for tuition. This makes no sense to me.

Very useful article. Thank you for sharing this information with us!

I just opened up a 529 account with Fidelity using their Age based portfolio and chose the Index fund investment option to keep the fees to the minimum.

One thing to note, is that it seems like the $14,000 annual limit is per parent. So, if you file your taxes jointly with your spouse, you can contribute up to $28,000.

We live in NJ and unfortunately don’t have any benefits to opening a 529 here.

My question – what about a custodial account? Has anyone gone this route instead?

Little late responding to this, but I am not sure your statement “Can You Dictate A Certain Percentage Of The Contribution To Be In Cash?” is correct.

I have a plan in Virginia that my parents started for their grandchild, and that one I cannot dictate anything to cash since I chose the James Madison fund. But I also started a plan in Florida when we lived there. In that one, I can choose my investments, which I chose as 70% domestic equity, 20% International, and 10% Small Cap. I could have chosen some in cash but I didn’t. I’m now in Pennsylvania where they also have cash options. I am debating whether to put money on — on one hand, higher fees than Florida or Virginia, but PA colleges do not look at what is in a PA 529 for financial aid purposes.

I only wish when I sold my house in Florida in April 2016, instead of renting it, which we discussed and you said you hope I had invested it well, I wish had put more of it in a college fund or index fund, instead of in cash.

HAs the house in Florida not appreciated further one year later? I forget what you said. In SF, prices went up by another 5%-7% over the past 12 months, but are finally starting to slow.

If I had kept my house with pool in Florida, it would have appreciated. However, because my employer was paying all selling costs (taxes, 6% commission), I sold it in April 2016. I had bought it as a short sale 2 years earlier (with my employer paying all closing costs then too since I had relocated for the job). I made $30,000 + $6500 bonus for selling it fast. I miss the house, but numerous maintenance issues became apparent as we sold it. Sold it for $451,000, could have rented it for $3,500 / month. Also, since my employer gave me advanced notice that I had to move 1,000 miles away, I bought my current house, brand new, prior to selling the FL one. So when I sold the FL one, I had that equity, but I didn’t invest it fearing market was going to crash, though I did increase my monthly investments.

Ah, gotcha. Honestly, I think you made the right move to simplify. You can always go back and rent at a nice resort or Airbnb for nostalgia’s sake. That is GREAT your employer paid all those costs.

Great article and congratulations on your boy! I have a 6 month old baby girl and I researched the hell out of 529s last year. Do consider the difference in expense ratios among different states. Here in Oklahoma, I can deduct up to $10000 a year from state taxes but I chose the NY 529 plan over this despite the deduction. The expense ratio for a total market fund in OK is 0.35% while an aggressive growth portfolio (vanguard institutional total stock market 70% and Vanguard Total International Stock Index Fund (30%)) from NY 529 is only 0.16%. I plan to put in 14-28K every year until I max out and that 0.20% difference over 18 years is much more than the measly state tax deduction.

https://www.ok4saving.org/research/fees.shtml

https://www.nysaves.org/home/which-investments/individual-portfolios.html

Any thoughts on qualifying for more financial aid by switching w2 income to 1099 or s-corp income?

I also know the private and public schools include different assets when making aid determinations but I haven’t seen a good analysis on how to move assets around or how much money is too much to even bother.

Thanks! I hope you have some thoughts or pointers on this.

Up here in Washington state, we have the GET program, which is not actually a 529 plan, but a savings plan against tuition inflation (you pay today’s rate and it adjust as tuition increases). My husband used part of his (GI bill covered the rest), but the program has steadily gotten worse and more stringent when it comes to what is allowed to be charged to it.

Through that experience, we’ve decided not to enroll in the GET program for our son, and I’m leaning heavily toward NV or UT. This is definitely the best summary of 529 plans I’ve seen, so thank you. At this point I think I just need to pick one and get it up and running.

Thanks Sam for this post, it’s very timely as I too am in the same position of recently having a child and now thinking about how to fund their college education. I too live in California and have been eyeing either the UT or NV 529 programs. Also, I’ve been asking around and have read some people will instead open up a Roth IRA in their kids name as a Roth provides greater flexibility over a 529 plan, which can only be used for college: https://www.nerdwallet.com/blog/investing/roth-iras-trump-529-plans-battle-education-funding/

I’m trying to think through the practicality and wisdom of this. Do you have any thoughts?

So Sam, which 529 plan did you go with and what allocation did you choose? (I also live in CA and I use Nevada’s 529 and I’m stumped about where to allocate this year’s money! All cash and wait for a correction, or keep DCA’ing into broad stock index funds?).

Thanks for any thoughts!

Hi Scott, I’m still deciding. There’s no rush since the market is at an all time highs. I’m leaning towards the Nevada Vanguard plan or the fidelity index fund plan which only cost 0.12%. The reason is I am already a client of Fidelity and have my solo 401(k) and my SEP IRA there. So I’m for Milyer with the interface and it’s easy to transact and the more you have a good one place the more benefits yet. Also, if I’m going to index Road, which I will, it doesn’t really matter where I am the best so I’m for Milyer with the interface and it’s easy to transact and the more you have a good one place the more benefits yet. Also, if I’m going to index Road, which I will, it doesn’t really matter where I invest so long as the institution is reputable. Fidelity is huge and will be around forever.

Probably won’t superfund either. Instead, I’ll contribute $14,000 a year. Even at the market corrects 20% on $14,000, it’s not a big deal.

Thanks Sam for writing this and weight on the pros and cons. My son is 16 months and I have been debating weather or not to open a 529 for him since he was borned. We live in a state that doesn’t offer any tax exemption. Still looking into it.

I still remember that cold December night in 2015 when It was time to pay the spring semester bill. Low and behold there was $55,000.00 of student debt staring right at me (smack in the face reality check!). Soon the snow melted, the flowers bloomed, and the birds resumed their song. Another bill came in the mail demanding $15,000.00 (and notification of a 7% increase). I don’t know what burned hotter that day, the sun or my anger? But what I do know is that my drive for success became as unstoppable as Thor in a marvel movie. If one door shut, I opened two more.

Fast forward to June 2017. I now posses two lucrative jobs: full time at a government defense contractor and part time at a manufacturing plant. I’m now paying $1000.00 a week towards paying off those villainous loans. They will be eradicated by 2019! And my first non-debt paycheck I will cash 100% in for 1 dollar bills and roll in their crisp form.

I was always a good student at school with a good work ethic. Being in debt is what drove me to understand that good is not enough. I made myself into the best I could be. What I’ve seen first hand is students who don’t have any “skin in the game” and simply settle for good or worse, drop out. I might simply have a bias opinion, but I think paying for a child’s tuition can hurt them in the end.

BTW, Financial Samurai also played a large part as I stumbled across this website back in 2015!

Best,

Austin

I came across this: https://paulmerriman.com/turn-3000-50-million/

Not necessarily a college fund but a more long term approach to financially support your child.

Would you consider this?

Thank you so much!!! My second child is already 3 months old. for the longest time, I meant to start a 529 savings acct for my first child. I finally open an acct with wealthfront but did not contribute money to it. why? because I wasn’t sure if that’s where I want to place my money. now that you’ve mentioned that they use NV’s saving plan. I guess I’m going with them for sure. And I don’t mind the small fees, I’m an emotional investor, it’s best to have someone else take the rein.

Growing up fast! Yeah, I was pretty impressed with Wealthfront’s 529 plan. The thing is, their all in fee is 0.43% – 0.46%. It’s not the highest, as I just spoke to USAA’s Nevada plan and they charge 0.99% for one of their funds. But, it’s higher than the plan vanilla index fund structures at ~0.2%.

It does feel good to have piece of mind that someone else is on top of it though. a 0.26% difference on $100,000 = $260 a year. Not that much.

Sam, since you mentioned USAA, what do you think of them as an insurance carrier? Do you have any posts on personal (home, auto, umbrella) insurance? If so, would appreciate the link … thanks!

I love USAA. Great service. Been a member for 20 years. Father has been a member for 40+ because he served in the Vietnam War.

Insurance related posts:

How Does An Umbrella Policy Work?

The Ideal Amount Of Home Insurance

Disaster Insurance For Earthquakes, Floods, and Hurricans

I understand the emotional investor and someone else on top of mindset – but for me it smells too much ‘where are the customer’s yachts’.

My last couple of 529s are at scholarshare costing 8 basis points and fidelity/NH at 11 basis points. I would get no peace of mind paying 4x the fees for holding essentially the same assets.

Schwab will charge me 3 basis points for the same assets outside of a 529.

FAFSA is just the application. Since my college days in the 80s the feds involvement in financing college has ballooned – much like medicine. Odd that those two have exploding costs.

FAFSA get complicated fast but at the right income level there is no wealth level problem. Think at < 50K income one can be a billionaire and still get federal aid. And even above that level owner occupied houses and Romney level IRAs are irrelevant.

In general I think 529s are much more likely to cause trouble. All this is irrelevant for those without a taste for the govt teat. We have been closing out all of ours as the boy started high school.

Interesting points Ken. Why do you think 529s are more likely to cause trouble? Thanks for your insights!

It’s complicated and I’m certainly no expert; however 529 assets are reported on FAFSA and they feed into EFC(expected family contribution) thus often reducing financial aid. Here’s a piece on them:

https://www.forbes.com/sites/financialfinesse/2016/05/29/will-your-529-plan-hurt-your-childs-eligibility-for-financial-aid/#4138638e3b5f

If the parents are high income though I think the EFC will be substantial anyway so I’m not sure it makes a lot of difference.

Even if I wasn’t planning to suck on the teat though, many 529 plans have high expenses and if you’re not careful make more for the brokers than the customers. If I was planning on paying for my son’s college I think I’d be more likely to save in low expense index funds and take capital gains hits if and when need be.

Given the limited investment options and limitations on trades and penalties if the money’s not used for college I think I’d stay away from them. Especially if there’s no state tax break – as in california.

Why not do everything? Save in 401k, after-tax account, and 529 plan. That’s what I plan to do and more. Slicing and dicing the money for optimization. But maybe I’m weird b/c I find it fun to try and max everything out.

Because 529 plans are more expensive and complicated than cheap simple index funds. That said if you plan to fund your children(s) college expenses yourself I think the tax advantages may well help, especially if you’re in a high bracket when your kid(s) bills come due.

Me – I’d rather other taxpayers pay for my son’s education, course there are tradeoffs in minimizing MAGI as well.

Note – less than 25% of stanford students pay the full fare. At least 40% of berkeley students pay no tuition. What can I say deadbeats are everywhere.

Here’s a cute little snippet from Harvard:

“To address this problem, Harvard’s message is fairly simple. Few realize that Harvard’s financial aid programs pay 100 percent of tuition, fees, room, and board for students from families earning less than $65,000 a year. Families with incomes from $65,000 to $150,000 pay between zero and 10 percent of their income.Nov 8, 2013”

Retirees without gynormous pensions can often get below these income levels.

The expense ratio for index fund 529 plans are around 0.15 – 0.2%, right in line with other expense ratios for index funds.

I like how you keep saying teat of the government and getting other people to pay for your son’s education. Where does this attitude come from? I’m fascinated by this attitude.

What do you do for a living and how old is your son? How do you plan to get other people to pay for your son’s education instead of yourself? Just make less money and get grants? Grants are based on merit. You can get loans, but you’ll have to pay them back. What am I missing here?

Merit is no longer allowed. Stanford says it best:

Is Stanford tuition really free?

Under the financial aid program, which Stanford expanded in 2015, Stanford will continue to provide free tuition for typical parents with incomes below $125,000. Typical parents with incomes below $65,000 are not expected to pay tuition, mandatory fees, room or board.Feb 25, 2016

This setup is why tuition and fees have gone up so much in the last 30 years – you can either adapt to the reality or be the one paying for everyone else. Your choice.

I don’t understand. How do you get into Stanford or Harvard without doing well academically?

Stanford/Harvard are just examples, plug in UC merced or sonoma state and you get the same scenario.

The scarily high sounding tuition are the price a minority pay so that deadbeats like me don’t have to pay a thing. It’s just like obamacare. The main reason prices are so high is that so few are paying them.

Again if you’re in a very high tax bracket 529 plans can work out but be wary of high expenses and trading/withdrawal traps and penalties. If you’re not sure of the future than dirt cheap index funds and capital gains rates might well work out better.

Note – 15-20 basis points for a mainstream index fund is atrocious – and has been for over a decade.

California also has their own 2.5% penalty on 529 withdrawals – I opened 100+ scholarshare accounts back in the old days when they were giving out target gift cards for each account. Some hassle closing them – but it was interesting.

For those who can manipulate their MAGI the FAFSA is a very rich vein of teat sucking. Pretty sure my son can go to just about any school he can get in to for free. There’s a reason tuition costs are so high. He also gets free school lunch, free SAT tests, free just about anything.

At the right income level the FAFSA has no asset tests anymore, strange world huh?

Key phrases are ‘auto-zero efc’ and ‘simplified needs test’. Can have huge iras and if careful taxable assets and pay nothing for a child’s stanford education.

Is FAFSA money free money? I’ve only experienced loans, not grants with FAFSA. If so, what is that income level that cannot be exceeded and Wealth level?

I think the 529 plans represent an interesting dynamic on how the upper middle class and wealthy benefit all of society indirectly. Sound counter intuitive? Let me explain. For my home state of Illinois, the expense ratios in 2005 were ~1%. Now, the Illinois 529 plan will pay NO HIGHER than 0.67%, and possibly as low as 0.19% based on today options. This is a drop of from 33->80% Why did this happen? Because, among other things, the amount of money invested in these accounts has skyrocketed from $350 Million in Illinois in 2002 to $9 Billion in Illinois today. This has driven down the average expense ratio given that the fixed fees have a larger amount of money over which to spread. Who generally has invested all this money? Upper middle class and wealthier families looking for tax breaks.

We should be thankful for the vast array of options provided as a result of these extra pools of money. I’ve seen some poorly written articles based on the “Dream Hoarding” concept written about how the upper middle class in particular have tried to screw the lower income rungs but I think they miss the mark by targeting things such as 529 plans, which are open to everyone.

I love that you mentioned creating a plan in your name before your future child is born. Great way to get started.

The Indiana CollegeChoice 529 plan is amazing. $1000 tax CREDIT on the first $5,000 contributed per year!

It’s amazing how there are so many states that provide a tax credit to fund your child’s 529 plan, but here in expensive California, we get nothing.

Sam — I’m a huge believer that higher ed, as in a 4-year degree MINIMUM, is still the key to a good career path. I live in a state with a decent 529 plan. I want the state tax deduction. My kids are 5. I should be all systems go. However, I’m waiting to open up the account for a few reasons.

1- I don’t want to invest in stocks right now. In my opinion, investing now is a good way to lose 30-40% of the 529 value within the next 5 years. No thanks. As such, I’d be sticking the money in a 529 savings account earning 0.5%. Blech.

2- Occasionally other investment opportunities present themselves. I’d like some dry powder.

3- I find it hard to lock up college money for a decade when my kids are just starting Kindergarten. I have no idea what their college path will look like, how much I’ll need, etc.

So, what’s a guy to do? My plan is to use what I’m calling my Opportunity Fund to stay flexible. I’m planning to invest monthly in a State Muni Bond Fund that will grow, in theory, tax free with reinvested dividends (currently around 4%). Let’s say I’m a big conservative chicken and I do this for 15 years. I should have around $200k in the account.

Then, suppose I realize at that point that my kids need $100k for college between the 2 of them. I’ll take advantage of my state’s unlimited tax deduction carry-forward. I could stick the $100k as a lump sum in the 529 (or do it annually), and then enjoy the state tax deduction for the next 6 years or so.

I’m curious if you see any issues with this approach. Another option is we get a big market drop, in which case I’ll throw a lump into the 529 and invest in stocks more aggressively.

Cheers –Rich

Hi Rich,

Sounds like a good plan. One of the fears is that we’re putting money in at an all-time high, and Superfunding $70,000 up front may be too much, so spread it out over several tranches.

I don’t quite understand this statement:

“I’ll take advantage of my state’s unlimited tax deduction carry-forward. I could stick the $100k as a lump sum in the 529 (or do it annually), and then enjoy the state tax deduction for the next 6 years or so.”

How do you stick $100K lump sum in the 529 if you’re already been funding it and can’t superfund? Could you use some specific examples? What is this unlimited tax deduction carry-forward? The $3,000 a year?

I like to have a challenge and not co-mingle any funds for different purposes. So, the challenge is to max out the 529 plan to $370,000 in 18 years and only use the 529 plan for education. It’s motivating. Otherwise, I could just pay $370,000 for education out of different funds, but that won’t make give me as much motivation. I like a single focus for saving/investing.

Sam

I take your point about not co-mingling funds. It’s a bit cleaner. As I said, for now I’m going to stick most of my college earmarks into Muni Bonds, and I’ll decide exactly what to do with them later.

Here’s what I mean by this: “I’ll take advantage of my state’s unlimited tax deduction carry-forward. I could stick the $100k as a lump sum in the 529 (or do it annually), and then enjoy the state tax deduction for the next 6 years or so.”

In my state, there’s a limit on how much you can deduct on your state taxes each year. For example purposes, let’s say that’s $10,000. If my state tax rate is 5%, that’s a $500 deduction limit each year.

However, my wife and I could put a much bigger lump sum into a 529 if we wanted, I think it’s something like $140,000 for a one time contribution to avoid gift taxes.

So, let’s assume that when my kid is age 17, we have a clear idea of what he wants to do and so we decide to stick $100,000 in a 529. We can only deduct $10,000 of that in Year 1. BUT, unlimited carry-forward means I can deduct $10,000 in Year 2, and Year 3, and Year 4, etc, until the entire $100,000 is deducted (over 10 years).

Make sense?

The reason I was thinking about this is I wondered if there would be any benefit to superfunding a 529 just before college, when I have a better idea how much to put in there. Sure, you might miss the tax free growth along the way, but you could still get the full state tax deduction via the unlimited carry-forward provision.

Let me know if it’s still unclear and I’ll try again.

That makes sense. But I think super funding the 529 plan right before college completely defeats the purpose of the 529 plan.

Because what’s the difference between just paying for college straight up with after-tax dollars?

The goal to fund the plan early is to take advantage of compounded tax free returns over a potentially18 to 20 year period. So I think it’s best to have a mix of everything. But if you can afford to max out the 529 plan, Max out the 401(k), and Invest in an after-tax account then by all means.

True about the compounded tax free returns. My plan to fund it later on doesn’t make sense unless:

— I can use tax free Muni Bonds along the way.

— I think the crappy 529 investment options are actually poised to drop (rather than compound) due to market valuations.

— I can still get the full state tax deduction at the end.

— I want to wait until I have a clearer idea of how much I’ll need to save for college.

Totally agree, it’s unconventional and could possibly backfire.

I contribute to the Oregon plan to get the state tax deduction. Earlier this year, I moved the whole balance to NV. Oregon does not have recapture tax provision so I don’t have to pay back the tax benefit. Pretty awesome.

More details here – https://retireby40.org/moving-oregon-college-savings-plan-529-vanguard/

Hi Sam,

For the longest time, I avoided 529 plans. Rationale was – I can invest anywhere else, say buy a rental property for each of the kid – let it pay for their monthly expense when they go to college; or invest in an after tax account myself with complete freedom to withdraw whenever I want for whatever purpose.

But then in 2013, I decided to open the 529 plan for ONLY one reason: It saves on State Tax.

If not for that tax saving, I do not see any use of a 529 plan.

Also, I’d share with the readers where I invested – I used collegeinvest.org, and besides Vanguard, I also have a guaranteed 2.4-3% return using Stable Value Fund though MetLife Ins.

HTH.