President Biden's proposal to increase the capital gains tax from 20% to 39.6% for people making over $1 million a year sounds aggressive. Add on the Net Investment Income Tax of 3.8%, and we're talking a total long-term capital gains tax rate of 43.4%. That's too much in my opinion.

If this new long-term capital gains tax gets approved to pay for the American Families Plan, qualifying residents in California would pay a 56.7% combined state & Federal tax rate. New Jersey residents would pay 54.1%. New York residents would pay 58.2%. At the margin, people in these states with such means will relocate or find other ways to avoid taxes.

Thankfully, Biden's proposal never came to fruition as Trump became president. But, you never know about the future, so stay ready.

No matter how much you make or where you stand politically, I think most people agree we should keep the majority of our income and wealth (50.1%+) given we worked for it. The One Big Beautiful Bill Act extends Trump's tax cuts. That's a good thing if you're on the path to financial independence.

Do you really think it's fair if the government gets to keep more of your money than you do? I don't. Maybe if the government managed our money better. But the government is inefficient and politicians are sometimes corrupt.

Given only about 0.3% of Americans make more than $1 million a year, this potential capital gains tax hike won't affect the vast majority of us directly. However, it could cause rampant selling of assets by those who are affected, which would ultimately end up hurting most investor's portfolios.

How Does A Hike In Capital Gains Tax Rates Affect Stock Market Returns?

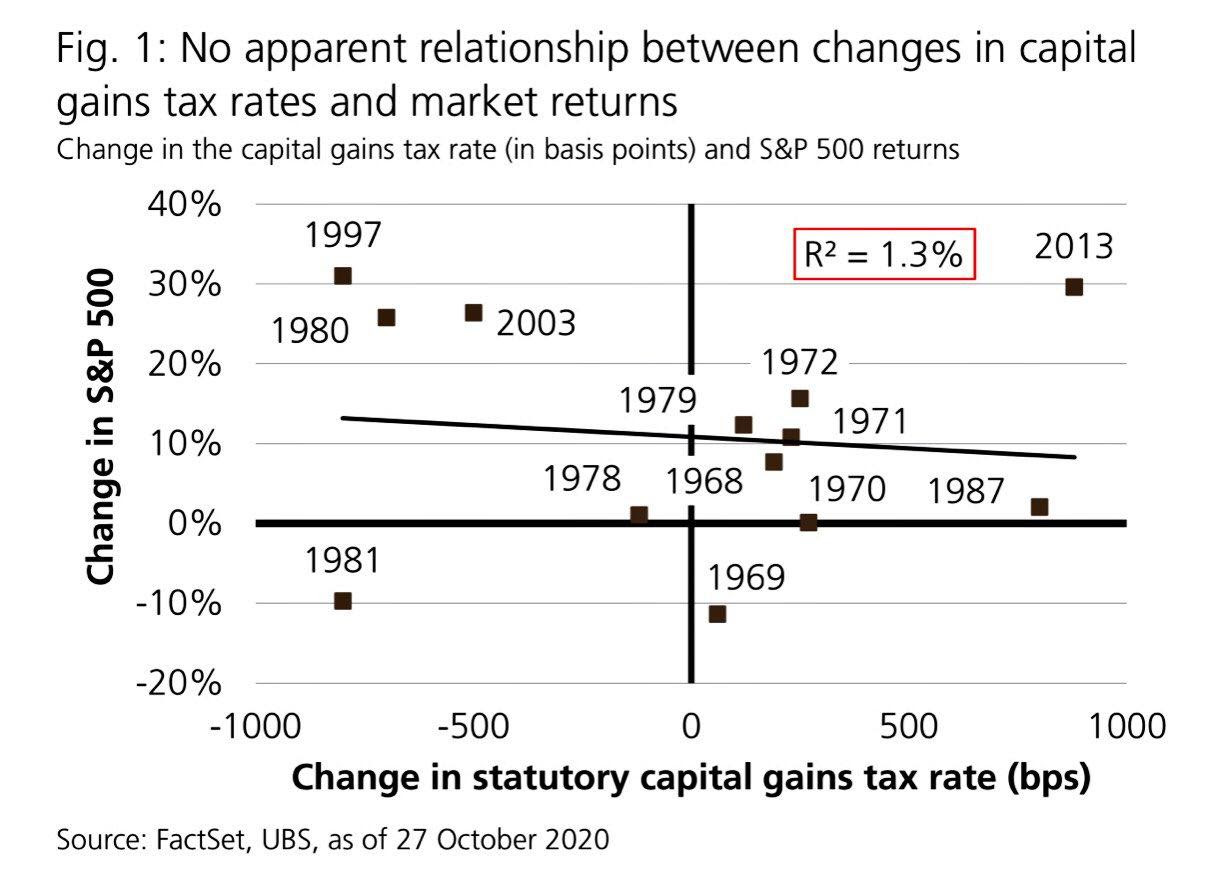

This chart from UBS states there is “no apparent relationship between changes in capital gains tax rates and market returns.” However, unless my eyes are deceiving me, there is a downward sloping line indicating lower S&P 500 returns and higher capital gains tax rates. The year 2013 is the outlier where returns were especially high in a higher capital gains tax rate environment.

The thing is, President Biden is looking to raise the capital gains tax rate by almost 2,000 basis points (20%). Therefore, if a 1,000 basis point increase lowers the S&P 500 return from 12% – 8%, perhaps a 2,000 basis point hike would lower the average S&P 500 return to 4% – 5%. Nobody knows for sure.

Thankfully for investors, President Biden will no longer be president and Vice President Kamala Harris lost to Trump in the 2024 presidential election. Given Donald Trump is for lower taxes and smaller government, there is no way such a huge capital gains tax rate hike will be implemented.

When Was The Capital Gains Tax Hiked Previously?

The last time capital-gains taxes were hiked, in 2013, the wealthiest households sold 1% of their equity assets, according to Goldman Sachs. According to the Federal Reserve’s distributional financial account data, the top 1% held $17.79 trillion of equities and mutual funds in the fourth quarter of 2020.

Therefore, a 1% selling of stocks this time would be about $178 billion. This selling could hit the markets leading up to the passing of a capital gains tax hike.

However, I don't think a long-term capital gains tax hike to 39.6% will happen. Instead, there will likely be compromise to get some tax hike passed to help pay for all the stimulus spending.

For equity investors, at the margin, ETFs should benefit over mutual funds given ETFs are more tax efficient. ETFs' unique “in-kind mechanism” allows them to avoid incurring capital gains during the year. See chart below of the largest ETFs with the lowest expense ratios.

The two headwinds for stock investors are higher taxes and Federal Reserve tapering (less monetary stimulus, less buying, etc.) on the horizon.

Therefore, I am perfectly fine with de-risking my stock positions into strength and enjoying the YOLO Economy to the maximum.

How A Capital Gains Tax Hike Affects Different Earners

Beyond the implications of stock market returns for all investors, the other issue about the capital gains tax hike is how one should decide to earn money going forward. Ultimately, you want to earn money as tax-efficiently as possible. In other words, focus on building passive investment income.

Before we start, let's clarify how the capital gains tax hike is applied. The capital gains tax hike will affect capital gains above the COMBINED income + capital gains threshold of $1 million.

For example, let's say you earn $900,000 in income and $500,000 in capital gains. The capital gains affected by a potential capital gains tax hike = ($900,000 + $500,000) – $1,000,000 = $400,000. Sorry for folks who think making just under $1 million exempts you from paying a higher capital gains tax rate, if one gets approved.

See the short-term and long-term capital gains tax rates for 2023.

1) How The Startup Employee Gets Affected By A Capital Gains Tax Hike

Let's say you join a startup for a $100,000 a year salary discount for lots of equity. Your income is $100,000 instead of $200,000 for a 1% stake in the company. At a $100,000 income, all your capital gains are taxed at a 15% rate if held longer than a year.

Let's say 20 years later your company gets acquired for a handsome sum of $100 million. Further, there is no dilution in your stake. You receive a $2 million windfall.

However, instead of getting taxed at a 15% long-term capital gains tax rate, you are taxed at a 43.4% rate (39.6% + 3.8% NIIT) for the $1 million above the $1 million threshold. Let's say you live in a state that doesn't have state income tax or capital gains tax.

Let's say your first $1 million gets taxed at 20%, which leaves you with $800,000. Your second $1 million gets taxed at 43.4%, which turns to $566,000. Therefore, you receive $1,366,000 after paying taxes on your $2 million capital gain. Your effective capital gains tax rate is 31.7%.

The $2 million in salary you would have earned over 20 years would have faced a 20% effective tax rate. Therefore, we can add $1,600,000 ($2 million X 80%) to $1,366,000 to equal $2,966,000 in net income and net capital gains after 20 years.

Not bad. However, being a startup employee will get marginally worse if the capital gains tax hike is passed.

2) How The Mature Company Employee Gets Affected By A Capital Gains Tax Hike

If you had spent 20 years working at a mature company for $200,000 a year with no windfall, you would have also made the same total gross income of $4 million.

However, the $4 million in salary would have paid an effective federal tax rate of about 20.5%. Therefore, after 20 years of working at a mature company, your $4 million in salary would have netted you $3,180,000.

$3,180,000 is higher than the net proceeds of $2,966,000 by the startup employee. And the reality is, the startup employee probably has less than a 20% chance of getting a $2 million windfall. Even if the company was sold for $100 million, the startup employee would probably see his stake diluted by at least 20%.

See: Don't Join A Startup If You Want To Get Rich: Baremetrics Case Study

Time Value Of Money Consideration

Finally, given the time value of money, the mature company employee could have easily saved and invested some of his income for greater returns. For example, let's say the mature company employee invested $35,000 a year of his salary in the S&P 500. If the S&P 500 returned 8% a year for 20 years, the contributions would be worth $1,729,802 versus $700,000 if he had left it all in cash.

The mature company employee is now ahead of the startup employee by about $1,214,000! The odds are already against you to strike it rich at a startup as a common employee. A long-term capital gains tax hike will only make your odds worse.

Therefore, if there is a long-term capital gains tax hike, you may want to join a company that pays you the highest salary up to where income tax rates go up. In other words, if income tax rates go up for $400,000+ income earners, then the ideal income may be $400,000.

You can then spread out your capital gains to ensure you never hit the income limit where you must pay a higher capital gains tax rate.

3) How The Small Business Owner Gets Affected By A Capital Gains Tax Hike

Let's say you agree with me the easiest way to make money from home is to start your own website. You don't want to be at the mercy of a government shutdown if another pandemic hits. You also want to one day have a sustainable family business to leave to your children. Therefore, you go ahead and start the next great blog.

For the first three years, you make about $2/hour on average after grinding away for 40 hours a week. But you don't give up because you know the secret to success is 10+ years of unwavering commitment. So you keep on working on your side hustle before and after work.

Then, in year five, your website starts regularly generating $5,000 a month in profits before tax. And by year 10, your website starts generating $20,000 a month in profits before tax. Someone tries to low ball you and offers 5X operating profits, or $1.2 million. You decline!

Assuming you unrealistically had $0 salary, your first $1 million would turn into $800,000 after paying 20% long-term capital gains tax. The remaining $200,000 would turn into only $113,200 due to a 43.4% long-term capital gains tax over $1 million.

Your after tax proceeds are about $913,200. Even if you could get a steady 4% annual return, that's only $36,528 a year in investment income.

A More Reasonable $4.5 Million Offer

You keep grinding away for three more years. Then another company offers you a more reasonable 15X operating profit offer for your website. Your website is now generating $300,000 a year so that's $4.5 million!

You're tempted to accept. But if you do, you'd only be left with $1,981,000 ($3.5 million X 56.6%) on the $3.5 million above the first $1 million. Again, let's assume the first $1 million pays a 20% effective long-term capital gains tax rate. Your total proceeds after tax would be about $2,781,000 ($1,981,000 + $800,000). Not bad. But can you imagine paying a $1,719,000 tax bill on your $4.5 million sale? What an economic waste!

Further, $2,781,000 in net proceeds still only generates $111,240 a year at a 4% rate of return. That's not much compared to the $300,000 in annual operating profits you were generating. And if you lived in California, the $3.5 million above the first million would be taxed at 56.7%. Ugh.

Forget it. No rational person would ever sell their cash cow business, especially in a low interest rate environment. The more millions you get, the more you will pay in taxes. It is much more efficient to earn a reasonable salary + distributions to pay less taxes. Less inventory of small businesses to buy means the overall value of small businesses should go up.

4) How The Long-Term Homeowner Gets Affected By A Capital Gains Tax Hike

Finally, we have the long-term homeowner who is sitting on more than $1 million in capital gains beyond the $250K/$500K tax-free profit exclusion. Think about your grandparents buying homes before the 1970s. Does the homeowner sell, pay a high capital gains tax rate, and then downsize to a smaller home or apartment? Or does the homeowner keep the long-time home and pass it down to his or her children through their estate?

It seems clear a capital gains tax hike would encourage long-term homeowners to keep holding their homes, thereby lowering inventory. It's already difficult enough to move out of a home you've lived in for 40+ years. So many wonderful memories! Why would you then sell it to pay a 43.4% capital gains tax?

Besides, it is reported President Biden may not touch the estate tax threshold limit, which currently stands at $12.92 million per person for 2023. Although the “step-up basis” may be eliminated, it probably won't matter since only about 0.1% of American households ever have to pay a death tax. However, without the step-up basis, may also never want to sell given the large capital gains tax bill.

Higher Long-Term Capital Gains Tax Could Be Positive For House Price Appreciation

Therefore, an increase in the long-term capital gains tax rate may actually serve to boost the housing market even further. In addition, if the 1031 Exchange rule remains intact (under fire), I suspect more people will roll over their capital gains into new properties or Opportunity Zone Funds.

Personally, I plan to continue investing in rental properties and private eREITs for capital and rent appreciation. In an inflationary environment, I want to be long real estate as much as comfortably possible.

The Sustainability Of Income Is Important

Having a $1+ million financial windfall is nice. But it depends on how long it took you to get it. To then have to pay a huge capital gains tax rate would be unfortunate. This is especially true if your income plummets the following year, as is the case with most business owners who sell.

In my opinion, you aren't considered a top 1% income earner if you cannot sustainably earn a $1+ million income for years. You would need to earn $1+ million for three years in a row to not consider your income a fluke or a financial windfall.

If you are a typical W2 employee, making over $1 million a year is extremely difficult. You must put in way more than 40 hours a week. Further, you likely must produce at least $10 million in attributable revenue for your firm. Finally, you probably also need the economic conditions to be fantastic to enable you to produce and earn so much.

Some people can hit a top 1% income every once in a while. But to consistently earn over $1 million a year for decades is practically impossible at the moment.

Despite only 0.3% of Americans earning $1 million a year, only 0.1% of estates pay a death tax. This goes to show that accumulating a top 1% net worth may be even harder.

A Look Into Investment Banking

In investment banking, less than 1% of employees make Managing Director. Managing Directors usually have a salary between $400,000 – $500,000. Therefore, a Managing Director needs to generate enough revenue or have a team that generates enough revenue to warrant him or her a bonus of at least $500,000 – $600,000 to hit $1 million.

Making $1 million is definitely doable for a Managing Director during a bull market. But as we know, bear markets sometimes happen. Further, your firm could randomly lose billions from a bad prime brokerage relationship.

Just observe what happened with Archegos Capital costing $10 billion in prime brokerage losses to various investment banks. Bonuses for those employees likely will get hit this year, even if they had nothing to do with Archegos Capital. Land mines are everywhere.

Hard To Make Big Money For A Long Time

The other issue is longevity. To make $1+ million, the pressure is always on to produce. Randall Dillard, the former head of investment banking at Nomura said, “Managing directors in investment banking last around 18 months. Most people simply cannot handle the amounts of revenue they are expected to generate year after year.”

I find Dillard's comment to be true. I had a revolving door of Managing Directors during my 11 years at my old firm. A MD almost has a lifecycle of the median NFL player of 3.3 years!

Instead of making $1+ million a year, it may actually be better to earn $400,000 a year divided by two working parents and “cruise.” When it comes to money, it's funny how everything is relative.

Below are the short-term and long-term capital gains tax rates for singles and married couples for 2023. Here are also some long-term capital gains tax examples to avoid any confusion.

Related: 2024 Federal Income Tax Rates

The Easiest Way To Sustain A Big Income

The easiest way to sustain a $1 million income is by having $50 million in investments generating a risk-free 2% a year. In this scenario, you will likely be able to generate $1 million in income forever. Too bad amassing $50 million is almost impossible for all but the lucky few.

Of course, you don't need to generate $1 million to be happy. You just need to generate enough passive investment income to cover your desired living expenses. Achieving this goal gets you 90%+ of the way there to living a great life. The marginal 10% really isn't going to make much of a difference to your happiness.

Therefore, in a positive way, raising the long-term capital gains tax might save overworked people from trying to work even more for the elusive $1 million income mark. I find there's an unhealthy desire in this country for excessive amounts of money. Post-pandemic, hopefully all of us have considered how to better utilize our time.

A higher capital gains tax rate might also encourage more people to hold onto their investments for longer. Instead of selling your big gains, borrow from them to avoid paying a high capital gains tax rate. Be like a billionaire and never sell your assets! If you never sell your assets, you'll never have to pay capital gains tax.

Aiming For A Much Lower Income

Our family should be comfortable living off $300,000 a year in passive income once we peace out again. At the moment, it's enough income to give us a savings buffer of at least 20%. As someone who has saved aggressively his entire life, I can't help but not want to continue saving post-retirement.

$300,000 in capital gains is taxed at a favorable 15% long-term capital gains tax rate. $300,000 in active income is also taxed at a reasonable 24% marginal federal income tax rate. To me, once a total effective tax rate starts surpassing 30%, it starts to feel uncomfortable. And once the effective marginal tax rate rises above 35%, my desire to go above and beyond disappears.

Unfortunately, if you are a startup employee or an exhausted small business owner who has a favorable exit, you will likely have to pay a lot more in taxes. However, that's still better than not having a financial windfall at all!

To build real wealth, it's generally a good idea to hold onto your assets for as long as possible. Let the power of compounding work its magic. Extending my holding period is one of the reasons why I invest in private real estate, private equity, and venture debt. 5-10 years from now, I'm confident there will be gains.

Let's hope a higher capital gains tax rate changes investor behavior for the better. May the potential increase in tax revenue actually go towards helping the poor and middle class prosper.

Diversify Your Investments Into Real Estate

Stocks are very volatile compared to real estate. Therefore, if you want to dampen volatility and build wealth at the same time, invest in real estate. Real estate is my favorite asset class to build wealth. Real estate is also a tax-efficient way to invest due to non-cash amortization expenses.

In 2016, I started diversifying into heartland real estate to take advantage of lower valuations and higher cap rates. I did so by investing $810,000 with real estate crowdfunding platforms. With interest rates down, the value of cash flow is up. Further, the pandemic has made working from home more common.

Check out the best private real estate platform

Fundrise: A way for all investors to diversify into real estate through private funds with just $10. Fundrise has been around since 2012 and manages over $3 billion for 380,000+ investors.

The real estate platform invests primarily in residential and industrial properties in the Sunbelt, where valuations are cheaper and yields are higher. The spreading out of America is a long-term demographic trend. For most people, investing in a diversified fund is the way to go.

I'm personally invested over $700,000 with Fundrise across multiple accounts. Fundrise is also a long-time sponsor of Financial Samurai as our investment philosophies are aligned

If my math tax is wrong, let me know! Everything is just an estimate. I will be updating this post when there is new information. Bottom line: avoid $1+ million windfalls and spread them out if possible. Join 60,000+ others and sign up for my free private newsletter for more insights.

A brilliant write-up! Thanks for offering such clarity on the subject.

Sam,

Thank you for Financial Samurai. I really enjoy reading your blog and find your topics very easy to read and apply to life. I really look forward to your posts. Your work here is very much appreciated.

In the article above, a comment stimulated a question that I have wrestled with for some time. You mentioned:

“A higher capital gains tax rate might also encourage more people to hold onto their investments for longer. Instead of selling your big gains, borrow from them to avoid paying a high capital gains tax rate.”

This is a question that I have struggled with over the years. Selling some high fliers balanced against a higher income could potentially push a person into a higher tax bracket. So there is the wrestling match of balancing big capital gains with moving cash most effectively to find the best total return.

Are you suggesting potentially avoiding capital gains by leaving those gains alone (not selling-let it ride) and instead levering margin?

I’ve struggled with this question in the past and would be curious as to your insight.

Thanks!

Sam, I noticed that you mentioned Charitable Remainder Trusts in one of your posts but didn’t go into detail about them. From what little I know it seems like an excellent way for some to sidestep LTCG and create annuity like income. Can you delve into these at some point?

Sam,

What am I missing?

I’ve read this post as well as posts about best states to retire. Colorado often comes up, but when I put a 200k income into state tax calculators comparison tools like those at smart asset I got around a 2000 a year difference between California and Colorado-not the astronomical difference people would have you believe.

Yes there are higher taxes on things like gasoline, but I’d you are retired and living in a walkable city maybe it’s not an issue?

And yes, housing prices are somewhat higher but not a lot if you’re living in Denver or Boulder. Plus in California you have prop 13 to help with property taxes where Denver or Boulder could raise your taxes higher forever. And I’ve noticed progressive cities like Boulder have passed a lot of excise taxes like sugar drink tax which effects the price of things like kombucha. Registering and buying a car in Colorado looks a lot higher too.

Other places like Texas…no income tax is fine, but they sure do make it up on property tax. If I were a lower wage earner who didn’t want to own, Texas would be a great place to play catch up.

Is it just those calculators are way off? I’ve seen other charts putting colorado at about 23% and California at about 24% though.

What am I missing because for $200 more a month I would rather live in California or Hawaii than Colorado, yet colorado consistently gets mentioned as being a great place to live and retire because of lower taxes.

One variable is your race. Colorado is a much more homogenous state than California or Hawaii. Therefore, if you are white, I think you will feel more at home in Colorado.

And if you are a minority, you’ll feel more at home in Hawaii or California. A lot of the data is driven by consensus and the majority. So it’s just natural things are like this.

But the skiing and hiking are amazing in Colorado!

“So it’s just natural things are like this.”.. What are you saying? What are your real feelings about race? Do you wish that you were in the majority and does this “color” your feelings or investments in California/Hawaii? Do you believe it’s inevitable that the West Coast will be dominated by Asians? What do you think about the long term prospects of California & the “United States” and how does this affect your portfolio?

I think people are rational and invest in what they want and tend to live where they are most comfortable. What are your thoughts?

I think you‘ll enjoy this post: https://www.financialsamurai.com/three-white-tenants-one-asian-landlord-opportunity/

Nerissa was asking about these “best places to retire” lists and why, for example, Colorado beats California. These state level calculations take into account taxes, but also median home prices, sunshine hours, crime rate, activities for seniors, etc. On these combined metrics, almost any state bets California, even in the priciest locales within that state, for the average retiree.

These lists have absolutely no “racial/cultural comfort index”, which is evidenced by super diverse states like Texas & Florida that dominate them. So apologies if I came off bad, but I wondered if there was some deeper reason for why you mentioned race on a banal comment about retirement tax planning. Maybe it’s a big deal for you?

Of course, I’d be lying if I didn’t admit that race/culture is A factor for me. Hawaii is an example. Although yeah tropical paradise, it has too many downsides to mention (boring, expensive, isolated, etc). In addition to all that, that the culture is anti-White (livinginhawaii.com/12-reasons-you-should-not-move-to-hawaii/), is enough for me to keep on flying, which I suppose is the desired outcome. Aloha.

Just offering a conjecture to why Colorado is perpetually so high beyond the usual reasons. Yet, plenty of people prefer California and Hawaii for retirement if they can afford to live there. The best state to retire in is subjective. It’s also hard to really know because most people just retire in one state.

I think it’s great you’re fired up about the topic of race, retirement, and other things. And I think you’ll be surprised at who creates the surveys and how people tend to gather around people who are more similar to them.

Even the SAT score getting dropped for college admission has something to do with race.

What race are you and tell me something about your background so I understand where you are coming from. thanks

Related:

If You Can Make It In Hawaii You Can Make It Everywhere

The Best States To Retire

Your Chances Of Becoming A Millionaire By Race

If the commenters here are okay with U.S citizens moving from high tax to low tax states, then you will be okay with the same happening internationally.

It is very easy for someone worth $25 mil plus to simply buy citizenship in another country and avoid this tax. Therefore as usual the tax will hit some doctor and successful biz owner while not affecting the 0.1% at all.

Would this tax be tied to inflation? I suspect not. Certainly Obamacare medicare investment tax of 3.8% sounded like it would only impact a few when it was written in 2010. It would only impact those jointly having a 250K investment gain..back in 2010 that seemed a lot…now about normal gain with inflation of 8 years. So now, instead of being a “rich” person tax it is a middle income tax. Some day…to be a low income tax. What ever you do to the rich…well..you eventually do to yourself, or your children.

My error..11 years not 8. It was written into law in 2010 but implemented in 2013…hence the 8 years.

Sam,

Do you have any idea how you will handle the possible change to a step up basis when it comes to leaving real estate to your children? It seems that in many cases, they could be forced to sell simply to pay the taxes.

“To build real wealth…” in America is by illegally avoiding taxes, which many of the most wealthy do. And $1M earners per year are not to whom I am referring.

Sam,

I’ve been reading your website since the beginning and I have never been so dismayed reading some of the comments on this post. Remember when you started this site how excited people were to figure out how to make money in order to retire early or provide a better life for their children, their families, their communities? Remember when you wrote articles about people who shouldn’t complain if they only work 40 hours a week and your audience agreed with you? Compare that to today.

I am one of the .03 percent people who will be affected by the proposed capital gains tax. I bought a small business over 20 years ago that was losing money. For the first 10 years I paid myself less than some of my employees. I plowed every penny of profit back into the company to help it grow and 20 years later my company posted a profit this year of 1.5 million. I paid 600k of that profit in taxes. For the 99 percent of people who don’t think they’ll be affected by this proposal you are wrong. If you think people like me who sacrifice our health, our families, our time to give the government more money to spend on people who don’t produce and just take you are sadly mistaken. The incentive is gone. My employees, “and many like them” who are unskilled labor who get paid far higher than market wages and benefits because I feel it’s the right thing to do are the people who are gonna suffer the most when I close shop and ride into the sunset.

The government and half of Americans are coming after my money now. Who do you think there gonna come after next when the well runs dry?

Sincerely,

Stealth Wealth

Don’t be sad. Given you run a business, you have a lot more flexibility to make less money to pay less taxes.

But if you have to let people go to make less, that is sad for them. Hopefully you can boost capex and take it easier. Or, you can just pay your employees a ton more to reduce profits.

Good to smell the roses after so many years! That is what I plan to do. There’s always a positive outcome if we focus on the positive.

STCG, LTCG, exclusions, exceptions, etc…

All noise that should be reduced in my opinion. I want an administration to focus on simplifying our tax code instead of adding yet another layer. I hate scenarios of “if this then A, if that then B, but if B can be combined with C, then D, but if D exceeds A, then E, but if E is 2x B, then F”

How about having the same tax rate for all capital gains? I get why we’d want to encourage and incentivize certain behaviors in investing (holding LT due to its tax advantage, putting money in traditional IRA, etc.), but it just seems like it’s overengineered that gives little-to-no benefit to the average tax payer. How much cleaner is the following? “If this, then no matter what, A”.

“If this then no matter what A” provides NO incentive to donate to a politician to have “except for B” included.

People think that politicians are looking out for “them” and going to go after the rich. Loopholes are not an “accident” or something nefarious people “abuse”….they are intentional. And they make those people fighting for the poor very very rich.

I didn’t even consider that, but exactly! Lobbying is already ingrained in the way things are, but perhaps that could change if some of the incentives are diminished (e.g., being able to deduct donations to politicians).

As an accelerationist, I think they should raise the rate to 100% and quintuple spending. I will always vote for Democrats because they will achieve this faster.

Capital has grown much faster than labor over 50 years. Half of Americans own 0 stock. The government has been pushing stock higher recently with bank bailouts, corp tax cuts, and ppp. Government policy has favored capital owners for a long time.

Now they realize the middle class needs a break and a chance to enter the capital game. More equal distribution of economic gains will provide safety nets to help a beaten down middle class to move to capital ownership.

Unfortunately it never works out this way. I can best illustrate this from a comment an African friend made to me when I was working in Malawi. He stated that you could have the Africans and Europeans change continents, leaving behind all of their belongings. Within one generation, the Africans would be asking for aid from the Europeans.

I see the same thing with lower and middle classes in the US. How much of their disposable income is simply wasted on the latest car, the latest electronics, cable television, trendy clothing, etc. etc. rather than investing towards their future? Rather than providing a more equitable distribution which will quickly work its way back to the wealthy, the lower and middle classes need financial education. Without that you can give them all the money and safety nets you want, but nothing will change. Just consider how many lottery winners or professional athletes have gone broke even after making millions. Unfortunately the wealthy really do not want the rest of us to learn these lessons.

Very true, but the economy still benefits from all that “simply wasted” spending.. and it’s usually Fortune 500 companies profits. Apple just had an AMAZING record breaking sales quarter of all their product lines, mac, iphone, ect. If people didn’t get stimulus checks… IPHONE sales would have been solid, but not record breaking. The market seems to be aware of this stimulus phenomenon because the stock went nowhere after record earnings.

Also simply raising the lowest wages won’t help cost of living problems. The current housing market is a perfect example of this inflation from higher wages. What’s the use of giving a Mcd’s worker an extra few thousand a year in income if his rent and housing costs goes up by equal amount? Raising wages doesn’t happen in a vacuum.

This constant assertion that this tax will cause the elites to pull their money from the market and hurt other investor is mind manipulating right wing propaganda. There is no place else to go. Real estate and other instruments that appreciate are all under the capital gains umbrella.

I’m so sure that that they will just sell all their assets because they aren’t going to get as much profit.

We have a major wealth distribution problem and the haves abuse the system to snowball money faster. This is a good step toward fixing that. .3 % make more than a million in income yearly. I would bet 90% of those make more than 10 million yearly. When you cross a certain threshold money begins to grow too fast. Not only can these people afford it, but they should be glad to pay it.

“.3 % make more than a million in income yearly. I would bet 90% of those make more than 10 million yearly.”

I’d love to take that bet! How much or what are you willing to bet?

It’s scary to hear such strong opinions from those who have NO CLUE about the realities of the economy and just listen to the media. The VAST majority (95%+) of those making over $1m make less than $10m. Most of those are small business owners, professionals and senior corporate managers. They generally work pretty hard for it too.

It’s also interesting he thinks most people consistently make over $1 million a year as well, ignoring my entire argument in the post about the difficulties of sustaining such an income level and why.

Maybe my post is too long.

It is too long if you’re trying to reach people like Anonymous. They need sound bites to tell them what to think.

You can try to educate them on the realities of a profession that makes that kind of money or statistics….but that doesn’t interest them. The easiest solution for them is “gimmie some of that”. And that only takes a tweet.

In the end, when they’re still poor and the politician that promised to help them is rich they scratch their beer belly and look around confused and angry….then it’s off to the next tweet that’s gonna save them.

I think the pro athlete example is the best case. Some of these athletes play 3.5 years or less roughly as you say. Some very few of them make the first round draft picks with the mega salaries. Talking like 32 people in the first round of the NFL draft as an example, and after the first two rounds the money drops a lot. I don’t recall the end but there is a min payment of like $300-400k or something. I’d say 90% of those players fall in that range, and eventually with skill, talent, and luck maybe make it to the $1-2M contract range, if they don’t blow a knee, or some other game changing injury and then they are out. Who knows the life impacts and medical bills following those pro careers as well. Now some of those players take their money and spin into other fields and crush, but seems its very few. More often than not, they are left to find a new career. I can’t tell you how many previous NFL players I have worked with in the past on construction sites. It seems unreal. Sure they may leave the site with a vet they bought rookie year, but other than that they are back to regular people in 3 years. Again with your example of MD’s killing themselves riding the lightning to try and hit $1M. It’s not like the market is going to be like oh cool, you hit that milestone time to pump the brakes and we’ll just keep paying you. If you raise the bar, the expectations raise too. So it’s hard to keep that pace without ruining your life. All the money in the world can’t replace time lost.

I have a friend that makes roughly $400k base, and then can bonus equal to or greater that. However, he sleeps about 3-4 hours a day (not even night it’s that inconsistent), he travels the world all over and any given day is in a different time zone, sometimes multiples a day. He tells me he hates his life, his health is terrible, and he looks like he aged 10 years in the last 18 months. Tell me… is more money really worth that? And should he have to cover more for those not willing to put up the fight?

I’m still thinking people look at the “rich” and think they didn’t do anything to get there. If that was truly the case, then we would still be talking about the exact same family names for the last couple hundred years, however we aren’t. Why? Because if the family takes their foot off the gas, inflation, taxes, and everything else will bring them down. You either produce or you fall to the way side.

Indeed. 3.3 year career for the median NFL player.

And no, aging 10 years in 18 months and looking and feeling unhealthy is NOT worth it folks! You will appreciate your health more after 40. And if you mess it up too bad before then, there could be irreparable damage.

Related:

The Health Benefits Of Early Retirement Are Priceless

The Desire For Prestige And Money Is Ruining Your Life

Don’t Make Over $400,000: Look At How Goldman Analysts Suffer

There are a few ways to shield capital gains, most made through real estate. And could include gains made in equity.

One way to look at capital gains is that it is a tax on inflation. If you buy a stock and hold it for ten years and it appreciates at the rate of inflation, you lose out if you sell it and are taxed on those gains. That’s the gamble taken.

On one hand, I’m indifferent towards an increase in capital gains rates. If you’re savy you can find ways to defer. And if you live in a state with high taxes, that’s a choice you made. Especially if you have only passive income.

On the other hand it sucks to be double taxed.

I think the whole increase of capital gains tax is dumb – but that being said…

Your comments about possible windfall exclusions are SPOT ON ! I haven’t really seen that discussed elsewhere – so good on you!

There are many situations where a large once-in-a-blue moon gain can happen to an otherwise “poor” person….there should be some type of windfall exclusion so the man does not hold the poor folks down.

Why? They seem to support the proposal? Maybe they just support it except for them?

Two things:

1) With the political climate of recent times, you can be assured that anything that Biden is able to get passed into law regarding the tax code will be undone by the next Congress and President. The pendulum swings to both ends almost constantly and never seems to sit in the middle long enough for more reasonable minds to prevail.

2) Your examples tend to reach the conclusion that the best thing for people to do under the new proposed tax structure would be to hold on to their investments instead of selling. This seems to be the purpose of the long term capital gains rate in general, although one could argue this is pushing it a little too far. Maybe we need a “very long term” capital gains rate that kicks in after 5-10 years, and that will be the more reasonable rates that we have now. Eh, nevermind, our tax code is complicated enough as it is.

This is propaganda. All he’s doing is returning the gains taxes to pre-Trump levels. I’m so mad this article is encouraging people to think about how to strategically work to live a better life! We should be all be able to just keep on doing what we have always been doing and expect different results and never change with the times.

It’s kinda funny how many of you voted for Biden, full well knowing taxes were getting raised. Now all of a sudden the issue of raising taxes is an issue, because its your money, not someone else’s! Hmmmmm maybe the idea of a smaller gov’t isn’t such a bad idea after all lmao

No administration actually practices small government though. Deficits and debt rise in both parties administrations.

There is a lot to unpack in Biden’s proposal. As someone who came from middle class and retired early though investing and saving, I’m divided on his tax increases.

– I’m for lowering the estate tax from $11.7M passed in 2017. This was a doubling of the prior limit and seemed like a giveaway to the rich. $6.2M seemed more reasonable even though this will be a big hit one day (if net worth grows as planned).

– I’m pro increasing corporate taxes, another unnecessary 2017 giveaway.

– I’m pro increasing capital gains taxes on the wealthy but not at 40+%. 35% max.

– I’m against eliminating step up in cost basis. Maybe cap the exclusion equivalent to estate tax limit. This one will hurt middle class people although they may not realize it until it’s too late.

– I’m against getting rid of 1031 exchanges. I have yet to use this as real estate investor but if it is gotten rid of, I won’t sell ever. I’ll just enjoy my cash flow, cash out refi and buy new properties. Its what I’ve been doing anyway. But it hurts older investors looking to trade their portfolio for lower maintenance properties.

Nothing wrong taxing the individuals who can afford it. Like always everything is temporary. Ying and Yang…..

The wealthy benefit disproportionately from infrastructure and rule of law paid for by public investment. Does a poor person benefit from regulations that make our stock market the home of the best investment vehicles in the world? No! Does their business or side hustle benefit from the efficient transportation network that is maintained and regulated by public investment? Of course not! They’re lucky just to be scraping by. When the very wealthy are benefiting disproportionately from our public investment dollars, should the shrinking middle class pony up to pay for crumbling infrastructure, just because they cannot afford a wealth manager to help shelter their income from taxes? Do you really think that is morally acceptable?

Even Warren Buffet agrees that the wealthy should pay more. Just be happy that it is just an income tax hike and not a wealth tax like you already see prevalent in other developed economies.

I find it revealing that Buffet and the rest of the ultra rich calling for tax increases NEVER simply gift the money to the government. That should tell you something.

I’m guessing you aren’t wealthy. Couldn’t make it so you’re fine with the government taking. As long as it’s from someone else. There sure are a lot of your type these days.

Not only did I “make it”, but I’m also preparing to retire early. I am glad to pay my fair share to help maintain services and infrastructure that allow me to realize my full potential. People who are not are called freeloaders. Stay stealthy my friend.

I don’t know who Warren Buffet is (maybe the rich founder of Golden Corral?), but Warren Buffett doesn’t give a fat rat’s backside what the capital gains tax is because his stated favorite time to sell is “never”. And as others have noted, he’s giving away much of his wealth to charity so the government won’t get it and waste it. Of course, many of the charities will probably waste some of it too, but he clearly trusts the Gates Foundation to allocate his wealth more than he trusts Joe Biden.

I prefer to place higher weight on what people DO than on what they SAY.

Thanks for providing so many clear examples of how the proposal would work. Tax stuff can get so confusing, but looking at examples really helps me understand how the gist of the calculations.

I’ve learned a lot over the years filing my taxes and now filing my mom’s taxes. There’s still a lot I don’t know, but each year I try and learn a little bit more. I’ll be curious to find out what the final verdict will be on the cap gains rate changes. thanks!

Sam, you are finally coming around. Over the past few months, you kept saying that we needed to pay more taxes to help those these fortunate. But finally today you appear to have changed your tune:

“Maybe if the government managed our money better. But the government is inefficient and sometimes corrupt.”

I am not sure what is changing your mind but whatever it is, it seems to be working.

My favorite example is his plan to expand Amtrak’s services. Anyone who has traveled to Europe, Japan, Korea, and most importantly China, quickly realizes that US train services are an embarrassment yet Joe simply wants to expand the network and does not even propose any HSR. It is almost as if he is nostalgic for his weekend trips from DC to Delaware and believes others will join him in his nostalgia. Defund Amtrak completely and use the savings for infrastructure that people might actually use. I say this as someone who has actually ridden Amtrak cross country numerous times but simply because I enjoy trains.

I’ve always felt the government is less efficient with our money than we are or the private sector in general. At the same time, we should all pay some amount of taxes to our country that has helped enabled our success and way of life. The question is, how much?

43.4% + state income tax seems like too much, which is why I don’t think it will pass.

Do you feel that it is our governments job to be more efficient with money than the private sector or an individual? Shouldn’t governments performance be benchmarked against other national governments? There are certainly other governing systems in the world besides federalism capable of making things happen more quickly, if that’s a proxy we want to use for efficiency. Like investing, checks and balances should be judged in how they’ve performed over the long-term…

Certainly understand the desire to comment on how to manage our personal finances with respect to potential tax changes.

Should the govt be more efficient than the private sector? Private sector outsources jobs overseas, fires people for aging or getting sick, constantly erodes benefits and pensions for workers.

Government provides a backstop of jobs for many that would be unemployed in the private sector. It solves social needs as well as business demand.

Mr. Manchin of WV says he won’t vote to raise the capital gains tax, and good luck getting any Republicans to support it. Manchin says he views it as double taxation. This won’t happen in the current congress.

Thank you, Manchin! I like how middle of the road he is on economic Policy. While I do believe we should pay a fair tax. This is aggressive and the spending proposals are definitely going to come back on my generation. People will just look for loopholes to avoid this.

How do you define fair? Personally I would be in favor a simple flat tax on all income with no deductions whatsoever.

I have always thought the following story was representative of the tax situation:

Each and every day, 10 men go to a restaurant for dinner together. The bill for all 10 comes to $100 each day. If the bill were paid the way we pay our taxes, the first four would pay nothing; the fifth would pay $1; the sixth would pay $3; the seventh $7; the eighth $12; the ninth $18. The 10th man – the richest – would pay $59. Although the 10 men didn’t share the bill equally, they all seemed content enough with the arrangement – until the restaurant owner threw them a curve.

“You’re all very good customers,” the owner said, “so I’m going to reduce the cost of your daily meal by $20. I’m going to charge you just $80 in total.” The 10 men looked at each other and seemed genuinely surprised, but quite happy about the news.

The first four men, of course, are unaffected because they weren’t paying anything for their meals anyway. They’ll still eat for free. The big question is how to divvy up the $20 in savings among the remaining six in a way that’s fair for each of them. They realized that $20 divided by six is $3.33, but if they subtract that amount from each person’s share, then the fifth and sixth men would end up being paid to eat their meals. The restaurant owner suggested that it would be fair to reduce each person’s bill by roughly the same percentage, and he proceeded to work out the amounts that each should pay.

The results? The fifth man paid nothing, the sixth pitched in $2, the seventh paid $5, the eighth paid $9, the ninth paid $14, leaving the 10th man with a bill of $50 instead of $59. Outside the restaurant, the men began to compare their savings. “I only got one dollar out of the $20,” said the sixth man, pointing to the 10th man, “and he got $9!” “Yeah, that’s right,” exclaimed the fifth man. “I only saved a dollar, too! It’s not fair that he got nine times more than me!” “That’s true,” shouted the seventh man. “Why should he get back $9 when I only got $2? The rich get all the breaks!” “Wait a minute,” yelled the first four men in unison. “We didn’t get anything at all. The system exploits the poor!”

The nine outraged men surrounded the 10th and brutally assaulted him. The next day, he didn’t show up for dinner, so the nine sat down and ate without him. But when it came time to pay the bill, they faced a problem that they hadn’t faced before. They were $50 short.

It is my understanding that the rate applies once “earnings” exceed 1MM not just a progressive tax once cap gains and dividends exceed 1MM as you describe.

Yes, then new rate would apply to income/gains over $1 million. And income/gains under $1 million is presumably left unchanged.

Perhaps you can share an example of what you are referring to. Examples with numbers always help make things clearer as this tax stuff is confusing.

“ The capital gains tax hike will affect capital gains above the COMBINED income + capital gains threshold of $1 million.

For example, let’s say you earn $900,000 in income and $500,000 in capital gains. The capital gains affected by a potential capital gains tax hike = ($900,000 + $500,000) – $1,000,000 = $400,000. So sorry for folks who think making just under $1 million exempts you from paying a higher capital gains tax rate, if one gets approved.”

Let’s say that I make $750,000 in W-2 and regular business income via a K-1 or Schedule C if sole proprietor.

Then additionally, I make $500,000 in dividends/capital gains, for a total of $1,250,000 in “earnings” (as I understand it from all of the media sources I have seen).

Does this mean that I pay the cliff rate on all of the $500,000 in dividends/capital gains since my “earnings” exceed $1MM, (as I believe the stated goal), or do I escape paying any elevated rate on this as my dividends/capital gains do not exceed $1MM as in your example?

The capital gains tax hike will affect capital gains above the COMBINED income + capital gains threshold of $1 million.

For example, let’s say you earn $900,000 in income and $500,000 in capital gains. The capital gains affected by a potential capital gains tax hike = ($900,000 + $500,000) – $1,000,000 = $400,000. So sorry for folks who think making just under $1 million exempts you from paying a higher capital gains tax rate, if one gets approved.

In your case, $250K is subject to higher capital gains tax.

In the current proposal dividends are not included in the capital gains increase. You would still pay either the 15, 20, or 23.8 percent rate on all dividends regardless of total income or capital gains. If this proposal went through dividend payers would be that much more desirable. T over Tesla :)