Are you worried about President Biden's tax hikes? Don't be. Biden's tax hikes won't be as bad as expected due to checks and balances. The Ways & Means committee will reduce many of Biden's tax hike proposals in order for tax legislation to pass.

Let's review the latest Biden tax hike proposals and what it means for your wallet.

Recap Of The Biden Tax Hikes

Here are the latest proposed Biden tax hikes. These proposals shouldn't affect the majority of taxpayers (90% won't be affected). Due to the need to compromise to get new tax legislation passed, the end tax hikes will likely be less than what Biden is currently proposing.

Capital gains. Biden wants to raise the top capital gains rate from 20% to 39.6%. The House plan would raise it to just 25%.

Business taxes. Biden wants to raise the top corporate tax rate from 21% to 28%. The House plan pushes it up to just 26.5%. Some Senate Democrats say they’ll only agree to raise the corporate tax rate to 25%.

Individual income taxes. The House plan would raise the top individual income tax rate back to 39.6%, which is where it was before the Republican-controlled Congress cut it to 37% in 2017. There’s also an extra 3% surtax on incomes above $5 million.

Wealth tax: Unlikely to happen due to little support except from the most left-wing Democrats.

Estate taxes. The House plan isn't pushing for a higher estate tax rate. Biden has proposed raising the top estate tax rate from 40% to 43.4% – 45%, bringing the total estate tax rate up to 60%+ if state tax is include. The current $11.7 million estate tax exemption threshold is set to expire in 2025. I've seen Biden call to cut the threshold to $3.5 million per individual, but it is unclear by exactly how much. All we can be sure of is that Biden wants the threshold lowered.

Higher SALT Cap. Several prominent Democrats want to restore the full deductibility of state and local taxes, or at least raise the cap from the current $10,000. If this happens, big expensive cities will see an uptick in terms of livability, desirability, and affordability.

Backdoor Roth IRA. This could go away given it seems like a loophole for the rich. We can have Peter Thiel and his $5 billion dollar backdoor Roth IRA to thank.

Time To Take Things Easier Under President Biden

If you combine a pandemic, exhaustion, and upcoming tax hikes, it's no wonder why millions more Americans are considering leaving the workforce. If people aren't quitting the workforce, they are looking for jobs that provide more meaning, despite less pay.

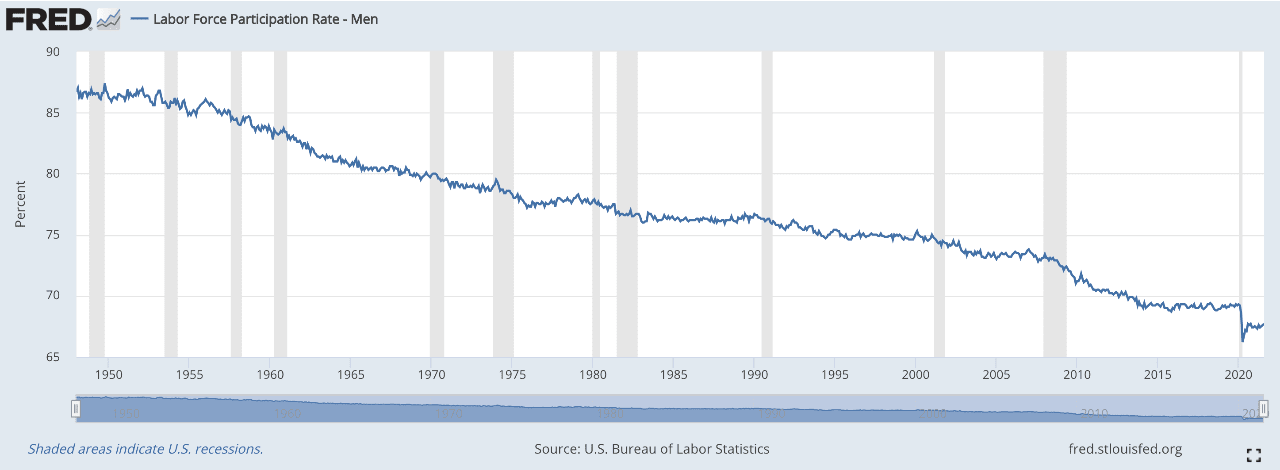

Personally, I believe the best time to retire is under a Democratic administration. Take a look at this fascinating labor force participation chart for working-age men by the U.S. Bureau of Labor Statistics.

It currently sits at around 67%. Notice how it's been going down for decades. It saw a step function down in 2020 and has seen only a ~35% recovery so far in 2021. We can safely bet the labor force participation rate for working men will be under 70% for the rest of our lifetimes.

So how are so many working-age men not needing to work?

- Unemployment insurance / government benefits

- Pensions / early retirement

- Investment returns

- The Bank Of Mom And Dad

- Under-the-table money / illegal work

- More working women

It's funny, but in my latest podcast episode about going back to work during a pandemic, I tried to convince my wife to go back to work. Alas, she saw through my chicanery and rationally refused again.

Working Less Is Logical

Taking it easier over the next few years is a logical move, especially if you've accumulated enough wealth to survive. President Biden's tax hikes makes working harder less appealing at the margin.

As your safety net grows, there's less worry of falling through the cracks. And as taxes increase, there's less incentive to work as hard if your net income is being cut.

I left work in 2012 when Obama was president. At the time, I was burned out and wanted to do something new. Obama wasn't a reason for me leaving work, but his tax policies did make me feel better about walking away.

In 2013, Obama allowed the top income tax rate to rise from 35 percent to 39.6 percent. Taxes on dividends and capital gains also rose. And a tax on investment income, included in the Affordable Care Act, took effect that year. Americans earning less than $250,000 were largely unaffected.

Thankfully, the stock market and real estate market reacted favorably. As a result, for some people, investment returns grew to be a significant percentage of overall income where active work income mattered less.

The hope is that the same thing will happen again, i.e., the tax hikes won't be so high as to derail the bull market, but high enough to help those most in need. As a result, more people will be able to take it easier as their investments do more of the heavy lifting.

Own Rental Property Without Having To Be A Landlord

Given we're all tired and tax hikes are on the way, it's good to earn more passive income. The more passive income we have, the less we have to work.

I'm bullish on single-family rental properties due to rising rents, rising property prices, and declining vacancies. However, something troublesome happened to me this week that reminded me why managing three rental properties are my max.

My tenant of 18 months texted me in a panic and said that after analyzing the utility bills since he moved in, the hot tub on the rental property was consuming way more electricity than we had originally thought.

As a result, he basically wants me to pay him about $3,000 since he pays the monthly electricity bill. He demanded a face-to-face meeting as this was “bad, very, very bad.” I've got to now spend time figuring out a fair solution.

I offered a solution that would bring his total cost down by ~$120/month going forward while rents have increased by $400-$600/month since he moved in. But so far, no agreement.

Counteract Biden's Tax Hikes By Investing More Passively

One big reason why I reinvested $550,000 of my 2017 rental house sale proceeds in real estate crowdfunding (the rest into stocks and muni bonds) is so that I could minimize dealing with conflict. Conflict bums me out, especially when one side is unwilling to compromise.

It's not like I was throwing hot tub parties all day and night with Financial Samurai readers! I've got kids to take care of, a book to write, newsletters to edit, and softball to play.

If you want to invest in the single-family real estate boom without being a landlord, check out Fundrise. Fundrise has been wisely building a single-family rental property portfolio across the heartland for years.

Now that heartland real estate and single-family rental properties are in strong favor, Fundrise investors are well-positioned to capitalize. For years, Fundrise and my philosophy on real estate investing have been aligned.

Regards,

Sam – Financial freedom sooner, rather than later.

If you want to sign up for my free newsletter, do so here. President Biden's tax hikes won't be so bad. All the same, you always want to have your money work hard for you so you don't have to.