There are may benefits of owning stocks over real estate. We've already discussed why I prefer real estate over stocks for most people. Now it's time to argue the other way.

I've been an investor in both stocks since 1995. I've also been an investor in real estate since 2003. Both asset classes are core asset classes to own for most people. Roughly 30% of my net worth is in stocks and 50% of my net worth is in real estate.

Out of my estimated $300,000 in annual passive investment income, roughly $27,600 of the income comes from stock dividends and $168,000 comes from rental income. Part of the reason why my stock dividend income is relatively low, besides owning less stocks than real estate, is that I'm mostly invested in growth stocks and the S&P 500 for potentially greater capital appreciation.

The Benefits Of Owning Stocks Over Real Estate

I was expecting much more backlash from coastal city folks in my article on why I preferred real estate. After all, real estate is more expensive on the coasts to own. You tend to dislike things you can't get.

But I also got heat from folks who live in the Midwest. The general feedback was that Midwesterners never felt anti-housing rage and that I'm a fool for preferring real estate over stocks since they've made more money in the stock market.

Well obviously you aren't going to feel a lot of anti-housing rage if you can buy a beautiful house for $350,000 a couple years out of school! And obviously you have a better chance of making a larger absolute return on your investment with stocks since housing is so cheap.

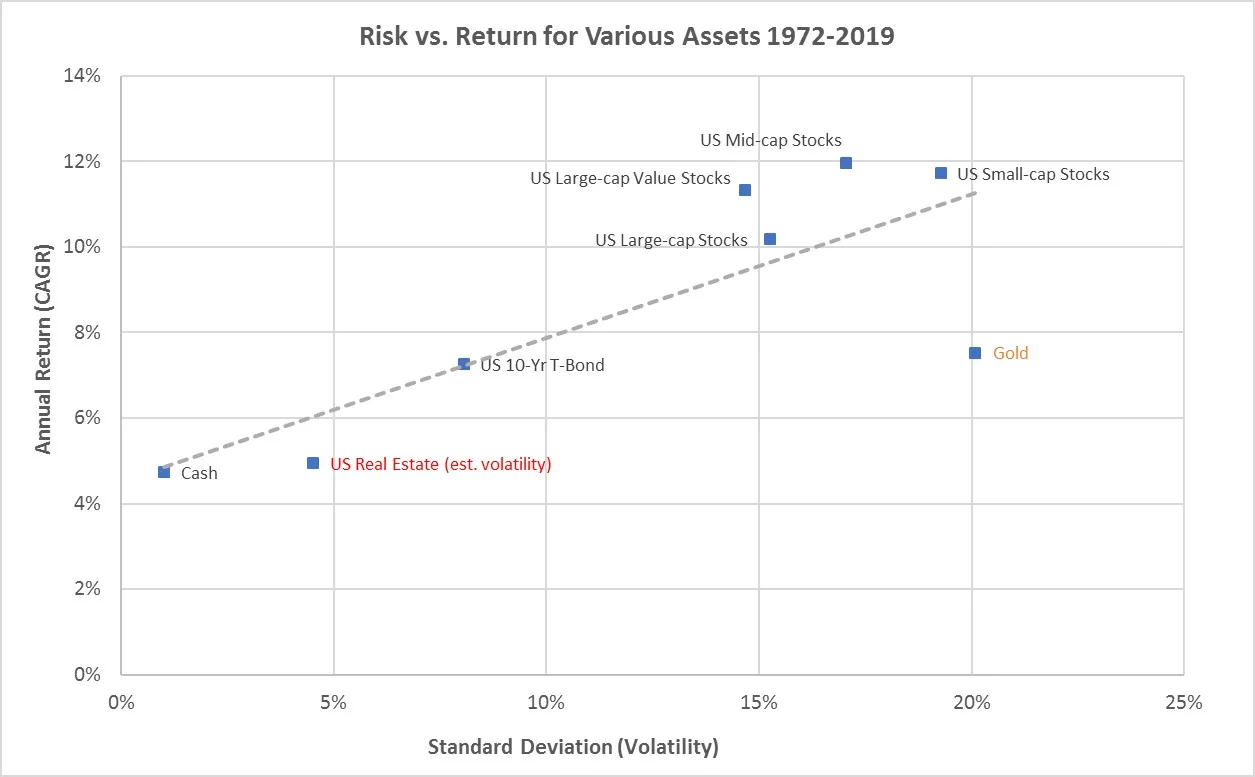

We already know that in the long run, stocks outperform real estate, un-levered.

The Midwest Has The Greatest Real Estate Investment Opportunity

What I do predict with great confidence is that 20-30 years from now, the anti-housing rage will have spread to the Midwest. Money is fungible. It will go where the returns are highest.

Residents from San Francisco, LA, Seattle, New York, Washington DC, and Miami will bring their bags of cash and either buy up non-coastal real estate directly through REITs or through real estate crowdfunding deals.

Making a fortune is about predicting long-term trends, and I'm certain diversity will continue to spread across America. Technology will make paying $4,600 a month for a two bedroom in a congested city like San Francisco no longer necessary.

Why? Because you no longer need to work in an office. By 2030, there will be more freelancers than W2 workers because today already ~35% of the American workforce are freelancers. Meanwhile, Trump will likely be president again after the failed assassination attempt. As a result, he will likely take care of the Sunbelt and Heartland states who voted for him.

Every opportunity will eventually be arbitraged away. Thankfully, such trends can take decades to play out. Face reality or get left behind.

If you want to invest in Midwest property, I'd take a look at Fundrise. Fundrise is a leading private real estate investor with funds focused on Midwest residential and industrial property. I've invested $280,000+ in Fundrise to diversify and earn more passive income.

Why I'm Always Going To Own A Good Amount Of Stocks

After selling my SF rental house and reinvesting the proceeds, I've got roughly 30% of my net worth in stocks. Although stocks give me zero pleasure or utility, they are a necessary component of my asset allocation because history has shown that stocks outperform inflation by 3-5X.

Here are some of the benefits over owning stocks over real estate.

1) Stocks have a higher historical rate of return than real estate

Over the past 60 years, stocks have historically returned ~10% a year compared to ~4% for real estate. You can also go on margin to boost your stock returns. However, I don't recommend this strategy. If your stock is declining your broker will force you to liquidate holdings to come up with cash if things go the other way.

With real estate, your bank can't force you to come up with cash or move out so long as you continue paying your mortgage.

2) Stocks are much more liquid than real estate

If you don't like a stock or need immediate cash, you can easily sell your stock holdings. If you need to cash out of real estate you could theoretically take out a home equity line of credit, but it's costly, needs getting approval, and takes at least a month to open up a new account.

I tried unsuccessfully to sell one property in 2012. It took a stressful 45 days to finally sell the same property in 2017 for $1 million more. So thank goodness for illiquidity in saving myself from myself! With stocks, it's so nice to be able to simply click a couple buttons and be done.

3) Stocks have lower transaction costs than real estate

Online transaction costs are now free, no matter how small the position you buy or sell. The real estate industry is still an oligopoly which fixes commissions at a ridiculously high level of 5-6%. The cost of selling a house is egregious.

You would think with the growth of companies like Zillow and Redfin transaction costs would significantly decline, but unfortunately they've done very little to help lower expenses for the consumer.

Check out this detailed breakdown of how much it would cost to sell a $1,850,000 home. If they charged a 6% commission fee, the cost would be $18,500 more!

4) Stocks require less work than real estate.

Real estate takes constant managing due to maintenance, conflicts with neighbors, and tenant rotation. Stocks can literally be left alone forever while paying out quarterly dividends. Without random maintenance issues you're able to focus your attention elsewhere. You can spend more time with family, grow your business, or travel the world.

If it made you feel more comfortable, you could hire a money manager for a fee of under 1% to manage your investments. Or you could just track and manage your portfolio yourself for free like I've done for the past 25 years.

5) Easier to diversify with stocks than with real estate.

Unless you are super rich, you can't own properties in Honolulu, San Francisco, Rio, Amsterdam and all the other great cities of the world. With stocks you can not only invest in different countries, you can also invest in various sectors.

A well-diversified stock portfolio could very well be less volatile than a property portfolio. People forget that buying property is a highly concentrated bet, often with debt, in a single asset.

6) Easier to invest in products you care about.

One of the most fun aspects about the stock market is that you can invest in what you use. Let's say you are a huge fan of Apple products, McDonald's cheeseburgers, and Lululemon yoga pants. You can simply buy AAPL, MCD, and LULU. It's a great feeling to not only use the products you invest in, but make money off your investments as well.

As soon as we started actively using Netflix in 2011, we bought some shares that have done well (wish I put my life savings in the stock in 2006 when Reed Hastings, the founder spoke at my Berkeley MBA commencement!). As soon as my wife signed up for Amazon Prime in 2016, we also bought some shares.

At the same time, you should also consider selling stocks on occasion to buy the things you want or need. Stocks have no utility, so you must sell stocks to realize its value.

7) Tax benefits.

For capital gains and qualified dividends, the maximum tax rate is 15% for taxpayers in the lower tax brackets.

For those in the highest tax bracket, the tax rate is 23.8%, including the 3.8% Net Investment Income Tax, associated with the Patient Protection and Affordable Care Act. Short-term capital gains tax (<1 year holding period) will be taxed at the normal marginal income tax rate.

Although these tax rates are quite reasonable, they can't compete with the $250K/$500K tax free gains for singles/married couples who sell their homes after living in it for 2 out of the last 5. Now that's some great tax savings!

8) Protecting your investment in a downturn is easier with stocks.

If you think the end is near you can easily sell a stock or short it. But if the real estate floor gives way, there will be no reasonable offers as vultures will start swarming.

If you think the real estate market is about to implode, you can short homebuilder stocks like KB Homes, a homebuilding ETF like XHG, a real estate play like Home Depot, a REIT like O, or mortgage backed securities. But these hedges are inefficient. At least with physical real estate, you can buy insurance. But is buying insurance really a benefit when no insurance is required to buy stocks?

Here are some ways to make money in a downturn. Here's also a bear market checklist to thrive as well.

9) Less taxes and fees with stocks.

Holding property requires paying property taxes usually equal to 0.5 – 2.5% of the value of the property each year. In 40 – 200 years, you'll have paid for the full value of your property in taxes alone.

Then there's maintenance costs, insurance costs, property management costs, and transaction costs to deal with. With stocks, you can build a portfolio of ETFs for free on Fidelity. Or you can have a digital wealth advisor build and maintain your investment portfolio for just 0.25% a year.

From a property tax perspective, the only states that seem reasonable to own property are Hawaii (0.28%), Florida (1.06%, no state income taxes), Washington (1.09%, no state income taxes), Wyoming (0.61%), Colorado (0.61%), Utah (0.68%), South Carolina (0.57%), Louisiana (0.51%), Arkansas (0.62%), Alabama (0.43%), and Nevada (0.86%, no state income taxes).

Characteristics Most Suitable For Real Estate

* Believe wealth is made up of real assets not paper.

* Know where you want to live for at least five years.

* Do not do well in volatile environments.

* Easily spooked by downturns.

* Tend to buy and sell too often.

* Enjoy interacting with people.

* Takes pride in ownership.

* Likes to feel more in control.

Personally, I like to invest in Fundrise, a private real estate platform that has multiple funds investing in residential and commercial real estate. Fundrise focuses on the Sunbelt region, where valuations are lower and yields are higher. Fundrise manages almost $3 billion for over 350,000 investors. I've invested $300,000+ in Fundrise and Fundrise is also a long-time sponsor of Financial Samurai.

Characteristics Most Suitable For Stocks

* Happy to give up control to those who should know better.

* Can stomach higher levels of volatility.

* Have tremendous discipline not to chase rallies and sell when things are imploding.

* Likes to trade.

* Enjoys studying economics, politics, and researching stocks.

* Don't want to be tied down.

* Have a limited amount of capital to invest.

The Main Reason Why We Own Stocks Today

Real estate is a younger person's asset class. I had all the energy in the world in my 20s and 30s to buy, manage, and remodel real estate.

Now that I'm in my 40s and have a wife and children to take care of, I simply do not have enough time or desire to manage real estate. As a result, I'm actively investing in private real estate funds.

The same thing goes for buying and selling cars. I had 10 cars between 22 – 34 because I was a car addict. I loved meeting up with people on Craigslist to haggle. Now, I'm happy to own one car for 10 years if it lasts that long.

If you want to own real estate, build your empire when you're young. You won't have the energy or two once you're middle-aged. I'm thankful the 2/2 condo I bought in 2003 is fully paid off. I'm also thankful I bought panoramic ocean view fixers in 2014 and 2019 that are both fully remodeled. We're never going through remodel hell again!

Now, we just want to own stocks, Treasury bonds, REITs, and real estate crowdfunding with our incremental investments. A simple life is a happier life!

The benefits of owning stocks are many. Just be prepared for the occasional 10% – 30% correction. Over the long run, stocks have provided positive returns to help millions achieve financial independence.

Invest In Real Estate More Strategically

If you don't have the downpayment to buy a property, don't want to deal with the hassle of managing real estate, or don't want to tie up your liquidity in physical real estate, take a look at Fundrise, one of the largest private real estate companies today with almost $3 billion in assets. Fundrise offers diversified funds invested mostly in residential and industrial properties in the Sunbelt region.

Real estate is a key component of a diversified portfolio. Real estate crowdsourcing allows you to be more flexible in your real estate investments by investing beyond just where you live for the best returns possible. For example, cap rates are around 3% in San Francisco and New York City. But cap rates over 10% in the Midwest if you're looking for strictly investing income returns.

Another private real estate platform to consider is CrowdStreet. Crowdstreet is a marketplace that mainly sources individual commercial real estate deals from various sponsors around the country. This way, you have more customization to build your own select private real estate portfolio.

With CrowdStreet, you must diversify your portfolio and do your due diligence on all the sponsors. Look up their track record, their management, and whether they have had any blowups before. Although CrowdStreet screens the deals, you have to do your screening as well.

Both platforms are Financial Samurai sponsors and Financial Samurai is a six-figure investor in Fundrise.

Stay On Top Of Your Money

Sign up for Empower, the web’s #1 free wealth management tool to get a better handle on your finances. In addition to better money oversight, run your investments through their award-winning Investment Checkup tool to see exactly how much you are paying in fees.

I was paying $1,700 a year in fees I had no idea I was paying. After you link all your accounts, use their Retirement Planning calculator that pulls your real data to give you as pure an estimation of your financial future as possible using Monte Carlo simulation algorithms.

The Benefits Of Owning Stocks Over Real Estate For Some is a Financial Samurai original post. Join 60,000+ others gaining financial freedom by subscribing to my free weekly newsletter here.

I didn’t think about owning real estate at all in my 20s because it just didn’t seem feasible. It felt so far beyond my reach. So all of the investing I did in my 20s was in stocks and ETFs. Fortunately, I worked hard, saved, controlled my spending, and had enough to add real estate to my investments in my 30s. Now that I’m in my 40s it’s hard to imagine my finances without both stocks and real estate. And bonds and treasuries too for that matter. Finding ways to diversify as my investments grew really helped my returns and lowered my stress as well.

I thought that it was interesting when you compared real estate to stocks in regards to investments. I have been trying to find ways to invest but I haven’t been sure how I should do it. I will be sure to consider buying an investment property as a secondary way to make money.

I like the summary of characteristics for real estate versus stock investors. Fairly accurate, IMHO for most rental-ish real estate investments.

Much like stocks, real estate is not a single class of investments. Most of the comments focused on rentals and the trials of managing tenants or management companies. I’m heavily invested in real estate, but only own 5 rentals that equity is less than 10% of net worth.

Real estate notes are, for a non leveraged investment, a much better solution, at least for me. It’s not set and forget like stock market. As a real estate investor, I like control. Currently the portfolio has 20 loans in 11 different cities. The terms are generally 12% and 2 points for 6-9 months with a 1 point extension. Meaning I can roll the loans about 1.5 times a year making for a 14%ish return on this money. Some years I beat the market, others I don’t.

Another option is to purchase performing or non-performing longer term mortgage notes. The returns can be similar to the above and in some cases much better.

Investing both the stock market and real estate has multiple options, it seems, however that most people are only familiar with rental real estate with crowd funded options starting to gain more attention.

I have never owned real estate and never had the desire to until we had kids. We were perpetual grad students and made no money but were also always on the move going from one postdoc to another. We have never been in one place for more than 4 years. The problem with renting isn’t space. It’s the horrid clientele within buildings. People are so disrespectful of common space and neighbors. We tried renting from a private landlord within a condo building thinking that would be more civilized as those tenants are stakeholders and in turn, ended up with a worthless landlord. Our fridge stopped working and he told me I must have set the temp wrong and refused to send a repair guy. I had breast milk I needed to keep frozen. I had it repaired myself, sent him the bill, and he then refused to deduct it from my rent. We got fed up, left the place in perfect condition at the end of the lease, and he refused to give our deposit back. In the end, we had to hire a lawyer. We have a credit score of 820, quiet family, were friends with the neighbors, and never paid our rent a day late. Landlords can screen tenants. The reverse isn’t as true.

Every scenario has issues. Renting has headaches. Owning has a different set of headaches. Generally, I have liked renting because it allows us the flexibility to move if a better career opportunity pops up. In addition, jobs are not as secure as they were in the last generation. I just think there is more freedom in owning stocks and I value freedom above all else.

I’ve rented over 20 years and have never had an experience like that with an owner. Thanks to investing the difference and not paying years of insurance, mortgage interest, property tax, maintenance fees, I have over a million in investments.

I greatly appreciate the quick reply and taking the time to read my comment. I am only here for one more year and then who knows where the Airforce will send me. Sucks I just got out of the barracks but Im glad to have been able to find a cheap way of living while pocketing in all my military Tax-free BAH and Cost of Living allowance money.

Hey FinancialSamurai, first and foremost, thank you for inspiring me with these blogs and continuing to create them. I’ve spent the last couple weeks reading all of them (maybe I missed one or two).

Anyways I wanted to ask for your opinion or if anyone else reads this, please chime in. I’ll go over quick details, I’m 24, credit score 760, drive an old car, I’m active duty air force, invested 5k in REITs, 1k in Stocks, 5k in savings (I wasn’t to bright growing up), currently living in Oahu, Hawaii, renting a small room for $600 and meal prepping to only spend $300 a month on food, my income is around 4k a month (21% of my pay going to TSP). If you were me, would you invest in a condo in Oahu using a VA loan where condos are 300k or keep renting so cheaply and buy a home when and if I go back to the mainland? I really want to get into real estate, but Hawaii man…. extremely expensive. Just looking for an opinion, and maybe some insight on Hawaii if you have any. I know I must do my own due diligence and trust my gut. Thank you!

I’ve noticed rents really weaken in Honolulu as a lot of new condos come online. I’d continue to rent for cheap, hoard your cash, and wait another year or two. Guess it depends on how long you plan to be there.

Both stocks and real estate can be pretty darn stressful. I bought some stocks yesterday during the dip and used up the available cash I had sitting in my accounts. That was the first time I’ve traded in a long time. I’m going to try and do a better job of legging in when I have cash on hand little by little. I focus on 0 commission ETFs most of the time. I also have a long time horizon plan for my stocks and fortunately don’t get tempted to sell very often. I don’t watch the markets that closely, even though I probably should pay more attention, which is why I don’t get the itch to sell. The downside is I don’t lock in gains, but with a long term game plan I feel okay with that most of the time.

Really disappointed. The market will not outperform SF real estate in any environment. Since you don’t suggest trading on margin, and since you favor diversification; we should compare a free and clear SF rental to a 60/40 stock to bond mix. Over a long haul, SF real estate appreciates about 9% per year. Your positive rental income after vacancy, maintenance, taxes and management (now the rental has minimal hassles) produces on average an additional return of 8% on investment. That’s a combined yearly return of 17%. You haven’t considered the real estate tax depreciation advantage. You havent considered that in a real estate downturn; rents decline a fraction of what the real estate declines, and since the real estate is free and clear and you are living on that rental income…you are still mostly good for that downturn period. Property taxes (with Prop 13) are really a non issue, especially since I’m considering net income after taxes. Let’s not forget that rents increase faster than the rate of inflation over any period, so you are hedged there. SF real estate is fairly liquid, list it on a Friday and have 8 offers by the weekend, all offers with quick escrows. In a real estate downturn it’s not as liquid, but you wouldn’t be a seller in that environment anyway. Because you are not going in and out of the real estate the commission and closing costs on a one time sale, many years down the road, are minimal. Owning SF rentals is like owning the SP 500…if the SP 500 appreciated over a long haul at 9% and paid an 8% dividend that was hedged against inflation. And since the market doesn’t perform that well, maybe you should have hired professional management, and kept your rental.

Don’t be disappointed. It’s not that big of a deal. Read this post to feel better: Why Real Estate Will Always Be More Desirable Than Stocks

What does your SF property portfolio look like? Are you buying more at these levels?

All of my rentals are in southern and central CA. I just used SF numbers since that’s where your property was. With regards to purchasing at this point in the cycle: I have found that CA real estate up-cycles tend to last 8-10 years. CA (as a whole) started appreciating in 2012 again, so I think we have a few decent years left. However, when I buy a property today, it’s at a fairly healthy discount from retail…or I pass. And, I have only been able to buy those better deals the last couple of years in central CA.

Got it. How do you find properties discount to market and what is the price point of the central California properties?

If I can only get a 3% absolute return on a property, I’d rather just buy something completely risk-free with no hassle At this stage in my life.

I totally agree about a 3% return, and real estate in much of the country barely outpaces inflation…but CA is a whole different animal. But I do think that even with CA real estate there is a correct time to cash-out and move into equities. When home values over many years of ownership rapidly increase, but their rents don’t increase at that same pace, your return, not on your initial investment, but on the money tied up in the property drops. When that gets to out of whack it would be a good point to move the money into equities and just kick-back with a reasonable withdrawal rate in retirement.

Central Valley CA prices are all over the board, but as an example: a bread-and-butter rental in Bakersfield has a market value of around $120,000 today and rents for $875 per month. At the bottom of the market in 2008/09 you could buy that property right out of the multiple listings for $60,000 and get $750 rent.

Today in order to get an acceptable return you need to buy the property under market (so not listed on the open market). More times than not my method to finding the great deals is direct mail. Buying that $120,000 property at a 25-30% discount an a cash transaction. Now you have a nice investment with built in equity. If the upward real estate cycle continues for another couple years (which it will) and even if the next down turn is deep (which it shouldn’t be with tighter banking), and even if you had to sell at the bottom (which you shouldn’t because this is your retirement income), you would still get out with all your money back.

Got it. At my age, I just can’t get excited about receiving $875/month in rent, gross or net. If I’m going to deal with people, liability, maintenance, etc I need much more. Even if a $120,000 property appreciates by 100% in 5 years, it’ll feel great, but it doesn’t really move the needle any more.

Perhaps I should bring the conversation back to comparing real estate to online businesses. There really is no comparison with which is better after trying both for years.

Which cities in SoCal are your rentals in? Is it completive to rent? I’ve looked at a few areas on Zillow (Pasadena, Glendale, etc) a lot of properties seems to just sit there due to high rent or rents are decreased from 3% to 5% every 15 to 20 days if the property sits there. There also seems to be a rent cap based on number of bedrooms and the cap is consistent.

Pasadena and Glendale are expensive “white collar” neighborhoods. This is an investment for you, not a home that you are going to live in with your family. Try looking at “blue collar” areas of So Cal (Lancaster and Palmdale would be a good place to start).l, the numbers will pencil out much better. Buy four or five rentals in these areas rather than a single expensive rental someplace else. This way when a roof goes, or a tenant turns bad you have spread your risk and still have the cash flow in that particular year from your remaining rentals. With the lower priced houses you will find very little in the way of rental rate fluctuations.

Sam instead of buying SF property years ago, wouldn’t you have had a better return and less headache putting it all in the stock market? I’ll take it even further, put it all in the stock market and rented in SF? When the big one hits do you really want to be or own in SF? Did you know emergency contingency plans of your surrounding communities are in place to receive the masses evacuating SF? What happened to SF real-estate in 1989? I have a beautiful place in KY and I rent around the world. Variety is important to me.

I’m looking at the returns from when I bought stock and one property in 2003, and real estate crushed the returns.

The property I bought in 2005 and sold in 2017 also did well, but not as well. Still, it cleared $1.7 million after taxes and fees from $320K down. Compared to the $320K I invested in the stock market around that time, it still doesn’t match up b/c of leverage, paying down debt, tax shield etc. See: Why I Sold My Rental Home

But I think you will love this post: Buy Utility, Rent Luxury: The Real Estate Investing Rule To Follow.

When you say “when the big one hits”, which fault line are you referring to? If the Hayward fault goes off (being predicted as the sleeping giant) then SF is not going to result in much damages whereas the East bay along the 880 will see damages. Loma Prieta in 89 did hit and a lot of the homes in the bay area (built in the 70’s and 80’s) held up. A lot of the new homes built since that time have better earthquake codes and standards to withstand a higher magnitude.

You don’t think SF will get rocked if the Hayward fault causes a 7.0 earthquake or higher? The Hayward fault is 1.5 – 2 hours drive closer than Loma Prieta, which was a 6.9.

I hope you’re right that there won’t be much damage in SF. Lots of buildings have ben retrofitted and improved.

Not clear why you feel you need to manage your own properties. You can hire a property manager. Those expenses can be written off and it’s a peace of mind. In the better areas of the bay area you’re less likely to rent to someone who you’ll need to evict.

Your comment about historical returns for stocks vs real estate is based on averages. Based on where you live you’re more likely to have a much higher return in a hot market. Take for example, one bedrooms in Cupertino sold for around $550k in 2006 through 2008. Now they are selling for $950,000. This is not normal nor the average. Hot cities in the bay area does not lose value (10 to 25% at most during a down turn) while the upside is higher.

Not only does the property manager lower returns, I didn’t want to manage the manager. But I have many reasons for selling one property, namely rents fell 15% when I tried to rent it out, but property taxes stayed elevated and the selling price stayed elevated too. So valuations went higher. I’d much rather invest just $500,000 in real estate crowdfunding and get the same or higher operating profits than the $2,742,000 house with $815,000 in debt.

Are you buying property now in the SF Bay Area? What does your property portfolio look like?

I’m still long two properties in SF and one property in Lake Tahoe. Just not crazy long with leverage anymore.

We have different experiences in terms of property managers. We don’t have to manage our manager. There are costs associated with it such as a 6% fee from rent and depending on the tenant, may need to do repairs inside the home, but those costs are deducted during tax time.

I’ve been tracking home prices/bidding in Emeryville/Oakland and the Tri-Valley since mid last year. Unless there is a correction in 2019, it’s no longer affordable. The cost of home ownership in those areas are now more than rent in those areas. For rental investment, even in the cheaper areas like Stockton, the home prices have gone up significantly and homeownership there is more than rent.

We currently have 4 properties, one paid off, two less than 3 years and one on the 30 year plan. We don’t plan on ever selling, so our strategy is a little different. The properties will be for our income when we retire and passed on to our children.

If property prices are no longer affordable, who can afford them?

I think everybody is different and has a different situation to deal with. I used to think property was the greatest thing on Earth, but not anymore in my 40s and not after building web properties.

For example, a $2.74M place I sold was generating ~$5,500 a month net after everything. Without a mortgage, it would generate $7,400 a month. That’s a 3.1% annual yield + any appreciation. I’d much rather invest $2.74M for a 10% net rental yield, or $270,000 a year + appreciation in the heartland. See: BURL: The Real Estate Investment Rule To Follow

I just want a simpler life now.

“If property prices are no longer affordable, who can afford them?”

People who wants to park their money (all cash buyers) into real estate and generate income through rent. Or people who are tired of renting and wants pride in home ownership. Prices are definitely higher (in areas I’ve looked at) now than compared to Q3 last year, by a margin of at least $50,000 on just the listing price. The inventory in the bay area is low, so homes in the same location are listed after one sells.

You’re in a unique situation since you have more money to work with. The more money you have to work with, the more options you have to make more money. Even your $500,000 investment in RealityShares is more money than the avg 20% – 30% down payment on a home.

Sam,

I like how you’re flexible in giving merit to points of views that are valid even if you do have your favorite asset classes. This article goes to show that different assets may be a better than others depending on one’s life circumstances. I don’t live in a HCOL area but purchasing real estate in my 20’s was not the best move financially because I could have accumulated much more wealth if the money had been put into the stock market. Granted, I purchased property in 2006 at the peak of the housing market but it would have been a good exercise to calculate the rates of return on the various investment options at the time. Now that I’m writing this, I realize that I had come up with Plan A to sell the place should I have needed to move. What I didn’t anticipate was the property being so underwater that I wouldn’t be able to sell and would possibly have to rent the place out. Had I thought through a Plan B of renting out the place if unable to sell, I would have seen how expensive it was to continue carrying the property.

Since you brought up that predicting the future is key to making a fortune, it had occurred to me recently that my profession as an internal auditor is at stake. One of the trends now is for internal auditors to be expert data analysts. I can foresee that the next step would be to use machine learning where computers can analyze data to detect errors and fraud which would reduce the need for auditors. Luckily, I have just 14 more years until retirement. My backup plan is to move into an administrative position, at the university I’ve worked for the last 16 years, if my position actually did become obsolete.

Hi FS,

Nice article as always, but I think you made some qualitative and quantitative analysis errors in your write-up. These might be minor, but I just want to offer an alternate viewpoint.

I think you really glossed over the higher rate of return inherent in stocks over real estate. This is an important factor as time in the investment absolutely affects your total wealth level dramatically. The longer you’re in stocks, the greater your total compounded wealth. It’s typically much easier to grow to $1 to $10 million in stocks in real net worth than it to do that with real estate (due to the lower rate of compound growth). What you truly get from owning real estate is a larger return of cash (typically 6-8% vs. 3% in dividends). This emphasizes that you should own stocks when you’re young (to generate high rates of compound growth and overall wealth) and keep your day job/business venture as your actual work activity. At later stages in life you then transition to real estate to reduce your overall wealth volatility and to generate a higher cash return on your currently created wealth. I think it’s much more valuable to find a way to get to $2+ million as a liquid net worth and then find opportunities to generate cash return so that you have $100k to $150k coming in to cover all of life’s expenses.

I also think that the leverage argument is minor or not a largely attributable value/parameter to differentiate between stocks and real estate. Most analysts look at leverage from their personal viewpoint and fail to realize that all business ventures are inherently leveraged to begin with. That’s why you can see inherent RoEs of 20 to 30% for business operations like Coca Cola and Diageo. They have done the heavy lifting for you and, while it may not be as highly leveraged as commercial/residential real estate, it’s usually sufficient that you’re gaining most of the inherent benefits of leverage while incurring lower level of risk that’s typically inherent in real estate (current coastal run-ups not withstanding). Since we all know that leverage is not a linear risk function, we should be able to agree that you want some, but you don’t want LTCM levels. Stock investments typically have this built in and don’t require further analysis on an investor’s part.

Got it. How long did it take you to get to $10 million in stocks versus $10 million in real estate?

I’m not sure some homeowners about their homes for $100,000 years ago, and we are now set on $1 million in equity or more would agree with you. They are compounded return was pretty good too. Further, you can buy high dividend paying utility stocks for cash flow.

Real estate was much quicker and helpful in building my wealth due to leverage. Taking concentrated risk in SF plus leverage was very helpful.

Oh I’m not that old/wealthy yet!! Just hit about $2.5M recently. It took my wife and I seven years (after my MBA) to move from $150k to there. I expect to hit $8M in about 6 to 8 years (the faster the downturn and eventual recovery, the faster that happens) around late 40s to maybe 50. I will state I also used real estate (LA) to boost my net worth by buying in 2010. What I’ve seen is really good returns on the RE ($250k initial to near $700k), but I’ve got really great returns on the stocks ($150k to $550k) over the same time period.

I have seen a higher cash return on the RE, but higher overall rate of return on the stocks.

I expect to transition to a higher percentage or RE once I hit 50 and have to put my kids through college and start to stop worrying about trying to make more money, as opposed, to just keeping it.

Luckily my wife and I will have the pension also so we expect no long term general living expenses!! The money will only be for the occasional splurge.

Got it. I guess it’s good to extrapolate and and plan ahead.

I don’t know many people who to expect a tripling of net worth in just 6 to 8 years. What is the math work in your case?

I’d love to carve out $2.5 million of my net worth and triple it as well. In fact, that’s exactly what I’ll do if you show me the way!

Thx

A simpler life is a happy life FOR SURE.

The simplicity and low maintenance is the reason why I like stocks and index funds. Also I love your reason about owning companies you care about; I have some or those as well.

Hi Sam,

100% agree with you when you say “a simple life is a happier life”!

You could not have said it better.

I fell much more comfortable with stocks than with real estate. Real estate needs much more time than stocks and I don’t think the returns outweighs the benefits. However, I think some real estate can help in diversifying one portfolio that is full of stocks.

Moreover, in Switzerland, the price of real estate is really high. It’s a huge barrier to owning something. One day, I still think I will owe a house, but probably only for living in, not for income via renting.

Thanks for another great post.

I’m still in my 20’s but have essentially relegated myself to just putting my mid-to-long-term money in index funds. My wife and I work in pretty ridiculous industries (private equity / startup), so we’re both willing to sacrifice a percent or two of return in favor of less brain damage – that said, I don’t think extra time on our part would change the equation at all.

As you note, stocks win on an un-levered basis (I’d point out many public companies are decently levered, but that’s neither here nor there), so I find it hard to convince myself to put money in anything else. Currently we have ~90% of our net worth in stocks (or about 80% if you count 401(k)/IRA since those are in Vanguard target-date funds that also comprise some non-stocks). Looking at current P/E ratios, I sometimes cringe before depositing 50% of my paycheck into more stocks, but if I don’t plan to touch the money for 20+ years, I guess my question is why change? If you don’t have the time to deal with RE and other non-passive investments, is there any reason to put true retirement money elsewhere?

And as a side note – Sam, I’ve been reading your blog for a couple months now and have found it to be one of the rare finance blogs I can identify with – so thanks!

23 percent real estate

67 percent stock (80 percent US)

4 percent alts

15 percent art

0 percent bonds

<1 percent cash

I’d like to get the alt number up to 10 percent with up to 1 percent of that 10 percent being in crypto.

If I follow through on buying a 2nd home before 2020 election then real estate holdings would go up. Unsure, if will follow through on getting the second home though. Need to see what the climate looks like around that time. Stocks are still relatively cheap right now. A 0 percent rate of return for the S&P this year would mean stocks would be really cheap next year. None of the tax plan for the rich is baked into stocks yet.

Numbers are off. Art is about 5 percent

I feel very comfortable with stocks. Real estate is worth while if you are diligent and ready to grind to find a good deal.

Have to be realistic though and realize that like anything else you are competing for those amazing deals and have to treat it like a business. I think if a deal presents itself along the way to own real estate directly it is a worth while endeavor.

I own a modest place and am happy to have low costs in a HCOL area.

As far as stocks go I think it is proven to be one of the greatest wealth builders of our time. It is very hard to stick to a solid strategy over the long term though. Most people jump in and out and end up getting burned. If you can have a long term vision it is fantastic.

I care about electric cars, and reducing fuel costs, but am in no hurry to buy any TSLA @ this point :P

Sam, would you consider just owning REIT funds rather than invest in actual properties? It’s essentially got the best of both worlds since you will receive distributions from profits of the properties, while not really having to do any of the work in managing a property.

With that said, as a “lazy” investor who knows better now than to pick stocks (with the help from the school of hard knocks), nothing wrong with investing in plain ol’ low fee index funds.

Low fee index funds are the Ronco Rotisserie of investments. You can “set it and forget it”, unless the house is on fire.

You make a good point about stocks’ superior returns and liquidity. But to take it a step further, I prefer equities because real estate doesn’t provide a sufficient illiquidity premium to merit the leveraged risk and transaction cost. If stocks provide a better return with better liquidity and bonds provide a similar yield with better liquidity (and collateral), why take on the illiquidity at all?

Real estate is still a great diversifier of net worth, but seems to be an inefficient investment vehicle, in my view. I use RE solely for diversification, akin to commodities etc.

Fair point. I do wonder whether liquidity is overrated. If real estate was really liquid, it would be easier to sell during the downturn and miss out on all the upside. For so many asset classes, holding for the long term is generally better.

Fair points. I do wonder whether liquidity is overrated. If real estate was really liquid, it would be easier to sell during a downturn and miss out on all the upside. For so many asset classes, holding for the long term is generally better.

Liquidity is nice to have, but when we are working, have passive income, and side hustles, perhaps liquidity is not as necessary as we think.

Liquidity is nice to have, but when we are working, have passive income, and side hustles, perhaps liquidity is not as necessary as we think.

Before fire selling any asset, I would just eat Ramen noodles and drink water every day.

As I mentioned later, the real reason to own real estate is not for a return or liquidity premium, but a return of cash premium. The three investments classes all meet different investment criteria as they have done now for millenia, and which is why they still also exist separately and distinctly. The stocks generate high return with a high levels of volatility and liquidity and low levels of current cash. The bonds generate a guaranteed rate of cash (low to medium levels) with low volatility and high liquidity, while real estate generates a high level of cash (potentially) with low levels of volatility and low liquidity. If you need cash for current expenses, you invest in real estate. If you’re looking to generate long term wealth, you invest in stocks and if you need guaranteed cash over a specific time frame you invest in bonds.

They aren’t really competitive asset classes so much as structured for different needs asset classes.

Sam,

I’m with you on low equity allocations and high R.E. allocations spread across your assets. I think you having 30% in equities is pretty wise as it’s risk-averse, especially at a time like the present. Like you I have a high allocation to R.E., mainly through crowdfunding. I love this 8% preferred payout I’m receiving as the I.R.R.’s slowly build up over time.

Good post. You can already see that happening in the outskirts of the Bay Area. Those areas are starting to see their prices climb because people can’t afford the Bay Area. My daughter became an ER nurse in Bakersfield for the experience, and while salaries are much lower there. She looks at the Real Estate prices in the Bay Area and the cost of child care, and is now contemplating buying a nice house in Bakersfield. Houses won’t appreciate like they do in the Bay Area, but she can afford a very nice house for 250,000 dollars instead of a shack for a million dollars. I don’t blame her.

Hi, Sam: I personally use Nassim Taleb’s Barbell Strategy: hold extremely conservative assets (real-estate, cash) and extremely risky assets (S&P, individual equities), no bonds. I think this mixture is better than, say, holding a single class of assets, or 60% equities, 40% bonds, etc. (the later is really hard to re-balance).

Taleb’s rationale is without safe assets as cushion, “long term” investors are likely to panic (2009 when market is -40%), or forced to sell if losing jobs, etc… Having panic myself in 2009 and sold some equities, I now keep a few years of living expenses in cash and never have to worry a down market.

The fact that you got push back for the Midwest housing rage means you might be on to something. You’re supposed to do what other investors aren’t, right? Haha.

So we just sold our rental and the whole process has been….yup… very very illiquid and slow moving. The grounds are looking shakey here with so much building in the pipeline and we needed funds for my parents who are movingggg….to Carolina. Still think you’re onto something with the amount of retirees.