Deciding on leasing or purchasing a new car is a big decision that can cost you money if you make the wrong one. As a car fanatic since the 1990s with dozens of cars under my belt since, let me provide some tips on how to choose.

I have both leased and purchased cars over the past three decades. Leasing or purchasing have their pros and cons.

Leasing Or Purchasing A New Car Decision

After 10 years, I'm sad to say Moose is gone! He just had too many problems that cost too much to fix as a 14 year old Land Rover Discovery II. I hated to let him go because he was like my big boy.

I still remember finding him with 87,000 miles at the orphanage (Craigslist) for $10,000 in early 2005. The owner got a sweet consulting gig in Amsterdam from Pricewaterhouse Coopers and she had to sell quickly. We agreed on the steal price of $8,000 and the fun journeys to Tahoe, Napa, and Carmel began.

I actually hate driving today. There are just too many cars in San Francisco and the Bay Area now that the economy has roared back.

Traffic was very manageable just three years ago, but condos are sprouting up everywhere downtown next to main arteries, making driving very stressful. The worst is when delivery or garbage trucks double park during rush hour and traffic backs way up. Dear local politicians, please outlaw such activity.

There was a point where I almost thought about not buying a car at all, and just using UberX as it is so cheap and signing up for a ride-sharing program since prices have come down so much. But in the end, I still valued my freedom of being able to get in a car and drive anywhere whenever I wanted.

The Decision To Lease a Car

After pondering whether to lease or purchase a new car, I ended up leasing a new car for simplicity reasons.

I went back and forth with your help between a sweet Jeep Grand Cherokee Limited for $39,700 and a Honda Fit EX for $19,025 for a couple months until the DMV forced my hand!

It was time to pay the $132 car registration renewal fee for Moose plus an $80 smog check fee if I wanted to continue. $212 isn't a lot of money every two years, but there was one other problem. I had been driving with my service engine light on my dashboard for 1.5 years! It was so annoying that I just put some black tape on the plastic cover of the dashboard to cover up the light.

When I asked the smog attendant whether he thought Moose would pass smog, he said “no” because they hook up cars to a computer diagnostic that will immediately catch the check engine light problem.

Lots Of Maintenance Problems With An Old Car

I would have to go to my mechanic, figure out how to fix the problem and then return back to the smog station once the light was off. Suddenly, the $232 in fees could very well balloon to $500+ and cause me to waste more time. Finally, I also had to buy at least one $220 M&S tire as well since my left rear tire was totally bald.

When I got to the Jeep dealer, I was all ready to get sold by the salesman. Instead, the salesman was watching the SF Giants game and didn't seem to care. I asked him to give me a deal I couldn't refuse and he said, “This is it.” So I left.

Deep down I felt that spending $44,000 after tax for another low fuel efficient car didn't feel right, even though it would have qualified as a great business tax deduction.

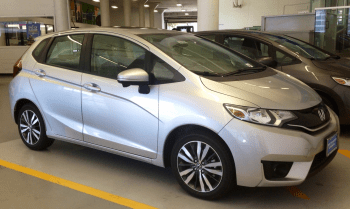

I went to the SF Honda dealer and there he was, a silver 2015 Honda Fit with alloy wheels and every option imaginable parked in the lot. You know that feeling you get when you see “the one”? I felt that when I saw the Fit.

Here are some of Rhino's features:

- Backup camera

- Right side view mirror camera

- 16″ alloy wheels

- Great dimensions of 160″ long, 67″ wide, 60″ tall vs. 184″ long, 75″ wide, and 75′ tall for Moose

- 6 airbags from 8 compartments vs. probably two non-operating airbags for Moose

- 130 hp from 117 hp for the previous model

- Two USB ports, 1 120V port, and 1 HDMI port

- Magic seats that can lay flat and go into the footwell

- Paddle shifters

- Bluetooth for handsfree phone calls and linking up to Pandora

- Moon roof and more

Honda Fit Felt Like Good Value As a Lease

I was blown away by all the features because Moose didn't even have a working CD player. The glorious feeling of always being able to charge my phone on long road trips is amazing. The ability to park in tight spaces where parking is a premium in SF is a huge plus. A city car is perfect for a city resident.

My biggest concern was on safety given the size and weight of the Fit. Large objects tend to hold up in crashes better. Further, bigger cars tend to bully smaller cars on the road.

I was happy to research that Honda skipped the 2014 model and went straight to 2015 because they wanted to comply with all crash test metrics. The 2009-2013 models didn't pass Insurance Institute for Highway Safety's front overlap crash test. Based on the latest IIHS test, the 2015 Fit overcame the failure and received the IIHS TOP SAFETY PICK award. Awesome!

Yes, Rhino might not be as manly or as sexy as Moose. Girls also will probably not be as interested in talking to me. But I think that being more eco-friendly and frugal with one's money is pretty sexy as well.

Besides, a confident man can drive anything. I've gone from rolling in a beat up Toyota Corolla hatchback to a $80,000 Mercedes G500 back down to a compact car and I love it.

Rhino helps cover the most important aspect of Stealth Wealth since a car is the most common clue that gives people's perceived wealth away. When it comes to leasing or purchasing a new car, you can show off more with a leased car.

Making The Decision To Lease Or Purchase

Something must have happened to lease rates over the past 10 years because leasing is now a very favorable financial option based on my research with five cars across five different dealers (Honda, Toyota, BMW, Audi, Mercedes).

I used to always be opposed to a lease because the end price compared to purchase always seemed much higher. But not anymore as the premium between leasing and owning has narrowed tremendously as you'll see below.

The other reason why I decided to lease was the desire for optionality. At the end of my three year lease, I want to have the option to either purchase Rhino for $12,746 (residual value) or swap him for a new car.

Optionality Has Tremendous Value When Leasing A Car

Maybe I'll want a larger car due to a new addition to the family. Maybe Rhino isn't as great in the snow with chains as I hoped. Who knows. Since I recently purchased my house, it doesn't feel good to spend a boatload of money on an asset that is guaranteed to depreciate.

There once was a time when I loved negotiating with strangers online to buy and sell a car. I didn't mind waiting for hours in the DMV to register a car either. But those days are long gone.

Now I'm very willing to pay a premium for freedom and convenience. Even though I have much more free time now than 10 years ago, I have less time overall given I've got 10 years less to live.

Some of you may ask why I didn't just pay cash for the car. The main reason is due to optionality again. I don't want to feel “stuck” owning a car in case I don't like it down the road.

The Cost Of The Car Lease

- $0 down e.g. sign and drive.

- $1,000 trade-in value for Moose, a 14 year old Land Rover with 130,000 miles and $500 in work necessary for him to comply with smog. I also need a $220 new tire.

- $20,117 total cost after trade-in, taxes, and fees.

- $235 monthly lease payment vs. $604 a month purchase payment over 3 years at an interest rate of 0.9%.

- Total monthly lease payments after 3 years = $8,462.

- Residual value: $12,746 (price I can buy Rhino for after 3 years)

- $8,462 in monthly lease payments + $12,746 residual price= $21,208 compared to $20,117 after taxes, fees, and trade-in if I were to purchase in cash.

Costs More To Lease A Car

In other words, I am paying only $1,091 (5.4%) more to lease the car with the option to purchase after three years vs. if I paid $20,117 cash. The optionality is worth at least $2,000 to me and I can easily make 2.2% guaranteed income on $20,117 a year. Furthermore, I'm actively paying down my 3.375% rental property mortgage.

If I were to purchase the car, the lowest rate Honda gives is 0.9%. The cost would end up being around $20,800 to finance the car over three years, or only $392 cheaper than my total $21,208 lease cost.

A $235 a month lease payment is less than 1% of my monthly cash flow and I'm going to put it on auto-checking payment. Rhino's $21,117 all-in cost (before $1,000 trade-in) also fits into my 1/10th rule for car buying as well.

Recommendations If You Want To Lease A Car

- Drive under 12,000 miles a year. 12,000 miles is the general standard mileage allowance for leases. Every mile over 12,000 costs 25 cents on average. You can get higher mileage caps for a higher price. I drove 4,500/year on average for 10 years.

- Cherish having the optionality to turn back the car after three years.

- Enjoy driving new vehicles.

- Lease an electric vehicle because its battery life might fade. Further, batteries cost $6,000 on average to replace.

- Don't have a trustworthy auto-mechanic to fix cars off warranty. My auto-mechanic of 10 years left SF due to high rents and moved to Oakland.

- Unsure about your future driving needs due to family size, job, etc.

- Want to maximize monthly cash flow.

- Don't like negotiating deals when it comes time to sell.

When you're thinking about leasing or purchasing a new car, you always want to think about the after-tax cost of owing the car as well. If you have a business, you can easily deduct the car lease.

Here is a post I wrote on how to get out of a car lease if you find yourself stuck.

Leasing Or Purchasing Is A Strategic Decision

Owning a car is generally bad for your finances. Besides the purchase price of the car, there's the recurring maintenance costs, parking tickets, moving violation tickets, DMV renewal fees, accident costs, and insurance. Everything adds up.

I totally forgot about my car insurance costs by buying a new car. Moose only had liability coverage that cost $286 every six months. I now pay $456 every six months for Rhino because it is mandatory I get comprehensive and collision insurance when leasing a new car.

That's a whopping 59% increase in my insurance costs that I forgot to calculate! I'm not going to starve paying $340 more in insurance every year, but that's an unfortunate expense.

The best way to minimize your car ownership costs is to hold onto your vehicle for as long as possible, buy a car that has a history of reliability, keep up with the scheduled maintenance, shop around for insurance, and be a good driver. Please follow my 1/10th rule for car buying as well.

Always think about your car as an ongoing liability. And if you have a car newer than 10 years, then maybe it might one day turn into a business expense if you decide to drive for Uber or deliver pizzas.

Leasing or purchasing a new car can work well either way. Just make sure you follow my recommendations before leasing or purchasing. If you do, you'll be able to comfortable afford your car and enjoy it too.

Related posts:

The Best Time Of The Year To Buy A Car

The Best Mid-Life Crisis Cars To Buy

Be More Responsible, Buy Or Lease A Cheaper Car

Follow my House-To-Car Ratio guide for fiscal responsibility and buy a cheaper car. If you want to eventually reach financial freedom, you should have a house-to-car ratio of at least 50. Cars are guaranteed to depreciate in value, houses tend to appreciate in value.

As the father of the modern-day FIRE movement, I want all of you to have more wealth and more freedom. No car can match the joy you will experience once you are financially free.

Buy Real Estate Instead Of An Expensive Car

Keep your car expenses to a minimum. Instead of buying a fancy new car, use the money to invest in real estate instead. This way, you can build more wealth and achieve financial freedom, which provides way more value than driving a nice car.

To invest in real estate without all the hassle and unexpected costs, check out Fundrise. Fundrise offers funds that mainly invest in residential and industrial properties in the Sunbelt, where valuations are lower and yields are higher. The firm manages over $3.5 billion in assets for over 500,000 investors looking to diversify and earn more passive income. The minimum investment amount is only $10.

Another great private real estate investing platform is Crowdstreet. Crowdstreet offers accredited investors individual deals run by sponsors that have been pre-vetted for strong track records. Many of their deals are in 18-hour cities where there is potentially greater upside due to higher growth rates. You can build your own select real estate portfolio with Fundrise.

I've personally invested $954,000 in private real estate since 2016 to diversify my holdings, take advantage of demographic shifts toward lower-cost areas of the country, and earn more passive income. We're in a multi-decade trend of relocating to the Sunbelt region thanks to technology.

Both platforms are sponsors of Financial Samurai and Financial Samurai is an investor in Fundrise funds.

Subscribe To Financial Samurai

Listen and subscribe to The Financial Samurai podcast on Apple or Spotify. I interview experts in their respective fields and discuss some of the most interesting topics on this site. Please share, rate, and review!

For more nuanced personal finance content, join 60,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

I used to always be on the buy used camp vs buying new or leasing. However, my perspective is starting to change that leasing is the best option. Unless I decide to buy a really used car that’s under $8K-$10K, I think it’s better financially to lease with better monthly cash flow that you can utilize to invest or use the money for something else instead of paying off on a depreciating asset.

I really think with cars just like real estate, “Rent Luxury, Buy Utility” applies. If you’re buying anything that’s less than $8K-$10K, and you’re mostly concerned about going from point A to B, then “Utility” applies. But anything above that, it’s a luxury. If you’re going to get anything luxury, it’s best to rent it(lease) and keep your monthly payments as low as possible.

I get it’s a good financial decision to drive a car like rhino, but life is short. You can clearly afford a nicer car, i would say go for it and buy the Porsche or range rover you have your eye on

[…] for 2016 and beyond. I decided to lease a new Honda Fit for $235 […]

[…] for 2016 and beyond. I ended up finally trading in Moose for a 2015 Honda Fit named Rhino! It costs $22 to fill up a tank of gas vs. $80 […]

[…] got a 2015 leased econocar for $235/month that’s covered under warranty, so my maintenance expenses should be minimal […]

[…] of the main reasons why I bought a 2015 Honda Fit was due to the advertised fuel economy of 32 MPG City, 38 MPG Highway, and 35 MPG overall. My old […]

[…] shows why it’s so easy for the typical person to get into so much financial trouble. Sure, financing and leasing makes cars more affordable, but it gives people a false sense of wealth, especially if they aren’t aggressively saving […]

This is the first article I’ve read that looks at car leasing vs. buying in the proper light — which is to say that it considers the broader picture of a person’s entire financial life. I have to buy a car soon to replace a 2001 Toyota that I actually got for free when someone in our family got ticked off trying to trade it in with little luck getting any value and simply gave up. I kept it running for two more years with minimal investment and avoided having a car loan on our records as we got approved for a mortgage and purchased a home. With two full-time salaries, my wife and I will be able to remain within the 10% rule and get a new one that fits our family of four, albeit the base-line, no-frills model. But after that home purchase, our cash savings is depleted. After factoring in the need to pay for daycare for the next three years for two kids, we’d have to scale back our retirement contributions or delay rebuilding our emergency fund in order to afford both a down payment and then higher monthly car payments going forward. And right now, our retirement funds are doing really well. We’re in our late 30s and I don’t want to cut those contributions back — not even to buy rather than lease a car. They’re worth so much more in the long term. In short, the leasing route will give me the chance to keep contributing to retirement and our emergency fund at our normal levels, and those contributions will appreciate significantly more than the few thousand I might conceivably forfeit if I buy our car as the lease term ends…or finally buy a new car outright at the end of three years. It would be great to save money and buy instead of lease, but as I back up and look at the entire picture the way Sam did in his situation, then I can’t really fool myself into thinking that I somehow save money buying a car this time around instead of leasing one.

Nice! In 2007, my girlfriend, now wife, worked in the online sales department of a home dealership. Despite the immense popularity of the fit, dealerships hated selling them because the margins were low.

Fun fact; “Rhino” has served as the unofficial nickname of 2 US military combat aircraft: the vietnam-era F-4 and the current f18e. Your rhino gets 30 mpg, while those rhinos burn several times the curb weight of your vehicle in a matter of hours.

Meant “Honda”, not ” home”.

Currently own my 8 year old car. Have 105K miles on it and its been paid off for a few years now. I have never leased a car before (I am 33 and have only had 2 cars lol), but I think I am going to go for it next time. Although I am very likely to completely ignore the 1/10th car rule lol

Would I consider a lease? Highly unlikely, as you’re essentially basing your calculations off of some numbers that may or may not be accurate (such as 3 year old value of a new car). Here’s an example of how I prefer to buy cars, based on my last purchase.

In 2010, I purchased a 2002 Camaro for $2700 (all in, that’s much less than the 10% rule!), which booked at the time for $4800. It was leaking oil on both sides of the engine from the valve cover seals. ($300 at a mechanic, or $50 DIY). As the only real major problem with the vehicle from a standpoint of functionality/safety, this means I started $2050 ahead (DIY). In the intervening years, I’ve put about 60k miles on the car, with an input of ~$1800 in parts, labor, oil changes, etc-and that includes installing a new stereo system, upgrading the brakes and brake lines, some electrical upgrades, and cosmetic modifications-none of which were necessities.

Once I put the next modifications in play (upgraded suspension) I’ll be over the book price that the car was worth when I bought it-with premium sound, improved suspension, brake system, electrical, and fuel MPG. Double that total amount of money and I still wouldn’t be at 10%. Granted you do have to know something about cars to do this sort of thing, but it’s a worthwhile field to learn something about considering the cost of owning a vehicle.

The next car I intend to “buy” is the ’65 Chevrolet C10 that has been waiting patiently for someone to give it some attention at my parent’s retirement home. With these trucks worth 30-45k after fix up, and essentially zero initial cost of the vehicle, I expect that an investment of 15k (and a significant amount of time) will return a pickup that is both fun to drive and worth more money than was put into it. If you go old enough, and you know what you’re doing, they don’t always depreciate!

Probably a smart move on your part to go with the smaller, stealth wealth vehicle that’s going to save you quite a bit on gas over what you were paying for your Disco (I happen to own a Disco II myself, that’s the truck my wife drives). You’ll likely more than make up for the insurance costs in fuel savings since you’ll go more than twice as far on a gallon of gas than you’re used to.

That said, I have never bought (or leased) new, and I doubt that I ever would. I just can’t deal with the depreciation when I know it isn’t necessary. You could have easily bought a 2012 Fit for the amount that you’re estimating you’ll pay at the end of your 3 year lease-although I can see an argument for the 5 mpg increase in mileage in the 2015 helping defray the difference. Really, I think that you just wanted to buy yourself a new car because you felt you could afford it-and you can-there’s no question there. You could certainly have afforded a far more expensive car too. What really will matter is if in 3 years you decide to purchase or not. If you decide not too, then this will be, in my mind, a bad decision. Otherwise it’s just one that I personally would not have made, although in your case I can to some extent see the financial rationale.

hello, would you mind letting us know who you mechanic is in oakland ? we are in the east bay and looking for a good mechanic. TIA

hello, would you mind mentioning who your mechanic was ? we are in the east bay and looking for a good mechanic. thanks in advance.

With leasing you are stuck with a contract for the term of the lease. I prefer to pay cash for my cars, 2-3 year used cars normally and have the flexibility to sell it if need be. You never know what life will throw at you and being stuck with a car payment with no job does not feel very good.

True- if you’re leasing as a way to squeeze a new car payment into your budget and you live paycheck to paycheck. But I am guessing that most of the followers of this blog have atleast a solid financial cushion or are already financially independent. But regardless, it is no harder (and possibly easier) to walk away from a leased car vs one you own. With a leased car you can:

-Find someone to take over the lease using a site like swapalease

-Make the remaining payments, buy the car out and then sell it outright (really no different than if you owned the car and needed to sell it)

-Make the remaining payments (remember, your obligations only extend to the end of your lease and if you have any kind of financial cushion and leased within your means, it should be very easy to afford this). And odds are that if your “doomsday scenario” occurs it won’t be in month 1 of the lease anyway.

-Plus your leased car will be under warranty for the duration of the lease- a better situation than having a used car that suddenly incurs a big repair bill soon after you get laid off

“With leasing you are stuck with a contract for the term of the lease” … This actually isn’t true. A lease is just another form of loan, one can simply sell the vehicle and then pay off the lender directly or pay a small fee and find someone to “assume” your lease using one of the new online services such as swapalease.com. Furthermore, if you have driven less than the allocated mileage at the end of the lease then you may have upside equity since the contract ‘residual value’ is based on mileage in which case you can sell the vehicle prior to handover and profit the difference.

FWIW – My fiance has a Fit, and it doesn’t affect his sexiness ;)

Excellent! Good to know Lisa! Smart man. Fit = Ferrari in SF.

I am very surprised you went with the Honda Fit! After all the posts about getting a 60k-80k range rover! The fact that this is only costing you less than 1% a month of your monthly cash flow is great. You are totally way below your rule of keeping car purchases/leases under 1/10 of ones yearly income. But yeah, still surprised from a high end choice to a very economical

choice of the fit!

I have been car less the past 3 years or so, mainly because I just don’t have a need to own one currently. I only need a car maybe a month or so at most out of a year these days, therefore renting as needed is a much better choice for me. If one doesn’t need a car very much out of a year, there are many advantages overall. I don’t have to worry about the upkeep of a car, insurance, DMV fees, parking/storage fees of a vehicle when not needed etc.

When I was home visiting recently, I went over to the Tesla show room at Santa Row in San Jose, CA. Currently I have no interest in buying any new car since I do not need one. I just wanted to see what all the fuss was about the Tesla Model S. They let me test drive the P 85, and I have to say its one amazing car, its like a rocket ship, unlike any type of fuel engine car. After the test ride I was sold on it! Maybe down the road when my income meets the 1/10 rule for a 110k Tesla haha.

$1.1 million or bust mate! :) Or, you can follow my Net Worth Rule For Car Buying. $2.2 million net worth and you are good to go!

I just road in my friend’s P 85 in the picture and his net worth is over $500 million… so I’m not kidding about this good guidelines!

Hmm- As much as I want a Tesla and meet the net worth criteria, I still don’t think I could bring myself to plunk down 80k plus for one.

What amazed me about the Tesla was is, performance wise it blew away cars in the same price range. I’ve driven other cars, never owned them. Such as the Porsche Cayenne Turbo, E92 M3, C55, 5 Series BMWs. I was shocked how a electric car like the Tesla felt better and possibly outperforms other high gasoline cars all from a fully electric motor.

Hopefully this technology keeps improving, and Tesla does come out with an awesome car that’s more in the 30k to 40k range.

Totally agree. I test drove a P85 as well and wanted it so badly after driving one. The good part about that is that it quenched any desire I may have had for high end gas powered performance cars. If I ever decide to spend that much money on a car it will be a Tesla. But I probably won’t have to. In 5 years, the mid level model should be out and used Model S will probably have depreciated somewhat.

Yeah, I kinda surprised myself. I agonized for two months… but really more like two years on what to buy. I wrote the post on the three car options, with a survey that pointed me towards the Range Rover Evoque for $65,000.

I just couldn’t bring myself to do it. City resident should logically buy a city car. I don’t like feeling stressed scratching or banging something expensive up. Furthermore, the uncertainty of a family size or my future after year 3 is why I stayed conservative.

Enjoy being carless!

I have never owned such a high end car. Always wanted too, felt that I would eventually. But as time passes and the more and more I grow my net worth. The less I desire the things that I thought I once wanted. I guess after saving and investing so much, you actually find it more thrilling to see it go up even more than spending it down.

Damn it Sam!! The Beast (1998 Ford Explorer w/ 255K miles) has been falling apart. Smells like burning oil. Passenger cannot open back driver side door. Lock on passenger door does not readily open. It still drives and stops fine. But it is an embarrassment when someone else wants to go somewhere in my car. I have been dreaming of a new car for a while. My wife asked me why I did not get a brand new F150 like I always wanted. At that point, I thought of Moose. I figured if you could stick it out with an older car, so could I. I bike to work most days and there are times when the only time I drive in a week is to my weekly softball game. I definitely have had “One more year” syndrome with this POS for a while. Now that you pulled the trigger on that awesome new car, I feel my will slipping.

Haha, sorry man, but the DMV and California screwed me! I’m not going to spend probably $200-$500 fixing Moose so his Service Engine light is fixed after 2 years of being broken to then spend $90 to pass smog and $164 (late) for registration! It wasn’t just the money, but really the hassle of another 2-4 hours. Forget it!

I have to say, I LOVE driving an up to date modern car. All these creature comforts I’ve been missing for all these years. Can’t beat the new car smell either! lol

But, I LOVE the old car smell too.

I saw a picture, and I thought you grew a pair.. and then i saw what you actually bought..

Just kidding (sort of). As long as you like Honda Fit and it makes you feel good.. to me these are the criteria.

As for buying vs. leasing.. I have always looked at it exactly the same way, in lease you are just buying a put option. In your case it’s a very cheap one, so going with it sounds like mathematically a sound decision.

I keep going between financing and leasing in current interest rates. Penfed financing at 1.49% is basically free money for 3 years – this is what I use now.

Fit is the new Ferrari Enzo man! What are you thinking of buying?

We are moving to Portland from Lala land.. So I am thinking of swapping my rwd 335i for a Range Rover Sport.. That car is just so awesome looking.. Working on justifying this expense to myself :)

Do it! The Range Rover Sport SUPERCHARGER is sweet. You only live once after all, lol. Almost as sweet as the 2015 FIT!

Congrats Sam! Your analysis and reasons for leasing pretty much mirror my own. I do get a little tired of reading all the anti-leasing, buy a lightly used car and drive for 10 years orthodoxy that gets repeated on many personal FI blogs. So it was good to read your more nuanced take on it. There are many reasons why driving a new or newer car can be a valid choice, even if you’re someone who is otherwise frugal.

Assuming you have good credit, I actually think leasing a new car makes more sense than buying a 2-3 year old used one at this point because

a) prices for used cars are unusually high

b) You tend to have more negotiation leverage with new cars; and manufacturers are more aggressive in terms of sales/leasing support

c) You can easily find (or order) exactly the car you want

d) Carmakers really do continually evolve their products and I often find that even comparing what appear to be 2 otherwise identical cars, but separated by a few model years, there are lots of changes that tend to add up to improved comfort/safety/convenience/performance/efficiency. At 5 years the differences are more dramatic, and a 10 year old car (even a former top luxury car) is generally trumped in pretty much all aspects by any new car.

I may be burned at the stake here for mentioning this, but I currently drive a leased BMW 5 series. Love everything about the car and the hassle free “ownership” experience. Got it for $400/0 down for a car that stickered at 55k. Ordered it exactly how i wanted it too. Yep, I’m an unrepentant lessee.

$0 down for a 5 series bimmer? Not bad! What is the year, exact make, and residual value?

May you burn in hell! Lol

Residual is 64% for 3 years/30k. Its a 2014 528i. Been averaging 27mpg which is nice too.

When I saw you decided to lease I thought you would describe how you managed all the moving parts of a lease to minimize your cost at the dealer’s expense. I figured you would tell us about how you reduced the cost of money, negotiated down the cost basis, negotiated up the miles, cut your back end responsibility, and minimized your cash out of pocket. I was more than a little disappointed. Seems like you took what the dealer offered without a lot of negotiation, not that the dealer would be willing to give much up right now. The new Fit is, well, new and it’s in short supply.

Yeah, leasing works for a business because it’s deductible, but overpaying never makes sense. I see a lot of hand waving and excuses, with an emphasis on flexibility, but no hard facts on the deal. Tell us about that sweet deal you made, and I’ll be impressed.

My sister in law has a 2012 fit. It is very similar, but I like the new design much better!

I’m quite envious, Sam. I’ve been eying the Honda Fit for a few years now, but I can’t justify purchasing a new car while the current one (1998 Honda Civic LX) refuses to die. You need to do another post about Rhino so I can live vicariously through you.

Of course, if Elon Musk’s prediction comes true and self-driving cars will be commercially available in 5-6 years, it may be a Tesla in my future instead of a Honda Fit.

I have a Honda Civic and it has been quite reliable for me. Interesting analysis on leasing. I personally don’t like leasing but if the opportunity is correct, leasing might be a good option to get a car.

I bought a new jeep wrangler 4 door in 2007 for cash. At 1200 miles the engine blew and it was in the shop for 2 months while they rebuilt the engine. I have always had weird little problems with the car over the years and really wished the car would have been leased so I could have returned it.

I love Honda’s, they’re incredibly reliable, but I’m surprised you leased the car. I guess the flexibility is a bonus, but knowing that you’ll pay more in the end to own it doesn’t seem like a great idea. But who knows, maybe traffic will get to the point where biking and transit make more sense than owning a car in 3 years. I know here in L.A. traffic is insane and growing daily. Yuck.